In last

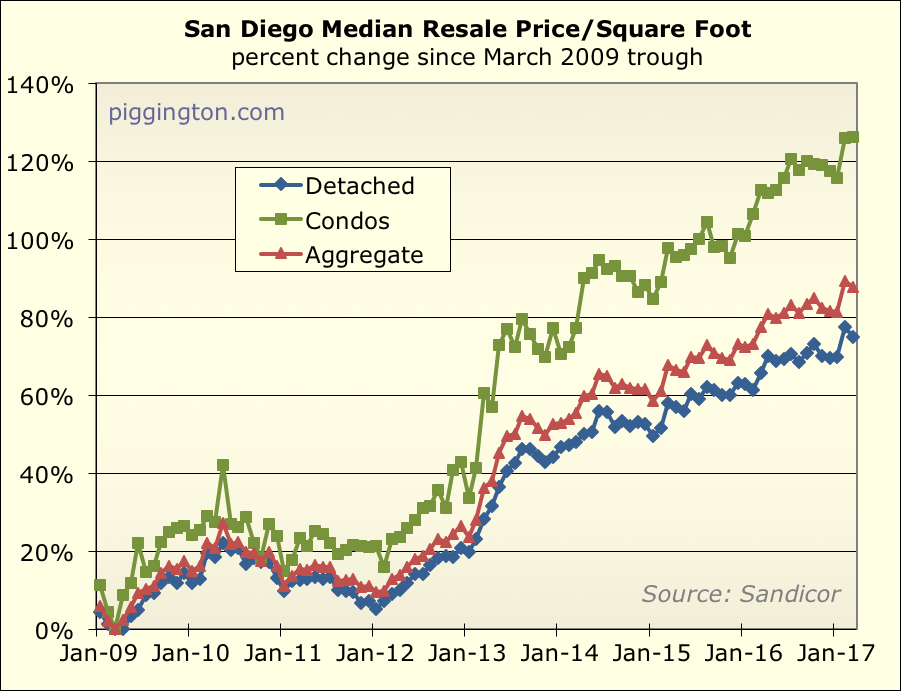

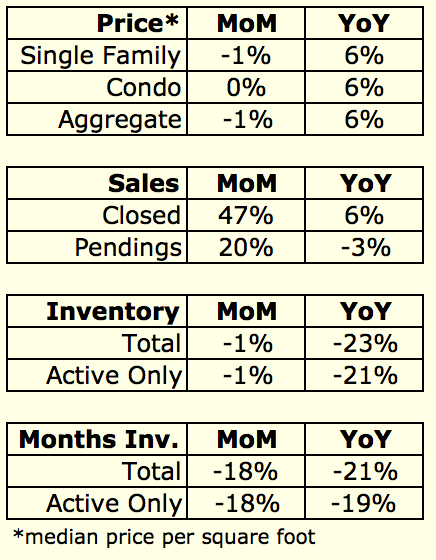

month’s update, we saw an unusually large one-month jump in the

price-per-square-foot metric, with single family homes up 4.5%. This

month, prices by that measure pulled back by 1.4%, indicating that some

of the increase was month-to-month noise. Still, when you combine the

two months, it makes for a robust 3.0% increase in February and March

together. By comparison, last year the single family ppsf rose by 1.7%

over the same period.

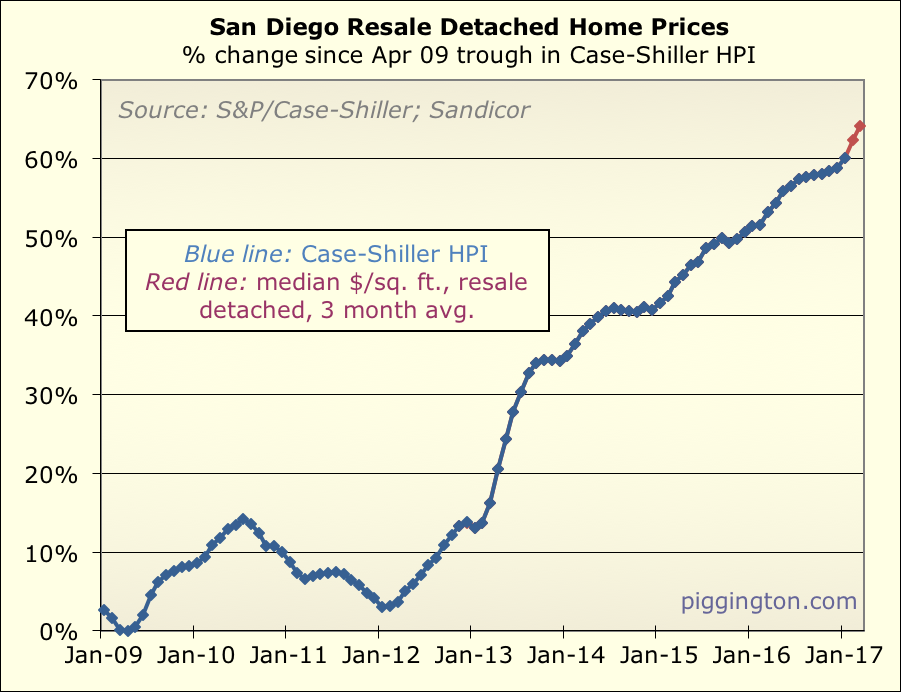

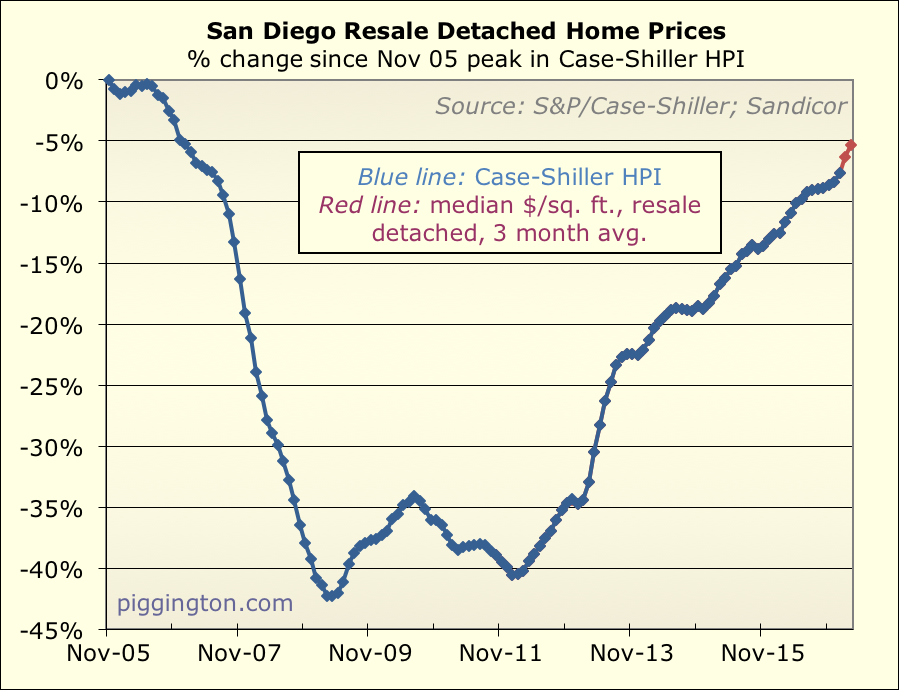

Here’s the 3-month average of the single family ppsf in red, which

gives a better idea of the underlying trend.

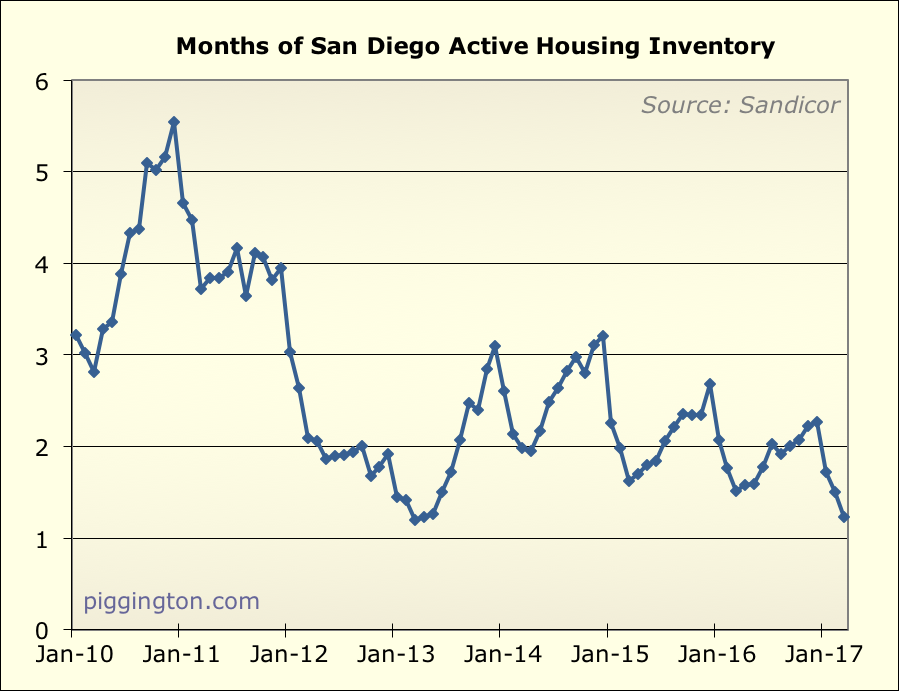

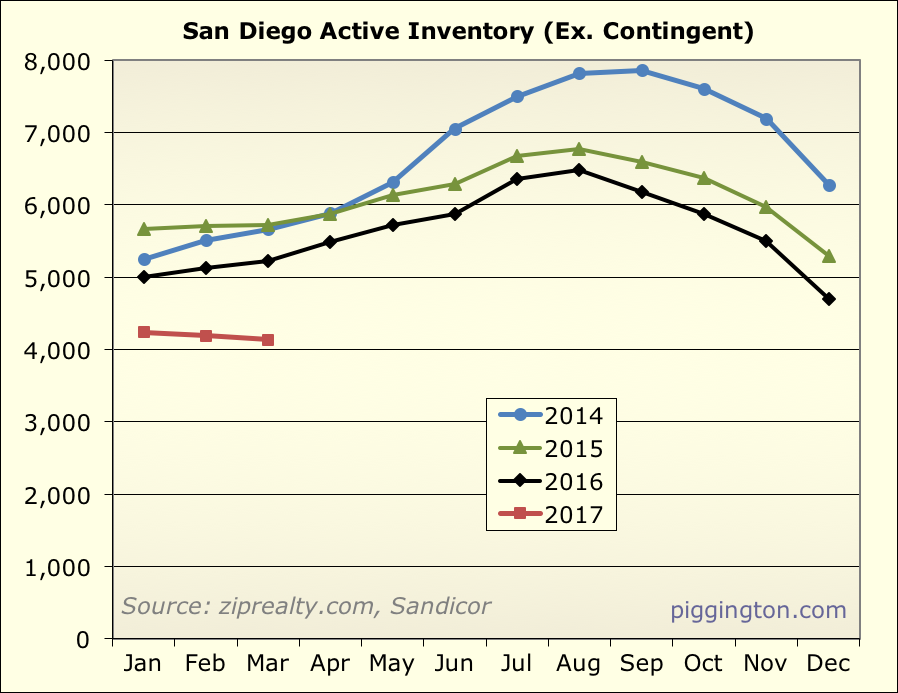

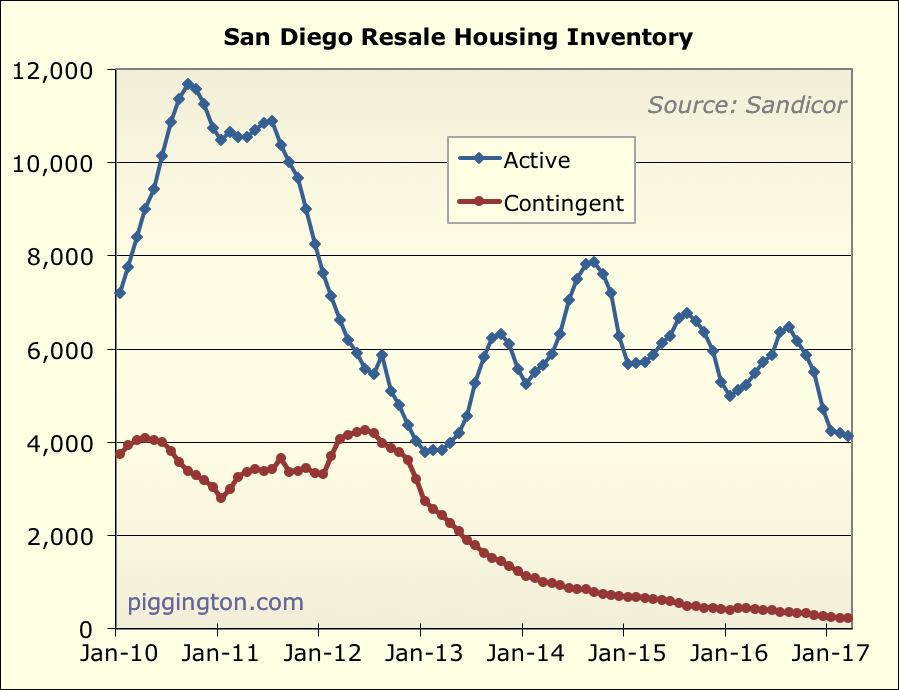

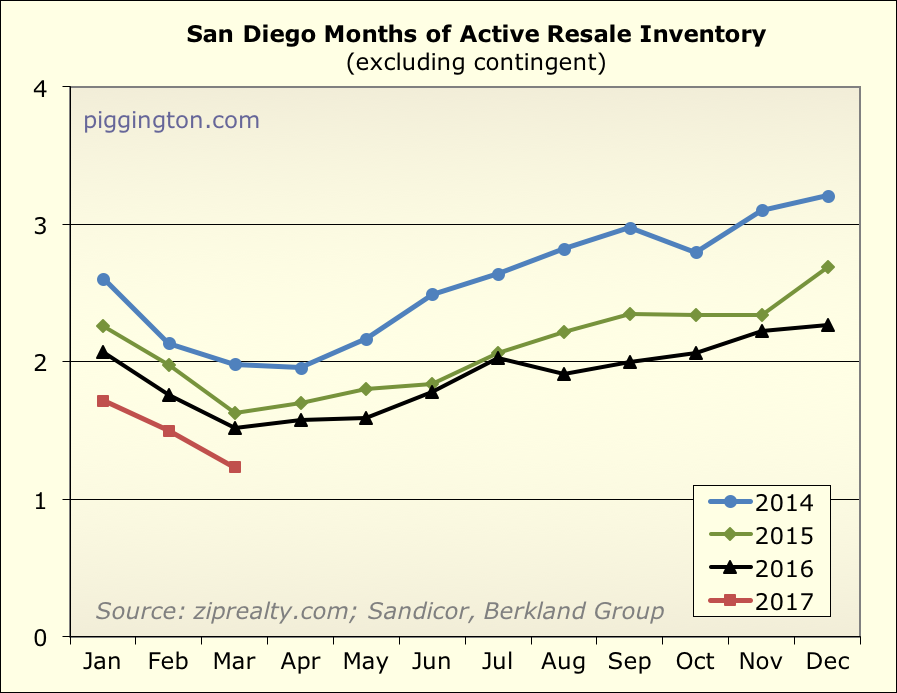

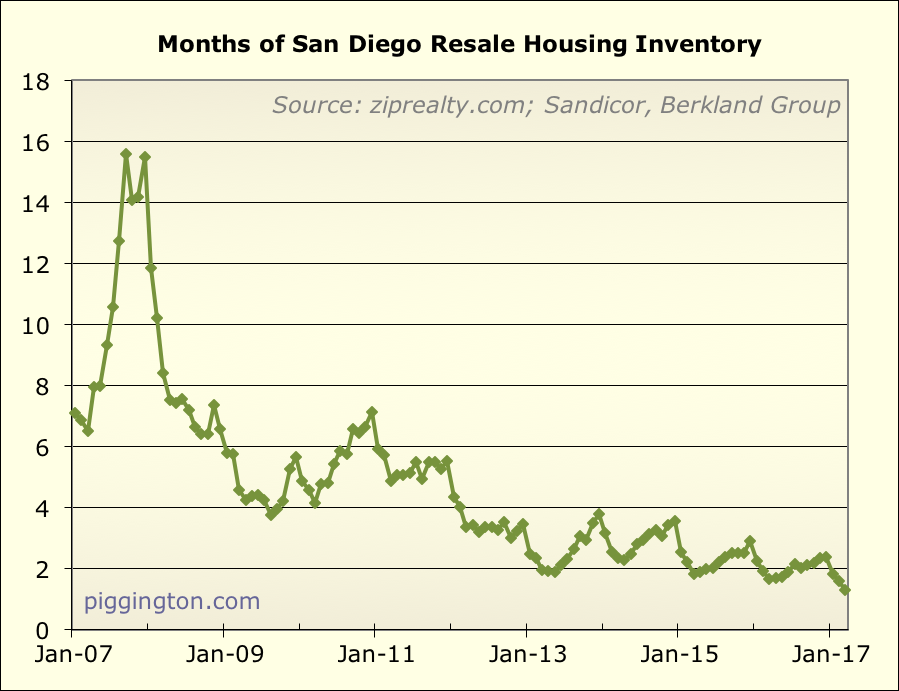

So despite the monthly noise, the price trend is strong — which is

what you’d expect given that active inventory is really low. Like,

2013-level low:

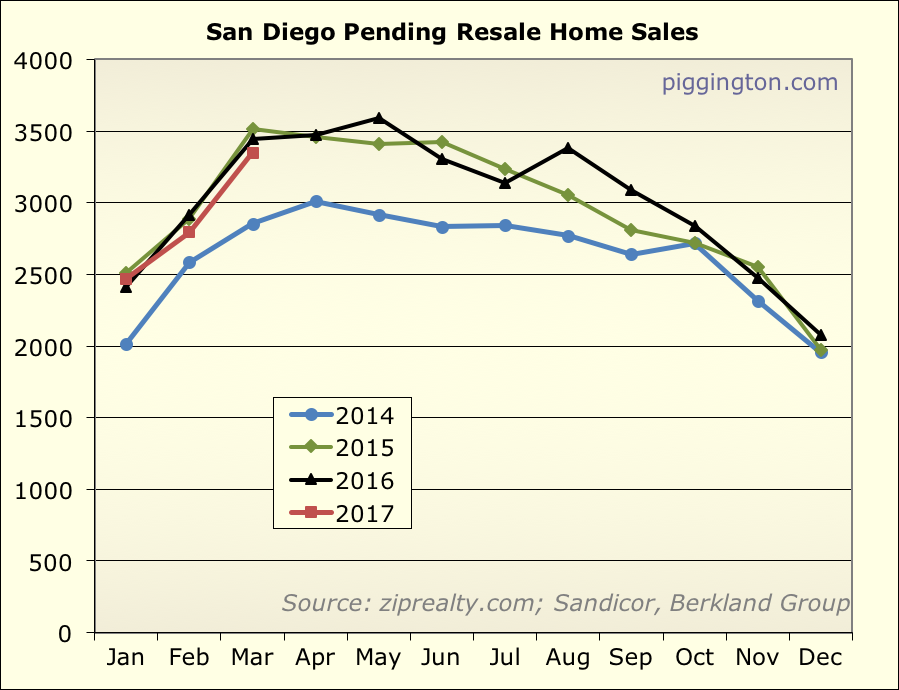

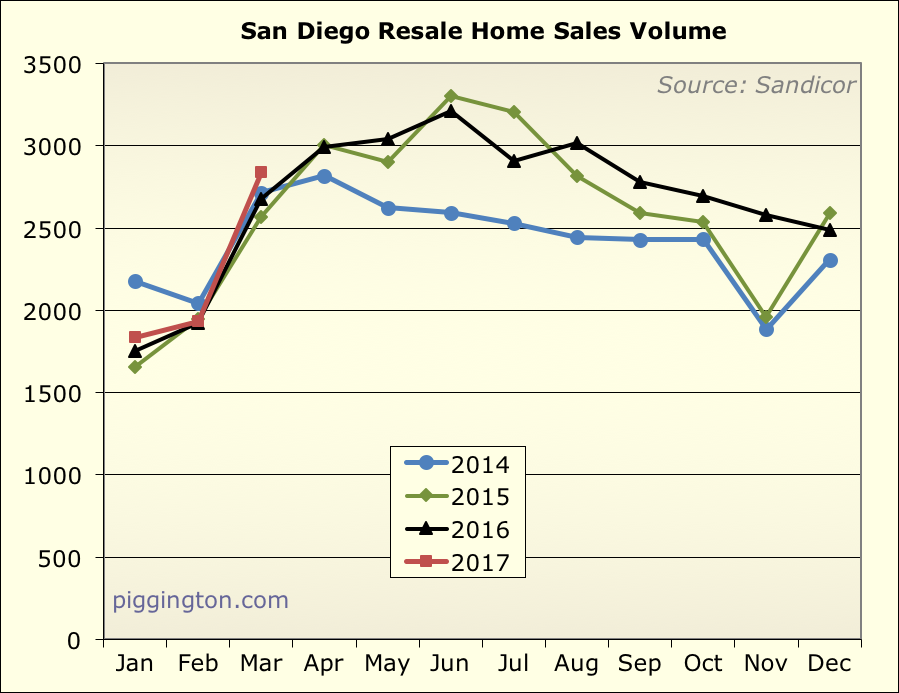

This, by the way, is not the result of a change in demand, which is at

pretty normal levels…

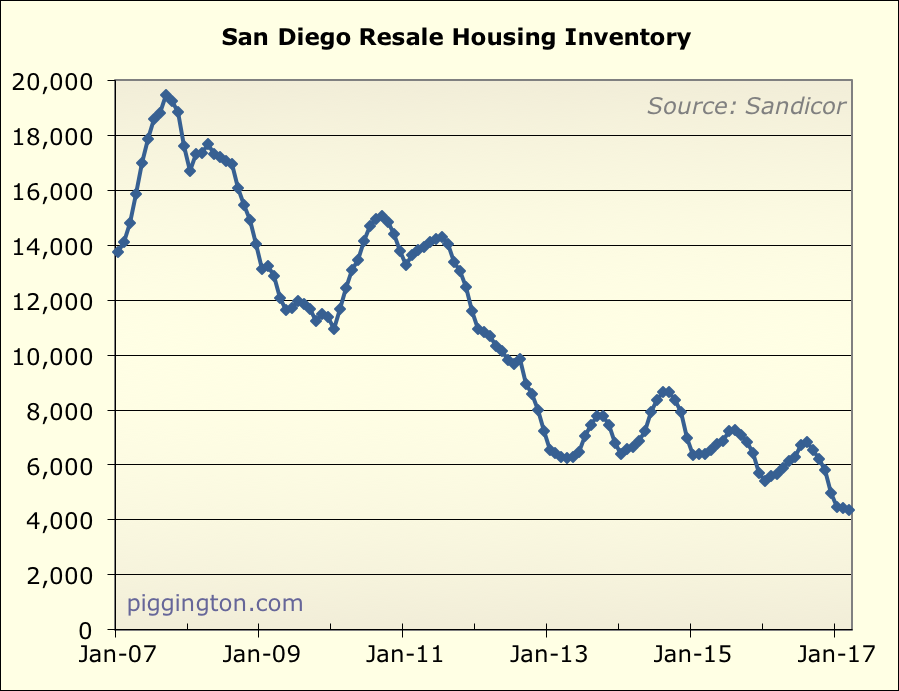

…but rather by a scarcity of homes for sale:

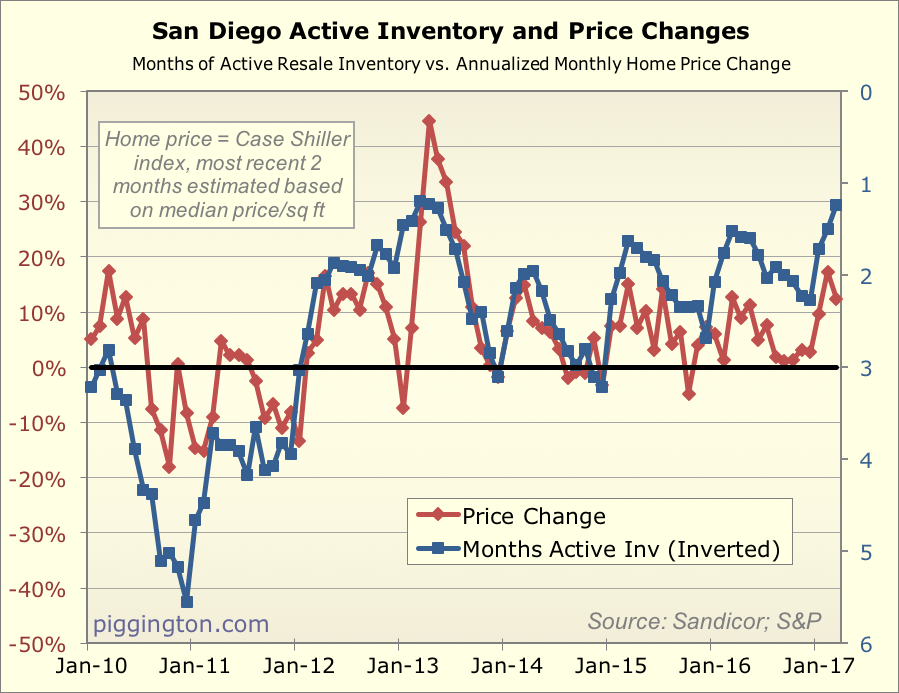

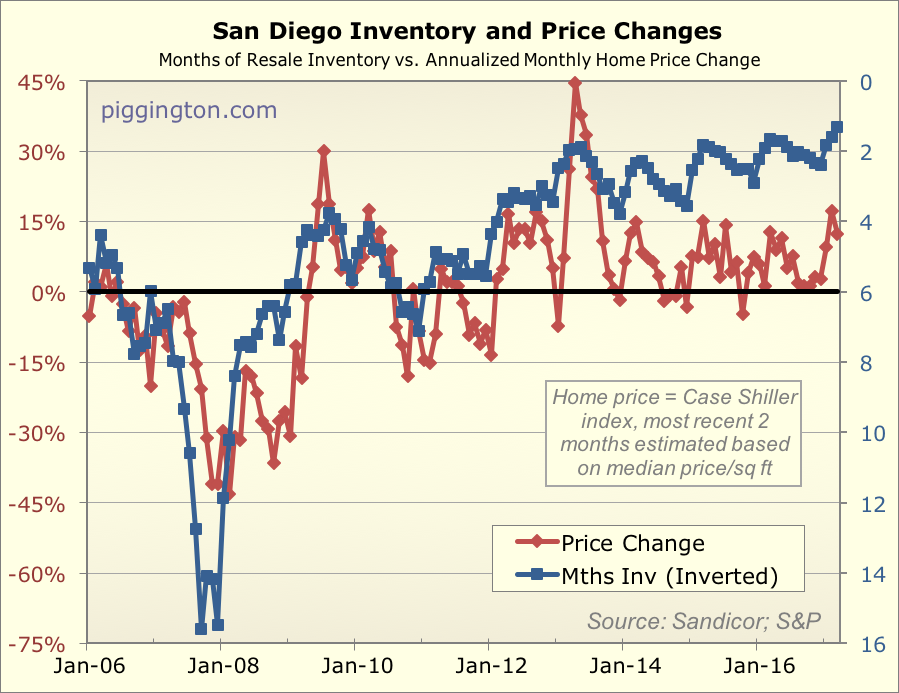

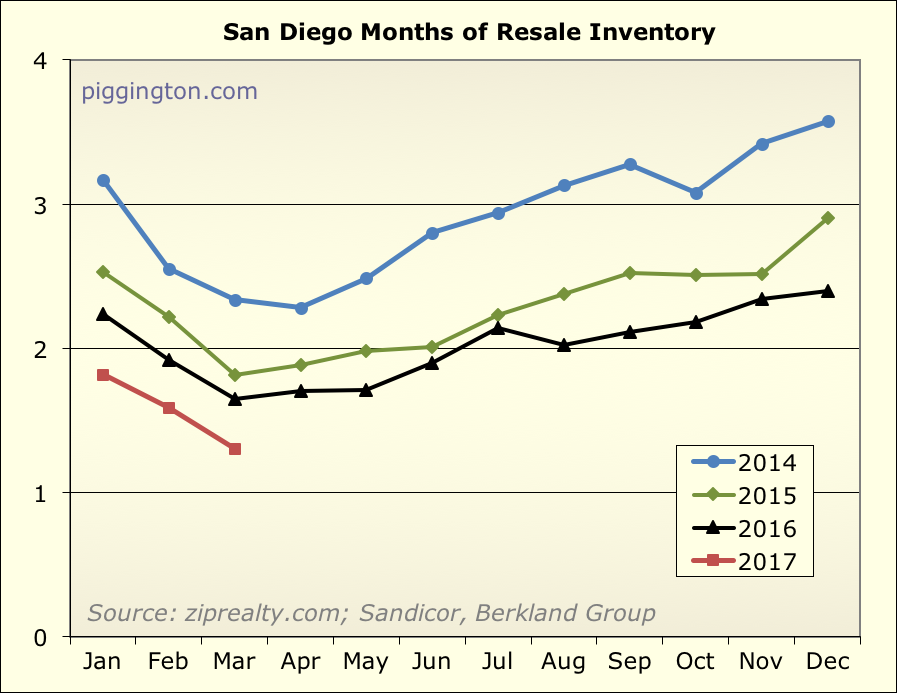

The low months-of-inventory in 2013 was similar to now, in that it was

driven by a normal-ish level of sales along with very low active

inventory. And, ‘member what happend then? Prices went bonkers,

is what happened, increasing 18% (Case-Shiller) for the calendar year.

Of course, that was off a significantly lower valuation base, but then

again, the months-of-inventory figure accounts for the level of demand

at whatever the current valuation is, which is probably one reason why

the relationship shown below has worked reasonably well across very

different valuation climates:

As kind of crazy as it seems, if months of inventory stays this low, a

2013-style price surge is in the realm of possibility. I’m looking

forward to seeing what the data tells us in the months ahead.

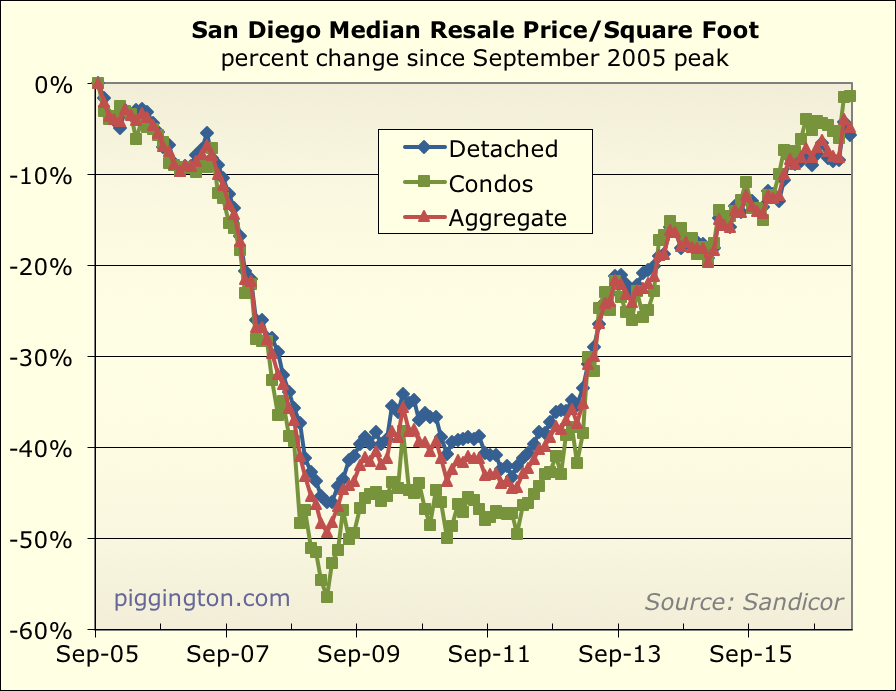

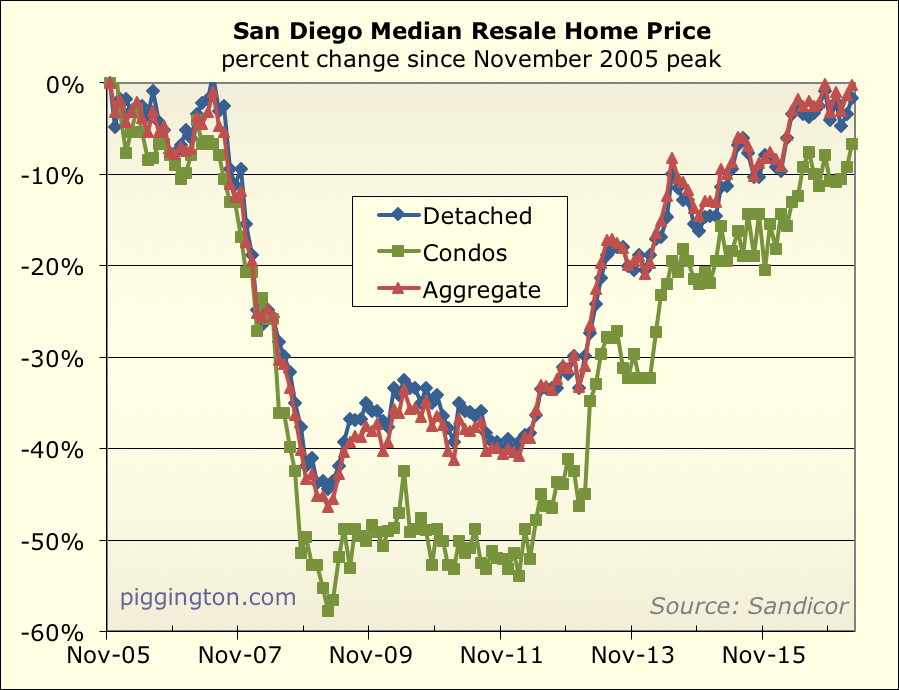

Further charts below (and if you want a flashback to what a real bubble looks like… enjoy).

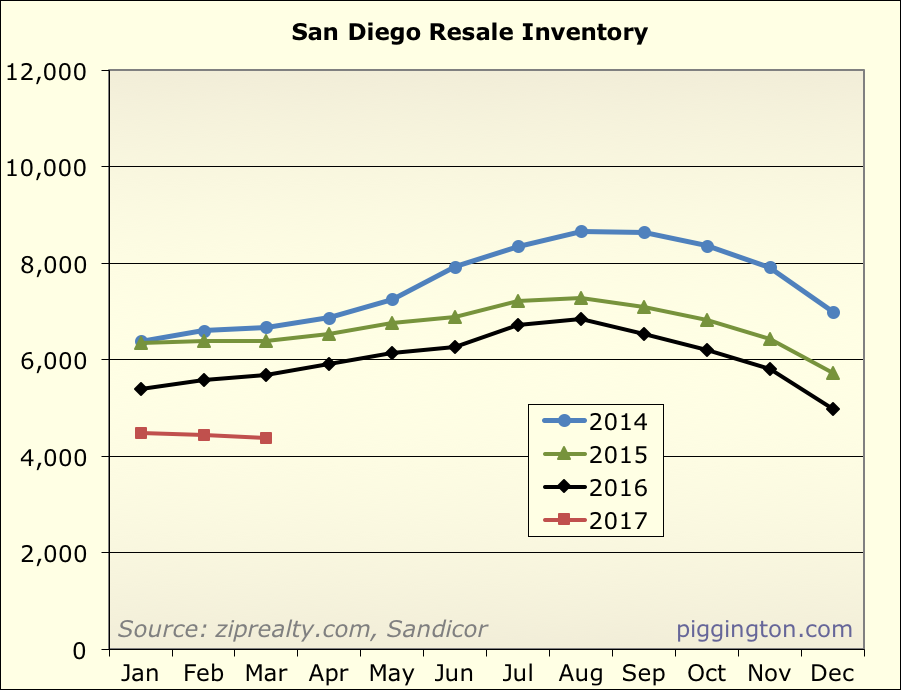

Last year was a “normal” year

Last year was a “normal” year and inventory rose from Jan to March from about 5500 to 5800, but for 2017 it looks like it fell from an already low 4200 to about 4100.

If rising early year inventory in the high 5000s led to a 7% house price gain in 2016, it seems like 2017 should be 10%+ with inventory in the low 4000s and falling.

Could you add the 2013 data

Could you add the 2013 data to the charts? It seems like the most direct comparison to now, it would be nice to compare directly on the graphs. Thanks!

Inventory is low because

Inventory is low because prices are/were rising — sellers are holding on with the hope of even higher prices and are afraid they won’t be able to buy something else if they sell.

The difference between 2013 and now is that prices are relatively high compared to the 2010s lows. Anything that will flatten prices (like an overdue recession) will shoot inventory up and repeat the cycle.

It’s not a credit bubble. It’s an artificial scarcity bubble.

SPD, why is the scarcity

SPD, why is the scarcity “artificial?” A large part of it is continued pop growth but no more new construction. Prices going flat will result in even less new construction.

I don’t agree there are more “shadow sellers” itching to sell when prices stop rising. Few people need to sell, just the normal churn from relocating and resizing. If anything, the extreme lack of inventory is creating an army of shadow buyers. We used to have 40+ condos for sale in 92107. Last time I looked, now there are only 4, two very expensive oceanfront units and two townhouses. If you want to buy just a regular apartment style condo at the market price, there are 0 for sale and you are a shadow buyer. I have also noticed that a very high share of the scanty inventory are renovation flips. Those will peter out soon too as the number of fixers to hit the market has been declining steadily.

So if anything, these flippers are artificially increasing inventory.

gzz – and population was

gzz – and population was still growing with very little new construction when the 40+ condos were available. The market (especially in CA) is not a rational thing.

The earlier (pre-2009) bubble was actually characterized by relatively high inventory and high growth in prices. All during a time of population growth and limited (obviously non-zero) new construction in central SD.

It’s all psychological. Do you feel lucky? Right now, people feel lucky and hope for increased prices, so they hold what they own. The moment they stop feeling lucky (Trump bubble going “phut”), that incentive to hold evaporates.

Every owner is a shadow seller. Everyone with a down payment is a shadow buyer. The only question is: what conditions turn them into actual buyers and sellers?

PS – looks like trustee sales have restarted…

https://www.auction.com/residential/ca/san-diego-county/2_cp/

biggoldbear wrote:Could you

[quote=biggoldbear]Could you add the 2013 data to the charts? It seems like the most direct comparison to now, it would be nice to compare directly on the graphs. Thanks![/quote]

Yes, good idea. I will do this for next month.

People have been throwing

People have been throwing around the term artificial for the housing market on this and other blogs since the beginning.

Artificially low supply leads to the current price increases.

Artificial demand due to easy money loans helped lead to the bubble.

Artificial changes in money supply after going off the gold standard, led to artificial inflation in the 70s and 80s.

Artificial birth rates in the late 40’s to 50’s led to artificial demand in the 60s

WWII led to artificial demand for new homes due to the return of soldiers.

Artificial demand caused by the industrial revolution led to the rise of urban America in late 19th century.

Our modern economy is humanly contrived, which naturally makes it all artificial.