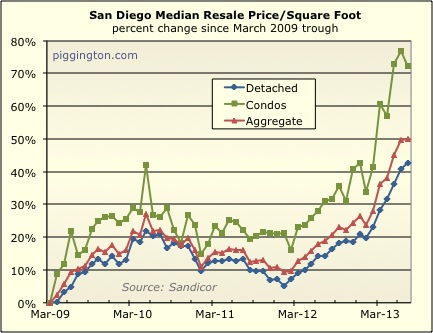

Prices increased last month, but at a slower pace than the

springtime frenzy:

Ignoring the wildly volatile condo series, the price per square foot

for detached homes was up 1.3% for the month. That’s actually

a decent clip, but quite a bit more modest than the 3-4% increases

we’d been seeing for several months prior.

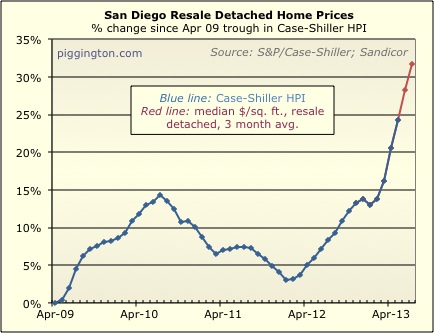

Here’s a look at the Case-Shiller Index in blue, followed by my

estimate of same in red. This averages 3 months of data, so

you don’t really see the deceleration in this chart like you do

above.

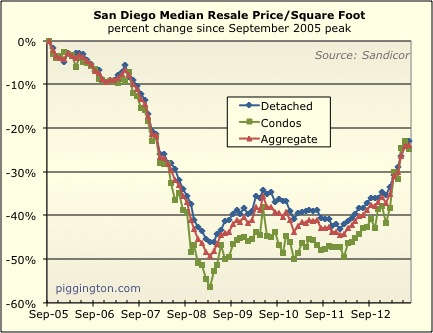

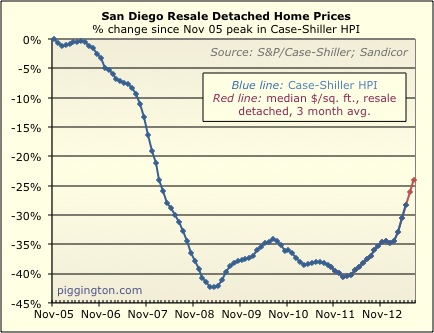

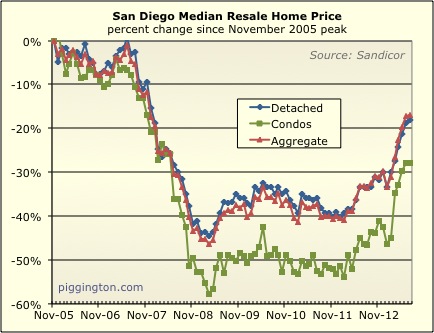

Here are the same two charts starting at the bubble peak:

And here’s the regular median (not median price per square foot)

starting at the peak — not as good a price indicator as those

above, but perhaps interesting:

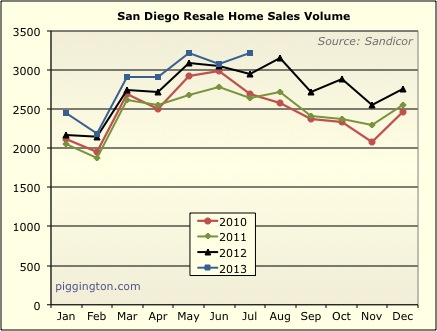

Sales activity was strong:

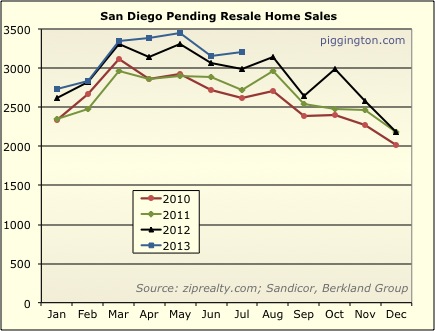

…though there has been some easing in pending sales over the past

few months:

This implies that sales activity may back off slightly, but it’s

still at a very robust level.

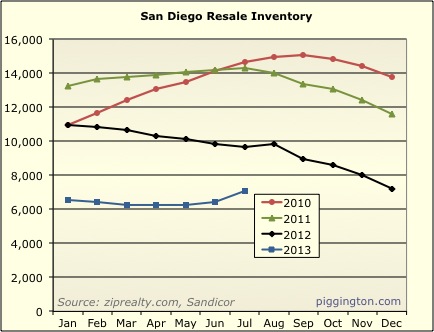

I guess the recent price runup lured some folks into putting their

homes on the market, because inventory jumped pretty

significantly. While still quite low on an absolute basis,

active and contingent inventory increased by 9% in July alone:

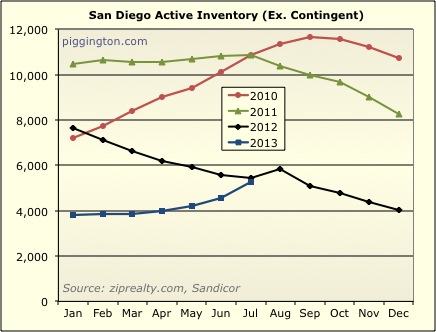

If we exclude contingent inventory (which we arguably should,

because those homes are already “spoken for” and awaiting bank

approval), we see that active inventory increased even more rapidly

at 16% for the month. We are actually back at year-ago levels

in the active category:

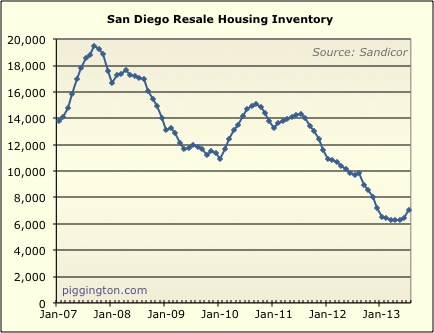

Here’s a long term chart of active and contingent inventory… this

shows that the increase, while sizable in percentage terms, doesn’t

really get us out of “undersupplied” status.

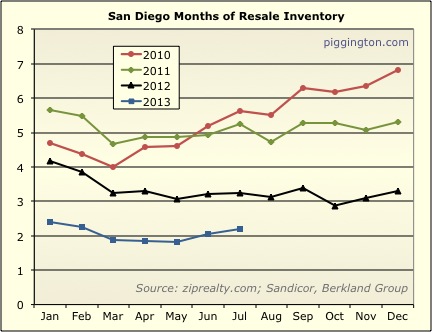

Months of inventory increased a bit:

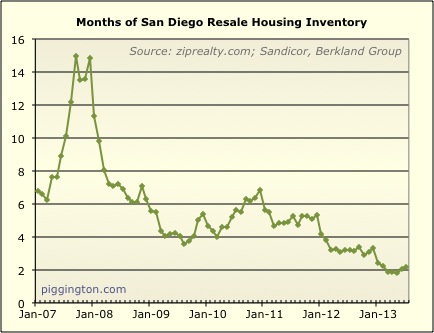

And here’s the long-term chart of months of inventory, showing that

this increase is really a blip and that we are still at very low

levels historically:

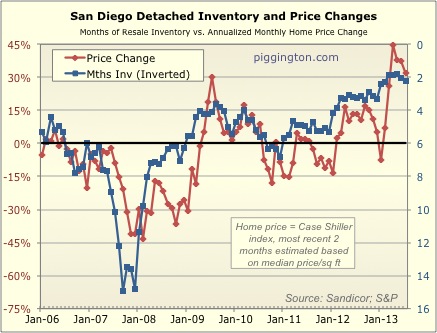

This is important because months of inventory has a very strong

historical correlation with price changes:

While the frenzied priced increases of past months are not likely to

continue, the level of inventory is supportive of further price

strength.

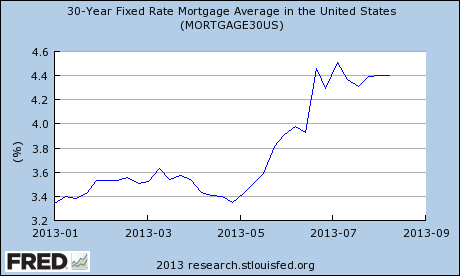

There is a significant wildcard in the mix, of course… and that

would be the recent increase in mortgage rates. I doubt we’re

actually seeing much of the rate increase in the graphs above…

they concern sales that closed in July, which means that most of the

contracts were probably signed in May and June. As the below

graph shows, rates weren’t far from their typical range for most of

that period:

So, the more abrupt part of the rate increase won’t even show up

until the August closed sales, and the full brunt won’t be seen

until September’s sales.

I would guess that the combination of rising rates and increasing

inventory will put an end to the recent quasi-frenzy

conditions. But, inventory is still quite low. And while

prices are getting a bit stretched compared to their fundamentals,

it’s nothing like we saw during the bubble, and interest rates are

still extremely low by historical standards. This means that

even with the recent rate bump, monthly payments are historically

quite low. So no more frenzy, maybe, but perhaps a

normalization to a more balanced market if rates stabilize at this

level. Let’s see what happens…

Excellent post Rich,

One

Excellent post Rich,

One thing that might be different than before is the number of homes bought with cash, seems to me these are not affected by interest rates as much. I know many people say they have all cash offers and then finance anyway (with low rates why not). Price seems more important to the all cash buyer.

^^^

Depends. Even if you’re

^^^

Depends. Even if you’re not planning to finance, ability to resell it at the price you bought it in future (hampered by higher rates) will affect your decision.

ALSO – if you’re buying for investment and rates go up, it means that there will be other investment vehicles that pay good dividends, so why bother as much with housing?

spdrun wrote:

ALSO – if

[quote=spdrun]

ALSO – if you’re buying for investment and rates go up, it means that there will be other investment vehicles that pay good dividends, so why bother as much with housing?[/quote]

Good point. I guess it depends on whether you’re expecting rents to increase as well.

Depends whether you are

Depends whether you are chasing yield, or appreciation (or both). If you are chasing yield you are probably already exposed to bonds as well, and looking for an exit. If residential RE is slowing do you sit in cash and wait to buy higher yielding bonds, or plow more into RE which may be a better hedge for principal protection, but is less liquid and loses out on near to mid-term opportunities. If Rich is right in his “distortions that threaten the stock market article” and Mark Hulbert of WSJ (Lofty Margins) would appear to agree, I think bricks and mortar has a chance of hanging in there as a last resort investment.

Perhaps a little OT but

Perhaps a little OT but speaking of bricks and mortar, seems like almost everything at Walmart’s website is online only. As more businesses find this is the way to go there will be plenty of commercial properties for sale. I’m betting in the next 10 years a Walmart will close and be converted to a homeless shelter. The new Walmart grocery store in La Mesa seems kinda empty when I go in there, ok only been there once!

moneymaker wrote:Perhaps a

[quote=moneymaker]Perhaps a little OT but speaking of bricks and mortar, seems like almost everything at Walmart’s website is online only. As more businesses find this is the way to go there will be plenty of commercial properties for sale. I’m betting in the next 10 years a Walmart will close and be converted to a homeless shelter. The new Walmart grocery store in La Mesa seems kinda empty when I go in there, ok only been there once![/quote]

This may be by design, or it could be a byproduct of their pretty severe logistic problems they’ve had over the last year. The intentional understaffing of both their distribution centers and stores has resulted in re-stocking issues in many of their stores. And walk-in customers can’t buy what isn’t on the shelves. It is not intentional, it’s a problem they’ve acknowledged.