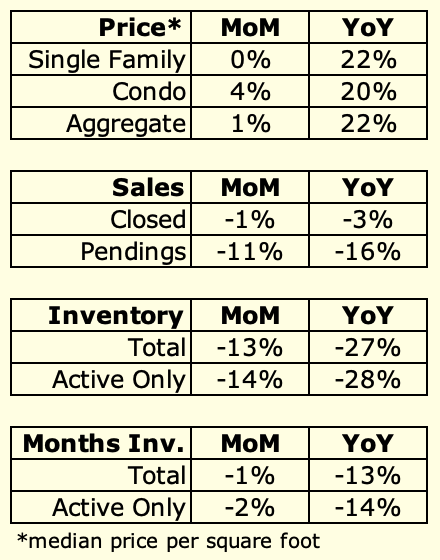

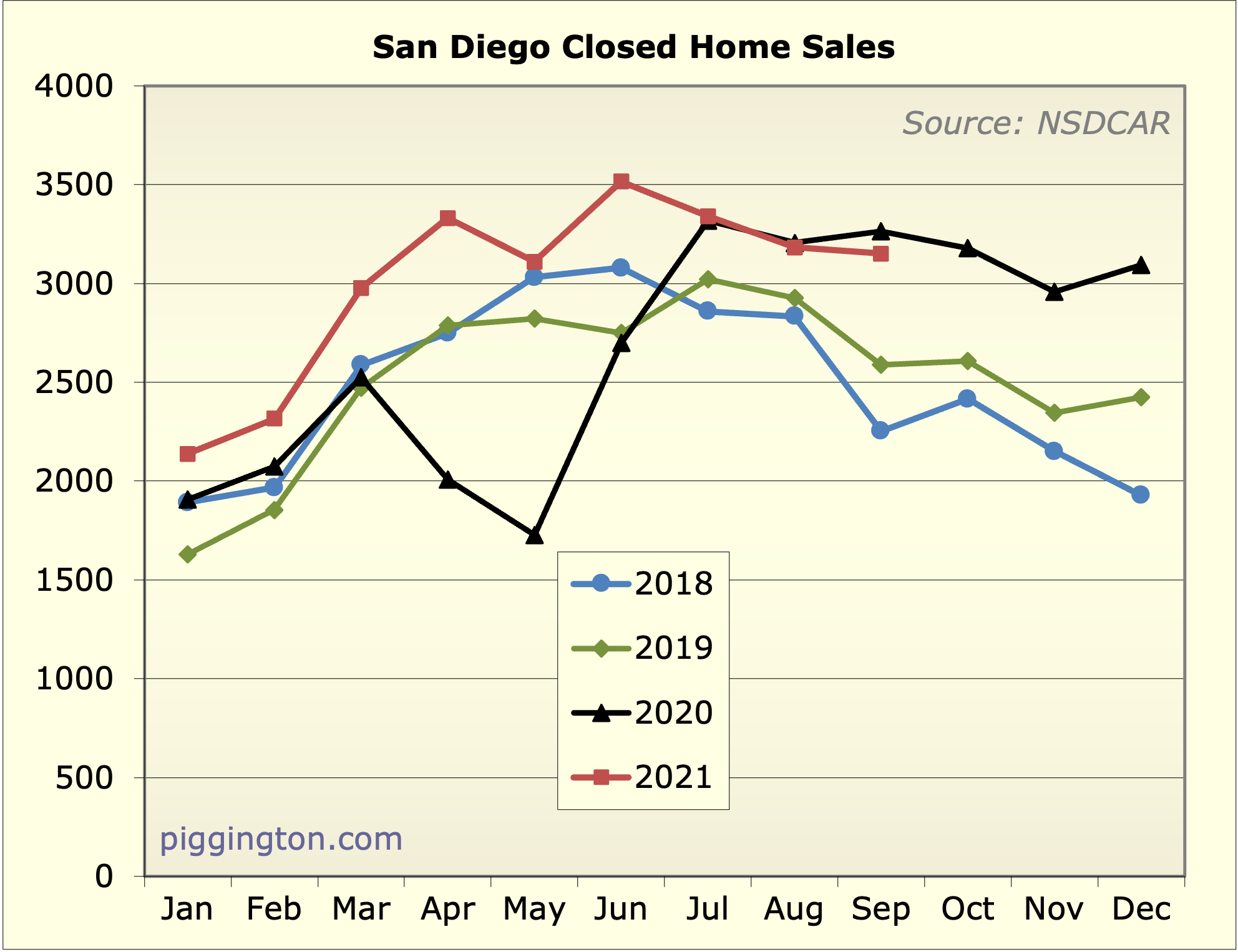

I have virtually nothing to add to last month’s description… the

market spent another month digesting the price overshoot during the

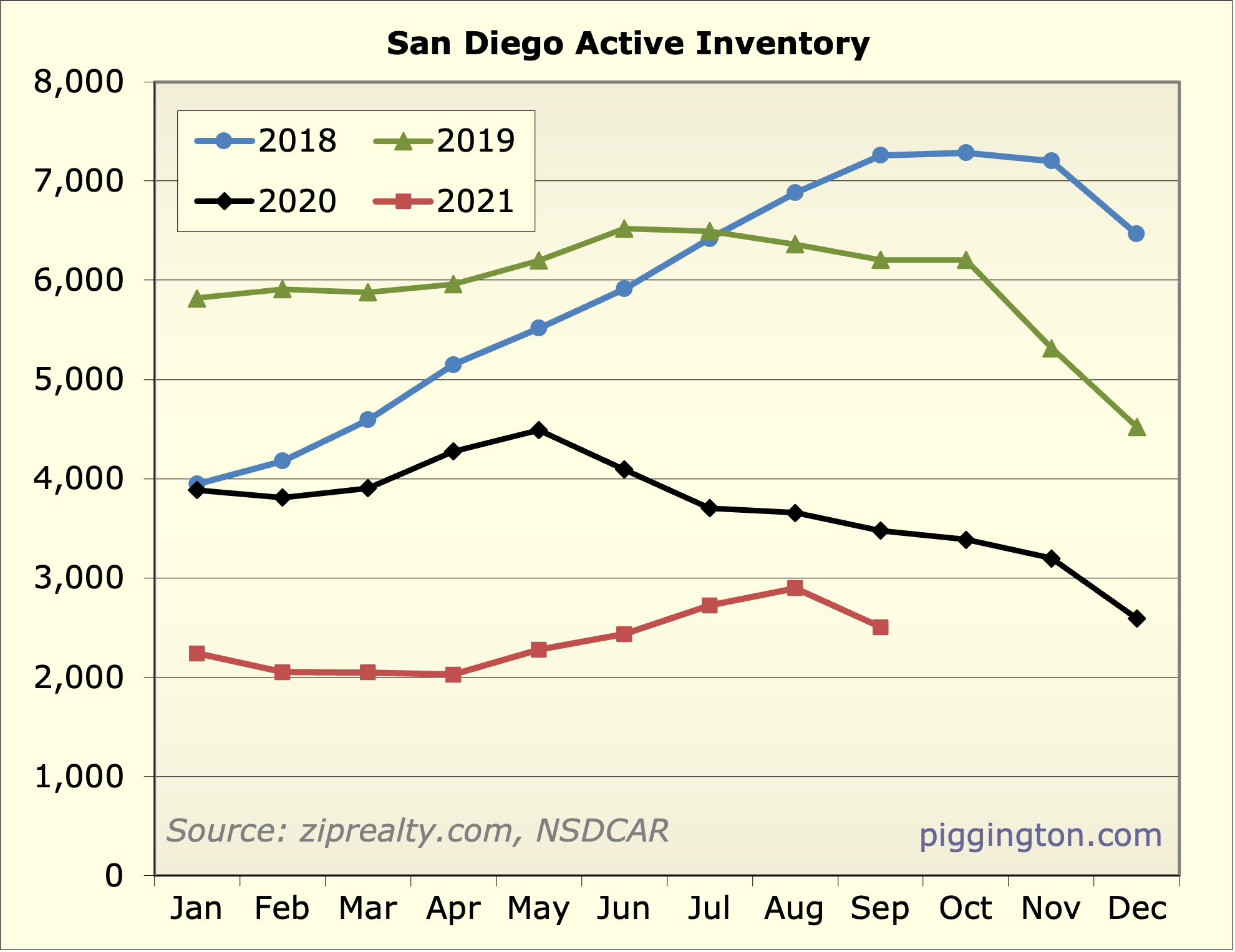

frenzy period, and inventory continues to be off the lows but still

really low. Not much to see here…

I have virtually nothing to add to last month’s description… the

market spent another month digesting the price overshoot during the

frenzy period, and inventory continues to be off the lows but still

really low. Not much to see here…

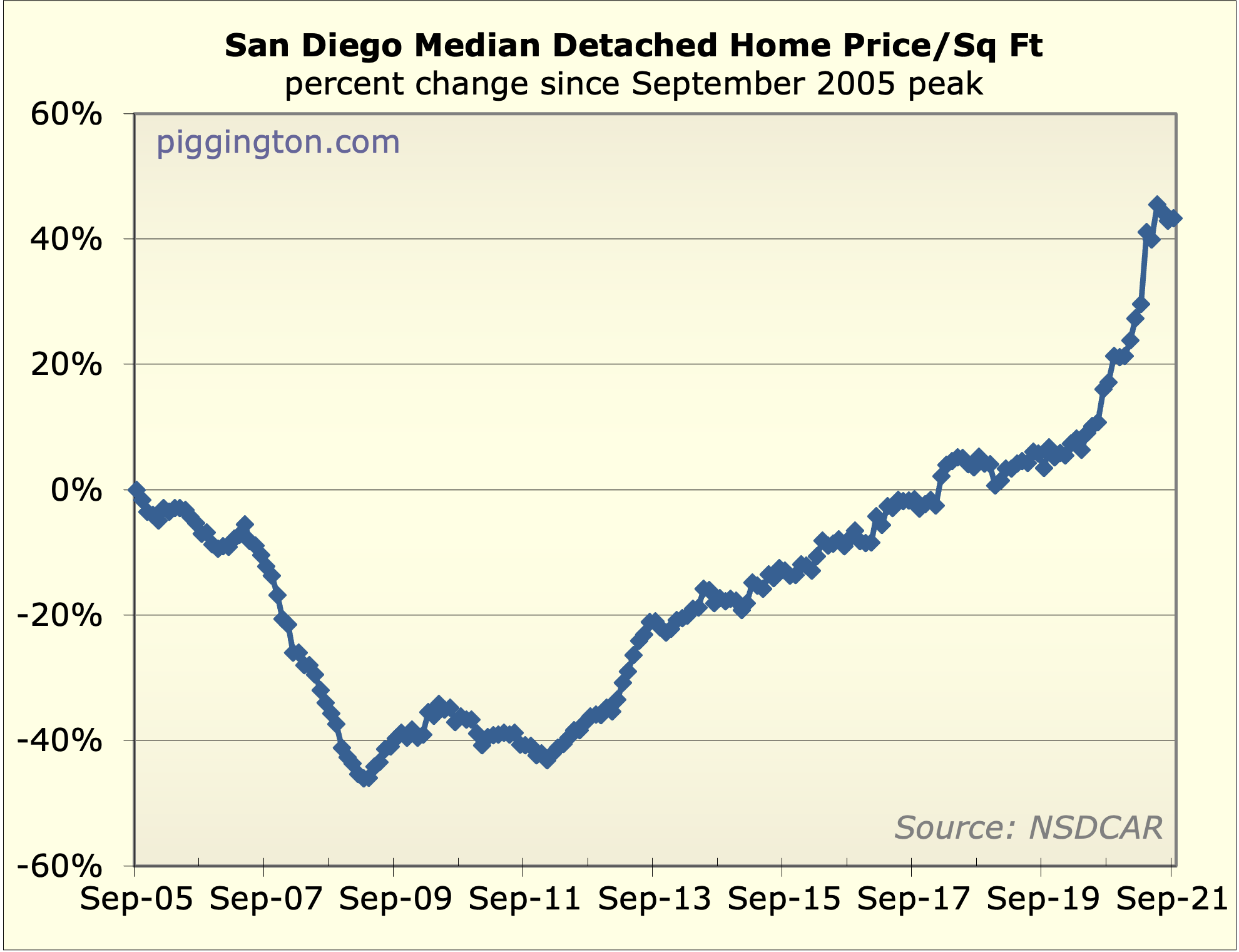

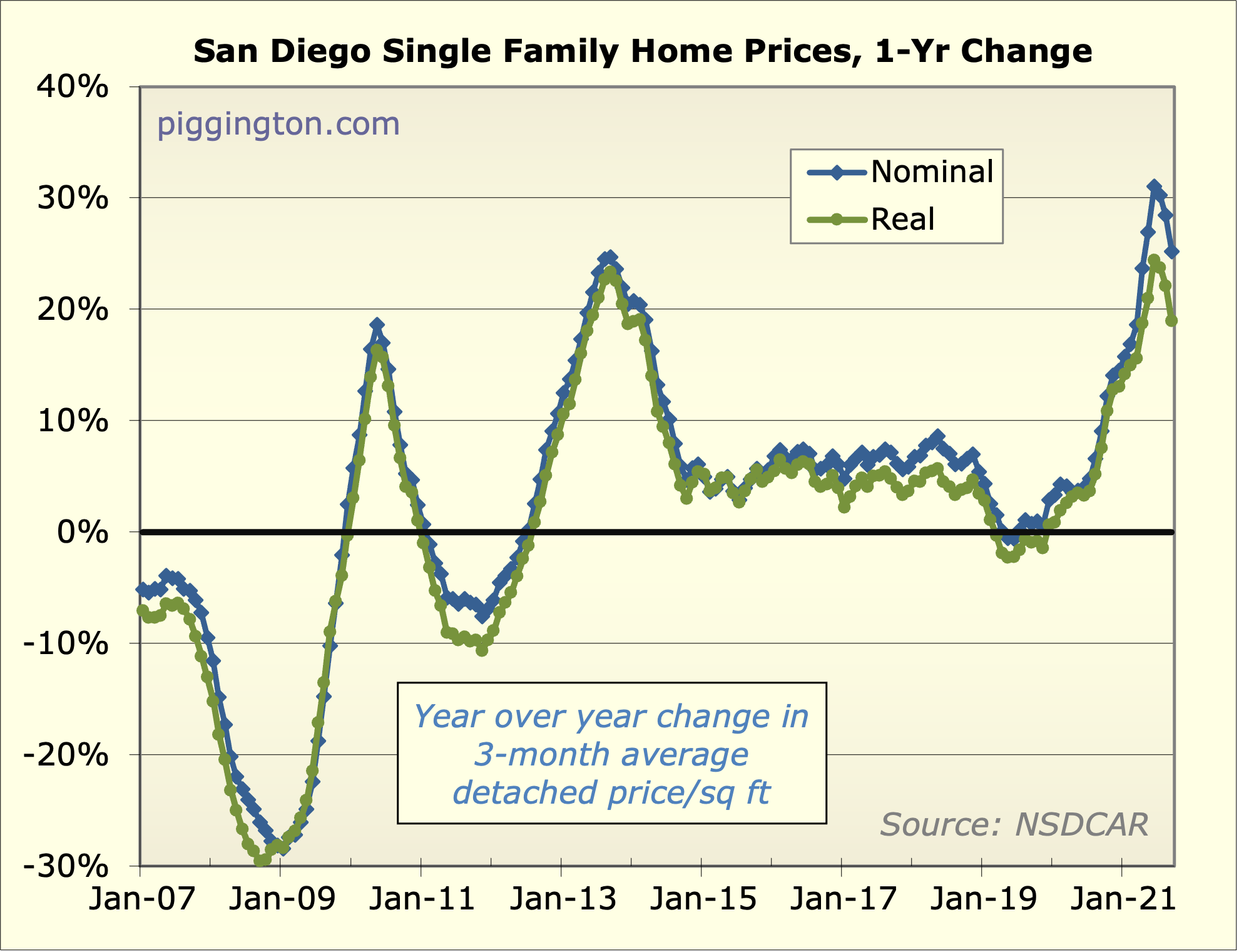

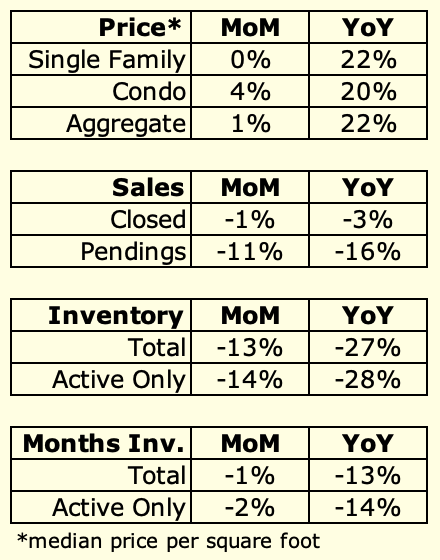

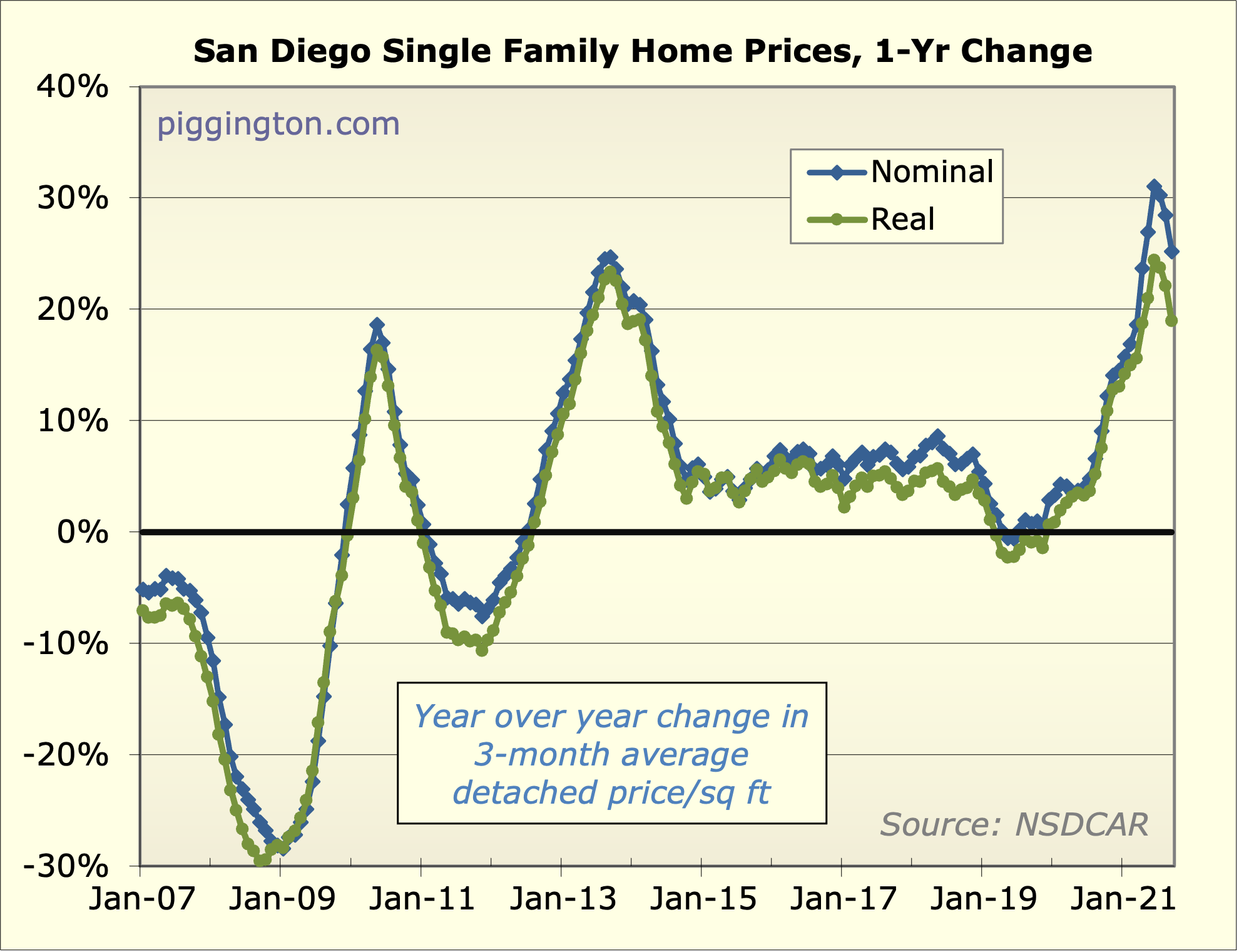

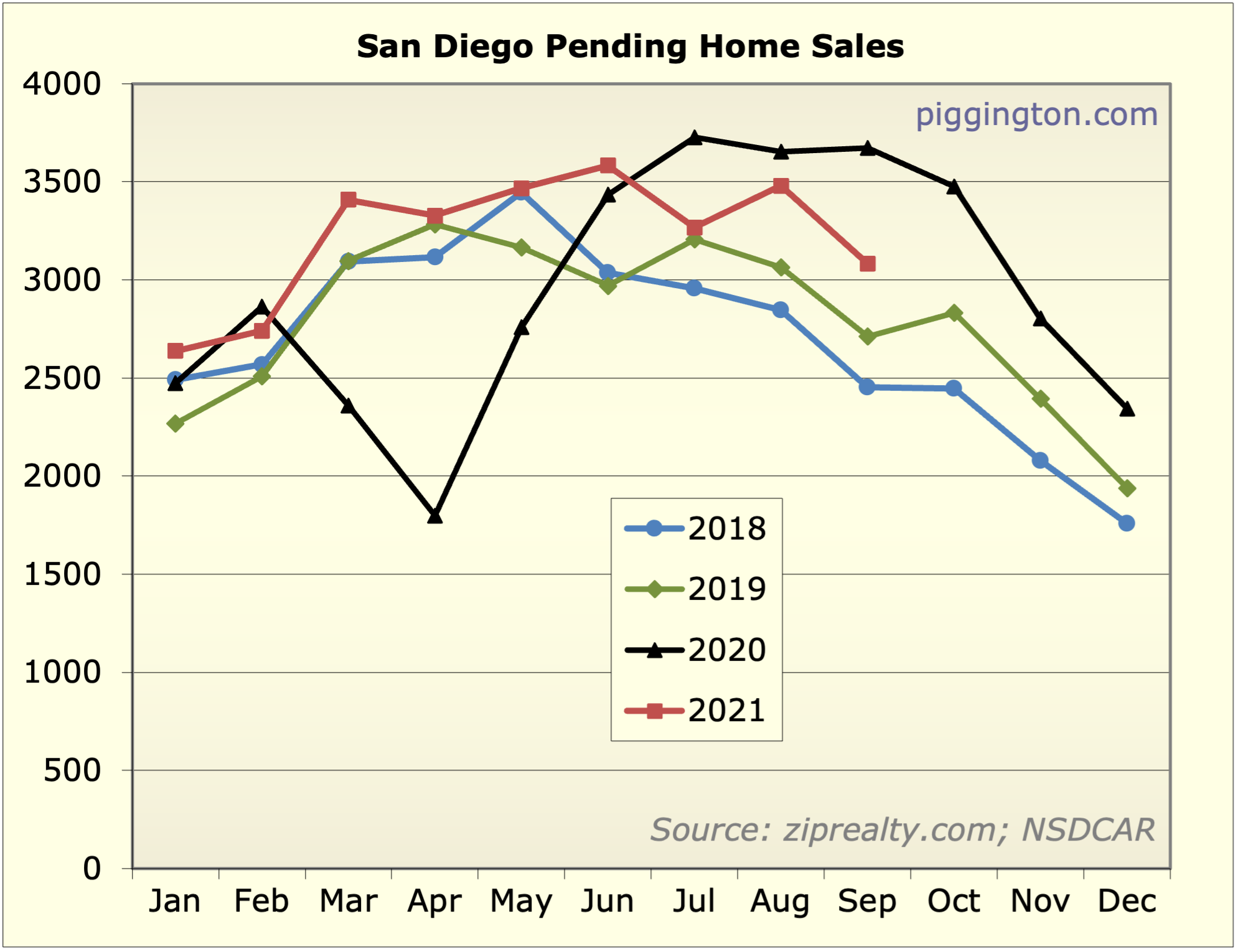

The big thing to see is a

The big thing to see is a giant price increase failed to attract marginal sellers.

Home selling requires typically some lead time and planning. There has now been plenty of months since the price “melt up” and the inventory hitting the market is depressed, not elevated.

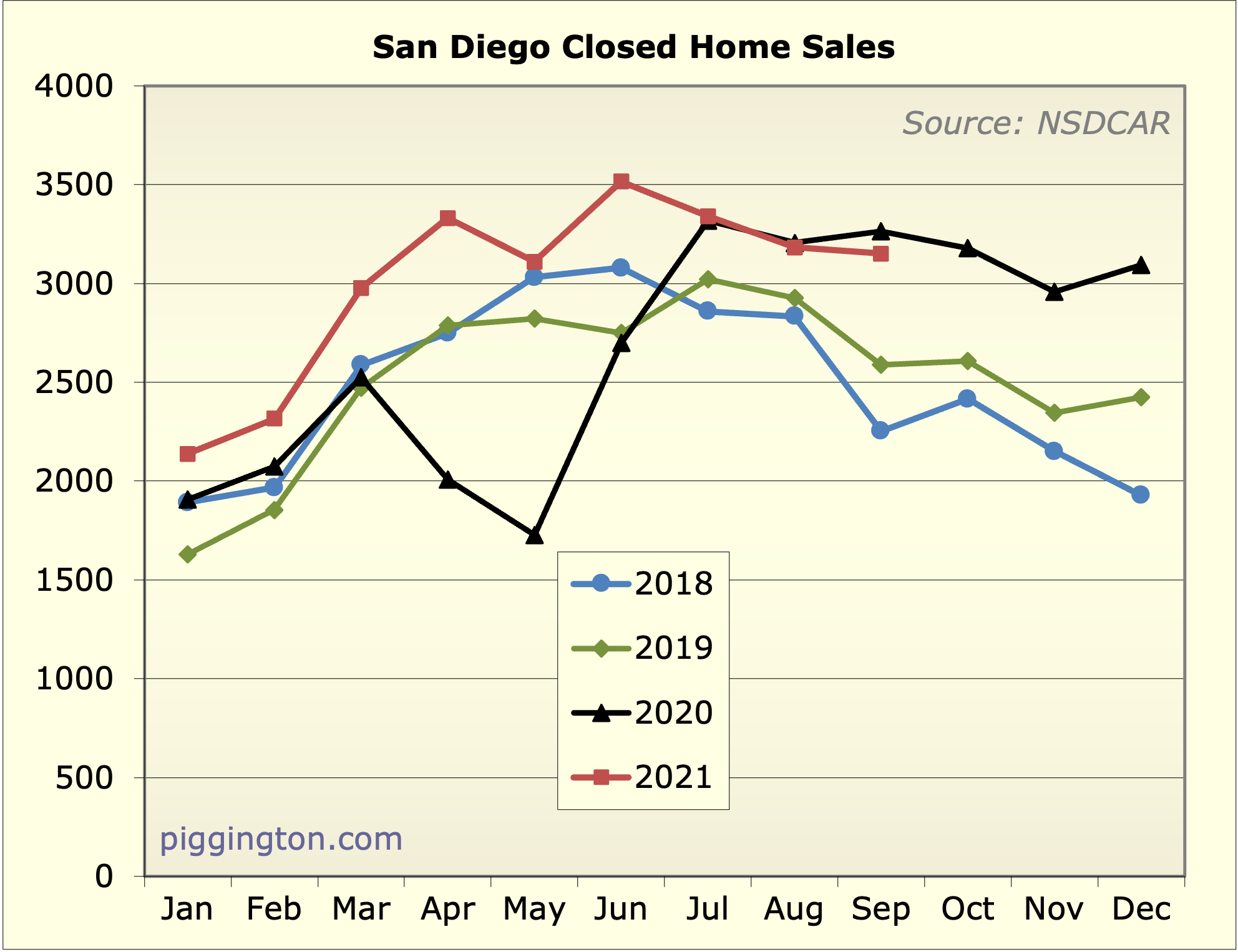

CalculatedRisk has a substack now and featured some San Diego data.

Bill notes San Diego new listings in Sept 2021 are down 24% versus 2020 while Denver and Vegas had growing new listings.

https://calculatedrisk.substack.com/p/1st-look-at-local-housing-markets

He also says the base conforming loan limit will go up 18% on 1/1/22 with some lenders already jumping the gun. More rocket fuel!

My refi has been delayed by 3 weeks and counting by the understaffed IRS screwing up and taking forever to respond to automated requests for my corporate tax return “transcript”. (Personal can be done online instantly). I’d be really p—d off if this were delaying my purchase of a residence. Makes me nervous as well since market rates have gone up about a .2 over my rate.

Consider this a data point that despite low rates, underwriting is way too strict. This one dumb item should not hold up a sub 50% LTV loan involving perfect credit and high income.

This makes me appreciate how smoothly my prior refi was with Optimum First, which I heartily recommend if you are comfortable with all online mortgages.

Might want to consider

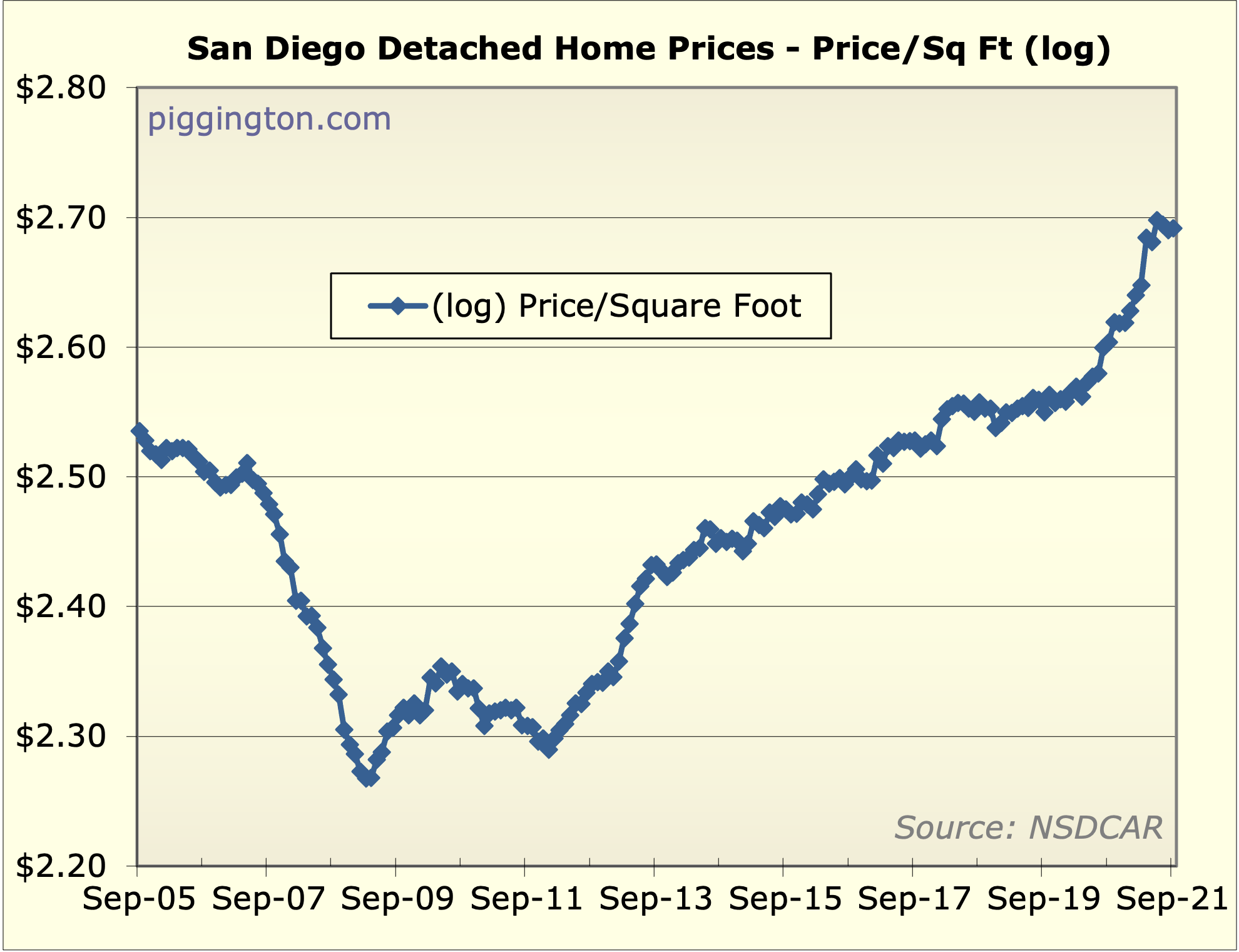

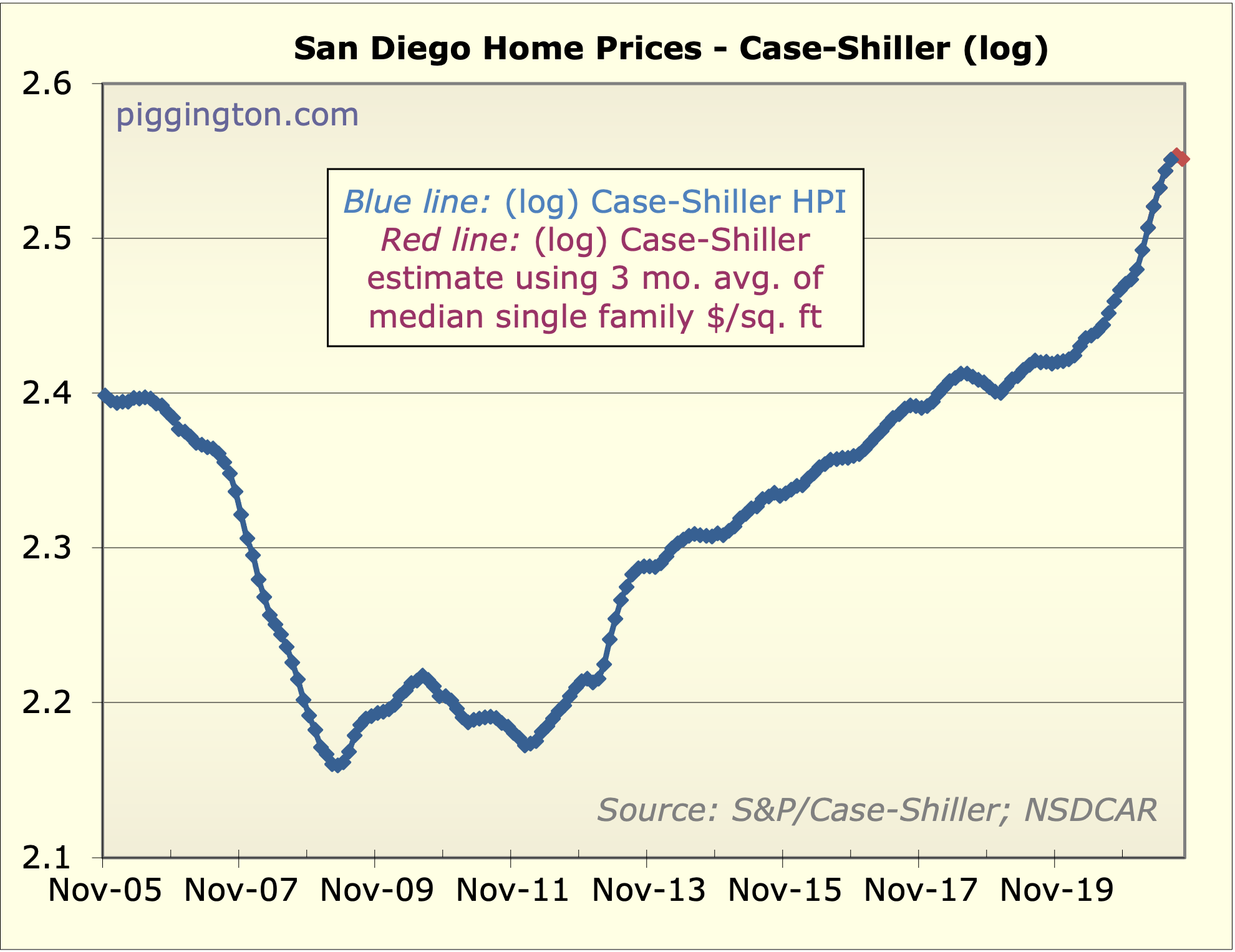

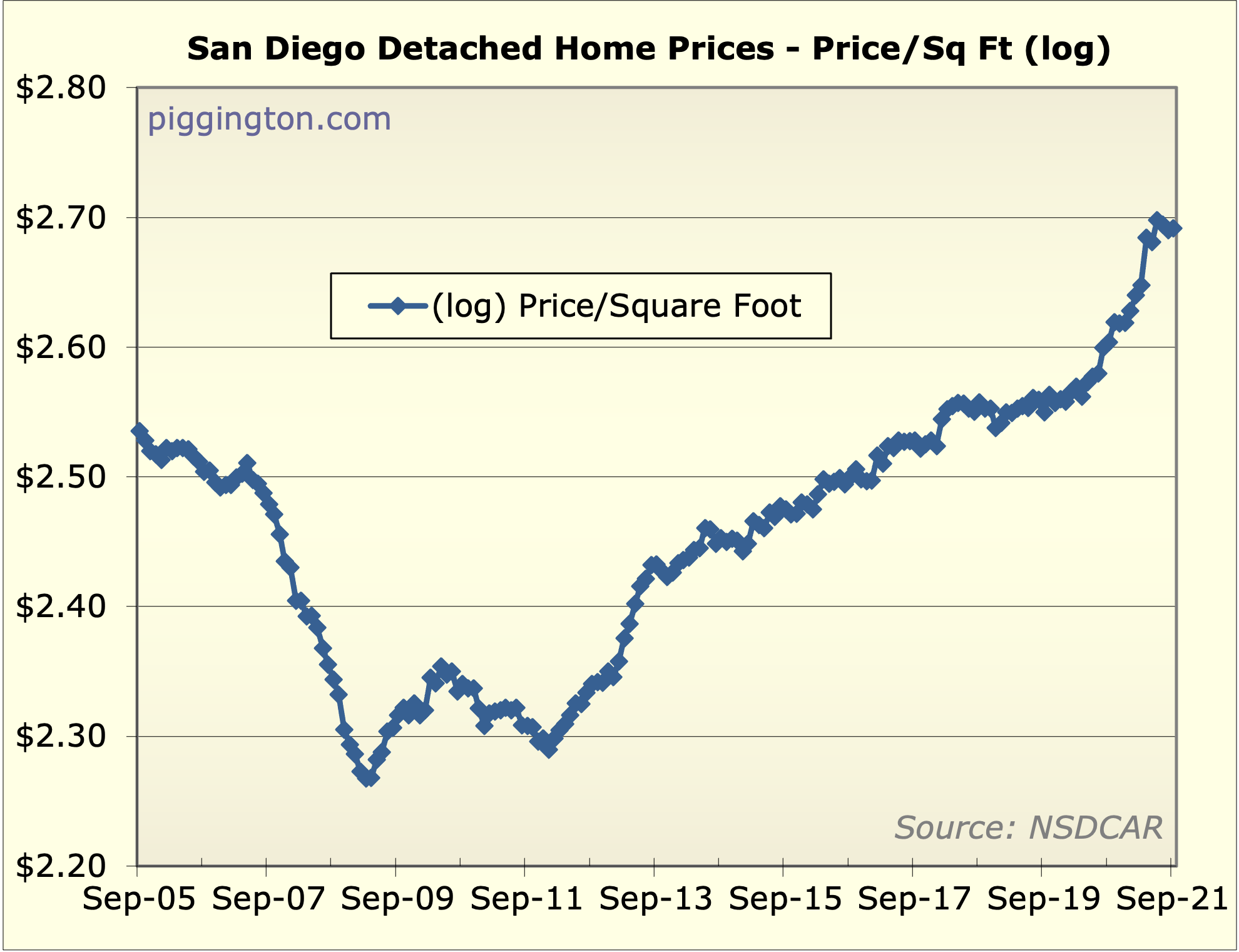

Might want to consider removing the $ from the y axis of the log chart. Turn $500/sqft prices in to $2.70 better to use Excels built in log scale option than that a log of the data and then plot that.

Goofy wrote:Might want to

[quote=Goofy]Might want to consider removing the $ from the y axis of the log chart. Turn $500/sqft prices in to $2.70 better to use Excels built in log scale option than that a log of the data and then plot that.[/quote]

The thing is, log scale axes look terrible in Excel. It looks better to use linear scale, and chart the log number (a tip from a reader). But you are right, I will remove the dollar sign. Thanks for the suggestion!

I’ve been wondering for a

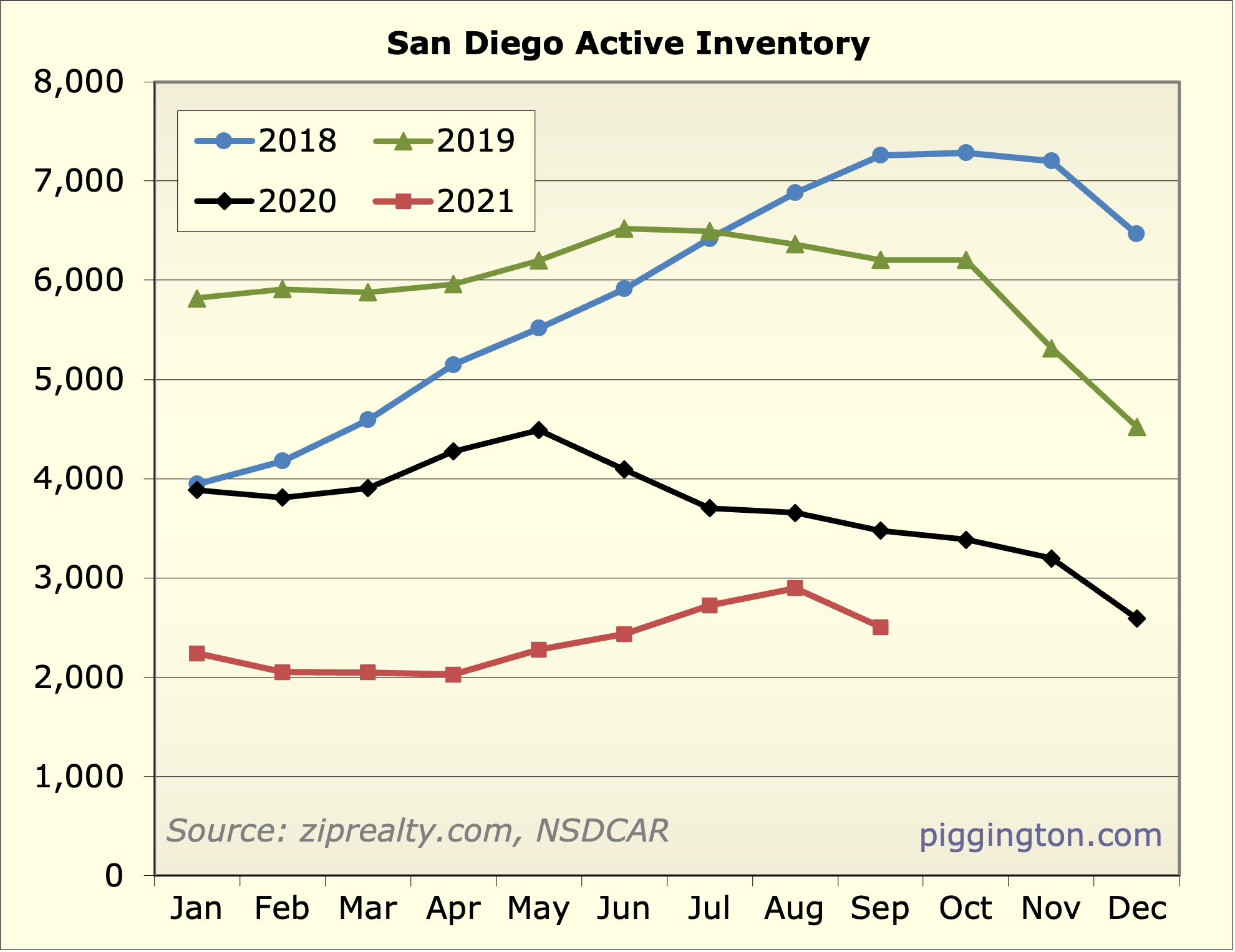

I’ve been wondering for a while if there isn’t some reason we aren’t recognizing why inventory is so low, and if this is a permanent condition. Econ 101 would tell you that with price increases, supply would increase, and demand would decrease but that doesn’t seem to be the case. And when I look at the active inventory chart or the months of inventory chart, while there are ups and downs, the overall long term trend is toward lower inventory.

Is it possible that with new sites like Zillow and Redfin the new normal level of inventory is lower? If so, why? Or maybe sellers are now more likely to ask a not very high price and rely on bidding wars to run up the price? Or is there some other cause that is producing a new normal level of inventory that is lower? If not, why haven’t prices risen enough to cause demand to drop and supply to increase until we reach the normal level of inventory?

I can certainly understand the idea that if demand shot up suddenly inventory would fall and it would take a bit of time for it to return to normal. But low inventory has been a theme for several years now. Isn’t that long enough to adjust? I would think so. So why hasn’t it? Or are we in a world where the new normal is lower inventory than in the past?

RE while seemingly simple on

RE while seemingly simple on the surface is very complex and full of market inefficiencies. A few thoughts

– Appraisals put a cap on prices in short term and restrict ability of demand driven prices to rise enough to create equilibrium

– Who wants to sell when prices are rising rapidly? Your house will be worth more tomorrow…maybe a lot more. The marginal sellers will wait until signs prices are actually starting to fall

– Technology has accelerated the velocity of the market. Houses sell faster and even when more hit the market they come off the market faster so inventory does not rise that fast

– Inventory is rising many places just not here. Around me its off 50% from last year. There seems to be a permanent shift in incremental demand coming here the market cannot satisfy particularly in SFR market

sdrealtor – Do you think that

sdrealtor – Do you think that the way realtors market/price houses has changed and is impacting this?

No. When markets are like

No. When markets are like this we don’t know where the market is and just price to let the market suss it out. It was the same back in 04 with the range prices. It’s all cyclical. What is going on is the market place not the realtors

XBoxBoy wrote:I’ve been

[quote=XBoxBoy]I’ve been wondering for a while if there isn’t some reason we aren’t recognizing why inventory is so low, and if this is a permanent condition. Econ 101 would tell you that with price increases, supply would increase, and demand would decrease but that doesn’t seem to be the case. And when I look at the active inventory chart or the months of inventory chart, while there are ups and downs, the overall long term trend is toward lower inventory.

Is it possible that with new sites like Zillow and Redfin the new normal level of inventory is lower? If so, why? Or maybe sellers are now more likely to ask a not very high price and rely on bidding wars to run up the price? Or is there some other cause that is producing a new normal level of inventory that is lower? If not, why haven’t prices risen enough to cause demand to drop and supply to increase until we reach the normal level of inventory?

I can certainly understand the idea that if demand shot up suddenly inventory would fall and it would take a bit of time for it to return to normal. But low inventory has been a theme for several years now. Isn’t that long enough to adjust? I would think so. So why hasn’t it? Or are we in a world where the new normal is lower inventory than in the past?[/quote]

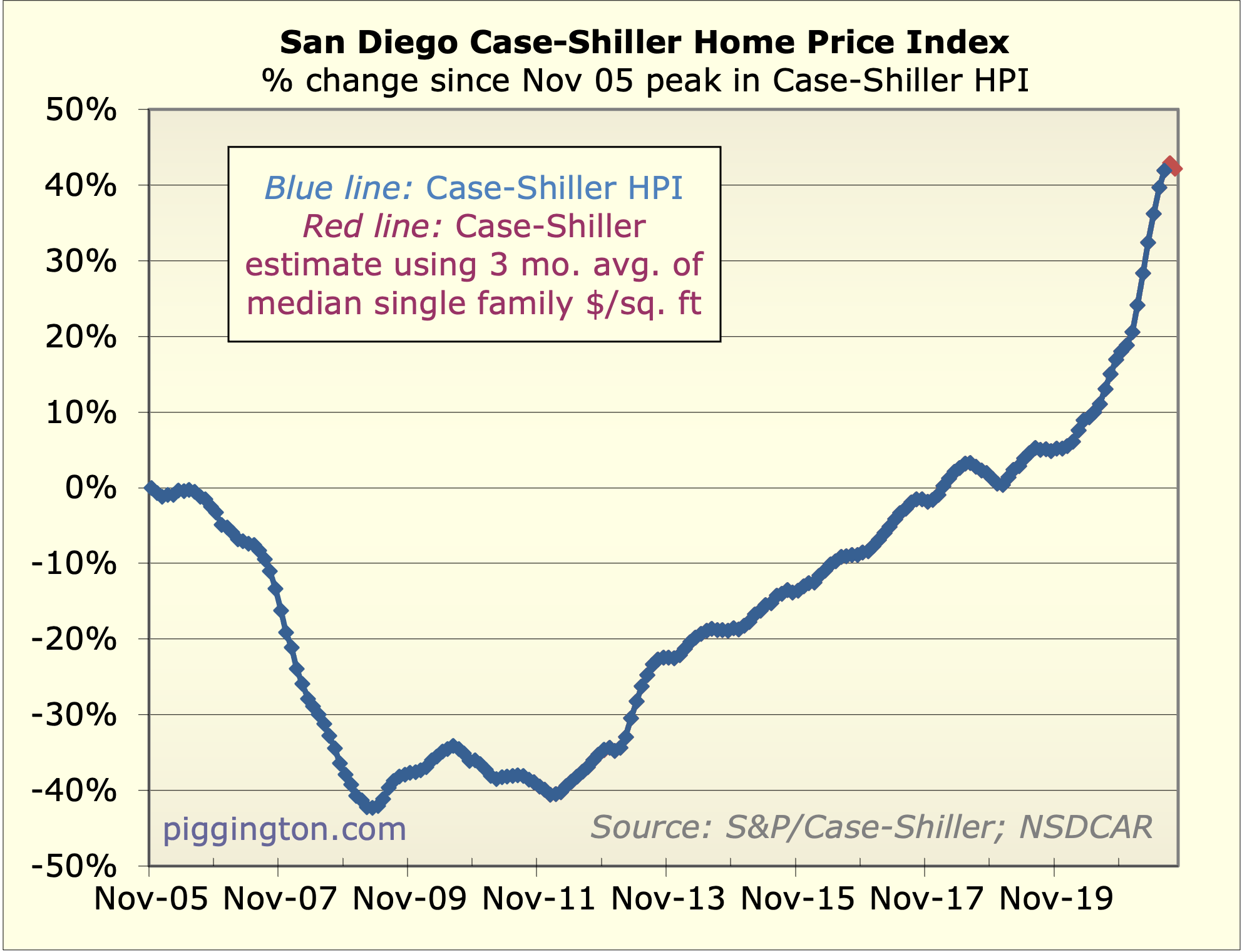

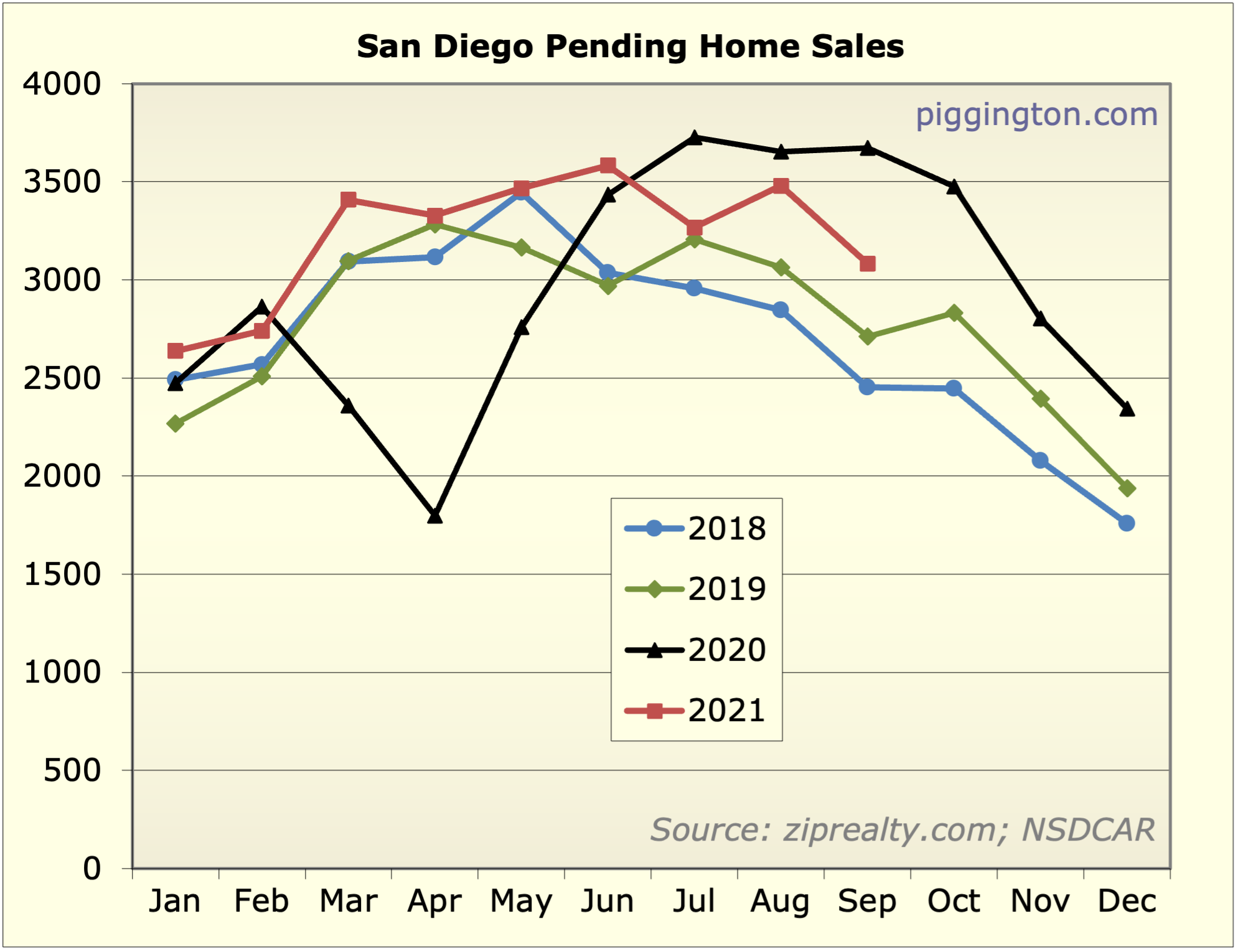

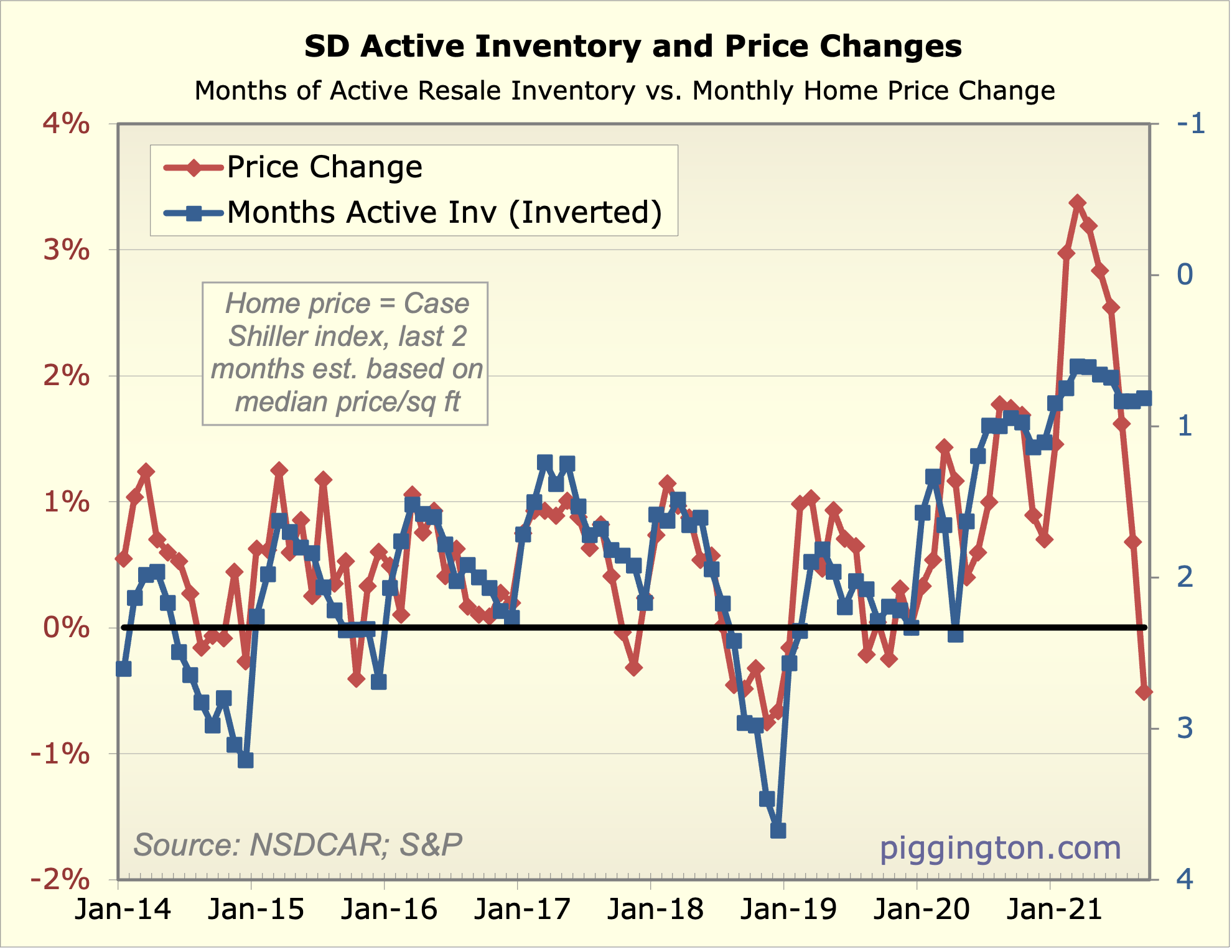

A few years back, gzz observed that there did seem to be a new equilibrium inventory level, likely due to Redfin et al. There’s definitely something to that — it really used to be the case that the equilibrium inventory level was about 6 months. Meaning — at above 6 months prices tended to decline, and below 6 months they tended to rise.

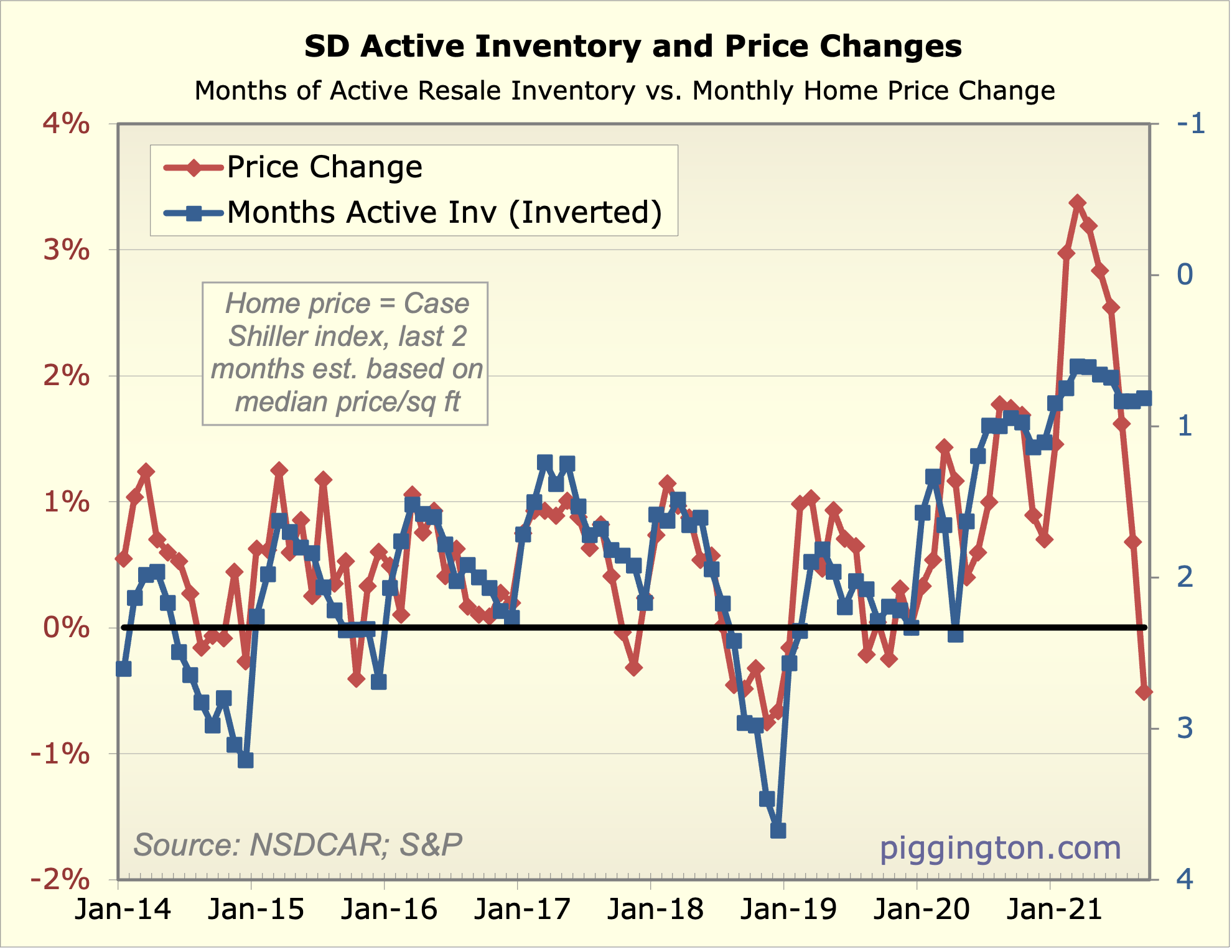

For the better part of the past decade, the equilibrium level appears to have been a good amount lower — somewhere between 2-2.5 months. You can see this in the last chart, which goes back to 2014 and assumes this new level.

My read on this chart is — during the frenzy, inventory got low, but prices overshot even considering. Now they are adjusting back — but we are still at an inventory level that suggests upward price pressure.

However, if there has been a post-pandemic change to the equilibrium inventory level, we’d have to re-examine this relationship.

Reich on inequality. I don’t

Reich on inequality. I don’t completely agree, but he gets right the importance of the trend of extreme increasing inequality.

https://www.eurasiareview.com/12102021-robert-reich-the-real-reason-the-economy-might-collapse-oped/

You all wonder why I say inflation will be tame but San Diego prices will bubble upward? It’s because our RE is a luxury good, status symbol, and trophy investment for wealthy people all around the world, and the wealthy will get a larger and larger share of the income and wealth of the world.

We’re not unique in this regard, but our prices are quite low compared to the others.

Did a recent Zillow

Did a recent Zillow search:

3BR under 1.5M, 1700 sf+

190 homes came up in greater North county

Oddly enough 6 listings owned by Zillow all grouped together.

Price range from 750K to 1M.

I’m sure there are more but notable they have a certain percentage of overall inventory even if it is 1-2%, meaningful.

Sorry folks, I had

Sorry folks, I had accidentally included the prior month’s “SD Active Inventory and Price Change” chart. (The last one). I’ve updated it to include the Sept one. Doesn’t really change the conclusion of what’s going on — still absorbing the overshoot… things are just a little more absorbed than they initially looked.

Great write-up

Great write-up Reeshard…

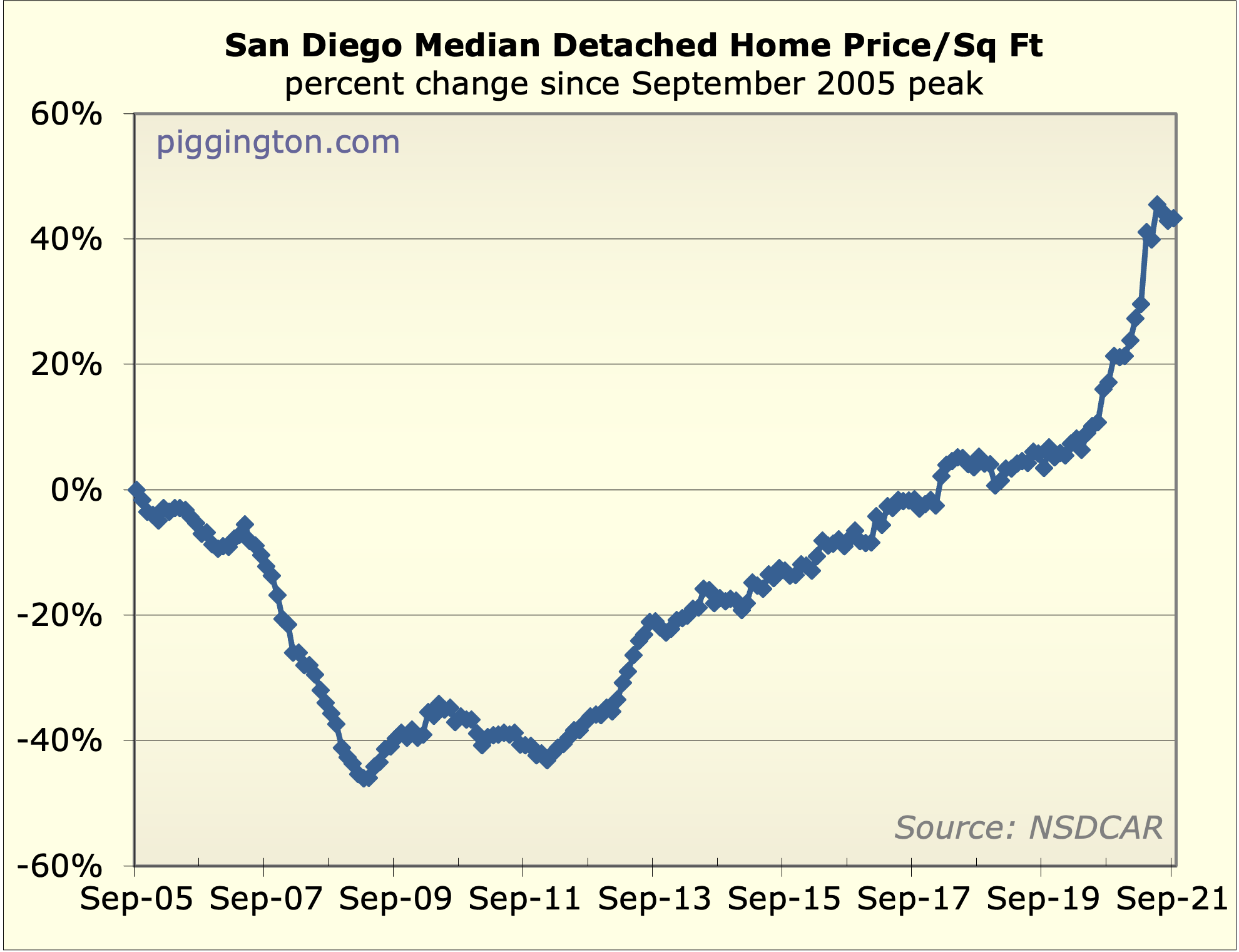

One thought experiment regarding whether or not housing is in a bubble. If you took the oughties bubble and put that peak at prior peaks (around 120 on the rent-to-per capita income), then the historical median would move down to between 90 and 100. In that comparison, we’d definitely be in a bubble at the current ~150. My point is… only in comparison to the last (and biggest by far) bubble is real estate not in a bubble. I don’t find that particularly comforting. Jesus, even down here in Mexico things are on fire… very disconcerting but… such is life.

Thank you sir. Agreed on the

Thank you sir. Agreed on the price-to-income/rent ratio. But the big question to me is… is that really the more relevant ratio? Given that the marginal buyer is typically financing with a fixed rate loan, is the monthly payment to income/rent one more relevant?

Put another way, if rates stay at these levels indefinitely, it could support a higher level of prices/valuations than in the past, I think… in this scenario, the purchase price valuation would be a lot more rational than it looks on that chart. (whether this will happen… I have no idea).

Econ 101 would tell you that

In other markets, higher prices is the cure for higher prices, but not in housing. The higher property value goes, the less likely someone is willing to sell.

Assuming the prospective seller wants to stay in the area, the only way to sell would be to rent, or downsize. Downsizing would cost 6% to sell and probably another 6% to buy, built into the purchase price. Not to mention a permanent higher tax base. And buying in a tight market has headwinds as well.

As for rent, the justification for lots of folks buying is the comparison between buying and renting. But Rent prices cannot go down by construction of the rental moratorium. Even with it ending last month, I believe the courts are not going to be seeing cases until Nov, and even with that we are still in the covid rental assistance period which doesn’t end until march of 22.

I would like to see a chart of historical rental price as a percentage of income for the area. Are these rent prices sustainable without gov assistance?

pinkflamingo wrote:

I would

[quote=pinkflamingo]

I would like to see a chart of historical rental price as a percentage of income for the area. Are these rent prices sustainable without gov assistance?[/quote]

The last chart in this article is pretty much that.

Thanks Rich. Is “CPI SD Rent”

Thanks Rich. Is “CPI SD Rent” rent that is adjusted for inflation? Is income also inflation adjusted?

From that graph it seems that the high rent prices are justified by the increase in income.

CPI Rent actually means the

CPI Rent actually means the rent component of CPI. So it IS inflation, basically, but just of rents. Neither number is adjusted for inflation, since they are just a ratio of each other. (Note: I didn’t update the source but for recent months I’ve been using a different rent index, as the CPI is understating rents due to pandemic distortions).

This is a pretty crude way of looking at it, and there are other factors involved… so rather than say rents are justified, the more anodyne way I’d put it is: compared with average income per person, rents are actually lower than the historic norm.

Thanks for elaborating. I

Thanks for elaborating. I agree.