Sorry Piggs, I didn’t get around to posting the December

numbers. But let us not dwell on the past*, and instead

soldier on to the January numbers.

*Though if you really want to, the December data is all in the

charts below.

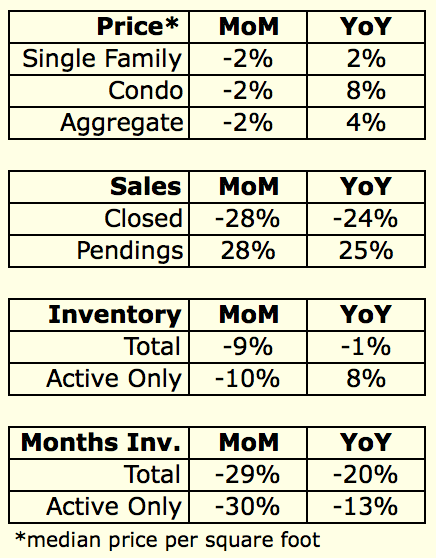

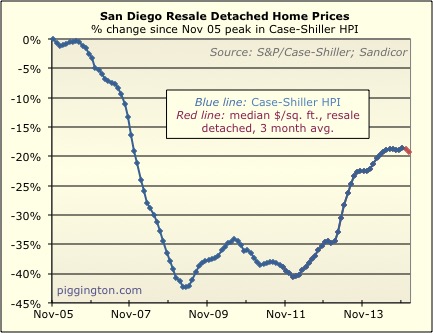

Home prices drifted down a bit, as might be expected given the

seasonality and the recent increase in months of inventory:

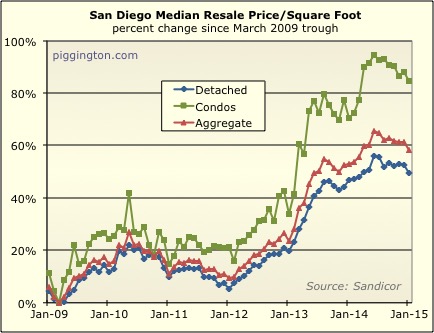

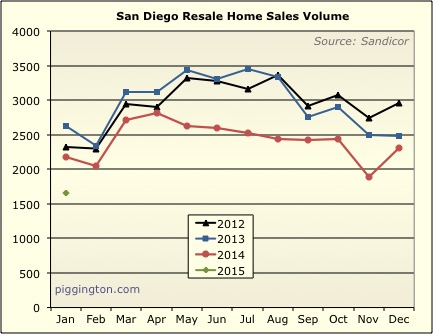

But here’s where it gets a little weird. Closed sales

plummeted by 28% from December (look for the little green dot on the

4-year graphs to follow):

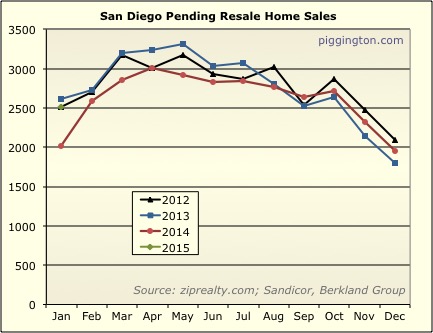

And yet, pending sales increased by 28% from December:

Now, some of the month to month stuff might be seasonal, but the

graphs show that there’s more to it. Closed sales were down

24% year-over-year, while pending were up 25%.

Well, “these*” data can be noisy month to month, so let’s see what

happens with this.

* For most of my life, “data” was always singular (a singular mass

noun, to be specific — yes, I looked that up). But all of a

(relative) sudden, you’re some kind of savage if you don’t pluralize

it. Or them. Or whatever. But old habits die hard, as my

double spaces** between sentences don’t tell you.

** I remember getting in trouble in high school typing class for

single spacing after periods. Now, only luddites

double-space. Make up your mind, society!

Got a little off track there.

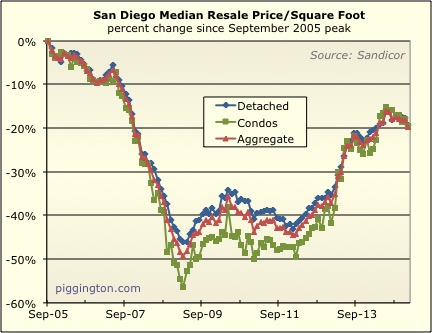

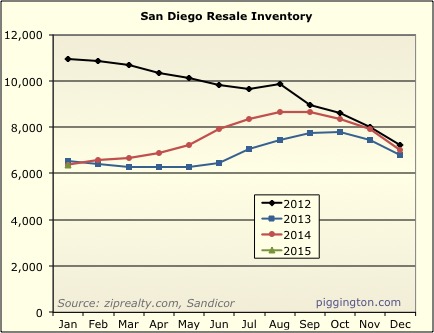

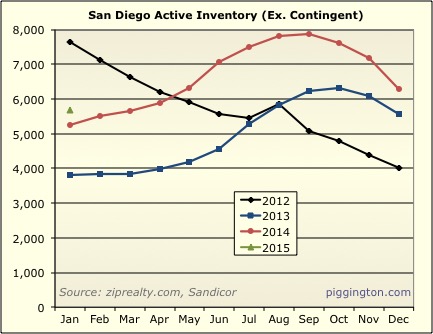

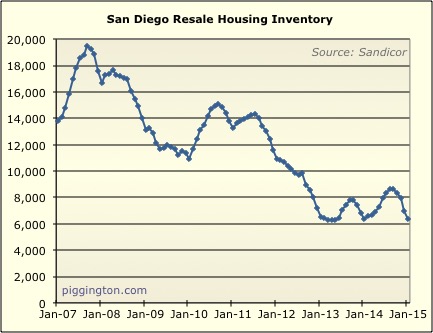

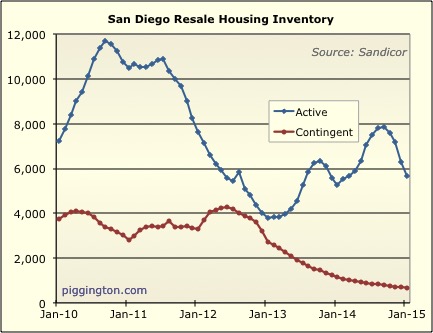

Inventory ended up just where it was at the beginning of the prior 2

years (which is kind of weird, actually);

Though active-only was a bit higher than last year, and quite a bit

higher than in 2013:

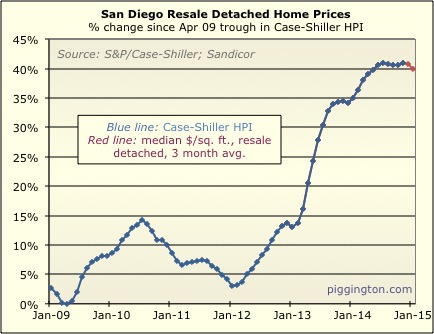

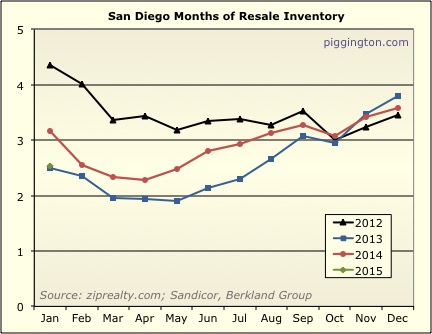

Months of inventory, which uses pending sales as the denominator,

dropped hard due to that big jump in pendings:

We haven’t seen a drop like this since early 2012:

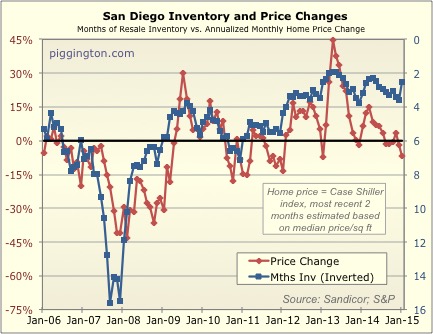

And these charts overlaying months of inventory and price changes

show that inventory is back at levels that have coincided with

rising prices:

It will be very interesting to see where this goes next month.

If it’s just noise in the data, then perhaps it will be back to

business as usual, with pretty steady prices. But if the

increase in sales activity is for real — and there could be

something to that, given the free-fall in lending rates lately —

then we could be in for higher prices ahead.

Does this mean it’s getting

Does this mean it’s getting harder to make a living as a realtor ? Never mind just noticed it’s “median” price per sq ft, kinda like they have in the union tribune full sheet analysis by zip code. When the total numbers are low the median is not very meaningful.

My understanding is because

My understanding is because both buyers and sellers tend to go away in Dec/January, they can be very weird months when it comes to the data.

I wonder how much an improving labor market can boost demand?