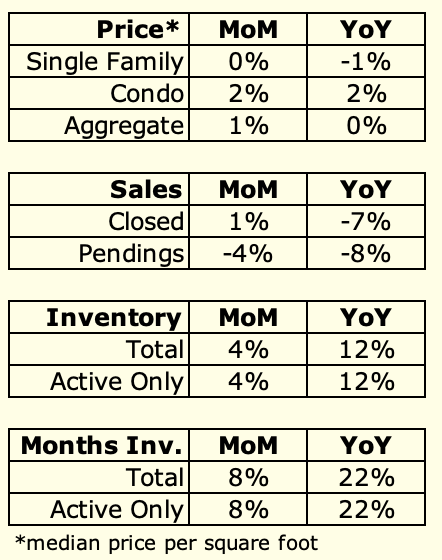

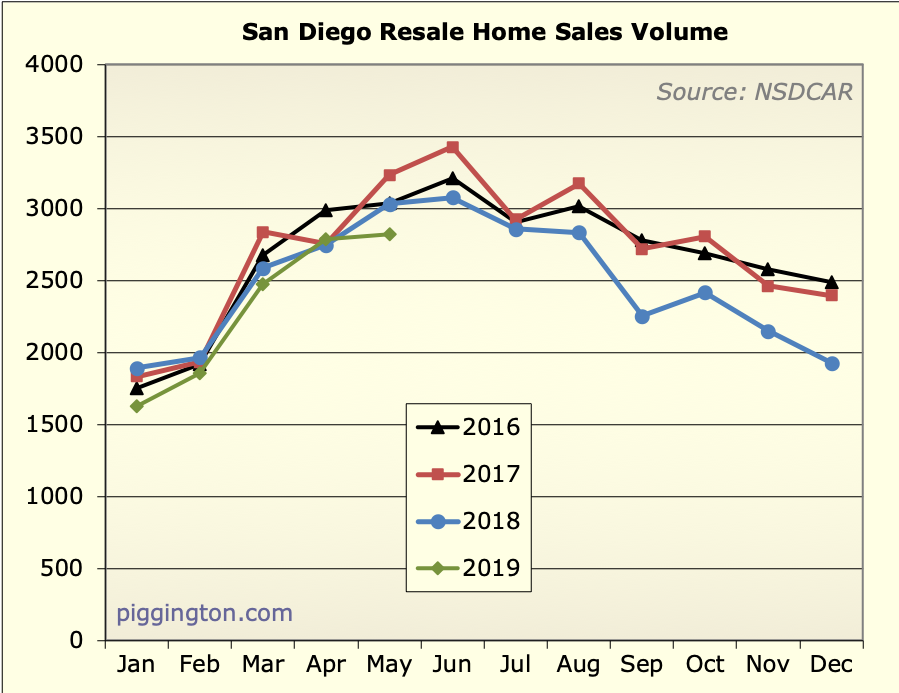

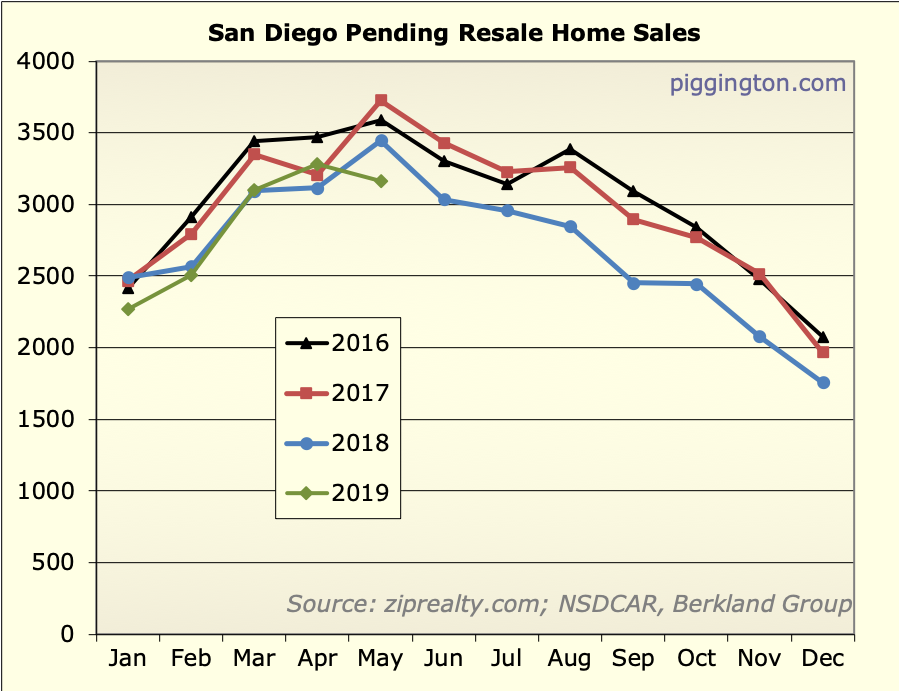

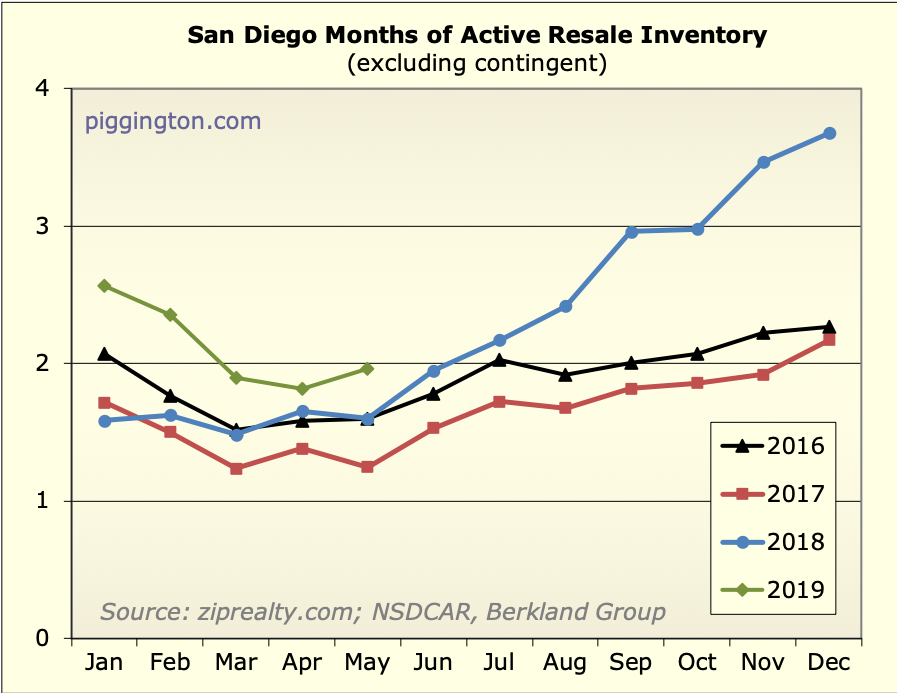

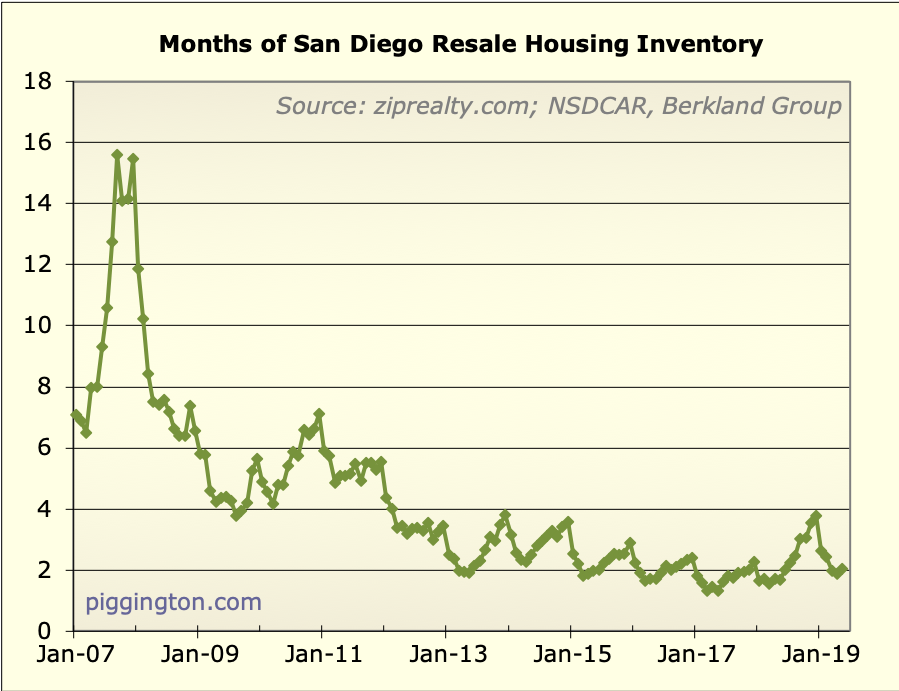

Mostly just charts this month, friends. A couple quick observations:

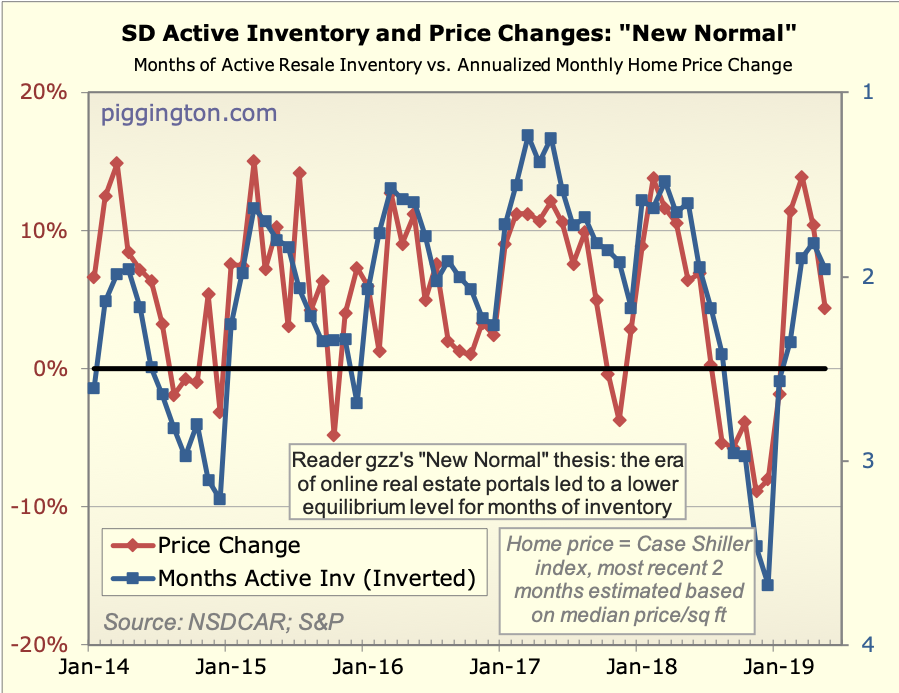

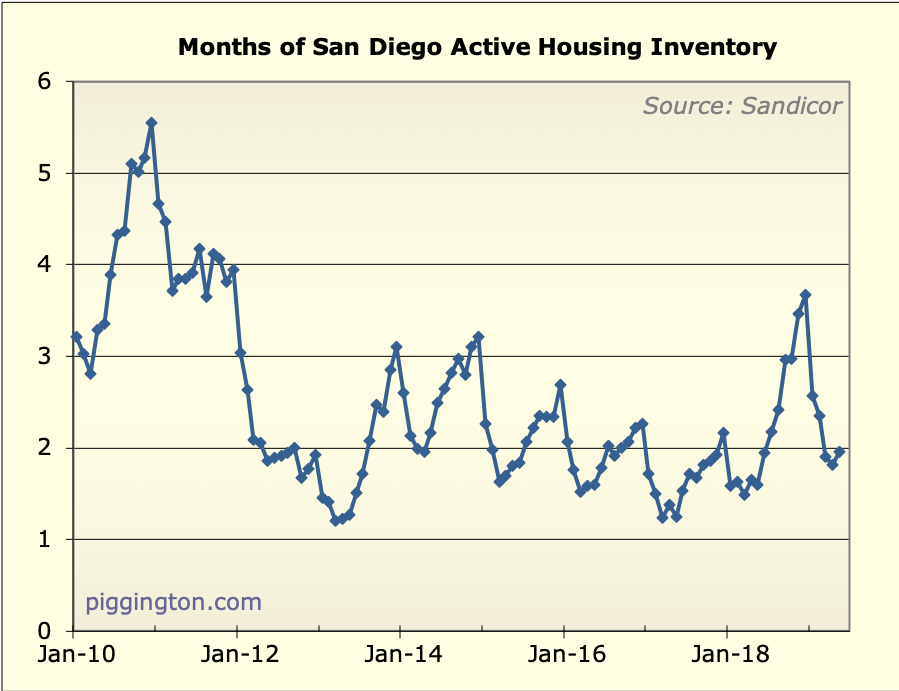

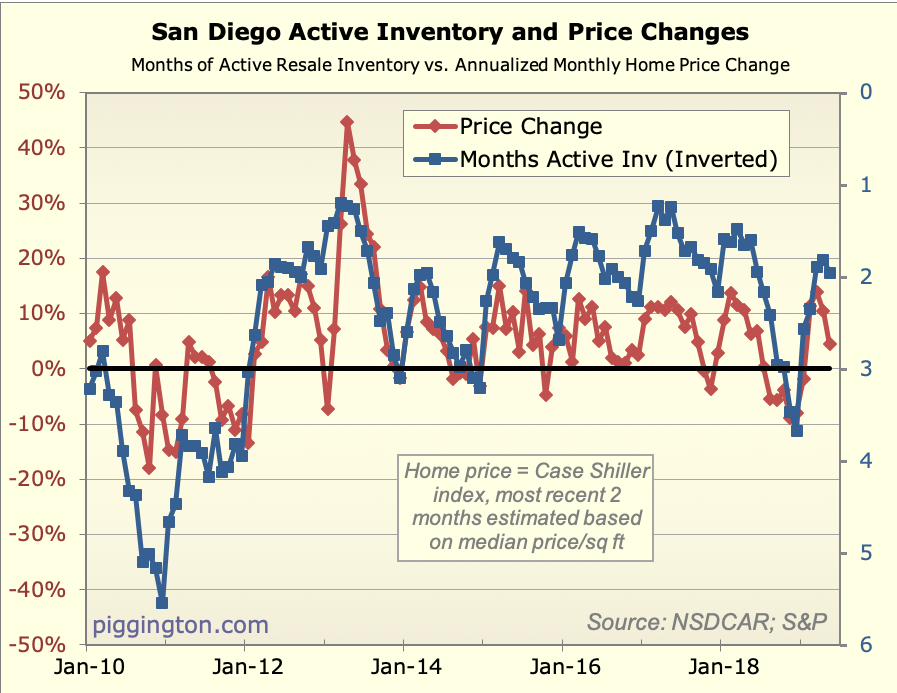

– The market was pretty strong again but weakened from the prior

month, in terms of both price and months of inventory… this chart

sums that up best.

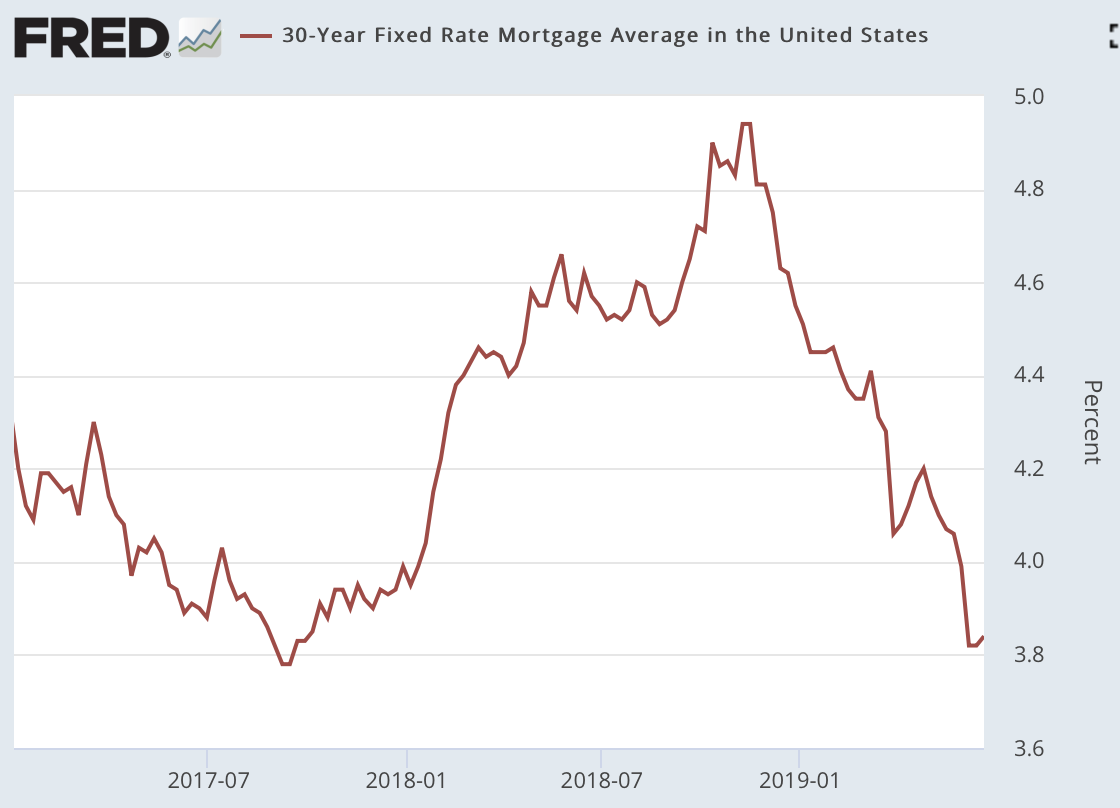

– But interest rates have dropped further, which should be a

tailwind in the coming months (if the new low level persists)

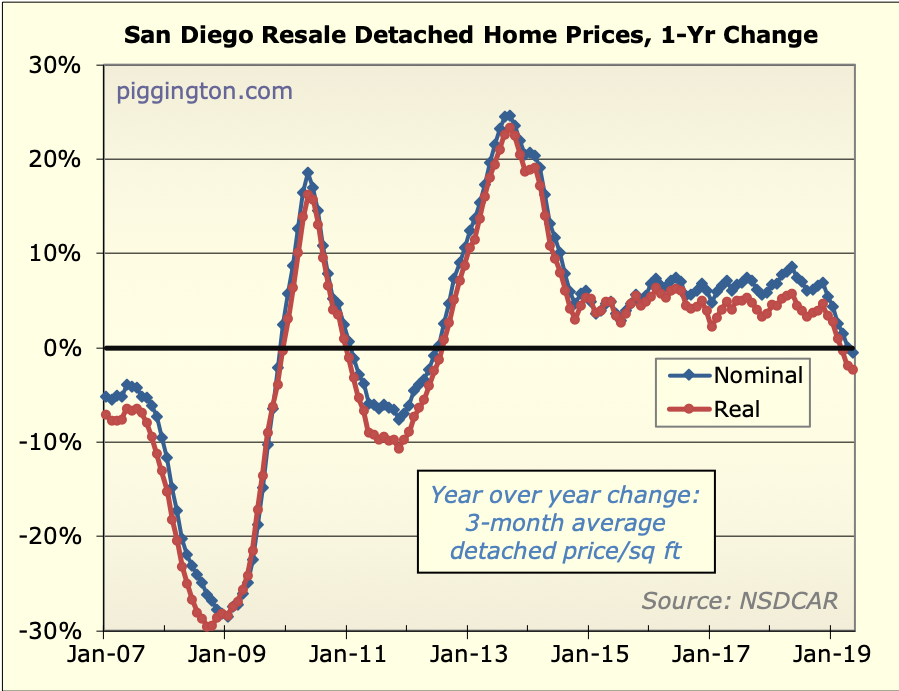

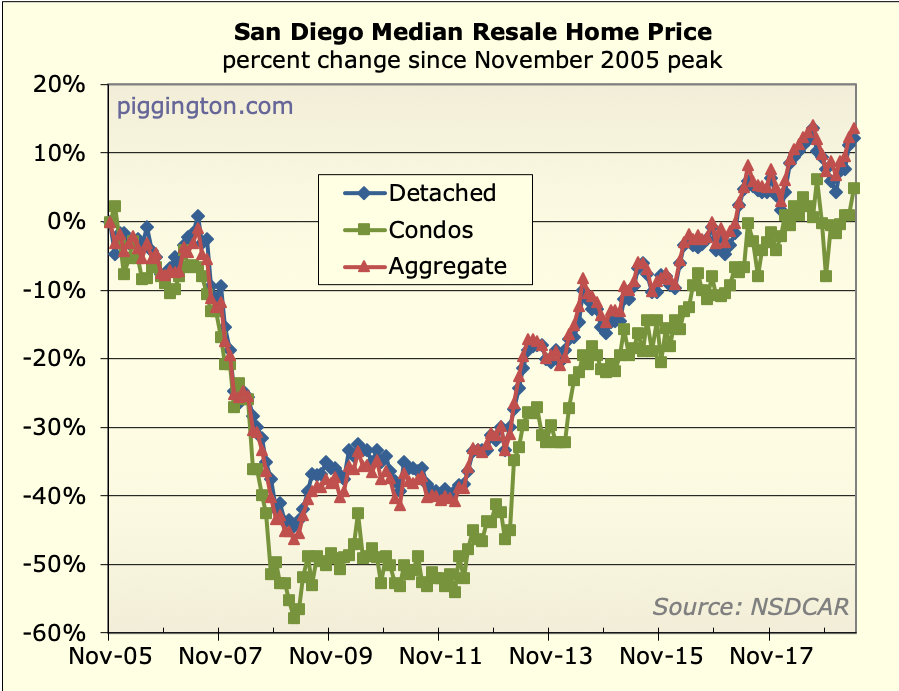

– FWIW prices are (slightly) down year over year in real and nominal

terms — but the comparison will get easier starting in July,

which is when prices started declining last year. Between that and

the drop in rates (again, assuming that persists), I am guessing we’ll be back in positive y-o-y territory soon.

More graphs below!

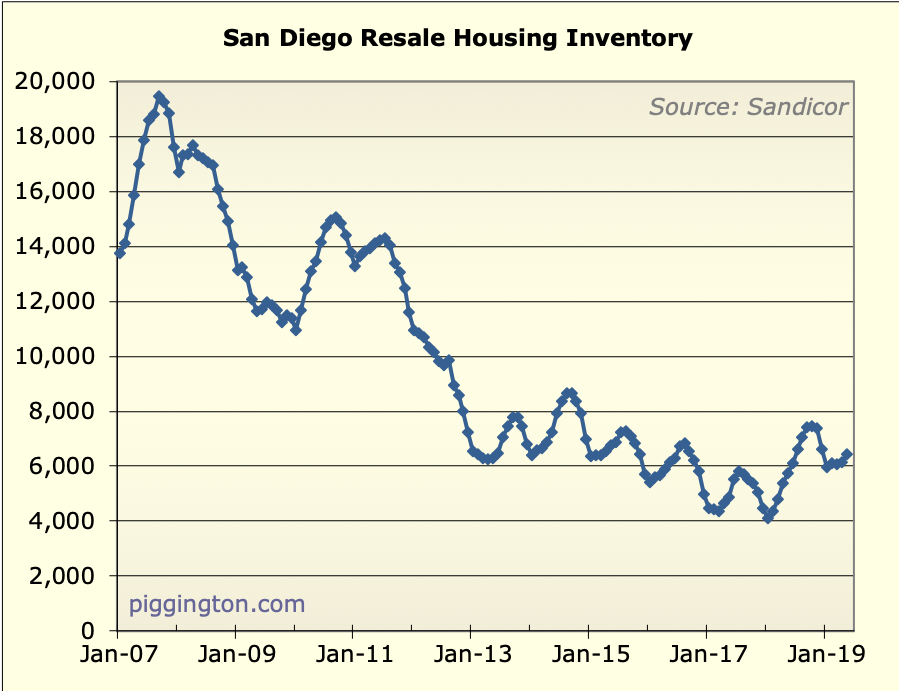

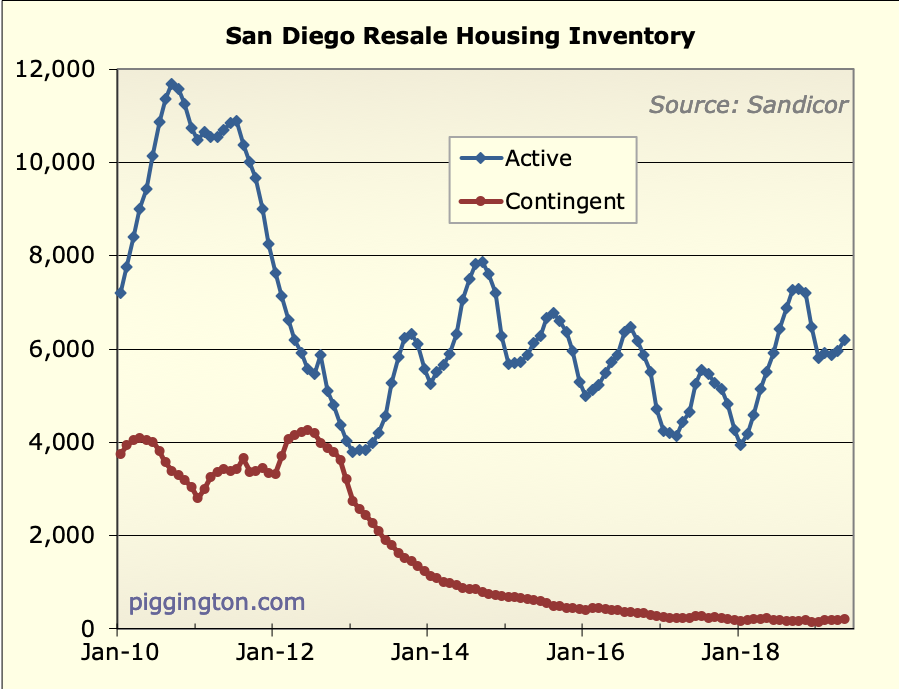

Looks like we’ll clock in

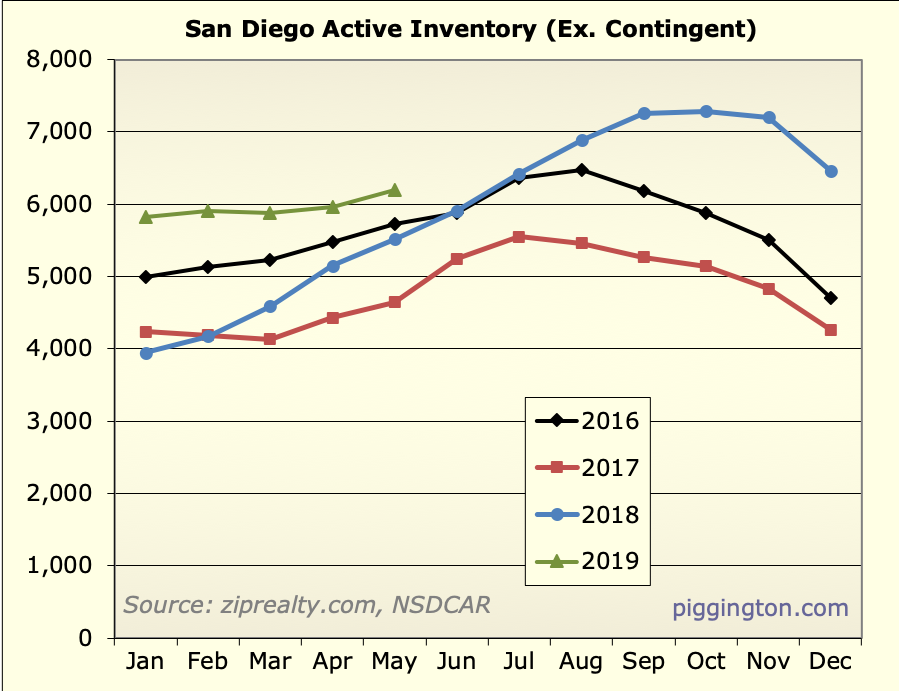

Looks like we’ll clock in around a 4-5% increase for 2019. The current two year low in rates though could turbocharge the market if it sticks or falls further. We still have a few hundred extra properties in inventory before buyers start really competing for limited listings.

The bright side of the slowdown in appreciation: the dollar appreciation is still pretty good because the base is higher than during the happy period of 8% gains.

Oddly 15 and 30 year mortgages have almost identical rates.

2012 and 2016 were the only times in the past 50 years with 10 year yields around or below 2% for an extended period.

Is everyone here doing refis? I am not because my purchases happened to be near or below the current rates.

Home building permits tank

Home building permits tank 58% in SD County:

https://www.sandiegouniontribune.com/business/real-estate/story/2019-06-12/homebuilding-tanks-in-san-diego-county

If this holds up for the rest of the year, we’re looking at construction dropping from the 9500-10,000 range if the past 5 years to only 4,000.

That could very well be a net change of nearly zero since many permits don’t involve additional units, just replacing existing ones or even decreasing them.

San Diego city’s raw 2018

San Diego city’s raw 2018 population growth was the most in California and 8th in the USA.

https://timesofsandiego.com/politics/2019/05/23/census-bureau-san-diego-posted-8th-largest-population-increase-among-big-cities/

SD County’s population increased about 17,000 last year. Add in maybe a net increase of 2000 housing units and the long term decrease is desired household size (due to later marriage, fewer kids) and a tight market should get tighter. Absent a recession, I think the rent growth slowdown from 6 to 3% increase won’t last long.

So much new construction is high end 2/2s. I think it would be healthier to have more of a mix. They don’t seem to actually rent that much more than 1/1s.

That nearly all construction is high end does make sense. It really isn’t that much more expensive to have granite and stainless everywhere.

Rates hit a new 2.5 year low

Rates hit a new 2.5 year low today, 1.974%.

Yield curve inverting even

Yield curve inverting even further … been inverted for three months so far. Rail/truck traffic decreasing. Housing stagnant despite falling rates. BTW, the Fed cut rates 2-3x before the 2008 recession, still didn’t prevent it.

spdrun wrote:Yield curve

[quote=spdrun]Yield curve inverting even further … been inverted for three months so far. Rail/truck traffic decreasing. Housing stagnant despite falling rates. BTW, the Fed cut rates 2-3x before the 2008 recession, still didn’t prevent it.[/quote]

The situation now is quite different than 2008. Mortgage rate has 2 parts, one is the 10 year treasury yield, the other part is the risk premium. Since government took over control of GSE, the risk premium has been pretty constantly around 1.7%. But before September 2008, Fannie Mae was a private company, so its mortgage bond investors demand whatever needed in the open market for the risk for holding the bonds. Even after Fed cut rates all the way to 2% in summer of 2008 from 2007 high of 5.25%, but the risk premium were very high due to high default rate of mortgage. So the mortgage rate in 2008 was still around 6% the same as in 2005-2006, that continued to deflate housing price and mortgage bond price. It was government take-over of GSE that marked the turn-point of housing collapse. That actually shortened the financial crise and led to eventual recovery. In the short term it aggravated the situation – Lehman stock dropped 30% the day after government announced Fannie Mae take-over. It was then treasury secretary Paulson’s intentional choice to let Lehman to go under to create scare in the market, so bail-out money can come and Goldman Sucks can be saved.

Current yield inversion is only partial. 2 year and 10 year never inverted for a single day this year. The spread between 10 year and 30 year actually has widened since Nov last when rate peaked. The low 10 year rate has lowered pretty much all the rates, from mortgage, consumer credit to junk or BBB corporate bonds. Those are all positive factors to the economy. It also made stock less expensive. Bond is an alternative choice of investment to stock, once bond gets pricy, stock look less expensive. Still too early to call recession purely from yield curve now.

The next recession probably

The next recession probably won’t be lead by housing in the same way as 2008. There are other indicators. Rail/freight traffic down, labor market not adding many jobs per ADP report.

Newest job report was a

Newest job report was a blockbuster!

Sent rates above 2% again, to 2.03. Right now the only developed nations with rates above 2 are the USA and Greece.

https://www.bloomberg.com/markets/rates-bonds

A lot of wealth will be generated and saved in 2019. Where will it head, to the stagnant economies with negative yields of Japan/EU? The politically unstable developing world, which lacks strong property rights?

Or the USA, booming, strong yields, stable currency, strongest investor protections, very low taxes on investments/wealth?

A perfectly plausible scenario: yield convergence sends 30-year mortgages below 3%, prices rise sharply, a new bubble forms.

One month of good data

One month of good data doesn’t a blockbuster make … jerb creation was bouncing between 250k and lower quantities for a while before the 2008 ‘cession began…

https://data.bls.gov/pdq/SurveyOutputServlet

Tick, tock, tick, tock, tick, tock…