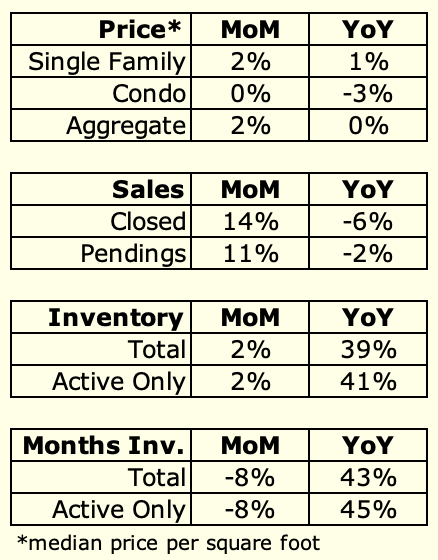

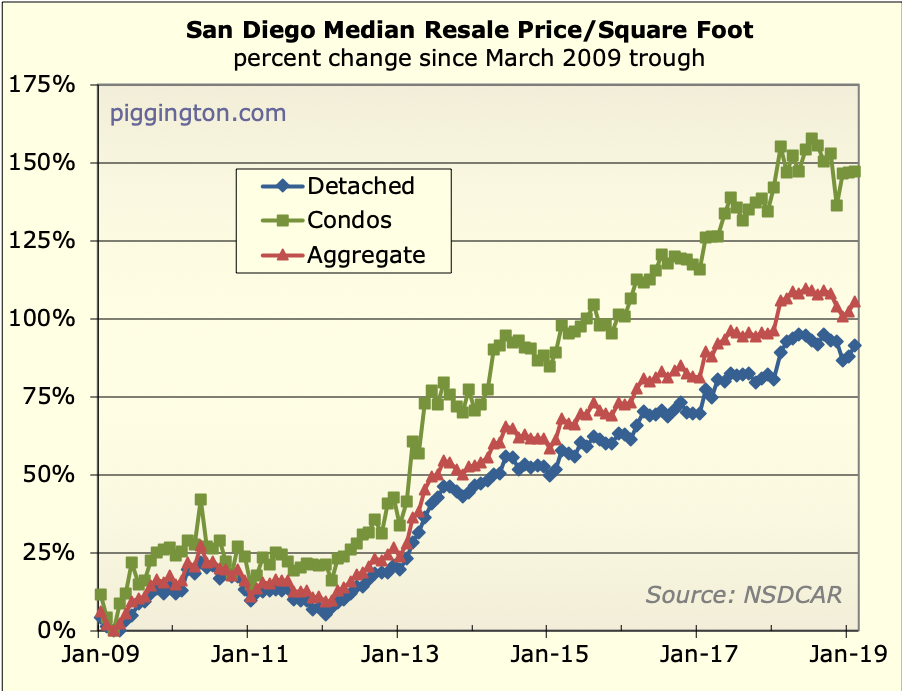

After declining into the end of the year, prices have gained a bit:

December was weak enough, however, that the 3 month average

single-family pr/sqft was still a new low. Note that the current

correction is unlike anything seen since the housing bull market

began (which I date Jan 2012, as that was the date of the inflation-adjusted

low).

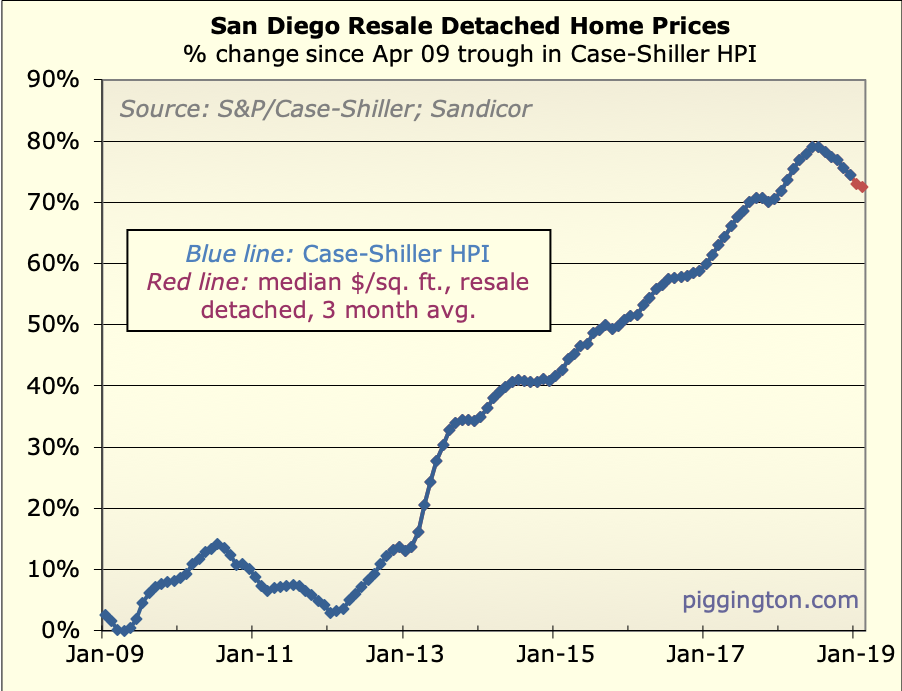

Here’s a fun new graph… the year-over-year change in the single

family home price per square foot (I used a 3-month average to

smooth it out a bit):

While still positive, the annual price change is at the lowest point

since very early in the boom. Prices will need to keep rising for

this to avoid going negative, as the more difficult year-over-year

comparison happens later in the year. For what that’s worth.

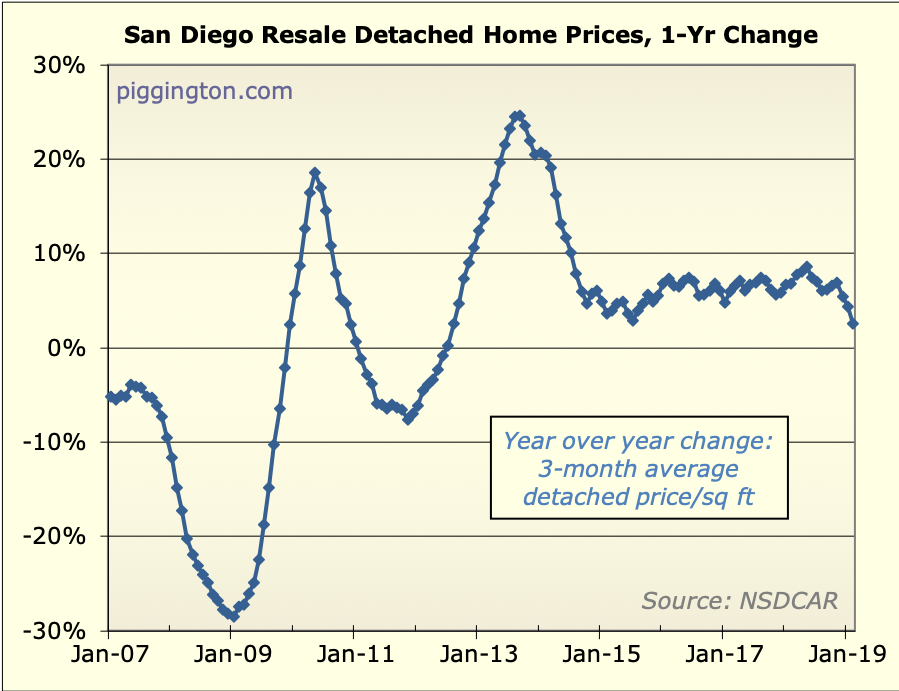

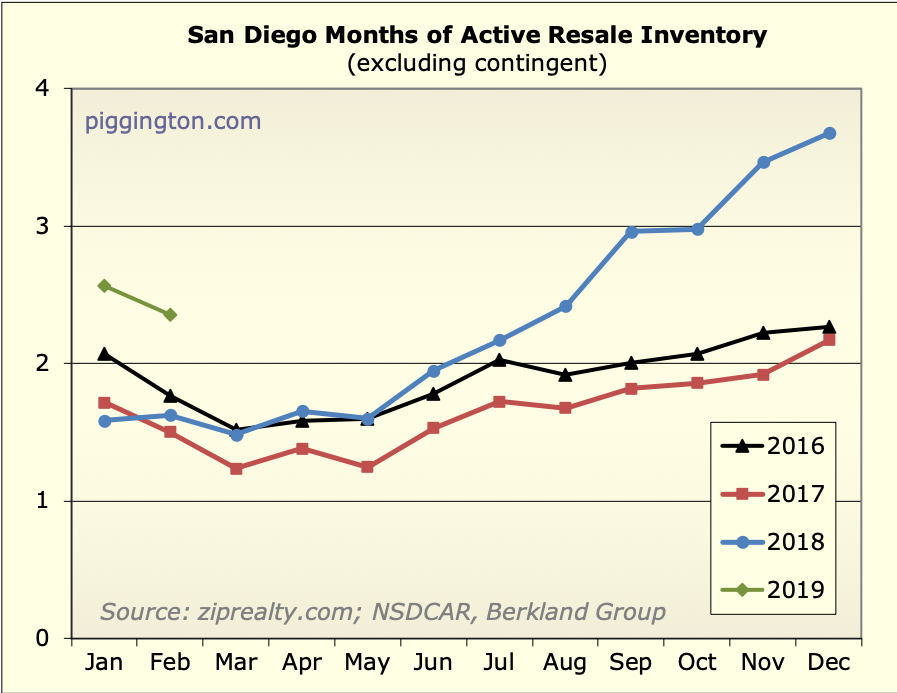

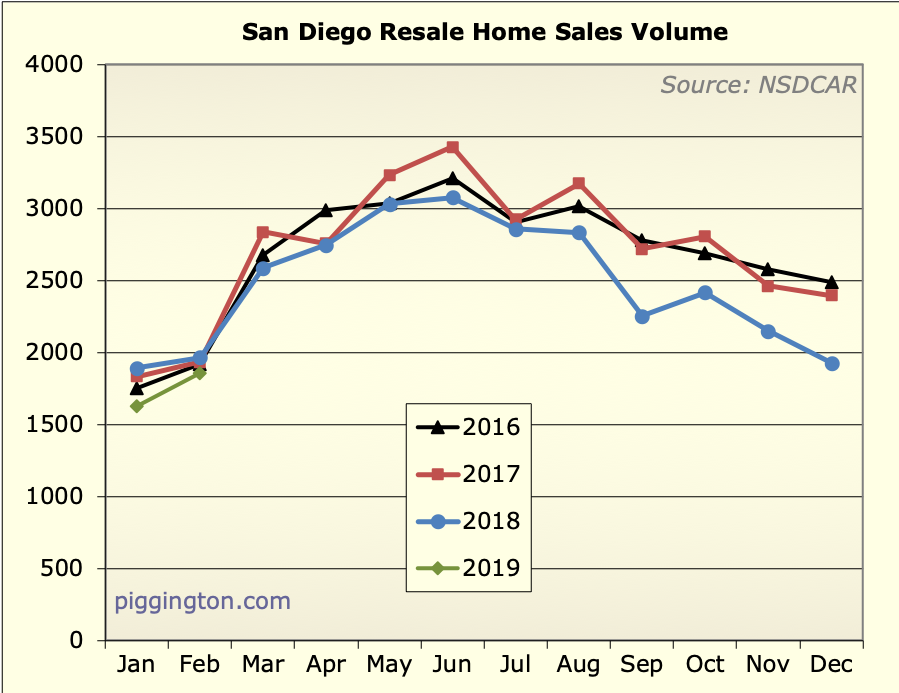

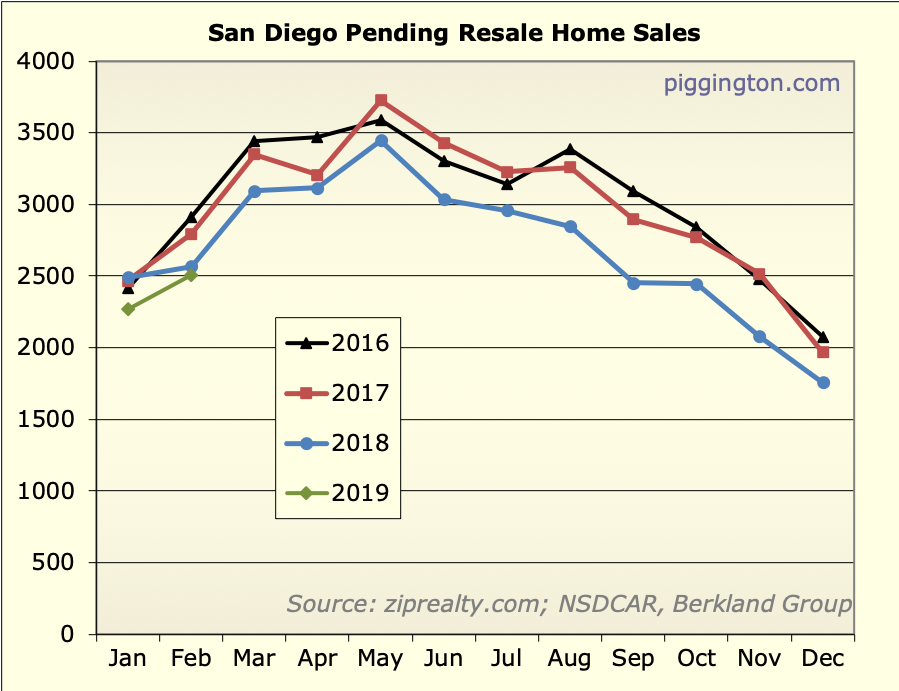

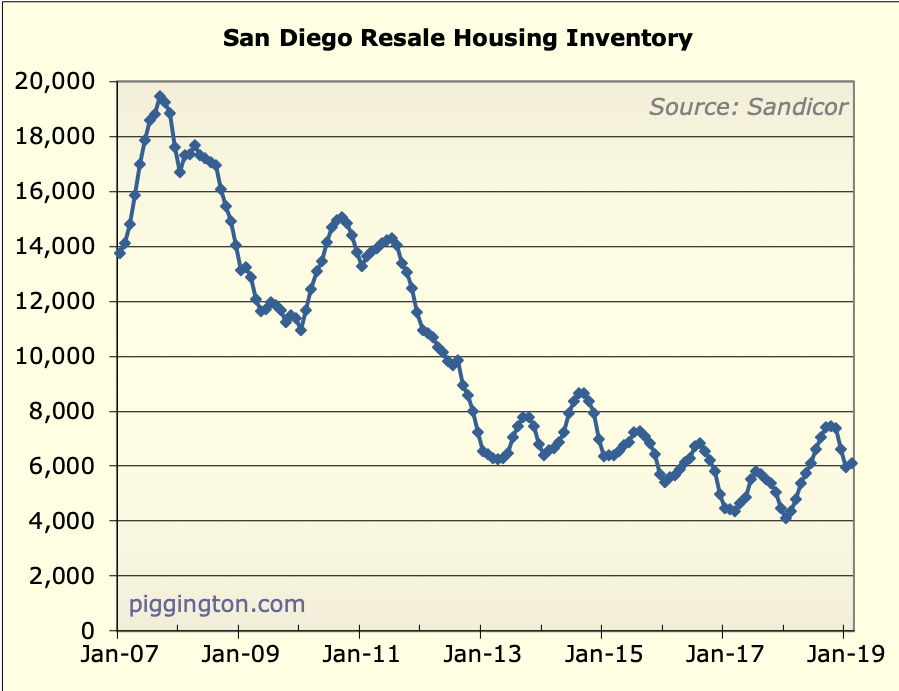

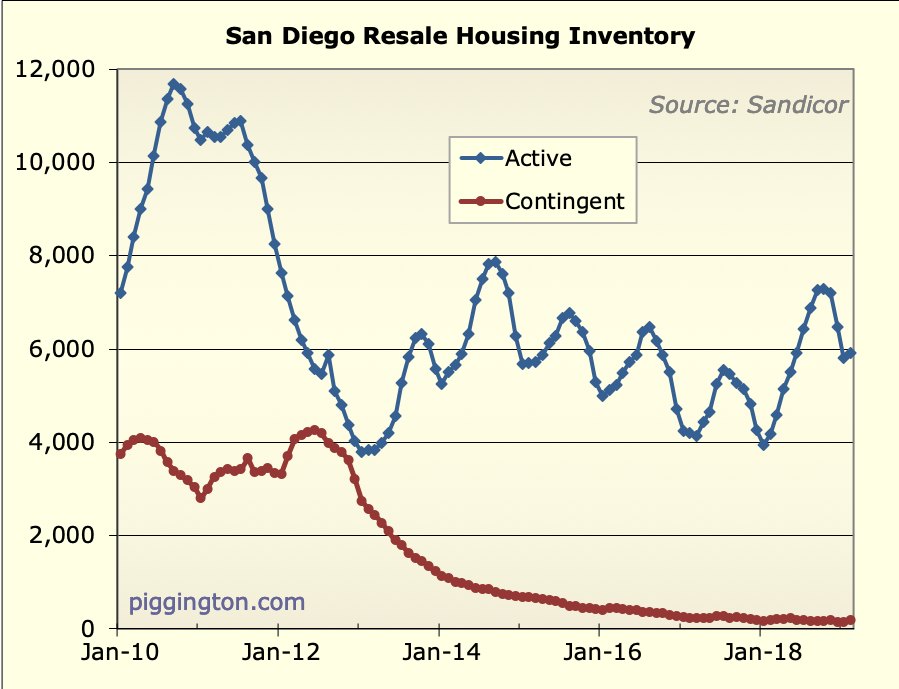

Inventory declined quite a bit, comparative to the prior year. If

you look at the gap between Dec 2018 (blue line) and Dec 2017 (red

line), it was huge. There is still a gap between Feb 2019 (green)

and Feb 2018 (blue) — but it’s smaller than the December gap.

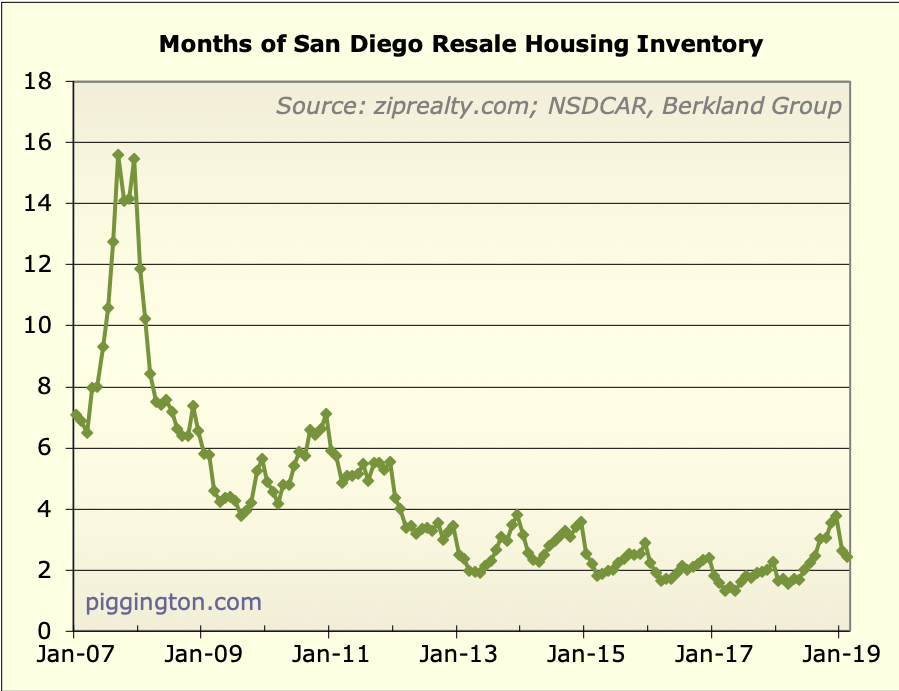

The same goes with months of inventory, to an even greater extent.

Months of inventory is higher than this time last year, but the

year-over-year gap is way smaller than in December. So again, a

relative improvement over late last year.

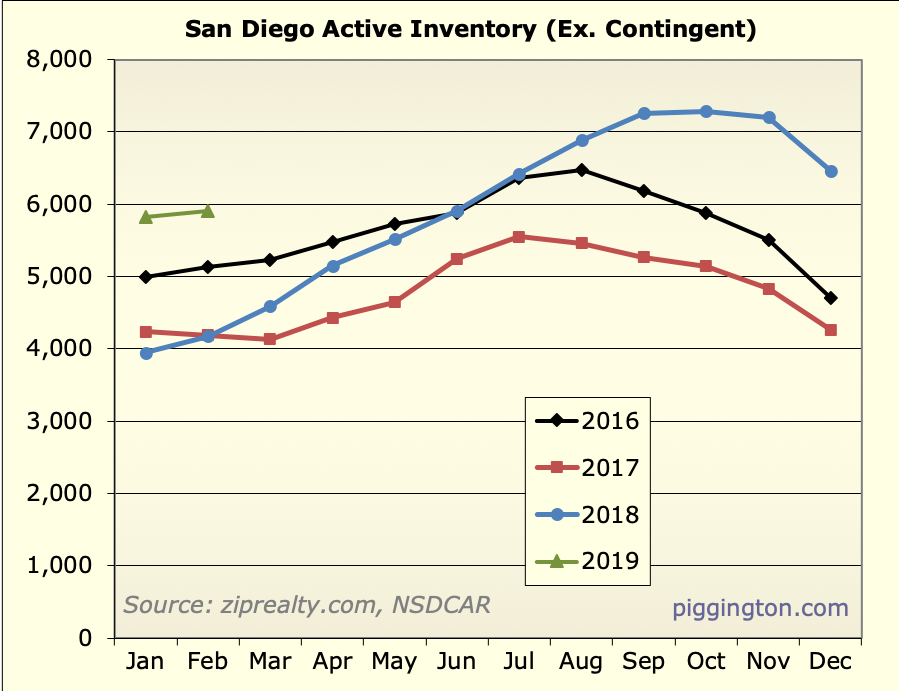

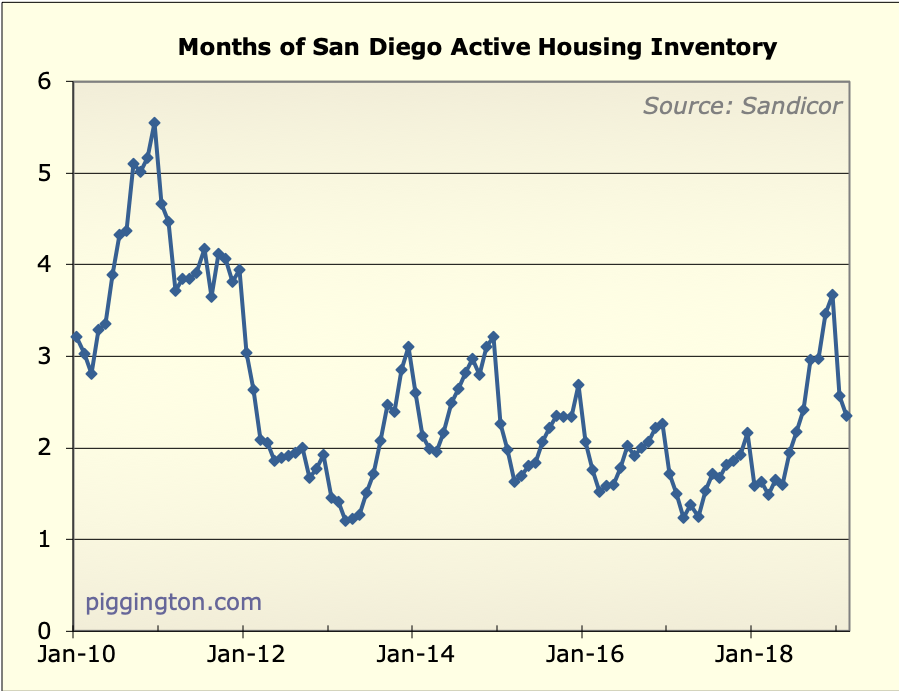

Just looking at a linear graph shows how sharp the drop in months of

inventory was over the past couple months (it’s still the highest

February level since the boom started, outside of the very beginning

in Feb 2012):

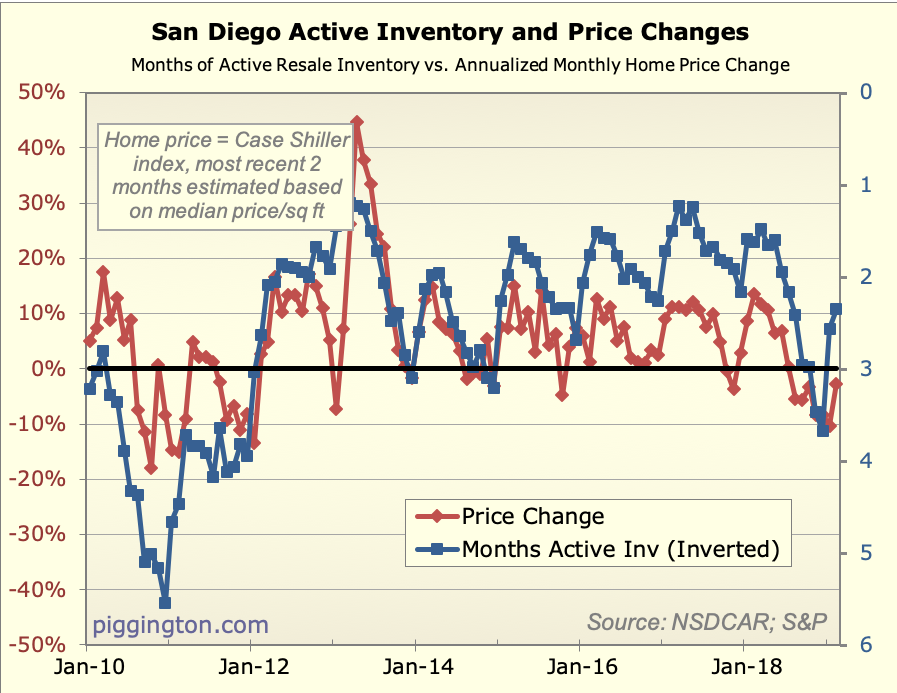

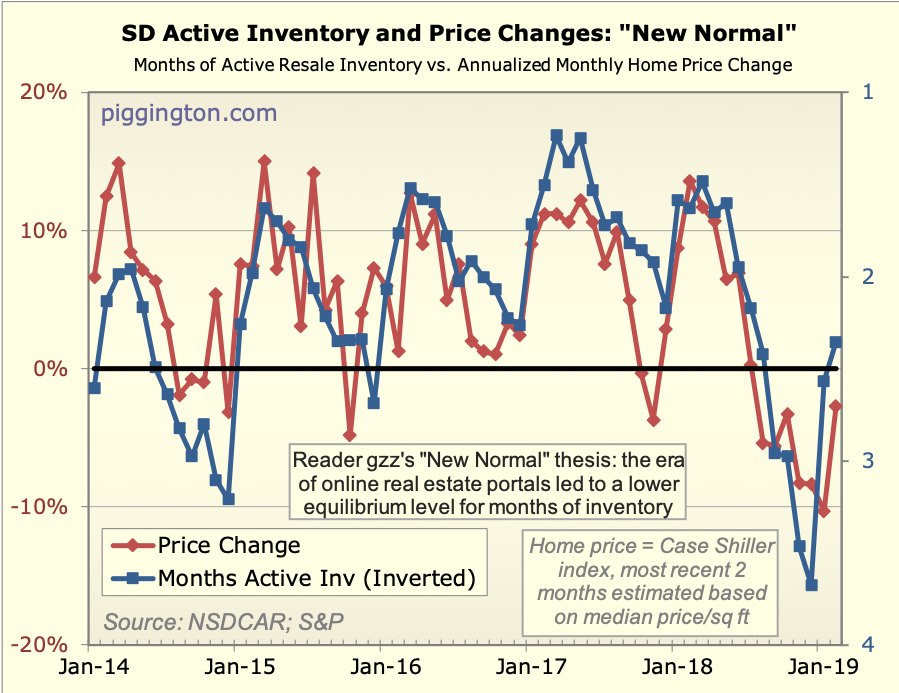

Here’s months of inventory vs. prices:

If these relationships hold, it seems like the current level of

months-inventory is consistent with pretty stable prices. Of course

this may change as the spring selling season progresses.

More graphs below:

As usual, many thanks for the

As usual, many thanks for the update and the insight Rich. It seems like the housing market is slowly on the mend for San Diego. Hindsight from most “experts” will point to moderation and slight reversal in mortgage rate as the cause of the change. I think additional contributor is sellers getting more realistic and lowering their asking prices to reflect changing market conditions after years of hot market. But it seems like the sales volume is low in 2019, so maybe inventory is dropping because of less listings coming to market?

My own “prediction” is conditions will continue to improve slightly resulting in a very moderate 2-3% appreciation at the end of 2019 YOY. This is predicated on no rate increases. If rate increase back to 2018 highs or even higher, I would expect some gradual but sustained weakness and negative or flat YOY for at least 2 years. Curious that Case Shiller has San Diego as the worst performing market out of the 20 it tracks for the last couple of months. I wonder if that is noise or shows some local weakness relative to other areas in SD?

SD investor wrote:Hindsight

[quote=SD investor]Hindsight from most “experts” will point to moderation and slight reversal in mortgage rate as the cause of the change.[/quote]

FWIW I think that’s probably a good explanation.

It seems a little early to

It seems a little early to say the market is on the mend. Even with the drop in mortgage rates, affordability is still a major challenge. The home price increases over the past few years have far outstripped household wage increases. Low appreciation seems a reasonable prediction, but further price declines a very likely if this historically long economic recovery finally starts to slow down.

Thanks for the data, Rich.

“Mending” the market would

“Mending” the market would require a 30% drop … look at affordability stats for buying in SD. The market was in the dumper in 2008-12 and overcorrected in the opposite direction. The hangover will be “fun” to watch…

It’s not just mortgage rates, by the way. Chinese and Latin American investors might find the climate in the US a bit frigid these days.

spdrun, have you seen any

spdrun, have you seen any recent articles or data showing the degree of impact foreign investors have on the SD market?

Barring any major economic challenges, I think a 30% drop in home prices seems unlikely. Part of the crazy price run-up over that past 5 years was a correction to normal from a depressed/undervalued 2011 market. A significant component of an asset’s value is the income-stream produced. As long as rents continue to increase or hold steady, home prices should be relatively stable. Though current lack of affordability could continue to cool the market putting some downward pressure on motivated sellers. I think it would take a prolonged recession & job loss/ out migration to force rents & home prices to come down materially.

No system responds in a

No system responds in a perfectly damped fashion — have you considered the possibility that the “correction-to normal” overshot, just like the previous correction undershot, and that rational prices are somewhere between 2011 and 2017?

Also, 15-20% of San Diego’s population are non-citizens, legal or otherwise. Would you be rearing to buy in the current political climate if you’re an executive order away from a non-renewal of your visa? Even 10% of a population is a big deal as far as a market.

Yes,I definitely think the

Yes,I definitely think the correction overshot, but it’s hard to say how much. Maybe 10-15%? The the factor that makes me less bearish is the current rents. Not only do rents drive housing value from an owner’s perspective, but rental cost is the alternative measure against buying. Rents were considerably cheaper relative to a PITI mortgage payment (10-20% down) during the last housing peak, than today. I think would-be buyers focus more on their monthly budget than the actual home price, so that delta between monthly outflow is important. For this reason, I also think the new tax law may have had a significant dampening affect on sales.

I think your point about foreign investment is valid – especially regarding the political climate & the impact of that uncertainty. I was just literally wondering if your comments were based on recent info. I’ve read about high foreign investment rates in the bay area for example, but I haven’t seen anything specific or definitive on San Diego. It would be interesting to see how much the impact is… if it’s really material to the current market.

I don’t believe foreign

I don’t believe foreign transactions is a big fraction of San Diego. I would love to see 15 to 30% correction, but I think that will require a big negative catalyst like a recession. Inflation will likely be 2 to 3% with wages are up higher. So even with zero appreciation, housing would be negative 2% in real prices. With unemployment at 4% and rates at 5%, no significant new supply, I can’t imagine a large drop.

Are non-citizen residents

Are non-citizen residents even counted as foreign transactions?

Weekly mortgage rates now at

Weekly mortgage rates now at a 14 month low!

Good refi rates help lock in current homeowners, let others tap equity for additional purchases, add to the buying power of current renters or upgraders.

Looks like in addition to the

Looks like in addition to the new weekly low, the ten year may hit a new daily low. On Jan 3 it had a 1-day plunge and quick recovery the next day. As I write, it is now below even that and 0.7% below the late 2018 peaks.

I really like the new graph

I really like the new graph thanks Rich! Does the data only go back to 2007? I am wondering if it’s possible to see the same graph including the time period of 2003-2007.

strawman’s graph: rough graph

[img_assist|nid=26789|title=strawman’s graph|desc=rough graph of percent changes between 2000-2010|link=node|align=left|width=100|height=62]

I did the poor man’s graph from 2000-2010. If we are cycling, it looks like we’re in 12/2006 …

Rich do you know where I can download the medium sale price data? I can do a better graph and analysis if I had more data points.

Case-Shiller is the only

Case-Shiller is the only publicly available thing I’m aware of…