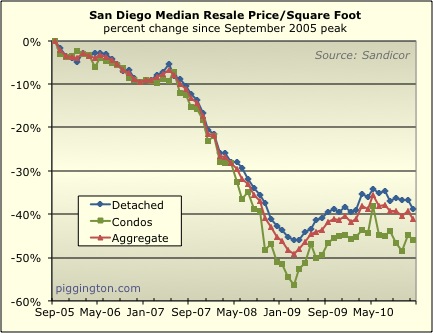

Well, so much for the spring 2010 double-tax-credit-stimulated

rally. The last of the effects of that entire affair have been

wiped out with the latest month’s drop in the median price per square

foot. Prices by this measure were down in December by 3.5 percent

for single

family homes, 2.4 percent for condos, and 3.0 percent in

aggregate. This brings the overall median price per square foot

down to 1.2% lower than it was in December 2009 — the first

year-over-year decline in this price measure since October 2009.

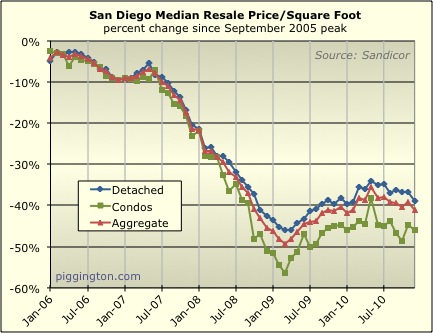

Here’s that chart again with fancypants vertical gridlines:

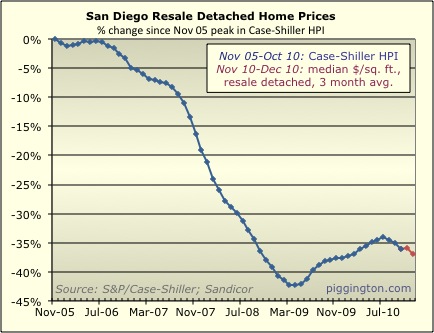

With this month’s sharp decline in the detached median price per square

foot, the proxy Case-Shiller index resumed its decline, dropping by

1.4% from November’s estimate:

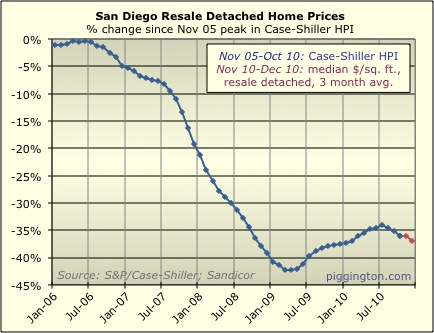

Gridlines:

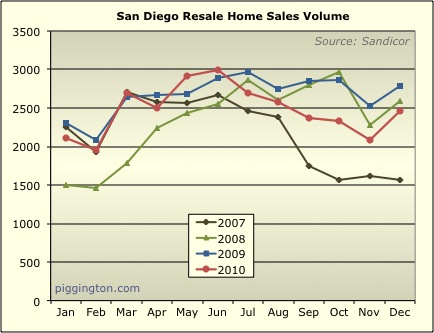

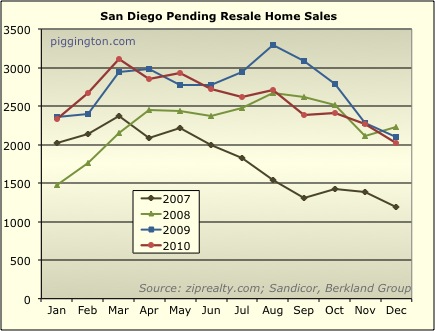

Closed sales rose and pendings dropped. Both changes were

consistent with seasonal patterns evident in (most) recent years.

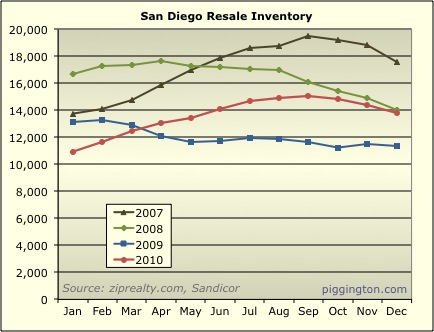

Inventory continued its recent decline, but remained over 20% above its

late-2009 level.

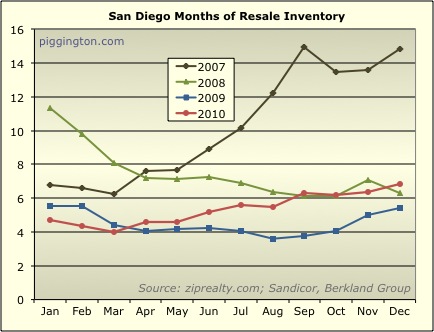

Months of inventory, which I base on pending sales, rose — also fairly

typical for recent Decembers. Inventory was at 6.8 months’ worth

and 26% higher than in December 2009.

Reviewing the changes between December 2009 and December 2010 (with

apologies for repeating myself on some of these)…

Prices: down 1.2%

Closed sales: down 11.8%

Pending sales: down 3.9%

Inventory: up 21.2%

Months of inventory: up 26.1%

…things look a lot less promising heading into 2011 than they did at

the outset 2010. Things could change, of course, at the drop of a

government-stimulated hat. But for the time being it looks like

prices on the whole are more likely to fall than to rise.

In mostly-unrelated news: anyone up for a bit of boom-time nostalgia

should proceed to this entry

on Jim’s blog, where a user with the handle “Mozart” seems — judging

from his or her use of peak-vintage permabull debate tactics —

to have just started firing off blog comments immediately upon waking up

from a 5-year coma.

Keep the dream alive!

There are a lot of people out

There are a lot of people out there with that mentality (Mozart). It’s hard to really see what’s going on right now with an objective view until you can break your mind free from the idea that real estate was ever supposed to be priced at the levels it was during the peak of the bubble. For those that can’t do that these prices just look too good to be true.

I think San Diego still has a ways to go before prices become affordable.

This all looks to be

This all looks to be perfectly in line with what most of us have been expecting. A relatively stable market with some slow bleeding downward particularly in the off peak market season. If this trend continued through May closings it would most likely be indicating something more substantial. Only time will tell.

ShawnHCRW wrote:There are a

[quote=ShawnHCRW]There are a lot of people out there with that mentality (Mozart). It’s hard to really see what’s going on right now with an objective view until you can break your mind free from the idea that real estate was ever supposed to be priced at the levels it was during the peak of the bubble. For those that can’t do that these prices just look too good to be true.

I think San Diego still has a ways to go before prices become affordable.[/quote]

Nailed it.

Almost everything after 2001 was entirely due to the credit bubble. There is no rational reason to believe we’ll see those prices, inflation-adjusted, ever again. Too many people don’t seem to understand that.

CA renter wrote:

Almost

[quote=CA renter]

Almost everything after 2001 was entirely due to the credit bubble. There is no rational reason to believe we’ll see those prices, inflation-adjusted, ever again. Too many people don’t seem to understand that.[/quote]

Most people don’t think about it in inflation-adjusted numbers. So, I’m not sure what you mean by “Too many people don’t seem to understand that.”. Those who want price to back up to peak most likely want it to go back up in nominal term, not inflation-adjusted term. I’ve shown data that income has risen over 50% in nominal term since 2001. I’ve also shown that due to rate decline and in conjunction to increase in income, people can afford to get loan 2x what they can in 2001 and still maintain the same DTI ratio.

Nailed it AN. But that doesnt

Nailed it AN. But that doesnt fit too many people’s model of what they want to beleive should be.

AN wrote:CA renter

[quote=AN][quote=CA renter]

Almost everything after 2001 was entirely due to the credit bubble. There is no rational reason to believe we’ll see those prices, inflation-adjusted, ever again. Too many people don’t seem to understand that.[/quote]

Most people don’t think about it in inflation-adjusted numbers. So, I’m not sure what you mean by “Too many people don’t seem to understand that.”. Those who want price to back up to peak most likely want it to go back up in nominal term, not inflation-adjusted term. I’ve shown data that income has risen over 50% in nominal term since 2001. I’ve also shown that due to rate decline and in conjunction to increase in income, people can afford to get loan 2x what they can in 2001 and still maintain the same DTI ratio.[/quote]

I’ve already addressed your post about the incomes (agreed with you). Fine, let’s say incomes are up 50%, then housing prices can be up 50%. I can deal with that. We can even agree that the lower interest rates are responsible for another x% increase in price.

OTOH, there have been thousands of houses built around here since 2001 to soak up a lot of those buyers. Besides, how many of those high-income earners don’t already own a house? I’m not saying rich people don’t exist, just that there aren’t enough of them to prop up the prices for everyone who thinks their house is “special.”

That being said, I think the market was already at a “normal” peak in 2001, and getting ready to roll over — you can see it in the sales and price statistics, too. Our economy was much better pre-2001 (before the stock market crash) than it is now. We had lower energy, healthcare, education, and food, costs in 2000 than we do now, as well. Look at what commodities have done in that time. Jobs are less stable today, and people are having to move more for employment. Then there are the retirement accounts…many people are at the same level, or lower, than they were in 2000. All of this will have a negative effect on pricing because people have less money to allocate toward housing costs.

And then, there’s the argument that it’s almost always better to buy when interest rates are high, especially if a buyer has a larger cash position. If inflation hits, rates should go up, which will have a negative effect on housing prices (IMHO — and the opinion of the Fed, apparently, since they are sitting on rates in order to keep housing prices elevated).

I’m not telling anyone to sell and rent at this point, but I wouldn’t be telling anyone to buy, **especially in the areas that were not allowed to fall due to all the intervention.**

Damn my house is in one of

Damn my house is in one of those areas that you say was not allowed to fall due to all the intervention. Like most of the homes in this area it is up in price by about 35% since 2001. I know this because the house next door (same model as mine) sold in 2001 and I have that data point while the one across the street (same model as mine) sold a couple months ago and I have that data point.

What happened to the 50% appreciation that I should have gotten because incomes are up that much and my X% increase because interst rates are much lower now. I dont get it. Your facts dont add up.

From what I’ve seen, prices

From what I’ve seen, prices are up much more than 35% in your area. What you tend to do is adjust the cost basis by adding the full cost of landscaping, window treatments, “upgrades,” etc. Buyers do NOT pay retail for those “upgrades.” It’s a myth from the housing bubble that a seller will get 100% (or 100%+!) back on improvements. At best, some very specific, well-done improvements might return 80-90% of the cost to the seller *in traditional markets.* Most improvements return less than that. New paint, carpet, and a good cleaning will give a seller the best return (possibly 100%+), but a fancy wall, trendy fixtures, or new patio will usually not do it.

Show me a house that is uup only 35% from 2001 (actual price, not your imputed value of their “upgrades,” and not one that is totally thrashed today), and I’ll give you $100.

Besides, you didn’t pay attention to all the reasons I’ve listed for why housing prices should be lower (IMHO), even after taking the higher incomes and lower rates into account.

When would you like to come

When would you like to come over and will you be bringing cash or a check?

I havent added a penny for upgrades. My house is pretty much as it was in 2001, as the one next door was in 2001 when it sold then and as the one across the street was when it sold a couple months ago with the exception that it has a very nice canyon view that mine does not.

The proof is in your email box now. Keep your money, but you are wrong.

CA renter wrote:Show me a

[quote=CA renter]Show me a house that is uup only 35% from 2001 (actual price, not your imputed value of their “upgrades,” and not one that is totally thrashed today), and I’ll give you $100.

[/quote]

Okay, here it comes…

Sdr e-mailed me an example of a 2001 sale and another home with a similar (same?) floorplan that sold in 2010 for 39% more than the 2001 home sold for.

After checking a few comps myself, I have to concede this part of the debate to sdr. While I could not find a home that sold for 35% or less than the 2001 price, the homes are generally selling for around 40-50% more than 2001 prices. While it’s not a total win for sdr, his estimate was definitely closer than mine, so he wins.

I have to add that prices had gone up quite a bit already by 2001, as they did in most places, but I agreed to compare to 2001 levels, and a bet is a bet. Besides, sdr’s area wasn’t even on the map in 2001, so it is probably even more desirable today than it was in 2001. I am surprised at the relatively low increase. He wins.

This does not mean that I think prices are going to remain stable or go up from here, because I think prices across the board will go to 2001 levels or lower, but the increases from 2001 are pretty mild because, while the lower and low-mid tiers have strengthened in the past couple of years, the mid-high and high tiers have weakened.

We still have our 2012 bet, though, sdr, and I’m going to win that one. 😉

Cash or check, it’s your choice; and you **must** take it. A bet is a bet, and I always keep my word.

I will take the win but with

I will take the win but with a caveat that an email proving that I was far more correct is about to be launched into your emailbox. If you were surprised at the relatively low increases prepare to be shocked into submission by the reality of even lower increases.

The example that sold 39% more than mine was on a prime view lot which mine is not. I wanted it and it was the 1st house sold in our phase. It defintely is worth a premium over mine and actually sold for 12K more than mine when new. We had more upgrades in the house and the base prices were about 20K apart. Using a more appropriate value for my house puts it at about 35%. The statement that prices are generally up 40 to 50% from 2001 around here is just plain wrong. They are really up closer to 20-35%. Here is an example sitting in plain site that you seemed to have missed.

This house just closed for $850K not far from either of our homes:

http://www.sdlookup.com/MLS-100048968-2150_Vista_La_Nisa_Carlsbad_CA_92009

Look at the pictures and you will see a nice lagoon view. The house across the street (same model but without a lagoon view) sold for $685 in 2001.

http://www.sdlookup.com/Property-D75DD9DA-2149_Vista_La_Nisa_Carlsbad_CA_92009

Thats 24% without giving any value to a lagoon view. Looking at comps in the MLS, 2150 would easily have sold for 700K perhaps a bit more. That puts appreciation since 2001 at roughly 20%.

These are not high end homes we have been looking at but rather mid tier for the area. The low end has admittedly appreciated more because the area has greatly improved the last decade and the base admission ticket price has gone up.

This does not mean that I think prices are going up but the notion of 2001 or lower pricing is pure fantasy. Time for the bear to give sdr the total win.

As for $100, here’s what I propose. When you pay for my dinner next year you can pay Rich’s also. He deserves it for providing us with this platform we have all enjoyed the last 5 years.

edit: just have to add that these current prices are also in a much lower interest rate environment which makes the gains in nominal prices that much less impressive.

I like the way you think.

I like the way you think. 😉

I thought about asking her to

I thought about asking her to donate it to a charity or to send to you to help cover some of your hosting fees but figured this would be more fun for all of us. And you deserve it!

sdrealtor wrote:I thought

[quote=sdrealtor]I thought about asking her to donate it to a charity or to send to you to help cover some of your hosting fees but figured this would be more fun for all of us. And you deserve it![/quote]

Absolutely!

We’d be delighted to treat Rich to dinner, anytime he wants. 🙂

It will be fun when you get to pay for our dinner in 2012, sdr; and we’ll cover Rich with the winnings from this current bet. 😉

Dont know if you remember but

Dont know if you remember but part of the bet was the winner brings wine. I just picked up a great wine for the night;) 2008 Caymus Special Selection. A treat for all:)

🙂

🙂

I encourage you two to make

I encourage you two to make as many bets as you’d like.

Finding houses that sold

Finding houses that sold close to 2001 nominal is easy in 92103.

This one is 8% over 2001 nominal.

http://www.sdlookup.com/MLS-100027977-4309_Avalon_Dr_San_Diego_CA_92103

This one is up 13% from the late 2000 price. The owner had an unfortunately choice of paint colors but it is a nice house and lot.

http://www.sdlookup.com/MLS-100016487-234_W_Palm_St_San_Diego_CA_92103

I think relatively speaking houses in north county coastal are doing better than houses in san diego urban coastal. Probably the improved schools and infrastructure have something to do with it as sdr suggests.

CAR, I think waiting for 2001 nominal prices is reasonable and if we continue to over-correct to the downside we will probably end up there in most if not all areas. I don’t think there is that much difference between 2001 and early 2002 nominal prices because of the tragedy so if you see something at early 2002 nominal that you love I would not hesitate especially if it fits your needs for the long term.

Pem

There is no way my house

Pem

There is no way my house will ever get back to 2001 nominal prices as most homes in NCC will not either. CAR and I have a bet which would require that and its not going to happen. Getting there would require a 25% decline from where we are today. The truth is, NCC is not particularly overvalued given the demographics of the people that live here. It is very affordable again to the type of buyers who typically look to live here. People are buying at 3 to 4 times income. Most are putting more than 20% down and loans are mostly under 3 times annual income which is a rule of thumb for affordability without even considering record low interest rates. If it got down to 2001 pricing the demand would be tenfold the supply. I am talking about typical 4 to 5 BR homes between 2000 and 3000 sq ft not anything fancy but the bread and butter homes around here. These are not bullish statments in the least, they are very pragmatic and reasonable based upon the facts.

sdr,

I agree that NCC has an

sdr,

I agree that NCC has an infrastructure “build-out” premium. It is hard to make the argument that Mission Hills, for example, has improved over the last 10-20 years but clearly NCC has. One thing that does concern me going forward about NCC however is the commute to job centers. While there are many more job opportunities in Carlsbad then there were 10 years ago, I would guess that a large number of people living in Enc/Cbad are still commuting to Sorrento Valley for work.

Having said that, I have a great friend that lives in LCV. Given the recent downturn in prices (and his rapid salary and net worth increase) I asked him why doesn’t he move closer to work (La Jolla, CV, etc) given that he works in SV. He said that he doesn’t want to move because his family loves Carlsbad and it would be difficult for them to switch schools.

In summary, 10 years ago my friend went to Carlsbad to get more house for the money than CV and now that he can afford the closer in areas he is staying in Carlsbad despite the commute because it has become an incredible place to live and raise his family.

Pem

I guess it is all

Pem

I guess it is all relative because coming from the East Coast the commute to Sorrento Valley is joke. There is a long term project to improve the I-5 commute and the changes they have made already have made a big difference. With that said, NC has grown and many resident’s work here also. A very high percentage also work out of the area or from home.

I completely understand your friend and know many many others like him. The lifestyle and sense of community up here is not easily replicated in SoCal.

pemeliza wrote:Finding houses

[quote=pemeliza]Finding houses that sold close to 2001 nominal is easy in 92103.

This one is 8% over 2001 nominal.

http://www.sdlookup.com/MLS-100027977-4309_Avalon_Dr_San_Diego_CA_92103

This one is up 13% from the late 2000 price. The owner had an unfortunately choice of paint colors but it is a nice house and lot.

http://www.sdlookup.com/MLS-100016487-234_W_Palm_St_San_Diego_CA_92103

I think relatively speaking houses in north county coastal are doing better than houses in san diego urban coastal. Probably the improved schools and infrastructure have something to do with it as sdr suggests.

CAR, I think waiting for 2001 nominal prices is reasonable and if we continue to over-correct to the downside we will probably end up there in most if not all areas. I don’t think there is that much difference between 2001 and early 2002 nominal prices because of the tragedy so if you see something at early 2002 nominal that you love I would not hesitate especially if it fits your needs for the long term.[/quote]

Agreed, pemeliza.

Yes, prices in some neighborhoods have most certainly done better than others. In our old neighborhood, prices touched what were probably 2000 levels before investors moved in and began flipping/buying rentals. They are now around 2002 levels — this was an area that never really slowed down, as it was a typical “starter” neighborhood, and prices went up by much more, percentage-wise, than the better areas. It was like a rocket between 1998 and 2005-ish.

If the Fed/govt hadn’t intervened, prices in all areas probably would have bottomed by now, and we would be trillions of dollars better off than we are after all the financial give-aways.