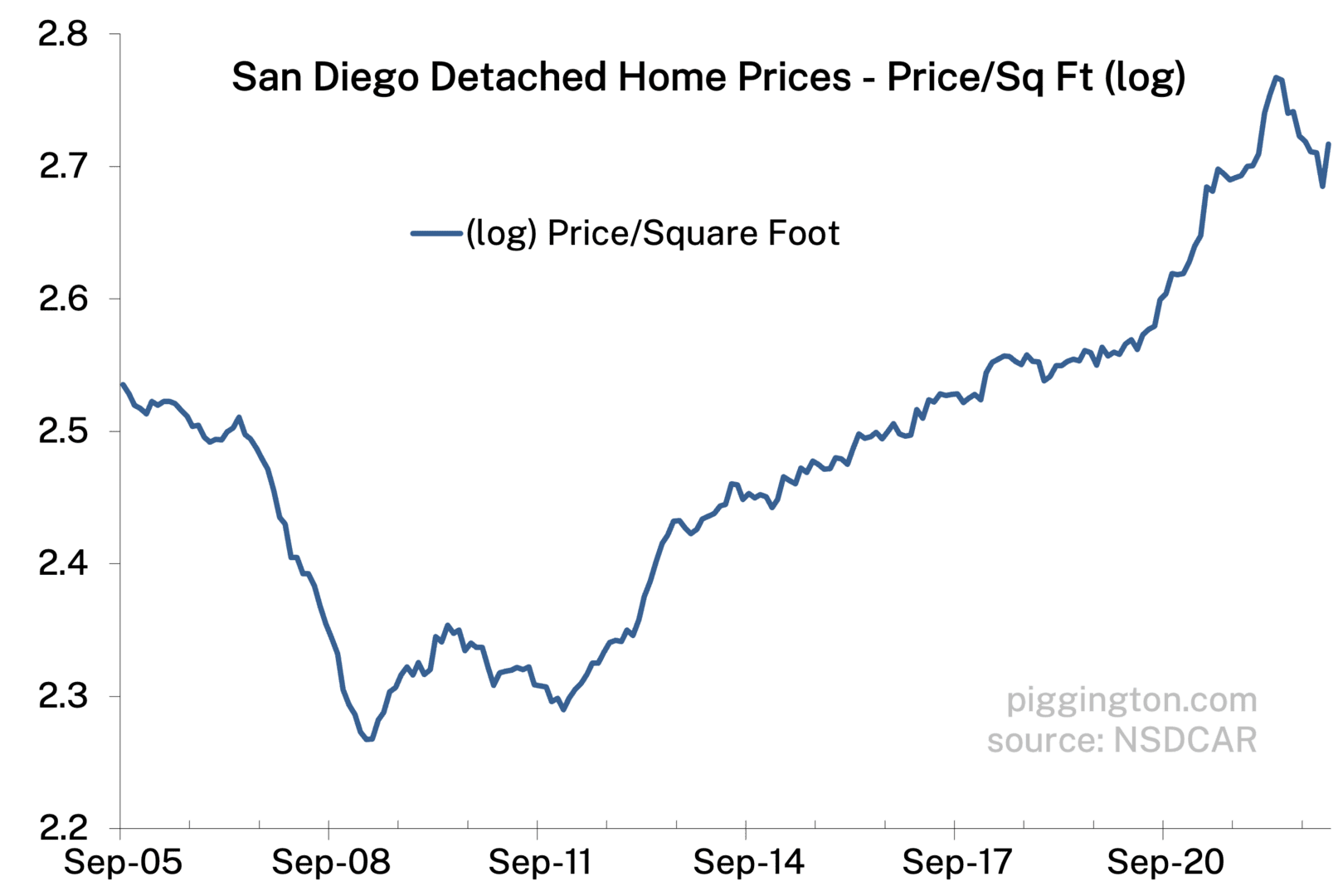

In the last update, I wrote this regarding the steep December drop in monthly home prices:

The single family median price/sqft got smoked for almost 6% in December, but that is likely due to compositional effects (a change in what’s being sold) as opposed to a “real” change in the market value of housing… This is just the kind of thing that shows up in a noisy data series like this. I think the takeaway is: whatever the actual change in home values might have been, it was likely to the downside.

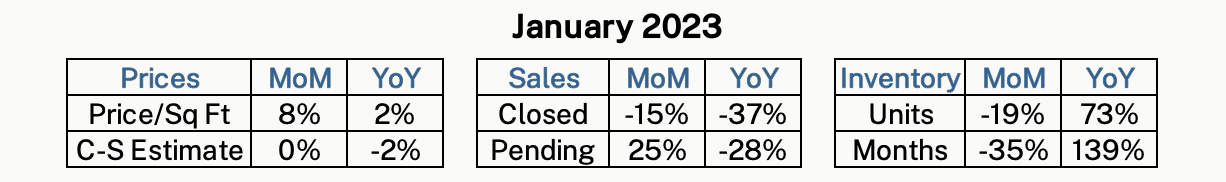

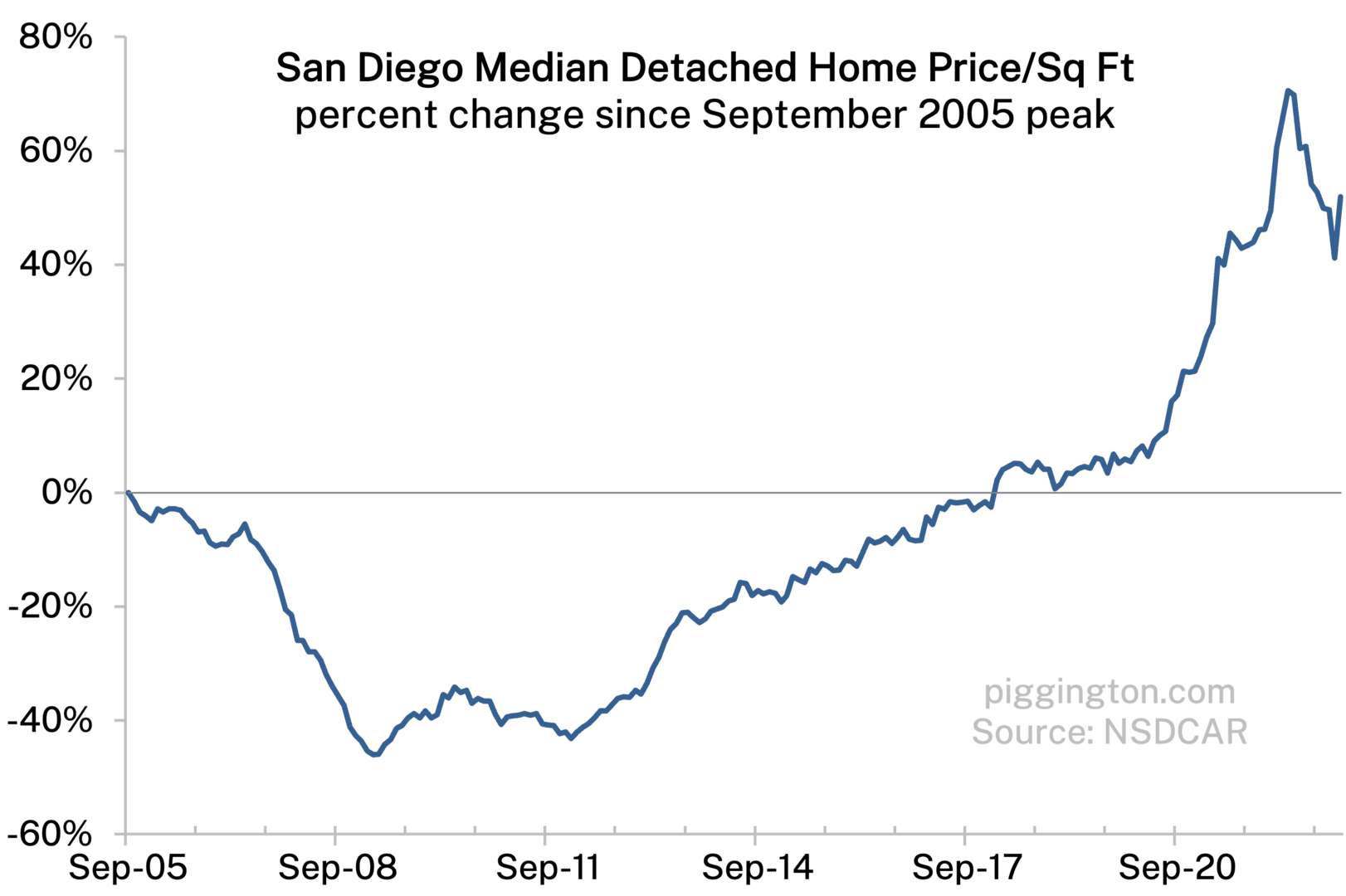

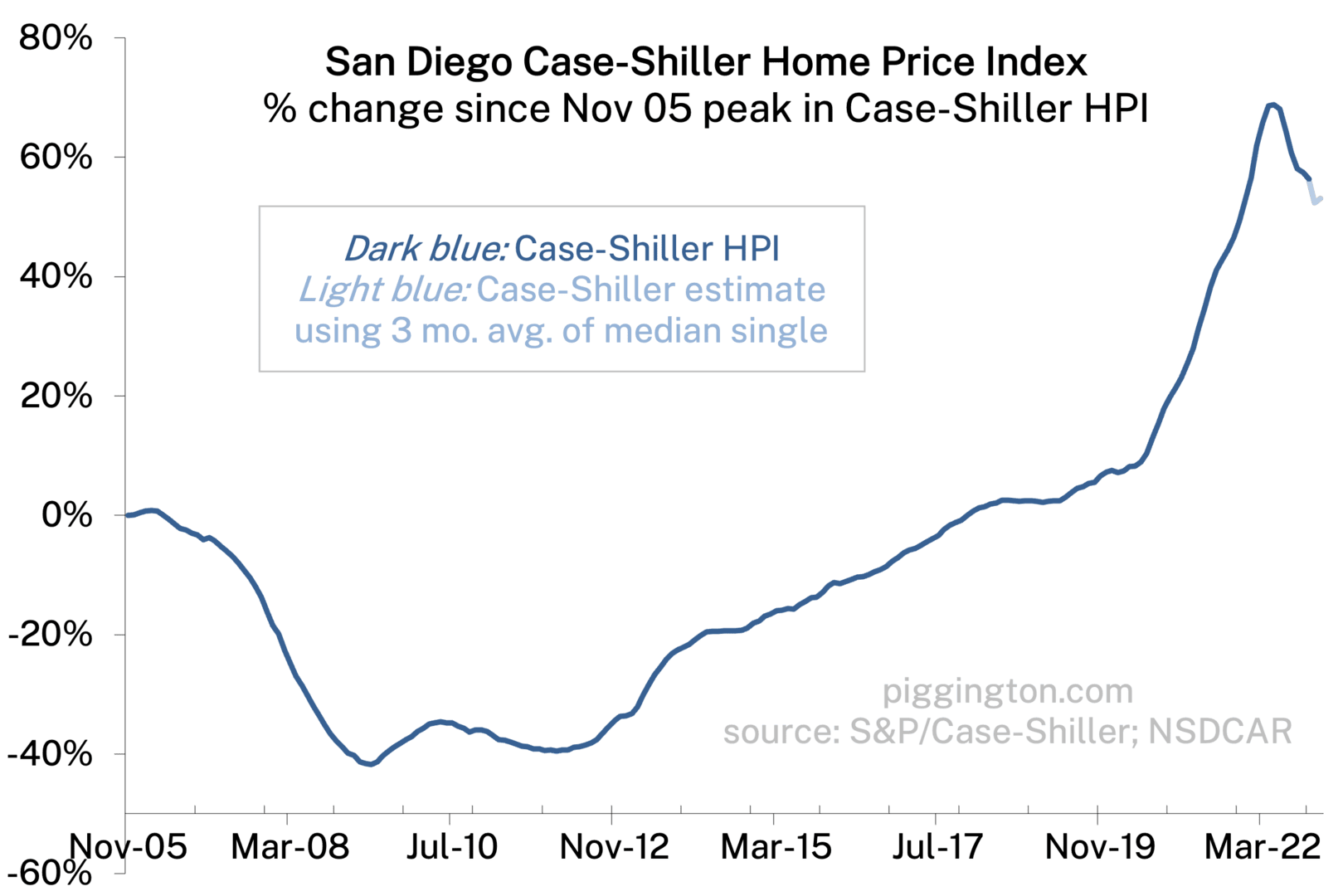

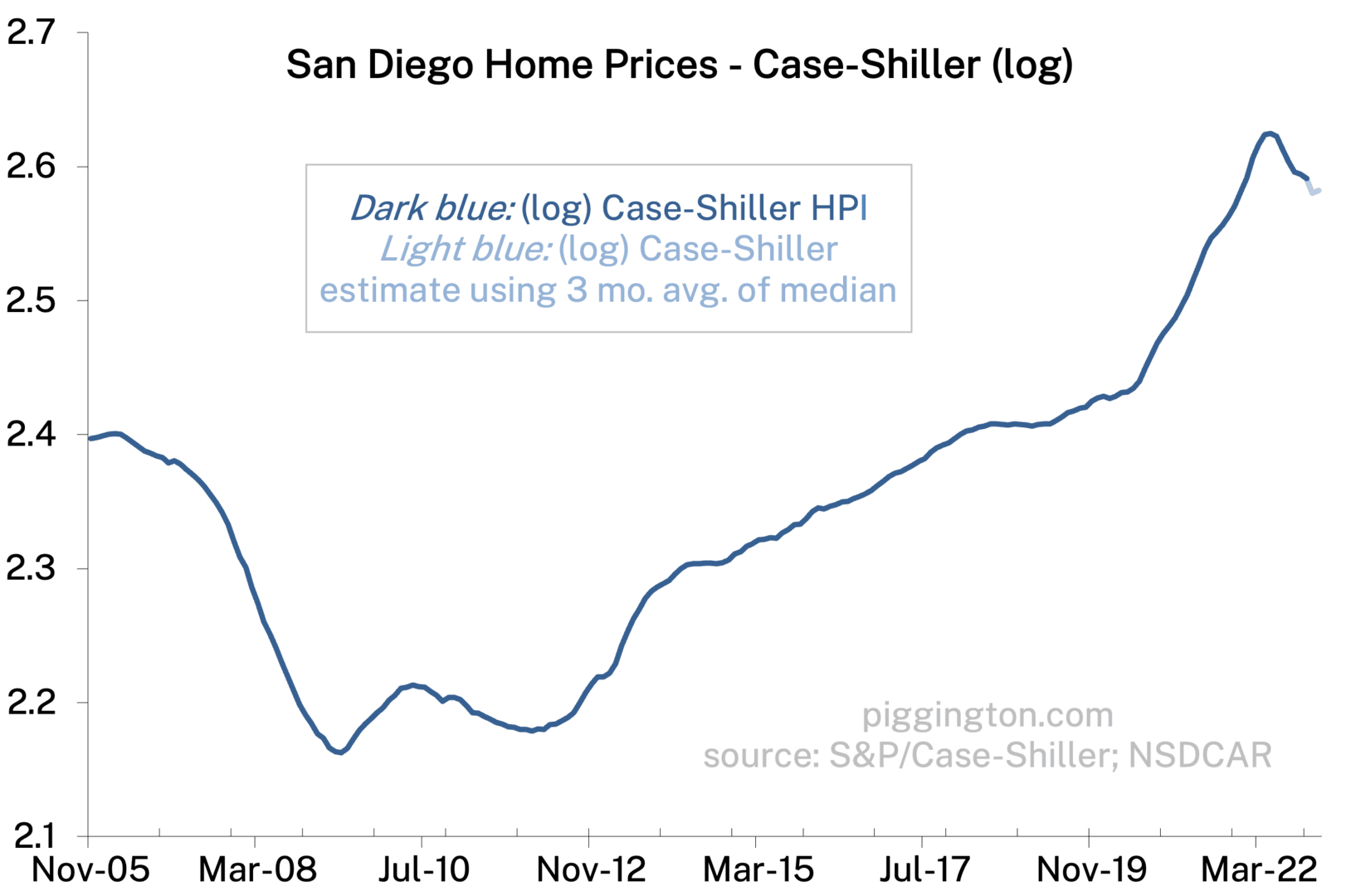

That conclusion might have been premature, because in January, the median price per square foot turned around and surged by almost 8%!

Clearly there is some major noise in the monthly figures here. While we wait for that to settle out, let’s take a look at supply and demand…

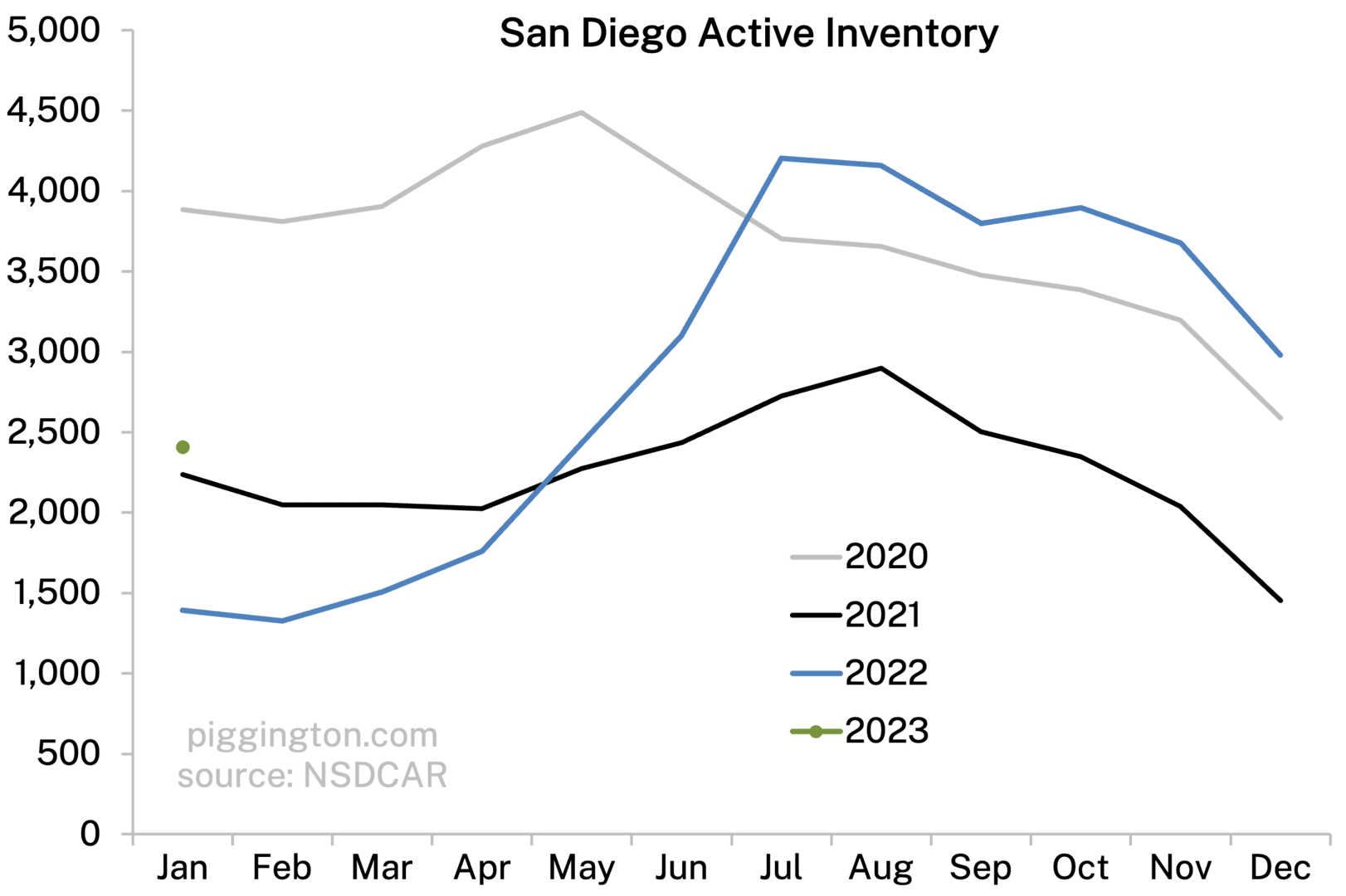

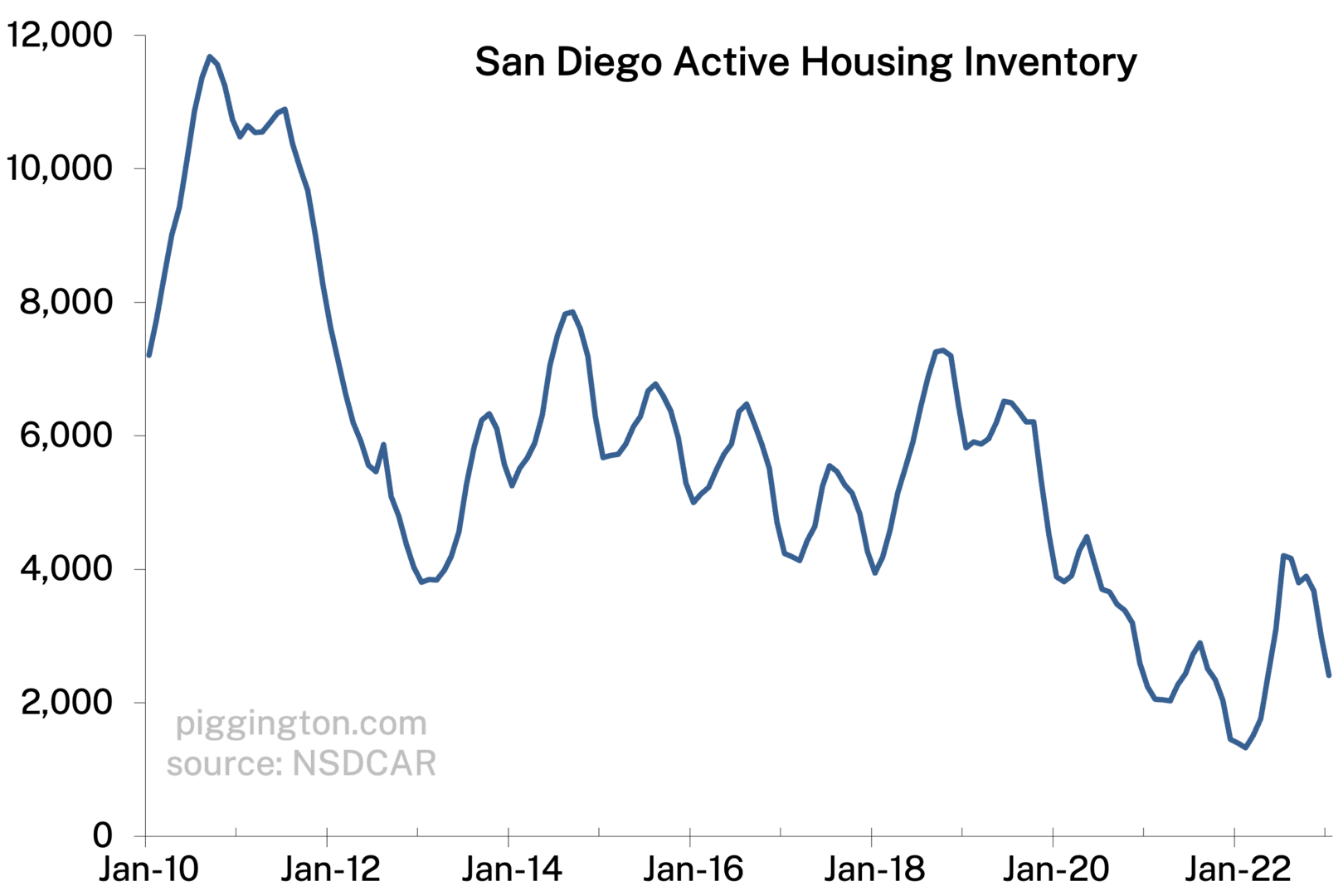

Inventory dropped by 19% from December:

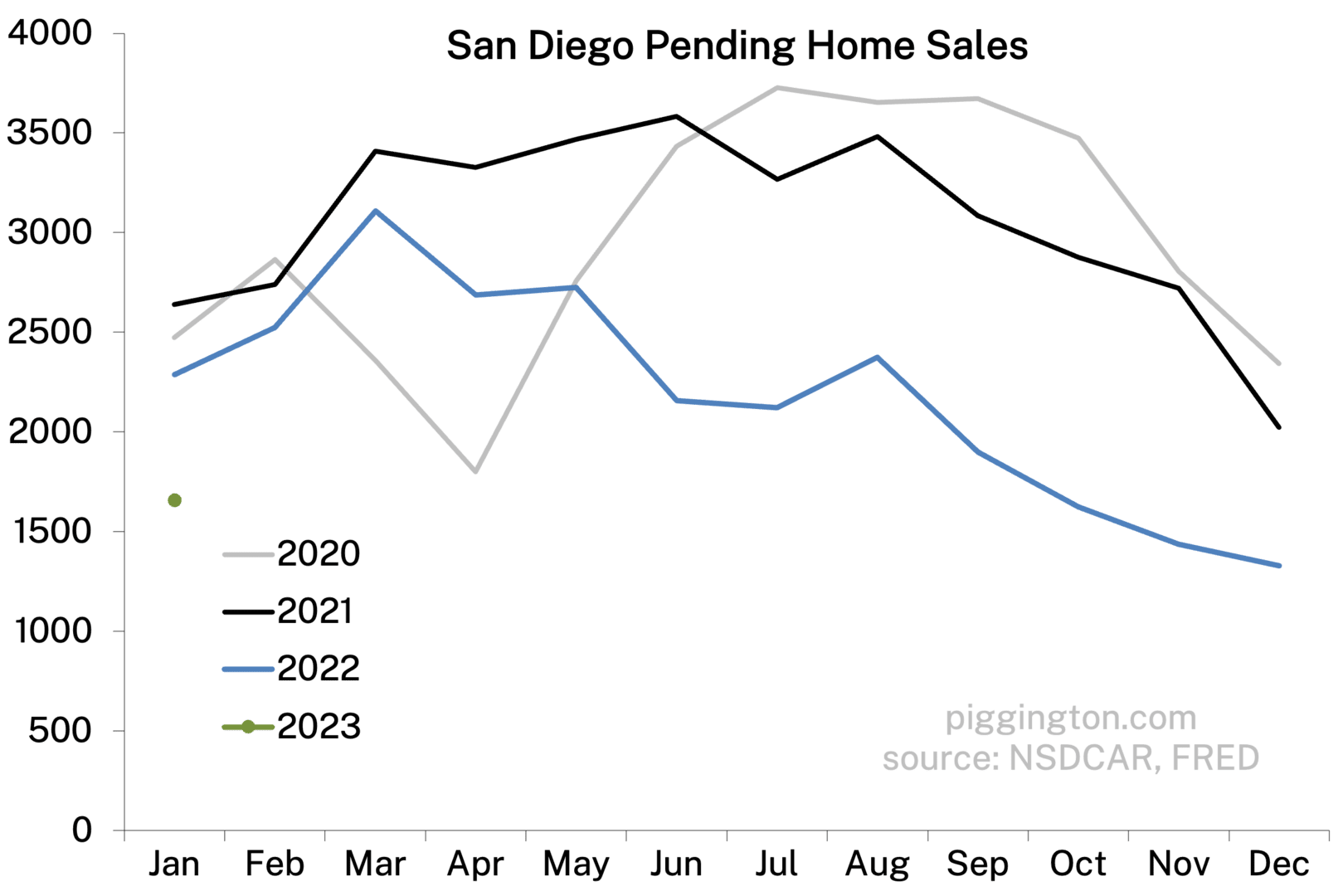

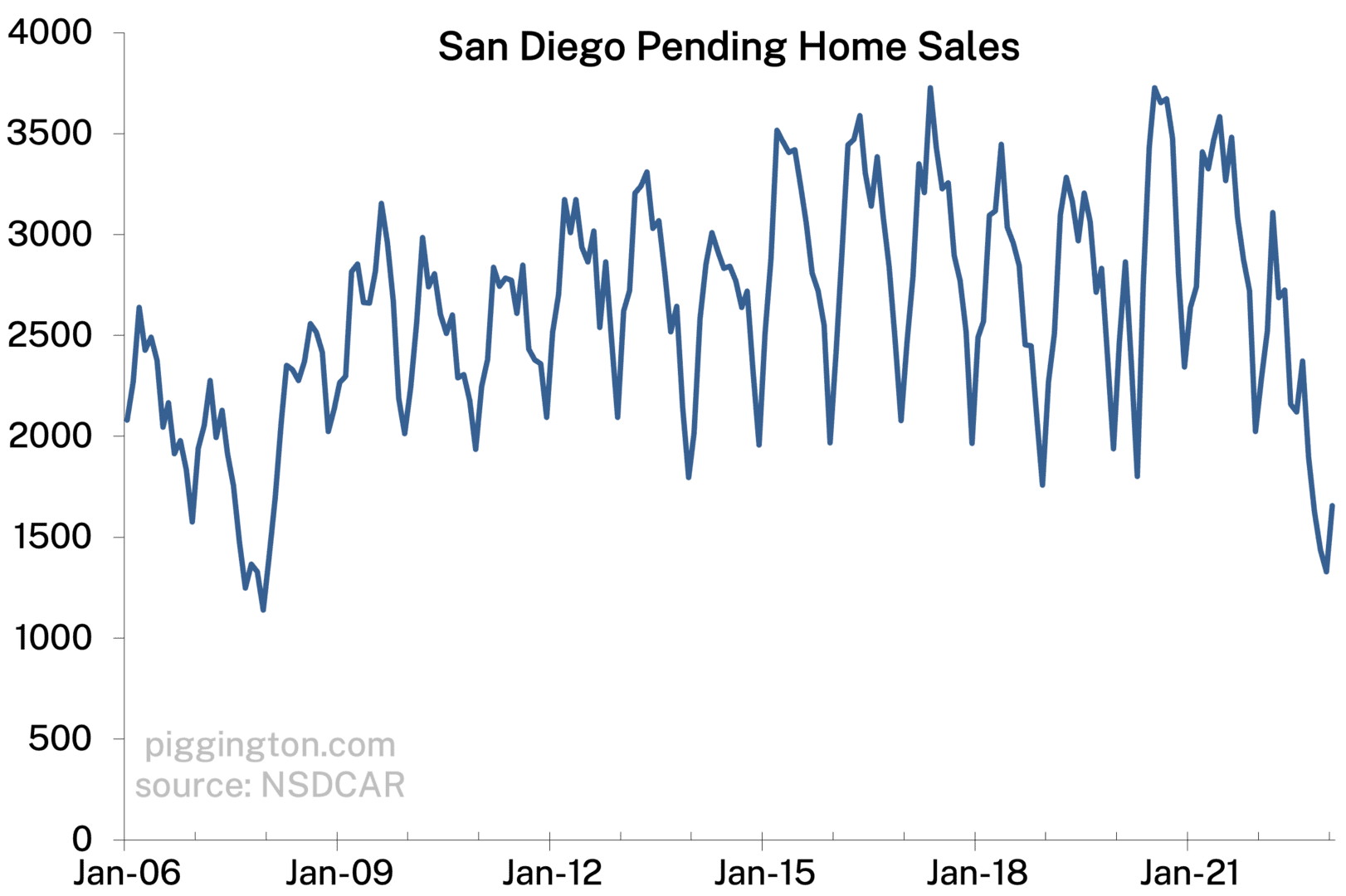

…while pending sales increased by 25%:

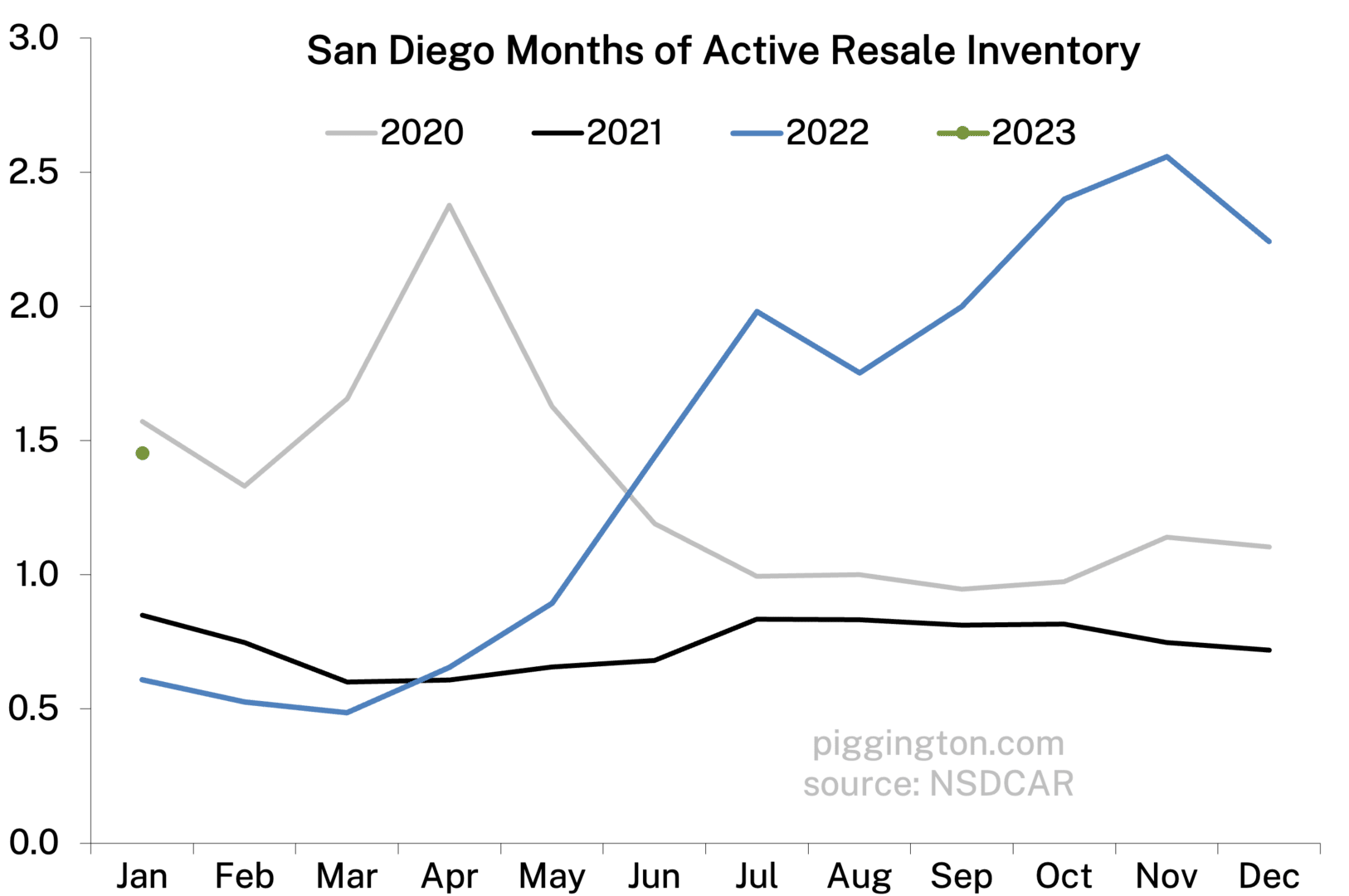

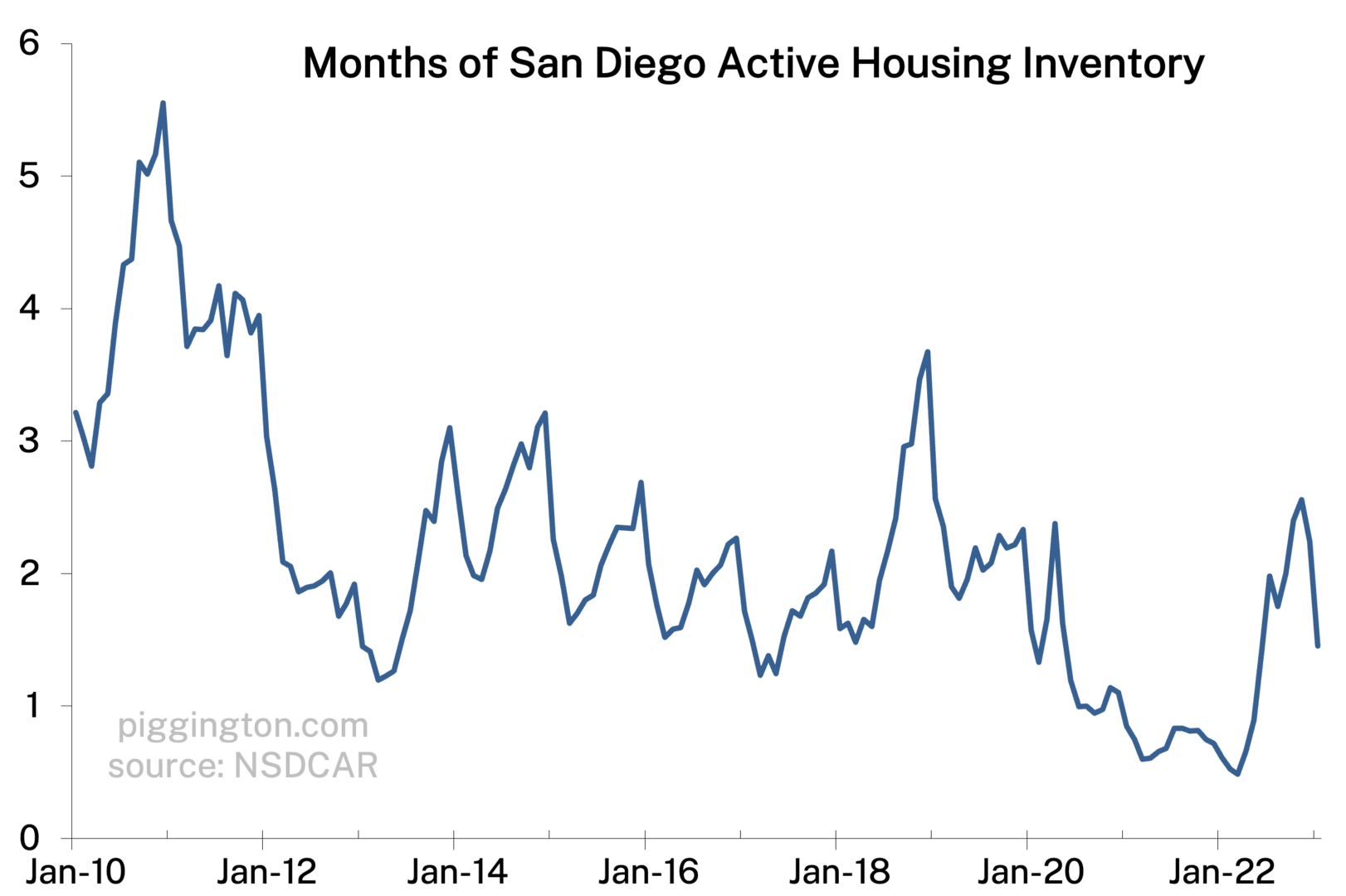

…resulting in a significant decrease in months of inventory:

Here’s a longer look at months of inventory. Comparing to post-GFC/pre-Covid levels, we’ve gone from “middle of the range” to “low end of the range.”

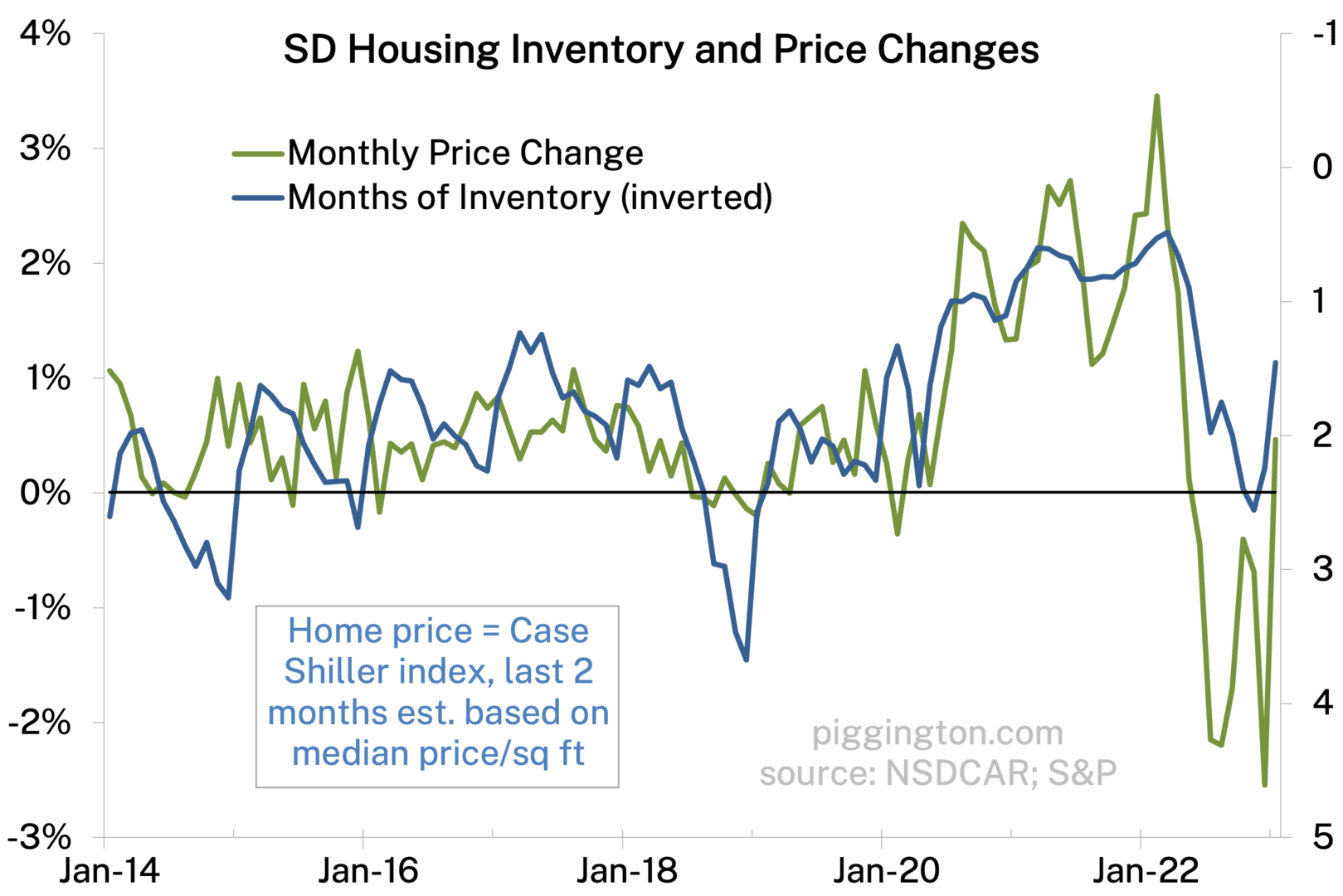

Bear in mind that this was January, which is seasonally weirder than most months. We will get a better read soon. With that said, here is the relationship between months of inventory and price changes. The current level of inventory has historically coincided with rising prices.

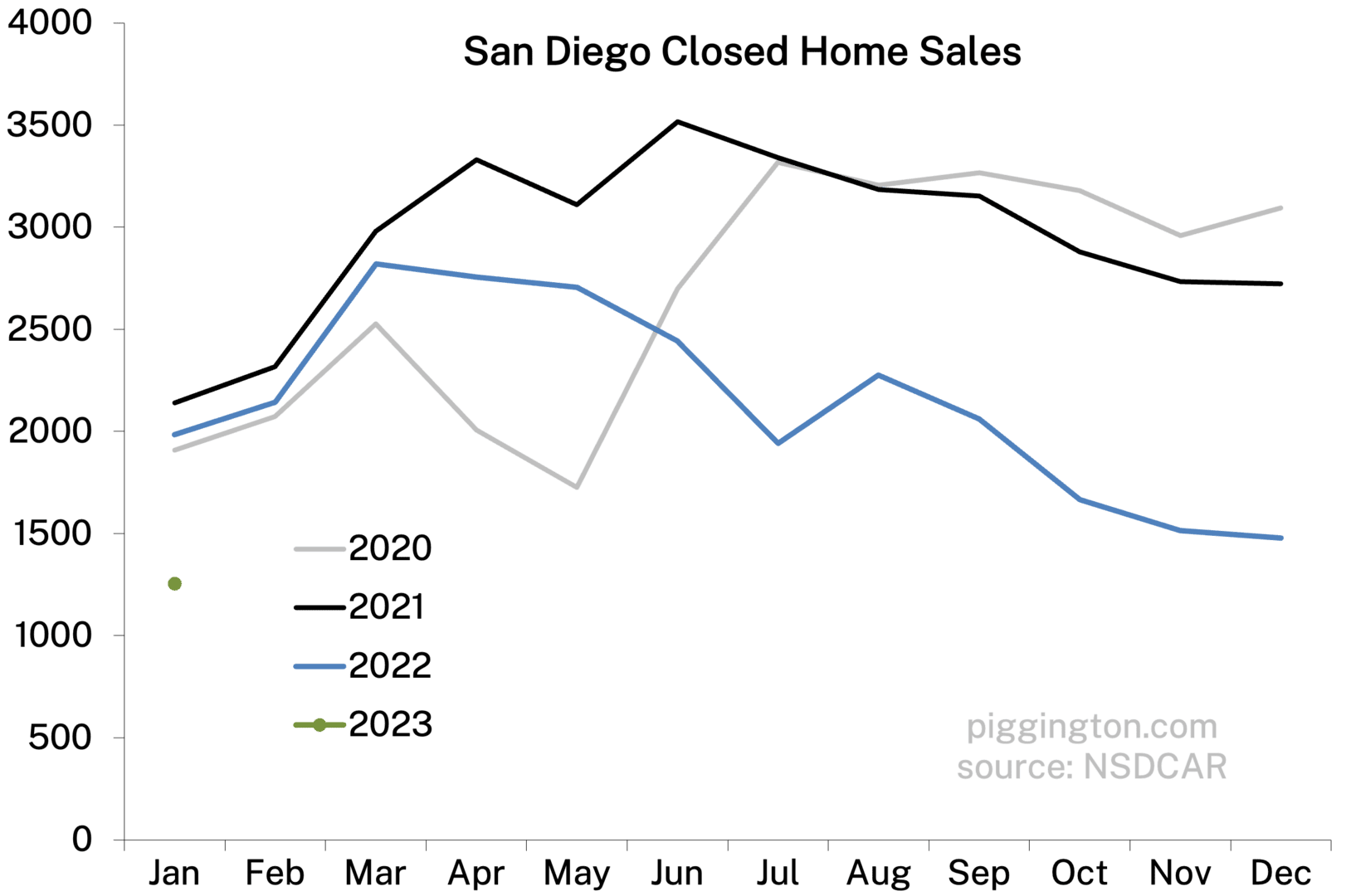

One interesting characteristic here is that while both supply and demand are in pretty reasonable balance with each other, both are very low compared to history. See the next two graphs, first supply and then demand. So it continues to be a bit of a standoff. Who will blink first?

More graphs below…

*zooms in on Q1 ’07*

Huh. Indeed, I do wonder who’s going to blink first. (Shooting for smug here. How’d I do?)

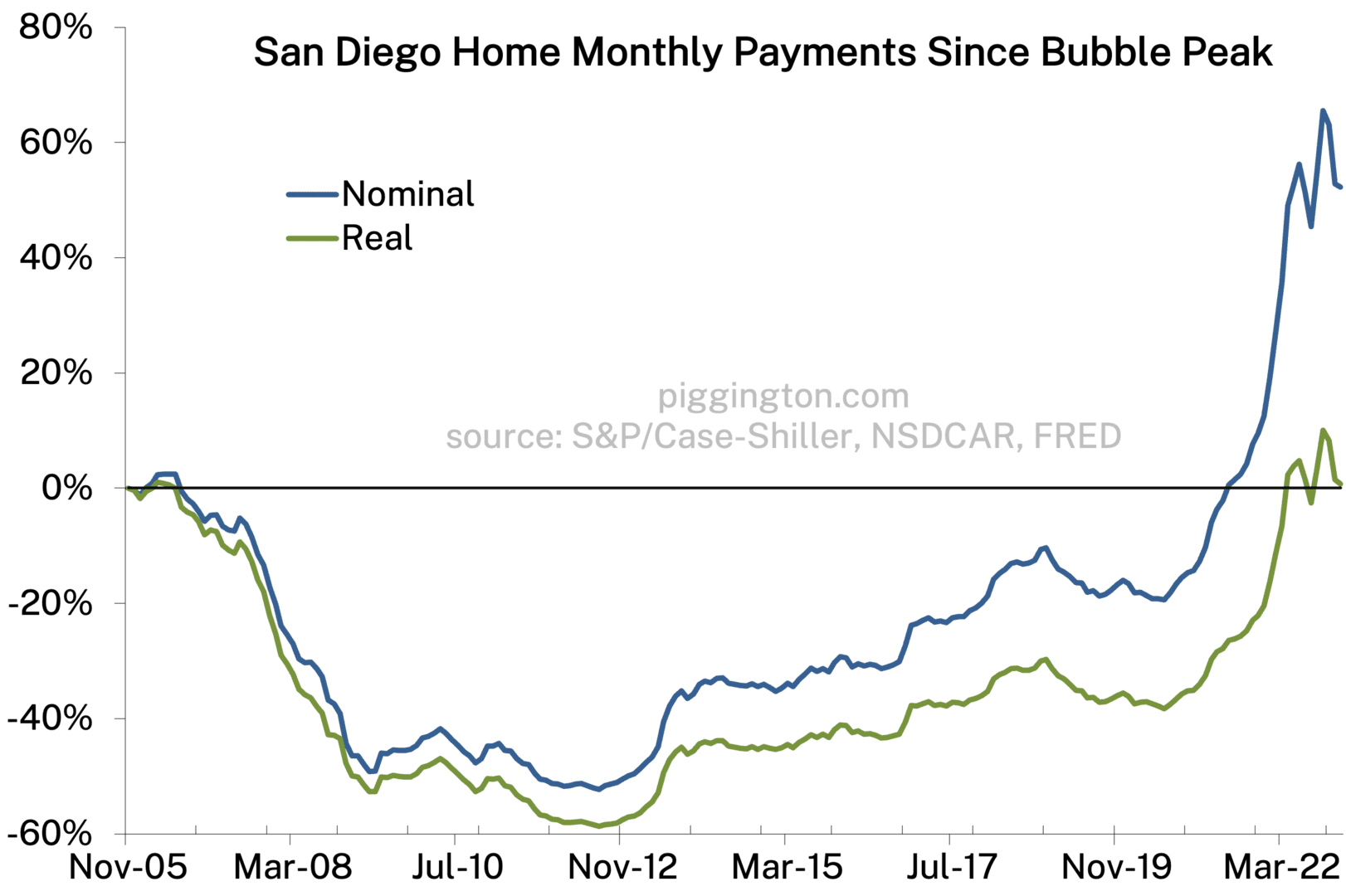

It’s a pretty different setup than ’07…

Different cause, same potential effect. I’m watching unemployment now more than anything now. If it continues not to budge, we might get the soft landing we’re hoping for.

It’s not a matter of blinking if new listings continue at abysmal levels. Even with significantly lower demand there are enough to buy what is out there at current levels. For falling prices we simply need supply to outstrip demand and for now that’s just not the case

Thanks for the updated info.

I am not optimistic about the next 12 months, about -3% is my base case. After that breather that will allow rents and incomes to catch up to prices, I think we’ll revert to the prior trend-line that reflects San Diego RE’s very strong fundamentals, which are supported by multiple long term economic trends.

We still haven’t fully digested the WFH shock to residential RE demand, nor the fact that crime/covid seems to have permanently reduced the amenities and attractiveness of SF/Seattle/NYC for high income and skilled workers, to the benefit for more “law and order” 2nd tier sunbelt cities like San Diego, Phoenix, and Austin.

I was on my weekly call with a SoCal housing economist who does a very nice job tracking what is going on. One thing he does is compare inventory levels and lsiting volumes to the 3 year average Pre-COVID.

For the year 2022 the number of homes listed for sale was down 25% from the pre-COVID number.

All counties including Ventura, LA, Riverside, San Bernadino, OC and San Diego afre down but we consistently down the most followed by the OC.

He just reported for the month of January 2023.

San Diego homes listed for sale was down 49% from pre-COVID January averages.

That dearth of inventory coming on precludes further declines

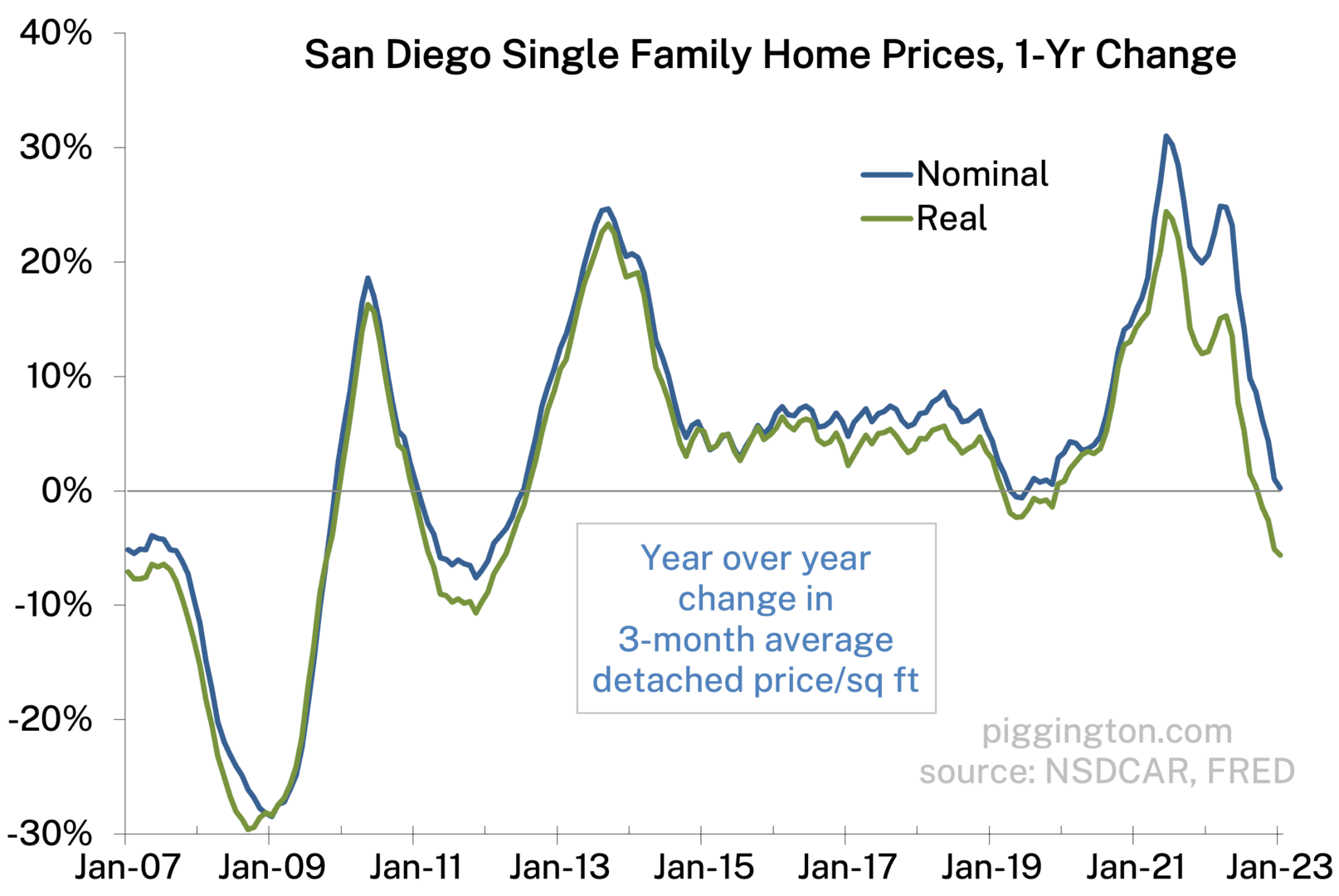

Interestingly the year over year reported numbers should start getting deeply negative soon around here. Jan through April prices soared here in 2022 and we will now be comparing the already lower numbers to higher y-o-y numbers from Jan -April 2022. Ironically prices wont actually be falling and may even be rising when that news starts hitting

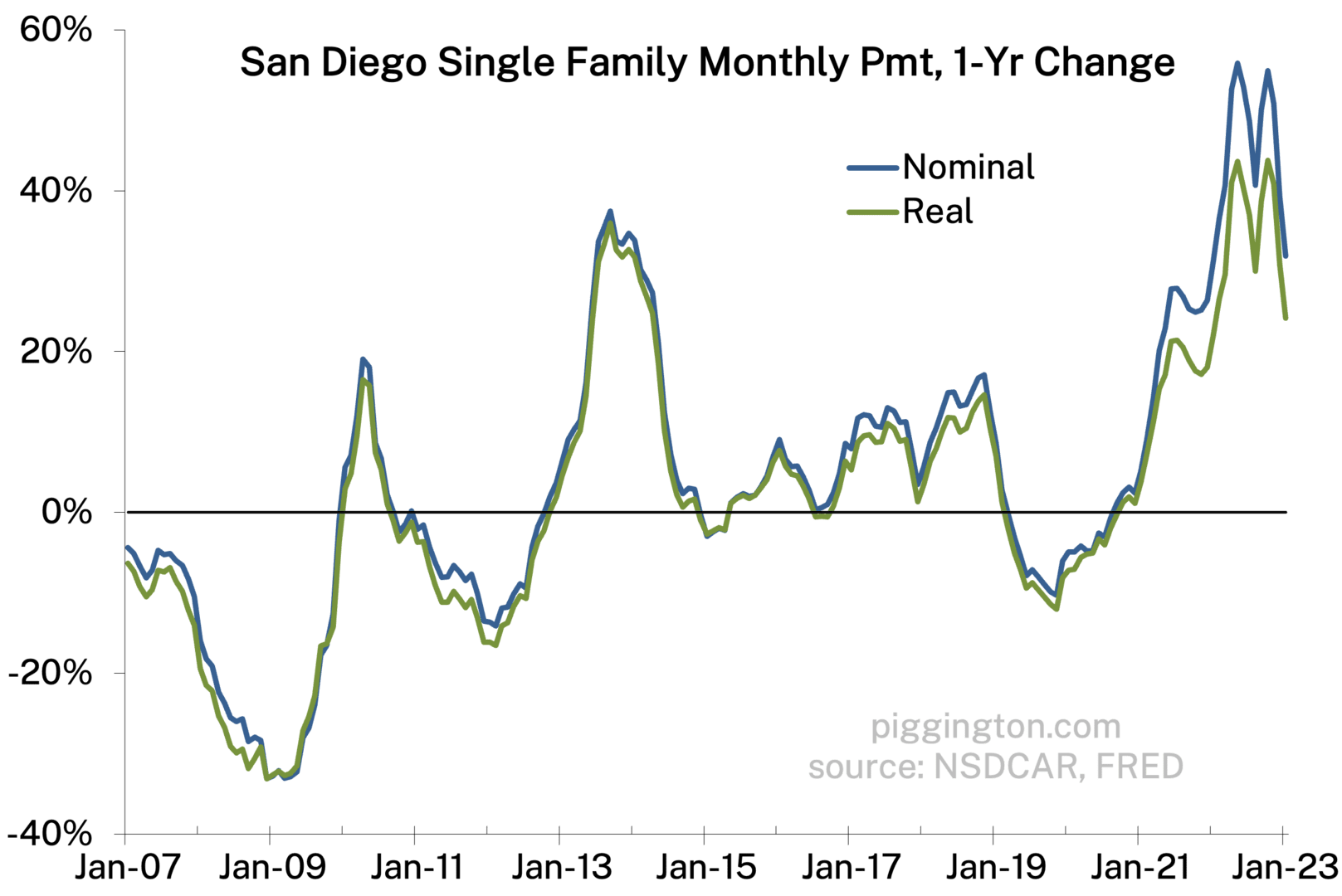

Interest rates are back on the upswing. Why? Prices of services are up 8% year over year and prices of food at home and out are up 11% and 8%, respectively. The Fed has a big inflation battle on its hands. It took years for The Fed to wring out inflation back in the ’80s. I have every expectation that such will be same, now.

Thus, I see no impetus for upswings in home prices. Spring should be telling.

This guy is a thoughtful, fact-based, logical commentator on the economy. He has been showing, for at least a year, how Services CPI, due to its large rent and owners equivalent components, will be driving CPI up for some time.

https://wolfstreet.com/2023/02/14/annual-services-inflation-rages-at-new-four-decade-high-overall-monthly-cpi-hottest-since-june/

Interesting times we live in.

“This guy is a thoughtful, fact-based, logical commentator on the economy.”

That is a very charitable description. Check out his housing graphs from ~5 years ago, arguing housing was a “bubble” based on comparing the NOMINAL PRICE to the bubble peak, on a linear scale chart, over a decade after the peak. Totally misleading, and the errors are egregious enough that it’s hard for me to believe it wasn’t intentionally misleading.

As for CPI, the Fed is aware of the lag in rents and they are looking through that. There’s a lot of good CPI commentary available out there — check out Jason Furman’s or Mike Ashton’s twitter feeds, as a couple examples off the top of my head. No need to patronize doomer clickbait sites.

Thx for saying what I wanted to but figured Id be a bit more diplomatic about

I’d agree that inflation is still persistent. It’s Gonna take time to get it under wraps and we all are gonna have to get used to these higher prices for things like eating out with i find quite painful.

As for home prices here my thoughts on rising prices this spring are solely based upon the balance of supply and demand. It’s gonna be a thinly traded market, only the rich need apply. It’s just the way it is for now. I can see another pull back starting in Summer

Lastly the wolf street guy does use logic, facts and data but he uses it his mind made up as to what he’s looking to prove. He does not veer and is guilty of confirmation bias as much as anyone I’ve ever read. Sometimes I agree but sometimes i can see his logic is very flawed and he’s simply selling his book

Rich, is there a way to insert a graph in a comment? Thanks!

There should be a wysiwyg editor but it’s broken, that’s on my list to fix. In the meantime, you should be able to use the html img tag? If that doesn’t work, worst case, mail me the graph and i will post it. (Ugly solution but it will do for now)

Thanks, Rich!

Wow rates sure did snap upward quick.

No way we hold up if 30-year mortgages stay at 6.9%.

What could certainly happen is a short and deep price dip that smart buyers grab with little competition and then refi.

I just scanned the FOMC minutes. They all want to keep raising rates and keep dumping long bonds. Double tightening on both ends.

Inflation is staying high and unemployment low.

Good time to short tech stocks that are holding up and have crazy valuations. SQ, NVDA, TSLA, EQIX. There are many worse small cap tech stocks but it is safe to short the lightly-shorted large caps.

I am gently increasing my REIT shorts too. In the past month a dozen giant premium office towers owned by Pimco and Brookfield in SF LA Boston and NY have defaulted on their mortgages.