Before we begin the Rodeo, you might be interested in a piece I just

put up at voiceofsandiego.org on National

Froth

Day, when we commemorate Greenspan’s first utterance of that

legendary euphemism.

Assuming you have now read the afore-linked piece, celebrated Froth

Day, and eventually sobered up, let’s move on the to last month’s

housing data.

Last month, you may recall, prices and sales were actually somewhat

weak. I theorized that buyers were holding off on buying in

April, waiting instead for the double tax credit opportunity beginning

in May and accordingly putting downward pressure on April volume and

prices. If this theory was correct, the market would surge

starting in May.

Prices

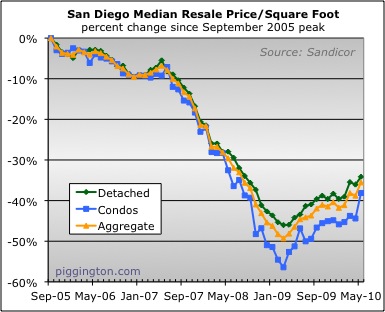

And surge it did. The median price per square foot was up

3.0% for detached homes. This is a good month, but looks pathetic

next to the 11.3%(!) increase in the condo size-adjusted median.

A volume-weighted aggregate of the two was up 5.4%.

Now we all know there is noise in this data, and that it is

particularly bad in the condo series where we just have a lot fewer

data points. But numbers like that are dramatic enough to

indicate that actual prices rose last month.

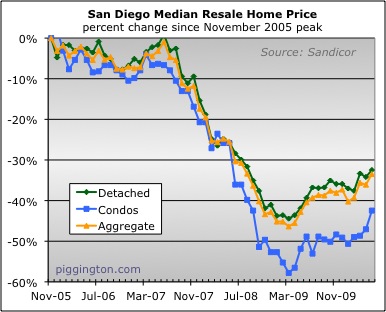

This was a rare month where the plain vanilla median was actually less

volatile than the median price per square foot. The aggregate

vanilla median was up 4.1%.

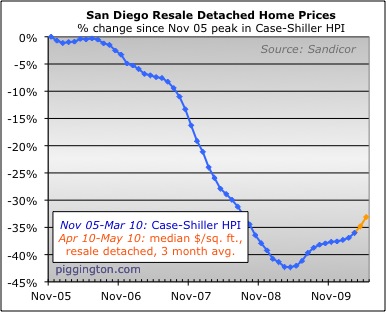

Here’s a look at the Case-Shiller proxy. Composed as it is of

single family prices, the wacky 11% condo number had no effect.

Still, the index was up an unusually large 2.6% for the month.

Supply and Demand

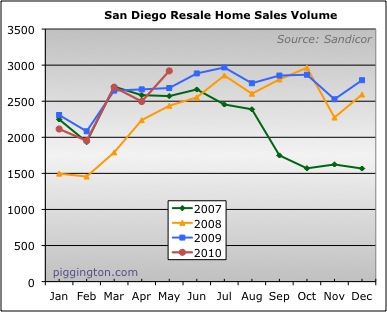

Volume boomed as we entered double-dip season, up 17% from the

prior month and 9% from a year ago:

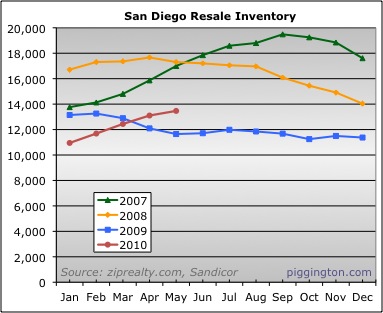

Meanwhile, inventory continued to creep up. Inventory was flat to

down for pretty much the entirety of 2008 and 2009, but it’s been on a

sustained rise since 2010 began. That’s something new.

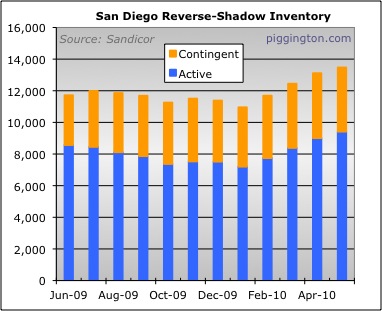

Incidentally, the increase in inventory is in the active category, as

opposed to the contingent category, meaning that the increase is due to

new for-sale homes hitting the market as opposed to a backlog of short

sales caught up in the approval process.

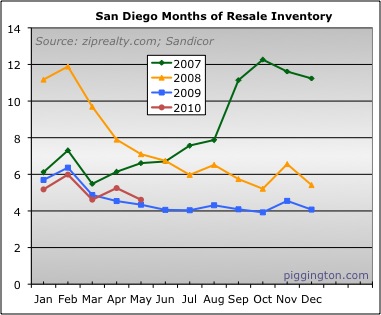

The surge in demand far outstripped the additional supply, so the

months-of-inventory figure dropped back to near-2009 levels:

Conclusion

Evidence suggests that the “holding out for the double-dip

finish line” thesis is correct. If so, the market should remain

strong as we enter the second and final month of the double-dip here in

June.

After that, I would expect weakness in July as the pressure goes into

reverse and buyers try to pull their closings forward into June.

Sometime after that, the California tax credit kitty will be run

down. Though it might not be that long at all. According to

the FTB site,

as

of June 1 the first-time buyer credit was already over 50% used up,

just one month into the program. At that rate the tax-credit

gravy train will have left the station before double-dip season is even

over.

So if none of the assorted credits get renewed, we could see a serious

lull starting in July or so. But, perhaps in honor of Froth Day,

the market is partying it up in the meantime.

I’d be curious to see the

I’d be curious to see the absolute dollar amount increase in the median values for condos and SFRs.

Classic economics tells us that when the gov. implements a tax on a product, the burden of that tax is shared by the buyer and seller. Even if only the buyer pays the tax, prices adjust downward such that the seller loses revenue. The shared percentage varies, depending on the slope of the demand curve (and maybe supply, too. Or maybe it is the relative slopes. I don’t remember. Maybe econProf can clarify.)

Similarly, for for a tax credit, the buyer and seller share the credit it because prices adjust – in this case, upward.

I’m curious to see if the abosolute dollar amount increase reflects this theory.

Buying using this soon-to-expire credit – especially this month – seems a very short path to being underwater on a mortgage.

Dude — You didn’t specify a

Dude — You didn’t specify a starting date so I picked Feb 2009, the month they passed the original federal tax credit.

Since that time, the median detached price has increased $65k and the median condo price has increased $50k.

Many have theorized that the tax credit increased home prices by much more than the amount of the credit because the buyers would receive cash up front that they could leverage to buy their home. To the extent that the price increase was caused mostly by the tax credit, this is clearly true. But, I don’t know how to measure how much of the increase was due to the tax credit vs. other factors (eg the Fed buying down mortgage rates, or the very low level of for-sale inventory).

Sorry. I was thinking April

Sorry. I was thinking April to May. This is the delta between the the month prior to the implementation of the Cali credit, and the first month where the Cali credit was in-place.

Gotcha. It was $10k for

Gotcha. It was $10k for detached and $18k for condos. By coincidence (I think) that is the amount of the CA credit and the combined credit respectively, for 1st time buyers.

Just anecdotal but I think

Just anecdotal but I think higher prices are starting to pull sellers into the market who either were or felt they were underwater. There are also some sellers that felt prices were too low for them to sell but with prices up a bit they are starting to test the waters.

If Rich’s prediction is

If Rich’s prediction is right, and I believe it is, we will see housing weakness again by July. These numbers may not be digested or widely available to the public until late summer.

Also in mid to late summer the census workers will start to be laid off. Jobs numbers will look stunningly bad for a while as well.

I believe that these forces acting together will damage the public’s perception of a solid recovery. It is going to be an interesting Fall.

A few thoughts. Rich you are

A few thoughts. Rich you are mostly correct about new inventory but don’t overlook contingents going back to actives because of buyers bailing. Totally agreed with sdr about sellers jumping in who are on the edge of underwater. Finally I do not think the halt of stimulus will hurt as much as two other issues. The first issue is that to many sellers have entered the market recently wit unrealistic price expectations. As a realtor you try and try to give sound advice but many times sellers simply cannot be reached so they need to sit on the market to live and learn. Second I feel we are near a seaonal low in the bond market and if the ppt can patch0 up the stock market then we may see a slow but steady rise in rates through the rest of the summer.

Well I don’t know what the

Well I don’t know what the stats show but I can tell you what I see in REAL TIME as a prospective home buyer.

In the “Prime Areas” you can get a house for 650K now that would have sold for 720ish just 4 months ago.

In the nice areas, not Prime nor the Barrio, but simply decent areas 550 today will get you what 650K got you just 4 months ago.

The areas I have been watching like a hawk are 92104, 92115, 92120.

In Real Time, prices are falling.

Or…..it could be that since inventory is increasing the “average” sales price is now available to more and more average people. Through most of 2008 and 2009 only those with the “right connections” were able to get properties that had huge price reductions.

In other words, you read all the time how prices are down 30% from the peak but the only stuff available to the Average Sucker that is for sale are only down 5 or 10%. What I am saying is that perhaps what I perceive as recent price declines are in fact simply the previous declines that are now available to everyone including the Average Joe and not just those in the know.

Sobmaz, I agree with your

Sobmaz, I agree with your post. I track 92103 and I see the same stuff you do.

Last year you couldn’t hardly find a house in Mission Hills under 600k now there are around 20 and furthermore 9 of them are at or under 500k.

Prices are being set at 5-10% below recent comps and the houses are sitting. Stuff that is closing is going for a very high percentage under list price. Seems like we have entered the second leg down and with sales volume falling off a cliff at the same time banks seem to be finally listing houses this could get ugly fast.

Interesting stuff as I’m not

Interesting stuff as I’m not seeing that in NCC. Thanks for the good observations

The one thing that is

The one thing that is becoming clear during this downturn is that quality of schools trumps everything else. The areas that are getting hammered are the ones with suspect schools. Location is important but appears to be secondary.

It seems like people with the money to buy these days are all fighting over the same couple of houses because at the end of the day there just are not that many places in San Diego county with the elite schools AND the elite locations.

So true but I wouldnt put

So true but I wouldnt put location as secondary just not able to stand on its own same as elite schools with poor locations would. If the Black Plague came back the undertakers would make a killing (sorry bout the puns). No matter how bad things look on a macro level someone is always making a killing. Those people want elite schools and the elite locations which is why they hold up better in times like this.

As you pointed out elsewhere we are defintely seeing elite locations with second tier schools taking a hit now.