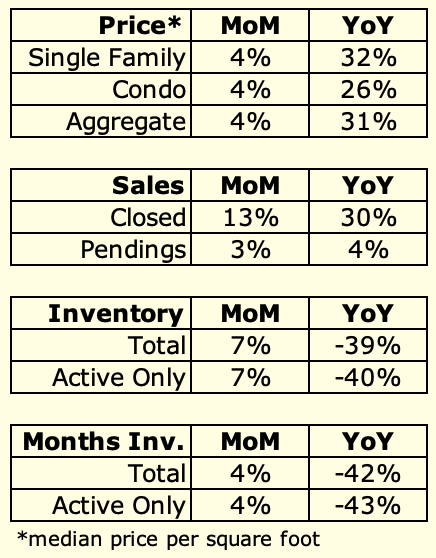

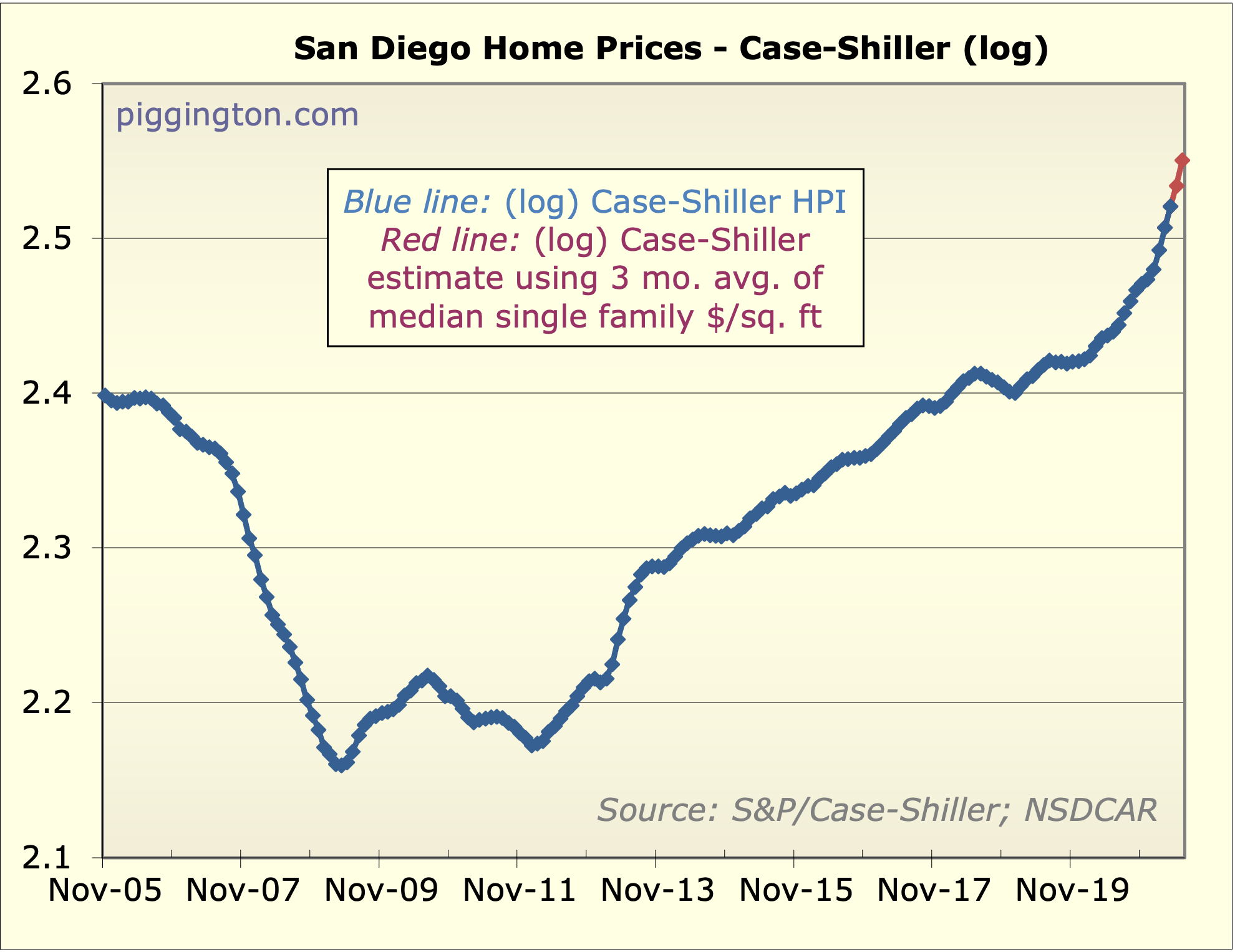

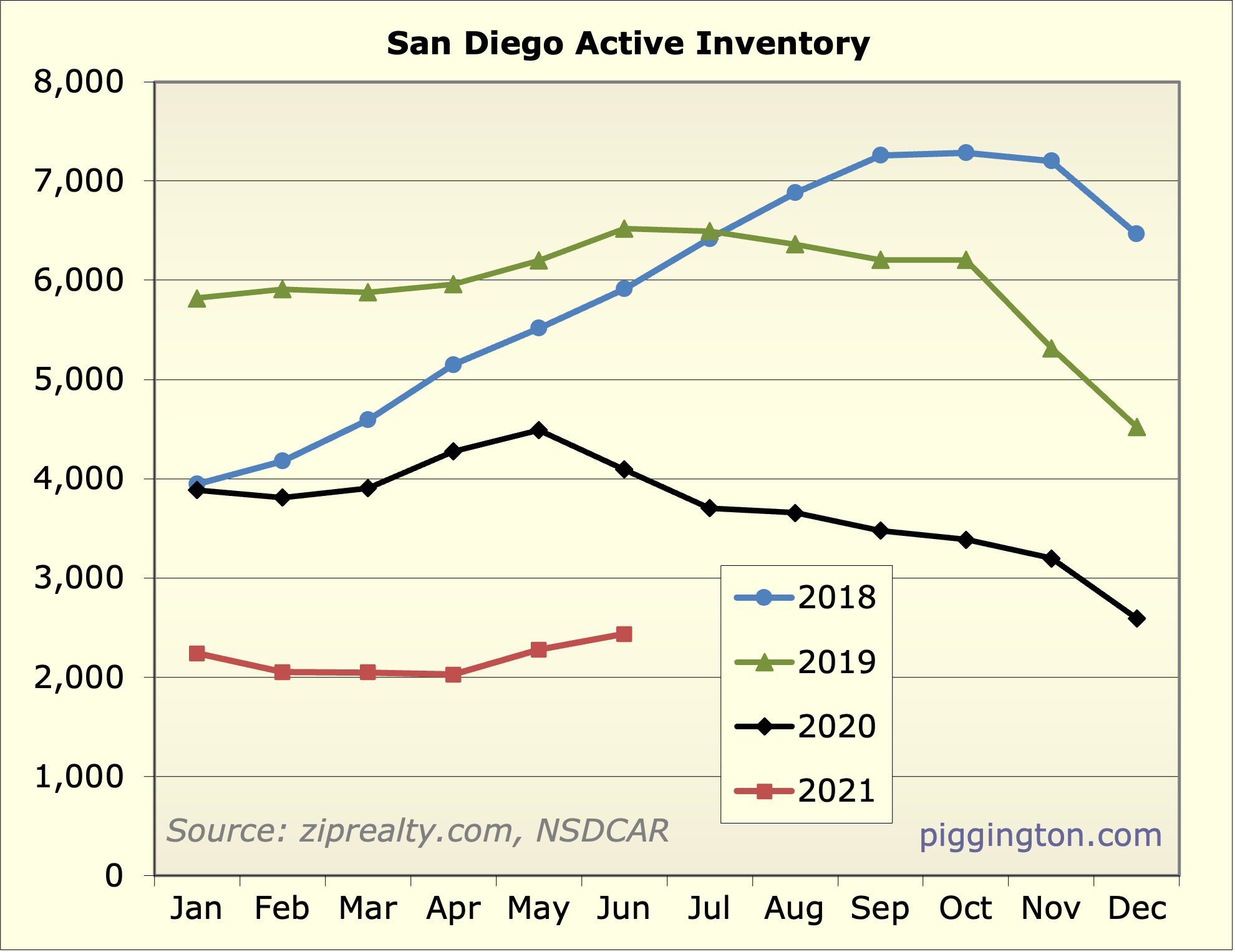

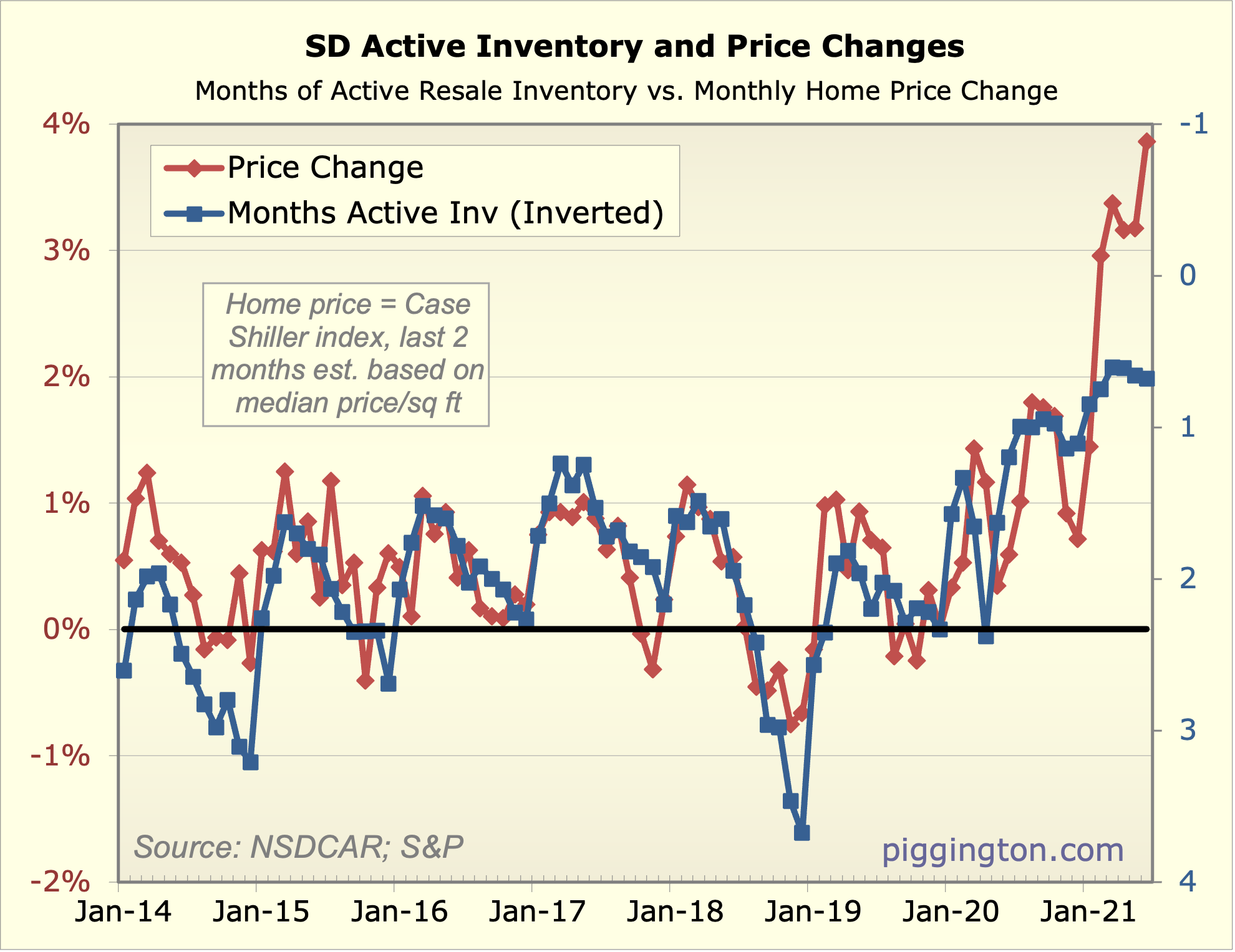

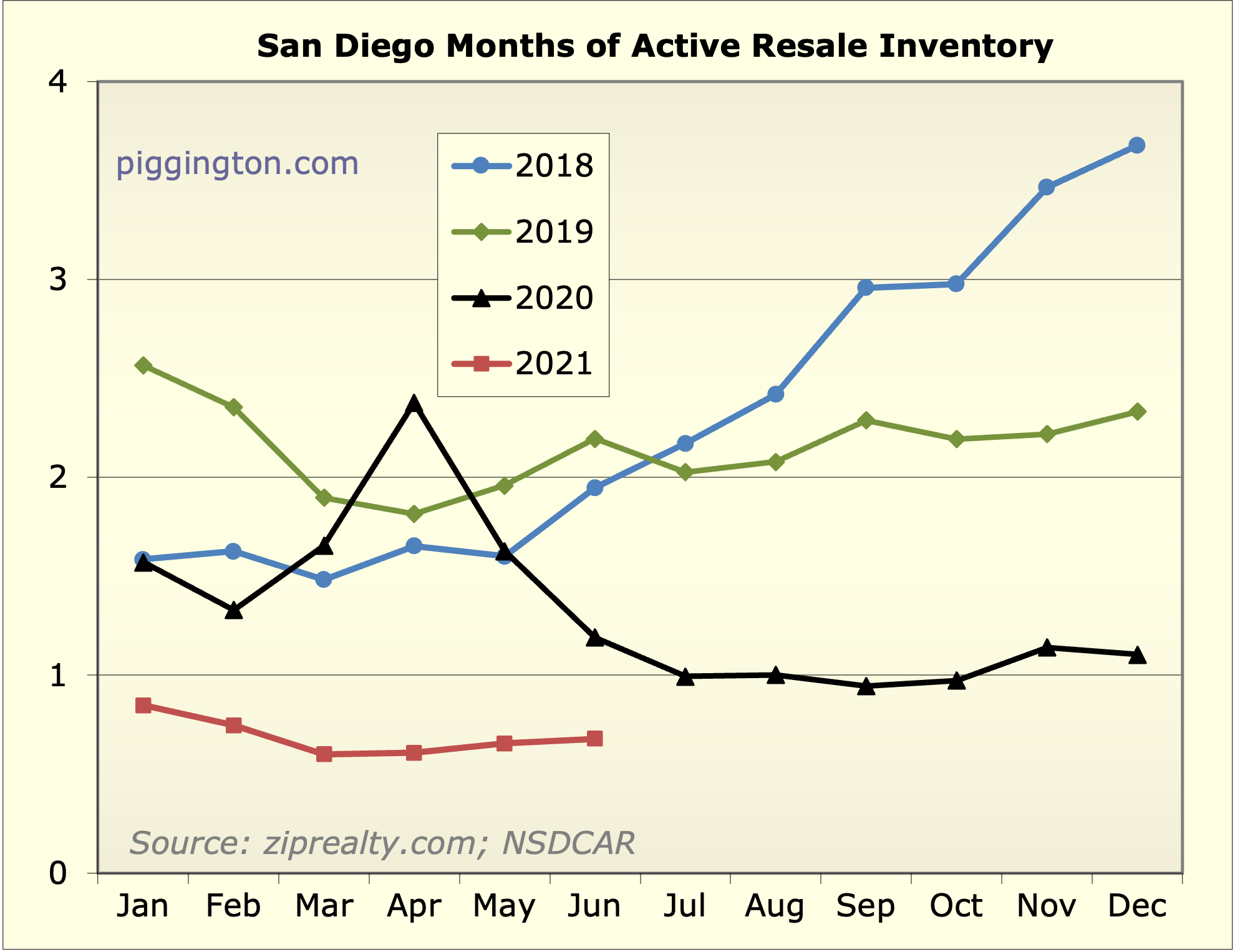

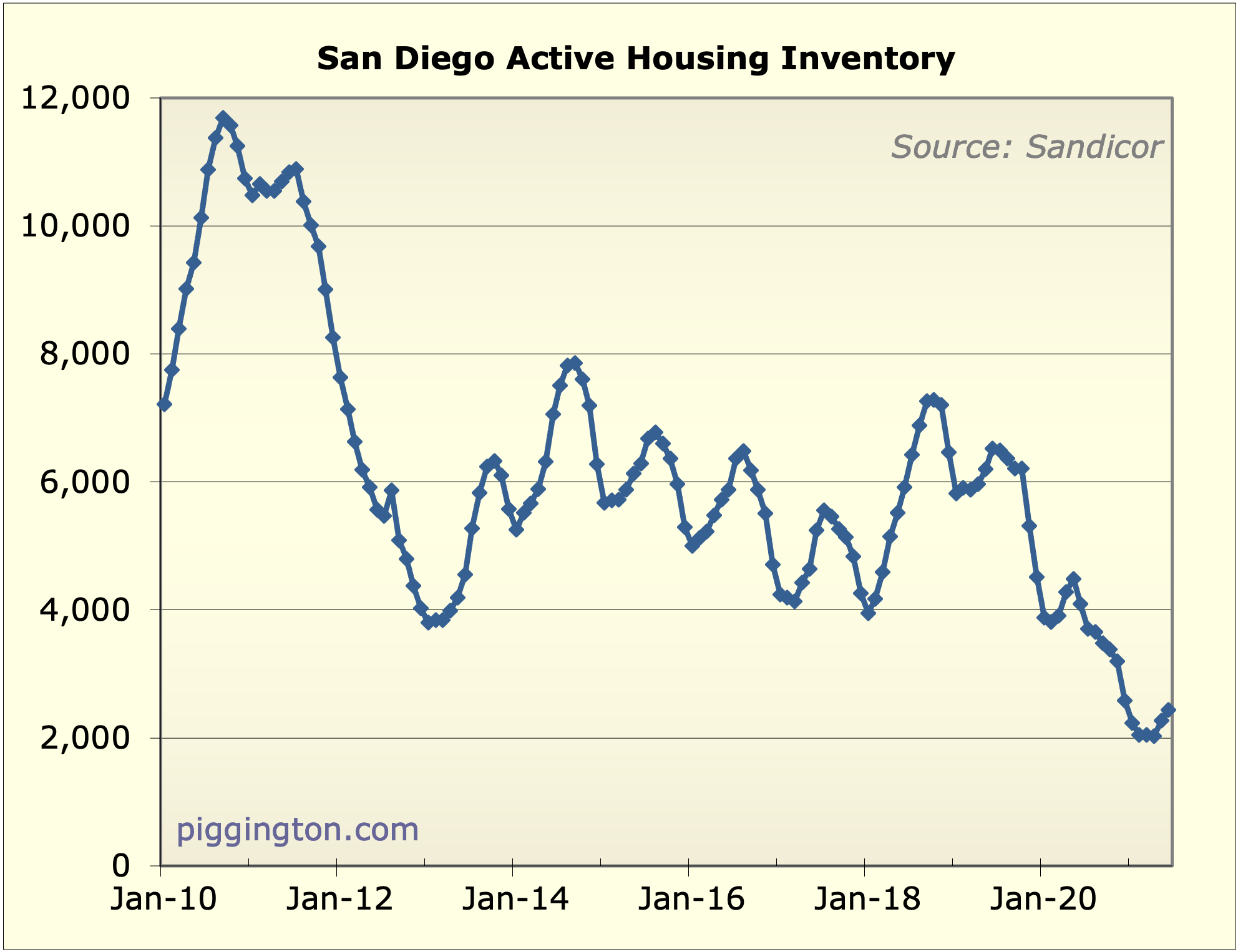

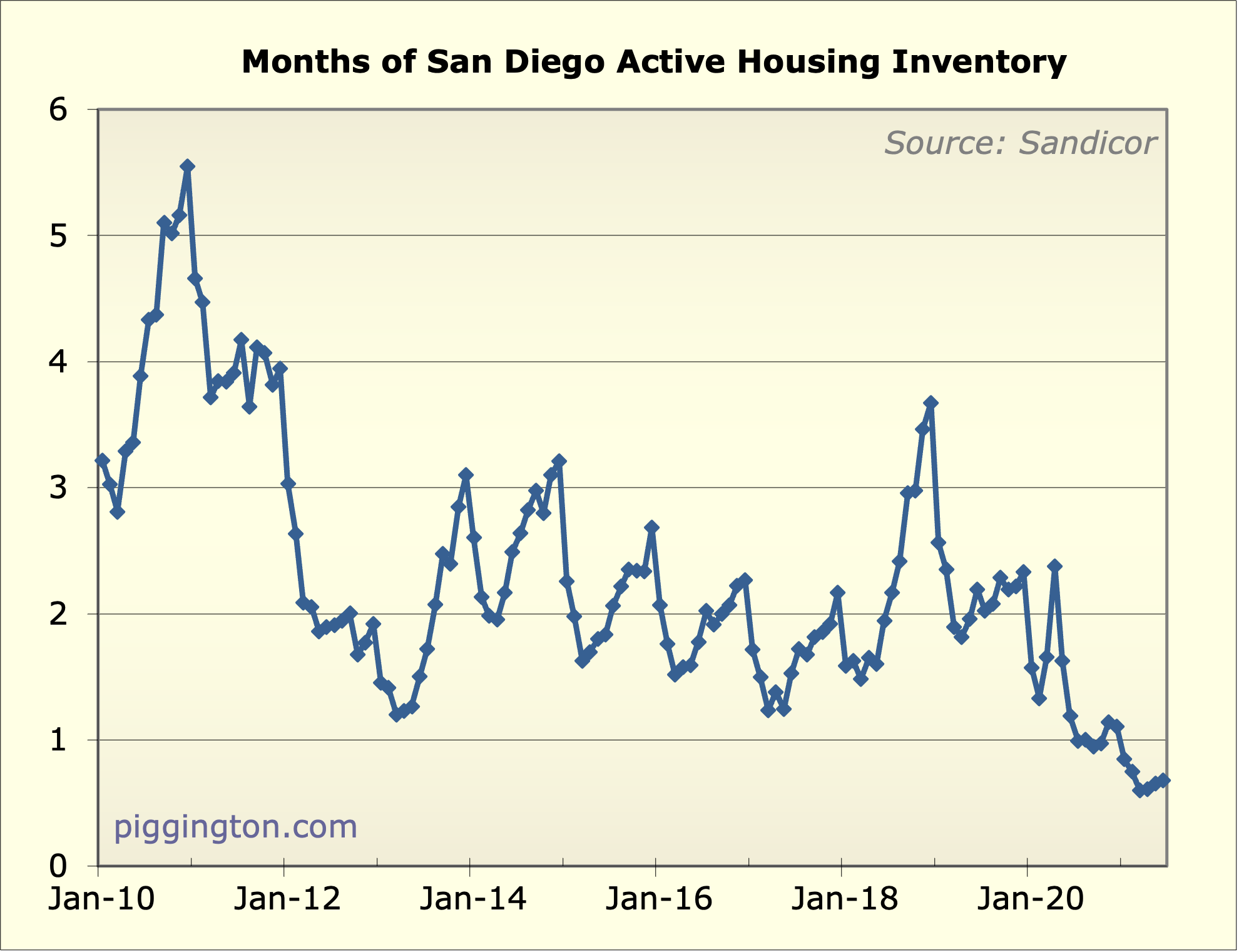

Inventory continued its barely-perceptible rise, and prices

increased further. It continues to look like the peak of the frenzy

has passed, but inventory remains very scarce.

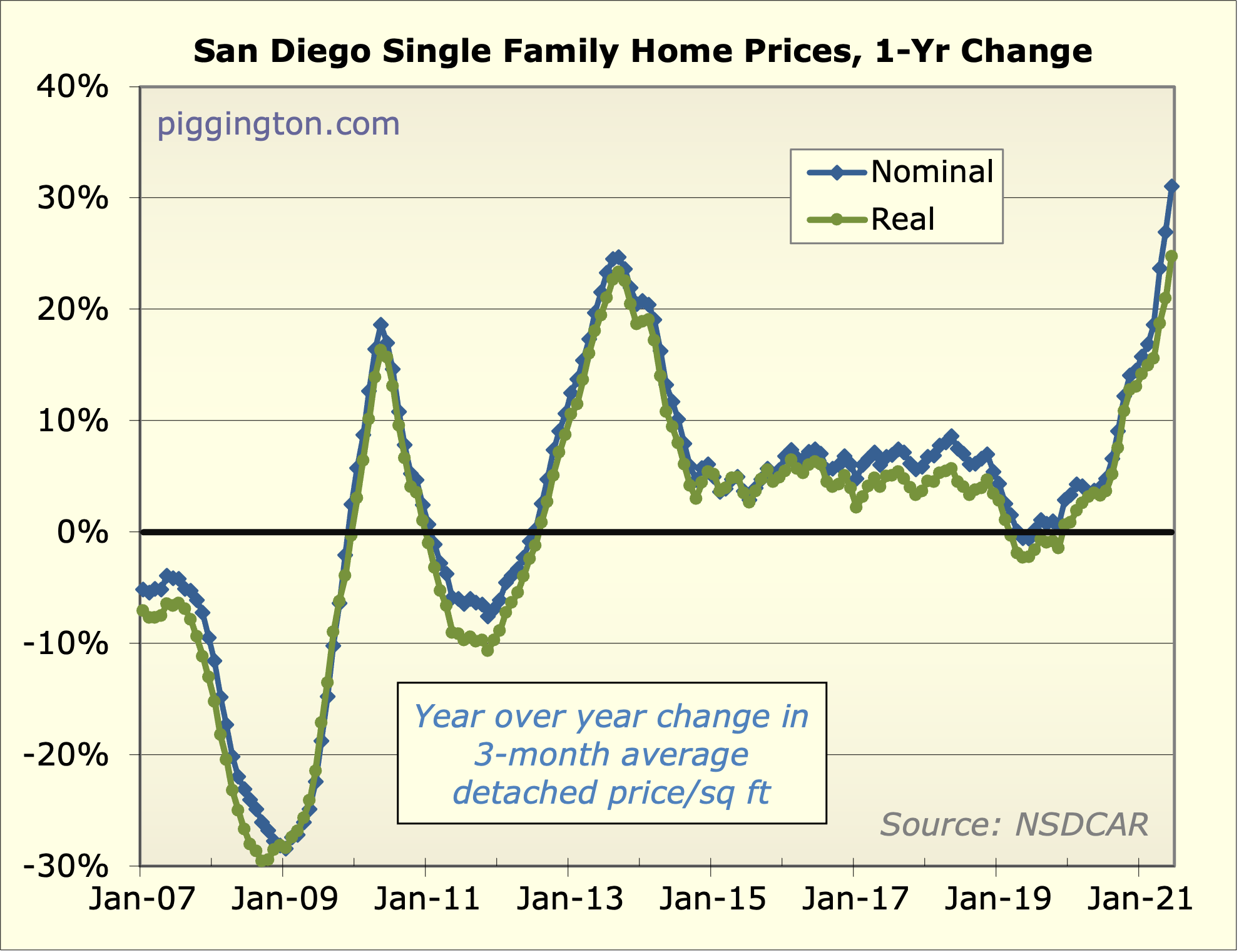

Crazy stat of the month: the single family price/square foot

increased 32% from a year ago! Incredible.

Graphs below.

Yup, go back to the April

Yup, go back to the April report and I reported numbers from the field that we were up 30%+ the past few months and even 40%+ some places. So this is just data catching up with what we saw in the streets months ago.

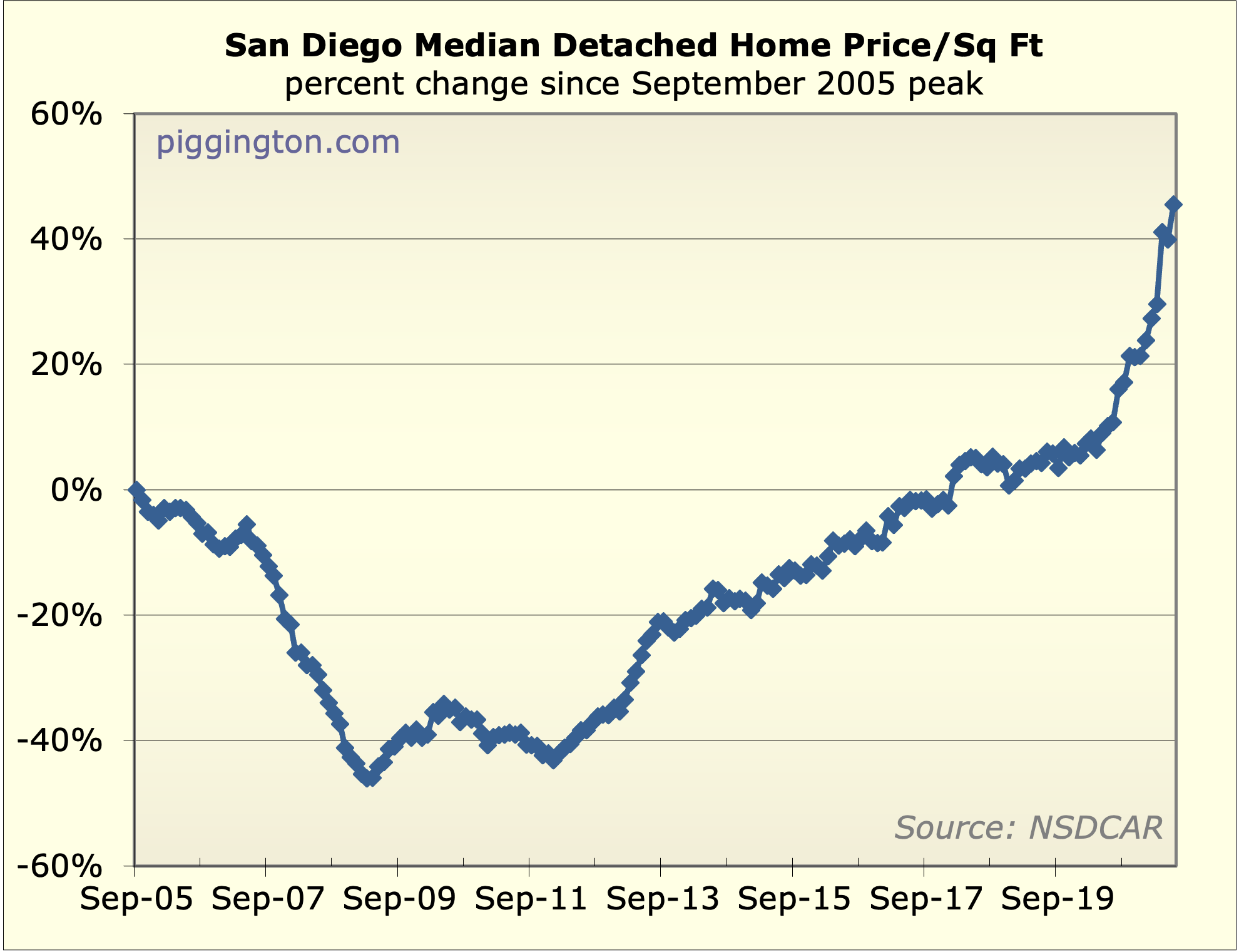

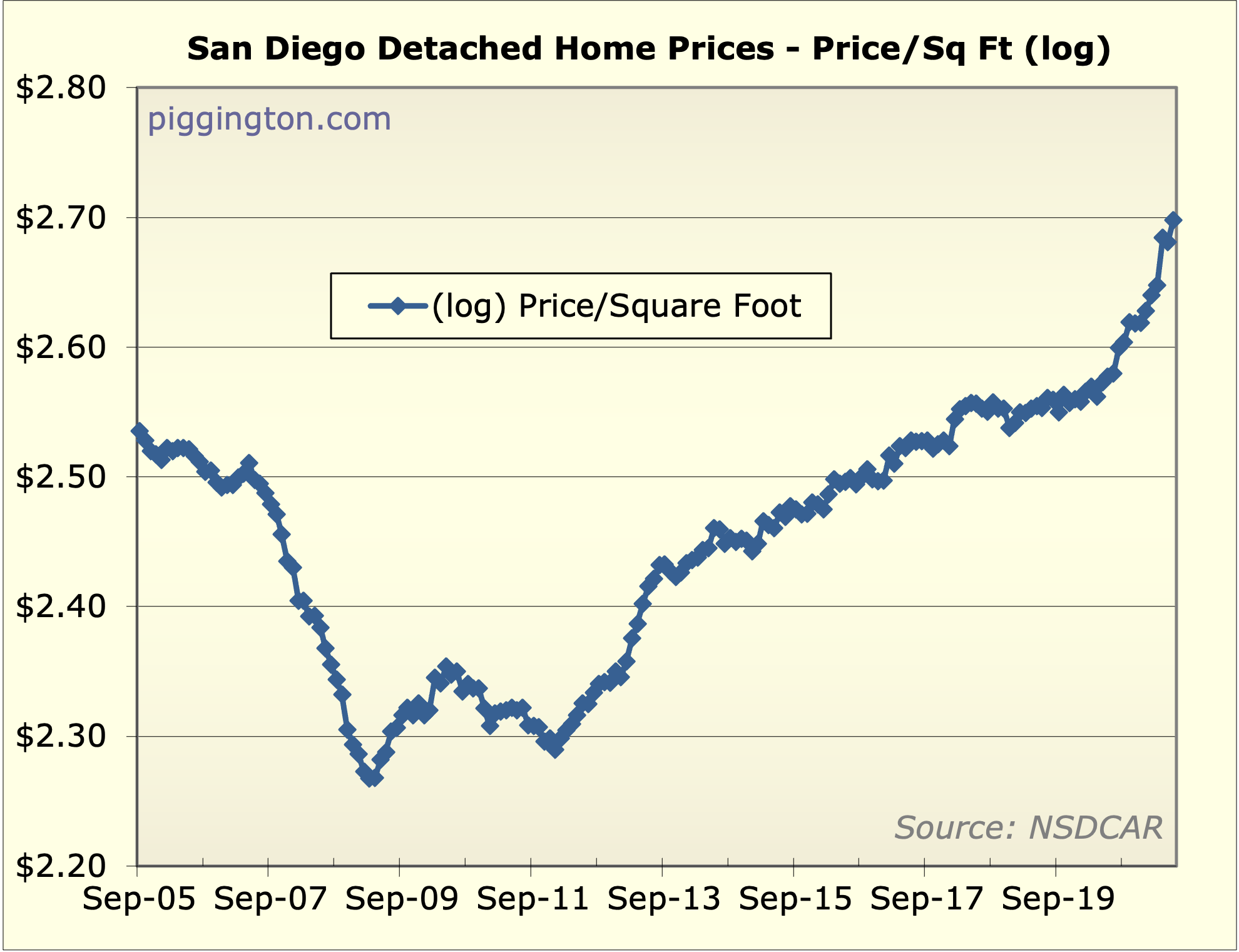

Here’s what is astounding to me. When the bubble was bursting the uber bearish view was we’d never see those bubble era prices again in our lifetime. Fifteen years later not only do we see those prices again but I’m seeing as much as 70% higher some places.

For years we looked at one sale in our hood for $1.15m in 6/04. It was the crazy high comp for over a decade for a nice but not top level home. I bumped into the listing agent on that one over the years often and we always shook our heads that the buyer was stuck forever. I drive by it almost everyday and always felt bad for a good, very successful guy with bad timing. I don’t anymore. The house is pushing $2m now.

yes the Fed was successful in

yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished!

deadzone wrote:yes the Fed

[quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.

Not just that, at peak of

Not just that, at peak of 2005/2006 bubble 30 yr fixed was at 5+%, today a 30 yr fixed 2.75%, nearly half. Adjusted for income and lower mortgage rates, effective cost of owning is lower than 2005 peak.

Rich Toscano wrote:deadzone

[quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006. I guess I am in the wrong line of business.

If wages are really up 70% since 2006, that implies a 3.6% average increase in wages, doesn’t compute with my experience. But if true, another sign of the massive inflation.

Once again, thanks Fed!

deadzone wrote:Rich Toscano

[quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006. I guess I am in the wrong line of business.

If wages are really up 70% since 2006, that implies a 3.6% average increase in wages, doesn’t compute with my experience. But if true, another sign of the massive inflation.

Once again, thanks Fed![/quote]

Still working the same place as 06? if so you have your answer

sdrealtor wrote:deadzone

[quote=sdrealtor][quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006. I guess I am in the wrong line of business.

If wages are really up 70% since 2006, that implies a 3.6% average increase in wages, doesn’t compute with my experience. But if true, another sign of the massive inflation.

Once again, thanks Fed![/quote]

Still working the same place as 06? if so you have your answer[/quote]

No that’s not the answer, looking for source of actual data. I don’t believe for a second median wages have gone up 70%.

sdrealtor wrote:deadzone

[quote=sdrealtor][quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006. I guess I am in the wrong line of business.

If wages are really up 70% since 2006, that implies a 3.6% average increase in wages, doesn’t compute with my experience. But if true, another sign of the massive inflation.

Once again, thanks Fed![/quote]

Still working the same place as 06? if so you have your answer[/quote]

I wouldn’t know if that’s true or not but career criticism aside wouldn’t that be a perfect apples to apples comparison?

Reality wrote:sdrealtor

[quote=Reality][quote=sdrealtor][quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006. I guess I am in the wrong line of business.

If wages are really up 70% since 2006, that implies a 3.6% average increase in wages, doesn’t compute with my experience. But if true, another sign of the massive inflation.

Once again, thanks Fed![/quote]

Still working the same place as 06? if so you have your answer[/quote]

I wouldn’t know if that’s true or not but career criticism aside wouldn’t that be a perfect apples to apples comparison?[/quote]

Not at all. Employers know some workers value stability and nearly all hate looking for jobs. Selling oneself is uncomfortable for many. As a result companies systematically under pay long term employees. One of my regular drinking buddies retired after a long career in HR. Name the biggest silicon valley companies and it’s in his resume. Have confirmed this many times over some great bottles of wine. Stay put, stay under compensated

deadzone wrote:Rich Toscano

[quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006.[/quote]

Since your career appears to be posting repetitive tirades about the Fed on a full-time basis, I’m not that surprised.

I got the data from the Bureau of Economic Analysis. You could have found it pretty easily, I suspect, if you cared about facts instead of reductionist narratives.

Rich Toscano wrote:deadzone

[quote=Rich Toscano][quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006.[/quote]

Since your career appears to be posting repetitive tirades about the Fed on a full-time basis, I’m not that surprised.

I got the data from the Bureau of Economic Analysis. You could have found it pretty easily, I suspect, if you cared about facts instead of reductionist narratives.[/quote]

You are the one that put out the 70% number without any specifics, sources or links.

But here is median salaries for San Diego County I found on Web.

https://fred.stlouisfed.org/series/MHICA06073A052NCEN

While it clearly shows a significant upswing in household income and this only goes to 2019, there is nothing close to 70% increase since 2006-2010 bubble area. I call BS on 70%.

deadzone wrote:Rich Toscano

[quote=deadzone][quote=Rich Toscano][quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006.[/quote]

Since your career appears to be posting repetitive tirades about the Fed on a full-time basis, I’m not that surprised.

I got the data from the Bureau of Economic Analysis. You could have found it pretty easily, I suspect, if you cared about facts instead of reductionist narratives.[/quote]

You are the one that put out the 70% number without any specifics, sources or links.

But here is median salaries for San Diego County I found on Web.

https://fred.stlouisfed.org/series/MHICA06073A052NCEN

While it clearly shows a significant upswing in household income and this only goes to 2019, there is nothing close to 70% increase since 2006-2010 bubble area. I call BS on 70%.[/quote]

FRED data is usually conservative and may not factor all forms of income.

Still was somewhat surprised myself it shows 41% from 2006 to 2019 or 3.1% avg, if we take the two last years and add to it, would be about 47%.

From St. Louis Fed on the limits of FRED data

“Household income is based on a survey that asks people about only their income, not their employer-provided benefits and retirement contributions. In a previous post, we showed that these benefits have increased relatively more than wages. Real GDP includes all income in the economy.”

IMO: much of the capital gains from higher end employment may not be captured here esp if it is deferred/401k/vesting is involved, Still very much income but the survey has limits.

deadzone wrote:Rich Toscano

[quote=deadzone][quote=Rich Toscano][quote=deadzone][quote=Rich Toscano][quote=deadzone]yes the Fed was successful in re-inflating Housing Bubble 2.0 even higher than the last one. Mission Accomplished![/quote]

False. Incomes are up 70% since the bubble peak.[/quote]

Where do you get that stat? I know my income hasn’t gone up anywhere close to 70% since 2006.[/quote]

Since your career appears to be posting repetitive tirades about the Fed on a full-time basis, I’m not that surprised.

I got the data from the Bureau of Economic Analysis. You could have found it pretty easily, I suspect, if you cared about facts instead of reductionist narratives.[/quote]

You are the one that put out the 70% number without any specifics, sources or links.

But here is median salaries for San Diego County I found on Web.

https://fred.stlouisfed.org/series/MHICA06073A052NCEN

While it clearly shows a significant upswing in household income and this only goes to 2019, there is nothing close to 70% increase since 2006-2010 bubble area. I call BS on 70%.[/quote]

First, you have the wrong start date. The bubble peaked in 2005, not “2006-2010”. You also have the wrong end date. It’s not 2019 but 2021 — I assumed you knew that.

You are looking at a different data series — understandable I guess, though I did refer you to the BEA, which only reports local per capita income, not median. But whatever, let’s use the series you found. If you use the right start date of 2005, and actually extrapolate the 2018-19 trend out to 2021 (income has actually grown faster than that since 2019, but whatever)… and the increase comes out to 67%.

You could have easily figured that out yourself, but why bother doing that when you can just decide to believe whatever you want and “call BS?”

Deadzone, your posts are garbage. They are just an endless stream of ill-informed, monomaniacal, combative, and incredibly repetitive rants. I’m tired of seeing them and I’m tired of you dragging every thread into the same endless, pointless, unbelievably tedious debate.

If you have something useful to add to the conversation, such as actual facts or really any topic besides your lunatic obsession with the Fed, please do so — without the pugnacious attitude. Otherwise, you’re going to need to take it somewhere else.

sdrealtor wrote:When the

[quote=sdrealtor]When the bubble was bursting the uber bearish view was we’d never see those bubble era prices again in our lifetime.[/quote]

Who had that view? It’s a silly forecast, unless the dude making it was in his 80s or something. It presupposes that there will never again be any economic growth or inflation. I guess some people had that forecast, but that was far out on the fringe.

By the same token, comparing nominal prices now vs. 16 years ago is meaningless, in my opinion. Consider the stat I mentioned above, that incomes have risen 70% since the peak — house that sold for the same price now as it did then would be selling for a massively lower valuation now. That’s what matters, not the nominal price.

I could put together a

I could put together a laundry list of former posters now long gone with that view and yes of course it was silly. Agreed but nonetheless it’s still amazing that prices are close to 70% above prior peak some places around town. Even with incomes up substantially it’s still a head scratcher for me. It speaks to power of the passage of time so many people underestimate

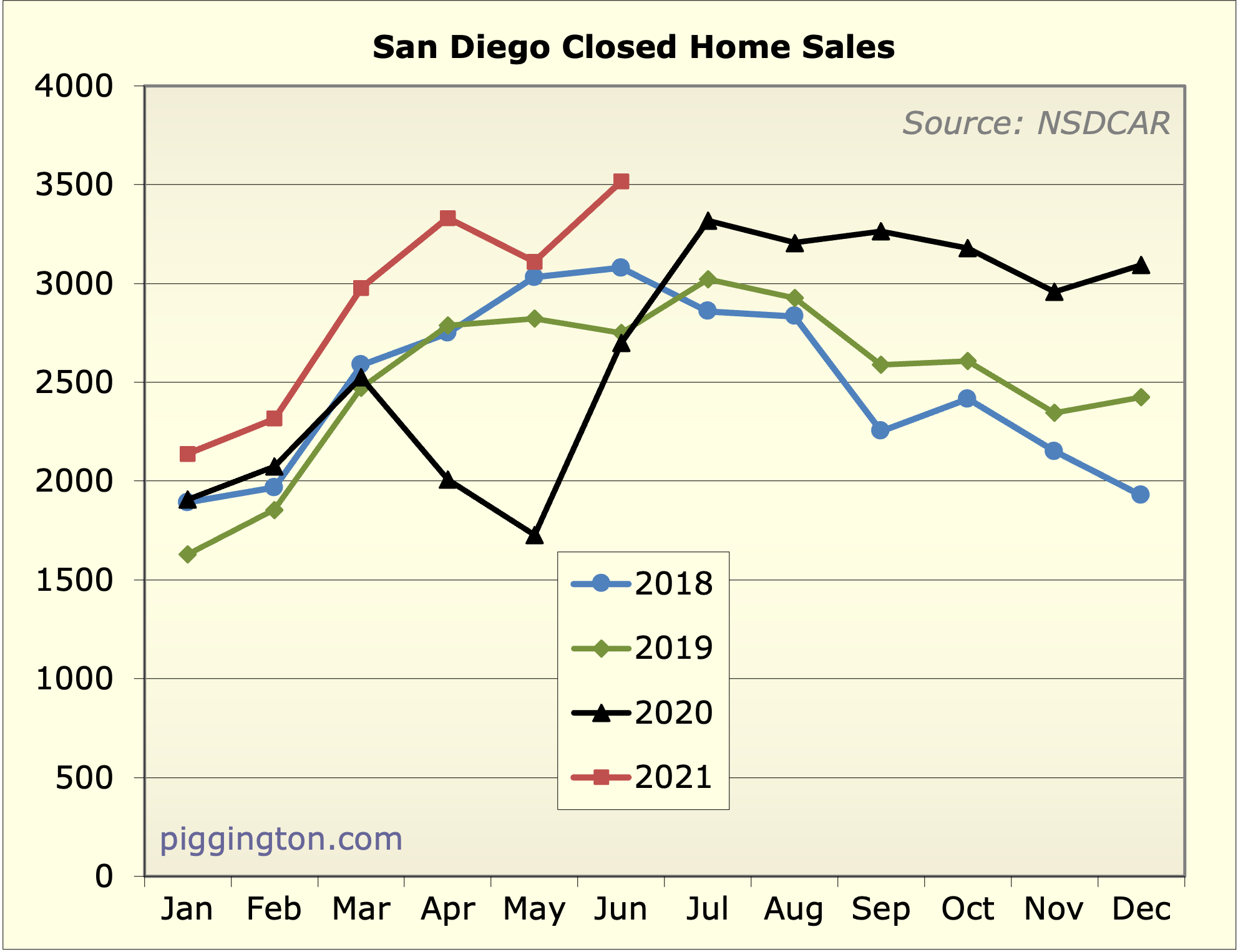

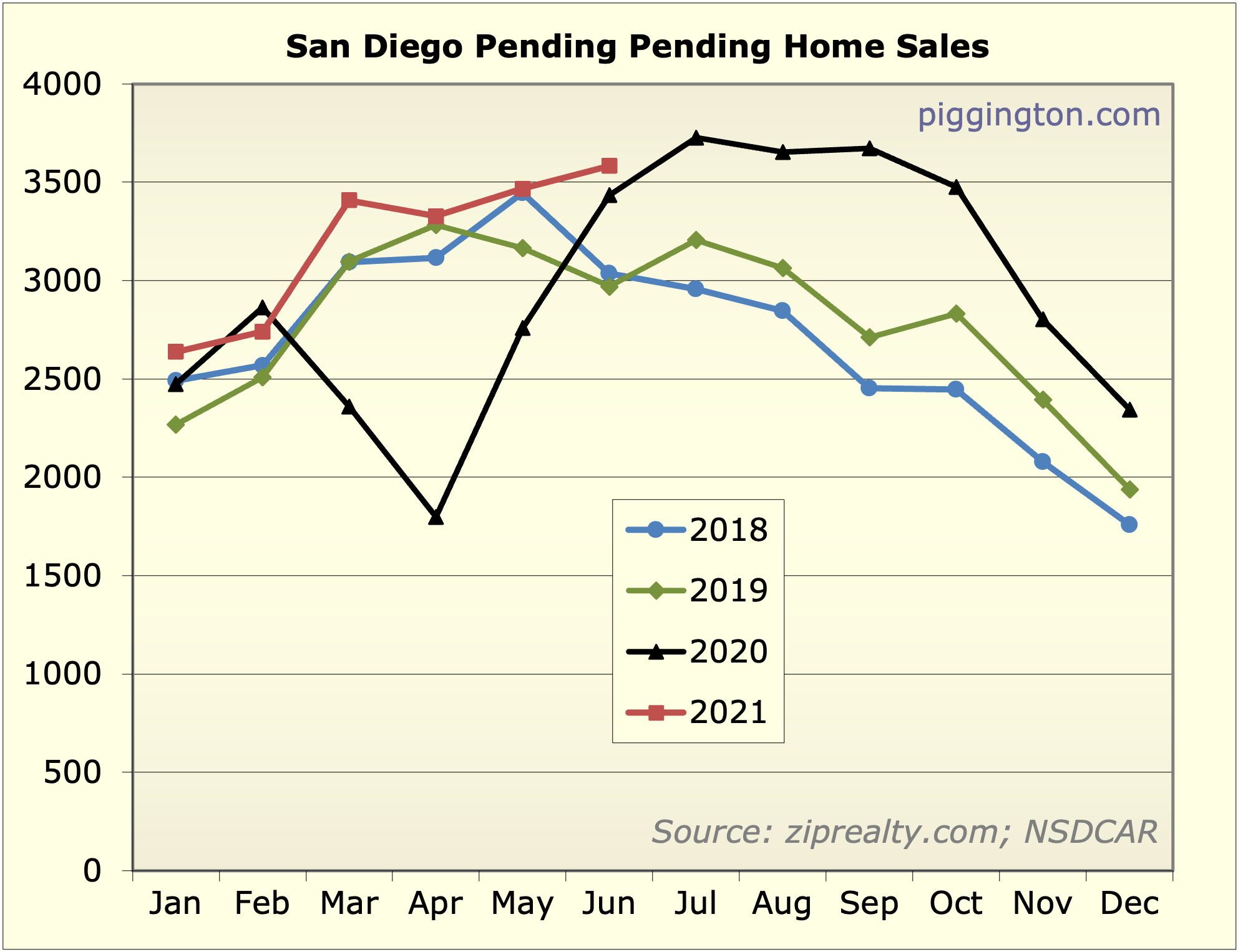

Looks like we’re now closing

Looks like we’re now closing in on 3x the 2009/2011 bottoms!

How far are we from my “crazy” quasi-prediction that Dec 2022 is 2x Jan 2019? Seems like we’re about on track.

More bullish trends:

Rates are dropping compared to what they were when the deals producing the 32% YoY stat were inked.

Seasonal spring inventory increase from April to June is lower than 2019, 2018, and 2017. About in line with 2016.

Strong rent growth.

Strong growth in peer markets supports SD’s relative value.

Full SALT deduction is on its way back. Thanks Chuck and Nancy!

gzz wrote:Looks like we’re

[quote=gzz]Looks like we’re now closing in on 3x the 2009/2011 bottoms!

How far are we from my “crazy” quasi-prediction that Dec 2022 is 2x Jan 2019? Seems like we’re about on track.

More bullish trends:

Rates are dropping compared to what they were when the deals producing the 32% YoY stat were inked.

Seasonal spring inventory increase from April to June is lower than 2019, 2018, and 2017. About in line with 2016.

Strong rent growth.

Strong growth in peer markets supports SD’s relative value.

Full SALT deduction is on its way back. Thanks Chuck and Nancy![/quote]

I bought a condo in SD in 2010. Sold out in 2016 for almost 3x. Today it is 4x. Those deals were widely available back then for those willing to step and buy them

I’ll respectfully disagree

I’ll respectfully disagree about my posts being garbage but the Piggington readers (what few are left) can make their own judgement.

But to be fair I agree this isn’t technically housing bubble 2.0. As I’ve previously said it is Everything Bubble 1.0. Sorry to be repetitious about the Fed but if you can’t see that the Fed is controlling this you are living under a rock.

I just find it amusing when folks on here act so surprised home prices are up so much, or crypto or anything else. With M2 going parabolic, prices are going to go up. You don’t need an advanced degree in economics to understand this

https://fred.stlouisfed.org/series/M2SL

Does anyone besides Deadzone

Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot? While I’d agree that it doesn’t affect payments that much, it certainly affects the deductibility of those payments. Do the graphs take that into account?

Reality wrote:Does anyone

[quote=Reality]Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot? While I’d agree that it doesn’t affect payments that much, it certainly affects the deductibility of those payments. Do the graphs take that into account?[/quote]

No one ever here claimed it wasn’t affecting asset prices. It’s just not the sole reason particularly a place like this.

sdrealtor wrote:Reality

[quote=sdrealtor][quote=Reality]Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot? While I’d agree that it doesn’t affect payments that much, it certainly affects the deductibility of those payments. Do the graphs take that into account?[/quote]

No one ever here claimed it wasn’t affecting asset prices. It’s just not the sole reason particularly a place like this.[/quote]

A place like this? A place like this was already higher than most, but low interest rates have lit a fire under asset prices all over. Our area is not special over the last 1 1/2 years.

Reality wrote:sdrealtor

[quote=Reality][quote=sdrealtor][quote=Reality]Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot? While I’d agree that it doesn’t affect payments that much, it certainly affects the deductibility of those payments. Do the graphs take that into account?[/quote]

No one ever here claimed it wasn’t affecting asset prices. It’s just not the sole reason particularly a place like this.[/quote]

A place like this? A place like this was already higher than most, but low interest rates have lit a fire under asset prices all over. Our area is not special over the last 1 1/2 years.[/quote]

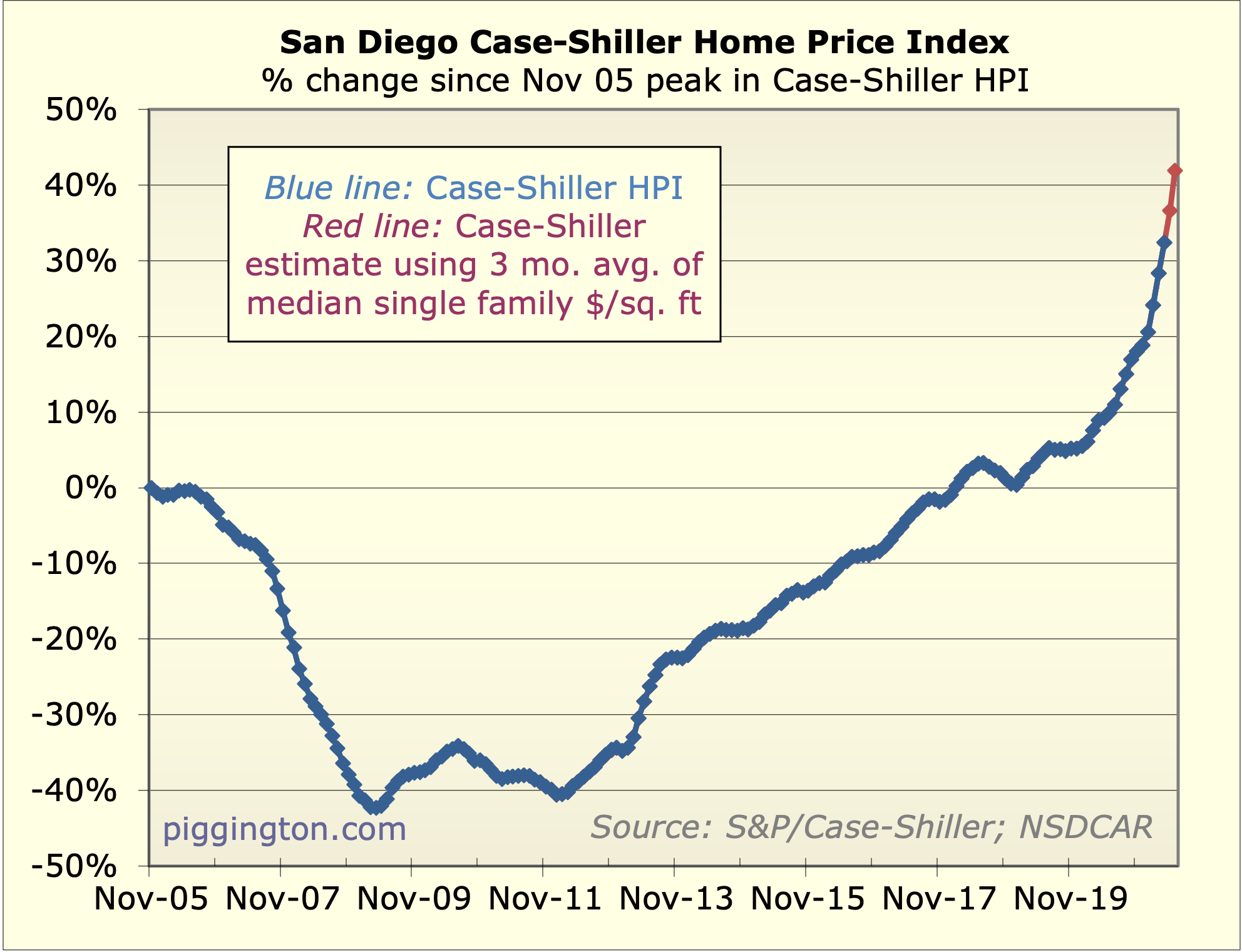

Might want to check Case Shiller. We along with Phoenix are top market in the country and I know there is quite a bit more coming once the data catches up with the reality I’ve seen for months. Wait for their next two updates for May and June

https://www.prnewswire.com/news-releases/sp-corelogic-case-shiller-index-shows-annual-home-price-gains-surged-to-14-6-in-april-301322155.html

Wait, I thought you didn’t

Wait, I thought you didn’t trust Case Shiller sdr?

But if you are correct about San Diego being way different, will have to compare long term charts of San Diego vs. other areas and US average. Are the differences between San Diego and US Average consistent or proportional? Or does San Diego’s chart jump up at a significantly higher rate than the rest during Pandemic?

San Diego has been appreciating at a much higher rate than the rest of the country for many years so just because it is doing so over the last year doesn’t necessarily prove anything. In other words, the trend of “wealthy foreigners” buying up SD RE has been going on for years, this is nothing new.

I do not trust it to be up to

I do not trust it to be up to date or accurate. The higher numbers are coming and will still understate what is happening here. Just the same we are on top of the best available data out there. And SD has not been appreciating at the highest rate for many years. If you make that claim bring some data.

Here is some more. Yes everywhere is up but we are up more and with greater momentum. In 20+ years I can never remember a time when SD could make that claim before backed by data

https://realestatedecoded.com/case-shiller/

You continue bringing out your tired arguments and even Rich finally got so fed up he called you out.

Here’s a tip. If everyone is saying you are off base but you think it others who are off base, evefryone is not wrong, you are wrong… its you not them.

sdrealtor wrote:I do not

[quote=sdrealtor]I do not trust it to be up to date or accurate. The higher numbers are coming and will still understate what is happening here. Just the same we are on top of the best available data out there. And SD has not been appreciating at the highest rate for many years. If you make that claim bring some data.

Here is some more. Yes everywhere is up but we are up more and with greater momentum. In 20+ years I can never remember a time when SD could make that claim before backed by data

https://realestatedecoded.com/case-shiller/

You continue bringing out your tired arguments and even Rich finally got so fed up he called you out.

Here’s a tip. If everyone is saying you are off base but you think it others who are off base, evefryone is not wrong, you are wrong… its you not them.[/quote]

Finally you bring out the Case Shiller data instead of your endless anectodal BS about what your “wine drinking buddy” or “best friend from HS” told me, good for you. That is a great chart, and I agree that it shows that starting in 2021, San Diego is appreciating at a higher rate than the US. But keep in mind, this is over a short period of a few months where this has picked up. Let’s see over a longer period how well it holds, not claiming it won’t but we’ll see.

Also, if you look at long term Case Shiller San Diego vs. US you will see that this again is nothing new. The discrepancy between San Diego vs. US average was even more extreme during the last housing bubble.

So again the data for today does not show anything we didn’t see in relation to SD price momentum back in 2005 timeframe.

And here’s a tip for you. I’m not the only one that disagrees with you or are tired of your arrogant, dbag attitude.

OK BoZone. My anecdotes come

OK BoZone. My anecdotes come from decades of expereince actually working in the industry not reading a few blogs in other cities. Ive got a slight bit more credibility.

You are the master of the strawman. My entire point is over the short term. Those charts are 3 months behind so it already has continued over a longer period. Ive never said these massive gains will continue coming in over the next few years. I do beleive they will hold at least along the coast and other prime neighborhoods.

Yes it was more extreme than the US avg but that is not what you said or what I said. SD was not the top dog in the last housing bubble. I can never remeber it being the top market. You keep moving the goalposts to fit your nonesense. The data comparatively to other markets is different than what we saw in 05. Markets like Vegas and Florida were the real hots spots they are not now

I dont require tips from you. Outside of you and your doomer twin missed the boat also Reality Ive seen no such accusations. You have been called out by numerous folks here most notably Rich. It is what it is BoZone

sdrealtor wrote:OK BoZone. My

[quote=sdrealtor]OK BoZone. My anecdotes come from decades of expereince actually working in the industry not reading a few blogs in other cities. Ive got a slight bit more credibility.

You are the master of the strawman. My entire point is over the short term. Those charts are 3 months behind so it already has continued over a longer period. Ive never said these massive gains will continue coming in over the next few years. I do beleive they will hold at least along the coast and other prime neighborhoods.

Yes it was more extreme than the US avg but that is not what you said or what I said. SD was not the top dog in the last housing bubble. I can never remeber it being the top market. You keep moving the goalposts to fit your nonesense. The data comparatively to other markets is different than what we saw in 05. Markets like Vegas and Florida were the real hots spots they are not now

I dont require tips from you. Outside of you and your doomer twin missed the boat also Reality Ive seen no such accusations. You have been called out by numerous folks here most notably Rich. It is what it is BoZone[/quote]

Where is the strawman? You are the one claiming things are different now regarding SD price momentum relative to US. I just pointed this same effect happened in Housing Bubble 1.0, but to even greater extent. Just look at the CS chart you yourself provided. SD was way hotter than US in 2005 to a larger extent than it is today.

But go ahead with your bullying and name calling when anyone disagrees with you.

No ever said SD wasn’t well

No ever said SD wasn’t well above the US average. That is your straw man. SD was not the hottest market in the country it was one of a bunch that typical outperform. Now it stands at the top of the mountain. There is a difference and you always seem to start the name around here so there’s that too

sdrealtor wrote:No ever said

[quote=sdrealtor]No ever said SD wasn’t well above the US average. That is your straw man. SD was not the hottest market in the country it was one of a bunch that typical outperform. Now it stands at the top of the mountain. There is a difference and you always seem to start the name around here so there’s that too[/quote]

I’m not arguing whether San Diego is or was top of the market. Point is San Diego, relative to US Average, was even more extremely out of whack in 2005 than it is now. That is to demonstrate that the premium, or “sunshine tax” or whatever you want to call it, was even higher in 2005 than it is now.

Reality wrote:sdrealtor

[quote=Reality][quote=sdrealtor][quote=Reality]Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot? While I’d agree that it doesn’t affect payments that much, it certainly affects the deductibility of those payments. Do the graphs take that into account?[/quote]

No one ever here claimed it wasn’t affecting asset prices. It’s just not the sole reason particularly a place like this.[/quote]

A place like this? A place like this was already higher than most, but low interest rates have lit a fire under asset prices all over. Our area is not special over the last 1 1/2 years.[/quote]

Exactly right. We all know and agree San Diego is special and worth a premium. But SDR continues to argue it is extra second derivative special since the pandemic started, just based on what he sees on the streets. I find it comical because I’ve checked local real estate related blogs of cities all over the country and they are all saying the exact same thing. They all think their areas are special because “People from California are moving here”, “the job market is so great”, “all houses are going for way over asking price within days of listing”, etc.

deadzone wrote:Reality

[quote=deadzone][quote=Reality][quote=sdrealtor][quote=Reality]Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot? While I’d agree that it doesn’t affect payments that much, it certainly affects the deductibility of those payments. Do the graphs take that into account?[/quote]

No one ever here claimed it wasn’t affecting asset prices. It’s just not the sole reason particularly a place like this.[/quote]

A place like this? A place like this was already higher than most, but low interest rates have lit a fire under asset prices all over. Our area is not special over the last 1 1/2 years.[/quote]

Exactly right. We all know and agree San Diego is special and worth a premium. But SDR continues to argue it is extra second derivative special since the pandemic started, just based on what he sees on the streets. I find it comical because I’ve checked local real estate related blogs of cities all over the country and they are all saying the exact same thing. They all think their areas are special because “People from California are moving here”, “the job market is so great”, “all houses are going for way over asking price within days of listing”, etc.[/quote]

ROTFLMAO! I actually work in this business and follow data at a microeconomic and macroeconomic level as an insider but you check a few blogs and are suddenly an expert trying to discredit me with your nonsensical anecdotes.

Rich is right abouot you. I dub thee BoZone

Reality wrote:Does anyone

[quote=Reality]Does anyone besides Deadzone agree that keeping interest rates low is affecting asset prices, including housing, a lot?[/quote]

I absolutely agree with that. I think most would agree with that.

I also agree directionally with many criticisms of the Fed. Primarily, they don’t care about asset bubbles. (They claim to, but they never actual admit when there’s a bubble underway). And I think they taking a big risk keeping policy so loose given the obvious inflationary pressures (yes, they may be transitory… but nobody really knows that for sure, and if they turn out not to be, the Fed is boxing themselves into a very difficult situation).

Also, fwiw, I disagree with the “bullish” contingent on many things.

The issue isn’t about whether interest rates matter, or being bullish or bearish. It’s with the tenor of the posts, as I described.

[quote=deadzone]I’ll respectfully disagree about my posts being garbage but the Piggington readers (what few are left) can make their own judgement.[/quote]

Thank you for respectfully disagreeing! Now prove me wrong. Be respectful to others, and make it about discussing and learning, not ranting and repeating yourself.

[quote=sdrealtor]Outside of you and your doomer twin missed the boat also Reality…[/quote]

Do you think that’s a compelling argument or something? It isn’t, it only undermines the rest of your argument. (Because why would you have to resort to such things if your actual argument was sound)? I’ve asked dz again, now I will ask you again to lay off the personal attacks.

No problem and I agree as you

No problem and I agree as you do that keeping interest rates low is affecting asset prices, including housing. How could anyone argue with that? What I am focussed on is that while everything is going up everywhere some markets are outperforming. One of those markets outperforming to the highest degree is right here. My mantra is always about outperforming the averages. If it wasnt Id buy index funds

I think most of us agree on

I think most of us agree on at least 90% of these topics. Me and sdr only disagree on the more subtle points but it is his condescending style and insults that cause the rub.

sdr’s main contention is SD has become more popular RE destination than even before. I don’t know that he is wrong, but there is not enough evidence long term to prove this yet. And as I’ve pointed out, SD RE has been more inflated than today relative to the US average which is clearly seen on the Case Shiller chart around the 2005 timeframe. So this remains to be seen and we won’t know the answer for sure until some years down the road.

Regarding inflation, I don’t understand how there can be any deniers on this. I see crazy price increases in both personal and business purchases this year like I’ve never seen. And to avoid raising interest rates or federal COLA, the Fed Chair invented the work “transitory” to justify continued asset purchases (ie QE infinity). Seriously, maybe I’m backward but I’ve never heard anyone use the word “transitory” prior to Powell. Now the media uses it all the time like it is a normal thing just like they’ve convinced us it is normal for the Fed to print money to buy financial assets in the first place.

Do or do not. There is no try

Do or do not. There is no try