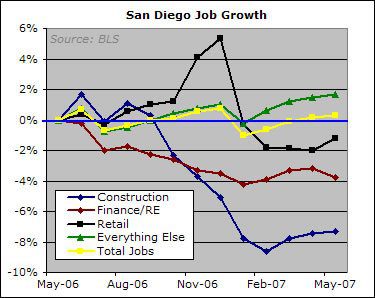

The employment sectors that benefitted from our erstwhile housing boom, while having experienced seasonal growth in recent months, continue to shed jobs based on a year-over-year comparison. Between May 2006 and May 2007, the construction industry lost 6,900 jobs, retail lost 1,800 jobs, and finance and real estate gave up 3,200 jobs. The three sectors shed 11,900 jobs between them.

I read this on Mish’s blog

I read this on Mish’s blog yesterday. I’m still in the camp that recession, starting with San Diego is a distinct possibility by the end of this year.

“Californians’ consumer confidence in the economy took a dive in the second quarter of 2007, plunging into the pool of pessimism by 19 index points. Economist Esmael Adibi called the drop “astonishing” – the steepest he’s seen since 2002 when Chapman University’s Gary Anderson Center for Economic Research of Orange County began sending surveys to California residents.

“There could be even more of a slump in the next quarter,” Adibi said, as the survey of California residents reflects diminished enthusiasm on the part of consumers in the state to buy big-ticket items over the next six months.

The 19-point drop, from 101.9 down to 82.8, is considered significant because the consumer confidence index hasn’t dropped this sharply since 2002 when the state budget was in flux. And that has people trying to hold onto more of the money they have – uncertain what tomorrow may bring.”

Agreed. If not this year,

Agreed. If not this year, the next one.

I had a conversation with my millionaire old lady landlord this morning. She’s a realtor and says the California real estate agent association says job growth is strong and things overall are all good.

People often claim this and point to the aerospace layoffs of the 90’s as justification for the high prices this time around.

I find it funny that housing tips back to reality and they instanly point at anything they can to convince would-be buyers that everything is okay.

I argue that this time around the layoffs are going to come as a result of the bubble popping, not be the cause of it. That makes a big difference in the timing of prices falling vs. employment levels.

As prices fall and foreclosures rise, everyone who made a buck of the boom – from cleanup crews, to managers of MBS’ – is going to feel the pinch. As those incomes dry up, prices will be hit even harder.

Detroit and Ohio are similar to the aerospace bust and as a percentage they are only slightly worse than California.

Nice slice and dice, Rich.

Nice slice and dice, Rich. Yep, those are ugly losses and weak growth.

And, the last three months’ seasonally adjusted data, month-over-month, is even more ominous.