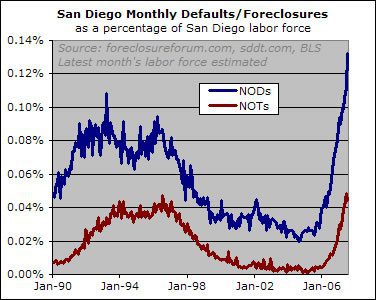

2,033 San Diegans went into default on their mortgages in July. This is up 19 percent from June and up 157 percent from July 2006. Even adjusting for regional growth, as the blue line on the accompanying graph indicates, the rate of default absolutely dwarfs anything we saw during the early-1990s recession and housing bust.

What a coincidence – The

What a coincidence – The number of sales for attached and detached homes through the MLS for the month of July is 2,050 as of this minute (3:26 PM).

Monthly foreclosures probably have more noise in them than monthly sales volume. Still, it kinda makes you wonder what happens if/when the number of foreclosures per quarter exceeds the number of sales.

Okay, I’ll admit it: I not REALLY wondering what happens – I’ve already got a pretty good idea.

As many homes have more than

As many homes have more than one mortgage, does each house get counted twice (or more) for NOD/NOT as they’re defaulting on multiple mortgages?

“As many homes have more

“As many homes have more than one mortgage, does each house get counted twice (or more) for NOD/NOT as they’re defaulting on multiple mortgages?”

_________________________

That’s my question as well.

Base on CNN’s foreclosure

Base on CNN’s foreclosure rate article, click here, San Diego is ranked #23 in the nation with 1 foreclosure filing in every 75 household.

I’ve been wondering how much

I’ve been wondering how much of the banks foot dragging on liquidating the REOs is due to staffing and how much is intentional to prop up their balance sheet?

I quickly eyeball Countrywide’s assets and liabilities and I wonder if their actual liquidation of the bank REOs would toss their numbers enough to drive them to BK?

N_S_R

I think you may be on

N_S_R

I think you may be on to something there. Maybe they’re not being completely honest about their liability……….