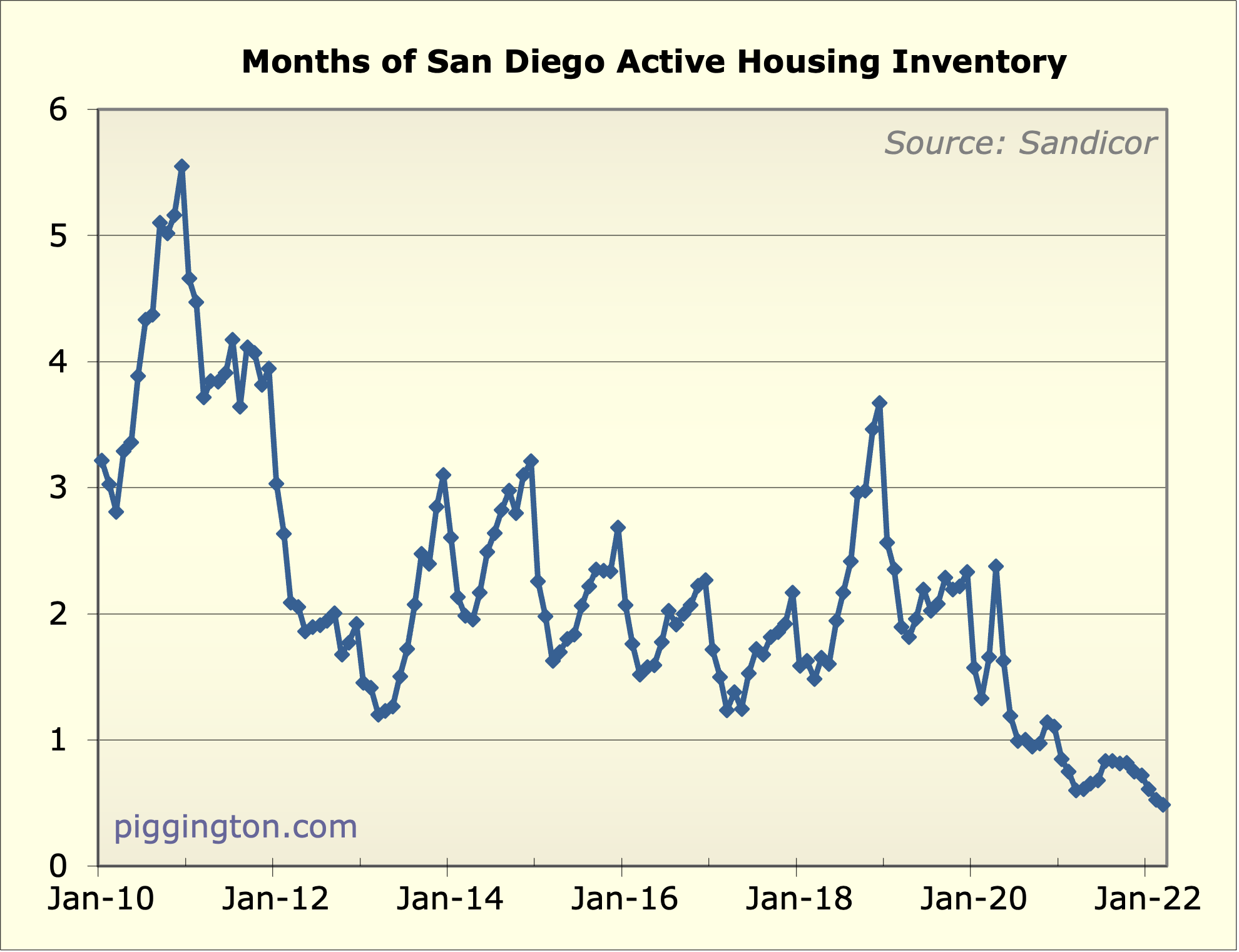

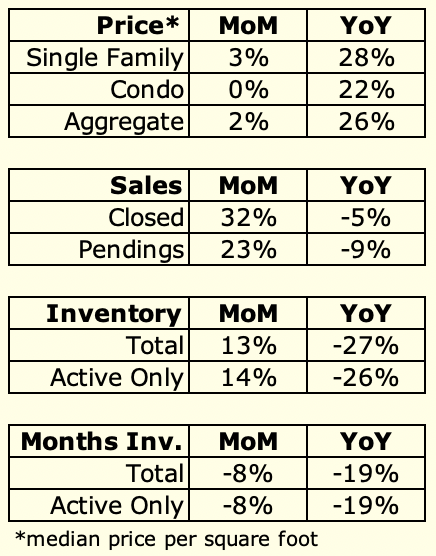

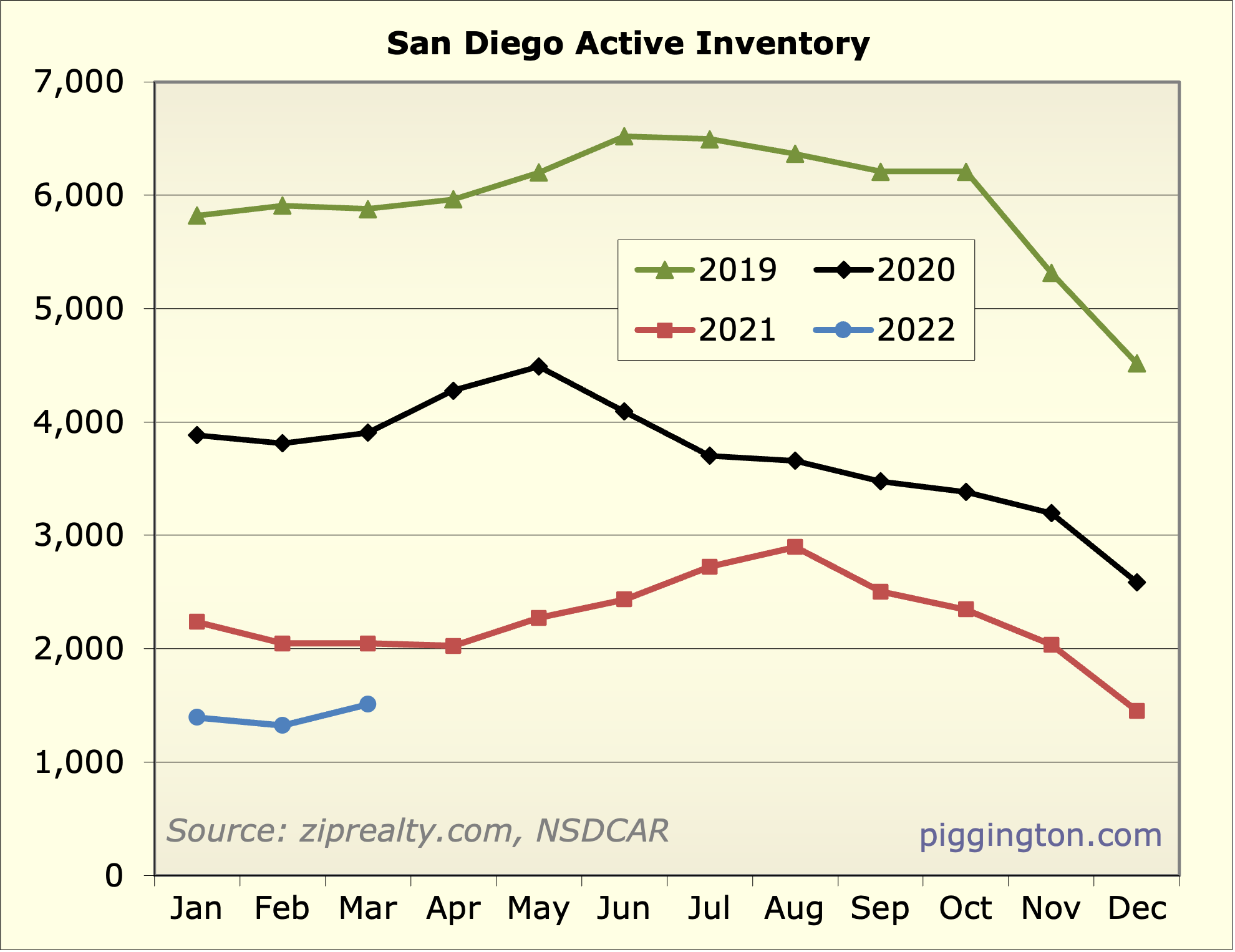

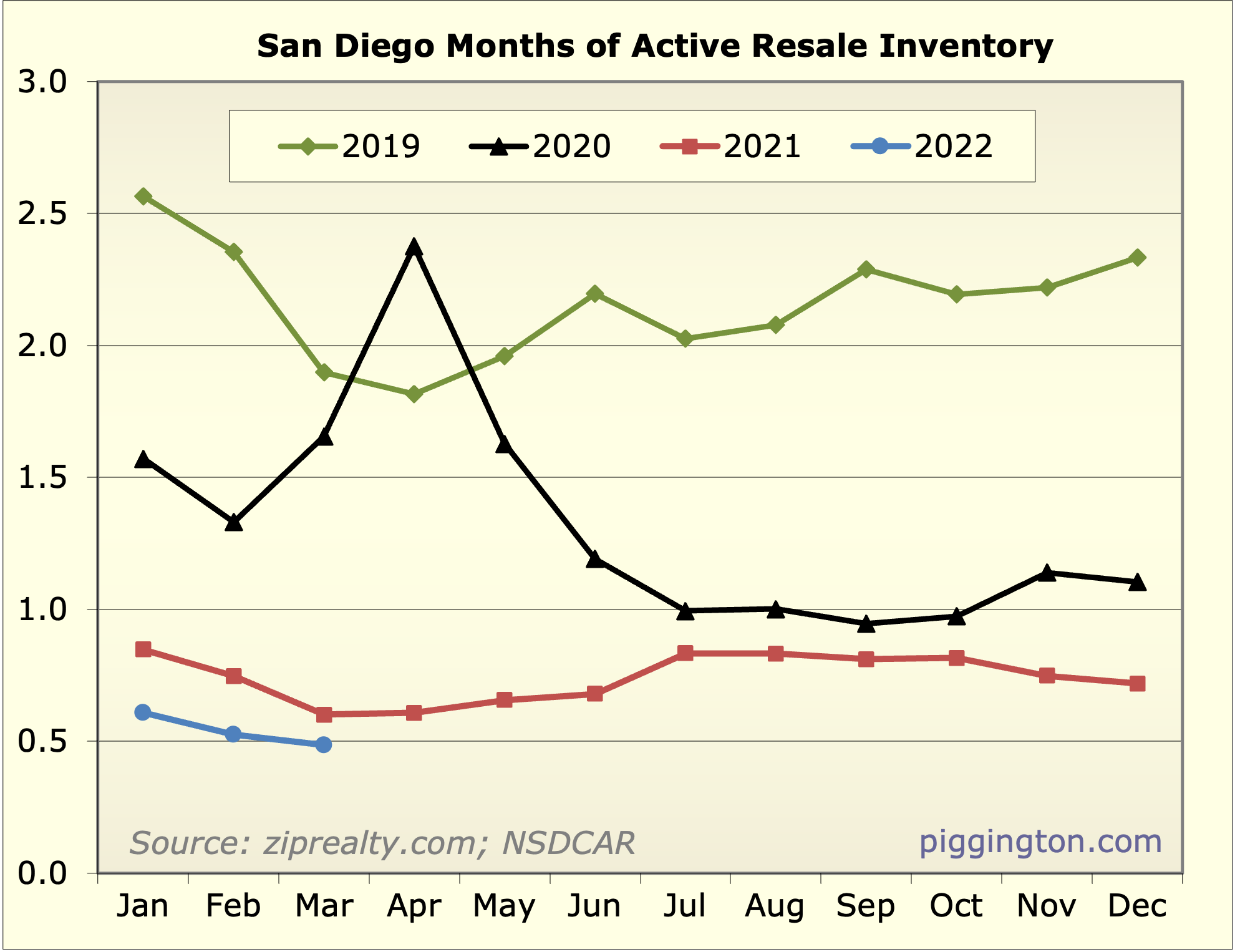

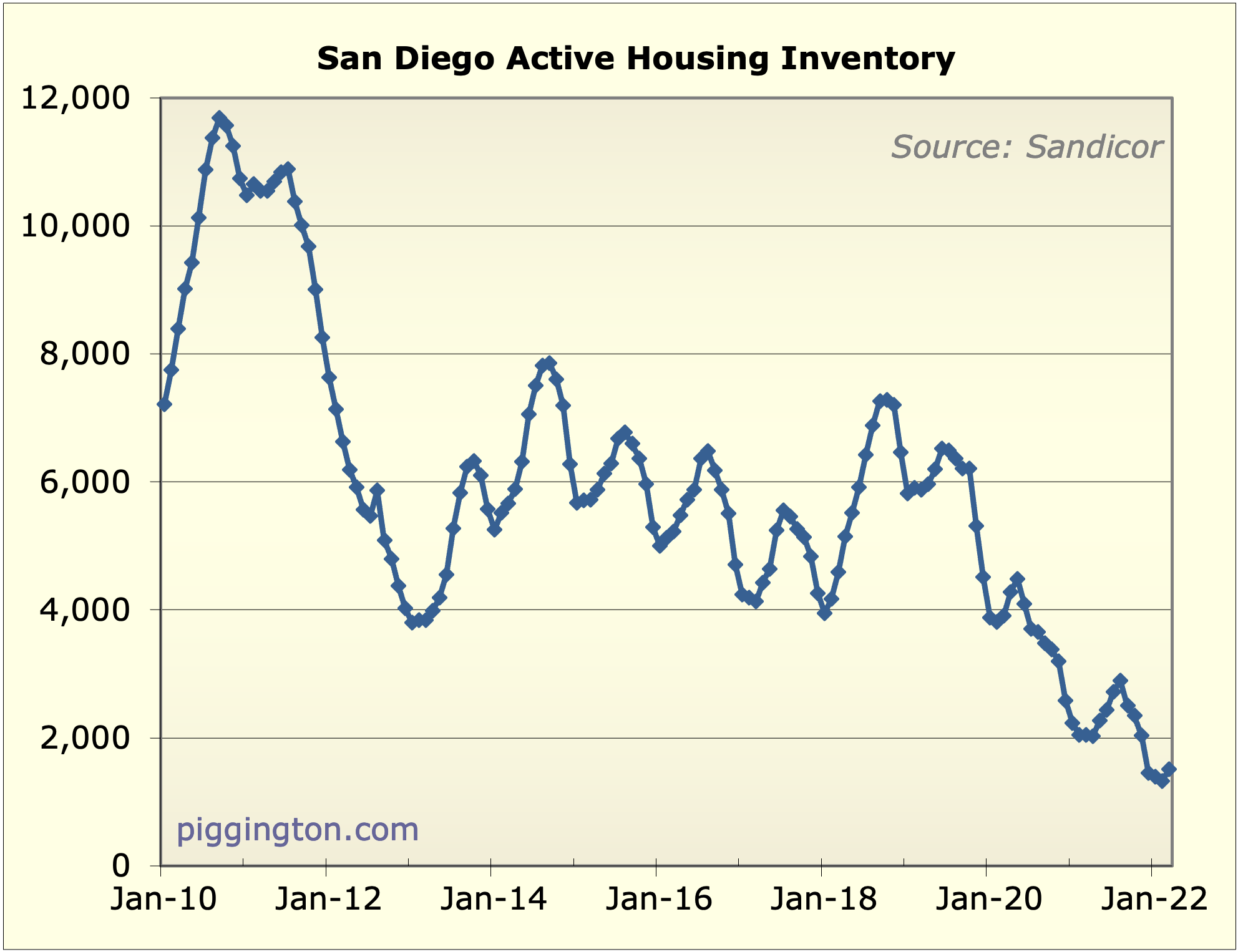

As of March, there was still nothing for sale. In fact we hit an

all-time (in my data) low in months of inventory:

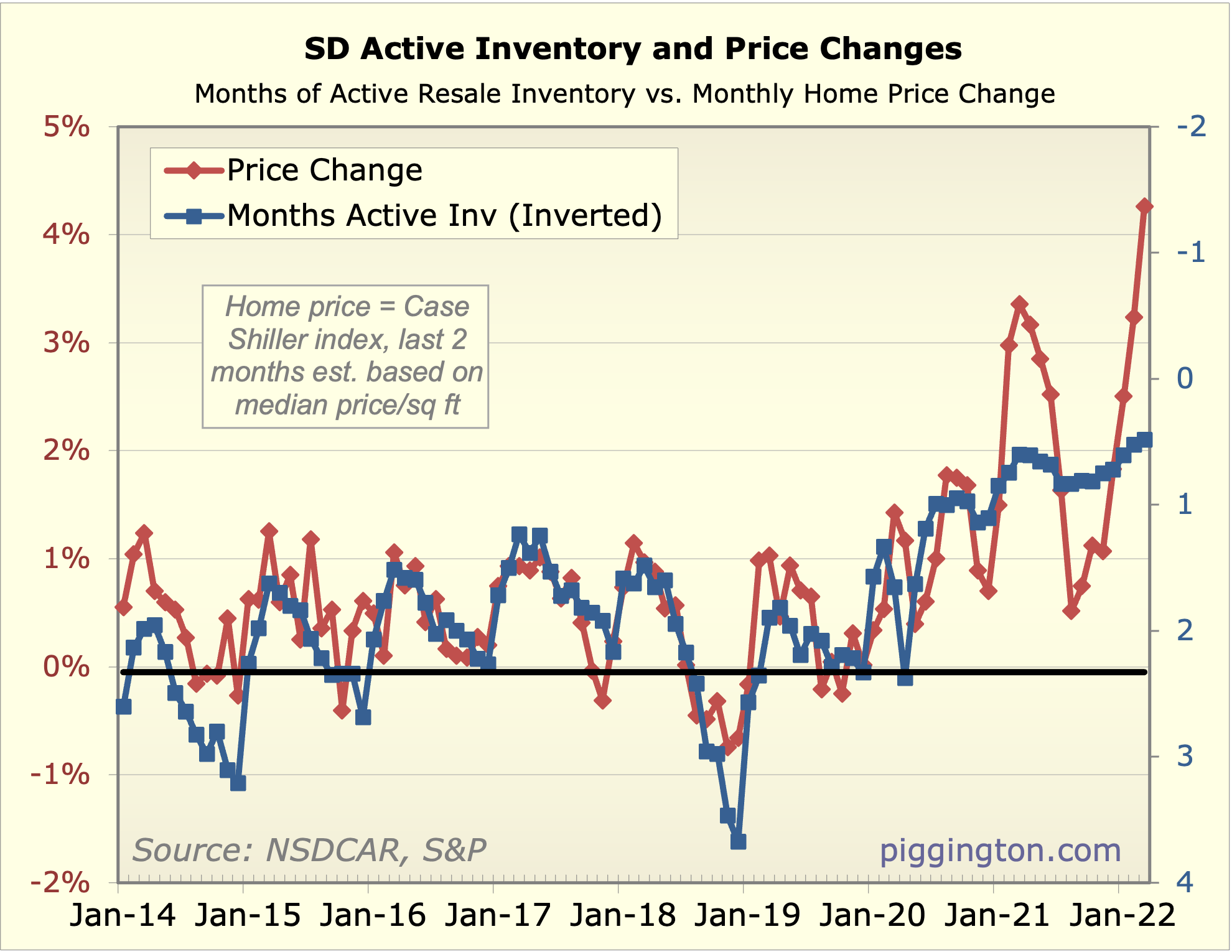

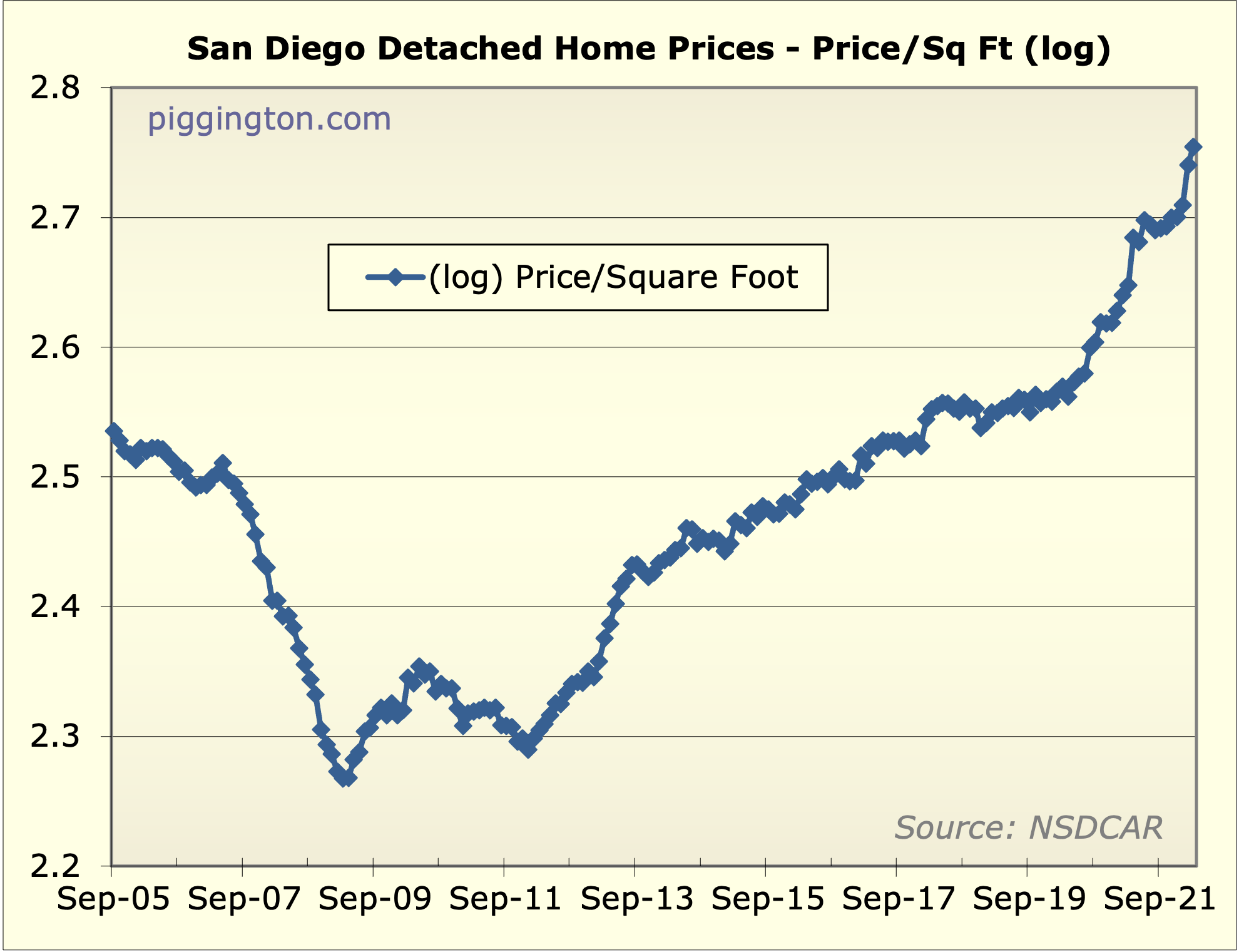

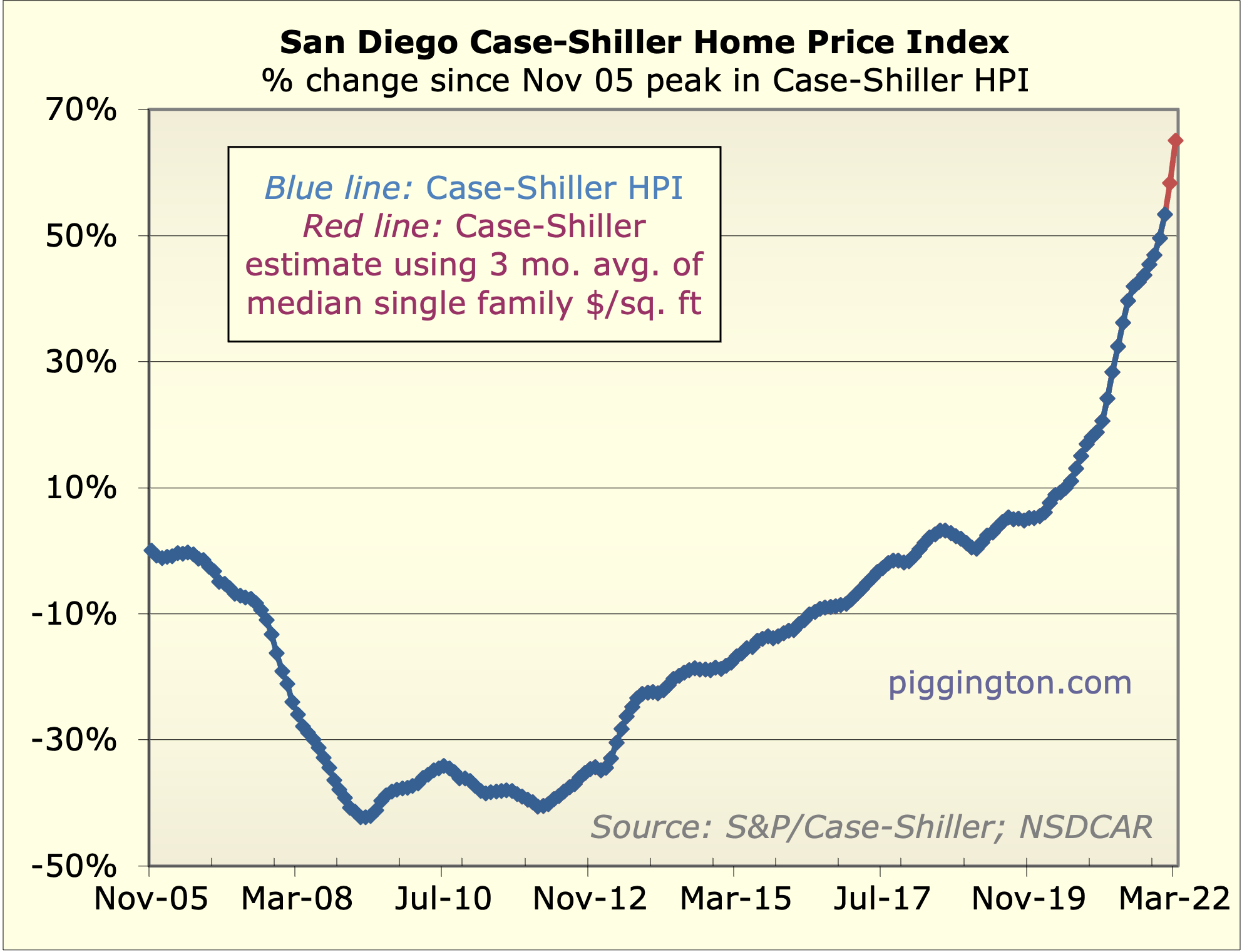

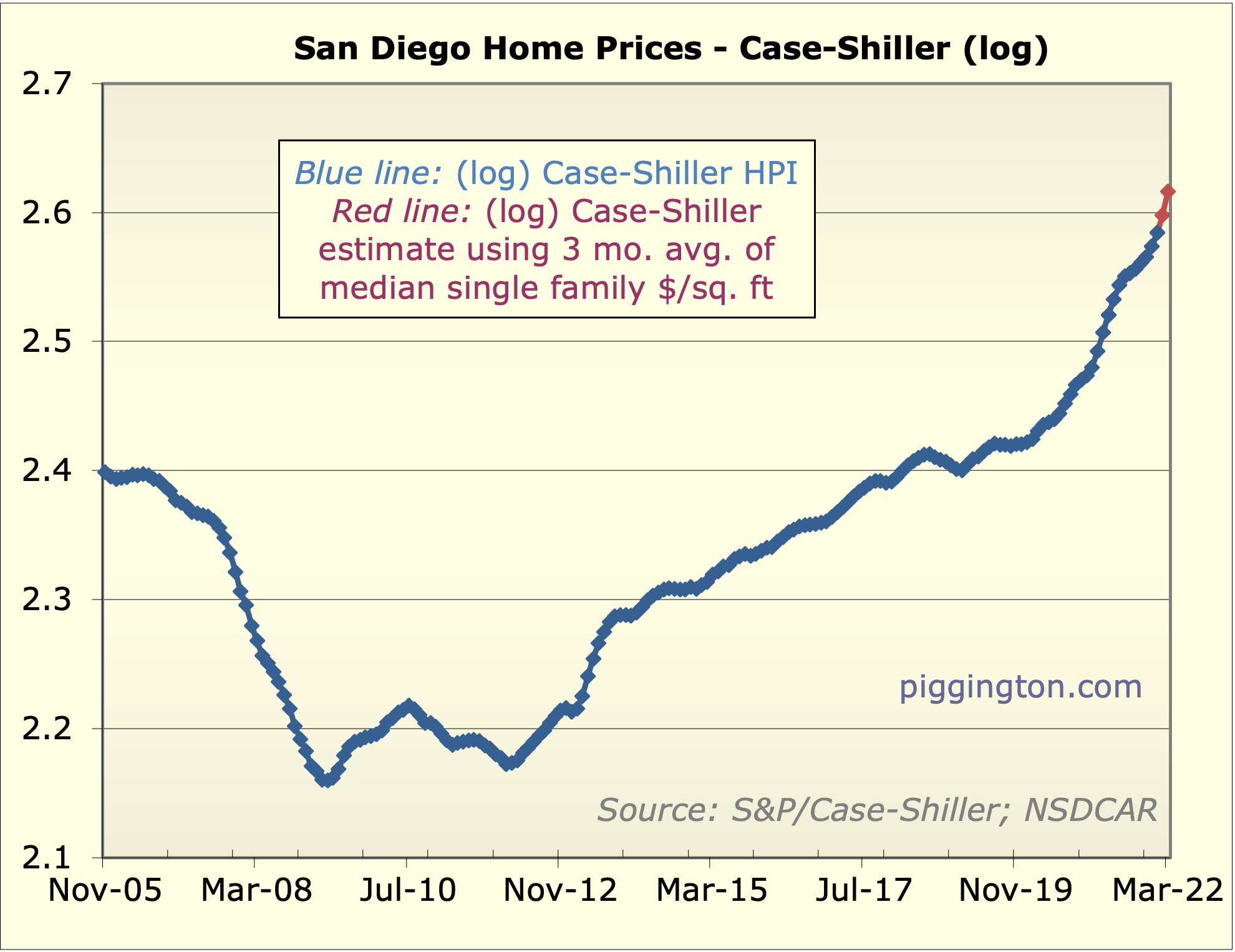

Prices rose accordingly:

Speaking of things going up really fast — 30 year mortgage

rates just hit 5%. This was at 2.9% 6 months ago! This is a violent

move, and because it started from such a low level, has a major

impact on monthly payments. I’ve made a couple charts to try to

visualize this impact.

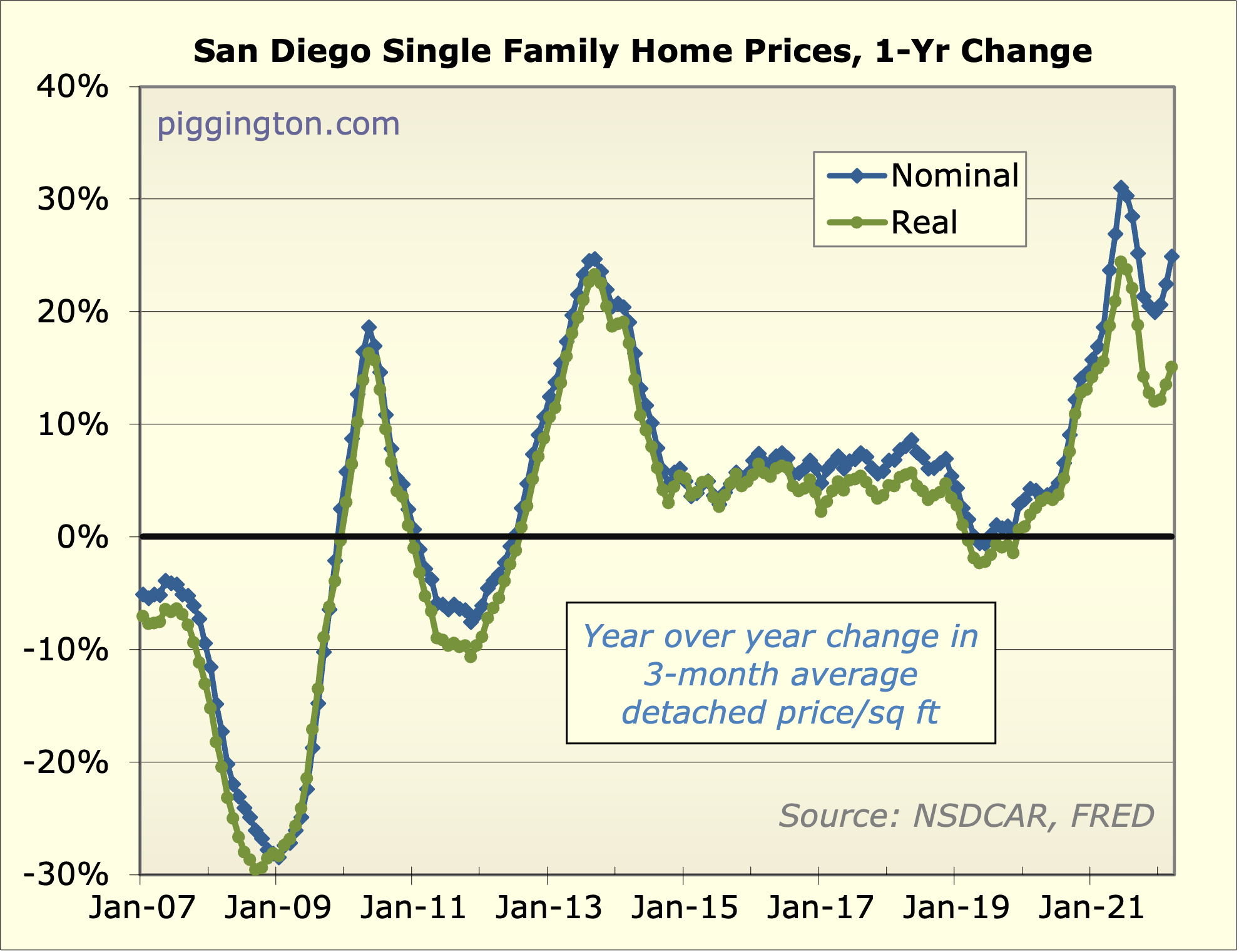

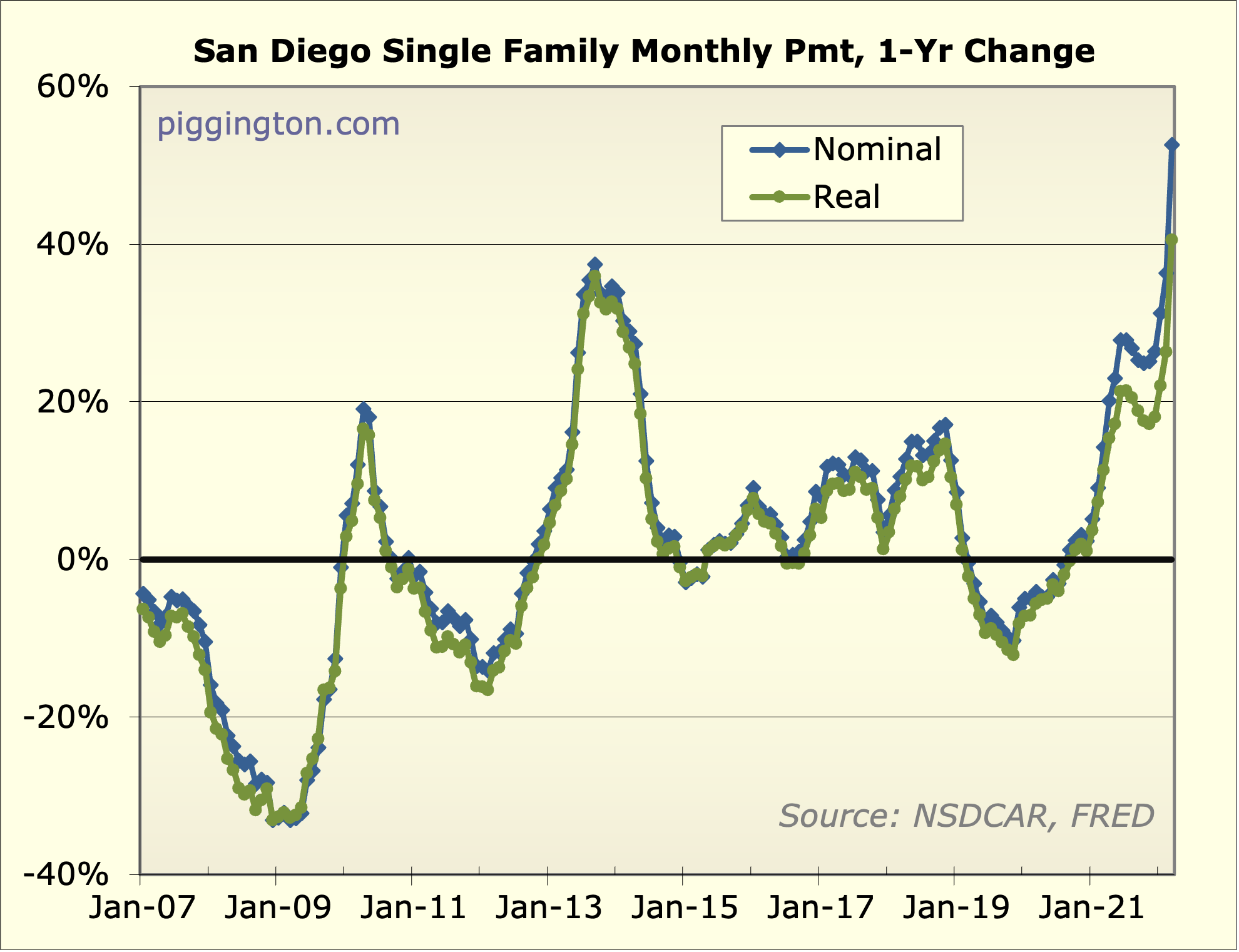

First, here is the year-over-year change in the monthly

payment (nominal and inflation-adjusted) on a San Diego home going

back about 15 years.

You can see that affordability has taken a massive hit — even

adjusting for inflation, monthly payments are up over 40% over the

past year.

There is a seemingly comforting aspect to this chart, though: we

experienced a similar rate of change back in 2013, and things were

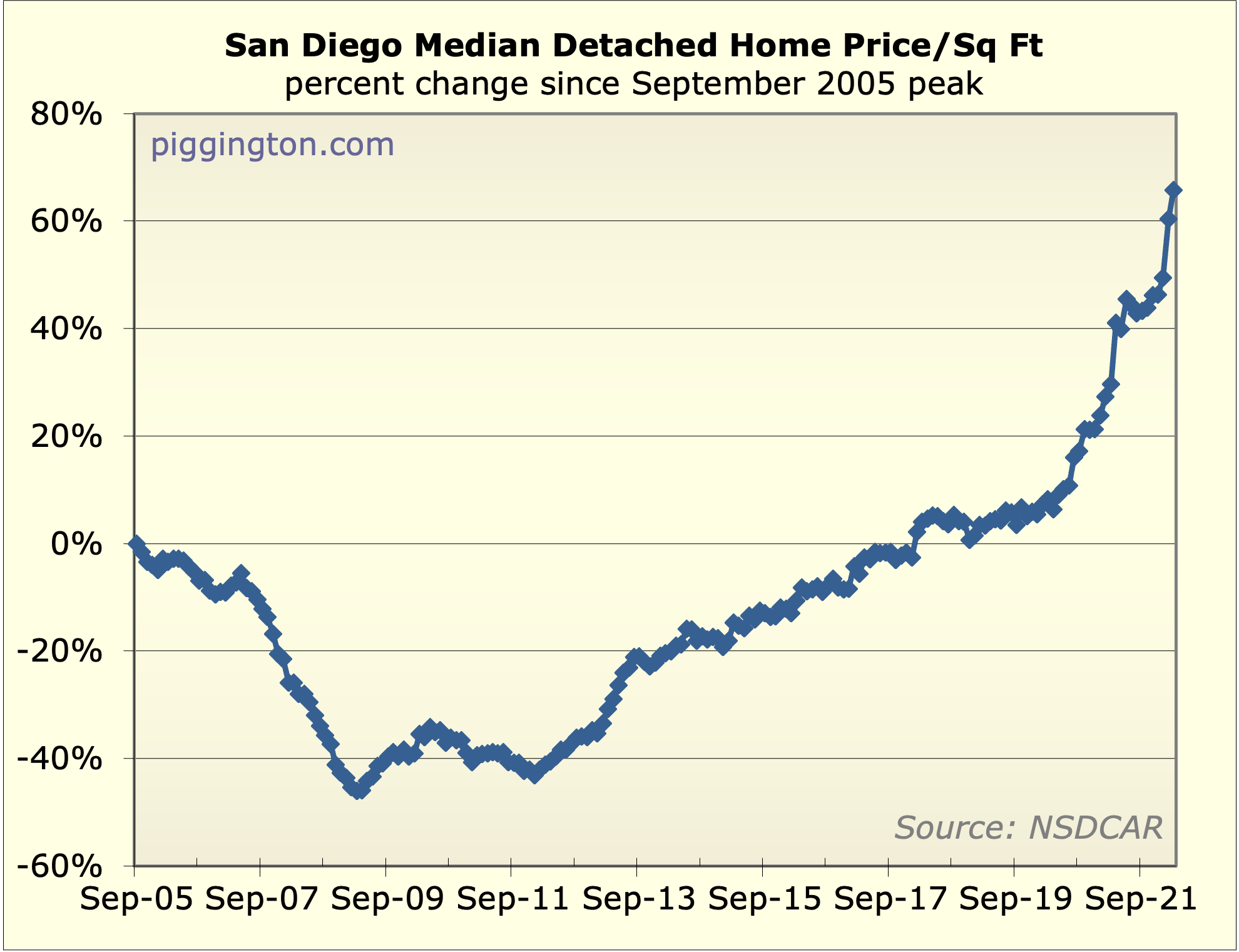

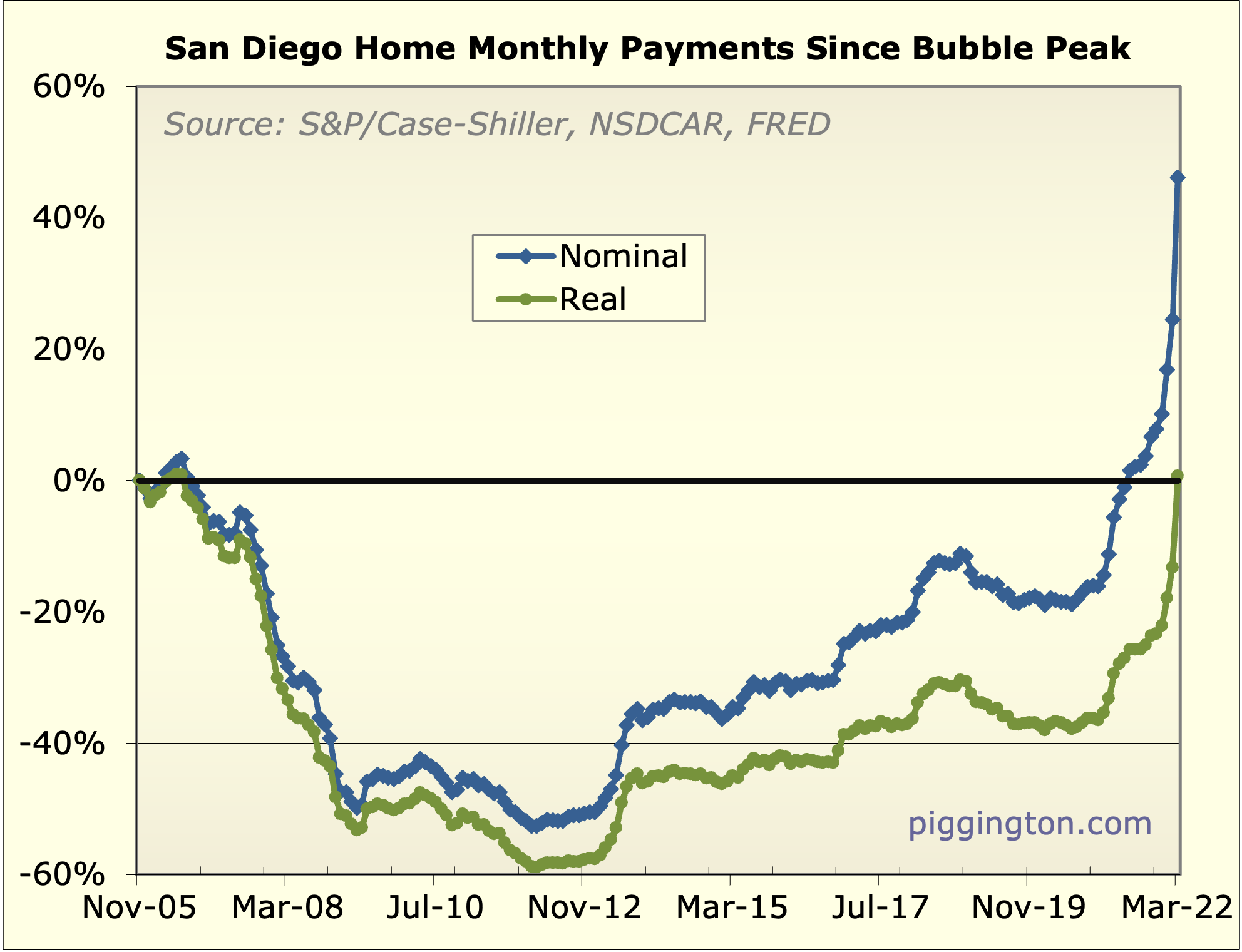

fine after that. This next chart illustrates the problem with that

idea. It shows the total change in the San Diego monthly

payment since November 2005 (the month the SD Case-Shiller index

peaked). At the time that the 2013 surge began, monthly payments

were down almost 60% from the bubble peak, in real terms.

They had plenty of room to go up while still keeping affordability

pretty decent.

This time around, the surge began from a much higher valuation

level, so that the inflation-adjusted monthly payment is now where

it was at the peak of the housing bubble!

This is not good or healthy. For years I’ve been saying that while

purchase prices were high, low mortgage rates were keeping payments

affordable, so perhaps the high valuations were sustainable. Well,

the bond market has just spinning roundhouse kicked the legs out

from under that argument. Without the “but muh low monthly payments”

rationale, the housing market looks a lot more vulnerable to

less-than-perfect conditions (to my rheumy, jaded eyes anyway).

I suspect some people are reading this and thinking, “Look at how

little inventory there is — it shows that demand greatly outstrips

supply. So what’s the problem? Everything is fine.”

Well, you could have said that exact same thing in the spring of

2004. (And many did). But what was happening at that time was a short-term

mismatch of supply and demand, which people misinterpreted as

meaning that no price was too high. But when the drivers of that

short-term mismatch went away, valuations dropped back to earth.

I’m definitely not saying that this is the same situation as the

bubble (see last year’s

housing deep dive for more on that topic). My point is that

short-term supply-vs-demand, while a great predictor of short-term

price changes, doesn’t tell you much about the long-term sustainable

price level.

(This seems as good a time as any to mention that San Diego’s population

has declined for the past 3 years in a row. Yes, I know

wealthy Bay Area people are moving here and I agree that’s a

positive for home prices. But that’s not the only piece in this

puzzle.)

So while the market is woefully undersupplied for the time being,

it’s also priced for perfection. And because perfection rarely

lasts, I have my doubts about the sustainability of this situation.

My guess is that if rates don’t come down, valuations will have to

adjust.

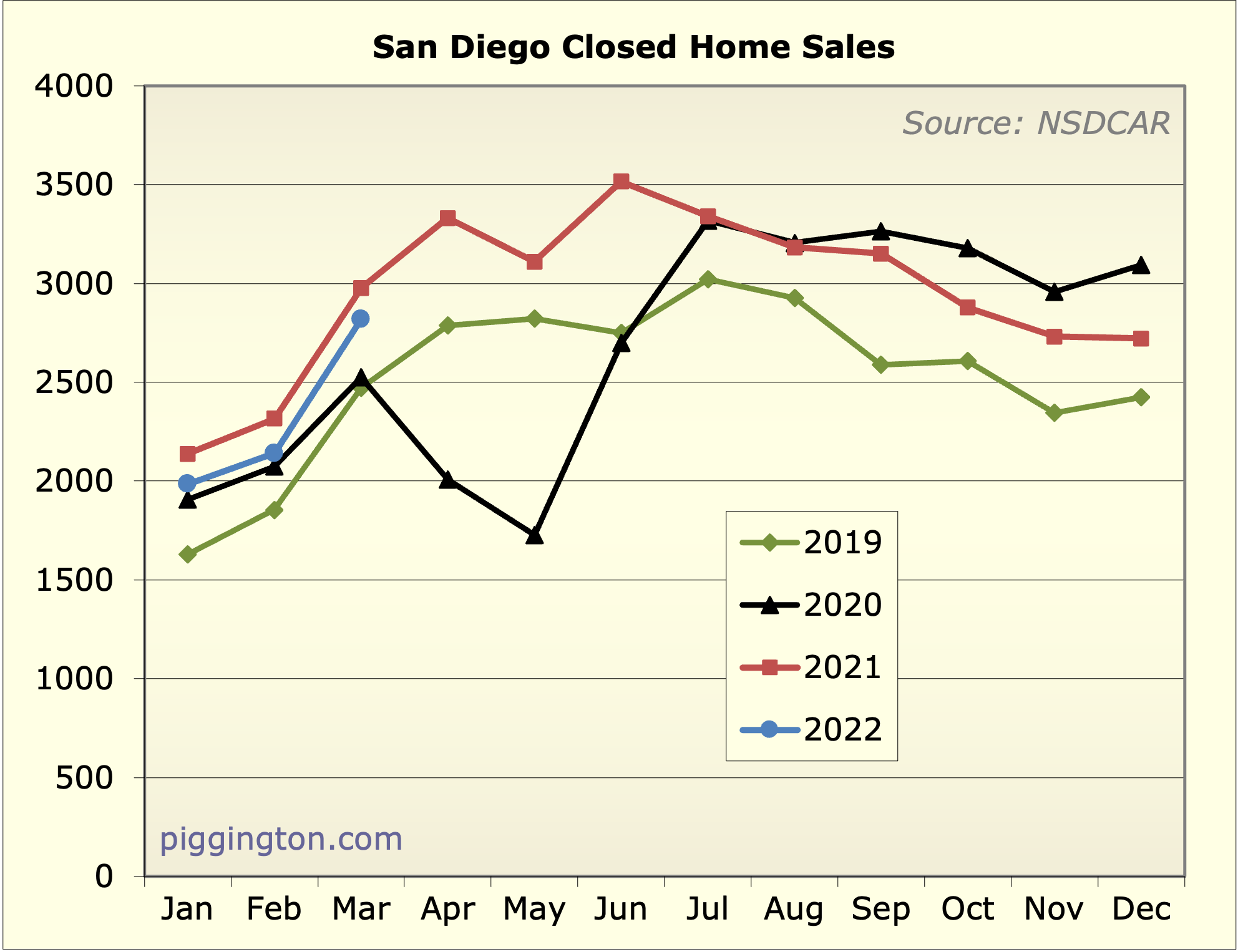

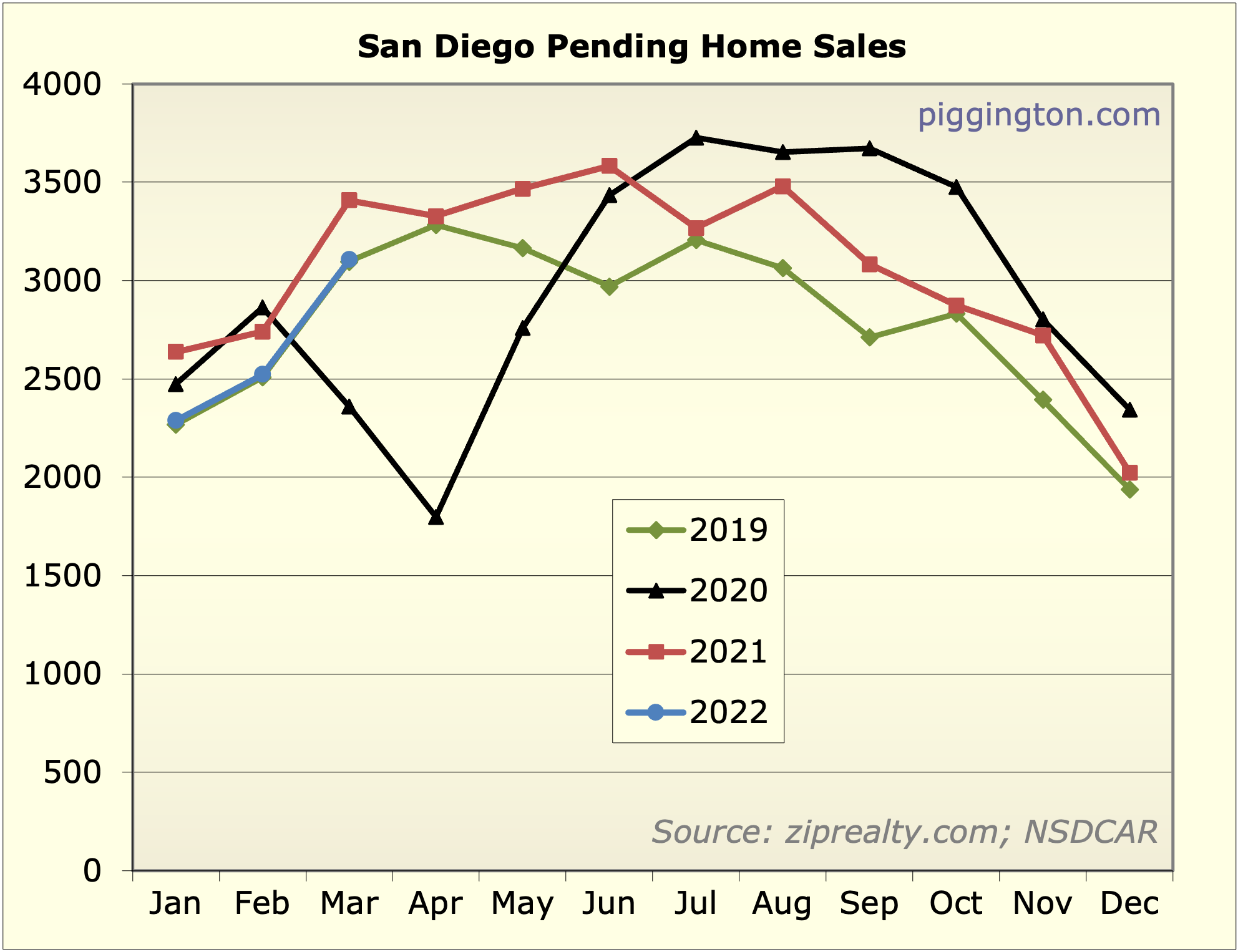

Some more charts below…

* Valuations, as a reminder, can decline due to fundamentals

(rents and incomes, in this case) rising faster than

prices, or prices declining, or some combination of the two.

** Chart note 1: as in my valuation

graphs, for the latest month’s data point I used the most

up-to-date interest rate, as rates have changed quickly and the

latest figure gives the most accurate idea of what current buyers

are facing.

*** Chart note 2: Bill McBride recently put out a chart of the

y-o-y change to nationwdie monthly payments, but I swear, I was

already planning on doing this chart! 🙂 I’m not stealing your

ideas Bill! Well, some of them, but not this particular one. BTW

Bill is a must-read for if

you care about the housing market.

It seems to me that we would

It seems to me that we would be wise to keep two things in mind:

1) Rapidly rising interest rates will slow demand, reducing what buyers will be able to afford, but not impact owners with existing 30 year loans.

2) Barring an incredible economic collapse, recent buyers (last 10 years) aren’t going to be foreclosed on. And without a lot of foreclosures I doubt we see much price drop.

What those two things combined lead me to believe is that we are probably coming to the end of 15-20% per year price increases, but also not a drop in prices.

XBoxBoy wrote:It seems to me

[quote=XBoxBoy]It seems to me that we would be wise to keep two things in mind:

1) Rapidly rising interest rates will slow demand, reducing what buyers will be able to afford, but not impact owners with existing 30 year loans.

2) Barring an incredible economic collapse, recent buyers (last 10 years) aren’t going to be foreclosed on. And without a lot of foreclosures I doubt we see much price drop.

What those two things combined lead me to believe is that we are probably coming to the end of 15-20% per year price increases, but also not a drop in prices.[/quote]

I’m not sure I agree with this take. Item 1 yes, but not the rest.

First, I don’t see why it would take an “incredible economic collapse” for some recent buyers to get foreclosed on. Some people would get foreclosed on in a mild economic downturn, and more would in a major one… it’s not a binary thing.

Second, perhaps more importantly, I don’t see that foreclosures are a necessary condition for prices to decline. All that’s needed is for the supply and demand picture to turn negative at the current price level. Foreclosures are one way for that to happen, but there are others.

In the early 1990s, SD prices dropped 17% (valuations dropped 27%) during and after a run of the mill recession. Valuations started that period lower than they are now, although monthly payments were somewhat higher. I’m not predicting that particular outcome, just pointing out that home prices can decline in the absence of an economic collapse.

Rich Toscano wrote:

First, I

[quote=Rich Toscano]

First, I don’t see why it would take an “incredible economic collapse” for some recent buyers to get foreclosed on. Some people would get foreclosed on in a mild economic downturn, and more would in a major one… it’s not a binary thing.

[/quote]

I definitely agree that it isn’t a binary thing and there could be some foreclosures. Maybe I should have said “enough foreclosures to cause a big enough increase in supply to cause substantial price drops”. While I won’t give you zero odds of this (like sdrealtor might) I think this is very unlikely for a number of factors.

1) Most current owners are up a good bit and so they have an equity cushion.

2) Most current owners either had cash or decent down payments before getting the loan.

3) Qualifying for loans in the last 10 years wasn’t as easy as in pre-bubble 2000s.

So unless we start to see a lot of layoffs, I don’t see many forced sales. (Thus the comment about “barring an incredible economic collapse.”)

Also I don’t see people selling if they don’t have to if prices do decline. A tremendous amount of current owners could wait out a downturn, no problem.

[quote=Rich Toscano]

Second, perhaps more importantly, I don’t see that foreclosures are a necessary condition for prices to decline. All that’s needed is for the supply and demand picture to turn negative at the current price level. Foreclosures are one way for that to happen, but there are others.

In the early 1990s, SD prices dropped 17% (valuations dropped 27%) during and after a run of the mill recession. Valuations started that period lower than they are now, although monthly payments were somewhat higher. I’m not predicting that particular outcome, just pointing out that home prices can decline in the absence of an economic collapse.[/quote]

I don’t agree with the above. I’ll grant you that some price drops could occur without foreclosures, but not enough to be a concern. (Less than 5% price drop?)

Currently supply is incredibly constrained. For price drops to occur supply has to really increase a lot and demand has to also collapse. We could argue about what constitutes a lot of increase in supply and/or how much drop in demand is a collapse. But the only way I see demand collapsing is a major economic collapse occurring. Rate increases will cause some to downscale their expectations of what they can buy, but they won’t encourage people to sell. (Quite the contrary, rate increases will encourage people to keep what they have!)

In the 1990’s when prices dropped, there was a fairly big recession in San Diego. (It was run of the mill nationwide but here in SD several major aerospace employers laid off a lot of workers. At the time SD was pretty dependent on that industry. Now SD is much more diverse.)

There’s another aspect here that I’m a bit reluctant to bring up because it is so hard to quantify. (Remember our slogan, In God we trust, everyone else bring data.) I believe there has been a big change in attitudes about real estate in Southern California since 1990s. People in Southern California have become house hoarders. Once they get a house, they rarely sell it. We can blame prop 13, or we can blame capital gains taxes, or we can blame how so many landlords have cash positive flow, or we can blame a psychology, but people hold onto houses once they get them. (Admittedly the psychology could change, but prop 13 and capital gains won’t. Rents I’m not so sure about.)

Bottom line to all this, I don’t see supply growing enough and demand dropping enough to cause any real price drops. Most likely we have several years of stubborn inflation along with higher interest rates. Price growth slows a good bit, and inflation makes today’s prices seem reasonable. My only caveat is that if the fed losses control of the economy (over tightens such that economy falls apart) then all bets could be off. And actually, I think that’s a lot more of a concern than San Diego’s housing prices.

OK, everyone always says the

OK, everyone always says the recession was so terrible here in the 90s but I’ve always been a bit skeptical. I will belatedly check it out…

… and here are the results:

Blue line is SD unemployment, red is nationwide. It’s definitely the case that it was worse in SD. It peaked a small amount higher, and looks to have lasted about a year longer (as measured by when unemployment peaked).

So it was worse, but not dramatically so. I sure wouldn’t characterize it as run of the mill nationwide, and a collapse for SD. They were in the same ballpark of severity.

That’s really not even the point though. My point was that you don’t need an “incredible economic collapse” for home prices to decline. (Or at least, you didn’t in the past). We can quibble over how to label the early 1990s downturn, but it wasn’t a dramatic collapse, I’m sure you’ll agree.

BTW as a funny aside… this conversation jogged loose a memory that I used to hear that argument all the time during the mid-00s housing bubble. The bulls would say, “yeah it declined in the early 90s, but SD was all defense/aerospace back then, we’re more diverse now.” To which I would reply: “yeah, now everyone’s a mortgage broker or real estate agent!” 🙂

And I actually did have the data to show that RE industry employment grew massively in that time, and was a major contributor to SD’s vaunted diverse and strong job market. That’s not the case this time around, just to be clear. It just reminded me of that little exchange I had so many times.

(And btw xboxboy — I know you were not among the people making that argument back then! This debate just brought up a fun memory.)

So reading through your other stuff. Perhaps some of the disagreement is definitional. (That is often the case when I find myself disagreeing with reasonable people such as yourself). Here’s an example:

[quote=XBoxBoy]’So unless we start to see a lot of layoffs, I don’t see many forced sales. (Thus the comment about “barring an incredible economic collapse.”)'[/quote]

I mean, I think I completely agree with that first sentence. But that (lots of layoffs) is not an “incredible economic collapse.” That’s a recession! And those happen sometimes, so it just doesn’t seem like such a far fetched idea. In fact with 8.5% inflation, an aggressive fed, and a (in my opinion) a speculative bubble that’s probably started to burst — a recession seems even a bit less far fetched than usual.

Then again, “incredible economic collapse” is pretty unambiguous so it’s not just definitional. I just disagree with the sentiment that it would take an incredible economic collapse for prices to drop (more than 5%). It seems to me like a run of the mill recession could totally do it. I guess we’ll find out if we get a run of the mill recession!

The house hoarding thing… yeah, some of that is plausible. But as you noted, so much of this is pro-cyclical. A lot of the hoarding is because people now think (again) that housing can only go up, that they’ll be priced out, etc etc. If it starts going down, that psychological tailwind turns into a headwind.

I mean, there are some secular positives for sure. I’ve laid many of them out myself. But you have to look at that in the context of prices. SD home prices have skyrocketed and now monthly payments have as well. Are the positives enough to outweigh that dismal affordability?

I have my doubts but I’ll keep an open mind. However — given where valuations and affordability are, I doubt we need to get all the way to economic armageddon to see some price declines.

So Ive got some real life

So Ive got some real life experience to weigh on that early 90’s recession. I moved here in mid 1991 when my father had passed to help my mom get back on her feet. I left the East Coast where there was a recession but still plentiful employment. I had a CPA having worked for a Big8 Accounting firm in NYC and after a career switch as one of the top 10 salespersons for one of the top medical supply companies in the country. Not only couldnt I get interviews for jobs in either field, I couldnt get a job driving a SuperShuttle to the airport just to make money. There was little to no work to be found here and I ended up starting my MBA instead. It was dramatically worse here than on the East Coast from an employment perspective. Back then I would hypothesize the employment figures here were boosted because the professional private sector was so much smaller and the public sector a bigger part of jobs (military, health care, governement services) back then

I also remember family members with homes that dropped 10 to 20% back then which was quite traumatic. The phenomena of prices increasing 20+% a year for multiple years is something that did not exist back then so that 10 to 20% fall was a very big deal.

I think a lot of what you are disagreeing about has to do with miscommunication and degree. xbox isnt saying there wont be foreclosures as he knows there always are. What he’s saying is there will be no Foreclosure Wave. Between large down payments mostly 20% or more and hyper appreciation unless they have pulled cash out the norm is to have 30 to 50% equity in ones home now if not more! I know Im getting close to 90% of a rather large number I never counted on or expected.

I also dont think xbox is saying prices wont go down but rather more that they wont correct back to any large degree. If you followed my comments on the market conditions on the NCC Monitor last Fall you will see I predicted exactly what happened this year calling the market then a “powder keg” about to explode come Spring. A 5% decline would be nothing in the grand scheme of things as we got more appreciation than that in Feb and March. A lot more!

To have large declines we need a large amount of non-discretionary sellers. Those that have to sell not want to sell. There will always be those that have to sell but the size of the potential need to sell category has shrunk in a big way. Here’s a simplistic example.

Bought house in 2000 for $1M putting 20% down and now have 2.75% loan with house worth $1.5M. Back of the envelope thats $22K interest, $11K taxes and $2K insurance so lets call it $3K/month. Lets pretend prices drop back to $1M and life gets in the way requiring a move. Do you sell a house that just lost $500K when you know you can get that back in a 5 to 10 years out here? Where else will you make that kind of money in your life? Would you be able to afford to move back if you sell and prices go back to those levels? Do you sell when you know you can rent that house for $4 to 5K and profit $2K/month? The answer is of course some will but the corollary is a lot fewer will!

The recent huge jumps have come on the backs of low volume sales to recent buyers who were well qualified, brought big down payments and bought mostly for long haul. They bought homes with rates much lower than those available today. They have rates well below 4% and buyers are still closing TODAY with rates below 4% not the higher rates available now. They can and will dig in en masse. The longer term owners even more so.

At the end of the day we dont need an “incredible economic collpase” for prices to go down but we would need one for them to go down significantly which would mean a lot more than the gains we just got the last couple months. We would need a massive uptick in non-discretionary sellers which just doesnt seem to be in the cards due to systemic changes in the postion of homeowners with huge equity postions, low tax basis and interest rates.

So what can happen? What is starting to happen now. More is coming on the market than is selling. Inventory is and will continue to build. Faced with more choices buyers will want discounts and will wait for them. Some sellers will provide them but a large percentage will just saw nah I’ll just wait this out here in Paradise. If they cant stay, many will say I’ll just rent it out until it comes back and pocket some monthly cash flow and maybe I’ll return someday. After all its Paradise.

sdrealtor wrote:

xbox isnt

[quote=sdrealtor]

xbox isnt saying there wont be foreclosures as he knows there always are. What he’s saying is there will be no Foreclosure Wave.

[/quote]

Absolutely. Wish I’d said it that well!

[quote=sdrealtor]

I also dont think xbox is saying prices wont go down but rather more that they wont correct back to any large degree.

[/quote]

I gotta make sdrealtor my editor.

I also want to add that I think sdrealtor has laid out several of the big issues really well. We have so many owners who are so far from needing to sell, I just can’t see enough foreclosure to drive real price drops.

And think about it this way, suppose over the next year prices drop 5%, but inflation runs 7%. You’ve only got a nominal price drop, not a real price drop. Or suppose 3 years and 20% drop with 7% inflation. Again, only a nominal price drop.

[quote= Rich Toscano]

That’s really not even the point though. My point was that you don’t need an “incredible economic collapse” for home prices to decline. (Or at least, you didn’t in the past).

[/quote]

I think you’re making a mistake by comparing today to the 1990s. So many people today have significant equity. They have tax breaks built up. They have wealth they never thought they would. They have seen friends leave San Diego never to be able to afford to return. Etc. As sdrealtor points out, even if the economy turns bad, a huge percent of people will dig in and not sell.

Also our language leads us to make statements as if they are all or nothing, but in fact we’re talking about odds. What are the odds that we get a 5% nominal drop? Personally, I’d only give it a 30% chance, and sure for that you’d wouldn’t need an economic collapse. But so what? If you got a 5% nominal drop, that would be returning to prices of when? Last January? By Xmas it will only be a nominal price drop, not a real price drop.

But to get a real price drop of say 20%, well I give you less than 1-2% chance of that. (Particularly since I figure we are in for another couple years of robust inflation. Although who knows.) And honestly, I don’t see how you get to a real price drop of 20% without a wave of foreclosures, and I don’t see a wave of foreclosures without an incredible economic collapse.

Good idea to use

Good idea to use probabilities to cut through potential semantic issues. I have a very different take on the probabilities, and would give substantially higher odds than you for both price decline scenarios you outlined.

We’re just not going to see eye to eye on this one, it seems.

I don’t really want to start going in circles on it (if we haven’t already), but it feels kind of incomplete to just say what I just said and walk away. So I’ll add this: I think the difference is that we are coming at this analysis from very different angles.

It seems like you (and sdr) are approaching it from a narrative-based analysis, making specific predictions about what will happen and how people will react.

This is a reasonable way to do it, but I personally have a deep distrust of financial market narratives. I’ve seen them go wrong so many times (including my own). So my personal philosophy, for better or worse, is to heavily discount narratives, and to base things more on the numbers.

The numbers tell me this: we have had a very, very rapid surge in both prices and monthly payments. First of all, it’s entirely reasonable that something could return to a valuation level that it was at just a couple years ago. You can give me lots of narrative reasons why that won’t happen, but again — I just don’t find those convincing. Because again, over and over I’ve seen very compelling sounding narratives explain why there’s a new permanently higher (or lower) level of valuations, that turned out wrong.

Second, when valuations get this high/unaffordability this low, that just introduces fragility, and makes the market more vulnerable to something going wrong. What might that be? I could speculate but that would be more narratives. The point is that the higher valuation goes (and it is very, very high) — the higher the risk is of something unexpected going wrong.

So that’s where I’m coming from and, I think, why we are landing in a different place. I’m not saying I it won’t turn out how you say — it totally could. I think I just give a significantly higher weight to the possibility of things going in unexpected ways.

Rich Toscano wrote:

We’re

[quote=Rich Toscano]

We’re just not going to see eye to eye on this one, it seems.

[/quote]

True, and that’s fine. The point isn’t necessarily for one of us to convince the other of a specific scenario but to try and extend our thinking to better understand the situation. How much weight you put on certain factors and how much I put on other factors is probably going to differ, and there’s nothing wrong with that. And of course in the not too distant future we’ll know which scenario plays out.

And also, I reserve the right to change my view in the future if the data changes. I’ll tell you that when the pandemic first hit I was pretty sure, “Well, that’s it for people trying to sell their houses. Everyone is gonna hunker down and the housing market is gonna take a dump.” Boy, talk about being wrong! So, while I encourage you to consider how strong the position of current owners is, and that without a wave of foreclosures we won’t see real price drops, know that my track record of predictions isn’t anything to crow about.

Yes, well said and I agree.

Yes, well said and I agree. (And as to track records… neither is mine!)

Rich Toscano wrote:Yes, well

[quote=Rich Toscano]Yes, well said and I agree. (And as to track records… neither is mine!)[/quote]

Serious question for you maybe to help you come to our side a little. Here is a rough scenario.

You now have a crystal ball! Its capable of predicting home prices over the next 2 to 3 years but then it has no further insight

#1 Your house is going to drop in value by $200K over the next 2 to 3 years! Would you sell it and sit on sidelines?

#2 Your house is going to drop in value by $400K over the next 2 to 3 years! Would you sell it and sit on sidelines?

#3 If neither how big of a drop would it take?

For arguments sake we can use Zillow values both current and historical as your data points.

sdrealtor wrote:Rich Toscano

[quote=sdrealtor][quote=Rich Toscano]Yes, well said and I agree. (And as to track records… neither is mine!)[/quote]

Serious question for you maybe to help you come to our side a little. Here is a rough scenario.

You now have a crystal ball! Its capable of predicting home prices over the next 2 to 3 years but then it has no further insight

#1 Your house is going to drop in value by $200K over the next 2 to 3 years! Would you sell it and sit on sidelines?

#2 Your house is going to drop in value by $400K over the next 2 to 3 years! Would you sell it and sit on sidelines?

#3 If neither how big of a drop would it take?

For arguments sake we can use Zillow values both current and historical as your data points.[/quote]

Without having run numbers, just based on gut feel: no on #1 (after taxes/selling fees there wouldn’t be enough left). Yes on #2.

I don’t really see how this would bring me to your side though. I already understand the financial and emotional frictions involved in selling. I’m just allowing for a scenario where there is a big shift in the number of people who want to (or are able to) buy at current valuations, vs. the number of people who want to (or have to) sell.

PS “have to sell” does not

PS “have to sell” does not equal foreclosure. For example, if someone gets a job in a new city, wants to buy there, and isn’t rolling around in down payment money… they effectively have to sell.

The point was to get you to

The point was to get you to think about the actual issue from your own situation and if you actually ran the numbers my guess is #2 would not be an automatic yes either. Your not getting a mortgage rate like you have so quickly. You may get there but you would also be faced with giving up a home you have no doubt grown to like and may not be able to replace again. You also dont know whats gonna happen after 3 years and if history repeats as it usually does this market always seems to come roaring back with a vengance. Its much easier said than done.

And I understand that foreclosures arent the only have to sell situation as divorce is probably the biggest which you did not mention. I have seen countless people leave the area but hold onto their homes here over the years be it to return someday or because its a better return than what they get where they are going.

The math has never been like it is now either. You may well have a prop 13 tax basis a million or more below its current value. Rents have soared providing cash flow that never existed before. Having a sub 3% mortgage as a hedge is somethng we may not see in our lifetimes.

Unless you are moving somewhere even more expensive, renting your house here is likely a net positive boosting your annual income. There are low down programs widely available in those cheaper markets. You could pull out a HELOC that you can cover with your postive cash flow in many cases. People have options like never before.

The potential advantages to holding on have never been stronger here with all these. On top of it we have a city that is on a strong long term upward trend of tech and life science jobs.

There will always be sellers. There just are and will continue to be a smaller number of them for the foreseeable future.

Good points. I don’t have

Good points. I don’t have anything to add aside from what I said to xboxboy above.

Regarding the deal though — having had a chance to mull it some more, I consider deal #2 a no brainer that I would definitely take. I know I’m not normal though. (Although, I asked my wife and somewhat to my surprise, she was all over it too).

PS – “You also dont know

PS – “You also dont know whats gonna happen after 3 years and if history repeats as it usually does this market always seems to come roaring back with a vengance.” This is a reason to take the deal! You get an opportunity to trade up before that happens.

Fair enough. So I picked

Fair enough. So I picked those numbers figuring #1 was about 10%ish and a Jan/Feb number and #2 about 20%ish and late Summer/early Fall last year value. I think there is a fair chance you’ll get there in next 3 years so you may want to ponder that move. I do think you under estimate how tough it is to buy when markets are roaring back. Saying it’s a no brainer is very different than packing up and going , though it’s much easier when it’s just one or two of you. Finding good real estate here has rarely been easy and I’m pretty sure you have a much better than average piece already.

Any way it’s all just hypothetical and my point was to get you to take the leap from market analyst/observer to potential participants:)

Lastly I chuckled when you

Lastly I chuckled when you said I know I’m not normal. Everyone thinks they aren’t and that others are different. But in the end most of us want the same things and think a lot more alike than different. You’re a lot more normal than you think

I would go with neither #1 or

I would go with neither #1 or #2. However, I would cash out refi to pull out $400k and wait for the bottom to buy another house. If it crash harder than 20% like in 2008, I’ll just stop paying my mortgage to get the bank to negotiate w/ me or live mortgage free until they kick me out.

here’s an answer from someone

here’s an answer from someone who bought in high enough over LP that it seemed crazy, but luckily seen the gains go higher, both are easy no’s.

im pretty sure fmv has us around 50% equity and my 30 year rate is 2.875. so those are 2 big cushions against market regression.

so let’s forget all the painful stuff that goes along with moving and pretend I was an unattached person with the flexibility to do whatever I wanted at a moments notice, my choices would be cash in what would be a quick $500k gain now, with extra PP for the future, but be at the whim of wherever rates go in 3 years. or go back to break even in 3 years but be on the low rate. A family member just closed last month at a rate that would have had me paying $25k more per year just in interest and just a month later it would be even more than that, so honestly I don’t think I’d risk the rates. my last mortgage was around 4% and it wasn’t at the bottom of the recession but it wasn’t far from it either.

We have some neighbors considering selling their 10-20 year homes now because they just made an extra $500k-1m and think it’s a good idea to take it. But I think most of them were getting into a selling window anyway, and since they are downsizing more protected from the rates if they are renting or planning to buy something smaller outright. I think the whole world refied at some point in the last few years too, so I’d guess even longer term owners who are way beyond me on the equity and looking at much bigger (taxable) gains ($1m+) but would have a similar risk on rates if they needed to find something comparable in the future. but I think the only way I’d answer no was if I wasn’t expecting to be looking for the same thing all over again in 3 years (or obviously if I wasn’t happy with the home I was in right now).

Thx and you’re on your own

Thx and you’re on your own again. Well stated

Rich, I’ve got nothing to disagree with for me it’s all about magnitude. I have no problem seeing a 5-10% pullback in the next one to three years. Beyond that my confidence levels drop precipitously. And to get back to pre pandemic levels that would require at least 40-50% drops and my confidence level for that does not exist

Rich Toscano wrote:

I don’t

[quote=Rich Toscano]

I don’t see that foreclosures are a necessary condition for prices to decline. All that’s needed is for the supply and demand picture to turn negative at the current price level. Foreclosures are one way for that to happen, but there are others.

[/quote]

Reading back through this I’m wondering if there are occasions when prices did fall a good bit without foreclosures. In the 1990’s when prices fell I believe there were a fair number of foreclosures, but I don’t have any data to back up that view. Clearly in the 2007-2008 crash there were a lot of foreclosures. But can anyone name a time where prices dropped much but there were few foreclosures?

Many people celebrate drastic

Many people celebrate drastic increases in real estate & stocks prices and are VERY HAPPY about it, they are rich.

I believe what going on is terrible. In one generation US will be a class society, there will be two classes, Haves & Have Nots. Haves will have ownership of most assets & Have Nots will be renters and living paycheck-by-paycheck forever. If you are a kid from Haves family you will be set for life, and if you are a kid from Have Nots family you will stay in your Social Class for the rest of your life.

When I express this view in my office, I encounter enormous resentments from my co-worker, which does not surprise me.

I would say I agree almost

I would say I agree almost everything you said here. As a buyer, I and a few friends who are also looking for houses decided to stay put now, either voluntarily or being forced (as saying “priced out”). I will buy when I feel comfortable and less risky, but now it isn’t (92011 area). I don’t know if I can use stock market as an example, the psychology might be similar: ordinary people, I mean ordinary people, tends to buy high and sell low. Some of the reasons people are chasing high in housing market now are: to settle down, using house to counter high inflation, believing house price will continue going up, FOMO. Personally I think house price is still in uptrend for a short term. Long term? Not sure,need to see how strong the balance sheet reduction and rate hikes are.

Another comment on”now everyone’s a mortgage broker or real estate agent!” I know lots of people are in RE market, but really feel that was when I went to often houses last month, there were two listing agents were also the owners, and I just looked less than ten properties.

moon wrote:I would say I

[quote=moon]I would say I agree almost everything you said here. As a buyer, I and a few friends who are also looking for houses decided to stay put now, either voluntarily or being forced (as saying “priced out”). I will buy when I feel comfortable and less risky, but now it isn’t (92011 area). I don’t know if I can use stock market as an example, the psychology might be similar: ordinary people, I mean ordinary people, tends to buy high and sell low. Some of the reasons people are chasing high in housing market now are: to settle down, using house to counter high inflation, believing house price will continue going up, FOMO. Personally I think house price is still in uptrend for a short term. Long term? Not sure,need to see how strong the balance sheet reduction and rate hikes are.

Another comment on”now everyone’s a mortgage broker or real estate agent!” I know lots of people are in RE market, but really feel that was when I went to often houses last month, there were two listing agents were also the owners, and I just looked less than ten properties.[/quote]

I think that is a good plan and would not be in a hurry if life allows that. The rapid increases are past and we could/should see not only some retracement but equally important a much better selection to come. Ive lived and worked in S Carlsbad for most of the last 30 years. Ive watched and worked through all the changes and development around here. Happy to answer any questions you have.

Funny that you mention listing agent owners that are now selling as I have referenced that a few times in my posts. I know most of the long term agents around here and we are all self employed. The vast majority have lived modestly and many never could afford to become homeowners. Those that did mostly never could or knew how to plan properly for retirement. The same can be said for loan officers. Those with homes are nearing retirement and have a golden path ahead if they sell those homes and move somewhere less expensive. Ive seen a bunch do that the last few years, it seems to be picking up and I expect even more to. It wont be a big wave of inventory as there just arent that many but rather just an interesting thing for me to watch safely from the sidelines as Im in the very small minority with both the home and savings.

just checking in as a reader

just checking in as a reader over the last couple years who found the blog while moving from elsewhere in socal. basically I think both narratives are fundamentally right.

I’ve been in socal for about a decade and having considered all of la/orange/sd county for a good chunk of that time SD seemed out of balance with LA and Orange. There was clear value here relatively speaking, which I would guess has now evened out to some degree. We pulled the trigger a little over a year ago so haven’t looked around too much since but I would guess that for single family homes especially, SD county has outpaced the other 2 (especially if narrowed to take out the super high end in the other 2 which is likely where a big chunk of their markets has been pulled up). The pandemic was a big accelerant/enabler on this shift for all the reasons that have been widely discussed (remote work, affordability for families, schools, growing homeless issues in metro, etc). All of that is to say I do think there’s more of a durable shift at play here (and if you look at all the LA/Bay Area restaurant chains stretching into north county I think the commercial side sees it too). A bunch of the other recent move-ins have had similar stories to ours whether they are from Bay Area or LA.

But with all of that said I agree with Rich that there is still a macro world that adheres to certain fundamentals. The growth is not sustainable. My SFH was listed last year at a price that would have been highest sale on the block by over 10%. We paid more than 10% over that LP. Today a neighbor is in contract for what amounts in total to +75% more than the original LP on mine (that would have at the time been a record).

So where does the tension net out between whatever inevitably comes from the macro world and the out of towner trend bringing SD county potentially more in line with orange/LA? No idea but it does seem like it would take an event = or greater to the last housing crash just to get me back to break even. And even if it did I’d definitely be in position to ride out.

I believe rates will start

I believe rates will start coming down.

The supply of $$$ that needs a home just keeps rising, while new debt issue by creditworthy governments and private borrowers is plunging.

Example: total municipal bond debt rose 1.7% YoY to Dec 2021, while nominal GDP rose 11.75%. Both the real supply and the supply as a share of the economy plunged.

Federal Debt to GDP is also going down from its covid peak of 1.36 to about 1.23.

https://fred.stlouisfed.org/series/GFDEGDQ188S

The combo of an inflation spike and cuts to QE policies have not really had that huge an effect. That’s because the long term trend is driven by demographic and political trends toward negative real rates and low inflation.

When the GOP takes Congress and forces huge cuts in domestic spending as a share of GDP, that will be another big blow against inflation and supply of public debt.

Since Flu called me “negative

Since Flu called me “negative indicator” I’d like to point out a post from Aug 2019, very shortly before prices went vertical:

“Are you opposed to riding the next bubble up on principle? I am a bear at heart, I am net short US equities. But I have shorted enough bubbles the past 15 years to know that another RE bubble is a-brewin’. ”

No longer net short equities, but I’d guess I have the largest short portfolio to net worth here. It’s a bit odd people think RE may slow down because of fundamentals like mortgage to rent ratios, while tech stocks have insanely irrational valuations, pretend Internet coins are a nominal $2 trillion dollar asset class because reasons, structurally failing industries like movie theaters and brick and mortar video game retailing have higher valuations than profitable and growing companies; etc.

I think the high income renting youngsters with coinbase and robinhood accounts that are down 30-60% chasing 200% gains may soon see the wisdom of and FOMO on RE.

YoY gains for Japanese or

YoY gains for Japanese or European buyers 12 months ago here would be more like 40%+ in their own currencies.

No safer haven than low crime, low property tax, high dollar rental yield San Diego!

Rich re: the foreclosure

Rich re: the foreclosure impact my simple mind would back up a step and ask why do foreclosures occur? Owners either can’t or won’t service the debt? Why can’t they? Or why won’t they?

Also, as a corollary, I could be way off here but I thought alot of longer tenured HO’s with nice equity cushions got stung last time around due to excessive equity withdrawals. Didn’t MEW spike massively last year?

The consumer/investor market cycle tends to play out generally the same way in my experience. Where we’re at is anyone’s guess but the air feels awfully thin to me.

DaCounselor wrote:Rich re:

[quote=DaCounselor]Rich re: the foreclosure impact my simple mind would back up a step and ask why do foreclosures occur? Owners either can’t or won’t service the debt? Why can’t they? Or why won’t they?

Also, as a corollary, I could be way off here but I thought alot of longer tenured HO’s with nice equity cushions got stung last time around due to excessive equity withdrawals. Didn’t MEW spike massively last year?

The consumer/investor market cycle tends to play out generally the same way in my experience. Where we’re at is anyone’s guess but the air feels awfully thin to me.[/quote]

I dont disagree it feels thin but we are somewhere we have not been under entirely different circumstances.

Here is some info on MEW.

https://calculatedrisk.substack.com/p/the-home-atm-open-in-q4-2021-closing?s=r

Cliff Notes version is big spike last year though still well below 07 bubble amounts with a highly devalued currency and much higher homeowner equity amounts.

Unlike the bubble I would expect a lot more went to home improvement with people sheltering in place. Last time a much higher percentage went to RV’s, plastic surgery, vegas trips, expensive cars (which are hard are backordered), jetskis, vacations etc. With rates up we’ll see a lot less of this in 2022. I dont think we are in anything close to overleveraged bubble era.

To answer your question as to why owners cant or wont service debt? Having spoken with hundreds of them last time around it was because they were so far underwater they saw no point in doing so. That also is not the case today

End of the day we are in unchartered territorry and I dont beleive we are in anything close to last time around.

Lots of whistling past the

Lots of whistling past the graveyard here imho. Many thanks to Rich; it was this site that helped us time our 2012 purchase of our little house near SDSU for 352K. Everything in our neighborhood now is going for a million or more. That fact alone convinces me that we’re about to see another drop of 20%-40%, as part of a national collapse in stocks, commercial and residential real estate and of course crypto and NFTs. Those last items I see as dropping 90%-95%, since they have no underlying real value.

I easily could be wrong. But history is riddled with bubbles that are exacerbated by times of lax regulation, which we’ve been in since the late 90s. We are way overdue for another collapse. Just going with my gut here, of course. Not a finance guy at all; don’t even have a 401K. But we haven’t touched our “equity” for a reason. Watching, and benefiting from, the last collapse only convinces me that a big shock is coming.

Just a thought.

Mark Holmes wrote:Lots of

[quote=Mark Holmes]Lots of whistling past the graveyard here imho. Many thanks to Rich; it was this site that helped us time our 2012 purchase of our little house near SDSU for 352K. Everything in our neighborhood now is going for a million or more. That fact alone convinces me that we’re about to see another drop of 20%-40%, as part of a national collapse in stocks, commercial and residential real estate and of course crypto and NFTs. Those last items I see as dropping 90%-95%, since they have no underlying real value.

I easily could be wrong. But history is riddled with bubbles that are exacerbated by times of lax regulation, which we’ve been in since the late 90s. We are way overdue for another collapse. Just going with my gut here, of course. Not a finance guy at all; don’t even have a 401K. But we haven’t touched our “equity” for a reason. Watching, and benefiting from, the last collapse only convinces me that a big shock is coming.

Just a thought.[/quote]

So you are gonna sell? If you are convinced your house is gonna drop 200 to 400K why wouldnt you? Thats the 401K you dont have

Congratulations, Mark, on

Congratulations, Mark, on your home purchase back in ’12 and on not levering up on your equity over these past 10 years! I am with you, that I see a big drop in San Diego home prices — my big metric is how out of whack median home prices are compared to median household incomes when compared to historical norms.

Per Zoltan Pozsar (formerly worked at The Fed and appears to be a conduit for information from The Fed via his perch as an analyst at CreditSuisse) on ZeroHedge, The Fed is prioritizing pulling the plug on demand and subsequent higher consumer prices, which they see fueled by the ‘wealth effect’ from inflated home prices, inflated stock prices, and inflated bond prices. Looks like a wild ride ahead. Glad you are in a great position to ride out the storm!

jg wrote:Congratulations,

[quote=jg]Congratulations, Mark, on your home purchase back in ’12 and on not levering up on your equity over these past 10 years! I am with you, that I see a big drop in San Diego home prices — my big metric is how out of whack median home prices are compared to median household incomes when compared to historical norms.

Per Zoltan Pozsar (formerly worked at The Fed and appears to be a conduit for information from The Fed via his perch as an analyst at CreditSuisse) on ZeroHedge, The Fed is prioritizing pulling the plug on demand and subsequent higher consumer prices, which they see fueled by the ‘wealth effect’ from inflated home prices, inflated stock prices, and inflated bond prices. Looks like a wild ride ahead. Glad you are in a great position to ride out the storm![/quote]

Same question for you. If you expect a big drop are you selling?

DaCounselor wrote:Rich re:

[quote=DaCounselor]Rich re: the foreclosure impact my simple mind would back up a step and ask why do foreclosures occur? Owners either can’t or won’t service the debt? Why can’t they? Or why won’t they?

Also, as a corollary, I could be way off here but I thought alot of longer tenured HO’s with nice equity cushions got stung last time around due to excessive equity withdrawals. Didn’t MEW spike massively last year?

The consumer/investor market cycle tends to play out generally the same way in my experience. Where we’re at is anyone’s guess but the air feels awfully thin to me.[/quote]

I dont disagree it feels thin but we are somewhere we have not been under entirely different circumstances.

Here is some info on MEW.

https://calculatedrisk.substack.com/p/the-home-atm-open-in-q4-2021-closing?s=r

Cliff Notes version is big spike last year though still well below 07 bubble amounts with a highly devalued currency and much higher homeowner equity amounts.

Unlike the bubble I would expect a lot more went to home improvement with people sheltering in place. Last time a much higher percentage went to RV’s, plastic surgery, vegas trips, expensive cars (which are hard to buy as they are backordered), jetskis, vacations etc. With rates up we’ll see a lot less of this in 2022. I dont think we are in anything close to overleveraged bubble era.

To answer your question as to why owners cant or wont service debt? Having spoken with hundreds of them last time around it was because they were so far underwater due to 100% financing they saw no point in doing so. That also is not the case today and is far less likely with huge gains coupled with no more zero down loans

End of the day we are in unchartered territorry and I dont beleive we are in anything close to last time around.

Thanks sdr great link.

I

Thanks sdr great link.

I don’t know what the average current post-MEW LTV average is in SD but i definitely agree that with the massive price spikes it does seem pretty doubtful that we’re anywhere close to the prior bubble’s over-leveraged market.

I suppose an inability to service debt is independent from LTV considerations, so that some combination of recession/job loss/wage destruction and broader market inflation could put owners in payment distress regardless of the level of equity. We wouldn’t see foreclosures but instead forced sales I guess? This could go to Rich’s question regarding prices drops without foreclosure waves.

The last go around I had a few friends who went the foreclosure or short sale route in connection with relocating out of SD. They were upside down and would have been cash-low negative on a rental so why take the loss. If they would have been cash flow positive, i assume they would have held the homes as rentals. I have alot of friends who were upside down on their primary and rode it out as the payments weren’t an issue.

At the moment it doesn’t even feel that prices have peaked yet given what i’m seeing.

I follow Poway and Scripps

I follow Poway and Scripps Ranch regularly and I’m seeing a lot more price reductions and homes that were pending falling out of escrow and going back on the market so that does seem to indicate some sort of shift away from the absolute power sellers have had so far.

the POST had an interesting

the POST had an interesting article w/ nation wide data

Rents are rising everywhere. See how much prices are up in your area

How rent has changed in 1,500 counties across the United States since the start of the pandemic

https://www.washingtonpost.com/business/interactive/2022/rising-rent-prices/?utm_source=pocket-newtab

The top 25 most overvalued

The top 25 most overvalued markets per Moodys. Of note not one in California or along the East Coast and pretty much constrained to what are considered red states. Did folks fleeing the liberal blue states for red states more in line with their politics set them selves up for financial ruin? Another thing that will be interesting to watch

https://www.fox29.com/news/us-housing-prices-top-25-most-overvalued-markets-2022-report?utm_campaign=trueanthem&utm_medium=trueanthem&utm_source=facebook&fbclid=IwAR1pdt6kLJoIQ6HHkVOnJaef4woB9AG3BEaYAqiaZ6cIMLc9aoOBTXHB2Mk#l3149eozb4op545i1to

sdrealtor wrote:The top 25

[quote=sdrealtor]The top 25 most overvalued markets per Moodys. Of note not one in California or along the East Coast and pretty much constrained to what are considered red states. Did folks fleeing the liberal blue states for red states more in line with their politics set them selves up for financial ruin? Another thing that will be interesting to watch

https://www.fox29.com/news/us-housing-prices-top-25-most-overvalued-markets-2022-report?utm_campaign=trueanthem&utm_medium=trueanthem&utm_source=facebook&fbclid=IwAR1pdt6kLJoIQ6HHkVOnJaef4woB9AG3BEaYAqiaZ6cIMLc9aoOBTXHB2Mk#l3149eozb4op545i1to%5B/quote%5D

I guess it depends on when you moved. If you were ahead of the herd and bought a few houses when you move, you could be sitting very happy today.

Yeah I was just being a

Yeah I was just being a little facetious and I’m sure most of them should be fine. After all they’re sitting on the biggest gains in many cases and they also brought their “California equity” with them. But you look at those areas and you see places that have run up an interest rates being low without the accompanying high paying job growth. At some point those areas should and will get hit a little harder. When they do I think they just might feel a little nostalgic for the California Equity they left behind and it’s relative invincibility