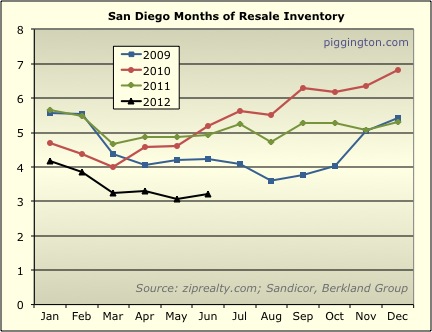

It was more of the same last month, as months of inventory remained

very low:

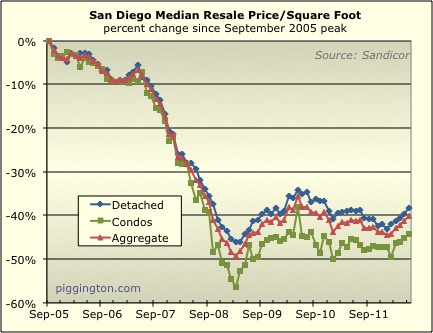

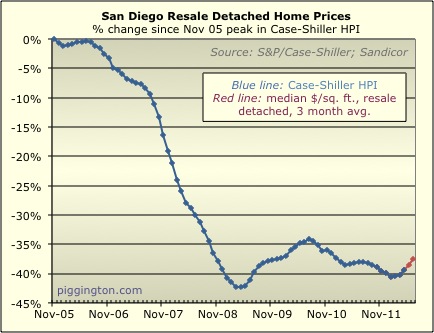

…and prices (as measured by the median price per square foot)

continued to rise:

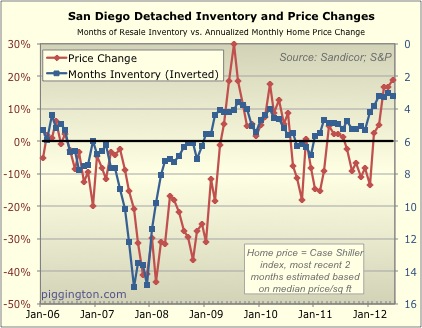

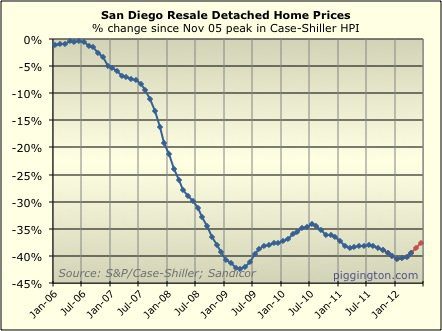

These two trends are tied together on this next chart, which shows

that months of inventory (inverted on the blue line) has done a good

job of predicting price changes (red line):

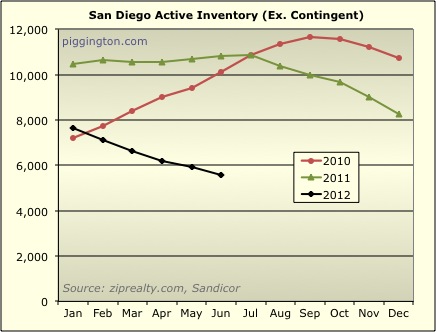

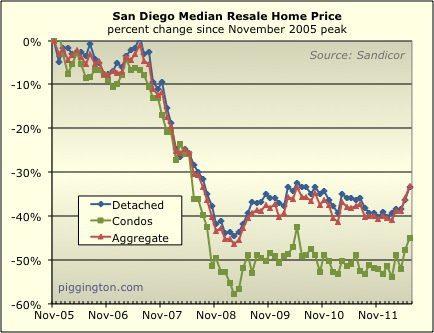

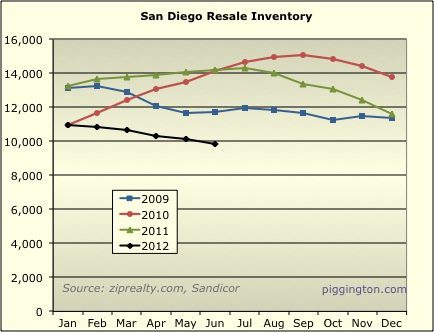

While we are now approaching the weaker part of the calendar year,

the trend towards tightening inventory continues:

…and months of inventory as pictured in the first chart remains

near multi-year lows. Unless something rather drastic changes,

this implies further upward price pressure in the months ahead.

More charts below…

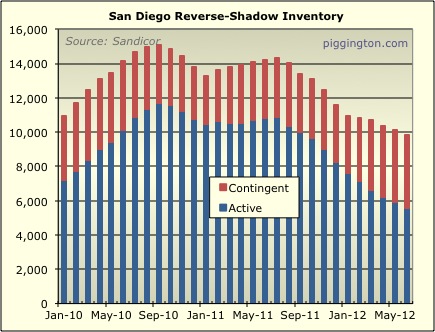

The things that jump out to

The things that jump out to me are

1. the inventory decline that has been going on virtually uninterupted since mid 2010

2. the rapid inventory decline over the last 12 months

3. the overshoot in late 2009

4. the flat market for 3 years thereafter

5. the undeiniable signs of recovery in every graph

Time for all the naysayers to pipe in with talk of manipulation, abnormally low interests rates and whatever fodder they choose for the day. I think we still have a good ways to go to undo all the damage but we sure have come a long way.

All I can say is: here’s

All I can say is: here’s hoping for a major war in the Middle East combined with more mess in Europe. I actually *like* when the economy is slow.

spdrun wrote:All I can say

[quote=spdrun]All I can say is: here’s hoping for a major war in the Middle East combined with more mess in Europe. I actually *like* when the economy is slow.[/quote]

Never mind any human suffering, as long as we can all be happy about a slow economy and the accompanying low interest rates

sdrealtor

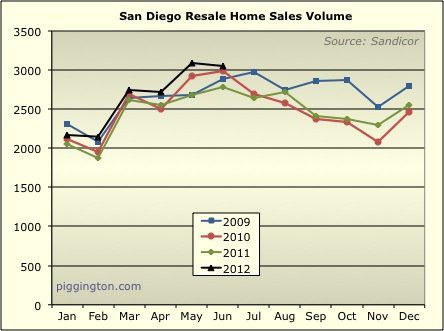

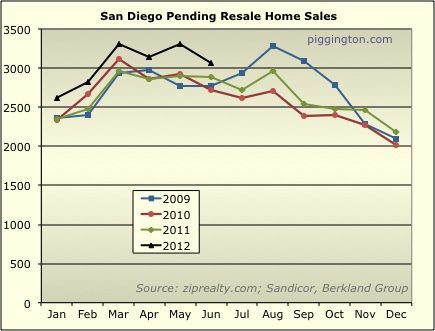

I’d add that sales

sdrealtor

I’d add that sales volume is higher than previous years (despite the low inventory).

What I take away from this is

What I take away from this is the data that is not included in the above.

The % underwater home owners and the average amount underwater.

This is very important info that is not included as it is the reason we are and will remain always on the verge of another great recession/depression as long as this condition remains.

Just one step from disaster, How many more years ?

For all anyone’s criticism, I

For all anyone’s criticism, I take a stand and stick by it. I don’t flip flop by the day like other realtors. I don’t own any real estate that is hundreds of thousand of dollars underwater. I make predictions stand by them and have been proven correct in nearly every case. Some day I’ll post on all garbage I have documented posted by some other guy. Safe to say Angelo’s biggest critic these days used to post how he was the smartest guy in the business. That he was the one who would save us all. I have that documented too with screen captures. I don’t post 2007 sales and call them peak prices either. You know who you are. Feel free to keep bringing it on.

Shovel

If I let go of my bias

Shovel

If I let go of my bias and look at those graphs objective everyone of them reads positively for SD housing. Yes we have lots of underwater homeowners out there? I know lots of them and most still in their homes are doing fine. I have clients who did short sales 3+ years ago who now have mid 700 Fico scores back and 20% down payments because they heeded advice to tighten their belts for a few years when their day would come.

The current mess will not clear itself completely in a year or two. That will take years to happen. But as I have maintained for the last 5 years time will heal all wounds eventually. Prices down a bit, rates down a bit, inventory down a bit, nominal incomes up a bit and time passed. Some day sooner than many think we will wake up and be past this. When? I don’t know, but it will be sooner than anyone imagined 5 years ago myself included. You can take that to the bank.

Sdr, you’re always bragging

Sdr, you’re always bragging about your predictions being right, but what are they exactly? You say”[s]ome day sooner than many think we will wake up and be past this.” Be past what, and when is sooner than many think? That is a little wooly for a prediction don’t you think? Most of us agree on the most important issues, and as a Realtor most probably understand where you’re coming from. Do you understand where your “naysayers” are coming from?

Jazz

My detractors said we

Jazz

My detractors said we probably wouldn’t see peak prices again in our lifetime and certainly not before 2020. I called a bottom in 2012 and I made that call back in 06/07. I predicted no more than 30% decline in general price levels for NCC and we never hit 25%. We are already heading back. I can provide links to hard numbers for specific categories of homes in specific neighborhoods that I posted on this blog. They have stood the test of time and were probably even a bit pessimistic at the time. I took more than my share of bullets. Most of the infantry has vanished when it’s my time to crow but I know they are out there wondering how I knew what they couldn’t comprehend. To me it was never rocket science and never will be. Just keeping ones eyes and mind open.

You are so cool SD Realtor.

You are so cool SD Realtor. Some day I too hope I can vaguely predict things that at some point might happen.

I’ll start now: I guarantee that within the next 90 days there will be at least a couple days in San Diego with sunshine. Bring it on naysayers! In 90 days I will prove you all wrong! I’m taking screen shots as proof and when it comes time to pay the piper, where will you all be then?!

Dude

My predictions were

Dude

My predictions were anything but vague. In 2007 when nearly everyone was calling for 50% plus drops I stepped out and put my money behind predictions of 30% being absolute Armageddon. In 2 months I will be collecting on a bet specifying not only the level of decline but specific neighborhoods, specific tracts within those neighborhoods and specific floor plans within thos. e tracts all of which is documented in the archives of this blog. How much more specific can one be?

As for the screen shot comment, that was directed at a specific guy who’s taken a few shots and me both overt and thinly veiled on his blog.

Outside of poway seller, who

Outside of poway seller, who was calling for greater than 50% drop?

But regardless, don’t pat yourself on the back too hard sdr, this thing ain’t over.

Go back and read the archives

Go back and read the archives from 2007. There were dozens of posters who were. My bet was with CAR and in two months it is over. The houses in question are now at roughly rent vs buy parity with 20% down. Prices would have to drop over 30% from current levels inNCC for us to hit 50% off. That part of this is over.

Can you give some examples of

Can you give some examples of good quality NCC homes that are rent vs. buy parity? I’m skeptical of that.

I will send it to you PM

I will send it to you PM

Thanks for the PM sdr. But

Thanks for the PM sdr. But without a specific example I am not entirely convinced. Specifically, you are making the case that a home that sells for 725K in your hood would rent for 3500 per month. I am VERY skeptical of that, in fact I don’t believe it unless I see it.

For $3500 a month rent you could live virtually wherever you wanted..

$3500 * 12 / $700,000 = 5.7%

$3500 * 12 / $700,000 = 5.7% – 1.1% = 4.6%. Actually a pretty low cap rate. The home should either sell for less or rent for MORE than $3500/mo if buying it is to make sense.

I went to craigslist and

I went to craigslist and found this one: http://sandiego.craigslist.org/nsd/apa/3176964717.html. Then I went to sdlookup and found http://www.sdlookup.com/MLS-120036384-2210_Azurite_Pl_Carlsbad_CA_92009, which is down the street. The one for sale is 200 sq-ft smaller. Assuming you can buy a similar 3100 sq-ft house for around $775k, with 20% down, your P & I is $3,004.83. Tax and insurance is probably about $850 and HOA & MR should come out to be about $420. So, PITI + HOA + MR = $4200-4300, depending on if you go with 0 point loan or 0 cost loan. That’s also before any deduction. So, it is parity even before deduction.

Isn’t exceeding parity the

Isn’t exceeding parity the whole point of owning property?

spdrun wrote:Isn’t exceeding

[quote=spdrun]Isn’t exceeding parity the whole point of owning property?[/quote]

Uh, no. The whole point of owning a primary resident is to live in a place that you want. There are plenty of places that exceed rent parity, but I wouldn’t want to live there. Rent parity would be a good enough sign to buy a primary resident. There’s a huge difference between rental vs primary as well. Also, I said, before deduction. Depending on your tax bracket, I’m pretty sure for most, after deduction numbers will exceed rent parity.

Here’s another example:

http://sandiego.craigslist.org/nsd/apa/3138353577.html

http://www.sdlookup.com/MLS-120014748-6961_Waters_End_Dr_Carlsbad_CA_92011

Rent = $3800, PITI + HOA + MR to own = ~$3300. Again, that’s before deduction.

If you’re talking about investment property, ROI anywhere in SoCal is not as great as the ghetto in places in Fresno. There, you can get a 3/2 house for $70k and rent it for about $900. That’s about 14% cap rate. No way you can get that kind of cap rate in SoCal, not even Temecula can get that kind of cap rate. I wouldn’t want to live there, but I’d consider investing there. Another example would be, in my area, cap rate for condo is around 9-10% while cap rate for SFR is 4-5%. Does that mean you have to put up with condo as a primary resident just because the cap rate is higher?

Even my apt in NYC is above

Even my apt in NYC is above parity before deductions, and NYC is notorious for a bad buy/rent ratio. And it’s in a fairly nice (if not very trendy) area, across from a gorgeous park and in a beautiful 1910s building.

But the question comes up:

Why not buy 10 3/2’s in Fresno, or a decent part of Poenis, AZ, or 5 of the same in San Ysidro and use the rental income to rent oneself a very nice pad in SD?

spdrun wrote:Even my apt in

[quote=spdrun]Even my apt in NYC is above parity before deductions, and NYC is notorious for a bad buy/rent ratio. And it’s in a fairly nice (if not very trendy) area, across from a gorgeous park and in a beautiful 1910s building.

But the question comes up:

Why not buy 10 3/2’s in Fresno, or a decent part of Poenis, AZ, or 5 of the same in San Ysidro and use the rental income to rent oneself a very nice pad in SD?[/quote]

Uh, because you still have to pay rent for that “very nice pad in SD”. Why can’t you buy 10 3/2’s in Fresno, or a decent part of Poenis, AZ, or 5 of the same in San Ysidro and use the rental income to pay for your primary resident, which is a very nice pad in SD? If the cost of buying your primary is cheaper than the cost of renting the same place, then why not buy it, use the rental income from those investment properties to pay the PITI of your primary AND saving money you would have spent to rent that same place. Having x amount of investment property doesn’t change the buy/rent equation for a primary resident.

You’re assuming that there

You’re assuming that there are unlimited funds for down payments on both. Personally, if the choice was between mere parity and decent cash flow, I’d choose the latter. At least it could carry me through rough spots, whereas a house at parity can’t translate to income.

($750k * .08) – ($561k * .06) ~= $26k/yr INCOME = ~=$2.2k/mo or 1.5k/mo after taxes additional for a rainy day. Reducing effective rent on the same place by the same amount, and in a pinch, one could break the lease and rent something much cheaper.

One could argue that your rent on the rented place will go up. But so will YOUR rental income.

spdrun wrote:You’re assuming

[quote=spdrun]You’re assuming that there are unlimited funds for down payments on both. Personally, if the choice was between mere parity and decent cash flow, I’d choose the latter. At least it could carry me through rough spots.

($750k * .08) – ($561k * .06) ~= $26k/yr INCOME = ~=$2.2k/mo or 1.5k/mo after taxes additional for a rainy day. Reducing effective rent on the same place by the same amount.

One could argue that your rent on the rented place will go up. But so will YOUR rental income.[/quote]

You’re right, I am assuming you can afford to buy your house and have the down payment. Again, my examples show’s it is cheaper to buy vs rent when you count in deduction. Also, keep in my the the mortgage will be fixed for 30 years. Can you say your rent will stay put for the next 30 years? If you have good tenants, I wouldn’t want to raise their rent. So, increasing rental income is not always a guarantee, especially if you have good tenants. Again, there’s more to buying a primary resident than just pure numbers. How much is it worth to you to be able to customize your home? How much is it worth to you to not have to worry about being kicked out or having to move? How much is it worth to you to have a place in the exact area/lot you want? How much is it worth to you to not have to worry about cost of housing after you retire (assuming you have it paid off after 30 years)? Also, not everyone want to deal with investment properties. What if you have no inclination and desire to invest in rental property? Where would you put your money? Saving or CD at 1% or the stock market and take that risk (many don’t know or don’t want to take that risk).

I’d put my money in a primary

I’d put my money in a primary that could be rented for a profit should I choose not to live there any more, or should I be unable to afford same due to some exigent circumstance.

True: your rental income isn’t guaranteed to increase. But neither is your landlord guaranteed to increase YOUR rent, for the same reasons.

spdrun wrote:I’d put my money

[quote=spdrun]I’d put my money in a primary that could be rented for a profit should I choose not to live there any more, or should I be unable to afford same due to some exigent circumstance.

True: your rental income isn’t guaranteed to increase. But neither is your landlord guaranteed to increase YOUR rent, for the same reasons.[/quote]

But you’re at the mercy of your landlord, while if you buy with a fixed rate, you’re guaranteed that your cost of housing will stay the same for 30 years and after 30 years, all you have to pay is Tax and insurance.

Back to the original example, PITI – deduction, assuming 31% tax bracket is ~$3300. If you rent the same property and assuming you stay in similar property, from year one, you’re ~$700-800 under if you’re renting. After 30 years, if rent increase average of 2.5% a year, your rent would be ~$8600/month. If you buy and stay put your tax and insurance would probably be ~$2k/month. So, maybe the number doesn’t look as attractive on year one, it looks VERY attractive in year 30 year. When your income is much more limited. This haven’t even consider the cost rent increase after you retire and if you stay alive for another 30 after that, your cost of rent will be HUGE compare to your tax + insurance.

(a) you could move to one of

(a) you could move to one of your rental properties

(b) you could sell your rentals and buy something else

(c) why do you assume that your LL will increase rent, but you yourself won’t be able to increase on your tenants?

(d) I said the other option was to buy a primary property that you could ALSO rent out for a handy profit if need be. It’s not as if properties that are above parity are all that scarce, even in SD.

Just a quick note. On the

Just a quick note. On the example AN provided that neighborhood has $250 higher MR and HOA then where I am. His tax and insurance estimate is $100 too high compared to what I actually pay.

His $3,000 P&I also includes over $800 towards principal. That puts us $1150 ahead before we talk tax benefits.

Whereas having rentals

Whereas having rentals capping at 7-8% will put you FURTHER ahead. Parity does nothing for you if you lose your day job, whereas with rentals or a primary that rents at a profit, you could at least have a trickle of income.

spdrun wrote:Whereas having

[quote=spdrun]Whereas having rentals capping at 7-8% will put you FURTHER ahead. Parity does nothing for you if you lose your day job, whereas with rentals or a primary that rents at a profit, you could at least have a trickle of income.[/quote]

Running the numbers doesn’t pan out the way you’re assuming. Using that same example, because it’s cheaper by ~$850/month buying vs rent after tax deduction, after ~17 years, you’d be able to save up $150k. Which will allow you to buy the same amount of investment properties as you would have if you rent and take the $150k to buy x amount of investment properties. This is assuming 7% cap rate on the $140k of investment properties and 2% yearly rent increase. So, assuming the one who buy won’t buy investment properties until he save up the $150k (after 17 years), after 17 years, the one who rent and the one who buy will be at parity. After 17 years, the one who bought will blow past the one who rent. After 30 years, the one who bought will be ~$450k ahead, assuming he/she didn’t buy anymore investment properties after 17 years. If he/she did, then the difference will be much bigger. Now, lets look past 30 years and you’re in retirement by now, the one who bought 30 years ago will have a month housing expense of about $1600/month while the one who rent will have a housing expense of $7k. So, after they both die 30 years after retirement, Both will leave their heir the same amount of investment properties. However, the one who bought will amass another $4M ($3.3M in cash and $700k from the original house, assuming it depreciate by 10% over 60 years) to give to their heir (assuming no appreciation of that $3.3M over the previous 60 years). So, your assertion that the renter will be further ahead doesn’t pan out. BTW, base on this example of the 2 properties I provided, they’re not at parity. If you count in deduction, the buyer have about $800/month advantage and if you count in the fact you’re paying down the loan, the buy would have another $800/month advantage. So, that’s $1600/month advantage for the buyer. Even if you put $140k in investment property getting a cap rate of 7%, that will only decrease the advantage of the buyer by ~$800/month, so the buyer still have an advantage of $800. This is also assuming your rental goes smoothly and you don’t have to spend any money fixing the place or lost rents due to change of tenants.

Meanwhile, the rental

Meanwhile, the rental property owner has a source of INCOME to fall back on if his dumb f**k of a boss fires him. Perhaps he could even move in to one of his rentals and have the others pay his expenses there.

The homeowner at near parity only has a burden. If income drops, tax breaks may mean jack-squat.

Speaking for myself, my goal is to be able to live for free and pay exactly ZERO per month for housing inside of a couple years. Property is worthless to me unless I can rent it out and actually have POSITIVE cash flow. And I’m not talking about positive flow that just pays off the principal.

spdrun wrote:Meanwhile, the

[quote=spdrun]Meanwhile, the rental property owner has a source of INCOME to fall back on if his dumb f**k of a boss fires him. Perhaps he could even move in to one of his rentals and have the others pay his expenses there.

The homeowner at near parity only has a burden. If income drops, tax breaks may mean jack-squat.

[/quote]

In that case you could rent out the primary and move in with your parents, sibling, or in-laws (or kids, I guess depending on age).

If you can own a houose at rental parity or better, you have a built in back-up plan to rent it out.

I like your idea above that for your primary you would buy something that would pencil out as a rental. Makes sense to me.

spdrun wrote:Meanwhile, the

[quote=spdrun]Meanwhile, the rental property owner has a source of INCOME to fall back on if his dumb f**k of a boss fires him. Perhaps he could even move in to one of his rentals and have the others pay his expenses there.

The homeowner at near parity only has a burden. If income drops, tax breaks may mean jack-squat.

Speaking for myself, my goal is to be able to live for free and pay exactly ZERO per month for housing inside of a couple years. Property is worthless to me unless I can rent it out and actually have POSITIVE cash flow. And I’m not talking about positive flow that just pays off the principal.[/quote]

Uh, unless your rental is in places you want to live, I rather be the buyer with rent parity. If you lose your job, you can rent out the other rooms and have your tenants pay for your house while you’re still living in an area that you want to live in. While, the one who rent would have to hope his rental income is enough to pay for his rent. Else, he’d have to move into one of the bedroom in his rental. Rentals with better cap rate wouldn’t be the type of property or areas I’d want to live in.

Good for you on your situation. If I own rental, I wouldn’t want to live in any of them, since the areas I want to live in have crappy cap rate and the area that I’d invest in with great cap rates are areas I wouldn’t want to live in. So, I’m glad that you’re willing to move into your rental. I wouldn’t want to do that. I want to live where I want to live and rental properties are there provide a steady source of income when I retire and not to be a place where I’d want to live in. What’s the point of retiring if you have to live in a shitty rental in a shitty area.

There appear to be quite a

There appear to be quite a few condos in SD in acceptable areas that pencil out at 7-8¢ on the dollar. Not talking about Encanto here. Same goes for NJ – I can get a building that caps at 8-9% in a very livable area, easy train trip to NYC.

Anyway, speaking for myself, if I wanted to spend $750k on property, I’d spend half of it on a nice place that rents for at least slightly above parity. The other half I’d spend on rentals that pay the expenses in the above-parity place. What I’d get first would depend on what kind of financing I could secure and how much cash I had on hand.

Rentals provide actual income. Renting rooms in a house at best pays for the house and little else.

Its a god plan but excuting

Its a god plan but excuting it is another matter. Hope you get there.

For some of us, an acceptable/livable area is not what we aspire to. Thats our choice just like your have this issue with authority and controlling our own destiny. Neither is wrong or right.

I am new to the forum. Not

I am new to the forum. Not sure if this an appropriate question, but I would like to see if I could chat over the phone or in person with one of the agents on the forum. If so, let me know how to contact you.

spdrun wrote:There appear to

[quote=spdrun]There appear to be quite a few condos in SD in acceptable areas that pencil out at 7-8¢ on the dollar. Not talking about Encanto here. Same goes for NJ – I can get a building that caps at 8-9% in a very livable area, easy train trip to NYC.

Anyway, speaking for myself, if I wanted to spend $750k on property, I’d spend half of it on a nice place that rents for at least slightly above parity. The other half I’d spend on rentals that pay the expenses in the above-parity place. What I’d get first would depend on what kind of financing I could secure and how much cash I had on hand.

Rentals provide actual income. Renting rooms in a house at best pays for the house and little else.[/quote]

A condo would be a last place I want to live in. I rather move to a different city and find another job than having to live in a condo that have 7-8% cap rate.

Your cap rate would have to be at 40% inorder for the $70k you’d spend on investment properties to pay for the expenses of your primary place. I don’t see any place that have that kind of cap rate from day one.

Renting rooms allow you live in a house/area you want. Living in your rental forces you to live in an area or house/condo you don’t want to live in. Big difference. You might want to pick the later but I’d pick the former. The later would be my last resort.

BTW, you seems to be miserable at your job and are constantly afraid of losing your job. That’s a horrible position to be in and I understand why you don’t want to depend on “the man”.

Where are you getting the

Where are you getting the $70k number from? In my scenario, the buyer would spend $375k for each of a primary and investment property.

I see an 8% cap on the investments, paying about $13125 after mortgage. Plus the other one would be rentable in a pinch at say 7%, yielding an additional $9000. Basically $20k of additional income that can be put towards rent in another city should you have to move for work.

What’s wrong with condos? Grew up in one, live in one (co-op, technically) now.

I’m not miserable at my job at all. I’m freelance, love most of my clients, but realize that freelance income may not be dependable in the long run. I’m also 100% not willing to get a full-time job, since that would compromise my freedom and ability to travel at will.

So the long-term alternative is to create my OWN job where I’m guaranteed an income without having to kiss anyone’s ass. Basically, I want to be in the position of having both freedom AND security by age 35.

Not be a slave with two miserable weeks of vacation and 50 hrs a week like the average American rube. Work to live. Not live to work. Basically, I want to live like a European in America, by way of exploiting those Americans who were too stupid to make good real-estate decisions 5-6 years ago.

spdrun wrote:Where are you

[quote=spdrun]Where are you getting the $70k number from? In my scenario, the buyer would spend $375k for each of a primary and investment property.

I see an 8% cap on the investments, paying about $13125 after mortgage. Plus the other one would be rentable in a pinch, yielding an additional $9000. Basically $20k of additional income that can be put towards rent in another city should you have to move for work.

What’s wrong with condos? Grew up in one, live in one (co-op, technically) now.

I’m not miserable at my job at all. I’m freelance, but realize that freelance income may not be dependable in the long run.

And I’m not willing to get a full-time job, since that would compromise my freedom and ability to travel at will.

So the long-term alternative is to create my OWN job where I’m guaranteed an income without having to kiss anyone’s ass. Basically, I want to be in the position of having both freedom AND security by age 35.[/quote]

It takes $150k to have 20% down on $750k property. So, that’s $75k to down on primary resident and $75k to down on investment.

Your PITI on primary would be about $2k. So, in order for your investment properties to cover your $2k PITI/month of your primary, it would need to yield you around 35% in order to cover your primary cost. Then to cover your cost of living, they would need to yield 40% to cover food and stuff.

If you rent out your primary, where would you live? In a box?

What’s wrong with a condo? Nothing, it’s just not for me and I would never want to live in one again unless I have no other choice. I HATE condo for my primary resident.

Have kids already compromise my freedom and ability to travel at will. So, a full time job won’t bother me one bit.

Good for you on your goal. I hope you get there. I know I can’t get there by 35 but I’m hoping to get there by 50. Only time will tell.

The numbers I stated say

The numbers I stated say essentially $22k/yr if all is rented out. That amount after taxes (say $1200/mo) can rent you a decent apartment in many parts of the US. Free housing, basically — even better than a rent-controlled apt in NYC.

Paying $750k for something that’s at parity or barely above gets you bupkiss for income potential.

This being said, I’m glad that more Americans don’t think this way. Reduces competition 🙂

spdrun wrote:The numbers I

[quote=spdrun]The numbers I stated say essentially $22k/yr if all is rented out. That amount after taxes (say $1200/mo) can rent you a decent apartment in many parts of the US.[/quote]

$1200/month can’t rent you a 1/1 in my neighborhood and my neighborhood is only average. I wouldn’t want a stuff a family of 4 into a 1/1. So, that would be FAAAAAR from desirable situation for me. If I have to move to the bay for work, damn, $1200 probably can’t even get me a studio.

BTW, if you buy a rent parity $750k place and you have to move for a job, guess what, you’d have income to pay for your new rent place and your rent parity primary (which would become rental) would make you ~$700/month income. Not as good as $1800/month before taxes, but still not bad. If you’re not laid off and end up working for 17+ years in the same city, you’d be in a much better position buying the place. You’re trading short term gain for longer term gain. I tend to think long term, so I’d pick buying in this example.

Assuming $150k initial cash,

Assuming $150k initial cash, I’d rather have the potential of $1800/mo. “A bird in the hand…”

This number will likely go up with time, so I *am* thinking long-term.

spdrun wrote:Assuming $150k

[quote=spdrun]Assuming $150k initial cash, I’d rather have the potential of $1800/mo. “A bird in the hand…”

This number will likely go up with time, so I *am* thinking long-term.[/quote]

While you’re thinking “A bird in hand…”, I’m thinking “tortoise vs hare”. You might pick the hair with “a bird in hand…”, I’d pick the tortoise.

While you’re thinking “A bird

Nah, my model is middle-ground. “Hare” model would be “fix and flip.”

spdrun wrote:

While you’re

[quote=spdrun]

Nah, my model is middle-ground. “Hare” model would be “fix and flip.”[/quote]

If that’s the way you’re justifying it, “Hare” would be put and call options. We’re talking about example of rent vs buying the same house. Between those 2 options, one will be the hare and the other will be the tortoise. Renting will make you more money in the short term but over the long term, buying the place will make you more money.

What about just making sure

What about just making sure that everything you own is above parity?

I also have much lower expectations than you guys. I’m fine with living in 3-400 sq ft per person, having grown up in relatively small houses by CA-in-2012 standards.

spdrun wrote:What about just

[quote=spdrun]What about just making sure that everything you own is above parity?

I also have much lower expectations than you guys. I’m fine with living in 3-400 sq ft per person, having grown up in relatively small houses by CA-in-2012 standards.[/quote]

I agree with that. The rent parity property I showed is above parity if you’re renting it out. The cap rate on it is not as good as properties in shittier areas though. I never said it’s good idea to buy a primary when it’s below parity.

Yes, your expectations is much lower than mine. I grew up in a 1300 sq-ft house with 6 people, so I know how it feels. That’s why I don’t want to deal with that if I can help it.

spdrun wrote:Not be a slave

[quote=spdrun]Not be a slave with two miserable weeks of vacation and 50 hrs a week like the average American rube. Work to live. Not live to work. Basically, I want to live like a European in America, by way of exploiting those Americans who were too stupid to make good real-estate decisions 5-6 years ago.[/quote]

Hmmm… I have 3 weeks of vacay, unlimited sick leave, 100% free healthcare for my entire family, and barely work 40 hrs. a week. All the while, getting paid pretty close to freelancing. If you add in my killer benefits, I’m pretty sure I’d be paid more than if I’m freelancing. I know because I’ve gotten a few offers for freelancing before.

I agree, work to live and not live to work. I’m doing that right now. Don’t need to wait till I’m 35 or 50 to do that.

Hmmm… I have 3 weeks of

I’d still take the freelance + property investment. Bet you can’t choose WHEN you take the vaca or take 3 wks in a row.

spdrun wrote:

Hmmm… I have

[quote=spdrun]

I’d still take the freelance + property investment. Bet you can’t choose WHEN you take the vaca or take 3 wks in a row.[/quote]

Sure I can and I did. I’d take full time + property investments. I bet you won’t be paid if you get really sick and need to take 3 weeks off. I bet if you get cancer or any other expensive illness, you’d have to pay more than $750/year to get treatments. I bet if your future wife gets pregnant, you can’t be sure your total cost would be $750.

I bet you won’t be paid if

NY = community-rating and guaranteed-issue-insurance state, unlike California 🙂 Though Obamacare should make things easier for you all as well.

spdrun wrote:

I bet you won’t

[quote=spdrun]

NY = community-rating and guaranteed-issue-insurance state, unlike California 🙂 Though Obamacare should make things easier for you all as well.[/quote]

You’re not answering the question. Can you be sure your total out of pocket is $750/year, regardless of what illness you get? I know I can. If I lose my job and get COBRA, I’d have to pay well over $20k/year to keep the same kind of coverage.

Deadzone

$3500 is on the low

Deadzone

$3500 is on the low side for houses like the one I sent you. A friend who moved up to LA and kept his just got $3900. I saw the new tenants moving in this morning on my run. There was a Benz in the driveway too. A friend with a slightly nicer one who moved up to RSF got $4500 for his.

I dont know when you last looked for rentals but the market went up substantially around her in the last 2 years. At least $500 on every decent 4BR with at least 2200 sq ft.

I will tell you what. I have a specific house you could buy in that price range. It would easily rent for $3500. Send me a PM with contact information, get me a pre-approval letter from a reputable lender and statements showing you have the money for the down payment. We can go see the house tomorrow morning and write up your offer on the spot! Do you want it?

BTW, in the example I sent you last night I didnt mention that the mortgage payment included $800 toward principal the very 1st month!

So do you you want it? If not, how about a $500 wager? I show you a house I can sell you in that range and show you rental comps inexcess of $3500. Is that not specific enough?

sdrealtor

[quote=sdrealtor]Deadzone

$3500 is on the low side for houses like the one I sent you. A friend who moved up to LA and kept his just got $3900. I saw the new tenants moving in this morning on my run. There was a Benz in the driveway too. A friend with a slightly nicer one who moved up to RSF got $4500 for his.

I dont know when you last looked for rentals but the market went up substantially around her in the last 2 years. At least $500 on every decent 4BR with at least 2200 sq ft.

I will tell you what. I have a specific house you could buy in that price range. It would easily rent for $3500. Send me a PM with contact information, get me a pre-approval letter from a reputable lender and statements showing you have the money for the down payment. We can go see the house tomorrow morning and write up your offer on the spot! Do you want it?

BTW, in the example I sent you last night I didnt mention that the mortgage payment included $800 toward principal the very 1st month!

So do you you want it? If not, how about a $500 wager? I show you a house I can sell you in that range and show you rental comps inexcess of $3500. Is that not specific enough?[/quote]

sdr, no I don’t follow rental rates in that area. But I am shocked that anyone would pay over $3500 per month to rent those houses. I guess the question then is why would they do that instead of buying if price parity is as you claim? Doesn’t make sense to me. But either way, I’m not interested in living in Carlsbad area so unfortunately I can’t take advantage of any good deals going on there. Nice area up there but pretty much BFE for those of us who operate out of San Diego.

A few examples come to mind.

A few examples come to mind. Young physicians with lots of debt and lots of income that will grow. Recently divorced with lots of income but don’t want to own and be responsible for big house. Recently moved to area and not ready to commit to specific neighborhood yet. Walked away from underwater house with non recourse loan with good income. Self employed with income they can’t or don’t fully document. Moved to area for schools and only staying while kids in schools which is only a few more years.

Right now in this area a 4br 2200 sq ft home will run you about 3000. A couple years ago you would have gotten a 2800 sq ft home for 3000. now a 2800 sq ft home will run you 3500 or more.

The nicer newer homes over 4000 sq ft rent for 4500 and up. They have no problem finding tenants either.

Time drop the very skeptical part. It’s very real.