There just isn’t much to buy out there.

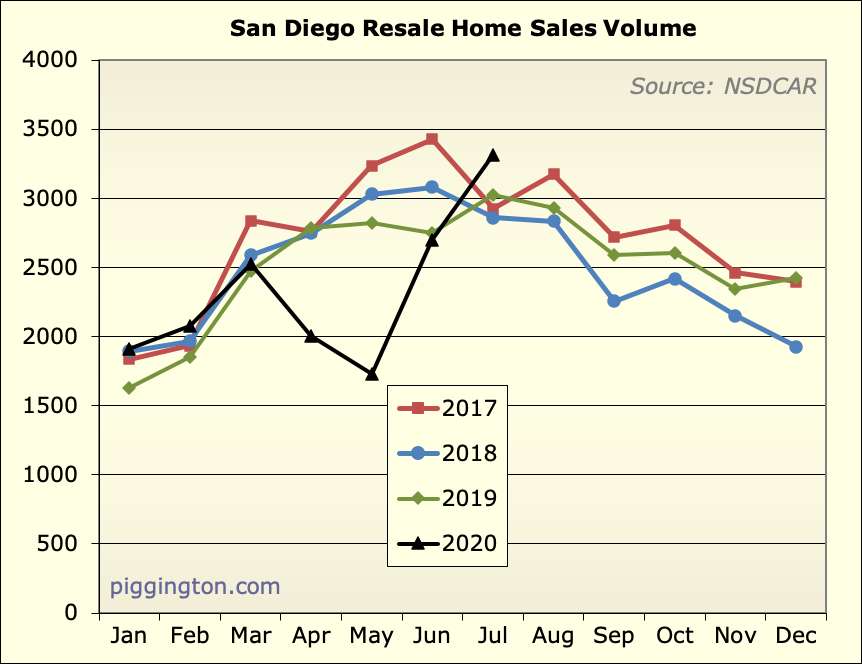

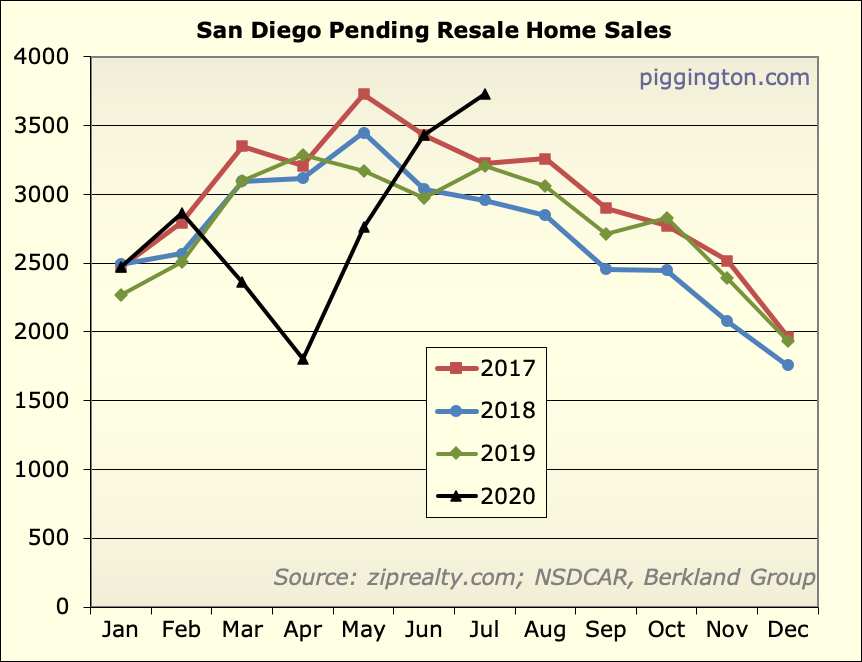

Sales are strong, but nothing crazy, when you consider the rebound

from the lockdown:

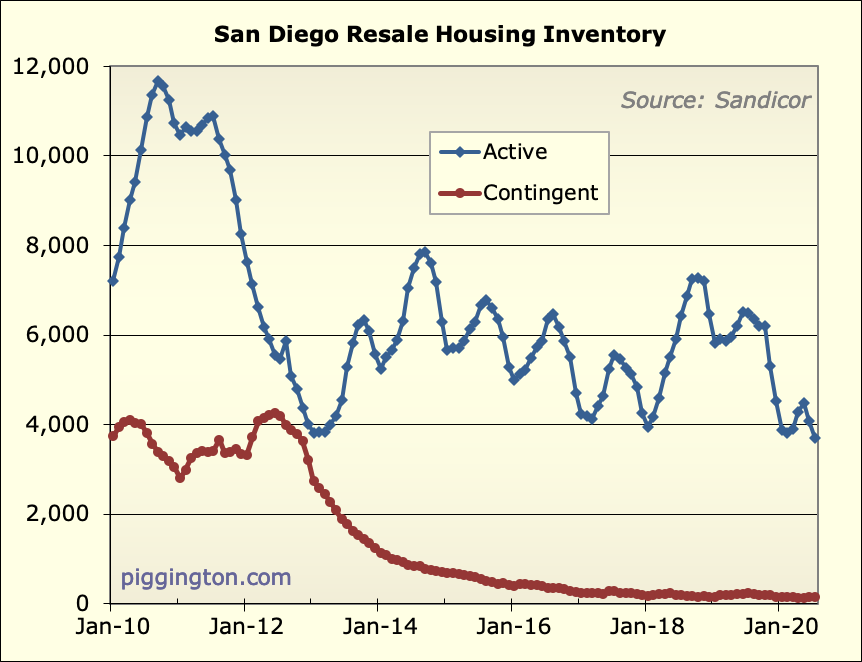

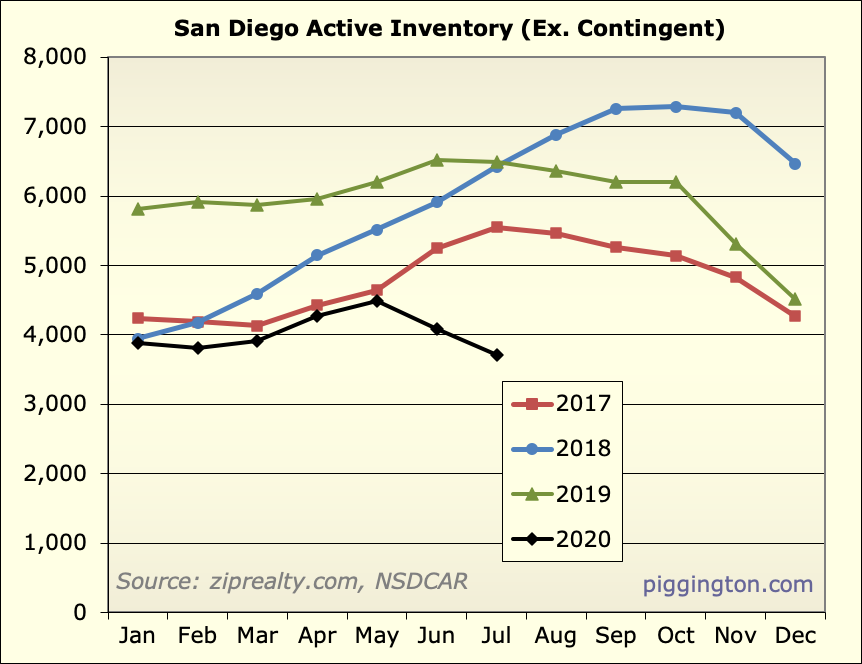

But inventory is the lowest it’s been since the post-bubble bull

market got started:

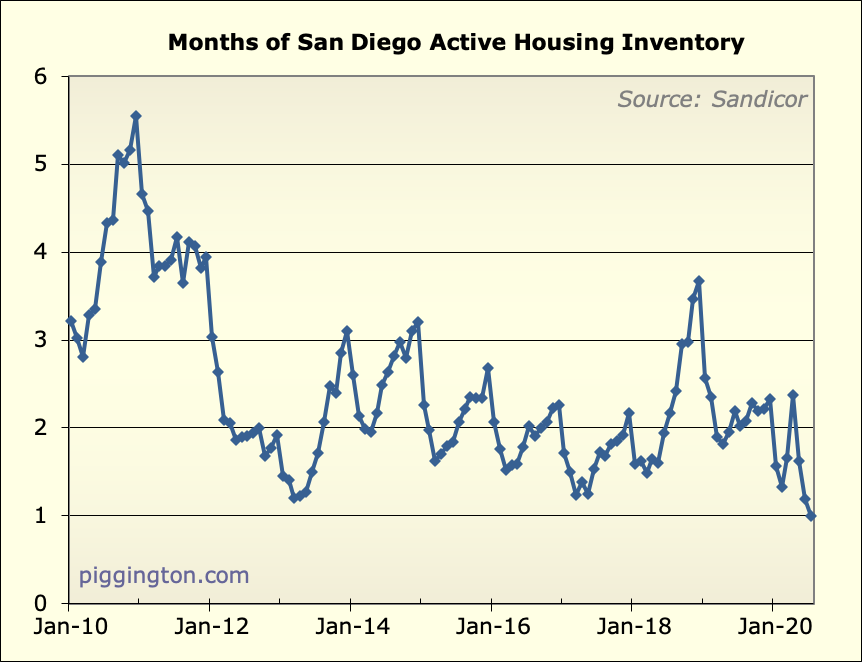

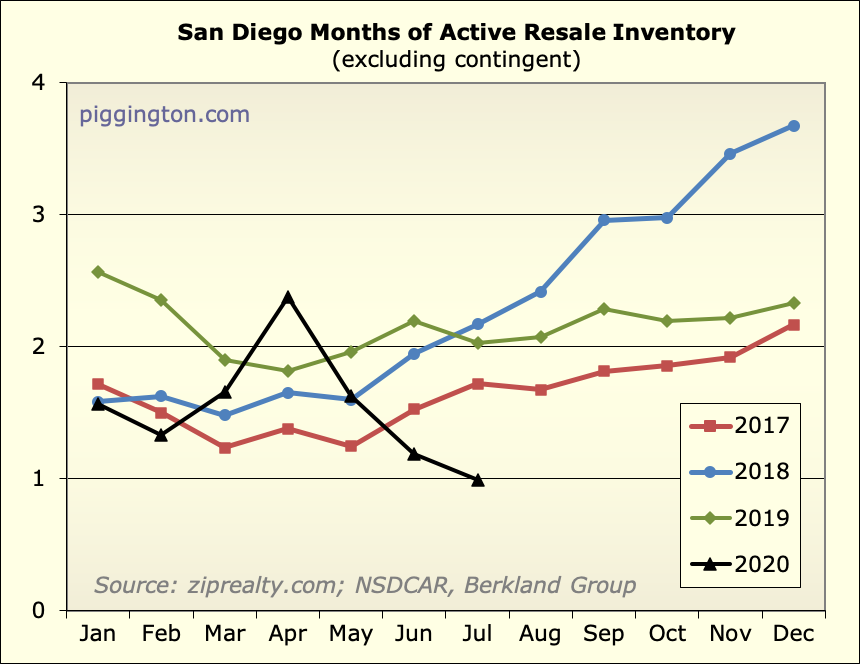

With months of inventory also below the prior record in early 2013:

Here’s a closer look at inventory compared to previous years.

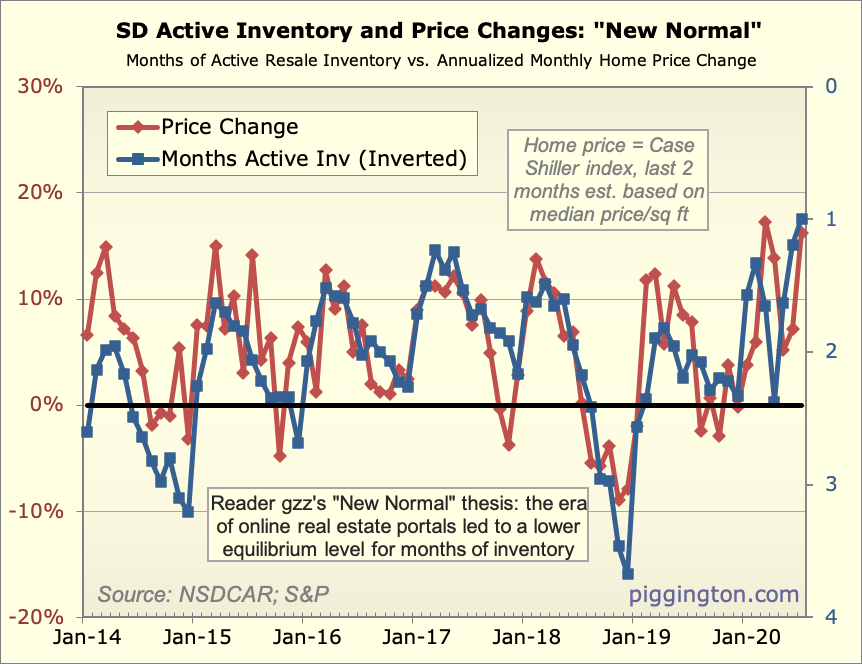

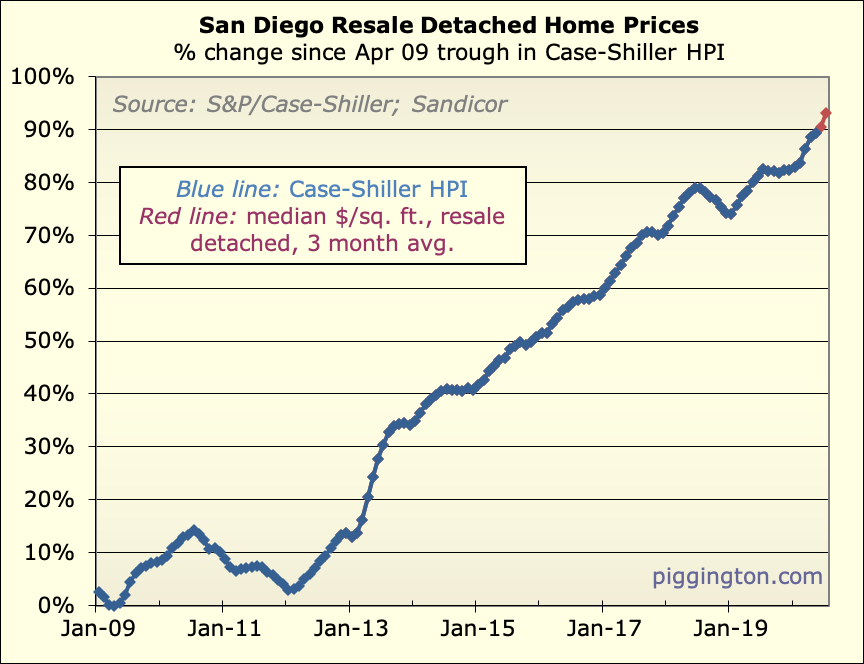

This level of inventory has historically led to price increases, and

that’s exactly what we’ve seen in the past couple months:

Expect more price increases to come, unless the inventory situation

changes very dramatically. (For this to happen quickly, I’d expect we’d need

some exogenous force, e.g. if rates were to rise a lot, or financial

markets were to enter another panic phase).

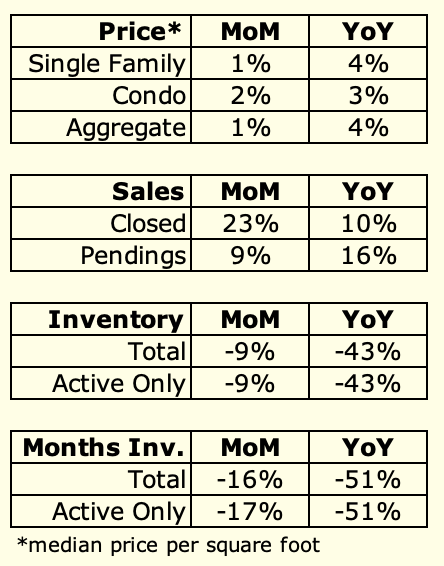

Here’s the mom/yoy wrapup. Months of inventory down 51% year

over year… wow.

Do you think we will see a

Do you think we will see a reversion to the mean in terms of inventory and a spike in inventory after the election in spring 2021?

loutran wrote:Do you think we

[quote=loutran]Do you think we will see a reversion to the mean in terms of inventory and a spike in inventory after the election in spring 2021?[/quote]

I don’t see what the election has to do with it. On the question of mean reversion in inventory, here are some thoughts:

– If prices go up, that will probably cause some mean reversion (higher prices bring out more supply and tamp down demand).

– Based on the drop in inventory, it seems like the pandemic has put many people’s plans to sell on hold. Once the pandemic is over, presumably this will go back to normal-ish. (ie, more inventory coming online).

– A more serious adjustment could result if rates go up, or more serious financial market pain as a result of the pandemic, or the economy being worse for longer than people are expecting.

Working theory here:

During

Working theory here:

During pandemic and post recovery period:

1. Taboo of UBI close to being broken even if called UI

2. Fed still buys bonds

3. “Most” inflation under control

4. Moratorium on foreclosures and evictions causes tighter supply

5. Many asset classes inflating at once: stocks, bonds, gold, real estate

6. Govt can throw more money at the problem and artificially keep interest rates low

7. Most goods outside of housing can have supply increased with additional labor/funds etc

8. Housing becomes one of several conduits for excess funds

9. Not saying this is all sustainable forever, but the lessons of 2008 seem are being put into policy very fast this time around

10. Group behavior becomes self reinforcing

Good luck to all

Rich Toscano wrote:loutran

[quote=Rich Toscano][quote=loutran]Do you think we will see a reversion to the mean in terms of inventory and a spike in inventory after the election in spring 2021?[/quote]

I don’t see what the election has to do with it. On the question of mean reversion in inventory, here are some thoughts:

– If prices go up, that will probably cause some mean reversion (higher prices bring out more supply and tamp down demand).

– Based on the drop in inventory, it seems like the pandemic has put many people’s plans to sell on hold. Once the pandemic is over, presumably this will go back to normal-ish. (ie, more inventory coming online).

– A more serious adjustment could result if rates go up, or more serious financial market pain as a result of the pandemic, or the economy being worse for longer than people are expecting.[/quote]

Pretty much this. Any changes will take time to arrive and come slowly

Yeah!!!

Comic relief, worst

Yeah!!!

Comic relief, worst listing in 92017 I’ve seen in a while:

https://www.sdlookup.com/MLS-200036624-92107

1. Withholding address for no apparent reason.

2. Strange distorted pictures with arrows that say —> Kitchen —–> Hallway. Possibly they did a walk-through video and then just did screencaps of it rather than real photos.

3. “Motivated seller” is charging a mere 18% more than what he paid in Oct 2019. No renovations, but there is now a tenant who doesn’t want to be disturbed.

4. “Pacific Village neighborhood in the heart of Ocean Beach”

Like the Holy Roman Empire, every word of that is false. There is no part of OB called “Pacific Village.” That’s the name of a small condo complex, and nothing else.

It also isn’t in the heart of OB. It’s a stretch to even call that area “the outskirts of OB.” It’s called Point Loma Heights.

gzz wrote:

3. “Motivated

[quote=gzz]

3. “Motivated seller” is charging a mere 18% more than what he paid in Oct 2019. No renovations, but there is now a tenant who doesn’t want to be disturbed.

[/quote]

That one was my favorite.

Well, if buying a house in

Well, if buying a house in San Diego is tough because of lack of inventory, perhaps San Francisco is a better bet because of increased inventory?

https://www.yahoo.com/news/san-franciscos-mass-exodus-twice-204700238.html

bibsoconner wrote:Well, if

[quote=bibsoconner]Well, if buying a house in San Diego is tough because of lack of inventory, perhaps San Francisco is a better bet because of increased inventory?

https://www.yahoo.com/news/san-franciscos-mass-exodus-twice-204700238.html%5B/quote%5D

I had a client that was able to buy in San Jose during COVID and would never have been able to compete for a great home up there otherwise

University City detached

University City detached supply: 0.08 months.

In other words, 12 detached sales the past 30 days, only one active detached listing.

For 92126 SFR:

Active:

For 92126 SFR:

Active: 8

Pending: 41

Sold in last 30 days: 28

Great to see Rich interviewed

Great to see Rich interviewed and quoted in the UT today! Just as good to know that if someone comes to check out this place they’ll see real estate talk. I feel like we just flipped this blog

CNBC with nationwide July

CNBC with nationwide July data:

The supply of existing homes plummeted 21.1% annually, with just 1.5 million homes for sale at the end of July. This represents a 3.1-month supply at the current sales pace, down from a 4.2-month supply a year earlier. It’s the lowest July supply in the history … since 1982. …

That shortage drove the median price of a home sold in July up 8.5% annually to $304,100. This is a record high nominal price but also the highest price when adjusted for inflation.

A flood of closings the past

A flood of closings the past week and minimal new listings has caused 92107 to fall to 0.83 month inventory.

This is the lowest ever for the market, though condos have been below 1.0 month supply pretty often.

I picked three other zips at random:

Scripps Ranch is 0.73 months

Lemon Grove is 0.70

Poway 1.00

The fact these random checks show 3 zips below 1 and a fourth right at 1 suggests the market is even tighter than Rich’s July report, potentially much tighter.

gzz wrote:A flood of closings

[quote=gzz]A flood of closings the past week and minimal new listings has caused 92107 to fall to 0.83 month inventory.

This is the lowest ever for the market, though condos have been below 1.0 month supply pretty often.

I picked three other zips at random:

Scripps Ranch is 0.73 months

Lemon Grove is 0.70

Poway 1.00

The fact these random checks show 3 zips below 1 and a fourth right at 1 suggests the market is even tighter than Rich’s July report, potentially much tighter.[/quote]

It is much tighter because a very high percentage of what is left on the market is expensive. 40% of the inventory is listed over $1M. If you look at deatched homes its over 50%.

Family member in small

Family member in small college city in the South, (so major covid economic impact), listed their high end tract house that has a zestimate of 265k for 285k on Monday morning. Multiple bids over listing price within hours of listing, sight unseen other than listing photos, likely to go for over 300k. 6 tours set for today, probably will have an accepted offer 8 days after listing.

And the zestimate is based on plenty of 250-270k 2019/2020 sales in the same subdivision.

The listing notes the large home office area off the garage, that probably helped.

Rich

What is the minimum

Rich

What is the minimum criteria you have to put into the inventory total for San Diego?

If I put in 1BR 1Bath on Zillow and no min sf and no max price, I get 5,162 units as of 09/06/2020 for all of SD county. exclude manufactured

If I put in 2BR, drops to 4815

2BR + min 1,000 sf = 4,294

If I cap the 2BR +1000 sf at 1M price, drops to 2646

If I draw about 15 miles from the coast, drops to 2473 units.

If I drop to 800K then 1955 units.

I think there is a reasonable argument that a data point would be useful as far as what the average person can afford.

When I remove condos, apartment and multifamily, drops to 1441 units.

if I add 3BR 2BR up to 800K and 1500 sf then about 837 units remain.

I’m looking at condos and

I’m looking at condos and single family homes, with no other criteria… not sure if that answers the question.

Thanks Rich, do you use the

Thanks Rich, do you use the whole county?

If you have any questions

If you have any questions post or PM. The MLS has much more refined search capabilities

Escoguy wrote:Thanks Rich, do

[quote=Escoguy]Thanks Rich, do you use the whole county?[/quote]

Yep

Zillow seems to include

Zillow seems to include smaller multifamily properties, eg fourplexes, that are not on most sites. Also zillow sometimes has small commercial properties, like a single little storefront on El Cajon Blvd.

Hi all,

I’ve been reading

Hi all,

I’ve been reading this site for about a year now. I would like to use the information to make good choices but am new at this so I thought I would post to get some feedback. I currently have low rent and have enough saved for a 20% down payment on a house up to $850k. I’m not sure if this is the time to buy but interest rates are so low I thought I prob should since I plan on holding onto the house a long time. Thoughts? Does anyone have any areas of San Diego they think would be good to buy in right now?

If you truly are planning to

If you truly are planning to hold it long term, I think it’s fine to buy now. Rates are so low, you are locking in a low payment even if the price tag is high (ie the low cost of money offsets the high home prices).

But if you can’t find a place you truly want to hang on to, I wouldn’t be in any rush to buy. It’s not a fun time to be a buyer right now, and valuations are high enough that the market is unlikely to run away from you. If you miss out on the low rates, the consolation is that prices will probably return partway to earth in a higher rate climate.

The net is… it’s not a bad idea to buy, as long as you have a very long holding timeframe. But nor is there any pressure to buy. That’s how I see it. Obviously there is some guesswork in there, so take it with a grain of salt…

Rich – What timeframe do you

Rich – What timeframe do you consider “long” in this current environment? 15+ years?

Andrew32 wrote:Rich – What

[quote=Andrew32]Rich – What timeframe do you consider “long” in this current environment? 15+ years?[/quote]

Yeah, something like that… enough time to where the low rates (saving a bit of money each month) can really benefit you.

Having done this almost 20

Having done this almost 20 years all over SD County I will echo what has already been said. I belive that anything worth doing is worth doing right so take the time to learn and find the right place for the long term. For me thats a place that you can see yourself being around 10 years. It doesnt have to be your dream home but it should fit your needs now and well into whatever the future brings.

Finding the right place means a location in SD that you will be happy living in. It means a good location in whatever community you end up. These two things will protect you on the downside. Ideally it also means a nice piece of land as more appreciation will be attributable to your land than your home. Thats where your above market rate upside comes from.

Rates are low and prices are high but there is nothing more expensive than buying the wrong house and having to move sooner than you plan or would like to.

Thank you all for your

Thank you all for your advice. I will holding for a long time. I love San Diego and don’t plan on moving. Now I guess it is time to find where exactly in San Diego I want to live long term. The search begins.

Thanks again

Yeah, I think it’s good to

Yeah, I think it’s good to begin looking. You never know when you’ll find that perfect place.

But like I said, my advice is not to be rushed into anything. Wait for the right place. The reason I say that is apparent in the most recent monthly report: inventory is extremely low, for reasons that are temporary. So I suspect you will have more to choose from down the road. Just something to keep in mind. Best of luck!

Alex, my view is you should

Alex, my view is you should look hard and buy soon.

Even a 5% price increase over the next 12 months comes to $40,000 on a 800,000 house. Is that 40k going to be a profit for you, or is it going to be a higher price and barrier to you ever owning?

It’s impossible to predict the best area to buy. My view is they keep building condos while the supply of central location houses with yards keeps going down, so they are the better long term buy. But condos are easier to invest and rent out and match the trend of aging population plus young people staying single longer.

Ultimately, there’s nothing like a very short commute to improve your life. So start looking walking distance from work, and expand from there.