Well, I thought the old “Shambling Toward Affordability” title for

this series of articles was a bit pithier but it just doesn’t

quite work now that home prices have been rising for the better part of

a year. In any case, regardless of the what we want to call it,

it’s time to check

in on San Diego housing valuations as of year-end 2009.

The 2009 home price rally reversed the direction of the shamble, but

it didn’t really change the overall picture, which is that San Diego

home prices (in aggregate, of course) are still at middling levels of

valuation.

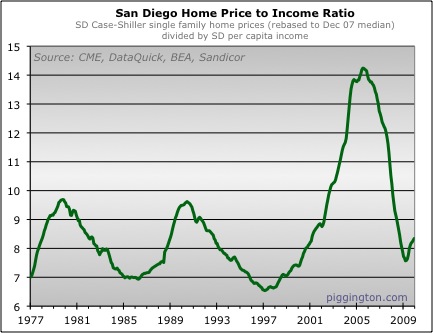

Here’s the price to per capita income ratio:

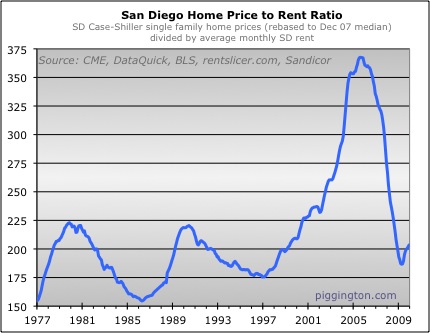

And the price to rent ratio:

Neither are close to “cheap” territory, but neither are they

expensive. As a matter of fact, the price-to-income and

price-to-rent ratios are, respectively, just 1.5% and 1.6% above the

median ratios since the data series started in 1977. Those

medians are admittedly skewed upward a bit by the recent protracted

boom period, but still, it shows that valuations are not too terribly

far out of whack.

Of course, these ratios don’t take heed of issues like shadow

inventory, the sustainability (or lack thereof) of the government

intervention that has played a big role in the recent rally, and so

forth. But that’s not what they are about — they are about

comparing home prices to their historical relationship with rents and

incomes, and from that standpoint prices are still within reason.

Mind you, that is the aggregate San Diego home price as measured by

the Case-Shiller index (or my proxy thereof, for the last couple

months). As we all know, different areas of San Diego may exhibit

a very different valuation profile. These countywide graphs

provide a starting point and a good 5000-foot view — they do not

substitute for area-specific due diligence.

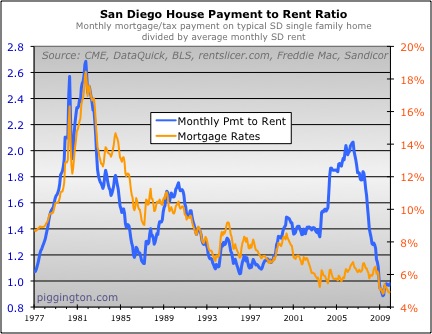

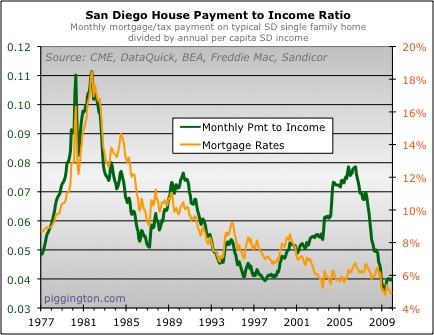

As opposed to the middle-of-the-road valuations for home prices,

monthly payments on homes are pretty much as cheap as they’ve ever been:

Since home purchase valuations are not all

that cheap, the low payment ratios are obviously a result of

ridiculously low mortgage

rates (helped to their current levels by heavy-handed government

intervention). As I’ve frequently pointed out, this is

nice if you are a buyer who is going to lock in at these low rates for

the very long term. But as far as it relates to home valuations

it’s not all that relevant. Low rates can provide a temporary

boost to the

market, but unless rates are going to remain low for a long time*, the

fact that they are low right now doesn’t affect the level of home

valuations that San Diego can sustain over the long term based on local

incomes and rents.

* –

They’re not.

I like to update the payment ratios

because they are interesting and they definitely have an impact on

current market conditions. That impact is extremely favorable,

obviously — which is to say that however the housing market is doing,

it would be doing worse than that if rates weren’t so low. But low rates should not be

used as an argument in favor of higher valuation ratios, as they often

are, because it’s

never worked that way (nor should we expect it to, for reasons

described in the previous paragraph).

For what it’s worth, I expect the

valuation ratios to go lower at some point in the years ahead.

The main reason is that all the government stimulus borrows from future

demand, so when the time comes to “pay back” that demand, there will be

downward pressure on valuations. The (potentially severe) rate

increase that I expect at some point would also put downward pressure

on valuations. (That would be no more permanent an effect than

the current low rates’ impact on valuations, but it could push them

down for a while).

This expected decline in valuations

doesn’t necessarily imply lower nominal prices, as currency debasement

could cause everything to rise in nominal terms. It just implies

that when the government stops providing so much housing-specific

stimulus (if they stop

providing so much housing specific stimulus), home prices will likely

begin to fall in relation to rents and incomes.

You’re awesome, Rich! 🙂

I

You’re awesome, Rich! 🙂

I noticed on your first two graphs that they are “rebased to Dec 07 median.” Are you referring to the wages and rents? If so, might it be relevant that wages and rents have been falling since then?

Not sure if it means anything, or if the declines in rent and/or wages are significant enough to change things materially.

Hi CAR – That is referring to

Hi CAR – That is referring to the home prices, specifically that the Case Shiller index has to be converted to a dollar price figure, which I did by using the 12/07 median (because that’s the first time I did this version of the graph).

Changes in rents and wages are accounted for, but in the shorter term, the home price movements are the big mover because they are just a lot bigger than changes in wages or rents.

Rich

Got it. Thanks so much for

Got it. Thanks so much for putting this together, as always. 🙂

Yes excellent stuff. Makes me

Yes excellent stuff. Makes me feel like a genius for closing in Feb 09. Doubt if you remember me asking you years ago if you thought there would ever be a time when a mortgage payment would ever be less than rent, but I think it happened in early 09. Now if I was flush with cash I would definitely wait for rates to rise before “investing” in real estate. I think cash investors would still be better off waiting.

honestly it seems like San

honestly it seems like San Diego is just bouncing off the bottom of a bubble.

Price to income is 8?

In the long term that’s utterly unsustainable.

It works because americans are working 2 jobs,

or their spouses are fully employed.

That is unsustainable. If you assume any level of unemployment going forward, you will see jobs per houshold drop….

patb wrote:honestly it seems

[quote=patb]honestly it seems like San Diego is just bouncing off the bottom of a bubble.

Price to income is 8?

In the long term that’s utterly unsustainable.

It works because americans are working 2 jobs,

or their spouses are fully employed.

That is unsustainable. If you assume any level of unemployment going forward, you will see jobs per houshold drop….[/quote]

8x per capita income has been the middle of the road valuation going back over 30 years… that seems pretty long term to me.

Note that I agree this will drop in the years ahead (for reasons described in the article) but I don’t see any evidence that it is an unsustainable ratio for the long term.

Rich

I think perhaps patb is

I think perhaps patb is relating the price to income ratio to what an individual or couple might qualify to purchase based on their income.

There has been a common misconception that somehow the aggregate price to per capita income has to be in the 3-4 range to be sustainable. People relate what one could qualify for for a certian income (e.g. 4x their income) to these ratios.

This is flawed for a number of reasons that we have discussed on this board over the years, here’s one …

Per capita income includes high school kids and other non- or part-time workers. Per the Census Bureau “Per capita income is the mean money income received in 1999 computed for every man, woman, and child in a geographic area. It is derived by dividing the total income of all people 15 years old and over in a geographic area by the total population in that area. “

The fact of the matter is

The fact of the matter is that fo San Diego P2I of 8 is utterly sustainable. The quantity of high paying jobs in San Diego is quite high. The region is flush with engineering, biotech, a large university and state college, as well a diverse job base of legal, business, accounting and other professional jobs. We did not even talk about the military jobs. It is well documented on this board that San Diego has always had a higher P2I ratio and always will. Those who feel it will come down to 4 or 5 will be waiting forever.

I do believe that when the bond market dislocates prices will drop substantially.