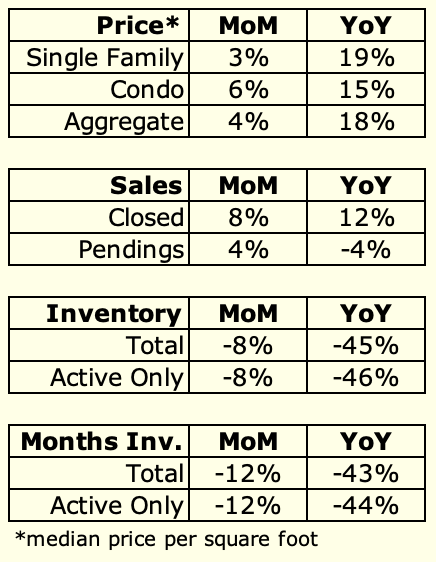

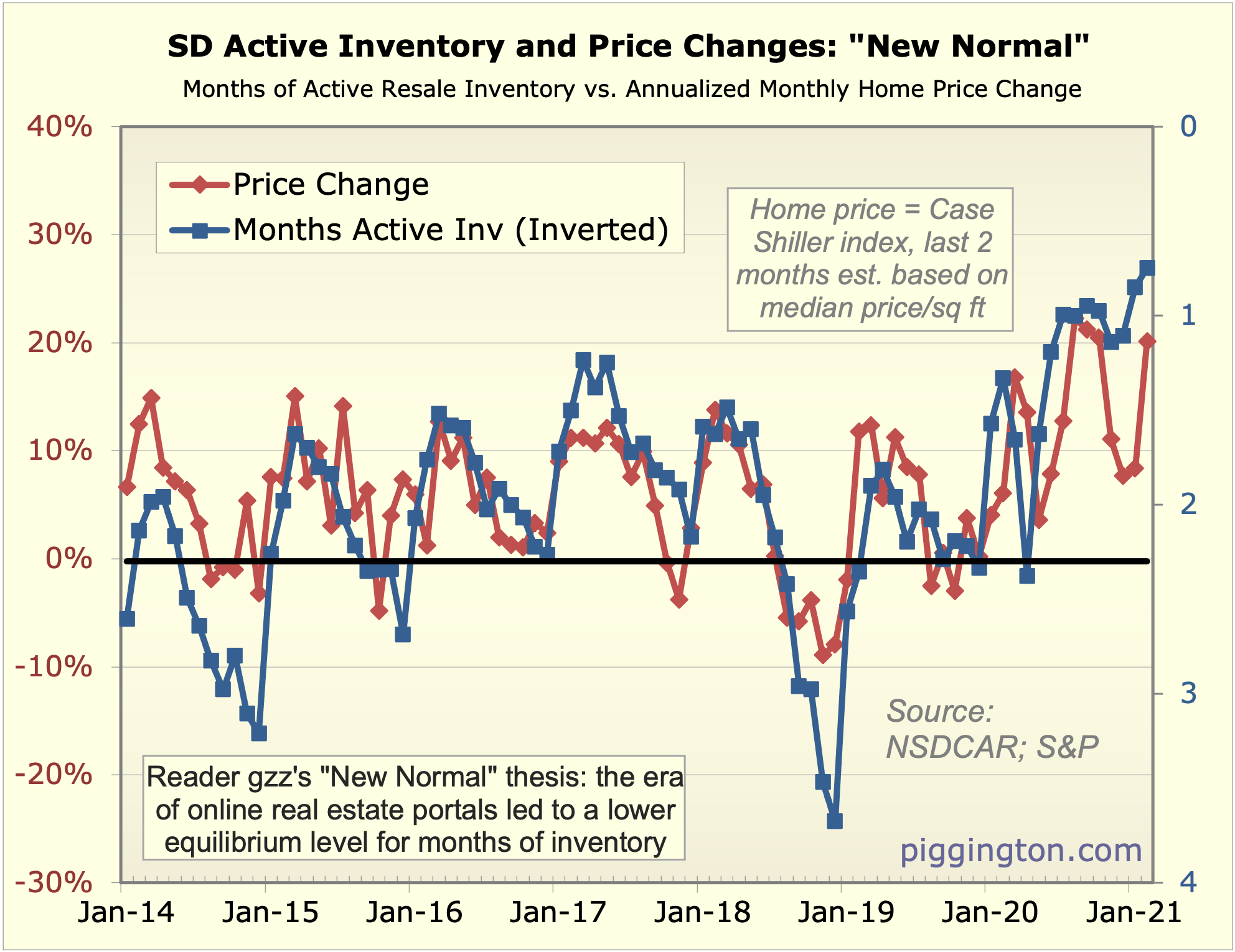

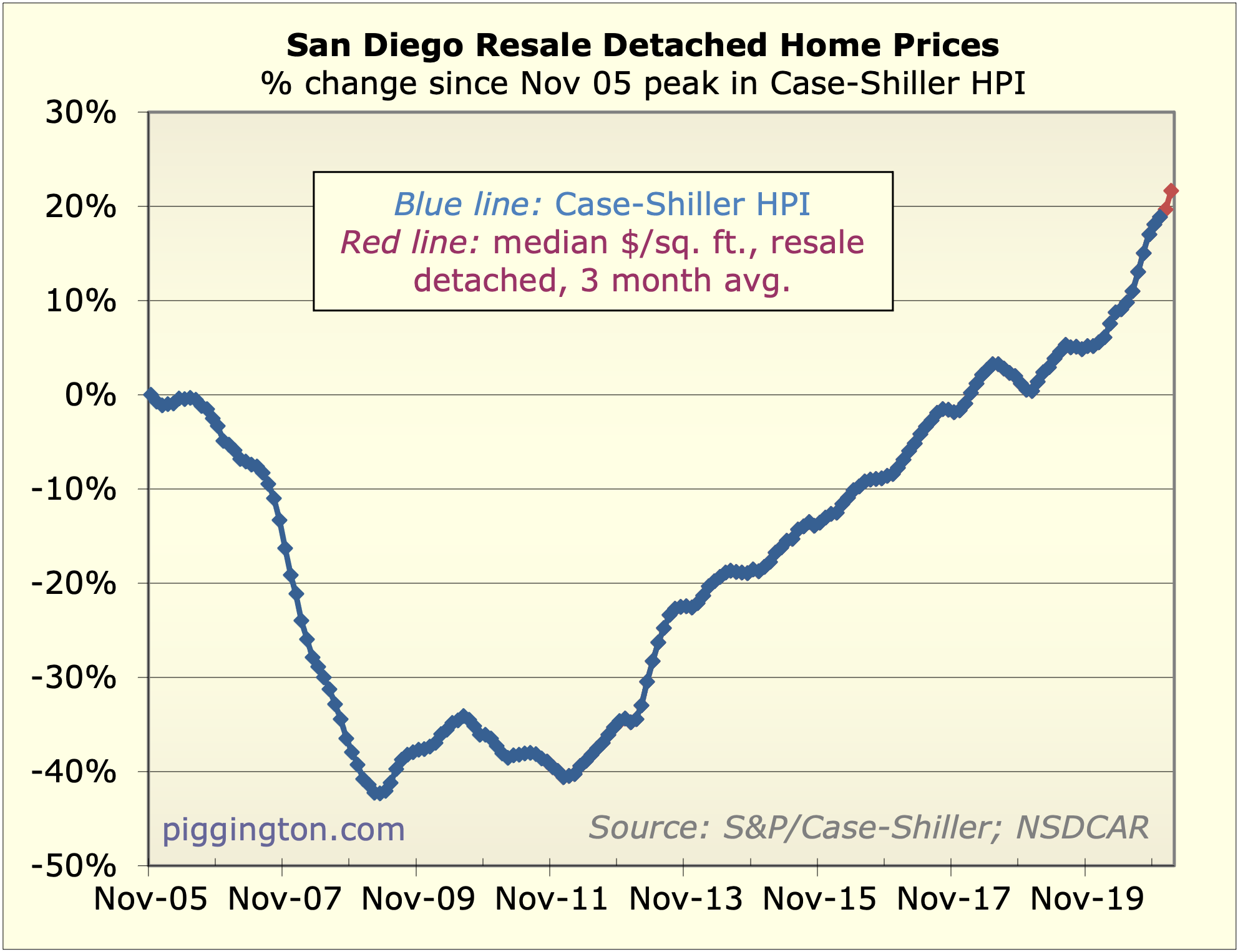

February was another blistering month for prices… even ignoring

the nutty condo numbers (they are very volatile), the single family

home price/sq ft popped almost 3%:

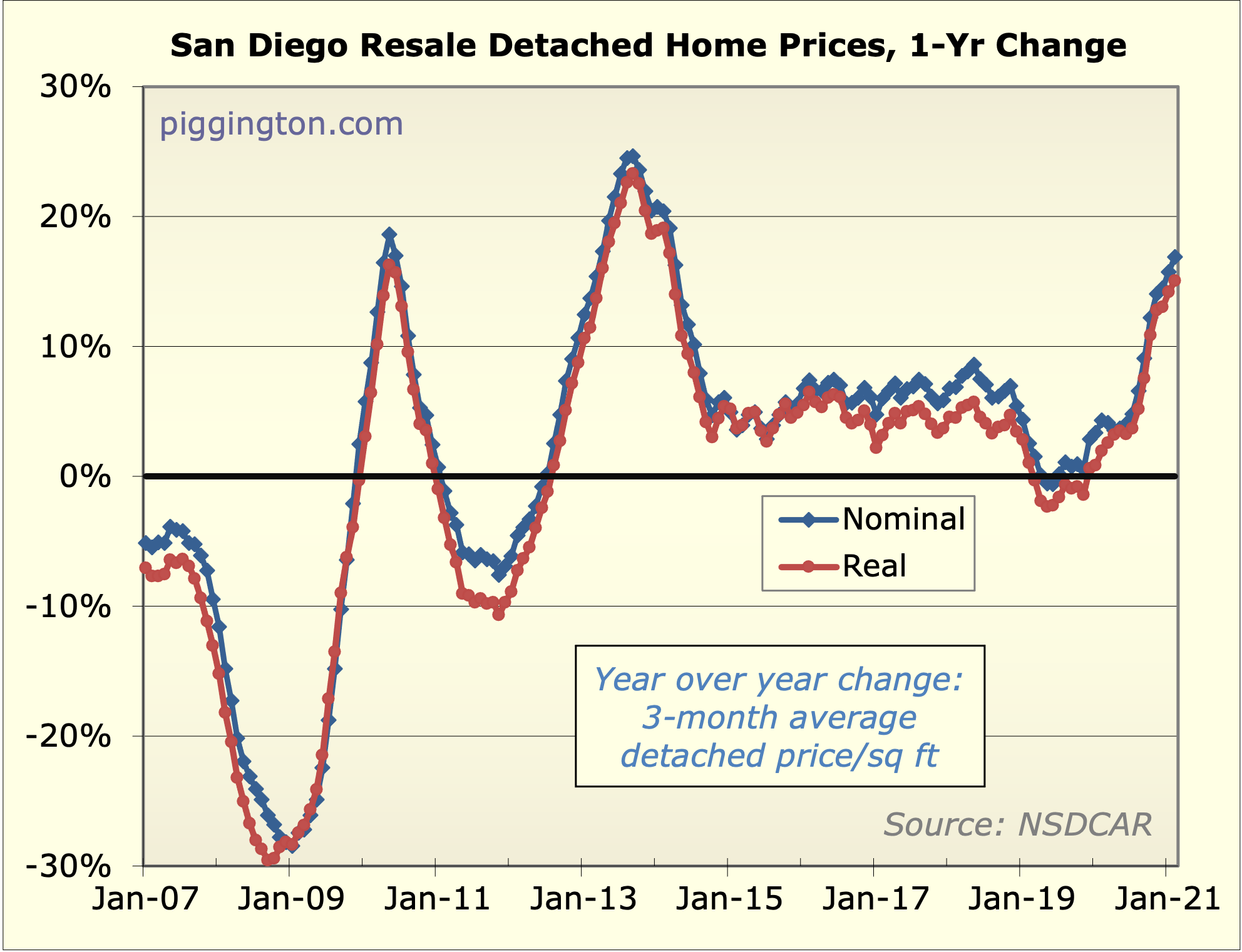

The latter, by the way, is now 19% up from a year ago. The pandemic

has put upward pressure on prices in 3 ways – increased demand,

decreased supply, and lower rates. As the economy opens up, all

three of these things should recede to some extent. It’s already

happening on rates — the 10 year Treasury yield is now pretty much

back to pre-pandemic levels. Mortgage rates have followed partway;

if they also return to pre-pandemic levels, that is a serious hit to

affordability atop the 19% price increase.

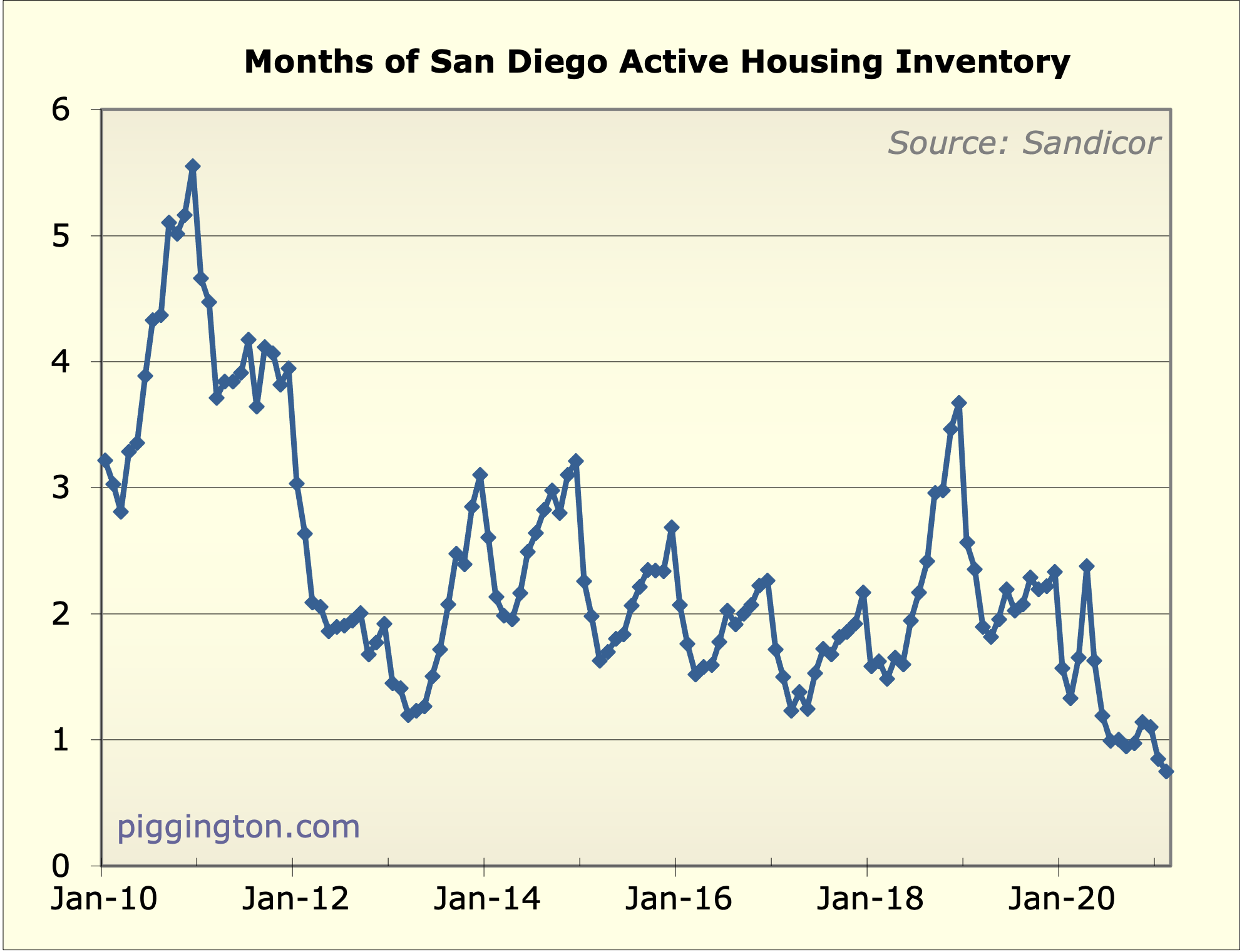

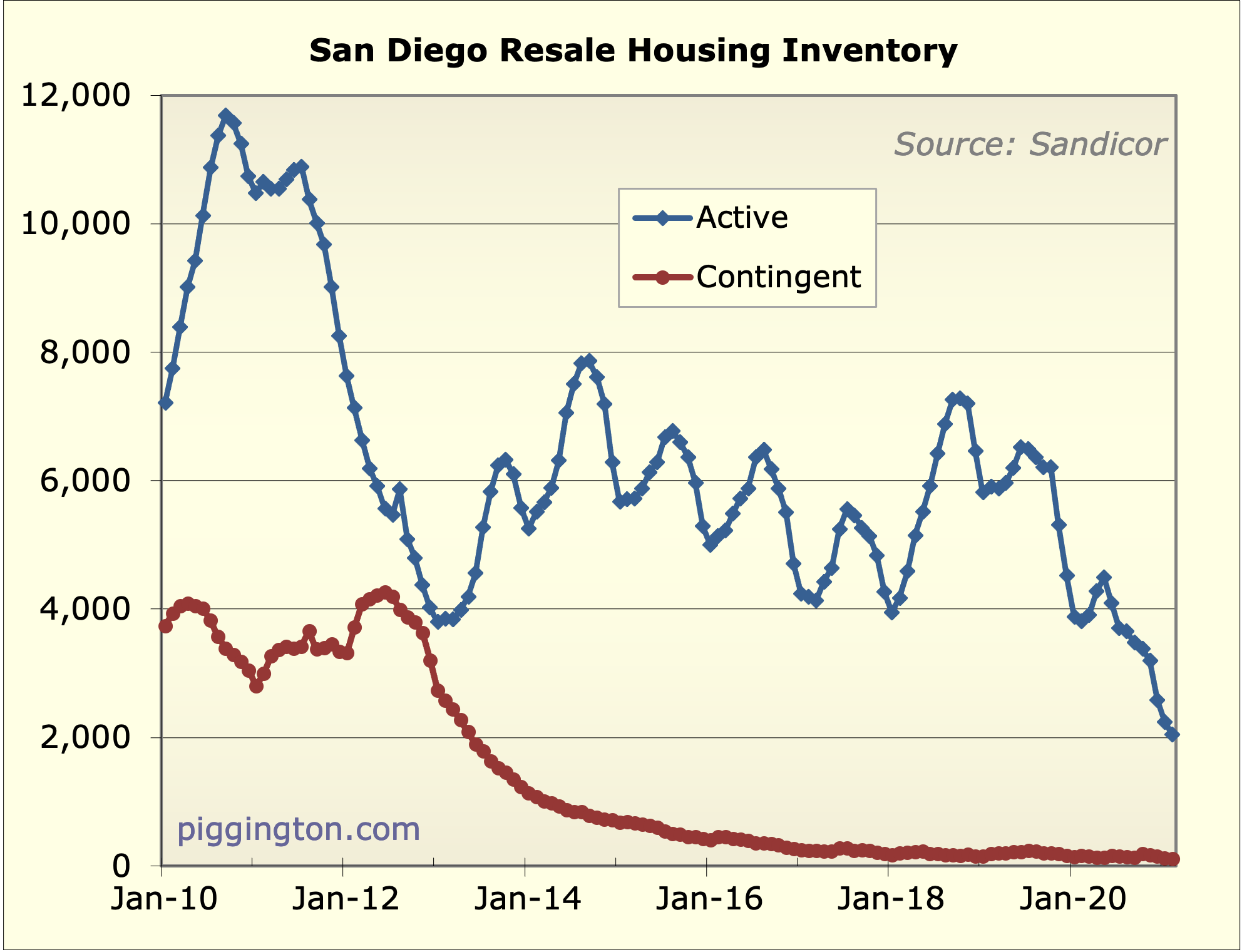

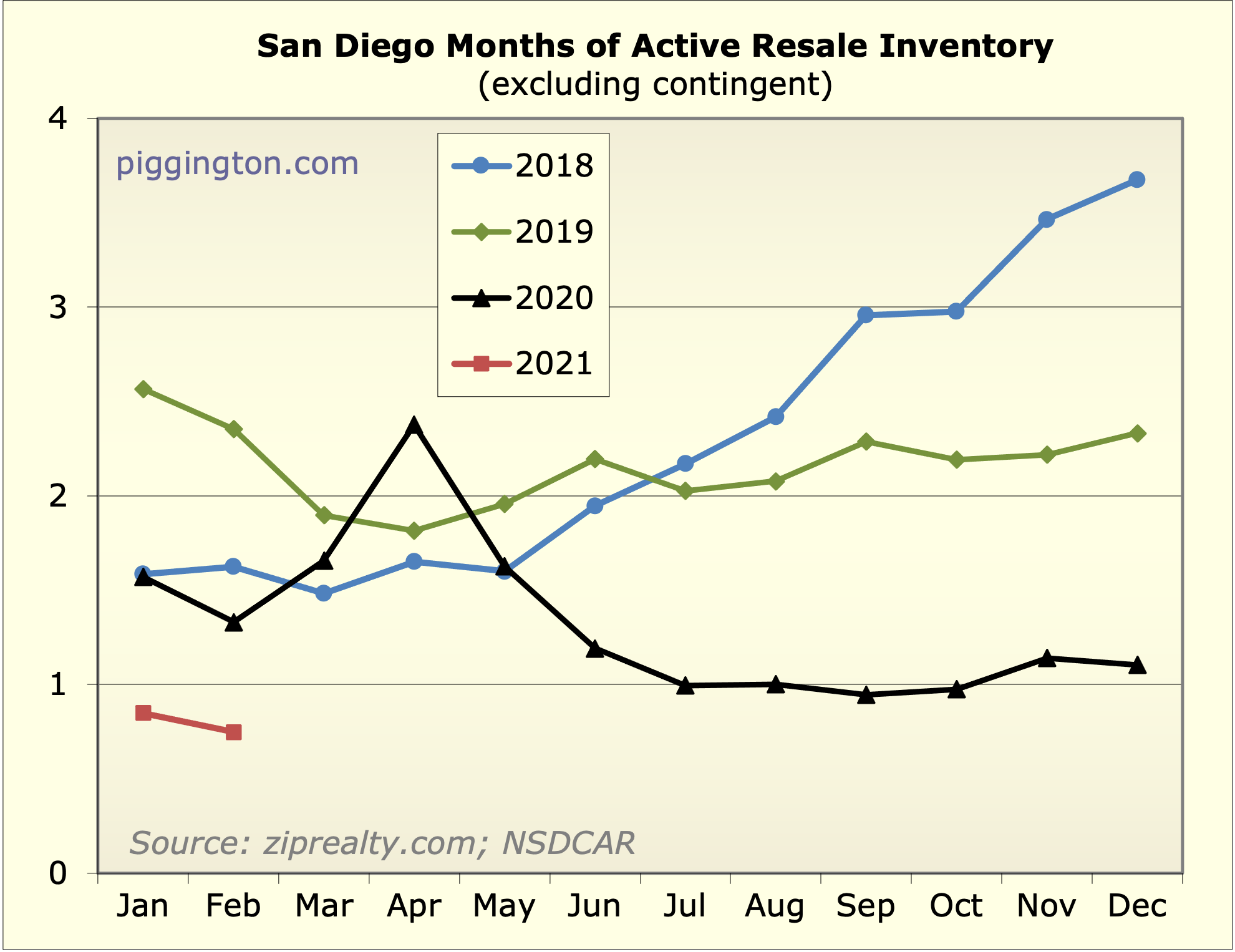

So it will be intersting to watch how the increase in rates effects

things, should it persist. Meanwhile the market is red hot. Active

inventory is the lowest since I’ve started tracking it:

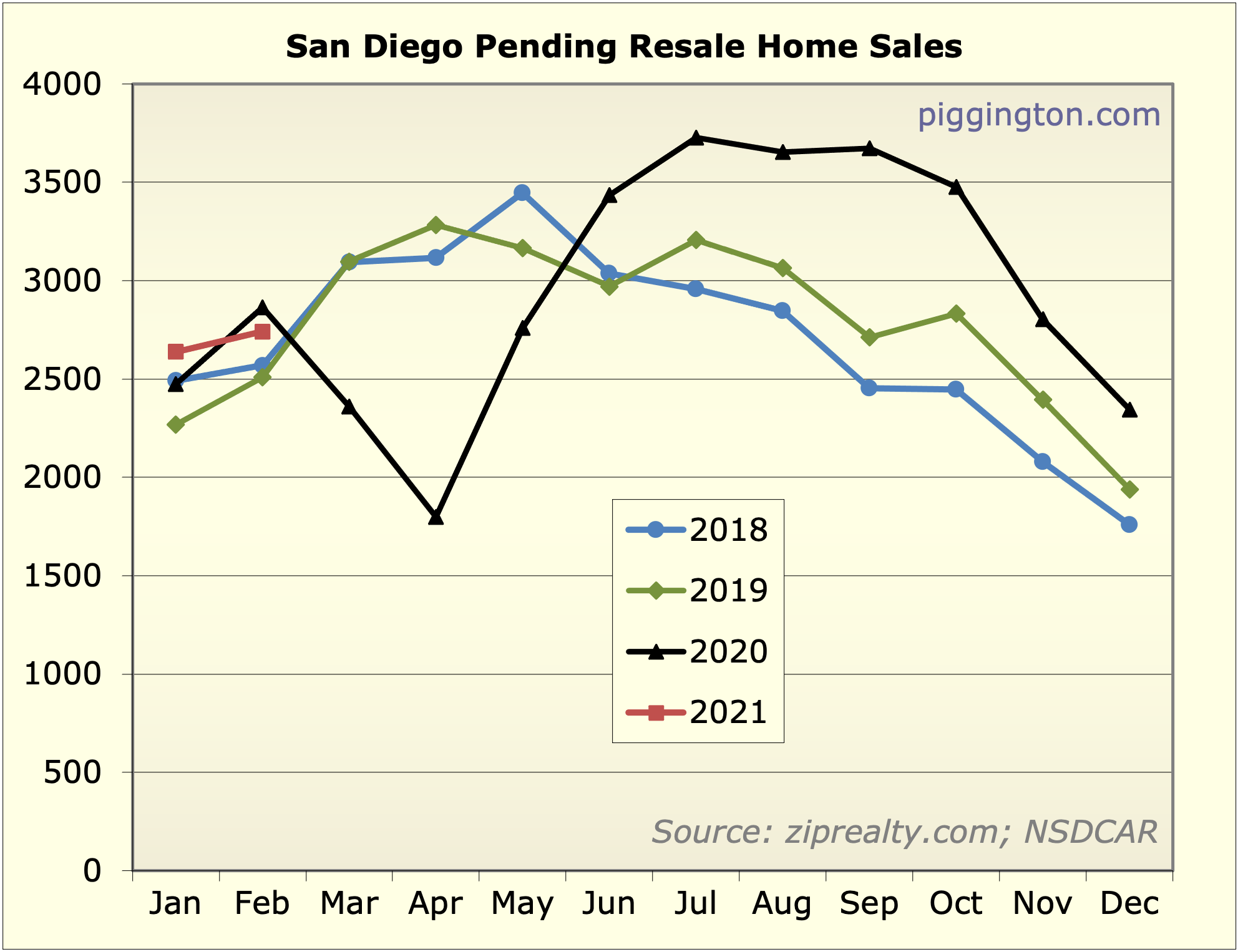

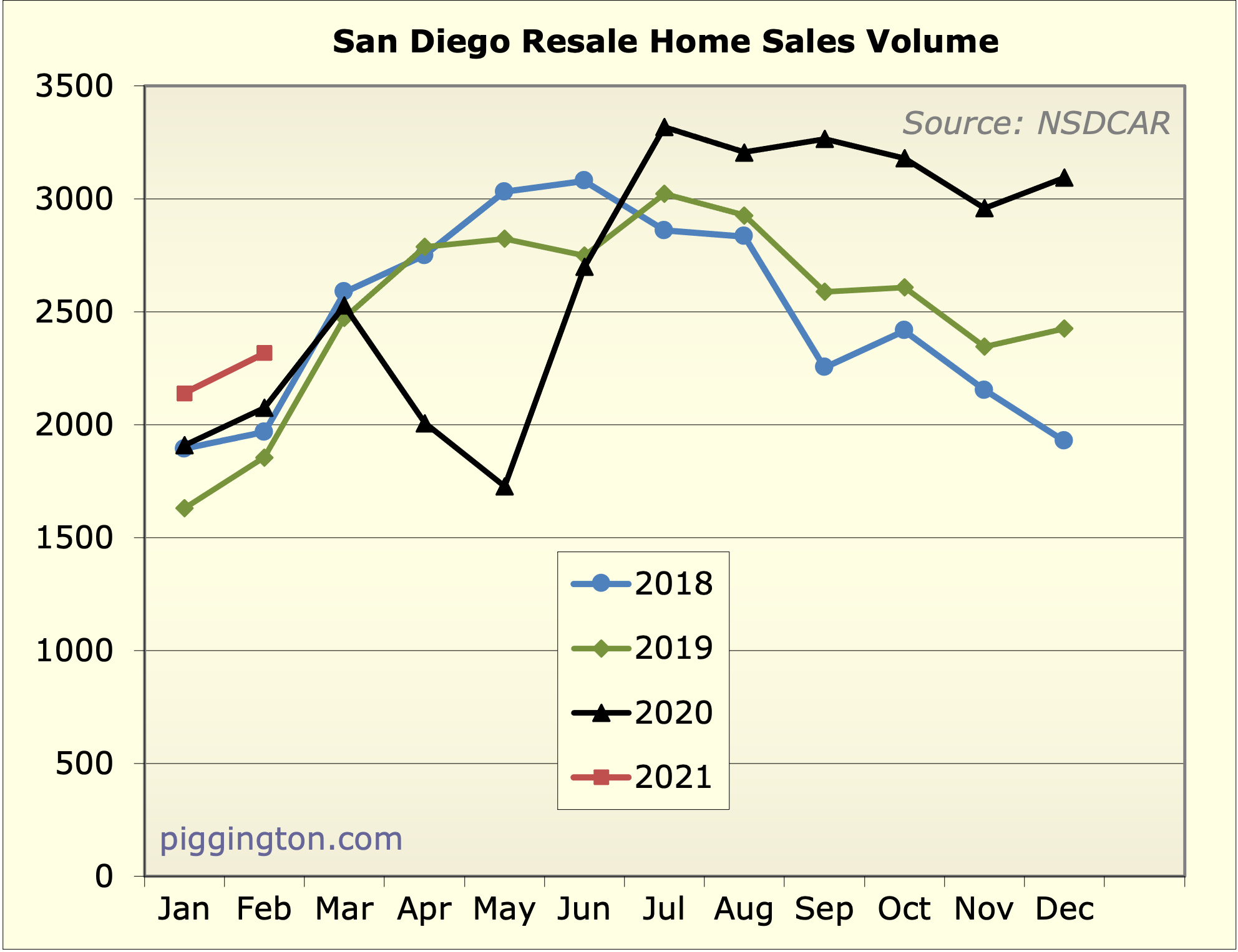

This is less a function of sales, which are fine…

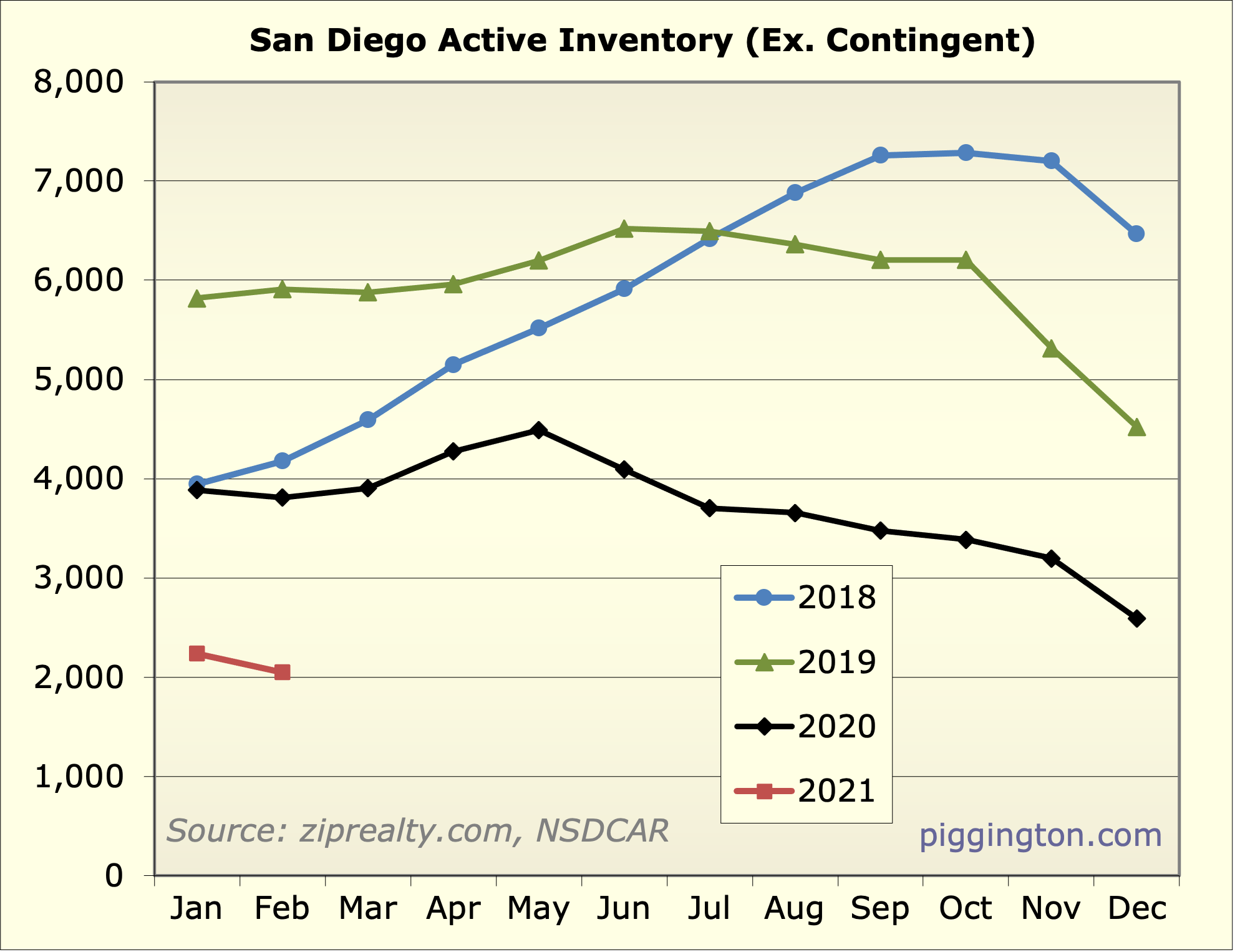

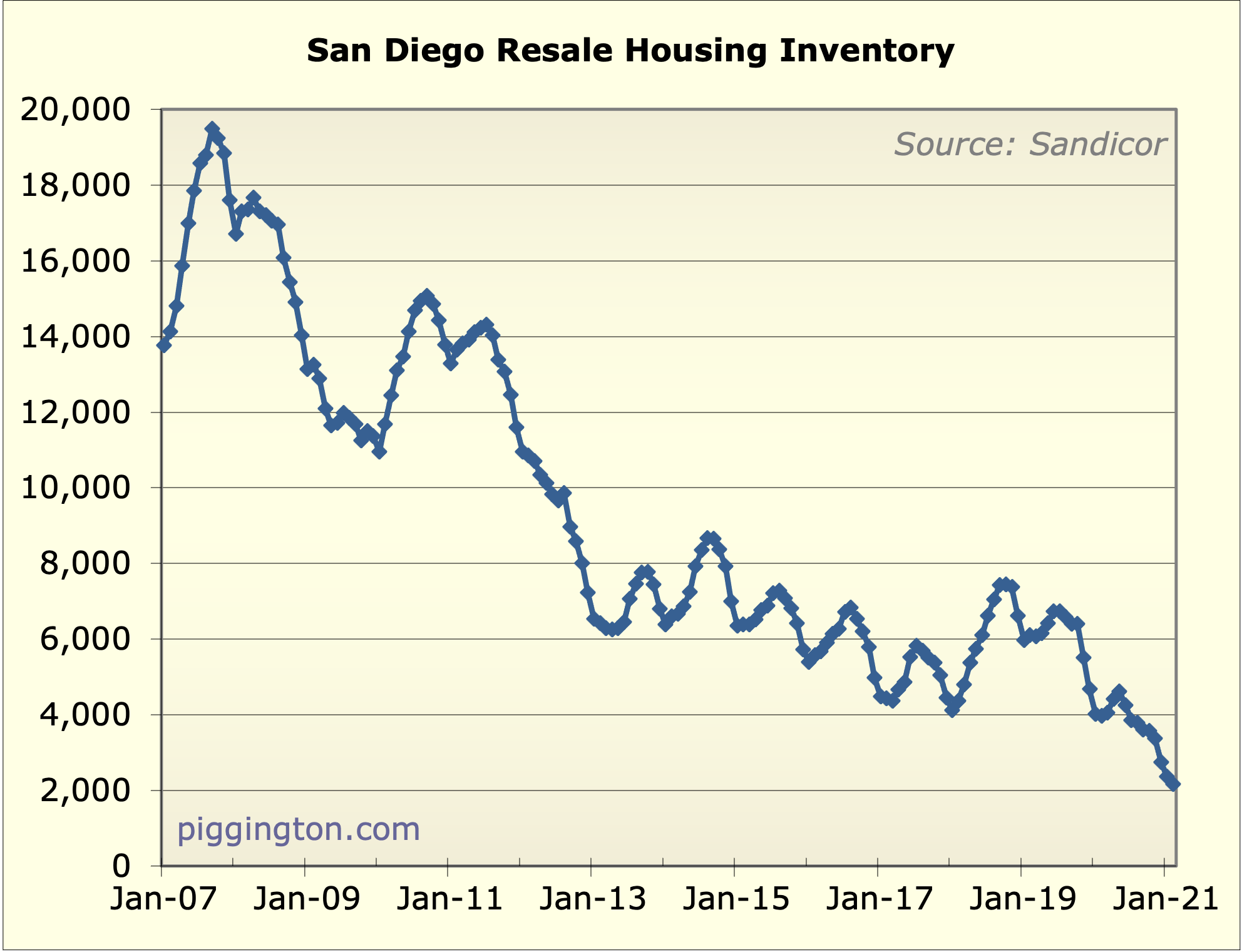

…than it is of available inventory, which is in the abyss:

Nobody wants to sell. Again, I would expect that to change as things

open up. In fact is seems plausible that there could be a good

amount of “pent up supply,” especially at these prices. Whether it’s

enough to meet demand is another question. Either way — for now

it’s exceedingly slim pickings, which suggests higher prices

immediately ahead.

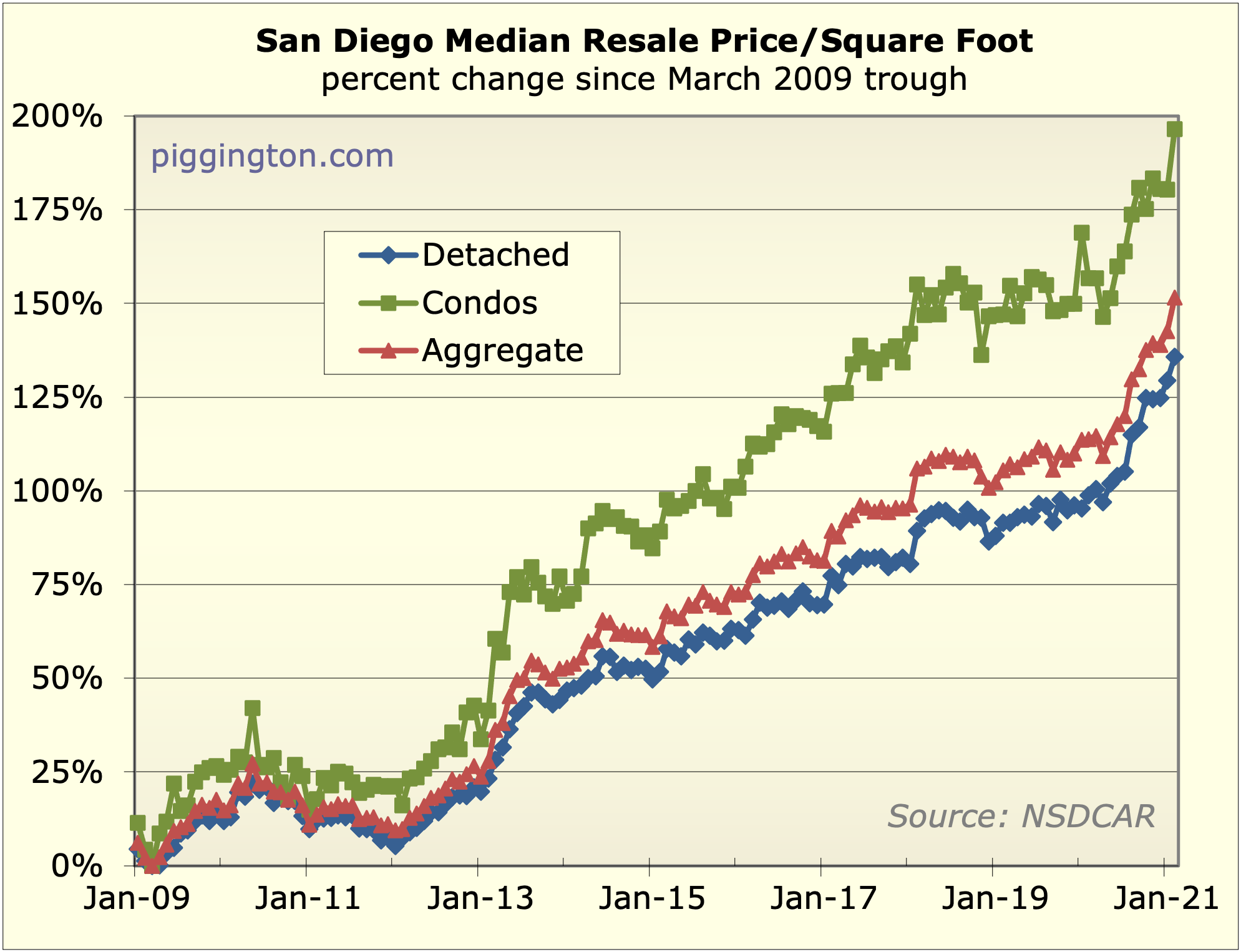

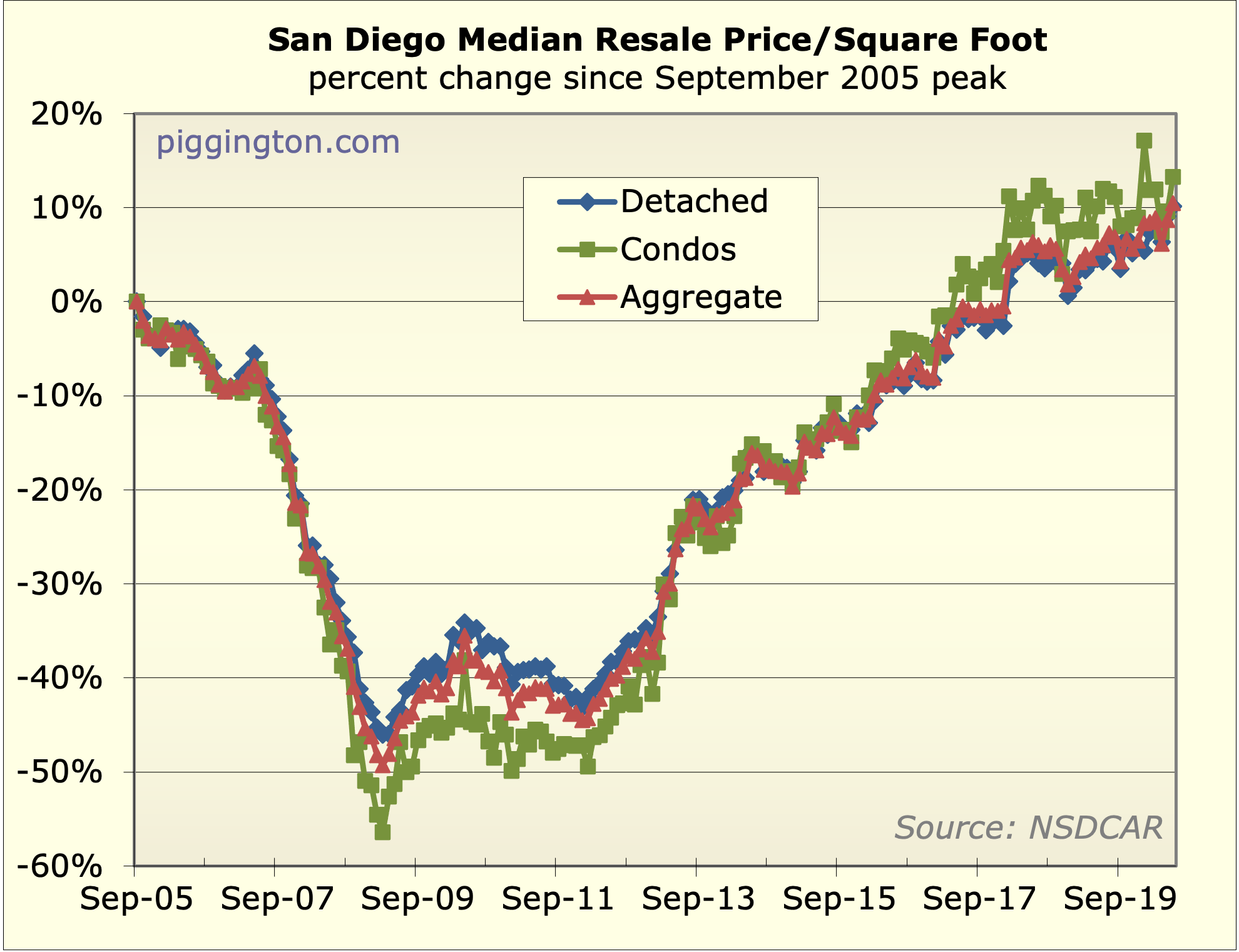

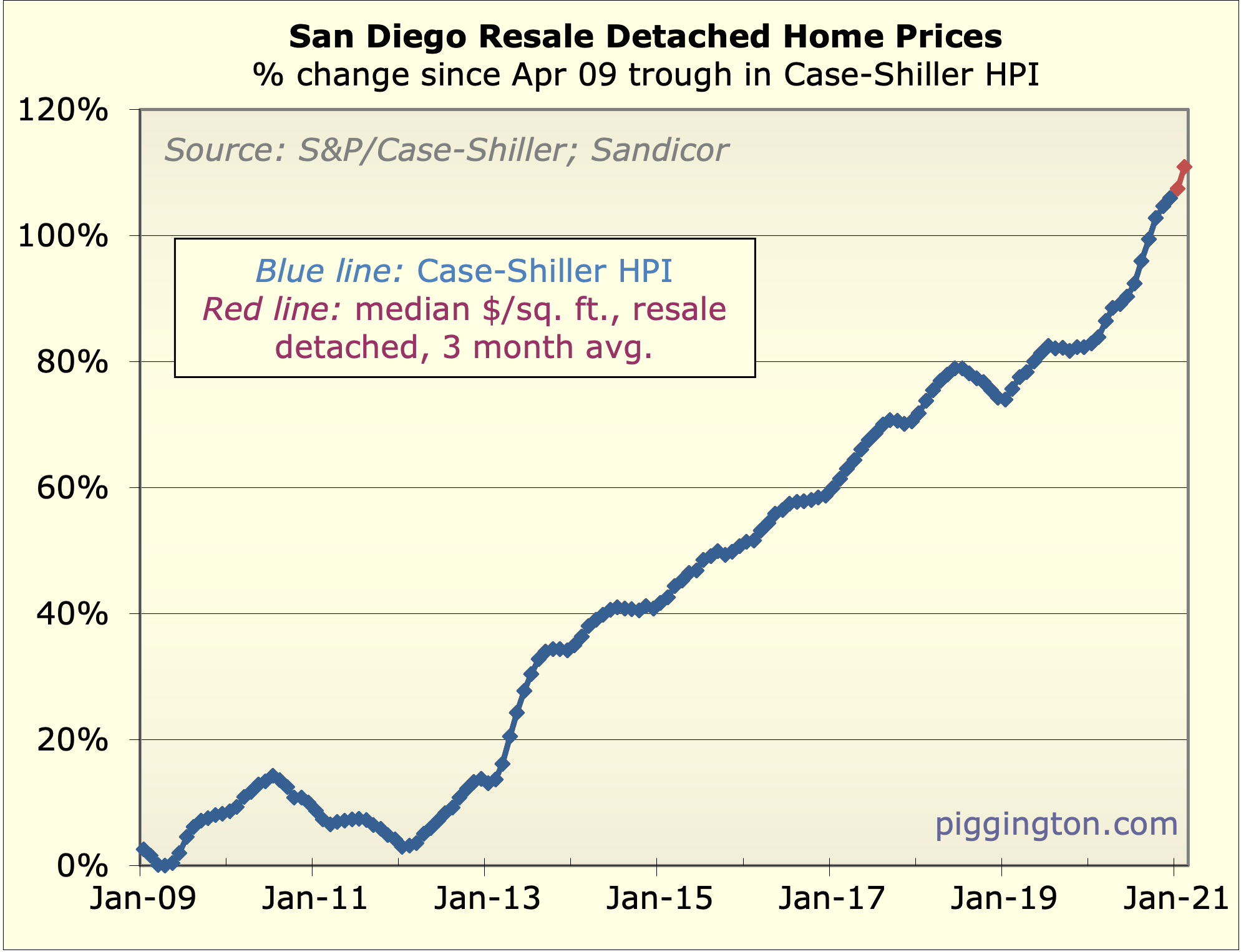

Assorted charts below…

Has inventory ever been this

Has inventory ever been this low historically?

If interest rates go up people will just assume they can refinance when the rates go low again.

I dont think inventory has

I dont think inventory has ever been this low at least per capita. And these prices dont reflect whats in escrow and going into escrow which is another leg up. House just down the hill from me listed at 1.2M closed today for $1.35M all cash 10 day close. This time last year, maybe $1.05M. Now this is a turnkey, upgraded one story overlooking open space so may be an exception to some extent but still. I’ll try to add some color when I run my numbers on the two micro market monitor threads

I am skeptical of pent-up

I am skeptical of pent-up supply.

Seems like the shift to work from home for professional jobs will be permanent, which in turn is a positive demand shock to San Diego because it is an especially nice place to WFH but not too far from the big west coast job centers.

It further shocks demand upward because people need more residential space if they spend 90% versus 50% of their waking weekday hours at home.

While 20% is a big hit to affordability, with the stock market booming, especially California-based tech stocks, I think people have plenty of firepower.

One of the rentals in 4S is

One of the rentals in 4S is coming up for lease June 1st, (did a short lease for current tenants back in Oct), decided to gauge the market and get ahead of things:

Takeaways:

1) many of the potential “tenants” really want to buy and used the viewing a a reason to engage on that front

2) some tenants coming from out of state are ‘afraid to sell their primary home until they identify a home they can purchase’

3) 4BR in North county is basically 4K plus now (if decent neighborhood)

4) some who came to look were selling their small condos but needed more space for a growing family

I decided trying to lease 3 months in advance is perhaps to early so will hold off til late April.

Personally, I can’t think of any reason I’d sell unless it was a very generous offer.

I’d sell if the yield on my

I’d sell if the yield on my cash were substantially higher than net rent.

That won’t happen for a while. Rent yields are 3% even in primo locations and conservative assumptions, and rents go up with inflation. That is still twice what treasuries pay, even with their recent increase.

I guess the question will be

I guess the question will be what will happen if 30yr mortgage rates go to 4%. Refi’s are starting to hit 3.5%

Just checked and refi today

Just checked and refi today would be 2.875% for me. Granted very low LTV and conventional but still not near 3.5%. I saw 3% for up to 750K with at least 20% equity and good credit

On occasion, I think it is

On occasion, I think it is helpful to look at the total number of homes below $1M.

Simple criteria: <1M, 3BR 1500 sf+ 2 BA

Draw a box from the border to just east of 67 and north to 76:

About 410 homes total on the market.

If I drop to 900K, then number drops to about 340 homes (SFH/condos/townhouses).

If I drop to 700K, there are only 150 homes.

These are clustered in four areas:

Escondido, El Cajon, Chula Vista, Oceanside/Carlsbad

So very thin pickings at that level.

I didn't think 700K would be the new starter home but that's where we are.

Back in the day, a couple of planeloads of buyers from China or elsewhere could have cleared this out in a few days. Would be interesting to know what portion of buyers are local vs new arrivals and at what price points to know how stable the market is.

How to have an honest

How to have an honest conversation with people who want to buy:

I know a few people who have been watching the market for years and want to buy.

One guy has done well in stocks and was just averse to real estate, but I think the constant price increases have gotten his attention.

Another couple wants to retire here and not be priced out.

I’ve said something like, 50/50 if prices are 5-10% lower in next 5 years but if you can hang on 10, you should be ok even if there is that kind of decline.

Am I wrong to give this guidance or should I just not offer an opinion?

Those are tough questions to

Those are tough questions to answer. Personally my feeling is if you are buying a home to live in and it makes personal sense these are great long term rates to lock into. Over time the enjoyment you get from your own home and the effects of inflation create wins for most no matter what happens with prices.

China keeps producing more

China keeps producing more and more wealthy people.

The reasons for them to have a bug-out house in the West are not changing, but the level of wealth and number of them is growing MUCH faster than the supply of nice locations to buy. Probably 6% per year growth versus 1% or less growth.

San Diego is far from the only spot for them. London, Switzerland, Vancouver, Dubai, Toronto, are some high profile alternatives in addition to all the USA alternatives.

Ultimately, however, SD’s Chinese population is growing and upscale and a home here is a safe place to flee from the PRC, a safe place to stash your family, a great investment long or short term, and a trophy. There’s also still a lot of relative value and bang for buck here.

Here’s Zillow’s numbers for

Here’s Zillow’s numbers for 2/2021

Typical rent is $2,380, $97, or 4.2%, higher than a year ago.

Rents in the highest-priced zip codes and lowest-priced zip codes have risen at the same rate, 4.4%

The typical home has appreciated $87,664 over the past year. It’s now worth $702,933, up 14.2% year over year and 1.5% from January to February.

For-sale inventory has fallen 25% compared to last February.

Hi, I have been trying to buy

Hi, I have been trying to buy a house as a first time home buyer the last 4 months and keep getting outbid. I have bid over asking by $50k+ on 4 different properties ($600k -$750k range) and did not get them. It is so frustrating and makes me sad I haven’t been able to buy yet. I am a little concerned because some of the properties I saved on Zillow in January, now have Redfin/Zillow estimates that are $50k-90k increases in such a short time. I was wondering if you have any updates on housing and curious on your thoughts on buying now?

Even in the current hot

Even in the current hot market, most homes are not selling for well over listing price.

I think you’re using Zillow’s various cool tools to find properties that are underpriced and then placing bids on them. But in this market, underpriced properties do go for well above listing.

So you’re doing the right thing to get a good deal in a normal market, but a strategy that just doesn’t work now.

My suggestion is to not hunt for deals on Zillow, but bid full price or a little higher on new listings as they come out.

Or if you want a really specific suggestion, buy this place:

https://www.sdlookup.com/MLS-210008806-2133-Chatsworth-Blvd-202-San-Diego-CA-92107

It’s big and in a pretty good area.

I wouldn’t sweat it,

I wouldn’t sweat it, considering there is half than normal inventory. I know it seems futile but keep at it within reason and eventually an offer will be accepted, yeah it may take a while and it sucks. Don’t overbid on a house unless you know it’s a long term home. Stay within your comfort zone. You dont want to grab a rocket before it falls or catch a falling knife. I also understand you see your plans getting more expensive and priced out. But in the grand scheme of things buying a home is just locking in a rent because you pay a monthly payment and not the price of the house.

Quick look on Zillow shows

Quick look on Zillow shows 2300 properties county wide as of 5/7/21. No filtering for size/BR/sf/location.

Always appreciate the full update.

With filters:

At 2BR 1000 sf, total is about 1920 units.

At 3BR 1250 sf: 1500 units.

At 3BR 1250 sf, max price 1.5M: 955 units.

At 3BR 1250 sf, max price 1.0M: 680 units.

At 4BR 1500 sf, max 1.0M: 297 units.

In a nutshell, the market for 4 BR starts at 650-700K for low end often in second tier locations.

900K seems to be the old 750K and a good benchmark for a standard 2000 sf 4BR SFH. 30-60 saves within a couple of days of listing is common.

Thank you all for the

Thank you all for the feedback. I really appreciate it.

I took a short break from looking and am ready to get back at it.

Geez, I think you’re right. Thanks for the recommendation. I like the area and had looked at something there before. I will keep looking around there to see what comes up.

It seems like you all have a lot more knowledge of all this than I do so just curious, do you think it is better to buy an older/smaller condo in an area close to everything over buying a new/nicer house a little more east but not too far like in La Mesa?

.

.