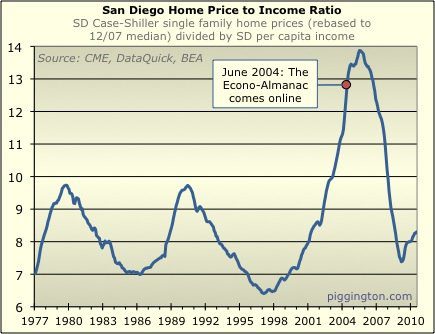

I’ve been updating the FAQ list and I thought it would be interesting to denote the start of the Econo-Almanac on a chart of home valuations (ie, CPI-adjusted prices) and sales. I used the beginning of 2000 as the start date because I like round numbers:

Sitting back and looking at this graph, a couple interesting observations jump out at me. First, it took fewer than 5 years for home valuations — not just nominal prices, but home "expensiveness" compared to everything else — to more than double. This increase is absolutely staggering. Nothing new there, I guess, but it continues to amaze me that so many people bent over backwards to come up with any rationalization they could to avoid the only explanation that made sense: a massive, debt-financed speculative bubble. I’ve learned a lot studying this bubble, but the most amazing has been the tremendous capacity that humans have to believe what they want to believe, to an extent that I never would have imagined possible if I hadn’t witnessed it in unfolding realtime.

As an aside, on the topic of rationalizations, I always have to laugh at the one that home price apologists were quickest to bust out. Since they couldn’t actually come up with any credible factual retorts, they’d always just attack the people making the bearish arguments, saying that they were just renters who were bitter because they couldn’t afford to buy homes. What’s so hilarious about that argument is that thanks to all the no-doc, neg-am, zero-down loans available for the taking, anyone could afford to buy a home. That was the cause of the whole problem! It’s just hilarious to me that even their ad hominem attacks were completely illogical.

This was definitely a common gambit, though, despite its absurdity. All the way through mid-2006, I’d estimate (though occasionally later, even as recently as last month) I was subject to nasty personal attacks about both my inability to afford a home (because I was apparently the only person in San Diego who couldn’t qualify for a no-doc, zero-down, neg-am loan) and my slow-witted inability to understand that they weren’t making any more land. I got plenty of hatemail, and the Craigslist and Union-Tribune message boards in specific were stomping grounds for people who absolutely loathed me.

I’m not mentioning this to generate sympathy — there’s a point, and that is this: you’d think that I had a website dedicated to emotionally abusing kittens, from the kind of stuff people wrote, not one that published some charts and graphs about what was going on in the housing market. Such a level of vitriol was telling. A true investor, and a true believer in the value of housing, would welcome such skepticism. The more people who doubted housing’s value, the true investor would think, the less competition to invest in houses, and the more people to rent from the investor. And yet this wasn’t the reaction at all. To suggest that prices would go down, or even to suggest that they would stop going up, evoked extremely violent reactions. This indicated that at some level, the bulls realized that it would all come unraveled if prices stopped rising — as always happens in a speculative bubble. Even they partly understood it at the time, though they wouldn’t admit it.

OK, that was a really long aside. The other interesting thing about the chart is the disparity between how easy it is to look back at the chart and see what was going on versus how hard it was to know at the time. The volume question was never too tough — there was a final surge of panic buying in spring of 2004 (this was the era of multiple offers, buyers writing plaintive letters to sellers explaining why they deserved to be the ones to overpay for the sellers’ houses, etc.) and then things went downhill from there. Prices were a different matter — there was never much question in my mind that they would decline, but the timing and extent of said decline was a lot tougher to pinpoint. Looking at the chart above, you can see that valuations topped out very slowly, over a period of about 2 years, pretty much going nowhere from late 2004 to late 2006. This multi-year topping process is so clear now, but at the time, while we all had our suspicions, none of us knew for sure what was really going on. (Although I would single out the later vintage hatemailers as really not knowing what was going on ;-).

Anyway, I just thought that was kind of interesting. It’s also instructive for our analysis going forward. Our human nature wants to retrofit our memories to overestimate what we understood at the time, as best described via Taleb’s "narrative fallacy." The character of the bubble’s end all seems so clear now, but it was a whole lot murkier in realtime — that’s something to keep in mind for the future!

the timing of the almanac

the timing of the almanac coming online and the drop in sales volume seems to support arguments that you are in fact to blame for the burst…

what do they say? the bear blog is mightier than the swindler?

Rich,

It would be

Rich,

It would be interesting to take the data and come up with a beta that would describe the upturn and and downturn in the market.

Rich,

Thanks for sharing

Rich,

Thanks for sharing your wisdom. As for the haters, ducks always envy the swans.

Rich,

I’ve been frequenting

Rich,

I’ve been frequenting this blog since shortly after it popped up. The data and analyses you were putting up – right from the beginning – resonated with me precisely because I had already been telling people this would happen for over a year.

With respect, the only thing you were ever unsure of was the timing and the extent of the correction. You always avoided sticking your neck out in terms of predicting the future but I always thought you were pretty clear about what you thought would eventually happen.

Some people might look back now and lay everything on the failures of the subprime lending and the secondary market. This is why we still have some bulls who persist in thinking that if everyone would just stop talking about those losses everything else would be cool.

But as far as I’m concerned the trigger could just as easily been one of the other excesses. The market psychology didn’t occur as a result of these enablers, these enablers were empowered by the market psychology. The whole point of an irrational market is that element of irrationality – and that’s exactly why it will always be impossible to predict exactly what will trigger the reversal and when it will happen.

Looking forward, it will be the contrarians who will again be in front. Seeing as how they didn’t ride the ship down to the bottom like most of the bulls these contrarians will be the only ones with a strong enough position to do anything when that time is right. Even though I think we have a ways to go yet, I’m already starting to see some areas of the market dropping to where there’s some relationship between pricing and fundamentals.

For instance, I just saw a market segment last week where the sales data is demonstrating gross rent multipliers (sale price / monthly rent = GRM) of less than 150. It’s literally been 10 years since I have seen GRMs that low. A GRM of 150 is still a bit high for most investors in a beater neighborhood, but once it drops to ~120 they’re going to start getting excited again.

I question exactly how much of a factor the market psychology will be in the next cycle, but I’m sure that no matter what it will always be a factor.

Rich……………….you

Rich……………….you have just learned something that many of us older guys learned when we were younger: “Revenge is truly a dish, best served cold”.

I’ve also had idiots argue with me, starting back in 2003-2004, when I told them that the housing market had slipped into the crazy zone and many people would live to regret paying too much for houses in SoCal. Some listened and a bunch didn’t. I personally know several people that I warned who have now lost or are losing their homes to foreclosure in L.A. and San Diego. There’s a lot of sadness in the world.

Rich,

I pretty much echo

Rich,

I pretty much echo Bugs on this one. In early 2004, I was begging ever one I knew to sell all their investment properties to no avail. I was fortunate to have worked in the venture capital world with a handful of the smartest people I have ever met. The most important thing I learned is that the smart money sells on the way up into the bull market and lets someone else try to grab the last dollar. Frustated at my inability to convey what I saw to those around me, I went looking and found this blog. I think you have done a wonderful job from day 1 at explaining the situation in a manner that anyone willing to listen could understand.

I’ve had my eyes on what are likely some of the same market segments as Bugs and have seen properties where the fundamentals and pricing are starting to look far more interesting than they have in the last several years. I also see other areas though where a huge gap still exists which I cant see clear to how they will ever come back into line.

But hey, I’m just another pompous windbag.

Thanks again Rich for all you’ve done.

I would argue that your

I would argue that your blog, and various posts aligned with it, are the perfect example of a truly free market. You put your name and reputation on the line based on some data that you’ve compiled. If you’re wrong, you must forever answer to the critics. If you are right, you gain a place among the elite who were ridiculed in a similar fashion.

I, and others like me, navigated to this blog because it was resonating a message that we believed but were not receiving from traditional media outlets. The un-regulgated Internets (:-)) wins again – power to the people!

test

test

BobS

Words of wisdom, well

BobS

Words of wisdom, well put.

Rich,

Though you like round

Rich,

Though you like round numbers, if you go back to 1997 it looks even more irrational (I know you already know this).

In our old neighborhood (O’side), home prices had already doubled by 2000/2001, from 1997/1998. Was telling people to hold off on buying in 2001, as prices would drop from there (still think that we’ll be seeing pre-2001 prices before it’s all over).

You are so right about peoples’ emotional reactions. Never seen so much vitriol about housing prices in my life. That would seem to indicate a certain level of fear, IMHO.

You’ve been a leader in the housing bubble community, and your thorough research has enabled many of us to stick to our guns when the going got tough. Thank you for all your hard work!

I would just like to thank

I would just like to thank you. About two years ago I started looking for a home. But before I took the leap I did some research online. You site is full of facts. All the realtor sites had no facts at all. And you cant argue facts. So thanks for telling it how it is and saving me a bunch of money.

Rich you rock!!!

tc

The thing that always

The thing that always confounded me was the frenetic drooling over multiple offers for what amounted to little more than shacks. You could feel the tension between buyers on open house Sundays, as they were suckered into vying for the same last remaining acceptable SFH. Those unable to sense the immediate madness, clearly either were lacking in mental capacity, or simply didn’t have the time in their busy lives to find out what was going on.

In the defense of those who already owned, it is perhaps understandable that having only just acquired new found wealth, and then having it just as quickly snatched away, quashing hopes of timely and secure retirement plans, may stick in the throat. And I suppose there are always going to be those who obsess and resort to verbal abuse when that realization takes seed.

I think what surprises me most is that Piggington, or at least its progenitor has not been interviewed on local news stations (at least not to my knowledge).

Rick-

One thing I wonder

Rick-

One thing I wonder about…is the market going down faster or slower than it went up? That would be interesting to know…

Truth and Representation

are

Truth and Representation

are not one and the same…often the human ( sic ) is constrained by a singular perspective, an angle, a spin…

Rich will be accused of this… and has been… with bilious attacks that are usually ill-worded and reflect a intelligence of the merest, least developed sort.

For me, this site has been illuminating, so much so that the new bride no longer is harping for a house, she has slowly absorbed the facts, has seen the ( now common) data regarding the historic bubble-burst and has accepted it for what it is/was – speculation, Ponzi, et cet.

Thanks to Rick and all the Piggy’s.

ciao for now…

Voz

I cannot tell you how

I cannot tell you how shocked I was in the summer of 2005 when I came back to the U.S. for a visit and checked on my rental property. I picked up a flyer for a house for sale across the street and almost fell down laughing. “They want HOW MUCH?”

I had not paid attention to the SD housing market for quite a while while overseas. I was the proverbial frog who got dropped into the pot of boiling water; and I did what all frogs in that situation do… I whipped out my Econo-Almanac and did my research, confirming my suspicions that, in fact, the water truly was hot even though the other frogs were saying that the swimming was good. I quickly hopped out before the lid was put on the pot.

Now I’m set. My wife thinks I’m a financial wiz and rewards me with copious affection; my kids call me father instead of “pops”, and I noticed a distinct increase in the level of service from my financial institution.

Frogs get no respect… but Piggs, now that’s a different story! Thank you, Rich for doing something so simple yet so profound; publishing data for us data junkies.

Rich – not much I can add to

Rich – not much I can add to what’s said. I too was looking at buying a multi-prop with the in-laws when my father in-law came across this site. We’re in LA but needless to say my perception has changed for the wiser since. I used to think I was saavy for not wanting to “throw money out the window by renting.” I’m on my 4th year of it, and can’t complain.

The haters are just bitter, and misery loves company. Speaking of which, where is ol’ Chamberlain now?

Rich,

To add a slightly

Rich,

To add a slightly different perspective from others, I have for the past few years and still, consider myself NOT qualified to buy a home, since I struggle to save and looking at my expensives, I wouldn’t be able to buy anything anyways at insane peak prices (assuming a “traditional” mortgage, if that still has meaning).

I’m probably a little younger than the average Piggingtonian contributer, and as such, I’ve never really been in the market to buy a house so far (I came of age, you might say, just as the bubble was starting to inflate big time), and am renting because that’s the only option I have. But I must truly say that Piggington has provided me with great solace, perspective, and ammunition against insanity. You put down in words what a lot of people like me have been thinking for many years.

So while many Piggingtonians are in a position to buy a house right now if they so choose (but still refrain due to good sense), have a certain amount of financial security and made a challenging decision to sell their properties during the peak and become renters, they have a vested interest in seeing data that supports their decision (and indeed the data absolutely supports their decision). I, on the other hand, never was in a position to make such a decision (have only been a renter so far), so I don’t look to Piggington for affirmation of my decision, instead, I look to Piggington (and have been for about 2 years now), for a certain amount of comfort, and, I’ll say it, for a trickle of hope that there is indeed sanity in the future of this insane Southern California housing market. To that end Rich, you and this site have been the light at the end of the tunnel for me. We must not kids ourselves, where we live and how we live ARE a big part of our lives, and your site and data gives me hope that perhaps I won’t be a renter for life!

Thanks.

calidesigner

Great Job Rich!

I started

Great Job Rich!

I started subscribing to your site 2 years and 13 weeks ago. At the time I said, “I want to know how long you have been saying the market was going to fall and if you said buy when the market was appreciating.” You weren’t around long enough and you were honest to say so.

I have read you long enough to believe that in time you will look at the data and be able and will to say that, “the prices are low and real estate is undervalued. Now is a good time to buy”. Thanks for your fine service.

For the Guy that asked about La Jolla. I live in the Boston area. People say that Brookline/Newton will never go down because they are like blue chip stocks. These areas have been sustaining their value lately. But just like a rising tide raises all ships, a setting tide lowers all ships. It is just a matter of time and a question of how far the tide will go out!