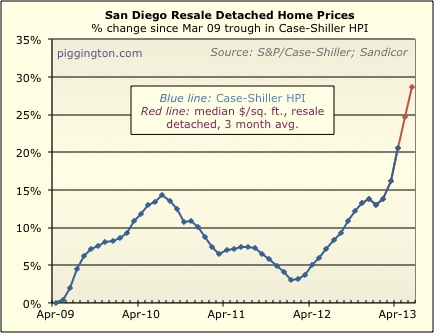

This chart of the Case-Shiller index (with my estimate based on

median price per square foot over the last two months) shows just

how different the character of this year has been:

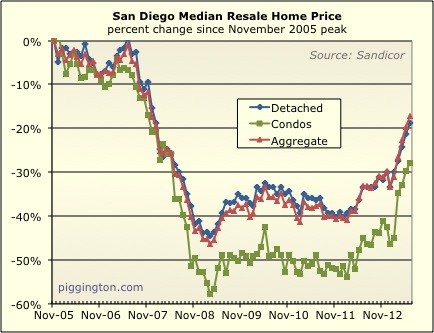

There was a plodding upwards of prices last year, for sure, but so

far this year, prices haven’t so much been plodding as exploding.

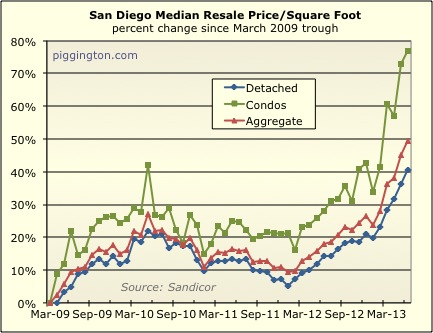

For a more granular look, here are the month to month changes in the

median price per square foot:

The condo series is a bit of a wild animal so I usually ignore it;

the underlying trend it better expressed by the more staid detached

home series (blue line). But even that has been on fire: the

detached home median price per square foot is up 23% from a year

ago, and up 16% in the first six months of 2013 alone.

This price surge has been due, as I’ve written about incessantly, to

ridiculously low inventory and even ridiculously lower mortgage

rates. One of those conditions persists; the other has changed

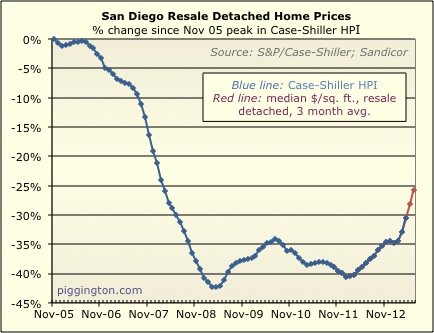

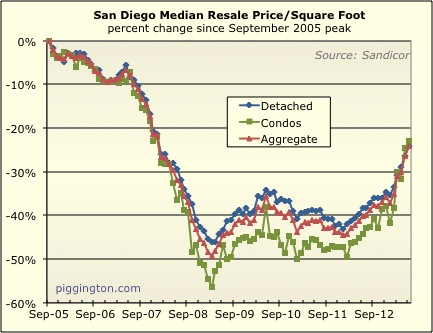

somewhat drastically. More on that below; first, here are the

above two charts starting at the peak of the bubble, followed by the

same thing but for the regular median price (vs. price per square

foot):

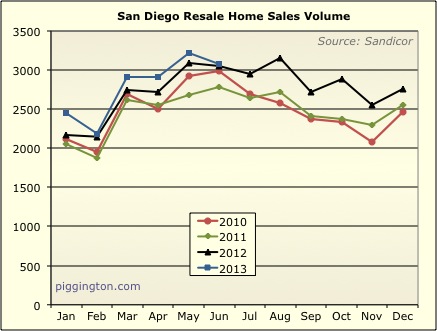

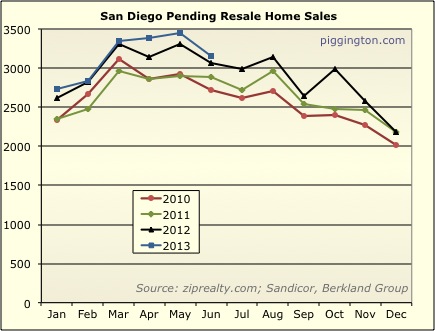

Onto some supply and demand stuff… sales continued their pattern

of being similar to, but typically slightly higher than, last

year:

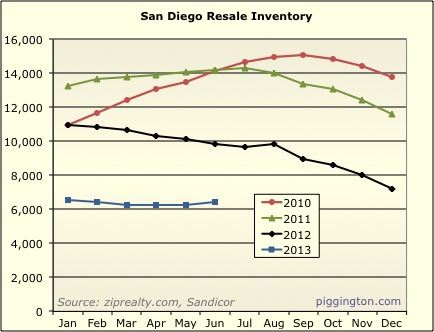

Inventory seems to have arrested its plunge, finally, and ever so

slightly turned up:

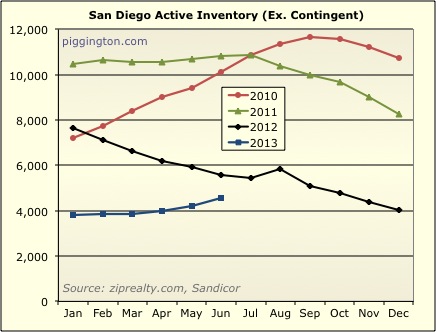

The increase is more pronounced if we look at active listings only,

which should be some comfort to potential buyers (as active

inventory is more “real” than contingent, which is in kind of a

limbo state):

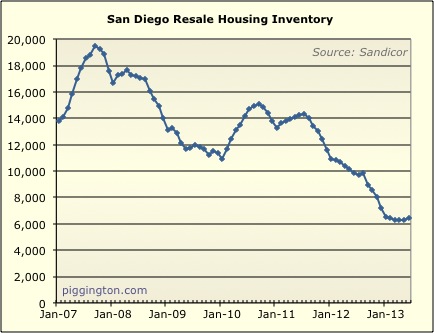

Here’s a linear look at total inventory, putting the small bounce in

perspective:

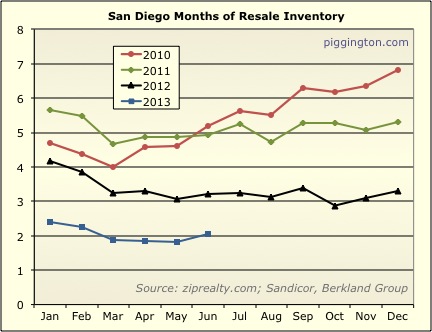

This has slightly improved months of inventory, but it remains

extremely low on an absolute basis:

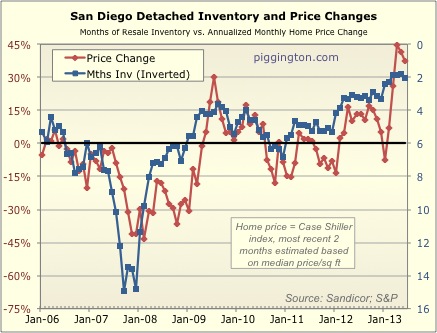

And of course, we look at months of inventory because it is a good

predictor of near-term price pressure, as the following graph

shows. The dramatic nature of the recent monthly price

increases can be seen on this graph too. All things equal, it

predicts more strong upward price pressure to come.

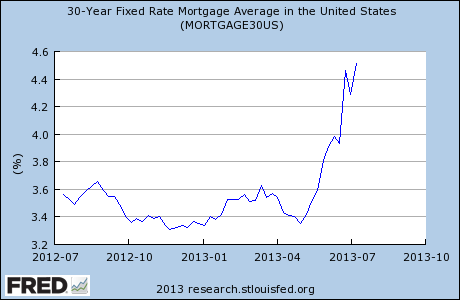

But all things are not equal… as everyone has heard by now, there

has been a dramatic increase in interest rates over the past couple

of months:

This is big, in my view. Low rates have been a big driver of

housing demand, for both investors (who are seeking out yield

wherever they can find it) and residents (who are compelled to buy

due to the favorable rent-vs-buy comparison enabled by super low

rates). This rate increase will almost certainly undercut both

sources of demand.

To what extent, I don’t know, but this illustration helps

demonstrate the impact: eyeballing it, the average mortgage

rate prior to the recent surge was in the range of 3.5%. It’s

now about 4.5%. A buyer who is trying to hit a certain

dollar-amount budget for a monthly payment just saw the size of the

loan they can afford drop by over 11% in about two months.

That has got to have an impact.

It could be slow to feed through to declining demand… in fact,

there may have been an early opposite effect in which buyers feel

like they should rush to buy before rates go up further (this is

what drove the final peak-volume mania phase of the housing bubble

in spring 2004). But it seems to me that this must cool off

the housing market as buyers find they can afford less, and

investors see that yields from other investments are less absurdly

low. This is to say nothing of the impact that a tightening of

credit conditions might have on our over-levered economy in general.

So the recent move in rates could be a pretty big deal. We

will see, I suppose. In the meantime, the housing market

continues to be supported by the level of inventory, which has

finally started to turn up a bit, but remains extremely low overall.

Why would one assume that

Why would one assume that May-June were on the same straight like as Mar-April (especially since inventory has shot up about 50% in the last month)? With the increase in inventory, June doesn’t seem right, or maybe the effect will be seen in July.

Inventory may have “shot up”,

Inventory may have “shot up”, but from an already very low level. So even after inventory going up a little, it is still extremely low and has a long way to get to anywhere close to normal.

spdrun wrote:Why would one

[quote=spdrun]Why would one assume that May-June were on the same straight like as Mar-April (especially since inventory has shot up about 50% in the last month)? [/quote]

Nobody assumed anything. That’s simply what the PPSF data show.

FormerSanDiegan wrote:

Nobody

[quote=FormerSanDiegan]

Nobody assumed anything. That’s simply what the PPSF data show.[/quote]

Yes.

Assuming cyclical nature of

Assuming cyclical nature of the housing market, with peak in late 70’s, trough in mid 80’s, peak again late 80’s, trough again in the mid 90’s. The average time from peak to trough about 8 years.

The last peak was suppose to be 2003, which would have meant a typical trough in 2011, which means the current increasing price is essentially getting us back to the regularly scheduled programming?

Not sure if I’m buying this.

Not sure if I’m buying this. Peak was in 2006, putting trough in 2014 or so. Furthermore, observe:

http://www.deptofnumbers.com/asking-prices/california/san-diego/

Prices flat in July. Inventory up about 60% since trough in Feb, mostly in one month.

spdrun wrote:Not sure if I’m

[quote=spdrun]Not sure if I’m buying this. Peak was in 2006, putting trough in 2014 or so. Furthermore, observe:

http://www.deptofnumbers.com/asking-prices/california/san-diego/

Prices flat in July. Inventory up about 60% since trough in Feb, mostly in one month.[/quote]

Sorry, I should have been clearer. I meant the peak was suppose to be 2003, instead of the persistent rise fueled by the loose lending, the peak was extended to 2006 and that price then lasted for another couple more years. So essentially the artificial price peak delayed the natural cycle by about 5 years.

Nice observation ocrenter.

Nice observation ocrenter. So if 2011 was the low then the new peak should be somewhere around 2019? This is a guess but I feel that prices were about 50% higher in 2003 than at the last late 80’s peak so maybe we should expect prices in 2019 to be about 50% higher than 2003 prices which sounds pretty reasonable. In fact here is a bread and butter house in 92103 near Balboa park that just traded at very close to (late) 2003 price levels.

http://www.sdlookup.com/MLS-130027390-3427_Herbert_St_San_Diego_CA_92103

So that means we need around a 50% gain from today’s prices in the next 6 years for the cycle theory to play out.

Jim Klinge has posted some

Jim Klinge has posted some stats to suggest that my concerns about higher rates at the end there may be overblown:

http://www.bubbleinfo.com/2013/07/17/mortgage-rate-panic/

It will be interesting to see what happens next…

You speak as if lower home

You speak as if lower home prices are a thing to be concerned about instead of celebrate.

As a 30-something who’s buying rental property in NJ and CA, I take the latter view. Mo’ chaos = mo’ opportunity. As to the idiots who bought during the 2003-2007 bubble, why should I care about ignorami like them keeping their homes? Fuck’em.

You’re reading into it…

You’re reading into it… that’s not my intent at all.

Believe me, I’ve been a longtime (very longtime) proponent of the idea that overpriced houses, and assets in general, are not a good thing.

Sorry if I misunderstood. If

Sorry if I misunderstood. If you’re of the “let those who made bad investments sell short and let (divinity of choice) sort ’em out” school, then I’m with you.

I would like to point out

I would like to point out that residents in those zip codes listed in JtR’s blog post are not bothered by a 1% jump in rates. Those are high income zip codes. The residents in those zip codes are not affected by higher rates today because not only do their incomes allow them flexibility, but those zip codes are dominated by high down payments from owner occupiers.

Besides, shouldn’t there be a lag for payment shock to show up in sales anyway?

According to Nick Timiraos

According to Nick Timiraos WSJ rates need to be 6% and prices up 20% before homes are unaffordable, but on a $450 k home the new rates add $250 to the monthly nut, which will sideline some buyers rather than generate new demand. Jim Klinge said the crazy pool of buyers has diminished considerably. Prices have already flattened apparently. But with supply still at 1.5% of households, it should continue to put upward pressure in prices. Or will it this time? Tighter credit, high levels of personal debt relative to incomes, unemployment, insurance costs on FHA, less investment/foreclosure activity …and now higher rates. Whatever, Helicopter Ben will come to the rescue if things falter.

Probably a large percentage

Probably a large percentage of those who bought at the peak will continue to ride it out at this point IMO.

2009 yea they probably were a lot easier to give up on it.

Doesn’t matter. If prices

Doesn’t matter. If prices drop, the market will be again dominated by short-sellers, as it still is in parts of my area — I doubt that MOST people own for cash. Here’s hoping.

Low inventory AND lower prices suits me fine.

spdrun wrote:Doesn’t matter.

[quote=spdrun]Doesn’t matter. If prices drop, the market will be again dominated by short-sellers, as it still is in parts of my area — I doubt that MOST people own for cash. Here’s hoping.

Low inventory AND lower prices suits me fine.[/quote]

So much focus on the monthly nut and affordability, but price is what it boils down to. I hope it becomes more relevant again. The tail has been wagging the dog for too long.

jazzman – you’re implying

jazzman – you’re implying that Bubble Bennie CAN actually come to the rescue with more QE. The headline yesterday was that we may be in a recession (aka negative GDP growth) despite four years of QE programs.

I think some markets are also more price (as opposed to nut) sensitive than others. Seems like people buy on monthly payments more in the Southwest and South. But go to places like the Northeast and Texas, and you end up with a lot more lending on portfolio, where you need 15-20% down at least to get your foot in the door.

Most of those markets are more steady than the wild gyrations we’re seeing in CA, FL, AZ, and NV.