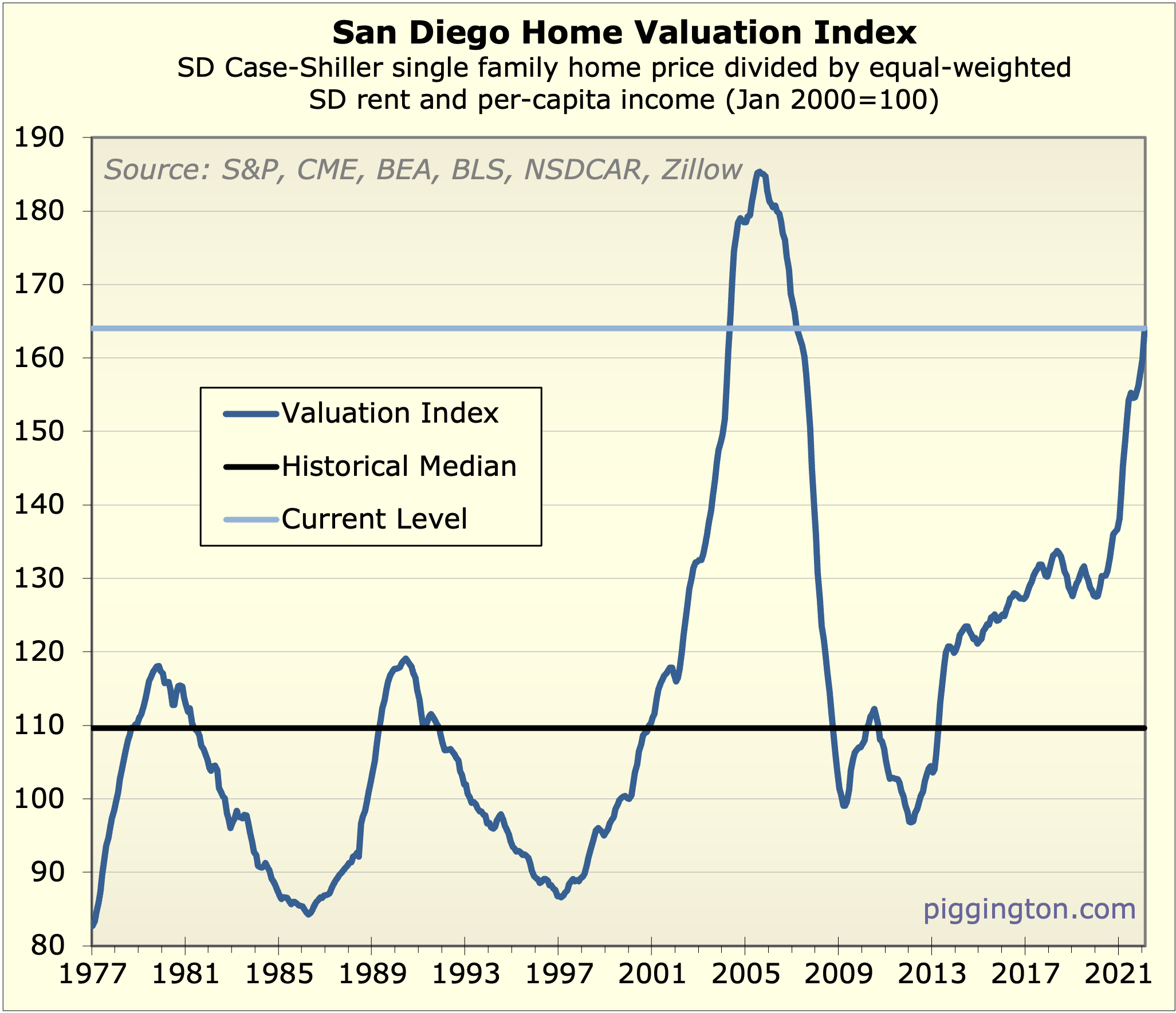

The price valuation index looks not too different from the last

update. It’s crept up a bit, but it in the same (albeit historically

quite high) ballpark.

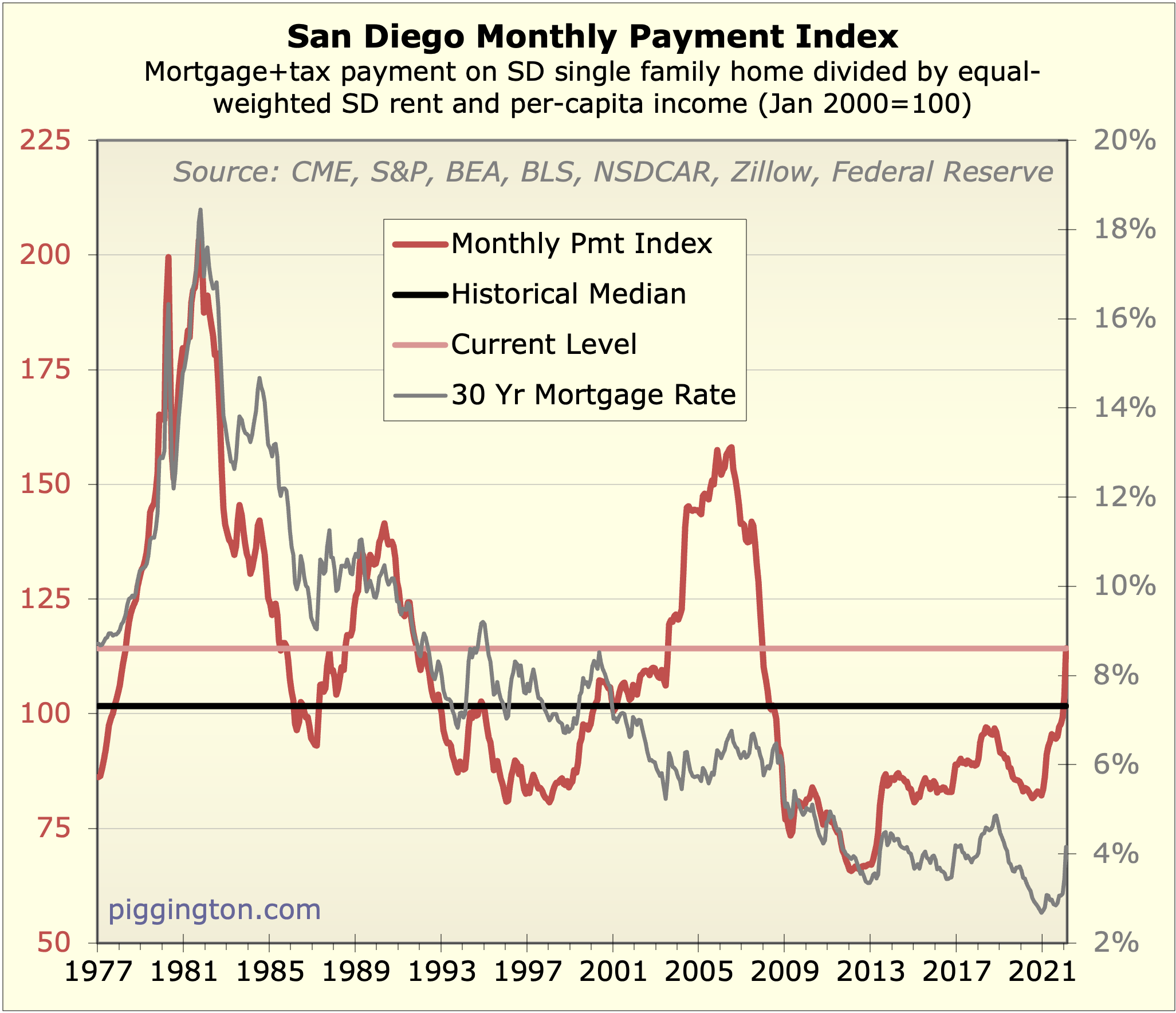

The monthly payment index, on the other hand, looks quite different

thanks to the recent pop in rates. The red line below shows that the

ratio of monthly payments to local incomes and rents has exceeded

its post-crash highs, and is now at a level last seen in mid-2003.

Up until recently, you could make the argument that despite sky-high

purchase prices, low rates were keeping the monthly nut pretty

reasonable. It’s a lot harder to do so now, and with inflation still

running in the high single digits, there seems to be a good chance

that it will become harder yet.

This seems unhealthy to me. I realize that there is nothing for sale

right now, and that the mismatch of demand and supply is pressuring

prices upward. Further out, I worry about the sustainability of

these prices and this level of affordability. I will note that we’ve

blown right past the affordability level that, when reached in 2018,

ushered in a mild housing downturn that lasted until rates declined

again.

I do think there is something to the idea that San Diego has had a

permanent shift upward in value due to the remote work revolution. I

suspect that might count for around 10% of the price increase,

though.* If you back that extra 10% out, we are just a few percent

above the historical median for affordability, although we are

almost 10% above the levels that coincided with the 2018 slowdown.

On a gloomier note, I still suspect there is a lot of bubble money

giving things a boost that, from the looks of things, may not be

long for this world.

There are a lot of moving parts and much that is unknown (as ever).

But we do know this: valuations are really high, and the “it’s ok,

rates are low” offset has just taken a major hit.

* I came up with this 10% number based on this very sophisticated

methodology: since Jan 2020, home prices in San Diego have gone up

10% more than the nationwide average (per Case-Shiller).

** Also note – I took a couple of liberties with the above

graphs. First, I am starting to re-integrate the use of CPI rent.

I just felt weird switching from a measure of new leases (Zillow

Observed Rent Index) to all leases (CPI)… it’s kind of apples

and oranges. On the other hand, due to the eviction moratorium and

the speed of the increase in rents, it really just wasn’t showing

up in CPI. So what I’ve done is to blend the two together, using

only ZORI at first, and blending in CPI in an increasing

proportion so that it will be all CPI again by mid-2023. I figure

3+ years should be enough for CPI to have fully digested whatever

is going on.

The second thing is that for mortgage rates, I used the most

recent weekly figure for the last observation in the chart (as

opposed to using the monthly figure for Feburary). This is kind of

similar to the issue with rents — rates changed so quickly that

we’d be missing out on info if we used the usually lagged/smoothed

sources, so I wanted to use the latest data available.

Cool. Thanks. It is expected

Cool. Thanks. It is expected that “it’s ok, rates are low” offset is gone.

But looks like there’s still some room for the valuation to get even worse. Stock market has now seems to go back up, ignoring the Ukraine war (it’s reasonable that its impact is limited), the yield is now terrible in all assets…even value stocks have appreciated more recently making the future yields worse.

It’s depressing for new savings…as we have to accept lower yields. The only positive development to me is that the 30 years treasury will soon yield more than my 30-years mortgage rate.

Where rent most comes into

Where rent most comes into play are currently renting buyers and RE investors. In theory the big middle of the market of existing owners buying one and selling another might be affected by rents. In practice I think they give it little thought.

So taking group one, they may (or may not) have a below market CPI rent, but they probably have outgrown their rental and are thinking about either upgrading to a another rental, or upgrading to a purchase. For them, the market rent of their potential upgrade rental is what counts.

For investors, nobody in SD buys with the intent of keeping lower CPI rents in place. And sellers too often realize that such tenants hurt value, so raise rent first.

Maybe you have to use CPI rent to do a long term chart, but it isn’t relevant to current purchase decisions like market rent.

This is a pretty big deal when SD market rents may be up 29% in one year.

https://www.realtor.com/research/december-2021-rent/

Rent increases are

Rent increases are accelerating! Most recent now shows YoY is 31.5% in SD.

See here, scroll down to Table 2.

https://www.realtor.com/research/january-2022-rent/

Are you gonna raise your

Are you gonna raise your tenants rents 31.5%?

I recently did my first rent

I recently did my first rent increases ever on both rentals. One is up 18% from 2017 the other up 28% from 2015.

They are still below market rent and I will be doing another small increase in January. But I don’t believe in squeezing every penny when I am doing well anyway. However, the 2017 lease had become about 35-40% below market. There are a lot of reasons besides making more money that it is imprudent to let that happen. It creates complex emotions and feelings of ownership and entitlement, and the IRS may consider it a gift or undisclosed income.

Just out of curiosity. Isn’t

Just out of curiosity. Isn’t there a rent cap of 10%?

Does not apply to single

Does not apply to single family homes

I recently went up 25% on

I recently went up 25% on one.

Had kept the rent flat for about 3-4 years.

Long story, don’t want to share too many details, but they had pleaded poverty and I was probably being too nice.

After becoming more aware of their financial situation in its totality, I went from $3500 to $4400. Market is probably $4700-$4800.

https://blog.firstam.com/econ

https://blog.firstam.com/economics/is-affordability-worse-than-the-2006-housing-boom-peak

More data, same conclusion

Rich Toscano wrote:

Up until

[quote=Rich Toscano]

Up until recently, you could make the argument that despite sky-high purchase prices, low rates were keeping the monthly nut pretty reasonable. It’s a lot harder to do so now, and with inflation still running in the high single digits, there seems to be a good chance that it will become harder yet.

This seems unhealthy to me. I realize that there is nothing for sale right now, and that the mismatch of demand and supply is pressuring prices upward. Further out, I worry about the sustainability of these prices and this level of affordability. I will note that we’ve blown right past the affordability level that, when reached in 2018, ushered in a mild housing downturn that lasted until rates declined again.

[/quote]

just was sent an eMail listing by Marcus and Millichap and something caught my eye (which I’ve bolded ‘below’)

2430 Union St, San Diego, CA 92101

Arguably the nicest Income Producing Property in Bankers Hill. Opportunity to Operate as a Long Term Apartment Rental at a 4.13% Cap Rate or raise the Potential Income by continuing the current use as a Short Term Vacation Rental. STR income potential north of $260,000/year & a Conservative 6% Cap Rate. Additionally the city has approved plans to build a 257 SQ FT Accessory Dwelling Unit (ADU) which should rent for over $2,000/month.

https://vimeo.com/181571776?ref=em-share

so 257 sq ft and rent is $2,000 a month???

perhaps its just me,… but I find this “unhealthy”