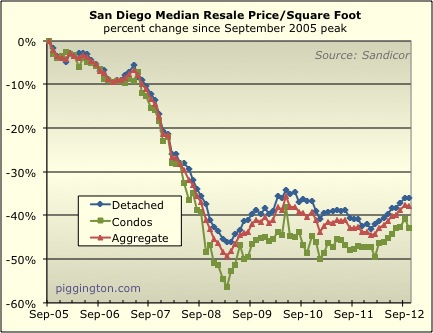

Prices flattened out or maybe declined last month, depending on how

you want to look at it… while the much less volatile detached home

median price per square foot actually rose by .3%, the condo median

ppsf declined by 3.3%, leading to an aggregate decline of .5%.

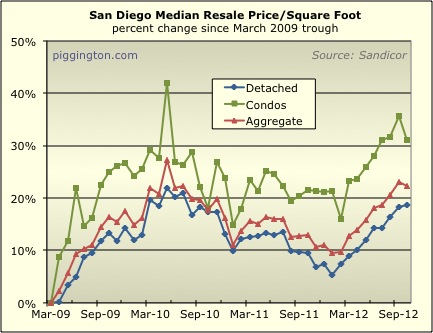

The above chart begins at the bubble peak; for kicks I made one

starting from the 2009 trough:

You can see what I mean about much greater month-to-month volatility

in the condo ppsf. For what it’s worth, I tend to pay a lot

more attention to the detached home series for that reason.

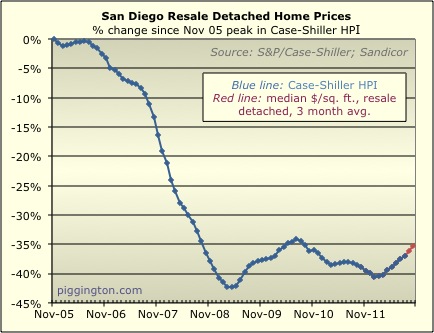

The detached numbers can be further smoothed by taking the 3-month

average, which I have done in the chart below in an attempt to

approximate what the Case-Shiller index (which also uses the 3-month

average for detached resale homes) will show when it comes out:

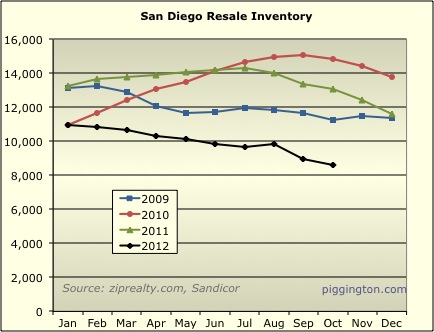

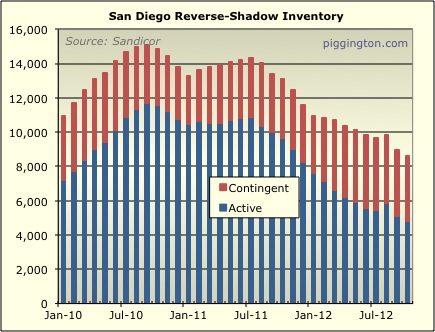

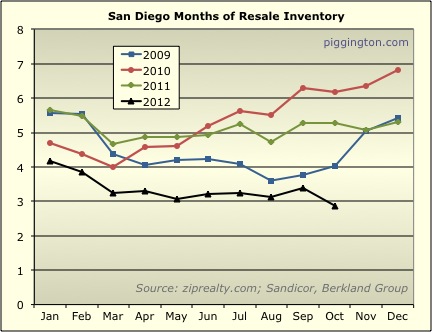

Now let’s move on to inventory, the lack of which has been helping

out prices all year. As is typical this time of year,

inventory has been falling — what’s unusual is that it does so from

such a low level:

The chart above includes both active and contingent (typically a

short sale awaiting bank approval) inventory. You could argue

that contingent inventory isn’t really “on the market” (at least not

at the moment, though it may return to the market) — in this case,

it’s really only active inventory that new buyers can go

after. And contingent inventory has reached an all-time high

compared to active inventory, as the following chart shows:

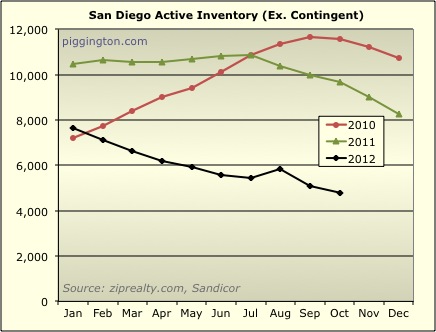

Here’s how things look if we just chart actives:

Note that there is about half as much active inventory as there was

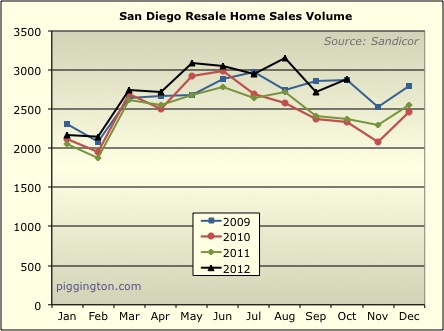

a year ago! And yet, sales volume is the highest (for October)

in at least three years:

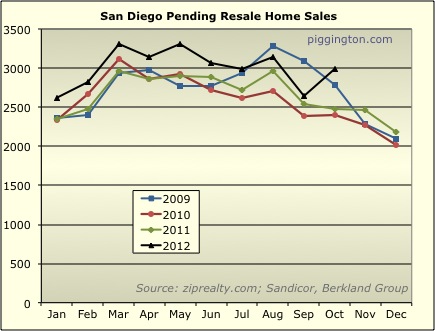

As a result, months of inventory is plumbing new lows:

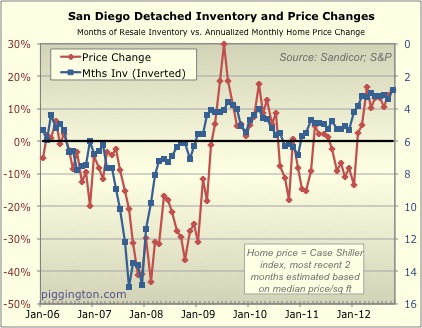

Here’s the chart I’ve been emphasizing that shows the strong

relationship between months of inventory and prices:

Prices do tend to weaken in the fall and winter months, but I

wouldn’t expect much of a price decline for as long as months of

inventory remains so exceedingly low.

Good.

Good.

It would be interesting to

It would be interesting to see the San Diego months of resale inventory going all the way back to 2000. Wonder if this was what really caused the peak/frenzy leading up to the peak in 2005/2006.

moneymaker wrote:It would be

[quote=moneymaker]It would be interesting to see the San Diego months of resale inventory going all the way back to 2000. Wonder if this was what really caused the peak/frenzy leading up to the peak in 2005/2006.[/quote]

Unfortunately that’s as far back as I have it. But, months of inventory was super-low during the hottest times, getting to its lowest iirc in spring 2004. I wouldn’t say it was the cause of the price rise, though… it was the effect of the insatiable demand driven by the bubble mentality and super-easy financing.

I would say that now is

I would say that now is similar to pre boom times. Although money is not “loose” it is certainly cheap to those with access to it. So with low interest rates, so much money sitting in cash, and low inventory, I think it’s triple witching time for the “rich” to start a real estate bubble of their own. I predict in the next 2 years a small bubble that will run real estate up 50%.

2 years is a bold prediction,

2 years is a bold prediction, but 50% is not. We can get 50% by 7% a year for 6 years. As flu said in other thread, we got 12% this year. So at this rate, we just need 3-4 years for 50%.

carlsbadworker wrote:2 years

[quote=carlsbadworker]2 years is a bold prediction, but 50% is not. We can get 50% by 7% a year for 6 years. As flu said in other thread, we got 12% this year. So at this rate, we just need 3-4 years for 50%.[/quote]

What evidence over the long term is there for 7% appreciation in home values. The 10+% per year during the bubble was an extreme outlier, traditionally you might get 2-3% at best over 10 year time frames. This past year just happened to produce a situation where December 2011 marked a low point so things are up, but look at the past 2 years, 3 years, or 4 years, and the return are low single digits even after the 12% gain.

livinincali wrote:

What

[quote=livinincali]

What evidence over the long term is there for 7% appreciation in home values. The 10+% per year during the bubble was an extreme outlier, traditionally you might get 2-3% at best over 10 year time frames. This past year just happened to produce a situation where December 2011 marked a low point so things are up, but look at the past 2 years, 3 years, or 4 years, and the return are low single digits even after the 12% gain.[/quote]

You are right. It is probably nonsense. I wrote that reply after reading this:

http://finance.yahoo.com/news/the-15-best-housing-markets-for-the-next-five-years-200056059.html?page=all

But I think traditionally, it should track inflation which is not going to be up that much in the next few years.

Could I have been right? Stay

Could I have been right? Stay tuned.

With inventory shrinking and

With inventory shrinking and price rising, I wonder if people have wrongly accused the “government manipulation” on this board. After all, the US housing market has a good crash and it now seems to be a short one as well.

It might be shorter if we remove all the “government manipulation” starting from middle of 2008, but three years at the bottom is not that bad, comparing to other countries. Unless, people think we haven’t seen the end of it yet. But almost every indicator right now is saying that the worst is behind us:

http://www.forbes.com/sites/trulia/2012/11/28/housing-market-recovery-accelerating-now-47-back-to-normal/

Comment?