Folks, sorry this has taken me so long. When urbanrealtor

starts offering to buy me booze just to get the monthly charts up, I

know I’ve been a huge slacker even by my own lofty standards of

indolence.

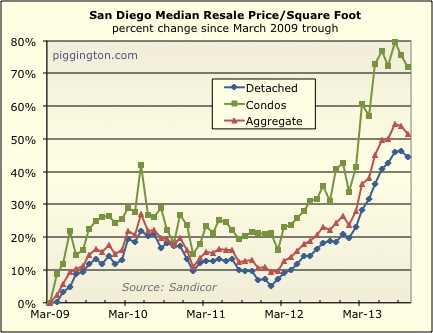

So without further delay, let’s do this. Starting with the

median price/square foot, we see that the rapid price apprecation

we’ve seen all year finally took a breather over the past couple

months, with prices by this measure flattening in September and then

falling in October.

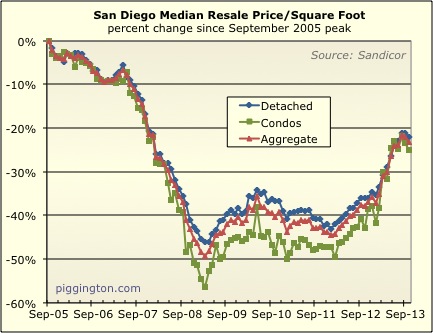

Same thing from the peak:

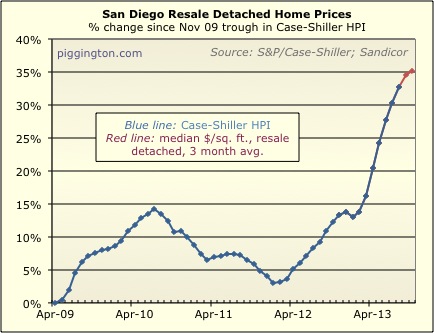

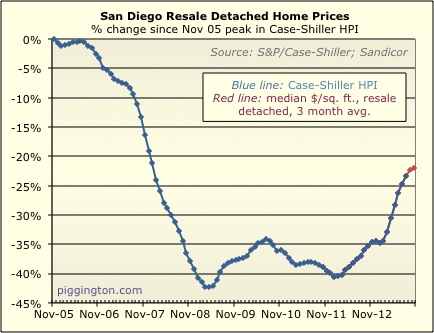

Here’s a look at the Case-Shiller index in blue, and then an

estimate of same over the last couple months in red. Due to

the 3-month smoothing employed in this calculation, this price

indicator was still rising as of October.

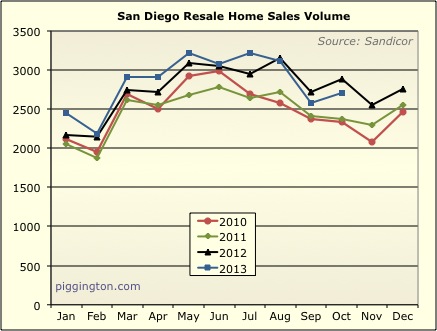

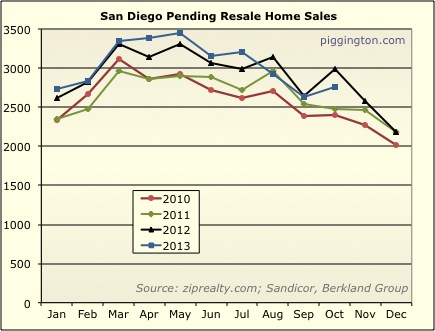

Sales volume has actually been pretty good… not quite as high as

last year (which lead into this year’s price ramp) but not too bad

considering the big jump in rates. That said, you can see that

rates did seem to have an effect, because volumes were at multi-year

highs right up until rates really started to bite:

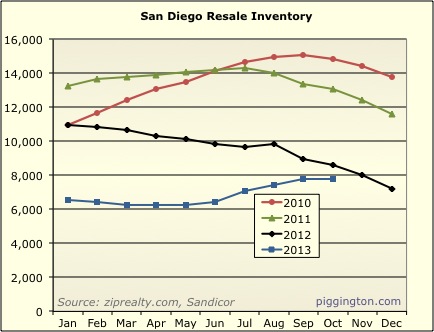

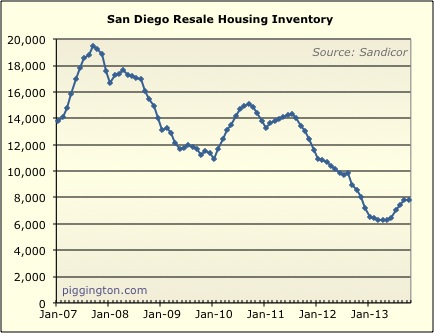

Inventory flattened out, but given that this time of year typically

seen a decline, I would interpret that as indicating some upward

pressure on inventory.

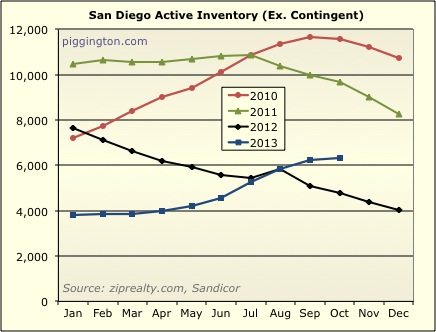

And if you take away contingent inventory and just look at active,

it was still rising over the past couple months, though not as fast

as previously. However, this is quite a bit different from

recent autumns:

So you can probably make a pretty good case that inventory is coming

out of the woodwork now and has probably bottomed. It must be

noted, though, that this increase is coming off a very low base, so

inventory continues to be quite low despite the recent increases.

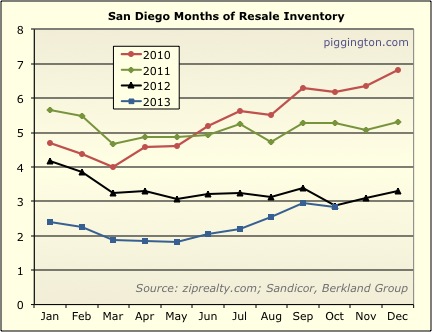

Months of inventory is accordingly still quite low, right where we

were at this time last year:

This longer-term chart shows that months of inventory is also very

low historically, despite recent increases:

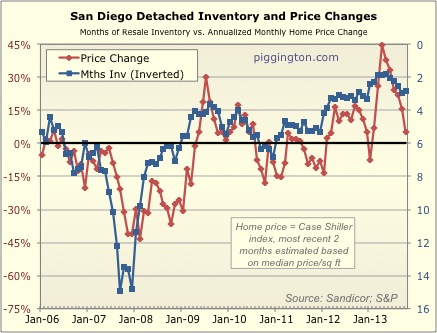

Here’s the chart I like showing the correlation between months of

inventory and price changes.

As months of inventory (the blue line, which is inverted) has come

off its lows, the rate of price increases has dropped quite quickly

(though is still positive since I am using the Case-Shiller index or

my proxy thereof for recent months). But it should be noted

that months of inventory is still comfortably above the level that

has typically distinguished between upward and downward price

environments. (This general vicinity is shown by the thick

black line at 6 months inventory).

So while the market appears to be taking a higher-rate-induced

breather from the frenzied conditions of earlier this year, the

chart directly above shows that demand is still strong and supply

pretty weak. The direction of the trend may have changed, but

the absolute levels seem to be what matter when it comes to months

of inventory — and the current level suggests that price pressures

remain to the upside for now.

The idea behind the months of inventory chart is that it gives an

idea of current supply and demand, and thus price pressure. It

really doesn’t tell you a thing about the long-term prospects for

housing or whether prices are sustainable. In my view, the

better way to do that is to compare prices to the long-term

fundamentals such as area rents and incomes. I’m planning to

update those charts in the not-too-distant future… if urbanrealtor

starts offering to buy me drinks again, I’ll know it’s taking too

long.

Thank you sir.

CE

Thank you sir.

CE

Yeah, thanks from me too.

Yeah, thanks from me too. Confirms a suspicion I had.

Rumor has it that

Rumor has it that urbanrealtor is aging a thick, dark, frothy bottle of Santorum Stout in his cellar. If I were you I’d require that as payment for next month’s charts.

The percentage of Active

The percentage of Active Inventory that is investor-owned and purchased since 2009 would be a useful indicator of overall investor sentiment. Lots of investors became property managers in the last few years. If price appreciation is slowing or even stagnant, is now the time to start booking profits?

mwseverson wrote:The

[quote=mwseverson]The percentage of Active Inventory that is investor-owned and purchased since 2009 would be a useful indicator of overall investor sentiment. Lots of investors became property managers in the last few years. If price appreciation is slowing or even stagnant, is now the time to start booking profits?[/quote]

It depends on why they bought those houses to start with. If they bought to flip in a couple/few years, then probably. If they bought it as a long term rental and are raking in the rents with positive cash flow, probably not.

This assumes that they’re

This assumes that they’re buying for one or the other, and not both. I wouldn’t want to own an underwater property that’s raking in rents, for example, just seems like bad juju.

spdrun wrote:This assumes

[quote=spdrun]This assumes that they’re buying for one or the other, and not both. I wouldn’t want to own an underwater property that’s raking in rents, for example, just seems like bad juju.[/quote]But it’s not underwater if you bought in 2009-2011.

However, even if you are underwater, if I’m getting cap rate of 10%+, I probably wouldn’t sell. I would probably buy more. It’s impossible to time things perfectly.

All I’m saying is that if I

All I’m saying is that if I felt prices would fall in future (perhaps with interest rates) and if I felt the risk of being underwater existed, I’d strongly consider selling.

It’s always some combination of rental income and appreciation (or depreciation).

My question was whether or

My question was whether or not it was possible to track this data. There aren’t that many investors in this situation in San Diego. Cap Rates of 6-7% (forget 10% today), particularly anything above entry-level, are the exception not the rule at this point.

mwseverson wrote:My question

[quote=mwseverson]My question was whether or not it was possible to track this data. There aren’t that many investors in this situation in San Diego. Cap Rates of 6-7% (forget 10% today), particularly anything above entry-level, are the exception not the rule at this point.[/quote]There were plenty of places in San Diego sold between 2009-2011 with cap rate 10%. You’re right that higher end homes have lower cap rate. That has always been the case. But not all of San Diego is high end. As to whether it’s possible to track this data, I don’t think it is. But maybe someone knows.

Thank you, Rich!

Thank you, Rich!

Haha, you’re so nice CAR…

Haha, you’re so nice CAR… you’re the only one who’d thank me for being a giant slacker! 😉

Slackers don’t maintain blogs

Slackers don’t maintain blogs like this and do all the work to provide the information like you do. I’m truly grateful for everything you’ve done over the years, and have been reading your work for ~9+ years now (man, are we getting old or what?). I owe you big time! Thank you so much!

Happy Thanksgiving, Rich! 🙂

Thank you CAR, as usual, you

Thank you CAR, as usual, you are very kind. Hope you and the family have a great Thanksgiving (and the rest of the piggs too!)

Rich

PS – “been reading your work for ~9+ years now” — crazy! 😮

There are 8% cap rates now in

There are 8% cap rates now in the right places. And what’s wrong with “low-end” stuff? A 1/1 condo or building full of 1/1’s is actually my IDEAL situation — less chance of being in the middle of a roommate catfight than in a 2+ bedroom unit.

I got about a 15% cap rate on

I got about a 15% cap rate on my condos bought back from 2009-2012. But when I sold my ROI on my cash invested was about a 250%+ ROI in about 2-4 yrs! Gotta love that. What I loved about investing in San Diego rentals from late 2008-early 2012 was the downside risk was tiny but the upside HUGE. You could buy below construction costs back then and get stuff for what it was going for in the late 90’s yet get 2013 rents. Yet everyone hated real estate back then. Many of the long winded “financial geniuses” that regularly post on this forum warned me against buying condos back then. Boy were they wrong. Be careful who you get your financial advice from. Make sure you get it from someone with a higher net worth then you.

ctr70 wrote:I got about a 15%

[quote=ctr70]I got about a 15% cap rate on my condos bought back from 2009-2012. But when I sold my ROI on my cash invested was about a 250%+ ROI in about 2-4 yrs! Gotta love that. What I loved about investing in San Diego rentals from late 2008-early 2012 was the downside risk was tiny but the upside HUGE. You could buy below construction costs back then and get stuff for what it was going for in the late 90’s yet get 2013 rents. Yet everyone hated real estate back then. Many of the long winded “financial geniuses” that regularly post on this forum warned me against buying condos back then. Boy were they wrong. Be careful who you get your financial advice from. Make sure you get it from someone with a higher net worth then you.[/quote]

So you’ve confirmed that at least one investor is taking money off the table. Can I assume this is because you’re doubt sustained price appreciation? What % of your ROI is cash flow?

mwseverson wrote:ctr70

[quote=mwseverson][quote=ctr70]I got about a 15% cap rate on my condos bought back from 2009-2012. But when I sold my ROI on my cash invested was about a 250%+ ROI in about 2-4 yrs! Gotta love that. What I loved about investing in San Diego rentals from late 2008-early 2012 was the downside risk was tiny but the upside HUGE. You could buy below construction costs back then and get stuff for what it was going for in the late 90’s yet get 2013 rents. Yet everyone hated real estate back then. Many of the long winded “financial geniuses” that regularly post on this forum warned me against buying condos back then. Boy were they wrong. Be careful who you get your financial advice from. Make sure you get it from someone with a higher net worth then you.[/quote]

So you’ve confirmed that at least one investor is taking money off the table. Can I assume this is because you’re doubt sustained price appreciation? What % of your ROI is cash flow?[/quote]

Yes I bought a bunch of condos from 2009-2012 as rentals. Originally the thought was to hold them for the cash-on-cash return. But the prices skyrocketed so quickly I decided to sell a few to hedge my bets and take the cap gain. Most of the ROI is from the Cap gain. But the cash-on-cash from the rent was also phenomenal as I bought these condos for about $130k and they rent for $1,500/mo. These condos are now going for $300k. I put about $35k into each for down payment + closing costs + fix, and each condo is up about $150k in price. So my original investment $35k turned into $185k-$190k gross on each condo. You can’t beat that return many places. And everybody hated real estate and thought I was crazy for buying back in 2009. Even though prices were dirt cheap in San Diego. Isn’t that how it usually goes. Now everyone wants it bad now that it’s gone way up in price. Really it was more like a 300%+ NET ROI after paying Realtor commission, etc on the sale. Everyone was on the Gold bandwagon back then, but the REAL Gold was San Diego real estate.

ctr70 wrote:mwseverson

[quote=ctr70][quote=mwseverson][quote=ctr70]I got about a 15% cap rate on my condos bought back from 2009-2012. But when I sold my ROI on my cash invested was about a 250%+ ROI in about 2-4 yrs! Gotta love that. What I loved about investing in San Diego rentals from late 2008-early 2012 was the downside risk was tiny but the upside HUGE. You could buy below construction costs back then and get stuff for what it was going for in the late 90’s yet get 2013 rents. Yet everyone hated real estate back then. Many of the long winded “financial geniuses” that regularly post on this forum warned me against buying condos back then. Boy were they wrong. Be careful who you get your financial advice from. Make sure you get it from someone with a higher net worth then you.[/quote]

So you’ve confirmed that at least one investor is taking money off the table. Can I assume this is because you’re doubt sustained price appreciation? What % of your ROI is cash flow?[/quote]

Yes I bought a bunch of condos from 2009-2012 as rentals. Originally the thought was to hold them for the cash-on-cash return. But the prices skyrocketed so quickly I decided to sell a few to hedge my bets and take the cap gain. Most of the ROI is from the Cap gain. But the cash-on-cash from the rent was also phenomenal as I bought these condos for about $130k and they rent for $1,500/mo. These condos are now going for $300k. I put about $35k into each for down payment + closing costs + fix, and each condo is up about $150k in price. So my original investment $35k turned into $185k-$190k gross on each condo. You can’t beat that return many places. And everybody hated real estate and thought I was crazy for buying back in 2009. Even though prices were dirt cheap in San Diego. Isn’t that how it usually goes. Now everyone wants it bad now that it’s gone way up in price. Really it was more like a 300%+ NET ROI after paying Realtor commission, etc on the sale. Everyone was on the Gold bandwagon back then, but the REAL Gold was San Diego real estate.[/quote]

Kudos for bucking the trend back then. We had a number of clients that typically invested in commercial real estate shift to residential. We put together a financing package to support their acquisition and medium term hold that worked out really well for everyone involved. Cash flow from rents was there to keep the bank happy and appreciation was amazing over a short period of time as the low end bounced off the bottom.

Nothing at all wrong with the

Nothing at all wrong with the “low-end”. Most investors start there. How many 8 CAPs could you buy today in SD County? My guess is not many.

Nothing at all wrong with the

How many do I need? 🙂 I’m not in any kind of rush but will happily offer when I see something good.

There were definitely cap

There were definitely cap rates at 10% (and WAY over 10%) from late 2008 to early 2012. Many of those properties purchased after the crash during the lows are now up $150k-$200k in price. I originally bought to hold long term, but prices went up so much so soon I started selling some of my rentals bought 2009-2011, and just closed on selling my first listing. The ROI was massive with the capital gain. We got appreciation in 1-2 years that I thought was going to take 5-7 yrs! I thought to hedge my bets I better start unloading some of these properties now and lock in some profits. If prices dropped the next few years, I didn’t want to kick myself. When asked once why he was so rich, Warren Buffet responded, “because I always sold too soon”.