Hello friends, sorry for the delay on this.

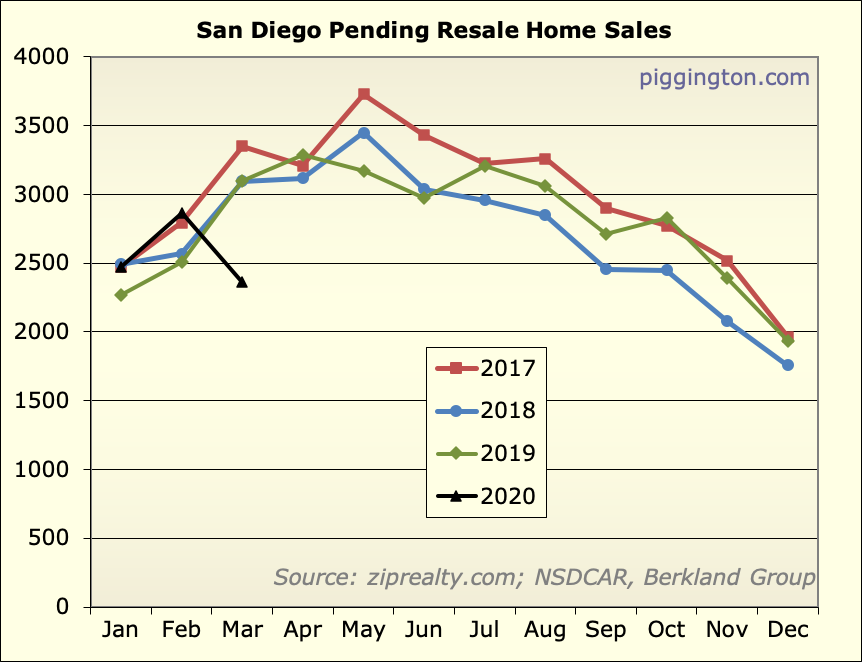

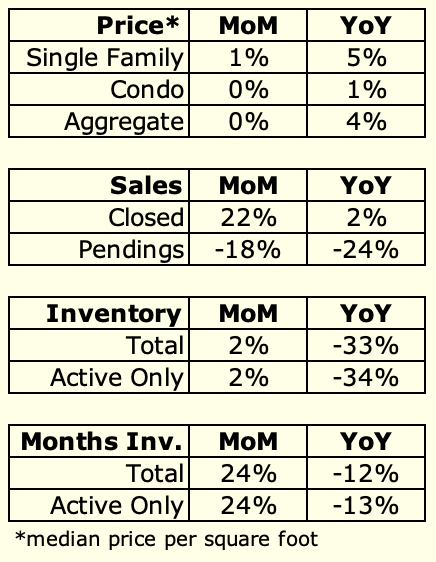

For the month of March, things looked pretty normal-ish, except for

pendings, see right below. Which all kind of makes sense given the

timing of the lockdown.

The April numbers will likely look a little weirder than March. In

the meantime, user sdrealtor has been posting some updates from the

trenches over on the previous

data update; see the comments at the bottom. It sounds like

the market is pretty resilient, from what he is seeing.

Graphs below and more to come when the April numbers are

available…

Moving over to this post some

Moving over to this post some observations since post a week ago on my corner of the world. Counts for SFR in every category remarkably consistent almost identical.

Around half of the properties that closed went under contract within a week at, above or very close to asking price. These are the homes active buyers are waiting for and when they hit the market they go quickly at full retail.

No signs of major price cutting yet and while some are pulling homes off the market its not excessive. Mostly people that decide to give up after not selling in a few weeks who overpriced their homes.

Cancellation rate of escrows by buyers seen at beginning of shut down has subsided but still slightly elevated.

Closer to home, in my neighborhood of over 1000 homes there is nothing on the market for the first time I can remember in 20 years. There are two in escrow and one is my listing. It was sold to a buyer that couldnt see it in person because there is a tenant in it, with photos from over 10 years ago at a what will be a new record price for this model. Dont ask me? This market constantly surprises me with how strong it can be even in the face of extreme adversity.

Bottom line, we are in a very restricted market that greatly impairs the ability to buy or sell a home and we are still chugging along. At least for now.

Next update and some definite

Next update and some definite differences this week.

New listings up about 25% but pendings almost double. Fall out rate continuing to drop and closer to what we typically see. Price reductions level from prior weeks. Closed sales down almost 50%.

So what does this all mean?

As we approach Summer new inventory typically increases and we are seeing the beginning of that. It may also be sellers gaining confidence the worst may be past or for them they need to start making tough decisions. Either way new listings are on the upswing.

Buyers are gaining the confidence the worst may be past and the pent up demand is starting to come out to meet the new inventory. Cancellations are dropping reflecting the newfound confidence

Solds dropped like a rock! Does that mean the market is crashing? Absolutely not it was fully expected as the shut down last month made it nearly impossible to buy or sell.We should see another 2 or 3 really low weeks of closed sales. As long as the surge of new pendings continues the trend will pass in a month.

Price reductions level. Sellers are digging in and dont want to “give it away”

On the solds, about 2/3rd closed at, near or above asking in less then a week. Those are the homes active buyers were waiting for. I did notice a small handfull of higher priced homes closing around 10% below asking in a sign that some just wanted out and took what they could get. Will keep an eye on this.

Overall, I consider this past week the first sign of green shoots. Whether that was a one time thing, will continue or reverse is TBD.

Next update and seeing nice

Next update and seeing nice follow up on what i saw last week.

New listings flat which was up about 25% from two weeks ago and pendings flat also. Fall out same as last week which is back at what we typically see. Price reductions actually down sgnificantly. Closed sales down a bit from last week

So what does this all mean?

As we approach Summer new inventory typically increases and we while we saw the beginning of that it should have risen more this week. Sellers arent listing homes at the rate we need them to.

Buyers confidence stayed higher than last month and its looking more as though the worst may be past. Cancellations are back to normal levels and panic is not a major factor anymore.

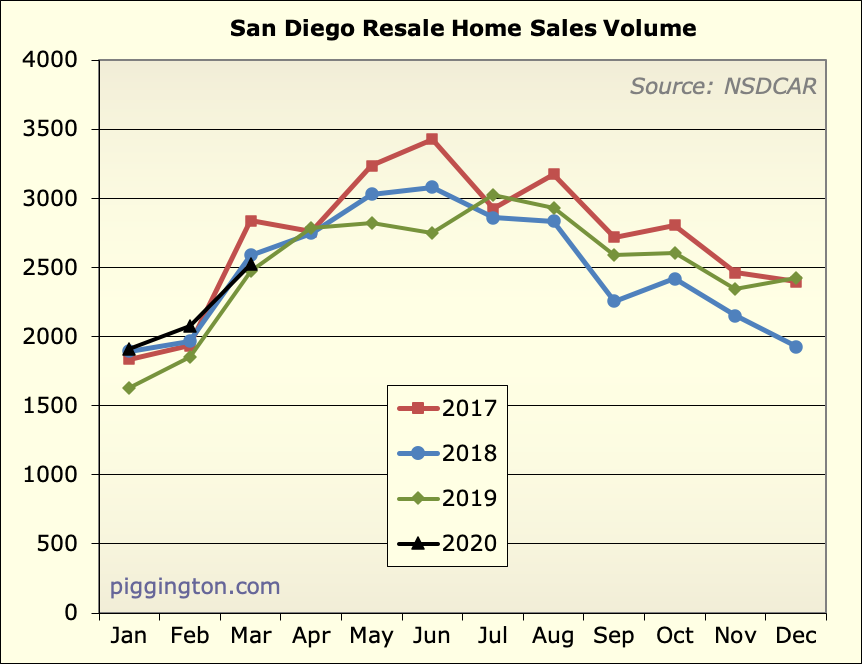

Solds dropped even more as expected! The shut down in March is now showing its head in lower April/May closed sales. I expect April volume will be down around 40% and May around 60%. By the time those numbers are widely published some buyers will see it as a sign the market crashed but the market has already started recovering and barring a set back will continue.

Price reductions even less frequent. Sellers are seeing the worst is past and holding firm.

On the solds, Im seeing a mixed bag. There are some sales coming in around 5- 10% below asking at all price ranges. I suspect we will see more of that as houses that went pending during peak uncertainty close but but if I had to guess those opportunities are going to get tougher to find.

Will keep an eye on all this but I consider this past week a follow through on the early green shoots.

Still so much in the air with this pandemic but current trends show no panic in RE market.

Thats all for now. See you next week

Thanks sdr!

Thanks sdr!

Update time and more of the

Update time and more of the same for the most part with one exception.

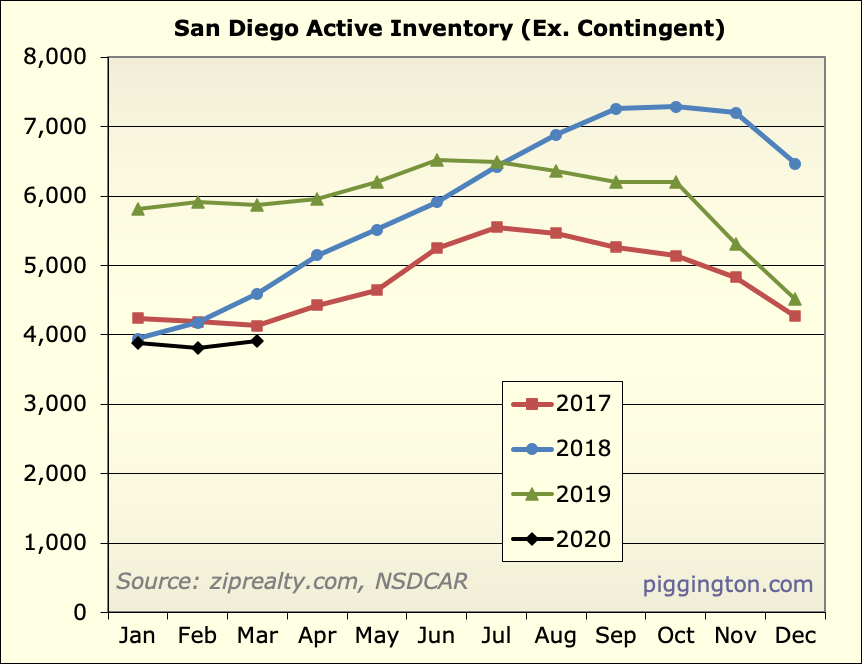

New listings up significantly. Its about time and looks like the folks wanting to move over Summer finally getting their butts in gear. Notably very little entry level detached homes with most of it in the mid range ($1M to 1.5M around here). Pendings flat for the 3rd week in a row. Price reductions still not elevated and most are modest reductions. Closed sales continue their decline and are at or close to what will be the bottom count for them.

So what does it all mean?

FWIW I took a quick look at 92126 MM. The detached market there starts around $600K. Seems like just yesterday I was selling houses to buyers there around $400K

FWIW was curious whats going on in MM. Looks like detached market there now starts around $600K. Seems like only yesterday I was selling houses to buyers there for $400K

Sellers are finally stepping up to sell. Buyers are still chugging along and it will be interesting to see if the additional inventory leads to more sales. My feeling is sellers will start overly optimistic (like one of my neighbors) and will have to come back down in price to recent sales if not slightly below.

Closed sales numbers in May will send brief shock waves when they first get reported but due to time lag will likely be yesterdays news. They could be down 60 to 75% but should rebound in June based upon sales the last 3 weeks.

The most interesting questions now are what will happen to the pace of new listings and will more buyers step up with more choices coming on the market

Thats all for now. See you next week.

FWIW just took a look at

FWIW just took a look at 92126 MM. It seems like the detached market starts around $600K there now. Seems like just yesterday I was selling buyers homes there around $400K

I have a hunch whatever is

I have a hunch whatever is going to hit White Collar San Diego hasn’t hit yet. The big question is how hard it will be.

Absolutely its on the early

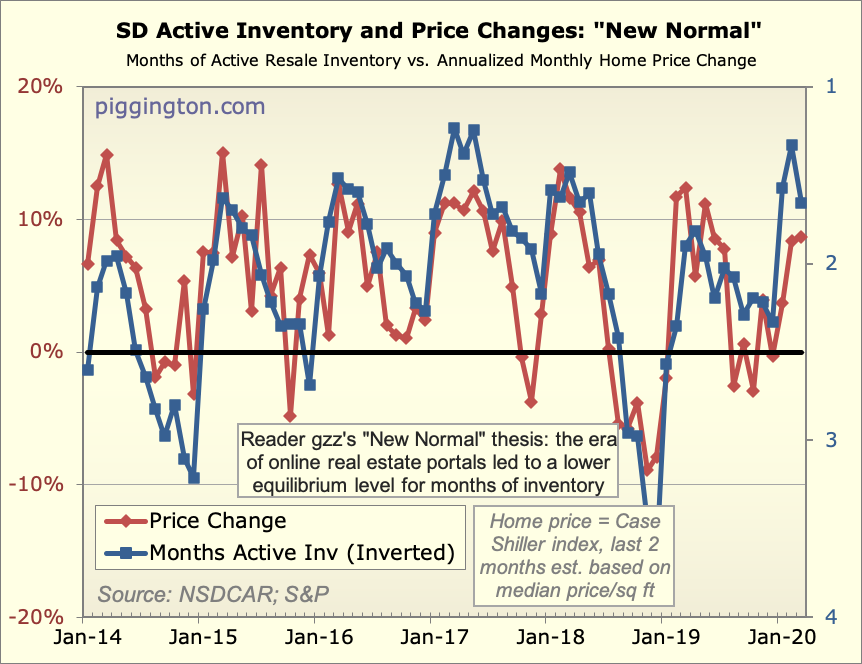

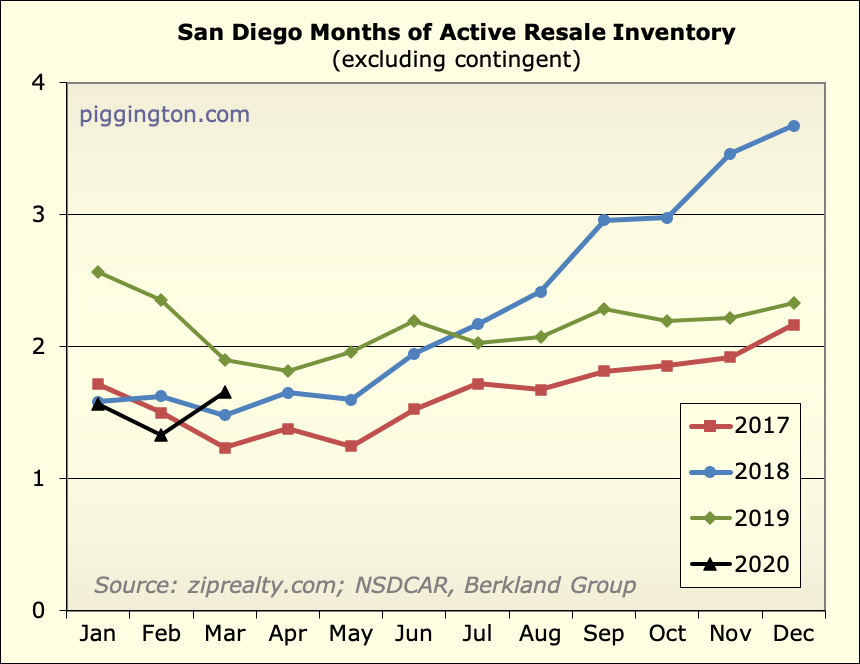

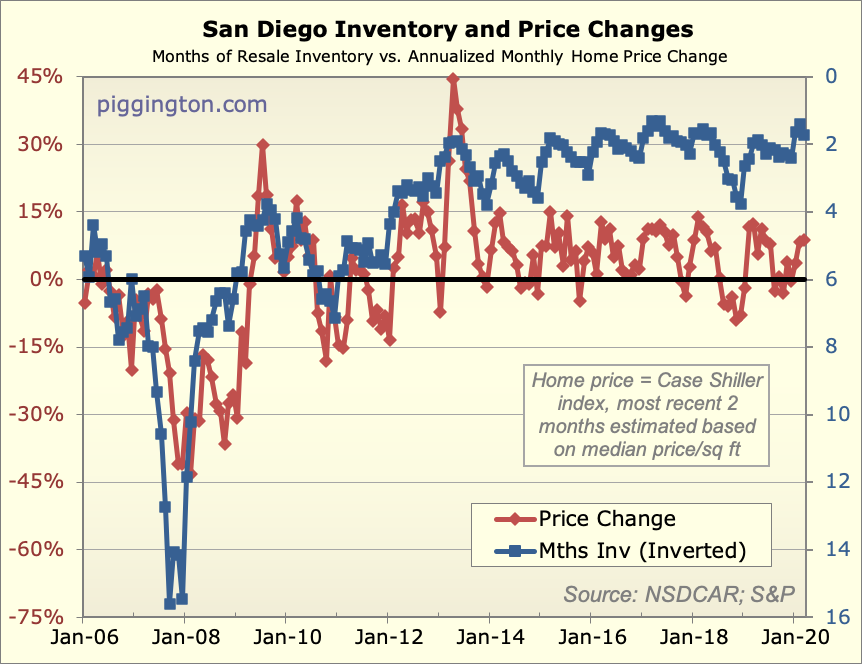

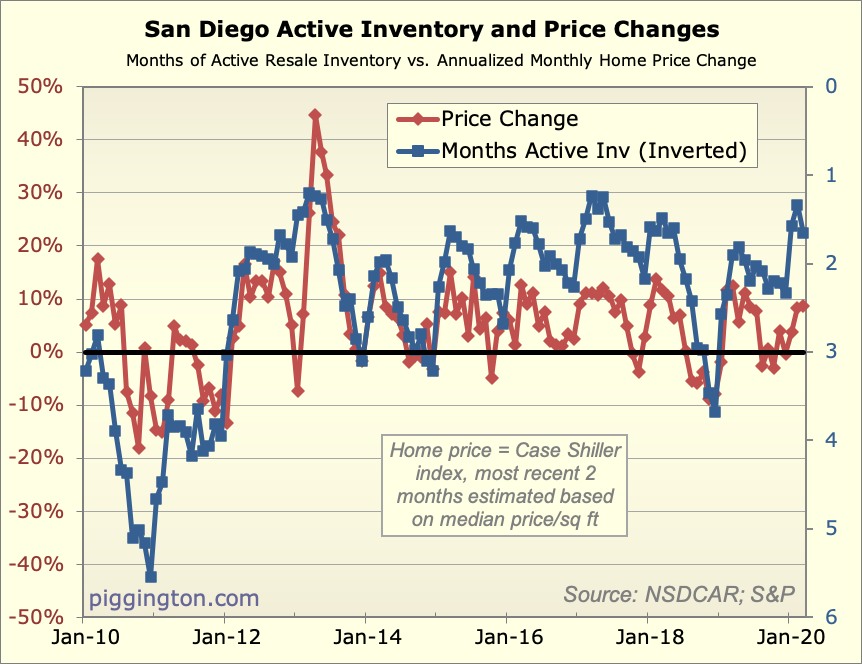

Absolutely its on the early side which is why I track things looking for inflection points. But as it looks so far barring the pandemic getting much worse than what we have now the impact will be quite muted. With inventory as low as its been sellers have been trying to push prices even higher. If they would be satisfied with last year we’d be fine and we may get a retracement to last year but Im just not seeing anything in the cards that would indicate a real collapse. Of course things could change…

Update time and more of the

Update time and more of the same for the most part with one exception.

New listings went down slightly but basically flat. Not seeing any mass fleeing for the exits. Still very little entry level detached homes. Pendings flat for the 4th week in a row. Price reductions still not elevated and most are modest reductions. Closed sales more than doubled over last weeks number. I expected a few more weeks of really low numbers. Last weeks closings was the bottom for that number.

So what does it all mean?

The market is getting back in line and functionally in an orderly manner. I thought May closed sales numbers were gonna be dreadful but after seeing the turn this week I dont beleive that anymore. May should look only a little worse than April.

Now comes the interesting time to watch. Contrary to what many beleive, our market usually slows down considerably once we get past Memorial Day and many folks focus shifts to graduation and Summer vacations. With those plans on the sidelines and shelter in place the last few months we may very well see the selling season stay stronger than normal through June and July. Im seeing a bunch of overly optimistic pricing higher than sales prices pre-SIP. I think those folks need to start getting more in line with recent comps which are solid but dont support the extra mustard. Whether or not demand stays solid through June and into July will go a long way toward determining what happens with pricing this Fall.

Thats all for now. See you next week.

Huge thanks to Rich and

Huge thanks to Rich and sdrealtor for the info. At this time, it seems that plenty of people have opinions about what is going to happen. But what I’m really hoping for is data instead. Looking forward to these post more than ever.

We were in the market to buy

We were in the market to buy a 6th rental in Feb/March (due to very special circumstances) corporate tenant looking for 5 year lease who we’ve worked with before. Needless to say, competition was intense (4S ranch area/I-15 corridor was target), some open houses had 60 visitors and 5 bids above asking. By my conservative calculations, some buyers were paying 2-3 years of appreciation to get the house.

We were finally successful with a bid early March but with the travel restrictions, our corporate tenants plans were put on hold until July. So we may revisit but most of homes were going at a 3-5% premium and that does make a difference to an investor.

So now we switched gears and did two refis: now primary dropping from 3.1% to 2.875%, cost is $2500, so a little over a year to breakeven but frees $250/month.

I think you’d find now that

I think you’d find now that the competition is much less if at all. Prices kinda firm but not overbidding much anymore.

Good job on the refi. I’ve been at 3.1 since 2013 and going into a new 30 year even at 2.875% would have been marginal with my loan balance as low as it is. If 15 year gets to 2.5% or lower it may be a go for me

I’ll have an update in a couple days but the trend last week seems to be continuing as it was and things I expected to happening are.

Just my $0.02 – we’re still

Just my $0.02 – we’re still very early into this and don’t fully understand the economic shift that’s occurring (or not). Prices holding firm assume that we get back to the economic fundamentals of Feb 2020. If this saga results in materially higher unemployment, I can’t imagine that won’t have some effect on supply (people who lost jobs and can’t afford their mortgage anymore) and demand (fewer qualified buyers). I don’t think we’ll really have a grasp of that for many months. As someone who was house hunting in Feb, we are fully back on the sidelines, rented a great house in a neighborhood we were hunting before this all started.

sdr – saw you at an open house on Geranium a few months back, you may remember. Really appreciate your insight here – glad to see you back!

Yes was great seeing you

Yes was great seeing you again also. I dont beleive we need to get back entirely to those same economic fundamentals as supply/demand imbalance can compensate for a bit of that.There is a bit of a gold rush mentality out here with regard to RE and sellers will resist selling in a down market.

This is for you evolusd specific to our area: To put some numbers on that the monthly interest on an $800K loan at 3.5% is $2333. Add $1000 for taxes, $150 for insurance and $200 for HOA gets you to hard costs of under $3700/month on what is a house that will easily rent for $4000 or more a month. So you are out of work, need to relocate or downsize dramatically but you can rent out the house until the storm passes. Even if you have to dig into savings you can cover a small shortfall. I say people will hang onto the homes anyway they can and wait for sunny days as that is what Ive see over the past 2+ decades here.

With that said there could and should be some price declines, there are the secular cycles whereby you can find a deal certain times of the year and there are always exceptions to be found by a steady eye of your own combined with an experienced agent. I think you will be positioned for that and should be able to do better than you could have in Feb but dont expect that beachfront house for under $1M;)

Weekly update coming tomorrow…..

Check out 92107 closings.

Check out 92107 closings. Quite a few have closed for 7 to 20% above list price 4-7 weeks after list date.

No sign of pressured sellers. The upside of tight lending standards the past 12 years is homeowners are nearly all people who had the ability to save $100,000 for their downpayment.

Correct on all accounts. Hard

Correct on all accounts. Hard to predict what is coming next but right now just a small bump in the road so far