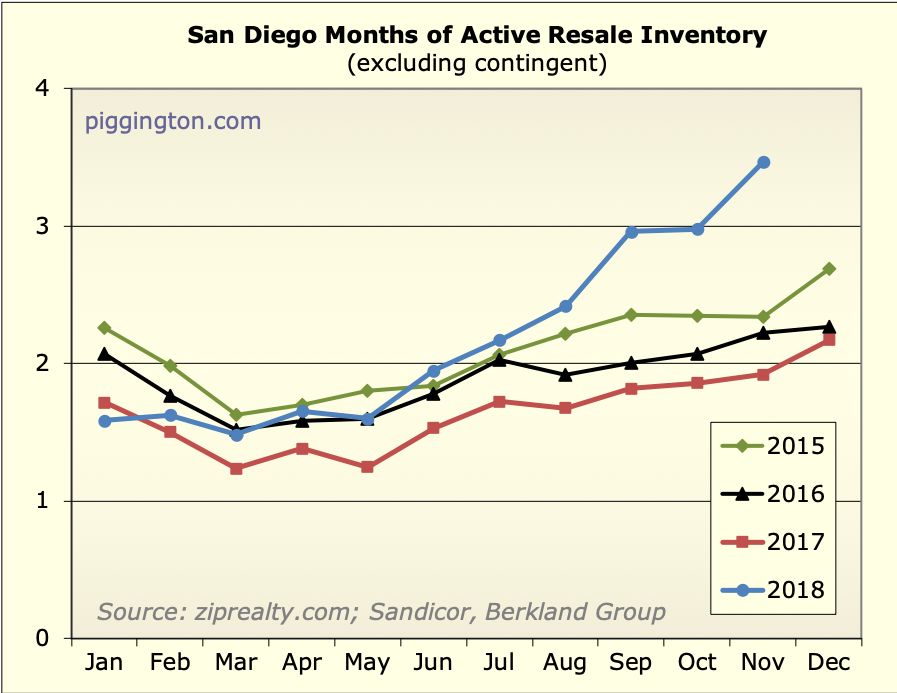

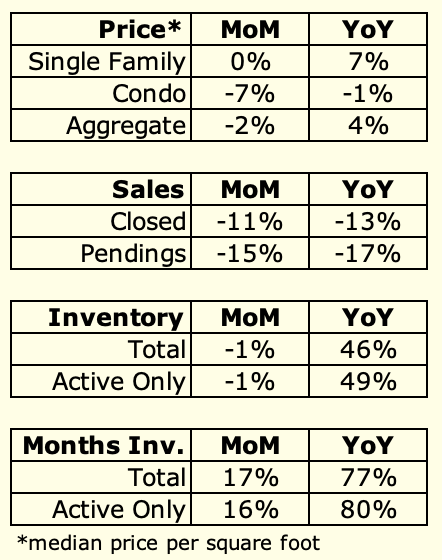

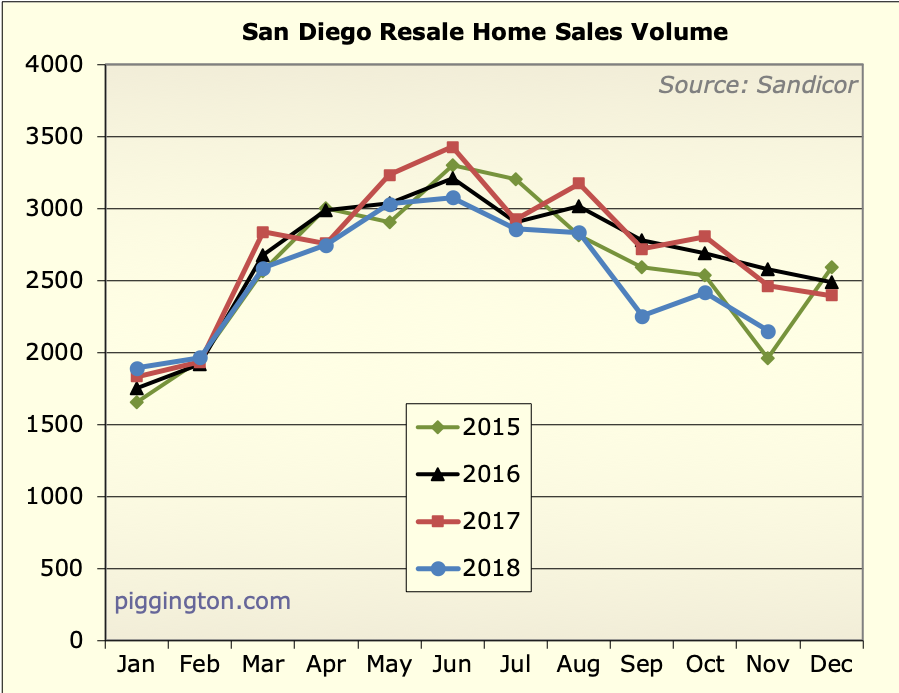

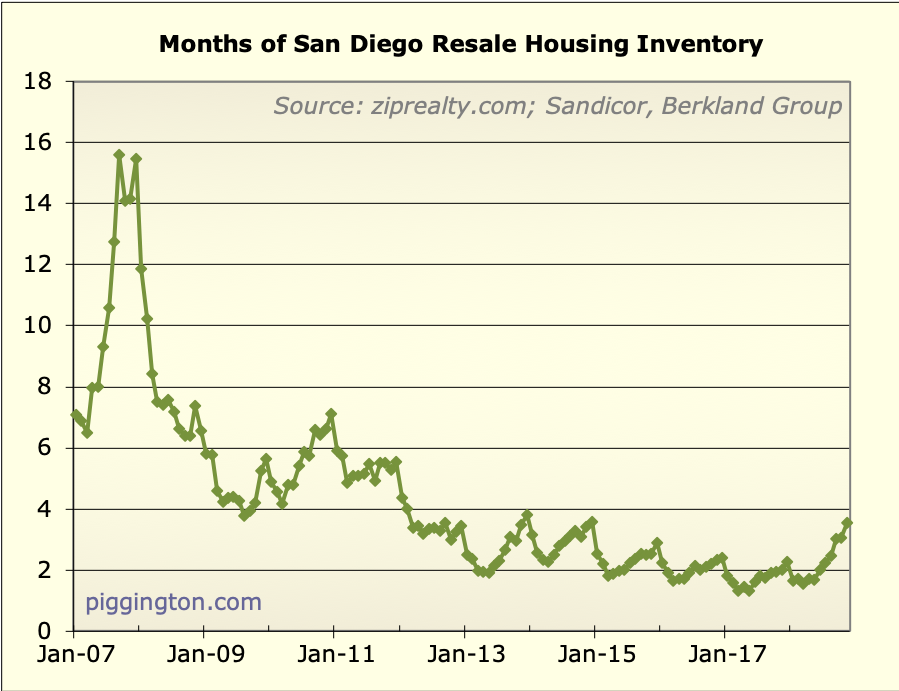

Months of inventory notched up another big increase in November:

This measure of supply vs. demand is now 80% above where it was a

year ago. Granted, that was coming off a very low level. But it just

goes to show how much, and how quickly, things have changed.

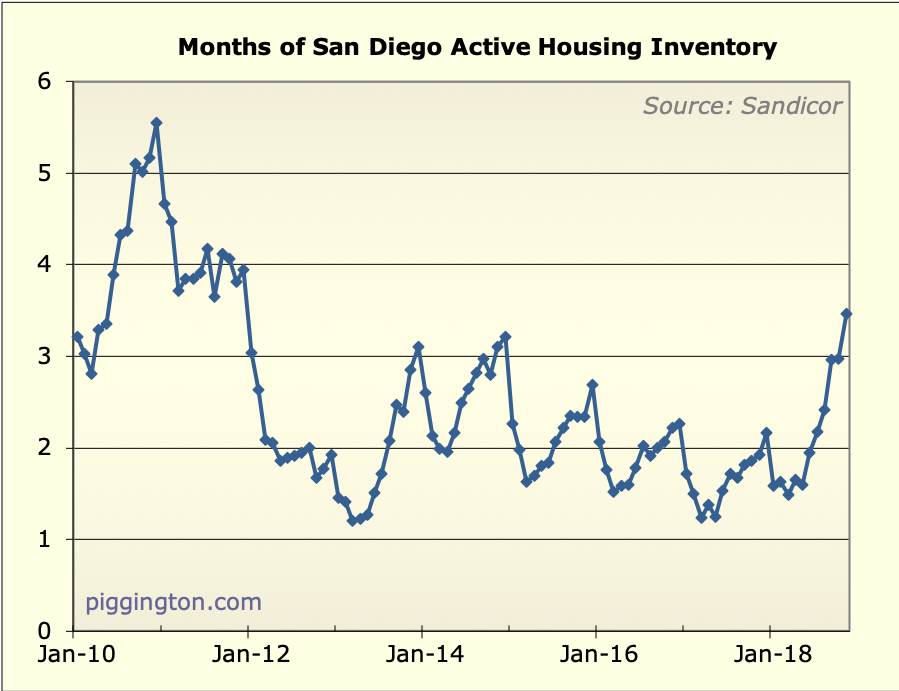

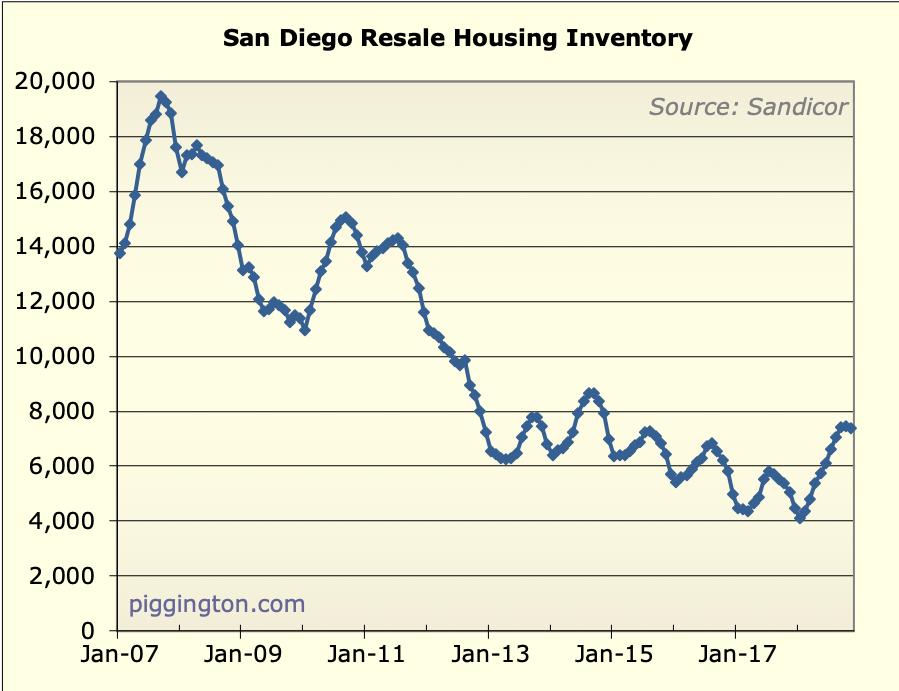

Here’s a longer term view to put that in perspective. It’s not too

far above late-2013 and 2014 levels. But it’s quite a bit above what

the market had gotten to recently — and it is the highest since the

bust ended. (In my view the bust ended in January 2012, which was

when prices reached their inflation-adjusted low).

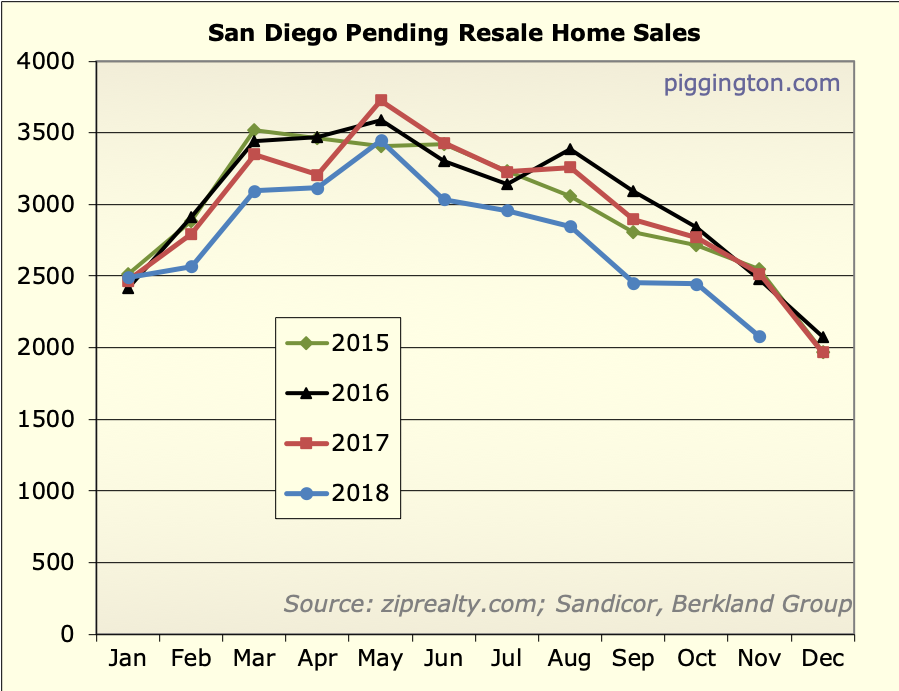

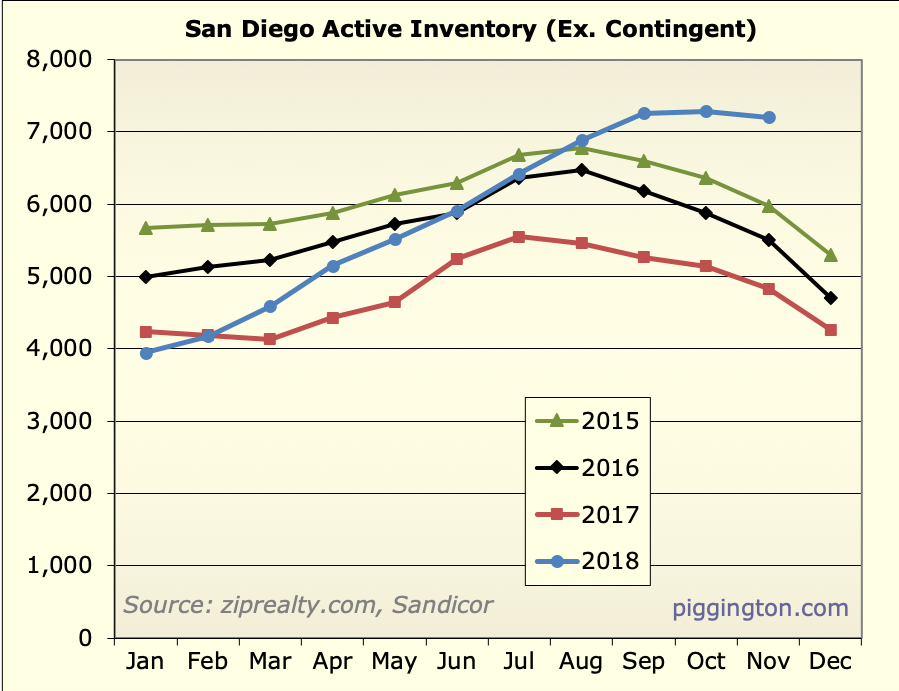

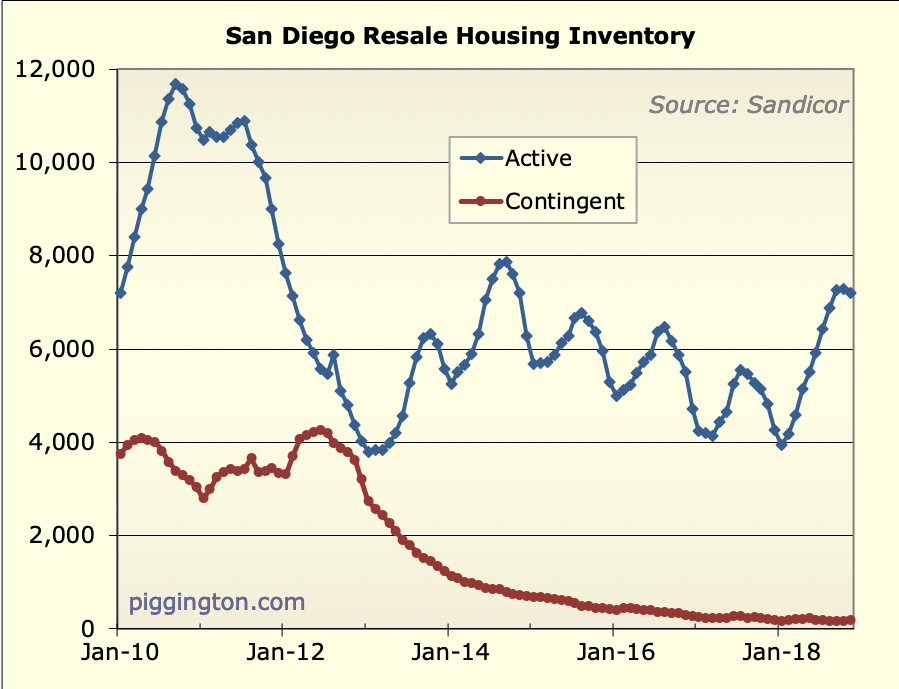

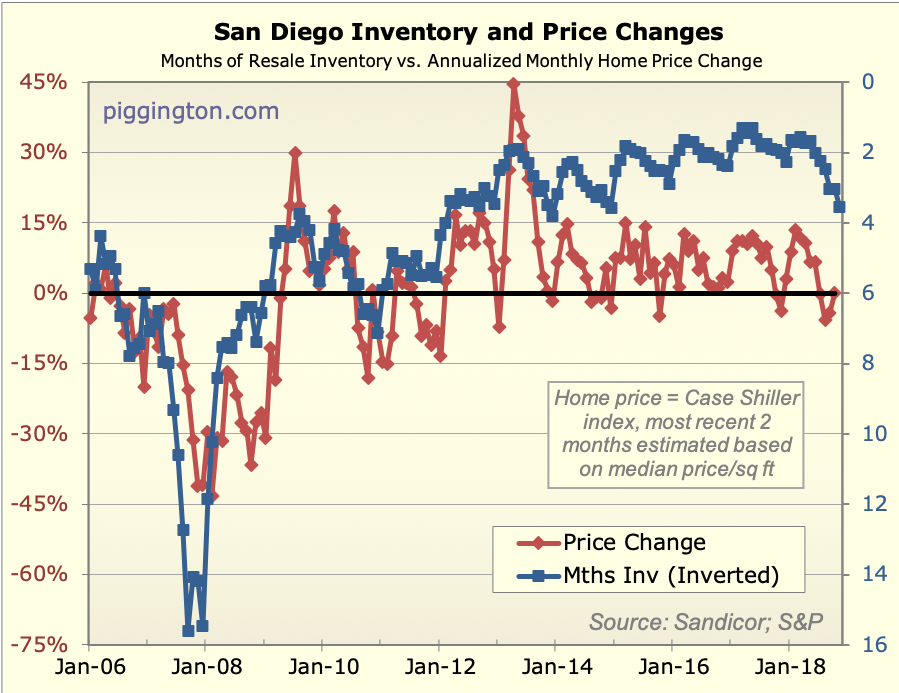

The rise in months of inventory is happening from both sides —

lower sales, and higher inventory. (Though in the case of the

latter, it’s more a matter of inventory holding pretty steady at a

time of year when it would usually be declining).

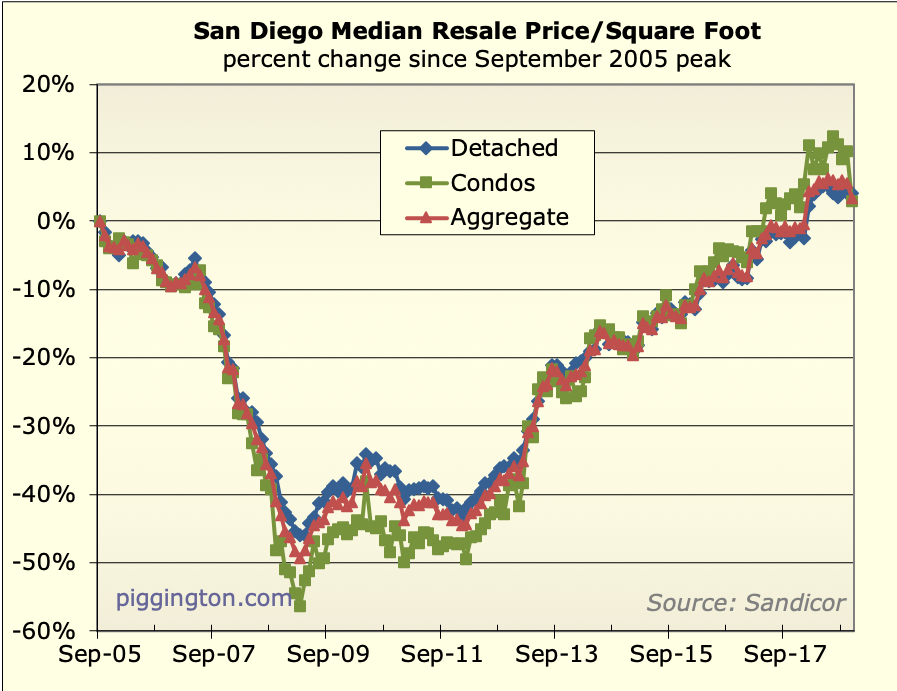

Despite that, prices seem to have held pretty steady. The singly

family price per square foot didn’t budge for the month. (Condos

were down a lot but that is such an erratic series that you can’t

read into a single months’ move).

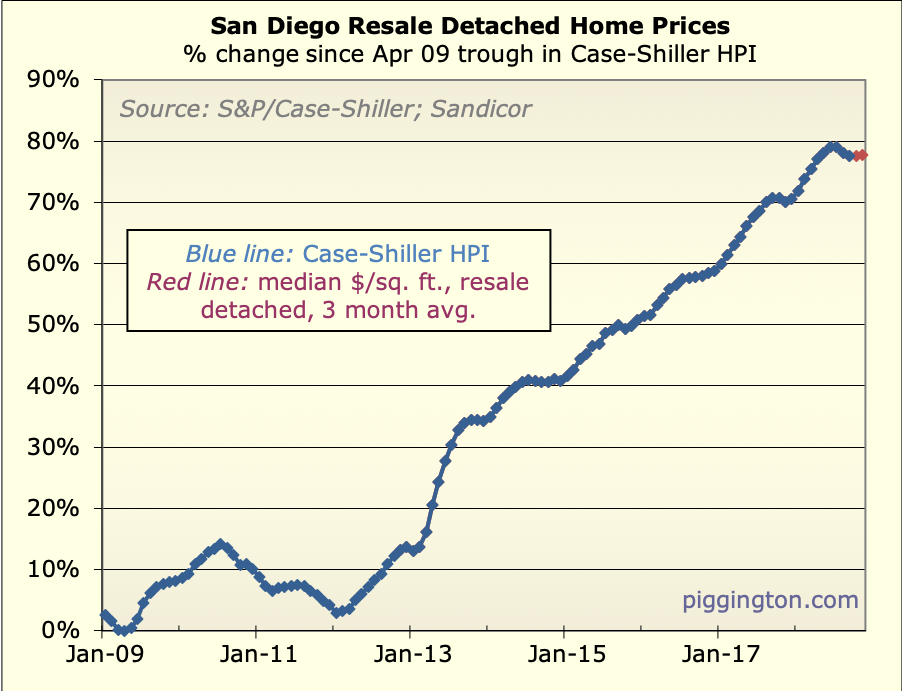

The Case-Shiller “proxy” was actually up a wee bit for the month,

but that’s pretty laggy.

I think we will probably see mild price declines in the months

ahead, based on the level of months of inventory. But that would be

a fairly normal thing for winter. It will get more analytically

interesting in spring, when we get to see how the market reacts to

this huge (relatively) increase in supply vs. demand.

More charts below.

Inventory is going down by

Inventory is going down by the beach:

Nov 4 v Dec 16

PB 131 to 113

OB 58 to 45

LJ 305 to 286

PL 74 to 64

10 Year Treasury Rates, proxy for 30 year mortgage rates, have also gone down from 3.23% in early Nov to 2.89% now. The positive effect of the higher conforming limit will also be felt soon.

Before any downturn in prices there’d be much higher time to sales than now. 3.5 months in the winter really isn’t very long to sell a house.

Meanwhile local rents, incomes, and job growth remain strong:

https://www.multihousingnews.com/post/rental-demand-eclipses-supply-in-san-diego/

I think some headwinds are cancelled developments during the crash got dusted off when prices spiked 2012-2014, and are now hitting the market.

My zip code went from about 5 to 15 condos for sale when a new project was completed on top of Voltaire St.

The coming recession should

The coming recession should fix any positive effect from slightly lower rates. Yield curve just inverted, hold on to your shirts…

The yield curve is not

The yield curve is not inverted and there isn’t the slightest sign of a recession. It wouldn’t matter if it did invert, the Fed wants to raise short term rates and can by fiat, but long term rates are set by market expectations and aren’t going up with it.

Anyway, hypo for you: say the economy does slow and mortgage rates go below 3.5% again. That would be such a large reduction in monthly payments it wouldn’t matter if rent growth slowed to 0. And people with 4%+ mortgages would all refi and be even less likely to sell later. (One reason I am not selling the “planned renovation flips I fell in love with” is the low tax base and sub-4 30 fixed year rate I got.)

Primary residents and small

Primary residents and small investors with 4% rates won’t be able to refi into a good rate if they just got laid off. Especially not if they got a 3% down loan when prices were high and don’t have much equity.

@gzz pretty sure yield curve

@gzz pretty sure yield curve has or was close. it was on marketplace. I love your unbridled optimism. Other news on marketplace.org 50 percent of cfos predict recession by next year and 80 p% predict by 2020.

It isn’t unbridled. After

It isn’t unbridled. After rising rates and several years of 8%ish price increases and 5% rent increases, San Diego condos are around breakeven now as rentals. No longer a no brainer to buy investment property even with conservative assumptions.

Still a no brainer to buy a primary even with the reduced tax break.

I see RE price increases of about 4-5% for the next 2 years, in line with rent increases.

“Recession predictions” have long proved to be worthless.

I was a permabear when I moved to SD in 2005 after I finished law school. Had a 6 figure income but saved and rented until late 2011.

I see rates have given up nearly all of their increases and are at February levels.

Inventory started its upward

Inventory started its upward trend above 2017 levels right about Jan-Feb 2018, even with (relatively) low rates. Instability in markets hurts confidence, and people running scared are a good thing…

We came to San Diego in 2000.

We came to San Diego in 2000. At the time, the stock market had peaked and some people I talked to mentioned that every time stocks had tanked in the past, that people put more money into real estate.

Not saying this will be 100% the case this time, but it does feel like the safer asset.

Many of the most popular stocks are down 20+% and recalling the 2000 tech bubble bursting, many went down 50,60,-80%. Of course, years later there was a recovery, after 9/11, Iraq war, financial crisis etc.

Needless to say, I’m glad there is more housing inventory as I do plan to buy more at reasonable prices. For me the ideal scenario would be very low appreciation rates of 1-2% for a few years which would hopefully be below inflation so effectively a slight decline. If interest rates stay put, that would be potent combination as I don’t see construction catching up with demand.

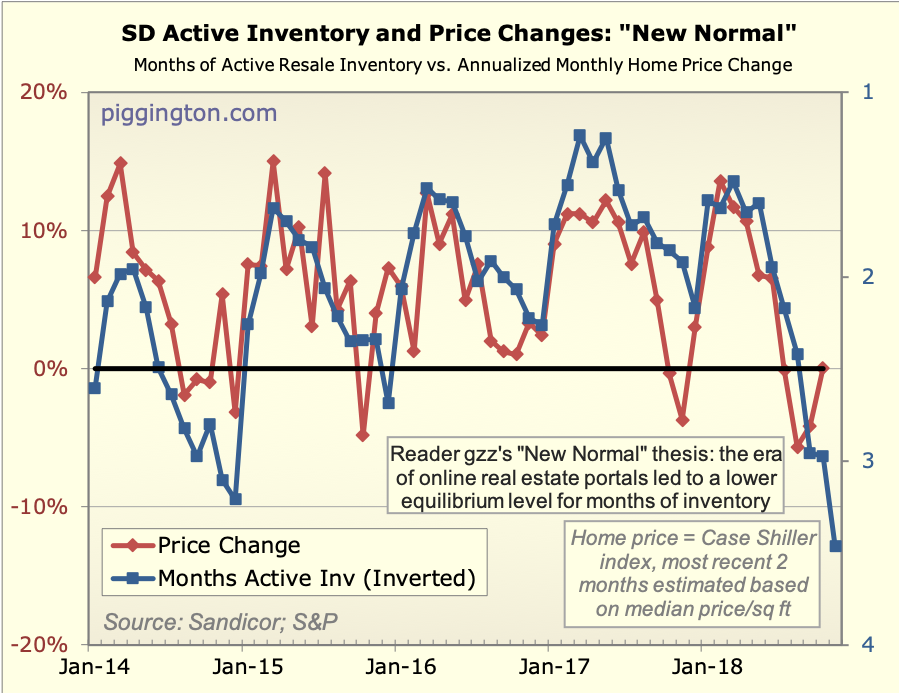

@gzz I look at these these

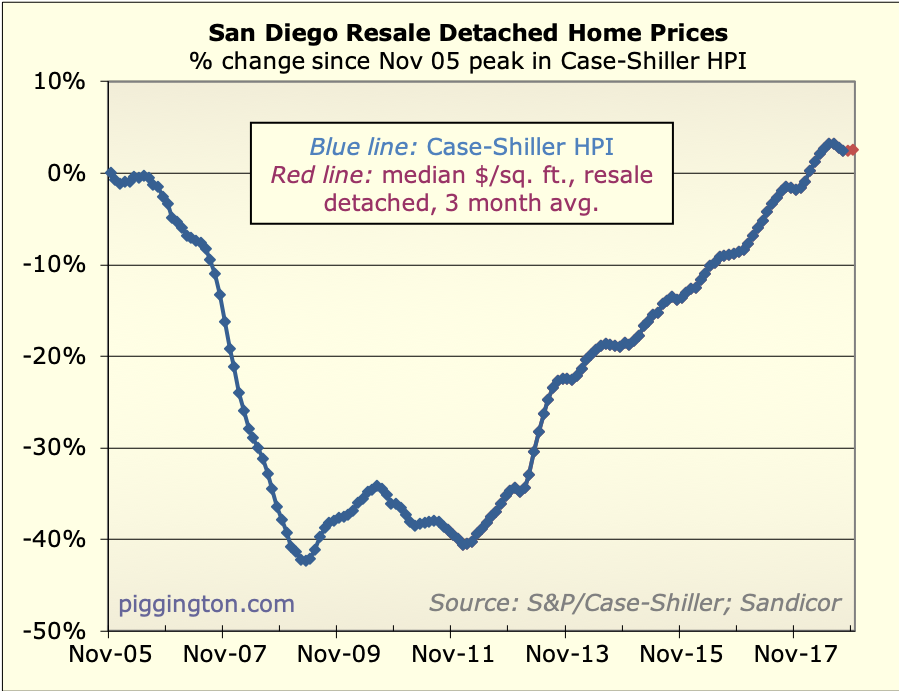

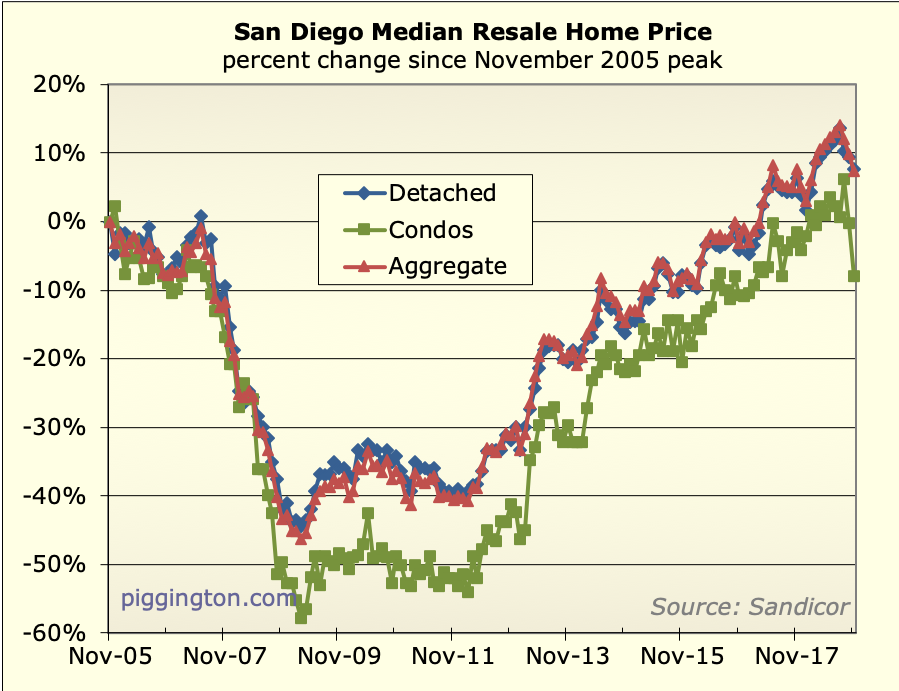

@gzz I look at these these graphs

And remember Rich saying that it always comes back to the historical medium.

The base of your argument is but rent is high. I know rents are high but it is not because people can afford to pay more rent. In fact they can’t, which is why there are ballot measures for rent control.

debt is at it’s all time high

Now it is possible we just have massive inflation and everyone’s wages go up through inflation. But just looking at the cyclic nature of housing/stocks. Even the fed not raising rates are signs that there maybe troubles ahead. Even inflation has it’s own set of issues.

We’ll have to wait and see. But I agree with Rich the graph will hit the historical mean one way or another.

pinkflamingo wrote:@gzz I

[quote=pinkflamingo]@gzz I look at these these graphs

And remember Rich saying that it always comes back to the historical medium.

[/quote]

I didn’t say that. I may have pointed out the fact that it always mean reverted in past cycles, but it’s not my view that it will necessarily do so in the future. Here’s a quote (from here) that better describes how I see it:

[quote=Rich Toscano]

I don’t believe that the market must necessarily revert to the median valuation of the past any time soon (or maybe even ever). While I’m generally a big believer in the mean-reversion of financial market valuations, local real estate markets are a weird enough animal that once in a great while, “this time” actually is “different,” to at least some degree. Structural factors like land constraints, changing demography, etc. could conceivably justify an indefinitely higher (or lower) valuation than the historical norm, and I think it would be irresponsible to just dismiss this possibility.

Nevertheless, it is an objective fact that San Diego housing is significantly more expensive than it typically has been in recent decades. This warrants caution, at the very least.

And while I think we should be open to the idea that higher valuations could be sustainable in the future, I also think that anyone claiming that “this time is different” needs to bring proof to the table, and not just point to current valuations as justification (as we can see, the market sometimes gets it wrong). Given the complexity of the market, this is not an easy thing to prove, nor for that matter to disprove.

[/quote]

Mean reversion is really just

Mean reversion is really just a shorthand for saying, the underlying factors, salaries, interest rates demography and legal restrictions. In point of fact several of those factors have changed dramatically in the last few decades. For instance in the early 2000’s SD built out its last two large pieces of flat open land, Otay and Carmel Valley. No more flat land will permanently drive the cost of construction higher. On the jobs front, San Diego has replaced many low value jobs since the 90’s with much higher paying ones. These factors both argue against a mean reversion, or rather a new mean.

Josh

The “higher paying job” thing

The “higher paying job” thing is accounted for, as incomes are in the denominator of the valuation measure. But yeah, the land constraint thing is the kind of thing that could permanently change sustainable valuations.

Regarding mean

Regarding mean reversion…

Interest rates appear to be permanently lower in the USA and everywhere else in the developed world compared to 1960-2008. That means housing is more valuable because the return on alternative investments is weaker. For the same reason I don’t expect any sort of long-term mean reversion in US stock PE ratios.

This is partly based on demographic changes: fewer working young people driving household formation and wanting to borrow.

It is also based on what appears to be a permanent increase in income inequality. Rich people save more, the “borrowing class” of credit-worthy middle class Americans is shrinking.

It is also based on overall income increases. There are inferior, normal, and luxury goods. San Diego housing is, in aggregate, a normal to luxury good.** Technical definitions here:

http://www.econport.org/content/handbook/Elasticity/Income-Elasticity.html

Finally, a growing share of worldwide income is in China, where household savings is extremely high. Those savings come here directly by way of Chinese housebuying in California, but also drive down rates and drive up prices because the amount of loanable funds is increasing worldwide faster than the demand for loans. Likewise, the big demand for loans that came from Southern Europe in the 90’s and 00’s seems to have permanently evaporated, even among the smaller share of that bloc that is creditworthy.

To see the impact of this, look at the share of world income in Italy/Spain/Greece v China in 2000 v 2019. The big saving country now has a much bigger share than the big spending countries.

**Rich people save such a large share of their marginal income, all or virtually all of their spending is technically on inferior goods. However, even for this group, housing is probably the “least inferior” of any of their major spending categories. When looking at rich people spending, it might make sense to use “percentage of spending” income elasticity rather than normal income elasticity.

In 1999, Italy still had a

In 1999, Italy still had a larger nominal GDP than China. It was passed by China in 2000, but they remained close until 2004. Now China’s GDP is 6 times larger.

Some additional happy

Some additional happy economic news:

1. 2018 economic growth appears to be 2.9%. That ties the strongest economic growth the US has had since 2005, when growth hit 3.5%.

2. Unemployment claims are at 45+ year lows, and that is without adjusting for population growth. The share of Americans making unemployment claims might be lower than any time in postwar history!

3. Treasury rates went down again today, to 2.55%. That is 0.7% below the 52-week high, and close to the 52-week low (already an 11-month low). We are getting to the point that a significant number of home buyers from 2018 can get additional monthly cash by doing a refi. So can people who purchased during the late 2013/early 2014 rate spike that lasted about 8 months.

So can people who might have a higher rate because of temporary bad credit or low down payment. They now have a great opportunity to do a 20 or 25% equity refi. Even at the same rate, if they can dump their mortgage insurance, that is saving them on average several hundred dollars a month.

Even if rates go back up in 2 months, many Americans will use this as a chance to lock in a much lower monthly payment for 30 years.

Tick … tock … tick …

Tick … tock … tick … tock …

Yield curve from 1 yr to 7 yr now inverted. 10 yr treasury back up to 2.66% (it was at 2.55% only briefly).

ISM manufacturing index partying like it’s 2008.

Those two are leading indicators, employment data tend to be lagging. Wait for the reaction when unemployment claims from the contractors affected by the government shutdown start coming in this month. Guess they won’t be buying houses either if they’re not paid.

30 year rates are still higher than they were at the beginning of last year, more or less at Aug-Sept levels. August and September were already slowdown months compared to 2017, so it’s unlikely that reversion to rates near 4.5% (30yr) will fix much.

This will be highly entertaining, anyway!

Sorry Rich. Didn’t mean to

Sorry Rich. Didn’t mean to put words in your mouth. And no one can predict the future but in the past, housing has always mean reverted. In other words, housing is more expensive compared to income, which puts more people at risk of default. One thing that was tracked in the last housing downfall was short sales and foreclosures. Rich can you please include an update on defaults?

There are multiple markers that seems to point that a recession/correction is not too far away for the economy. A turbulent overvalued stock market, inversion of the yield curve. It will be interesting to see how it affects the housing in sd.

Land contraints is interesting albeit I can’t help but wonder that areas with even tighter land constraints were not immune to housing cycles; the bay area for example.

It will be interesting to watch and see what happens in the next 2 years.

It is not true that “housing

It is not true that “housing has always mean reverted.”

Housing price ratios are more likely to revert because they include, some, but not all of the factors that drive prices. But they still often don’t. For example, Rich’s graph accounts for rent and income growth, but not population growth, land availablity, declining preferred household size, construction and permitting costs, tax incentives, and many others. His payment/affordability graph usefully accounts for interest rates.

Quoting rich “I may have

Quoting rich “I may have pointed out the fact that it always mean reverted in past cycles,” not claiming that it will. Will have to wait and see.