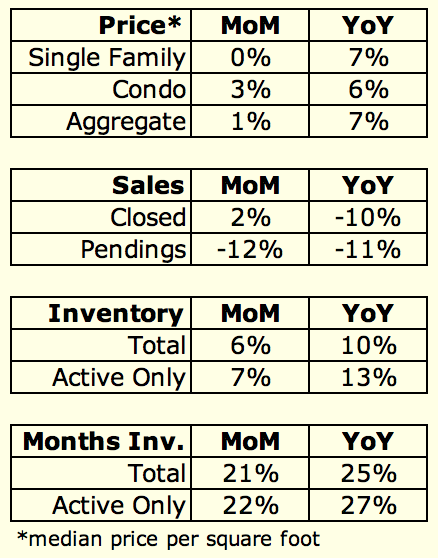

Let’s start with some big picture stuff… here are assorted MoM and

YoY stats:

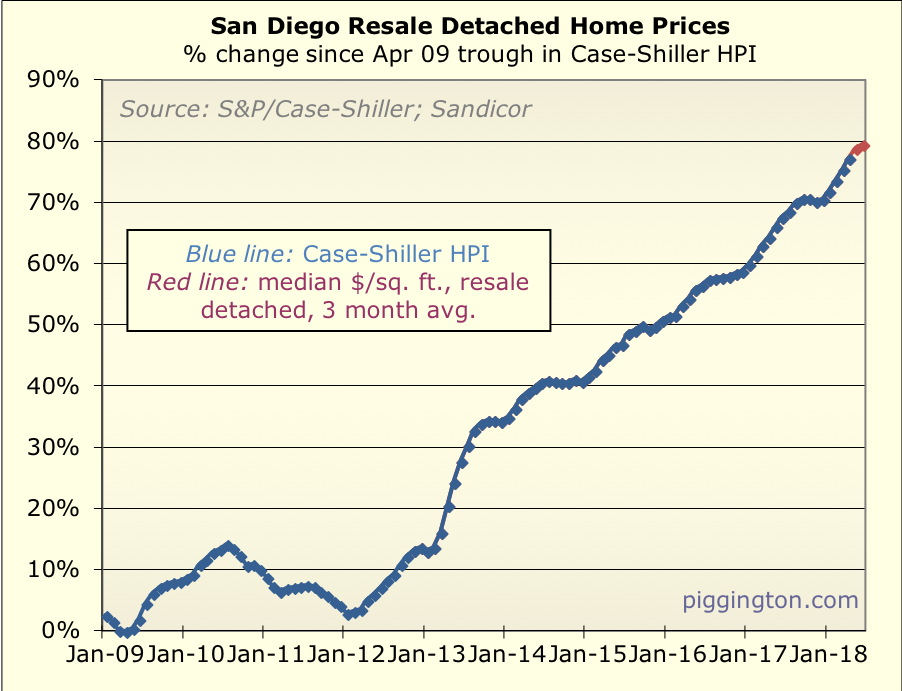

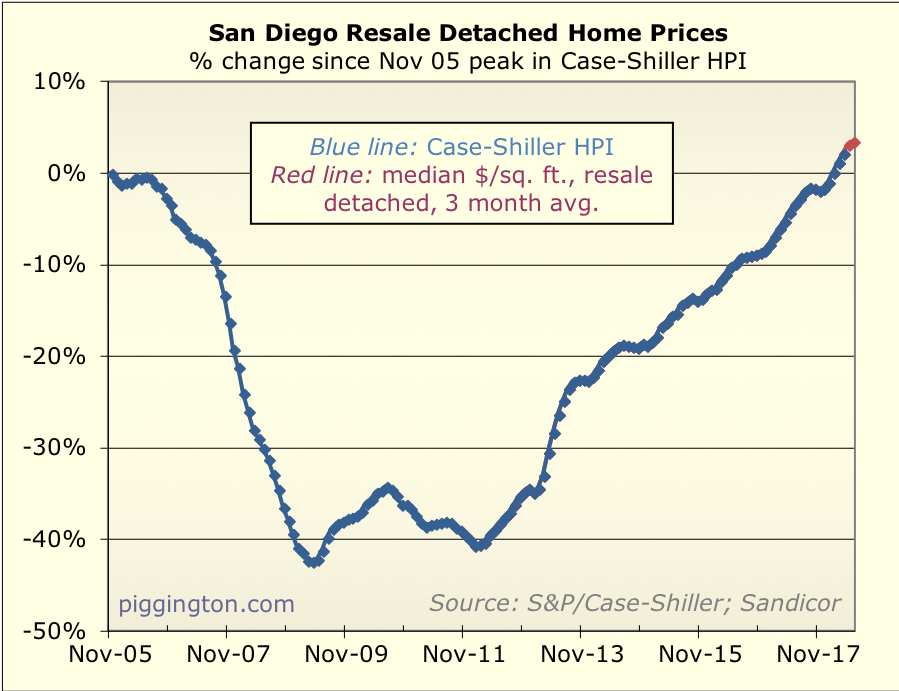

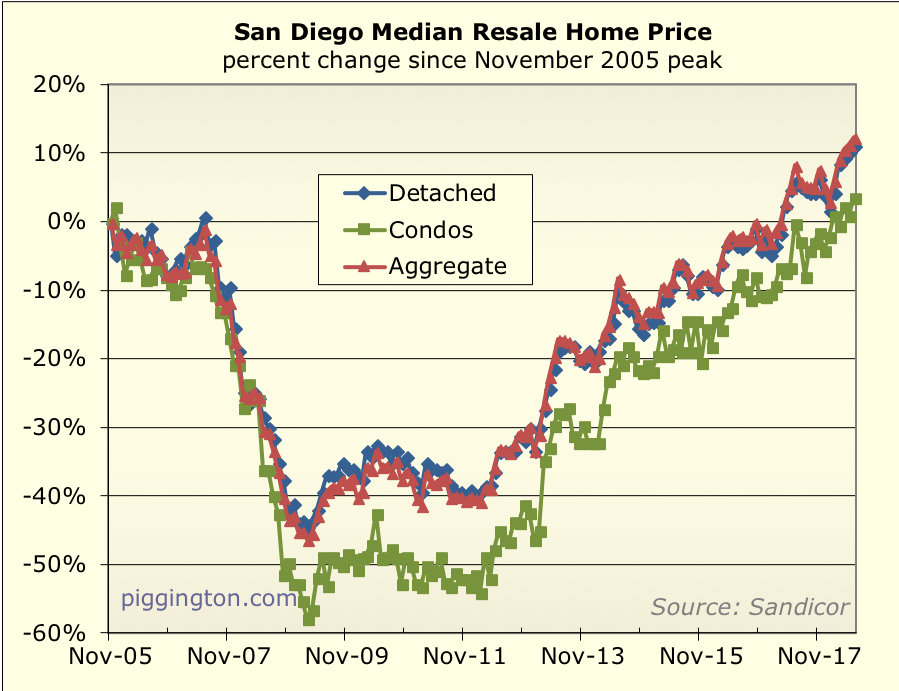

Prices have decelerated but are still rising, at least based on the

3 month average for single family homes:

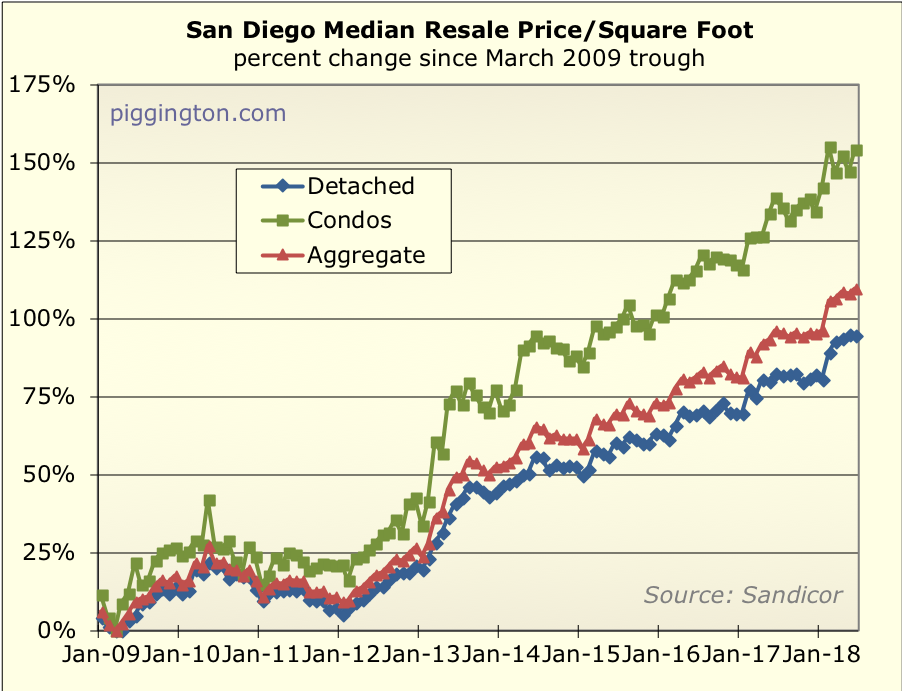

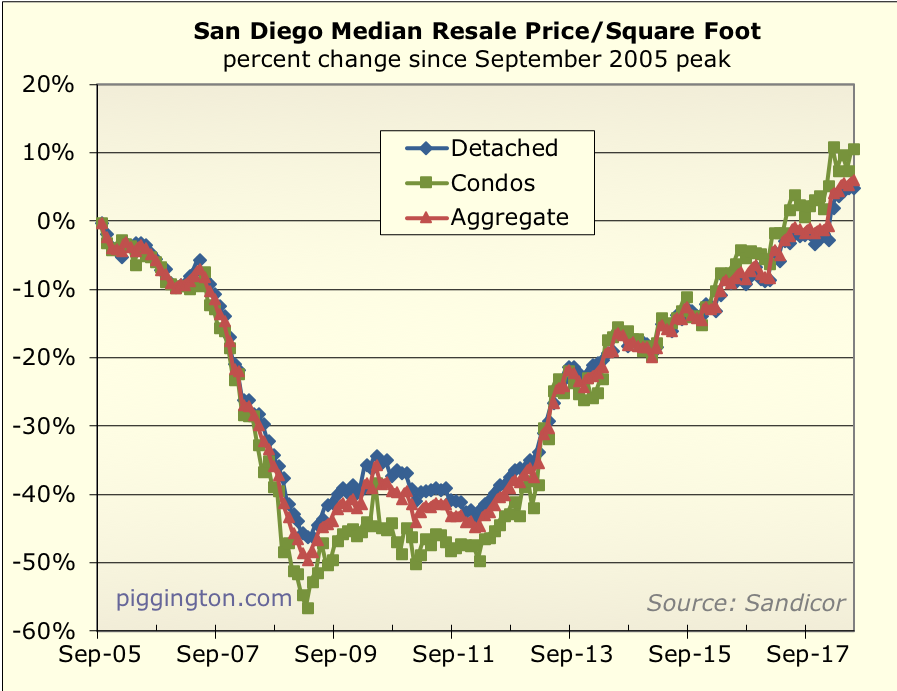

The monthly price per square foot is a lot noisier (with the condo

series pretty hopelessly noisy), but looking at single family homes,

it implies a pop earlier this year followed by a gentle rise (though

flat last month). This is of course a less accurate price measure

than the Case-Shiller index, as the latter actually measures

same-home sales.

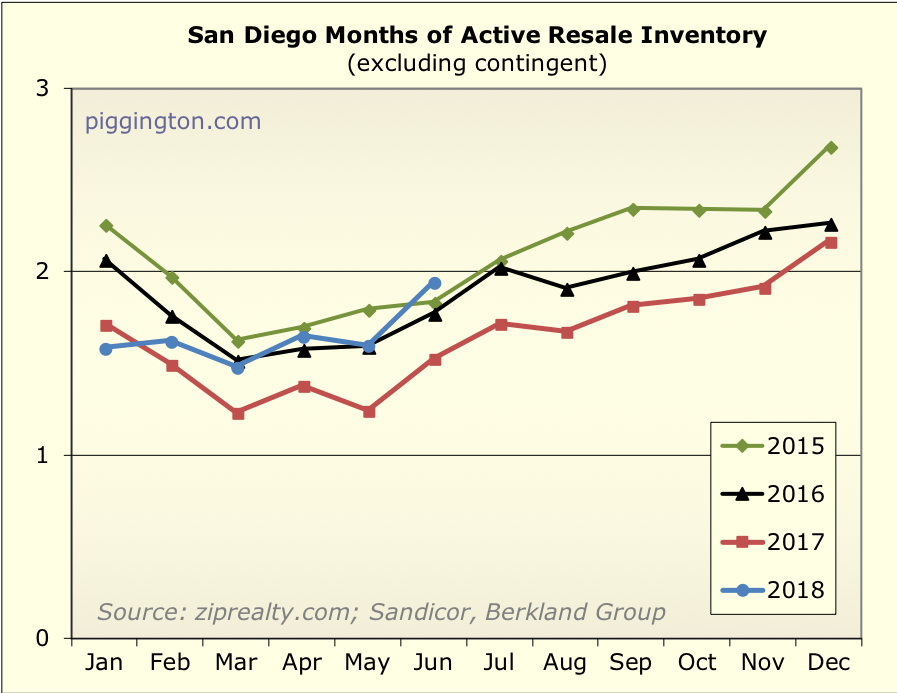

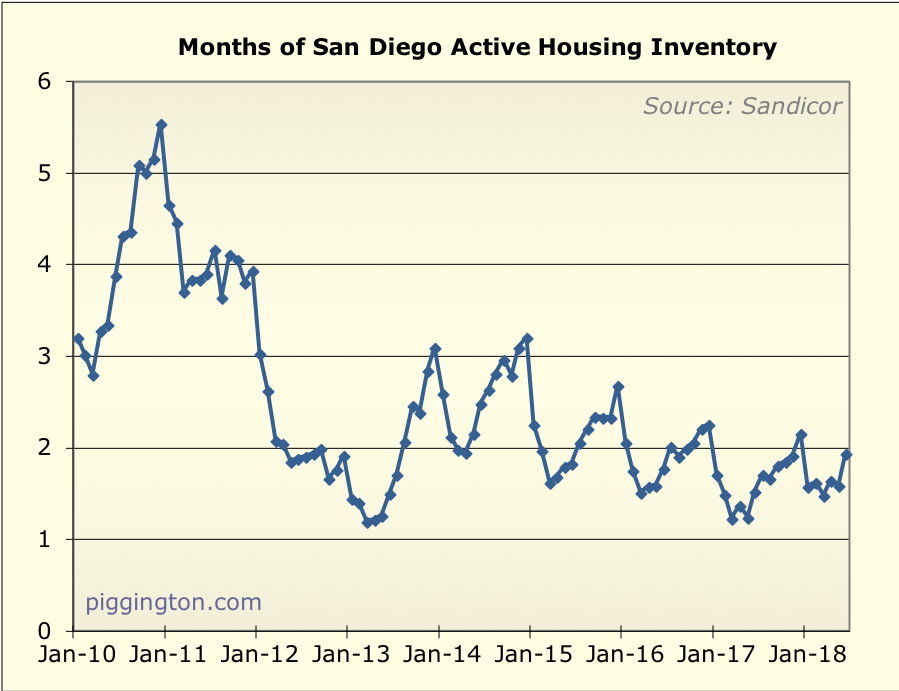

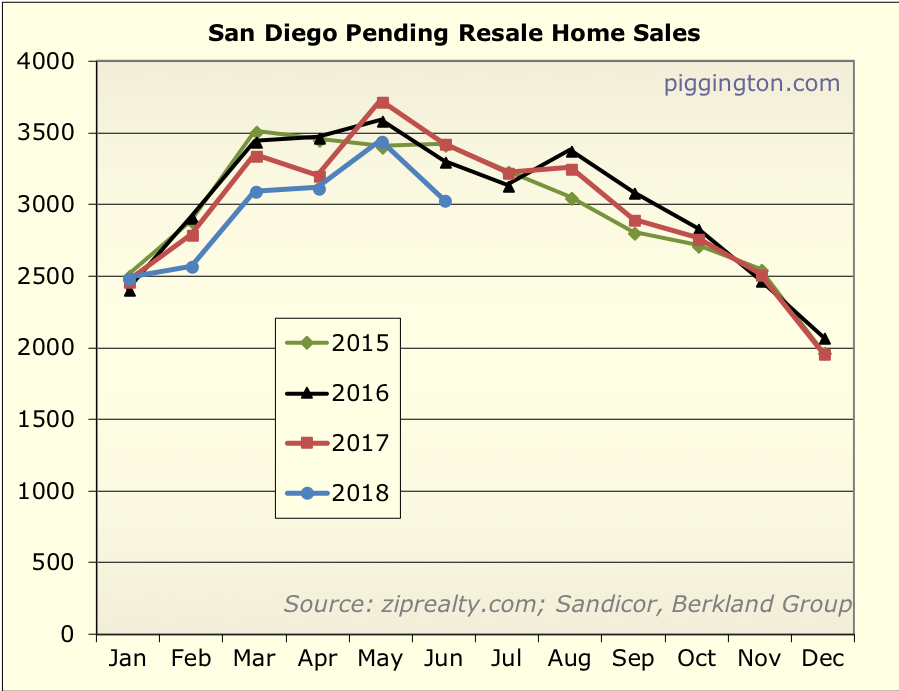

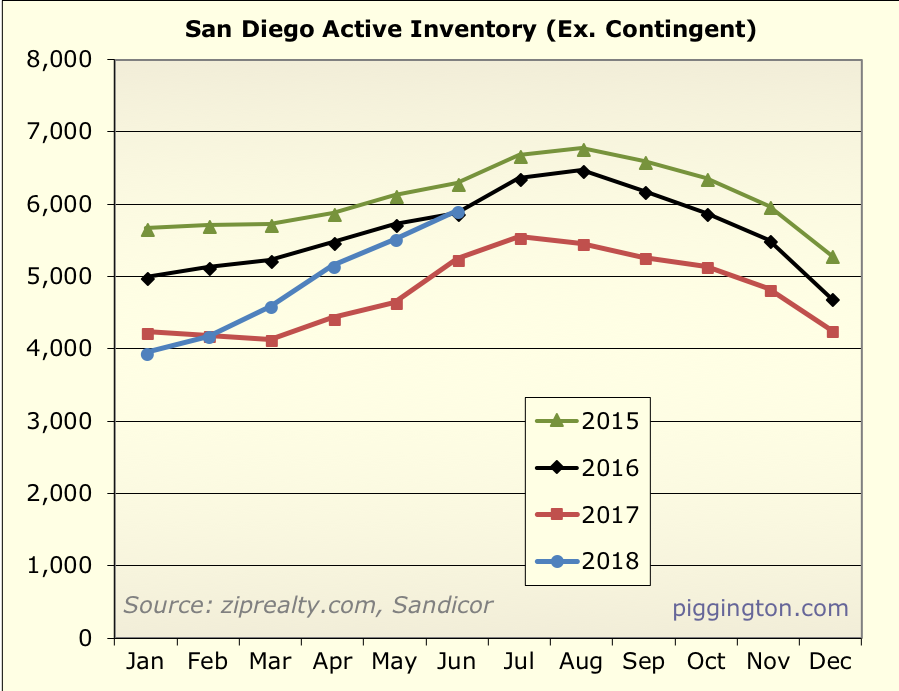

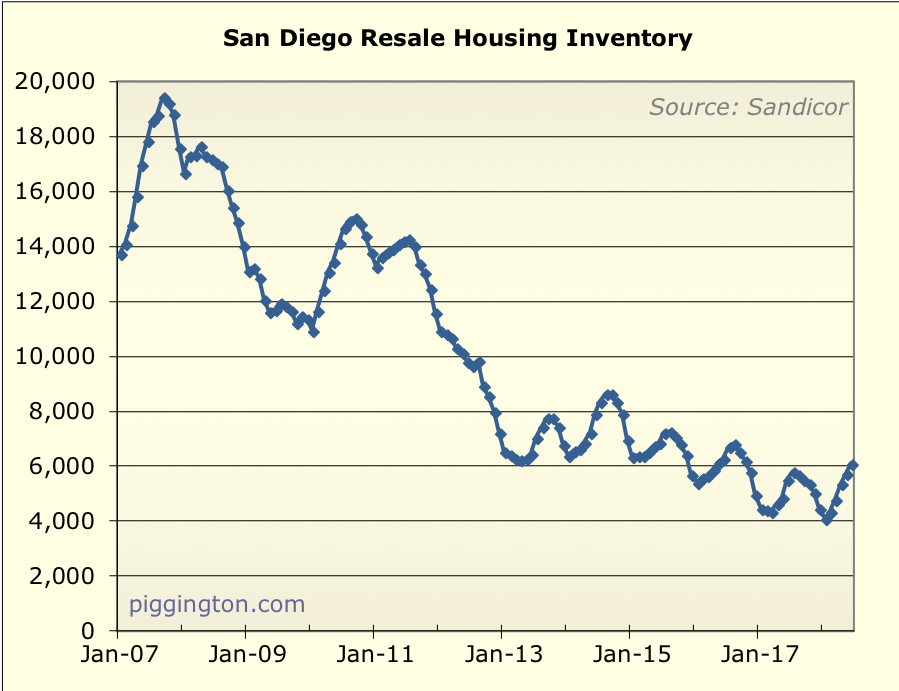

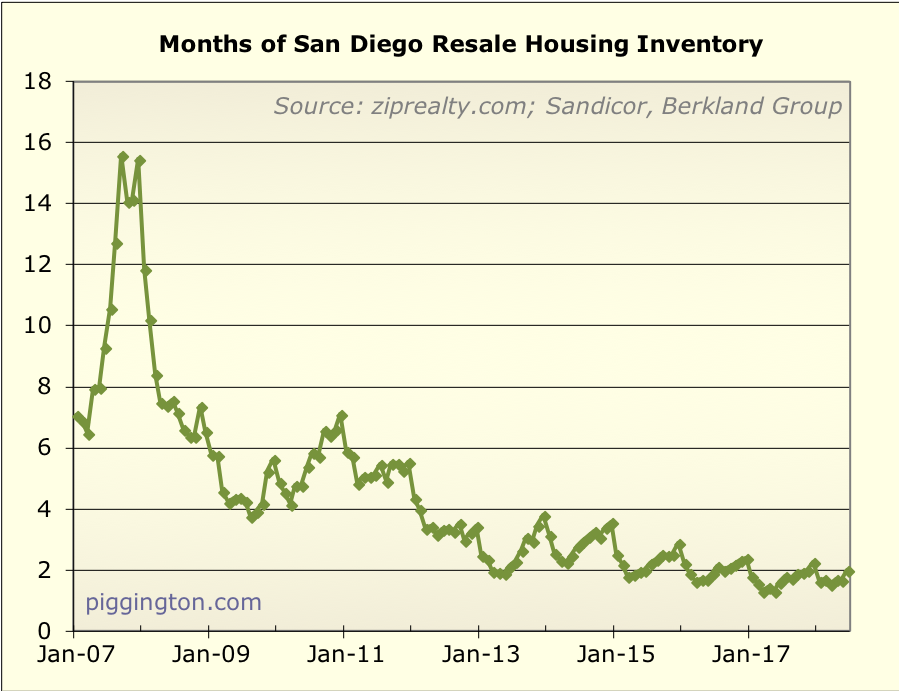

The most interesting development to me is the increase in months of

inventory. This is still very low historically, but it’s a

larger-than-usual increase which leaves the market better-supplied

than any of the prior 3 Junes:

Of course it’s just one month, so meaningless as of yet. But this is

definitely something I will watch in the months to come. An

sustained increase in months of inventory could mean that deteriorating

affordability (as a result of both price increases and rising

mortgage rates) is starting to bite. But let’s not get ahead of

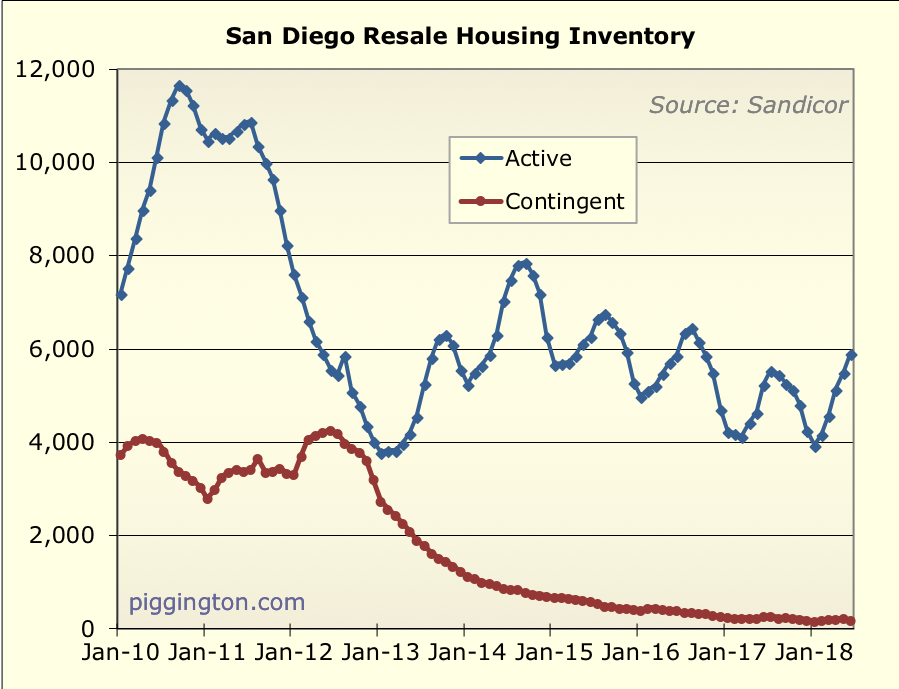

ourselves… for now, the market continues to be quite undersupplied

as it has been for several years:

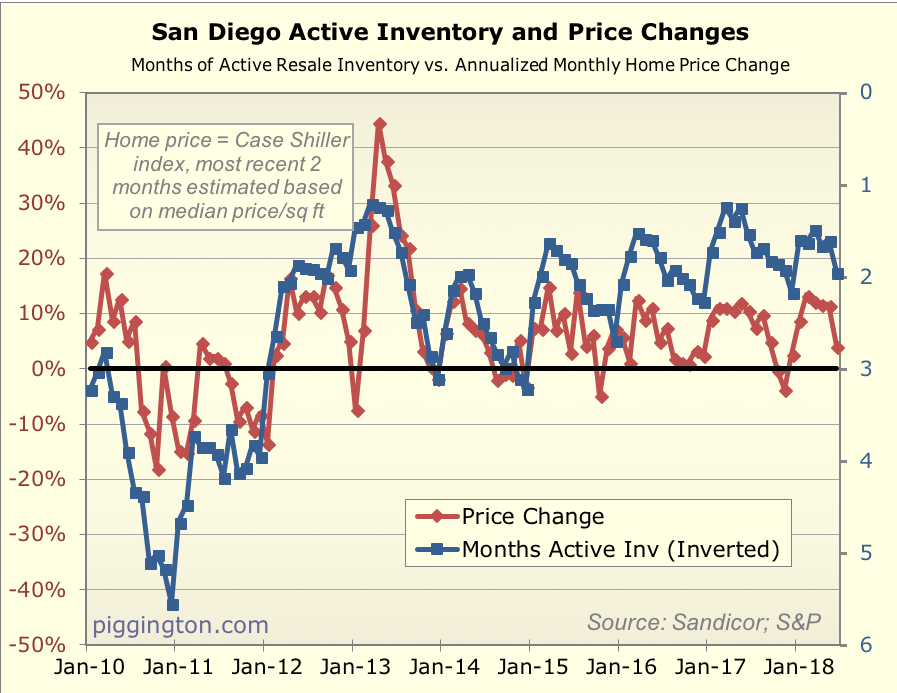

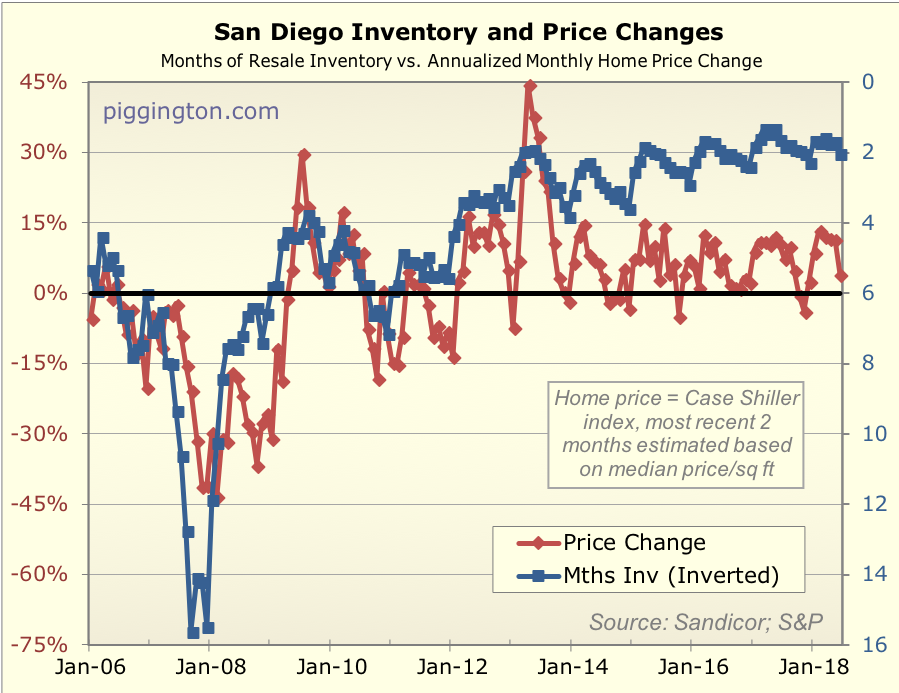

And, while months of inventory is a bit higher than recent Junes,

it’s still at levels that would imply upward price pressure:

Assorted graphs below…

I think the long-term secular

I think the long-term secular trend is toward lower inventory because technology makes finding a house so much easier than before.

Thus 3-month inventory might have been a bullish sign in 2003, but would not be today.

So between the unique bubble-bust-snapback situation of 2004-2014, and then before then pre-zillow, we really only have about 3 years of data on what the new normal inventory looks like.

gzz wrote:I think the

[quote=gzz]I think the long-term secular trend is toward lower inventory because technology makes finding a house so much easier than before.

Thus 3-month inventory might have been a bullish sign in 2003, but would not be today.

So between the unique bubble-bust-snapback situation of 2004-2014, and then before then pre-zillow, we really only have about 3 years of data on what the new normal inventory looks like.[/quote]

That is a really interesting theory. I’m going to mull that one over but my initial reaction is that it makes a lot of sense.

I’m going to make a “new normal” months of inventory chart to zoom in an that timeframe…

Here’s a chart just with 2014

Here’s a chart just with 2014 and beyond, with the axes changed up (eyeballing it) to show the correlation better.

[img_assist|nid=26664|title=new normal months inv|desc=|link=node|align=left|width=899|height=693]

gzz wrote:I think the

[quote=gzz]I think the long-term secular trend is toward lower inventory because technology makes finding a house so much easier than before.

Thus 3-month inventory might have been a bullish sign in 2003, but would not be today.

So between the unique bubble-bust-snapback situation of 2004-2014, and then before then pre-zillow, we really only have about 3 years of data on what the new normal inventory looks like.[/quote]

I do not think this is the case at all. The internet has made it is easier to look at houses but the MLS has been around since the 1800s. I might agree with you if more people were buying houses without agents but that is not the case at all.

Let us see what happens to the inventory when the economy shifts. We are in the 2nd longest economic expansion after the 2nd world war. Interest rates are low and the stock market is overvalued by any historic measure.

My only question is were is the inflation?

bewildering, most people

bewildering, most people technically have agents, but an increasing number of sellers are using discount agents, and I think a lot of buyers are using “cashback” agents or someone who works with the seller’s agent. The role for them is getting smaller and smaller over time, but unlike travel agents, they won’t disappear even for routine transaction.

To give you an example of the trend I am talking about, my last purchase I made an offer the first weekday after the property was listed, then increased it after a small bidding war a couple days later. Never bothered with a buyer’s agent, part of my offer was “choose no buyer agent or refer me to one of your choice, whatever makes the transaction easiest for you.”

Total time the place was on MLS as active inventory was about 4 days. This just isn’t something that would have happened in 2003. Even the first 5-10 years of online MLS listings, most listings were just a single exterior shot, and the most you’d see is maybe 6 pics. You also didn’t have the easy ability to track recent comps in the neighborhood with a couple clicks and google street and bird’s eye view. It is just a lot easier to narrow down what you are looking for without leaving home.

I remember my parents’ buying a house in the early 90’s. It was in a suburb of pretty similar homes, mostly from the same era, same lot size, same garage size, and same developer. Yet it was still a process that involved touring about ten different 4/3 2000sf houses over several months. And when Mom would narrow down the initial list from the agent, Dad would have to schedule a look for himself.

I am not aware of a single

I am not aware of a single good source for changes in rent. But it appears 2018 rent growth will be roughly in line with inflation of about 2% after many years of faster-than-inflation growth.

Right now it looks like the cheaper middle American markets have the fastest rent growth, making San Diego relatively more affordable.

Any

Any thoughts?

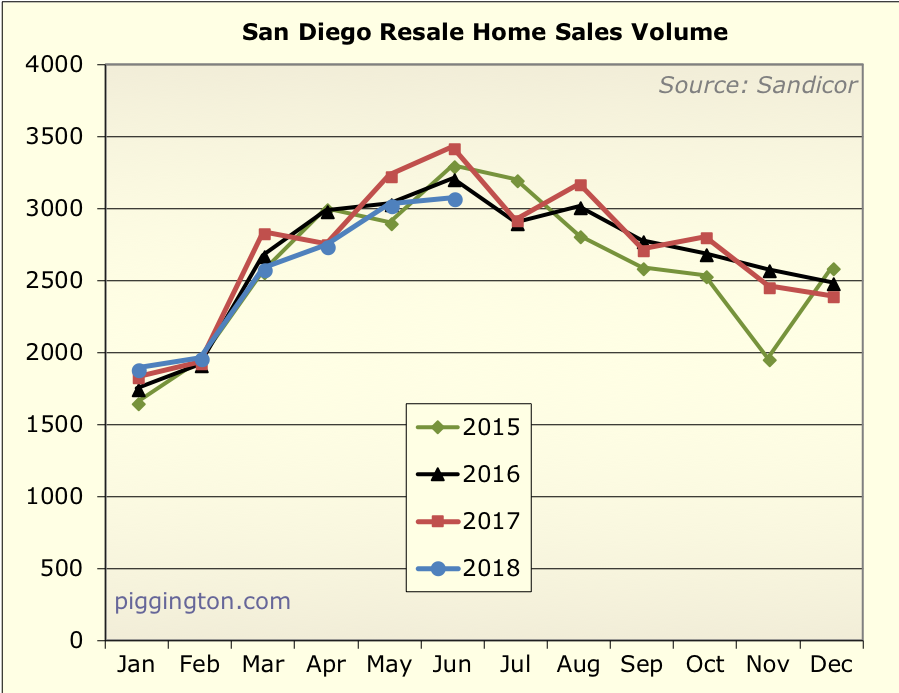

https://www.cnbc.com/2018/07/24/southern-california-home-sales-crash-a-warning-sign-to-the-nation.html

CNBC.com is dino-media

CNBC.com is dino-media clickbait. Monthly sales is a choppy data series. It says the reading is the lowest since 4 years ago. In other words, higher than the same month 4 years ago. How did prices do after sales volume hit that low point 4 years ago?

How’s Riverside real estate

How’s Riverside real estate doing? If I recall, their market (Temecula, specifically) jumped off the cliff at least a year before ours did when the bubble popped. It stands to reason that their market should still be a reliable forward indicator for ours.

JP, I don’t think Riverside

JP, I don’t think Riverside is a early indicator for San Diego. It more moves in line with the lower-end of San Diego. So like San Ysidro and City Heights condos, prices there rose more in the bubble, crashed earlier and harder in the bust, and now again have outperformed.

gzz wrote:JP, I don’t think

[quote=gzz]JP, I don’t think Riverside is a early indicator for San Diego. It more moves in line with the lower-end of San Diego. So like San Ysidro and City Heights condos, prices there rose more in the bubble, crashed earlier and harder in the bust, and now again have outperformed.[/quote]

Agree with this interpretation. Those places bubbled much higher, and crashed earlier (and harder). I don’t think that portends a leading relationship going forward.