As if on cue, the Anderson Forecast has offered up an example of how the median price routinely gets interpreted incorrectly. According to Kelly Bennet’s article at voiceofsandiego.org, Ryan Ratcliff, the Anderson Forecast’s go-to guy San Diego, claimed that "prices have stayed relatively stable for about six months." The Union-Tribune’s take on the same topic echoed a similar sentiment from Ratcliff:

He added that despite the gloomy statistics, the foreclosures have so far had no impact on local prices. In fact, San Diego’s median sales price has stabilized over the past three quarters, even as foreclosures rose.

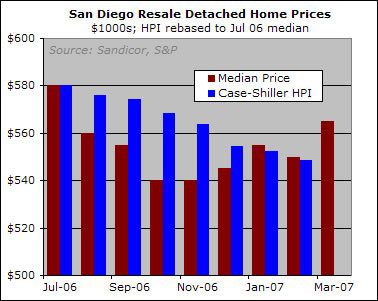

It’s true that the median sale price has stabilized over the past three quarters, but as I described in excruciating detail in my article on home price metrics, this does not mean that the market price of any given home is stabilizing.

At what point will

At what point will experienced forecasters realize that the true indicator of home pricing is found in the price per square foot?

It is like saying that the median price of sacks of gold ( In a hypothetical declining gold market ) has stabilized, never revealing that the sacks are getting larger and still selling at the same price.

The problem is even if every

The problem is even if every legitimate or illegitimate housing market “expert” used the price per quare foot gauge, they still have a bias on the info they present.

There are also additional factors like location location location, age of the house, actual condition of the house, lot size, ammenities etc., but it generally seems that most of the people presenting this data are for a quick stabilization of prices.

That’s why you get comments like “foreclosures have so far had no impact on local prices.” They interpret the data to indicate what will best serve their interests. They ignore the larger implications and tell people what they want to hear.

It’s not politically correct to say that millions will lose their homes due to rising rate, tightened lending, and the fact that millions bought over their heads.

My guess: The “experts” have

My guess: The “experts” have “invested” in the real estate market and they therefore have a vested interest in seeing things get back to “normal” (meaning record gains every year forever and ever).

They’re letting their personal biases get in the way of doing their job.

That still won’t change things mind you. It didn’t stop the Stock Market Crash of ’29 and the Depression that followed and it won’t stop the real estate market from collapsing.