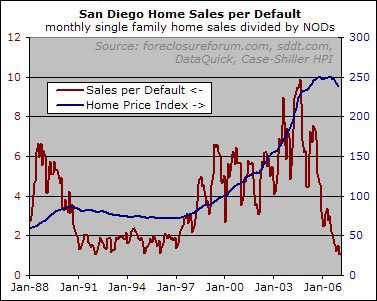

I speculated in an earlier entry that measuring monthly home sales against monthly notices of default would provide a fairly good read on the health of the housing market.

This idea is borne of the observation that excessive inventory does not by itself put much downward pressure on home prices. As long as sellers can hold out for higher prices, they can be depended upon to sit tight and do just that. Prices don’t fall substantially until too many motivated sellers — those who are forced for one reason or another to sell at whatever prices they can get — enter the market.

But how many motivated sellers is "too many?" That’s where the sales volume comes in. If must-sell properties account for just a small number of the homes being sold, the must-sellers are unlikely to have much effect on aggregate prices. But if enough transactions involve highly motivated sellers, prices could suffer.

Nice chart Rich. Yet

Nice chart Rich. Yet another indication that it’s time to party like it’s 1991.

If you look at the blue line

If you look at the blue line and compare this peak w/ last peak, the downward trajectory is much steeper this time around. We’ll see how deep this rabbit hole goes soon enough.

The chart shows a

The chart shows a correlation between the sales/default ratio and dropping prices, but I’m not sure we can say that rising defaults are creating more must-sell inventory.

If you want to know what lowers prices, you’d have to look at seller psychology. That would be the only true measure of must-sell inventory. This is the reason that NODs are not must-sell inventory:

People with NODs often do not want to sell. So what % of NODs is a listing? 5%? 20%? 50%? I don’t know. I pay for a subscription to foreclosure.com, and I rarely see an NOD listed for sale on the MLS. Rarely. Often I see the same house go in and out of NOD status, as the owner tries to bring the loan current. I’ve followed homes all the way to auction status, and they are still not listed for sale!

Further, an REO is not an MLS listing right away either. Banks need time to convert REOs to MLS listing. They have to tidy up, get an appraisal, evict the owner if necessary, so there is a lag time from REO to sale. Often the bank sits on the property. Check out the house on Twin Peaks Rd, which was an REO from the 8/06 auction until the 12/06 pending, and closed finally in 2/07.

Typically, there is a 1 year lag from NOD to REO sale, according to the Credit Suisse report Mortgage du Jour.

5% of homes on the MLS now are short sales, but that doesn’t seem to put downward pressure on prices, mainly because you’ve got a bunch of investors and sellers saying, “I NEED…” I NEED to get $520K or $1.1 mil, etc.

Due to seller resistance, foreclosure status is not YET correlated to price reductions.

What will reduce prices? I think the psychology has got to shift. There is still too much optimism. Sellers are still too demanding, with their “I NEED….”. A second factor will be rising inventory, and motivated sellers.

The key is that a NOD is not the same as a motivated seller. Just because someone has an NOD doesn’t mean they want to sell. Obviously, many are not selling.

I remember Rich once saying that real estate prices are sticky on the way down, and I can really see that happening now. Sellers are so damn stubborn. At a 5-10% price drop per year, this correction could take a decade.

I’m very interested in what will happen when the credit crunch continues, and people actually need a down payment. Today, you can still get 100% financing on a stated income loan, with a FICO above 680 or so. So the credit crunch, while started, is affecting only a small percentage of buyers. How will the credit crunch affect seller willingness to make a deal?

PS, I do see your point and

PS, I do see your point and you’re probably right, but I think Rich already had that idea covered if you read further on “The Voice”.

Notices of default — otherwise known as NODs, or the nastygrams that mortgage lenders send to delinquent borrowers — can serve as an indicator of how much must-sell inventory is out there. It’s a rough indicator, mind you. Plenty of defaulting homeowners end up working out their loans, even as some desperate sellers (whose motivation may stem from job loss, relocation, or divorce) enter the market without ever having incurred an NOD. While not a precise measurement, however, the number of NODs delivered in a given month likely correlates very well with the amount of must-sell inventory on the market.

Unless you’re a psychic, it would be pretty tough to actually measure the “seller psychology” with any accuracy. However, the NOD’s do seem to be a decent “indicator” for must-sell inventory. Certainly not anything exact, but enough to make a reasonable relational chart as Rich did. I think his chart makes a valid enough point.

sdrebear, I disagree with

sdrebear, I disagree with the author’s statement “however, the number of NODs delivered in a given month likely correlates very well with the amount of must-sell inventory on the market.” There is no evidence that I can find to support that statement, and I wonder how Rich came to that conclusion. It would be worthwhile for him to substantiate this somehow.

jg, the correlation that you cite is opposite. Price drops are causing rising NODs, not the other way around.

NODs are lagging indicators. I’m not sure why you used a 30month lagging indicator to predict prices. NODs rise well after a housing market has turned up, and are well known to be lagging.

I suggest that we predict price direction by looking at supply and demand. Now that we have access to inventories, pendings, and sales, we can forget about all those other factors. A few years ago, that data was not available. Prices for any good are determined by supply and demand, and housing is no different. We don’t need to look at all the other factors because they are instantaneously reflected: when credit tightens, demand immediately is reduced. When people leave the area, demand is reduced right away. So we are very fortunate to have access to the supply and demand data. I cannot predict the actual prices, but based on supply and demand, I believe we can predict the direction of prices.

Foreclosures and NODs are interesting just to prove that people are indeed in trouble, and that the bubble has burst, but it has no predictive value. We cannot say that rising foreclosures mean lower prices. Foreclosures are rising much faster than prices are dropping. I think the greatest price drops are due to investors leaving the market last year, causing a 30% drop in demand; investors were a huge part of the market.

Again, foreclosures lag what is actually going on. The 4300 pre-foreclosures in San Diego this month reflect 4300 people who had trouble making their payments in 2006. The people having trouble now are not even counted yet. Those 4300 people would have made decisions to list their home for sale last year, and if they had successfully done so, they would not be in foreclosure now.

I can’t wait for prices to drop either. But I am starting to face the fact that it could take a decade for prices to end up to 1999 levels. It’s a very very slow process.

If NOD’s are a lagging

If NOD’s are a lagging indicator, they probably aren’t predictave of the start of the downturn. They surely are predictive of the end of it. So they are predictive, just not of immediate future pricing.

Josh

Josh, read my article.

Josh, read my article. Economists do not use lagging indicators, and I have quotes from Cagan, Ratcliff, RealtyTrac, saying foreclosures are lagging indicators.

Foreclosures tell you that homeowners went into distress some time ago, and they could not refinance or sell their way out of the problem.

Eventually, this housing market will turn around, and prices start to rise.

But foreclosures will keep rising after the market has turned around, and those of you relying on NOD data are going to miss the bottom.

I am missing something here?

I am missing something here? jg made the point that NODs would be leading by about 30 months and is therefore a leading indicator. Why are you talking about it being a lagging indicator? Is there any evidence to this as well?

Outstanding chart, Rich.

Outstanding chart, Rich. Normalizing the NOD’s by sales certainly seems a fair indicator, based on the last downturn. That said, the linear scale might start to fail a bit (from an analysis perspective) if that ratio continues to drop.

OK, I am going to submit a

OK, I am going to submit a rare comment here now that Powayseller has seen fit to write an entire article on her site about this topic (with discreet statements like “ The Voice of San Diego has it wrong”) in addition to sending my voiceofsandiego.org editor a letter “correcting the story” (seriously – “correcting the story”).

As far as I can tell, PS, you have three issues: 1) you claim that NODs do not correlate to distressed inventory, 2) you claim that lower prices cause NODs, and not the other way around, and 3) you claim that foreclosures are a lagging indicator.

The first claim makes little sense. Who is forced to sell? For the most part, it’s people who can’t pay for their homes any more. If they could pay for their homes, they wouldn’t be forced to sell them. Do you honestly believe that there is no correlation between the number of people who can’t pay for their homes (as measurable by NODs) and the number of people who are very motivated to sell? It is so obvious as to be self-evident that these two numbers will move up and down together.

Of course, there is not a one-to-one relationship. But I never said there was, and if you’d taken the time to actually read and comprehend my story before issuing your “corrections,” you’d see that I specifically said that there WASN’T a one-to-one relationship, but that there would obviously be a rough correlation.

Your second argument, that lower prices cause NODs, isn’t an argument at all. Which is to say, you are just stating the obvious. Everyone knows that price appreciation prevents defaults, because homeowners in trouble can monetize home equity. Once prices start falling, this margin of safety goes away and defaults ramp up.

All obvious stuff. But for some reason, you seem to think that because price depreciation can lead to further defaults, that defaults (or more to the point, an increase in the number of people who can’t pay their mortgages) can’t lead to further price depreciation. Why? This is a self-reinforcing relationship… lower prices lead to more defaults lead to lower prices lead to more defaults. It’s the opposite of the virtuous circle we had on the way up. If elements didn’t self-reinforce like this we wouldn’t be prone to the boom/bust cycles to which we obviously ARE prone.

The last issue you are upset about is that foreclosures are a lagging indicator. But lagging to what? I agree they are a lagging indicator of financial distress in that they aren’t filed until people have already been delinquent for months. But so what? In a slow market like RE, they can still give signals about price pressures. The graph clearly shows that inflection points in the sales-per-NOD line have lead those in the price level (which, btw, was all I ever claimed). It’s right there in the chart, yet for some reason you deny it.

All in all, it seems you are either “arguing” against claims I never made or denying verifiable fact.

Rich

PS – (That’s postscript, not Powayseller) — While I’m here, to respond to “paranoid”: a graph with sales-per-NOT shows largely the same phenomenon, except it doesn’t lead by as much and is much harder to read due to the wider volatility of the NOT series.

Well, Rich, you answered

Well, Rich, you answered much more clearly than I could have.

PS – I saw you argue this point several month’s ago about NOD’s “only” being a lagging indicator and that they have no predictive value what-so-ever. I instantly had an issue with that thought, but never posted on it. Now that you seem to be trying to make a much larger point about it, I guess I’d like to interject a little more.

What’s odd about all this is that before, you seemed to get the concept that this bubble would not be bursting due to normal factors such as massive local job loss, or natural disaster as the Bulls have been feeding us for years now. This burst will be the result of the massiveness of this bubble in and of itself collapsing under its own weight.

Part of the collapse is the swing from a virtuous cycle to a vicious cycle where issues that normally lagged the other problems “causing” the collapse are now themselves additional “causes”. This is on top of new “causes” bulls never thought of before, like massive loan resets and severe credit tightening. The foreclosures themselves become a strong “third leg” of sorts to further drive down prices. Therefore, predicting (through NOD’s and a little math) these foreclosures IS very helpful in forecasting price declines. Will it predict a bottom? Probably not on its own, but seeing the NOD’s dry up 3-6 months before the actual foreclosures slow down would be a pretty good clue that things are finally getting better, don’t you think? (Kind of sounds like a leading indicator of market health)

If we know that NOD’s result in actual foreclosures at a given percentage (and we do) and also know that those foreclosures result in lower prices for those given homes (and we do), then it stands to reason that on a massive scale (which you yourself have predicted for this market), foreclosures can and will have enough economical impact to actually BECOME a driving indicator of FUTURE price reductions.

Just because foreclosures haven’t driven decline (wide spread) in the past (due largely to their shear lack of volume), does NOT mean that they can’t become that driver in the future. Nothing about how this bubble was created or its pure scale is measurable to past cycles. Things happened on the way up that never happened before. Is it so impossible to predict that there will be a few things on the way down that have never happened as well?

So, again, I’m more confused about how you have come to believe that only “traditional” forces can put leverage on the market (knowing what you now know about THIS market) and also how you believe people would honestly be willing (or able) to wait “a decade” for prices to come back to them.

By the way Rich… Nice write-up in the SD Business Journal!

I think there is some good

I think there is some good thinking going on, sprinkled with a little speculation and misunderstanding.

Rich,

what percentage of homeowners with NODs list their homes for sale?

Of those who list their homes for sale, how much below market price do they list?

What is the average DOM of those homeowners?

What is the % of list price that those NODs sell for?

Once you researched these questions, rather than just speculating about them, do you still think that NODs are causing price drops?

Not to interrupt the

Not to interrupt the conversation, but on the topic of NOD…Today the SD Daily Transcript refreshed their monthly figure. With 1517 NOD in March, San Diego broke the old record of 1484 in April, 1982. Of course today’s figure remains lower than the 1982 figure after deflating for population or housing units. Still, it WAS a 25 year old record.

poway, I really don’t think

poway, I really don’t think that’s what he’s saying.

You’re right about NODs not on the MLS. I don’t see them on, and you don’t see them on, nor does Jim the Realtor. But they are not on the MLS not by choice. The great majority of them are not in the position to compete with the standing inventory or with the new homes nearby.

So they take themselves out of the game and just let the clock run out.

But they are future inventory any way you cut them. So you take current sales volume and match it with future must sell inventory.

The key here isn’t to get months of supply. The key here is to see if there’s a relationship. meaning, if we have a build up of “future must sell inventory,” taken as a ratio vs “current sales activity” can we predict “future price drop?”

per the graph we can see the answer is yes.

you’re kinda splitting hairs here…

ocrenter, someone finally

ocrenter, someone finally gets it! NODs eventually add to inventory and it is rising inventory that will cause price declines.

The article seemed to imply that NODs are must-sell or distress inventory, which to me meant homeowners who are priced to sell. With so few ending up in inventory, how can they be distress inventory?

The REOs are the least desireable, since they did not even sell at auction. So the fact that a 2300 sq ft REO sells for less than a 2300 sq ft normal house, only means the REO lost the beauty contest.

I disagree on one thing. Months supply is absolutely crucial. It is only a high months supply that will lead to price drops. REOs are one component of rising inventory, which, in the absence of more sales, will cause months supply to rise. As MS rises, that means a smaller percent of homes on the market are selling, meaning if you want to really sell you’ve got to lower your price. And that is how prices drop for any product, be it homes, cars, orange juice, or gasoline. So MS is the only number that matters if you have to pick one number. NODs and REOs will raise inventory, so MS picks that up.

Note that NODs and REOs will continue to rise long after the bottom is reached. Those people looking at NODs are going to miss the bottom by a few quarters at least. They are lagging…there will be a ton of NODs in the pipeline when the housing market turns around, and the median won’t rise either for a while after the market turns.

The graph is confusing cause and effect, or at best, showing two things are changing together. As months supply rises, prices drop and NODs rise. We also see population drain continuing.

“NODs eventually add to

“NODs eventually add to inventory and it is rising inventory that will cause price declines.”

So why did inventory rise for a year and a half before prices started to decline? Bit of a coincidence that prices started to drop only after foreclosures picked up.

“Note that NODs and REOs will continue to rise long after the bottom is reached.”

That doesn’t make sense. And it’s not what happened last time.

You’re just ignoring the data that doesn’t fit your conclusions.

Speaking of which, nobody ever said that NODs “cause” price declines. But you keep acting like someone is arguing that point but nobody besides you has even mentioned it. This has been pointed out to you several times, but I guess it’s more data that you choose to ignore.

lurkor, prices started

lurkor, prices started dropping in spring 04 in the low end, but the median was rising for 18 months after.

The fact that you think prices dropped only after foreclosures picked up shows you are also confused and led astray by Rich’s graph.

Despite your arrogance, I will give you a little information. Yes, it defnitely IS what happened last time. Sales picked up in January 1996, but NODs kept rising for one full year, and peaked in January 1997. REOs stayed at above 1000 until January 1997.

Those of you following NODs and REOs are going to miss the bottom by about a year.

About the foreclosure link cited above: the author clearly shows selection bias when saying foreclosed homes sell for less, as it is the smaller homes that end up in foreclosure. I would guess the less desireable ones go for less. Here is the quote:

“In California, for example, Cagan found that the typical home sold for $494,000 while the median foreclosure price was $435,000 — that’s a difference of $59,000 or 13.5 percent.

There’s no doubt that $59,000 is a lot of money but there’s a catch: Cagan found that the big price differential between homes sold at market value and those sold through foreclosure was not the result of an apples-to-apples comparison. In practice Cagan found that lower-priced homes were foreclosed more frequently, so foreclosure sale prices appear lower than a comparison of like homes might show. “

“Despite your arrogance, I

“Despite your arrogance, I will give you a little information. Yes, it defnitely IS what happened last time. Sales picked up in January 1996, but NODs kept rising for one full year, and peaked in January 1997.”

HAHAHAHAHA that is perfect. You open up with a bitchy and cocky insult, and then go on to say something that is totally incorrect. That about sums you up in two sentences.

Go to http://www.sddt.com/Finance/EconomicIndicators.cfm?Report_ID=2 and you will see that in fact NODs peaked in March 1996 and moved steadily down from there. Do you think that if you are brash enough that nobody will notice that you are making up your “facts” to support your lame arguments?

Also, you accuse me of talking about the median rising, but I am talking about the case shiller index rising. Perhaps you don’t realize this, but the case shiller index is not the same as the median. Never mind, if you are loud and obnoxious enough, maybe a few people won’t notice that your “Facts” are all wrong.

I believe Rich’s point is

I believe Rich’s point is that you can have as much inventory as you want and the Month’s Supply can go to 10 years, but if none of those people are truly motivated to sell, then prices will not drop significantly.

What has caused all past significant price drops is a large instance of motivated sellers. Be that due to a massive job loss in an area, or natural disaster, etc. Well, this time around, there is a “new” disaster. It’s called the suicide loan.

Everything else seems great. Plenty of jobs, economy humming along, etc. The looming foreclosure rate IS the “shock” we’ve been waiting for. How best to predict these foreclosures? Ummm… NOD’s!

Here is a clip from a NY Times article referencing a study in Chicago of how just one foreclosure affects other homes in a neighborhood. They also talk about it getting worse when there are several.

As families are ruined, whole neighborhoods are imperiled. A Chicago study found that a foreclosure on one home lowered the price of nearby single-family homes by 1.44 percent, on average. The more foreclosures, the greater the effect. Vacancies are a particular problem because home buyers and businesses shun areas with vacant homes, while the cost for abandoned property must be borne by municipal taxpayers, draining resources at a time of need.

In pressing that NOD’s are a lagging indicator, you’re looking at the past and not applying it to the present situation. To predict a housing downturn, you must predict it’s cause. If you’re not looking at future foreclosures (and the long proven downward price pressures they bring) as a contributing factor, then you’re just not seeing and understanding this current market. We’ve seen the stagnation and slight drop that tightened lending and overheated pricing has caused, but the real “shock” hasn’t happened yet to truly motivate sellers down. Granted, I’ll happily give you that there are several other factors in today’s market that will help drive down prices, but the record levels of foreclosures (you’ve predicted as well) will be a major factor and a “shock”.

No matter HOW these people end up getting out of their homes after receiving a NOD (and yes, I know that MANY of them will work it out without a sale, but MANY others will not), it will be a motivated method. Even if they have the equity to spare, they might give that up to avoid full foreclosure, so that’s not recorded as a “short sale” or foreclosure, but it was still a “motivated seller” and was predicted by their receiving a NOD.

From the center for responsible lending (page 13), they illustrate very well how when “distressed prepaid loans” are added to actual foreclosure rates, the real picture of seriously motivated sales gets much larger.

One in 10 subprime mortgages in recent years have prepaid while delinquent. When these distressed prepayments are added to the foreclosure rates, the composite subprime “failure rate” approaches 25 percent within five years of origination…

…Undoubtedly the majority of distressed prepayments represent homeowners who could not make their monthly payments and turned either to a refinance or to the sale of their home to avoid foreclosure. In either case, they were likely to experience a loss in the process. For example, borrowers who refinance a delinquent loan typically will pay a higher interest rate on their new loan because of the higher risk. Also, if they prepay their loan during the first 24-36 months of its life, they usually will incur a prepayment penalty. Alternatively, borrowers who sell a home under pressure are likely to recover less than the full fair market value.

Bottom line. In bulk, foreclosures (no matter what the cause) and “distressed prepaid loans” can be a major cause of significant downward price trends. NOD’s are definitely predictive of this trend.

I understand that the banks will try and get as much as they can for each property, but truly, they do not want to be property owners. They have traditionally sold for less than market value.

One point that seems to have

One point that seems to have been missed: Rich’s chart does not show NOD’s, but rather sales normalized by NODs. That particular chart is paired with the home price index for a reason, to show that the sales/NOD ratio did in fact lead the previous housing downturn (and further to show the recent trend of the sales/NOD statistic.)

I continue to believe the composite chart is simply brilliant. Well done, Rich.

After looking at the graph a little more closely, the sales/NOD metric seemed to call the start of the appreciation phase, when the metric crossed back over 75 or so. Nonetheless, it would be interesting to see if this metric was also predictive over past real estate cycle — one sample point can be misleading.

It corresponds with the

It corresponds with the Cagan article nicely. Notice the sales/default parameter is too the left of the graph, continued appreciation stopped and reversed in both instances when sale/NOD crossed 4.

In Cagan’s studies of metro markets, he found significant price drops when Foreclosures to sales rose above 8%. At the current 40% NOD to foreclosure rate, that puts sales to foreclosures at 10% at Sales/NOD at 4. At a lower foreclosure/NOD rate of 30%, you’re still at Cagan’s 8% collapse indicator.

I just noticed that before

I just noticed that before reading your post, nsr. Looks like the S/NOD threshold was about 3 on the upswing.

There’s no doubt that

There’s no doubt that $59,000 is a lot of money but there’s a catch

Then perhaps you should have read the rest of the article or at least the next two paragraphs:

In the first half of 2006 — when homes could take several months to sell and price reductions were often required — foreclosing lenders had an incentive to offer at least a small discount to move their properties quickly.”

In other words, the foreclosure discount in California was not $59,000. It was something lower. How much lower? When Cagan compared foreclosed homes with properties of similar size, location and condition, he found a $25,000 price differential — a property with a fair market value of $460,000 typically sold for just $435,000 through the foreclosure process — a difference of 5.4 percent.

Read that again: in the first half of 2006, yeah, when everybody was blathering about a upcoming soft landing, before inventory really built, before foreclosures picked up, the discount was already 5.4% like for like.

Now read the another paragraph further in:

The more homes on the marketplace through foreclosure, the greater the foreclosure discount. In particular, Cagan found that “in markets where foreclosures constitute 8 percent or more of total market sales, foreclosure discounts are likely to be particularly large — often 20 percent or deeper.”

poway, didn’t you say

poway, didn’t you say earlier that rising inventory doesn’t matter and what matters is seller psychology?

and I didn’t say months of inventory do not matter. What I said was the reason for comparing NODs vs. sales is to get a workable ratio, not to get MOI.

but forget all that. you’re still missing the picture. NODs are future distressed inventory. It really doesn’t matter whether they are inventory now or not, they won’t sell anyway. one they are generally all underwater, two they need to be competitive short sales to move them, three that generally won’t work because the banks are too shorthanded and also not willing to give the ok to the type of short sales that would move these.

I don’t think rich ever said the ratio of less than 2 causes price drop. the point of the graph is if you have a ratio of less than 2 that’s an indicator for further lowering of prices.

if you use this sales vs. NODs ratio, you can figure out the bottom because even though NODs would still be high, sales would start to increase, which would cause the ratio to go up, signalling the end of the bottom.

Rising inventory matters

Rising inventory matters only if sales are falling, so it’s months supply that matters. But rising inventory in and of itself doesn’t mean anything; it only matters when months supply rises and sellers try to get competetive on price. So rising inventory gives the sellers the realization that they better get realistic on price.

ocrenter, you’re missing the point. I do agree that rising NODs will convert to rising REOs, which means more inventory. Rising inventory coupled with low sales means prices will be pressured down.

But Rich’s story was misleading to me, because it sounded to me like he is associating NODs with “must-sell” inventory. If he meant NODs to become REO inventory and raise inventory, he should have said so.

He wrote:

“While not a precise measurement, however, the number of NODs delivered in a given month likely correlates very well with the amount of must-sell inventory on the market. ”

That is plain wrong. NODs are definitely not correleted with the amount of must-sell inventory on the market. They are usually not in inventory at all.

NODs and REOs, when compared to homes of similar size and condition and amenities, are not priced lower than other homes.

I’m not sure if the ratio of less than 2 will cause price drops, because I don’t put much credence in any chart using the median to show correlation or prediction. The median is about the worst measure of prices that I can think of.

The average price is no better: it went up 3% in March vs. March 06. So average $/sq ft is equally useless it turns out.

I apologize if I offended anyone by correcting the Voice story. I have corrected many journalists, and find they are used to corrections in their business. If I get a story wrong, I hope I can be gracious in accepting a correction, and excited to have learned something new.

Once you researched these

Once you researched these questions, rather than just speculating about them, do you still think that NODs are causing price drops?

Sigh. According to Realtytrac, 40% of NODs end up foreclosed.

Foreclosures typically are already going anywhere from 2-50% below market rate. See Yahoo RE

As for Price drops causing NODS, idiocy. If you can make your payments, it doesn’t matter if the price drops or not, you can make your payments. If you can’t make your payments, then you get a NOD. Period. Strong appreciation masks the fact that many buyers couldn’t afford to make the payments. The only operative thing in a NOD is not making the payments. Dropping, flat, or slow appreciation as well as tighter credit requirements will prevent someone, are you ready for it, can’t make their payment from blissfully temporarily refinancing away the fact that they can’t make the payments.

Am I reading that right?

Am I reading that right? Currently the number of sales/NOD is 1:1? WOW!

It was only less than a year

It was only less than a year ago that the mainstream media started to cover (really cover) that the housing market was not going to go up forever. It took another 6 months or so for the media to start to talk about the underlying problems with the housing market, namely subprime mortgages. February 27th hit and that was yet another wake up call, albeit the most forceful one so far. This stuff is only STARTING to hit the mainstream public, the ones who think that RE can only go up. On the flip side, these results were a year or more in advance on this very website.

It is only recently that a good majority of the general public are talking about RE as not being the investment it was believed to be. The psychology IS shifting, it is just taking longer on the way down. There is a mountain of financial data that points to a big market correction. However, one monthly report comes out by some biased organization stating that pending sales are up and VOILA! The economy is back on track and the RE bottom is behind us! You still have hacks like George Chamberlain using the days on market (DOM) indicator as a part of his argument. Remember, there is still money to be made in RE advertising revenues and there are still MANY people that stand to lose from a rapid market correction. Make no mistake about it, the RE bulls are going to fight tooth and nail on the way down.

On another note, it would seem as though there is some historical “competition” between real estate and stocks for investor’s money. Doesn’t it seem a bit strange that they both depend on each other so much now? I could be reading into it more than I should, but it sounds a bit like 2-card monte to me.

Great chart, Rich.

Great Chart! What is most

Great Chart! What is most surprising to me is how little blue line dipped down and how it went sideways for nearly 10 years. Not only could this downturn last a decade it mostly likely will with much of the losses incurred in real rather than nominal terms just like last time. I’m sure the explosion this time around changes the scale of this graph which minimizes the last downturn but still…..

Psychology is very sticky on

Psychology is very sticky on the way down!

* PS – very glad to see you posting here!!!

Rich, great way to help make heads or tails of the data. I don’t know if you could place a patent on your data charting and manipulation techniques, or if the copyright notices on you site already result in that. But, if no one else is plotting the data in the particular ways you have been, then its certainly worth considering some sort of publication with you stats, facts and figures to help put in on the map.

Who knows your creative methods could some day become part of the industry standard economic bench marks.

Okay, I’ll stop gushing now…..

But, as always, great to see this kind of data.

Psychology is very sticky on

Psychology is very sticky on the way down!

Actually it’s not. Last go around, by the end of 1992, everybody knew if they were stuck or not.

Prices were sticky because sellers were stuck. They could make the payments but couldn’t afford to sell the house.

This time, more sellers are shaping up to not be able to make the payments and hence, won’t have a choice about the house being sold.

Rich

Your chart is simply

Rich

Your chart is simply elegant !!!!!

Curious about everyone’s

Curious about everyone’s thoughts on how the trend of ‘sticky declining prices’ might be affected by Web 2.0?

There’s so much more information available to the average buyer now, and it gets disseminated so much more quickly. There is an SF blog dedicated to deconstructing (detailed!) and ridiculing overpriced listings in the city. Plus there’s mashups galore out there –zip maps, crime stats, coffee shops per capita, commute times, API scores, greenspace…this has GOT to have some effect on the marketplace. What do you think it will be?

Very nice analysis,

Very nice analysis, Rich.

ps, how do you systematically measure ‘investor psychology’? Best way, I think, is to use a reasonable proxy that’s already out there. NODs — threat of proceeding to foreclosure — sure seems like a plausible one. And, given the nice tight leading (30 month) inverse relationship between NODs and prices, what’s not to like about NODs as a leading indicator?

[img_assist|nid=2372|title=|desc=|link=node|align=left|width=466|height=350]

Psychology is nice, but concrete, objective measurements are better. That’s why folks downplay reads of consumer confidence and place greater weight on actual consumer spending.

JG – Equally nice chart.

JG – Equally nice chart. Does this inverse relationship exist only for the last downturn (90s), or does it go further back? Do you see any changes to the 30-month timeframe given the huge spike this time around and more widespread access to information (e.g., the Internets)?

Greed that JG’s chart is

Greed that JG’s chart is fabulous. Can’t wait for the chart to peak and turn so I can plan get a plan in place for 3 years down the road.

This is pretty amazing. I’d

This is pretty amazing. I’d like to put something like this together for Alameda County. Do you know of publicly available data I can use?

Are you including condos or only sfr’s? I can search Alameda County records for NOD’s pretty easily, but there seem to be 2 kinds–a NOD on a lien (usually on a residence, as far as I can tell), and a NOD on deed of trust. Are these significantly different, enough so that you should filter out the NOD-liens as you construct the chart? Thanks.

Or, jeez, if you have the data available and can make it happen without too much work, I would LOVE to see it for Alameda County.

JC,

Some of the automated

JC,

Some of the automated valuation systems (like Zillow) might misinterpret those transactions as sales and it could affect their results. Actually, I should amend that; some of those systems WILL misinterpret those transactions.

JG, where did you come up

JG, where did you come up with the 30 months? Did you just chart the two and then see where the peaks align with the troughs and visa versa?

I have a question that I

I have a question that I would love some input on. I’m not specifially looking for a REO, but I’ve looked up a few of those properties on Zillow and other similar sites recently and noticed that almost all of them show very recent sales. Also, in most cases, the sale price was quite a bit higher than the value quoted by the site.

My question is when the banks take over the homes does this count as a “sale” and could this actually artificially inflate home prices in cases where the borrower owed more than the value of the home?

I hope this makes sense!

Thank you!

Rich,

can you plot the same

Rich,

can you plot the same figure, but using Trustee Deeds instead of NOD? I think that may give a better view, because TDs are really MUST SELL, better than NODs most of which never go to sale.

JG,

As always, insightful

JG,

As always, insightful graph. Question, did you shift the NOD data 30 months? Or, are the values “as is” in relation to time?

The NOD data and the Median data contrast very well and I wondered if that was naturally occuring, of if the data needed to be massaged to get that visual effect.

Thanks!

Rich,

One more thing. Her

Rich,

One more thing. Her case confuses indicators with he causes. Something can be an excellent indicator of a situation without being a cause of it. In this case we know the many of the causes of the housing bubble, what are are looking for is clear indicators of changes in the market.

At ocrenter’s request, I had

At ocrenter’s request, I had a closer look at the chart, and I still don’t like it. Nothing personal – I love the work Rich did with the Bubble Primer. It’s a classic!

However, I am troubled with this chart. First, it looks like it’s a proxy for sales, so we are back to sales and supply as the determinant of prices. The chart of homes sales/NOD, the red line, is basically the line of sales for the period 1988 – 1991.

Sales were falling (while supply increased) and that is why prices fell.

Rich added NODs to his ratio, without having any proof at all that NODs have anything to do with price drops.

We already know that NODs do not list for sale at lower prices, as my preliminary research has shown.

Where is the evidence that NODs are linked with the price falls we have already had?

The red line is going down fast in the last few quarters because sales are dropping, but are prices falling off a cliff? I do not see a correlation in this graph even, between the sharp drop in sales and the Case-Shiller price index, which has held fairly flat.

I think the burden of proof is on Rich, to show everyone how NODs are causing price drops, and what the big decline in the red line for February means, why any of this is related to the Case-Shiller index.

Typical PS debate technique:

Typical PS debate technique: when confronted about saying something that is provably wrong (” Sales picked up in January 1996, but NODs kept rising for one full year”), just ignore the question, change the subject, ratchet up the shrillness factor, and hope nobody notices. There’s no real conversation going on here, she’s just wasting our time.

Typical PS debate

Typical PS debate technique

Good point lurkor. Unfortunately, “shrillness factor” is a lagging indicator and many of us will have wasted precious braincells on the meanderings of powayseller…

Although, if you think about it, I think she actually helped reinforce Rich’s message on this particular topic.

Just trying to riase some

Just trying to riase some contraversy in hopes of driving traffic to her site. Obviously, no one is taking the bait.

I’ve been traveling for over

I’ve been traveling for over a week and haven’t kept up with this thread so I’m just now getting back to it… and my oh my the entertainment of which I’ve deprived myself.

I hate to beat a dead horse (or perhaps I actually enjoy beating metaphorical dead horses – I’ll have to give it a bit more thought), but here is my generic critique of Powayseller’s posts/critiques/whathaveyou: She doesn’t know what she doesn’t know. And that, my friends, is very dangerous is the world of economics and finance.

Let me use an example from my personal history to illustrate from my point. I worked at firm with a guy we’ll call Randy. Randy was a “very smart guy.” He had a BS in Electrical Engineering from an ivy league school and an MBA from a top-5 program. The guy was smart. On a scale of 1-10, he was a 9.8. A bright guy with a solid processor. Randy’s fatal flaw was that he thought he was a 12. And ultimately, that negative gap (9.8 – 12 = -2.2) caught up with him as he got in way over his head into some things he thought he understood better than everyone else, when it turned out in hindsight that he was the fool. He thought he knew more than he really did. That gap had seriously negative ramifications for the firm and, more specifically, for his career. (The guys at Long Term Capital Management suffered from the same problem.)

At the same time, another guy that I knew in the same business who was out on his own was not the brightest guy, but certainly no dummy. We’ll call him Ted. Ted was probably a 6 but thought of himself as a 4. So he had a positive gap, so to speak. And he invested accordingly – very carefully and only in things he really understood well. Well, Ted made a small fortune while Randy swan-dived into the muck.

I have no opinion on Powayseller’s general level of intelligence. Maybe she’s a 3, maybe she’s an 8. I don’t know and it’s not the point here. But one thing of which I’m virtually certain is that, like Randy, she knows far less than she thinks she knows – it’s self-evident from her many musings. And to turn the phrase of a famous poet, “that will make all the difference.”