It’s time for a little update on the long-term aggregate housing valuation charts. (The emphasis is on the word "aggregate" — let’s just get it right out of the way these charts are based on a single home price measurement that encompasses the high end, the low end, and everything in between).

To sum it up, we’ve gone pretty much nowhere since the prior checkup on these numbers as of December 2008.

The home price-to-income ratio had dropped further in the early part of the year, but rising home prices and falling incomes have combined to nudge the ratio back up in recent months.

I should note here that because there are no local income figures available yet, 2009 San Diego incomes are estimated based on the change to nationwide incomes. Also, the past couple of months’ home prices are estimated based on changes to the size-adjusted median single family home price.

The price-to-rent ratio has also notched some gains during the spring/summer rally, but the increase here was not as large as that of the price-to-rent ratio because the BLS actually measured an increase in San Diego rents for the first half of 2009. I am skeptical of this result, but as you can see in the chart below it doesn’t make that much difference. Home price changes are the big movers on these charts, and as with the price-to-income ratio, the price-to-rent ratio ended up being very near what it was the last time we checked it in late 2008.

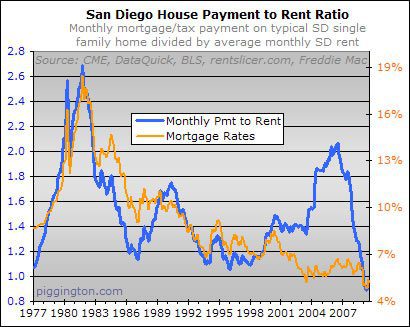

The next two charts update the monthly payment-to-income and payment-to-rent ratios. Both are up off their early-2009 lows, of course, but not by much — and those were all-time lows:

Of course, the apparent "cheapness" of the payment-based indicators has more to do with ridiculously low mortgage rates than with purchase prices being cheap. Believing that the last two charts indicate that San Diego homes are sustainably undervalued requires believing that mortgage rates will stay at or near current levels. That is not a belief I share, to put it mildly.

The more important price-based valuation metrics show that, in aggregate, San Diego homes are neither overvalued nor undervalued based on their historical relationships with rents and incomes. This was the case as of the prior update on these numbers, so given that the numbers have barely budged it should be no surprise that the conclusion is the same this time around.

If you erased the part of the

If you erased the part of the graphs from about 2003-2007 and modeled it after the previous cycles it would look…..normal. What the good lord giveth, it appears he took away. Outside of the pockets of resistance, it is actually a reasonable world once again. We’ve spent a couple of months talking about the disconnect a few areas are experiencing and those areas are some of the best places on the planet if you were to back up and take in the big picture. “Life, Liberty and a house near the beach in Southern California” is not was written, I double checked. But once again, for the working stiffs, for the young couple looking to have a stay at home parent, for the retired couple, as long as they don’t want a steak on a hot dog budget, they can buy a house for an old fashioned portion of their income, I say that is a good thing. It was also inevitable.

Rich-

Thanks so much–your

Rich-

Thanks so much–your charts have proven invaluable over the last few months as my wife & I monitor things to decide whether to dive in the pool or not. These charts give me a lot more comfort than I’ve had before that we’re getting close to the right time.

As you note though, these are aggregate numbers. Do you or anyone else have these kinds of data broken out by segment? In particular, since it’s been sticky, I’d be curious to see the high end curves. I notice that the P/I chart (#1) has bottomed just slightly above where the standard trough has been, and I’m guessing that’s an artifact of the high end stickiness…

Thanks so much!

Check out Pigg Eugene’s site

Check out Pigg Eugene’s site at:

http://sdhpi.blogspot.com

No valuation charts, iirc, but he does show how prices in various areas have changed since 2000 or so, so you can compare how over/underpriced areas are compared to the beginning of the decade.

rich

PS – Re your second paragraph… I would not characterize it as the chart having bottomed… there is no way to know that right now. I suspect that these charts have NOT bottomed out.

To my point on the prior

To my point on the prior thread, Eugene’s 3 tier graph does an excellent job of showing the high tier increased about 120% between 2000 and the peak while the low tier increased 190%. That pretty much flys in the face of the questionable hypothesis some hold that percentage declines in the high tier will mirror those in the low tier.

Looking at chart 1 & 2, we’re

Looking at chart 1 & 2, we’re not quite there yet in term of price. But looking at char 3 & 4, it seems like for people who only care about monthly payment, right now in some areas, it’s cheaper to buy than anytime in the last 30 years. I guess the big question is, how long can they keep rates at this level. Based on chart 3, between 1977-1987, average rates were around 12-13%. Between 1987-1997, average rates were around 8-9%. Between 1997-2007, average rates were around 6-7%. Only time will tell what 2007-2017 average rates will be.

No valuation charts, iirc,

No valuation charts, iirc, but he does show how prices in various areas have changed since 2000 or so, so you can compare how over/underpriced areas are compared to the beginning of the decade.

I do valuation charts from time to time. Here’s an old one

[img_assist|nid=11732|title=|desc=|link=node|align=left|width=100|height=71]

Thanks for the nifty charts

Thanks for the nifty charts Rich, very helpful.

I keep hearing people say that we’ve hit the bottom. Some point to the recent small increase in home prices. But Rich has previously pointed out that this is most likely seasonal and temporary, as in past downturns and corrections. Some point to charts like Rich has posted here, saying that since we’ve matched a prior trend that we’re “back to normal”. Why can’t the market continue to fall below prior trendlines?

It’s hard for me to believe that we’ve bottomed out here in San Diego, taking into account the record low mortgage rates, massive government involvement and manipulation in the market, falling wages, high unemployment, and most importantly, the still massive amount of foreclosures that are likely headed our way.

I do believe that the lower end areas in San Diego county may have hit bottom, or at least are very close. However, I will not be surprised to see prices continue to fall, especially in the mid and upper end areas.

Yeah, this is what I was

Yeah, this is what I was driving at. I said “bottomed” when I should have said plateaued–what I was curious about was how much further the middle and high ends have to fall in order to correspond to norms if you break them away from the low tier.

I’m also finding the notion

I’m also finding the notion of what exactly consitutes the middle and high-end is getting harder for me to grasp. C-S currently has mid at $267-$398 and high as everything above that. A year ago mid-tier was $372-$552.

I get that it all comes down together (including the tier definitions), but it seems like the current mix of sales being weighted to the low-end simply contributes to the illusion of a return to norms.

sdcellar–

I think so too,

sdcellar–

I think so too, because of what I am seeing watching the RB area.

Specifically, I personally looked at some condos in RB in 1995, near the previous bottom, which at that time were selling for $100K. Now those same condos sell for slightly over $200K. Using the government’s charts of inflation over the years, I calculated that the 1996 value, compensating for inflation, would be equivalent to about $140,000, which happens to have been the 1999 or 2000 nominal price of those condos.

Other Piggs have also commented that nominal 2000 or so prices would be equivalent, in buying power, to the 1996 bottom.

Meanwhile, a typical SFR in RB, currently valued at about $640K, retailed for a hair over $300K in January 2000.

This rule-of-thumbing implies to me that if RB prices were to drop to equivalent to the 1996 bottom, their nominal value would fall by half from their current level. Call me a dreamer if you will.

Rich Toscano wrote:

Of

[quote=Rich Toscano]

Of course, the apparent "cheapness" of the payment-based indicators has more to do with ridiculously low mortgage rates than with purchase prices being cheap. Believing that the last two charts indicate that San Diego homes are sustainably undervalued requires believing that mortgage rates will stay at or near current levels. That is not a belief I share, to put it mildly.

[/quote]

Following this idea, is it your suspicion that the overall cheapness (or lack thereof) will hold (presumably facilitated by lower sale prices or rent/income increases) or that things (prices and/or payment will get less cheap as a function of income and rent?

urbanrealtor wrote:Rich

[quote=urbanrealtor][quote=Rich Toscano]

Of course, the apparent "cheapness" of the payment-based indicators has more to do with ridiculously low mortgage rates than with purchase prices being cheap. Believing that the last two charts indicate that San Diego homes are sustainably undervalued requires believing that mortgage rates will stay at or near current levels. That is not a belief I share, to put it mildly.

[/quote]

Following this idea, is it your suspicion that the overall cheapness (or lack thereof) will hold (presumably facilitated by lower sale prices or rent/income increases) or that things (prices and/or payment will get less cheap as a function of income and rent?[/quote]

Hi Dan — What I was referring to specifically is my belief that interest rates will rise substantially at some point in the years ahead. That is the highest-confidence forecast I have regarding any of this housing stuff. I am less confident on just how home prices will react, but it seems that either payments will go up (if prices stay about the same) or prices will go down to keep payments in rough parity with rents, or both. So the whole point of that bit is that the low payment ratio is kind of an illusion that hinges on something that i believe is temporary. Is that what you were getting at? Not sure if I answered the right question there.

rich

Rich Toscano wrote:What I was

[quote=Rich Toscano]What I was referring to specifically is my belief that interest rates will rise substantially at some point in the years ahead. That is the highest-confidence forecast I have regarding any of this housing stuff.[/quote]

When you say at some point, do you forecast it rising substantially 5-10 years from now or more like 2-5 years from now? I think that alone can make a huge difference. Considering the median household income has risen about 35% over the last 8 years in nominal term, but it’s basically flat when you adjust for inflation. So, if rates rise substantially over 5-10 years might not have as big of an impact in price than if it rise substantially in the next 2-5 years. Don’t you think?

I personally thought rates would head to 8% by now, considering it was pushing above 6% 2 years ago. However, the economy crashed and the government have forced rates to be this low. Do you see rates rising w/out economic expansion or w/out inflation?

I see rates rising when our

I see rates rising when our foreign creditors finally come to terms with the reality that there is no politically viable way for us to pay them back what we owe them, at least not in real terms. As for when it happens – that’s never been my strong suit.

Rich

“no viable way for us to pay

“no viable way for us to pay them back what we owe them”

ie, a debt that can’t be repaid won’t be repaid

Maybe we can sell them

Maybe we can sell them Alaska. j/k

Rich Toscano wrote:I see

[quote=Rich Toscano]I see rates rising when our foreign creditors finally come to terms with the reality that there is no politically viable way for us to pay them back what we owe them, at least not in real terms. As for when it happens – that’s never been my strong suit.

Rich[/quote]

This is my bet (literally) as well. 😉

What I gather from reading

What I gather from reading these comments and charts is that one better be prepared to stay in their house for a very long time if they buy at today’s historically low rates and still-high prices.

Tomorrow’s buyer will not have ~5% rates to enable higher affordability.

We could easily have deeper value losses as rates increase. Add in transaction costs and the road to real equity gains becomes even steeper. But, timing is everything as Rich says.

It seems if you’re planning to stay in SD forever and have no need to move in forseeable future now is an ok time to buy.

Rich knows alot more about

Rich knows alot more about this kinda stuff then me, so take what I say with a HUGE grain of salt (read I am making this S%&t up), but I foresee two different events happening to adjust rates up.

This next year (12 months, I forsee an extension coming by October if things arnt not measurably better) I see BB ending his debt buy back/printing to buy down treasuries programs, and T-rates going back up to 4.5-5%, causing morgage rates to go to the 6.25-6.75% level, back where they were when the economy sucked, Creditors still purchased treasuries just like they always did, and fannie/freddie were loosing money but still doing their thang. (Ie where things were before uncle ben steped in with his helicopter money)

Itll take a while longer than that for our creditors to ‘wake up’. I would think more than 3-5 years. They buy treasuries to make sure their currencies dont increase compared to the dollar, supporting their export industires. What is that old saying about getting someone to understand something if their job depends upon them not understanding it? ALot of politiclly powerful people are getting rich on this flow of wealth to the USA, and they wont like it stopping just because it is the smart thing to do for the country as a whole.

Very well stated DWC… I

Very well stated DWC… I agree.

rich

Thanks Rich, always good to

Thanks Rich, always good to know I am not totally full of crap. Or, atleast, I am not the only one. 🙂

Also, could anyone enlighten me on something? I keep seeing yeilds on the 10 year go up to ~3.7%+, and then suddenly plummet to 3.4%. WTF is going on there? No one talks about it, and it happens in the midst of stock up/down swings, so it isnt ‘flight to safety’ stuff. In my head I have it all pegged to the Fed, but I dont really follow markets so I dont really know. It just seem like on Friday yeilds are 3.75% and on Tuesday they are 3.45% and I am thinking WTF! It is like there is a magical ceiling that everyone knows is there but no one talks about.

DWCAP wrote:Thanks Rich,

[quote=DWCAP]Thanks Rich, always good to know I am not totally full of crap. Or, atleast, I am not the only one. 🙂

Also, could anyone enlighten me on something? I keep seeing yeilds on the 10 year go up to ~3.7%+, and then suddenly plummet to 3.4%. WTF is going on there? No one talks about it, and it happens in the midst of stock up/down swings, so it isnt ‘flight to safety’ stuff. In my head I have it all pegged to the Fed, but I dont really follow markets so I dont really know. It just seem like on Friday yeilds are 3.75% and on Tuesday they are 3.45% and I am thinking WTF! It is like there is a magical ceiling that everyone knows is there but no one talks about.[/quote]

I’ve noticed the same thing, as I’m largely into bonds and other fixed-income investments. Not heard any explanation, but my tin-foil-hat theory also says it’s the Fed buying them (or some entity closely related or controlled by the Fed or Treasury). Would love to find out what’s really going on, but it is definitely unusual.

I’ve always heard that home

I’ve always heard that home prices are fairly valued when they are 3 to 3.5 times income. So we bottomed out at about 6 and now we’re at 8. Can anyone enlighten me on why San Diego is different and not subject to normal accepted ratios?

The 3x income is what an

The 3x income is what an individual should borrow to be safe, ie. you make 100k, don’t buy or at least don’t take a loan greater than 300 or 350k. Obviously if you make 100k, you sell the house you have had for 20 years, clear 400k in profit, you can shop above 400k if you like, even if you pay 600k, your loan is only 2x income and that is a conservative play even though the price is 6x your income.

The disconnect is that the historical median pay to median house price and the reccomended debt to income is not the same. There are reasons for that, the biggest being that only about half the population buys houses but all of the population is added into the median income. 19 year old college kids with part time jobs don’t buy houses but they are part of the median income stat. Median income to median house has never been 3x, never will be, but we use the stat because it is one that we can get at, both are published statistics. Median buyer to median house is probably 3x right now. If you took the actual median income of the homebuyers you would hitting the middle of the top half that actually buys houses, and that would be closer to the 75th percentile of earners.

Then you have to get into the difference between median income and median household income, because some households have more than one earner and of those that have just one earner, sometimes they are households of only one person, so they are not in the market for large suburban homes. It can get confusing, so the easiest thing to compare is the same parameters over different years, even if it is not a true measure of who is buying, median to median ratio of 5-7 is low, 11 is high, based on history, but you do not multiply your income by that factor and go shopping.

poorsaver,

we have gone round

poorsaver,

we have gone round and round on that one before. I am sure you can find some interesting threads on it, with alot of different point of views.

The reality of it though is two fold,

1) Median income doesnt equal median house. Students dont buy houses, Nor do retired people (atleast not in large numbers/pre bubble). The working poor have little to no hope of ever buying a house, without the governemnt just giving them money that is. (What was that stat, CA has 11% of the population and 30% of our welfare reciepients.) These people arnt buying houses. The median income encompases a broader group of people than those buying median houses.

-note houwever, that one could also point out that people who are in their highest earning years, say 50’s to early 60’s, already own houses and arn’t really going anywhere either. They skew the numbers up some. So what to take from this is that housing is priced at the margin, not the average. There will always be someone buying a house, and someone selling a house.

2) San Diego is an expensive city, and an expensive city in CA. Ca is FULL of property speculators, rich people looking to diversify, and immigrants who are very emotionally attached (not to take away anything from the native borns emotional attachments) to ‘home’. Peoples perceptions of ‘value’ matter alot, and in CA we have been conditioned to think any/all housing is of high value. That is why people were building McMansions in BFE and driving 2 hours each way every day. They were investing in their houses and not in themselves.

DWCAP wrote:poorsaver,

[quote=DWCAP]poorsaver,

Peoples perceptions of ‘value’ matter alot, and in CA we have been conditioned to think any/all housing is of high value. That is why people were building McMansions in BFE and driving 2 hours each way every day. They were investing in their houses and not in themselves.[/quote]

LOL. If all goes well I will soon, pardon my language, get the **** out of this whack-*** banana republic and leave the imminent “wealth-building” to the rest of you hot shots.

I recently enjoyed a tour of CO, UT, NV and the quality of life enjoyed in the first two is head and shoulders above the average joe trying to squeeze out a meager existence in coastal CA. And inland CA, unless one is a wealthy retiree in Palm Springs, is a backwater cesspool that makes the lesser areas of the deep south look good. This goes for Las Vegas as well. Every time I leave that city I feel like I just left an Indio Wal-Mart and need a 2 hour bath.

DW, you just described the mindset that can only lead to economic tears and perhaps a few dollars for the lesser fools.

Last one to leave this bombed-out laughingstock casino cum con game turn out the lights.

DD,

Ha, ha, you sound like a

DD,

Ha, ha, you sound like a bitter City-Data poster.

Key phrase: “I recently enjoyed a tour”

But, yeah, this con game sucks ass. I like the casinos, though, despite never going. You know, for $$$ reasons.

Folks, the problem is much

Folks, the problem is much more complex. As Rich points out, the affordabilty is lower due mainly to unsustainable and artificially low interest rates. The Fed is now monetizing our debt to keep these rates artificially low. This will end at some point. Then we have the issue of the coming tax increases in 2010 as the Bush tax cuts expire. So, any chart which attempts to compare income to price has to be adjusted for the higher tax rates. In other words, it is take home pay not income that matters. Next, social security payments will not see COLA increases for the next two years. Therefore anyone receiving these payments will lose ground in affordability. The main question going forward is whether or not the coming inflation is going to include the housing market. On one side of this equation the inevitable rising interest rates will greatly depress home prices, but in times of inflation people will be inclined to put their money in real assets (e.g.- gold or real estate). Those with existing fixed rates will not see a rise in rates. So the question of whether or not housing will rise comes down to ratio of fixed loans versus resetting loans. In our recent bust, the ratio of resetting loans was too high and the crash happened. This is the chart we need, but I do not know how to find it. What is the ratio (for all current real estate) of resetting loans versus fixed loans. What was this same ratio during our recent bust.