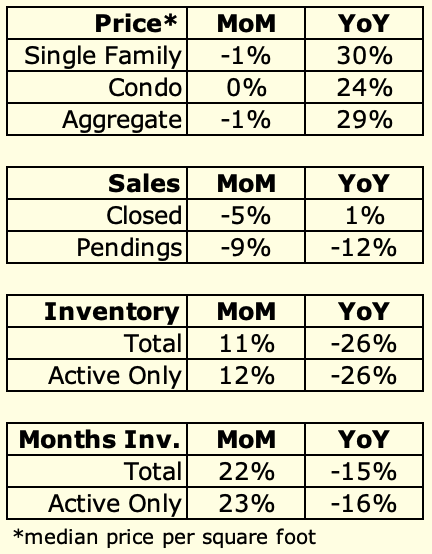

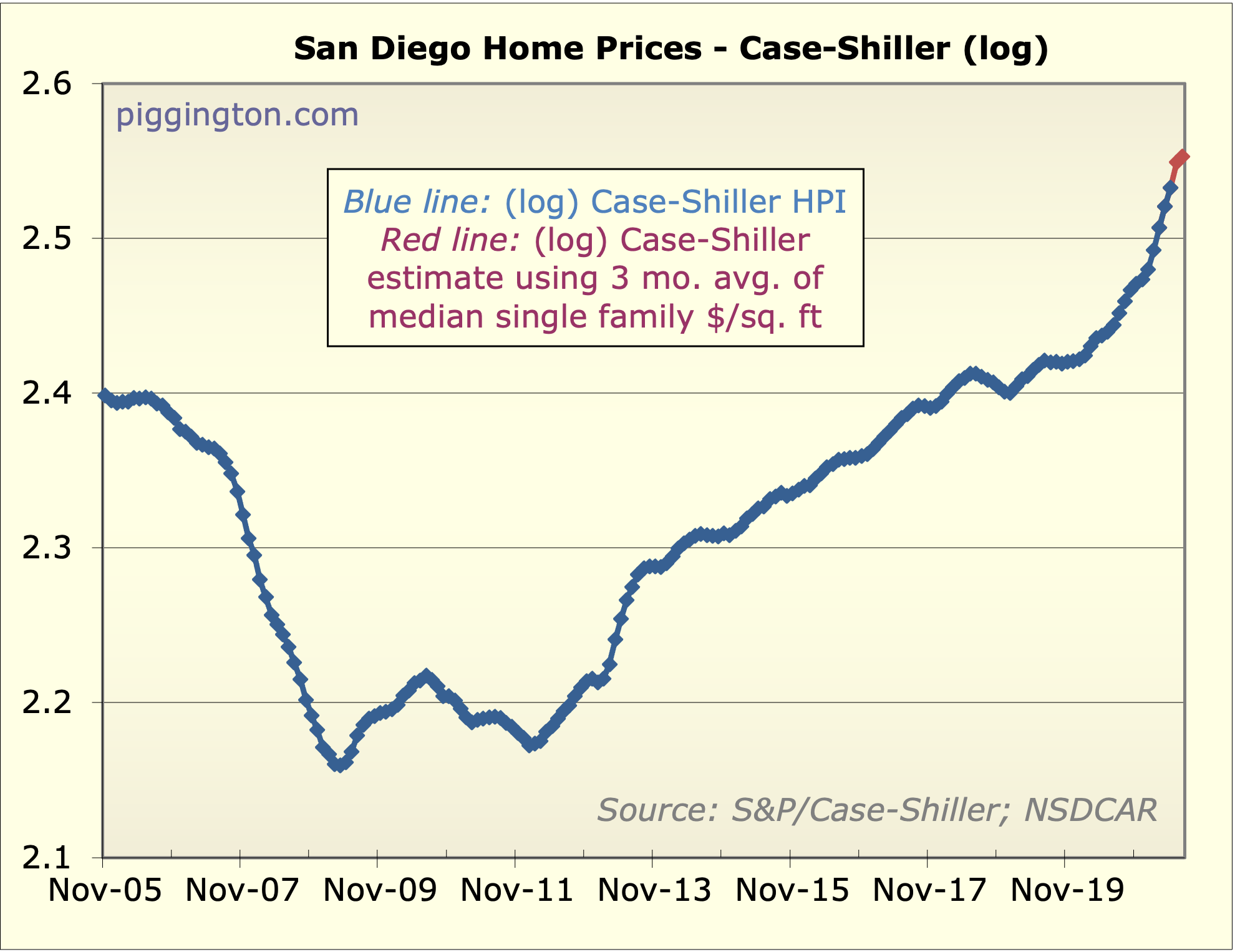

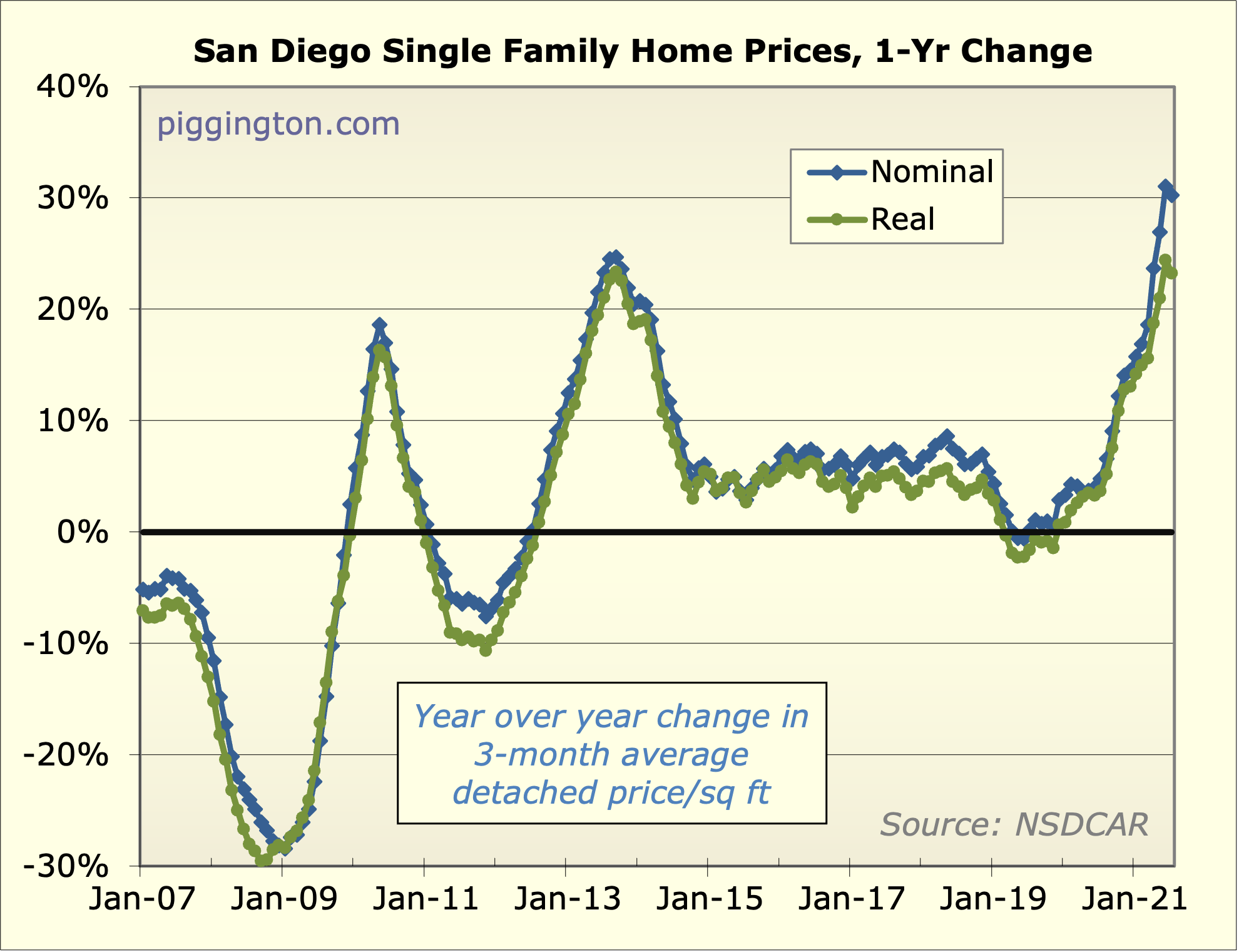

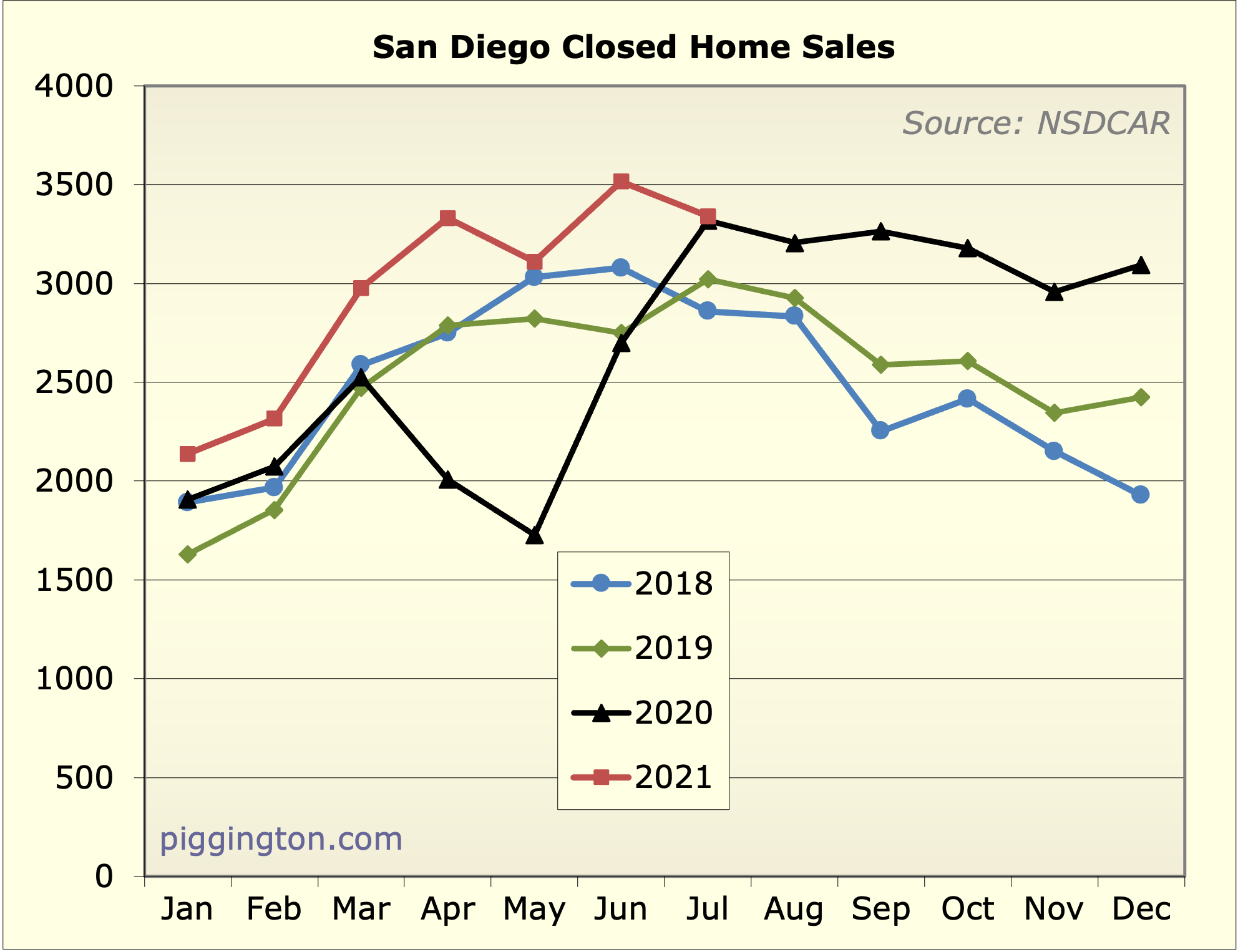

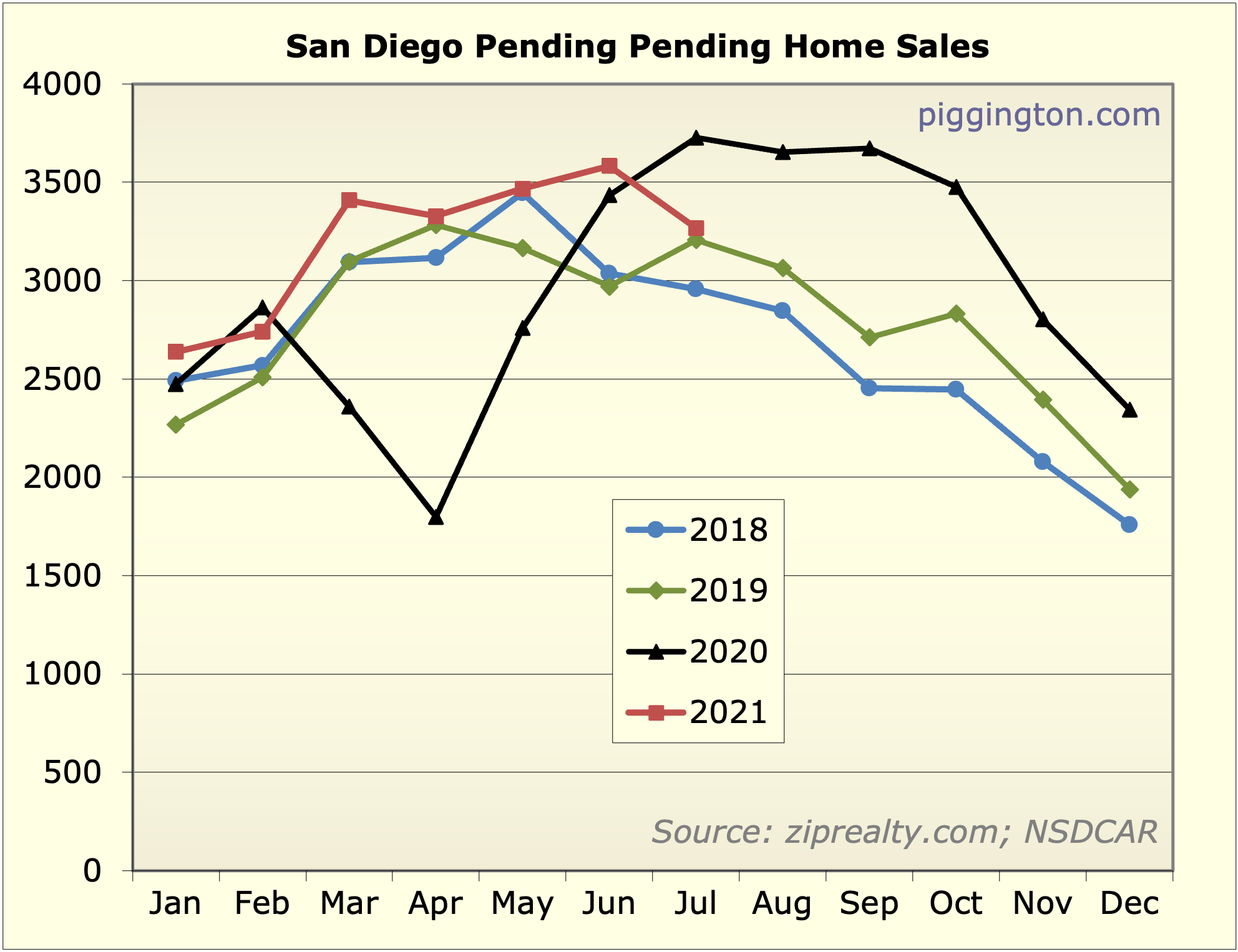

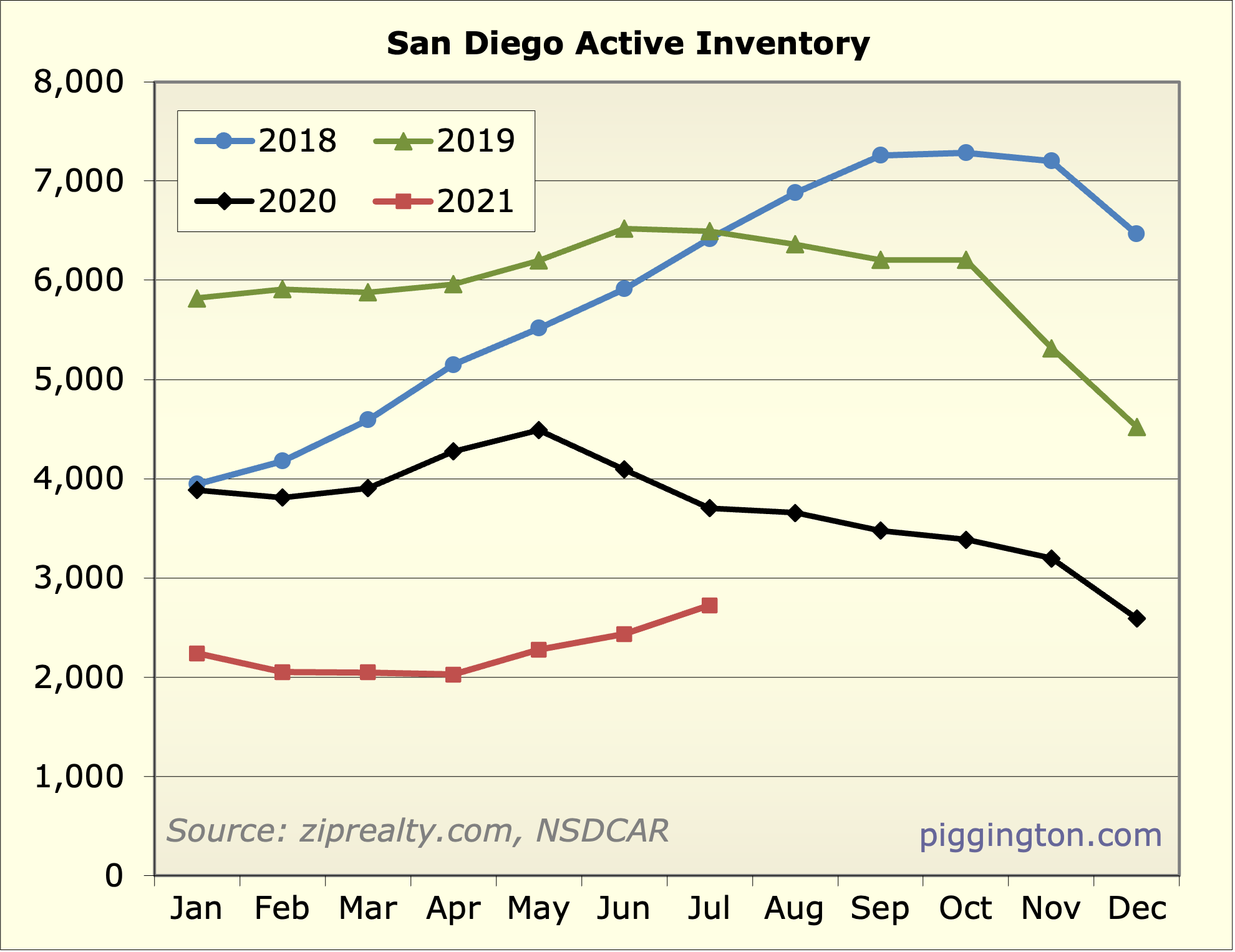

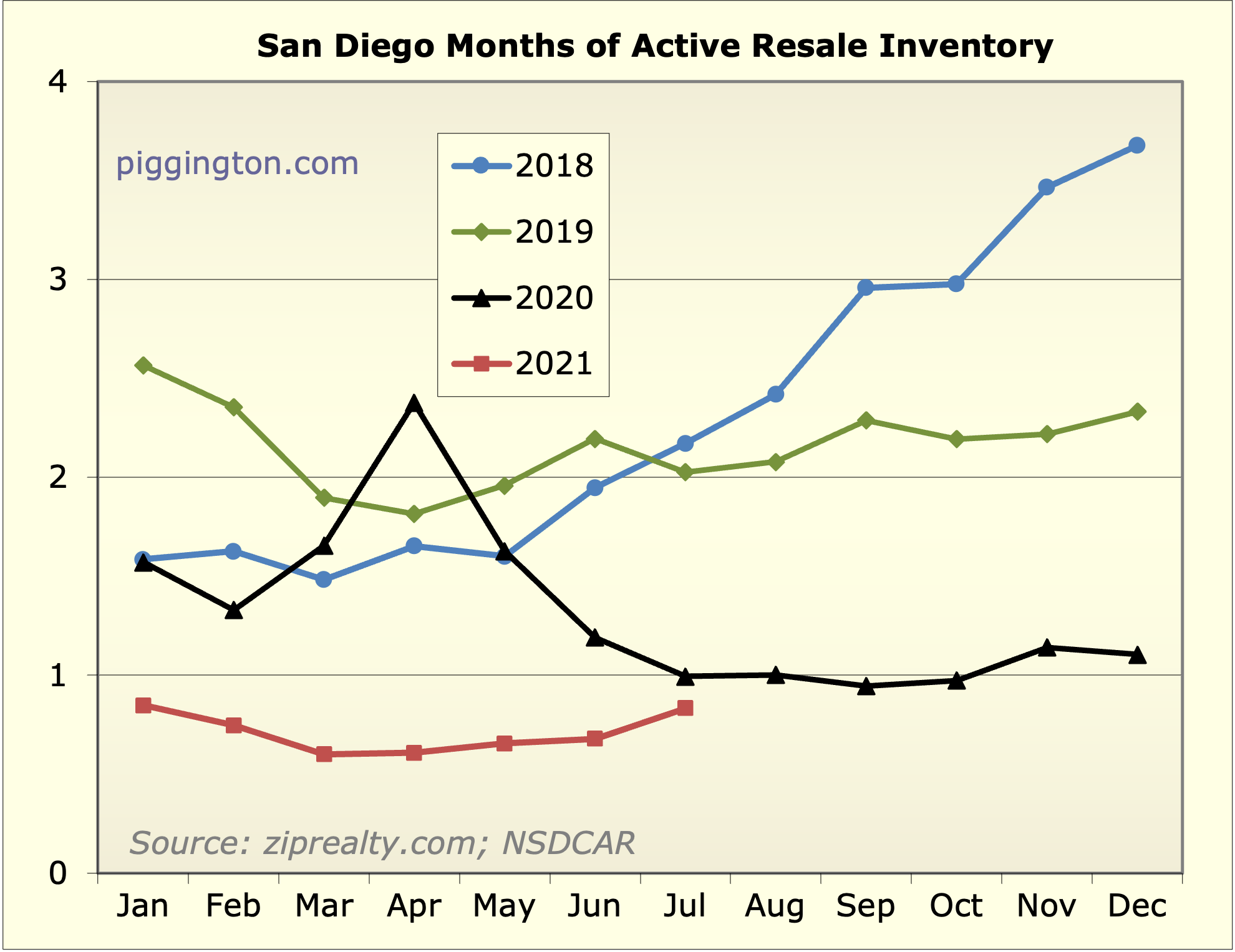

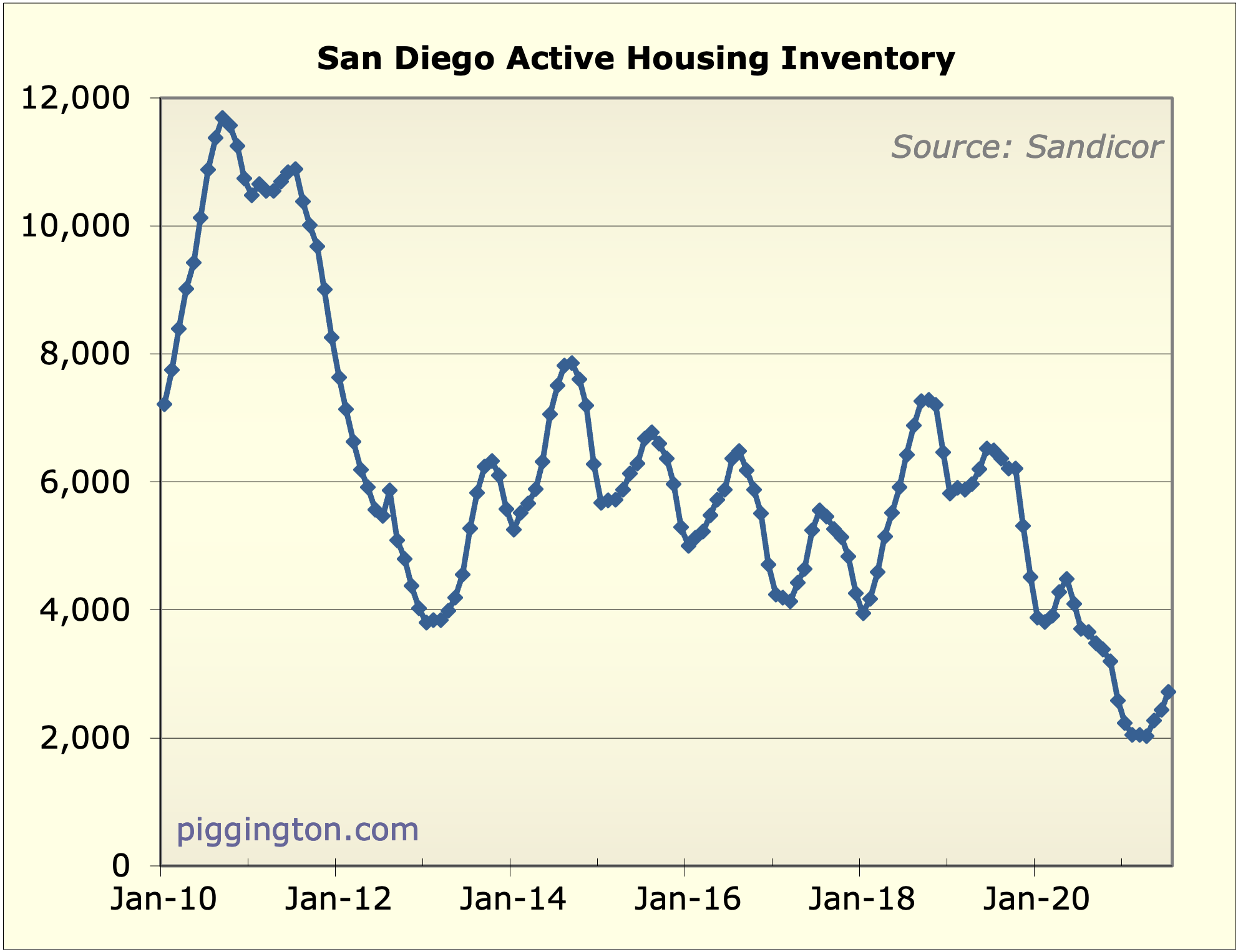

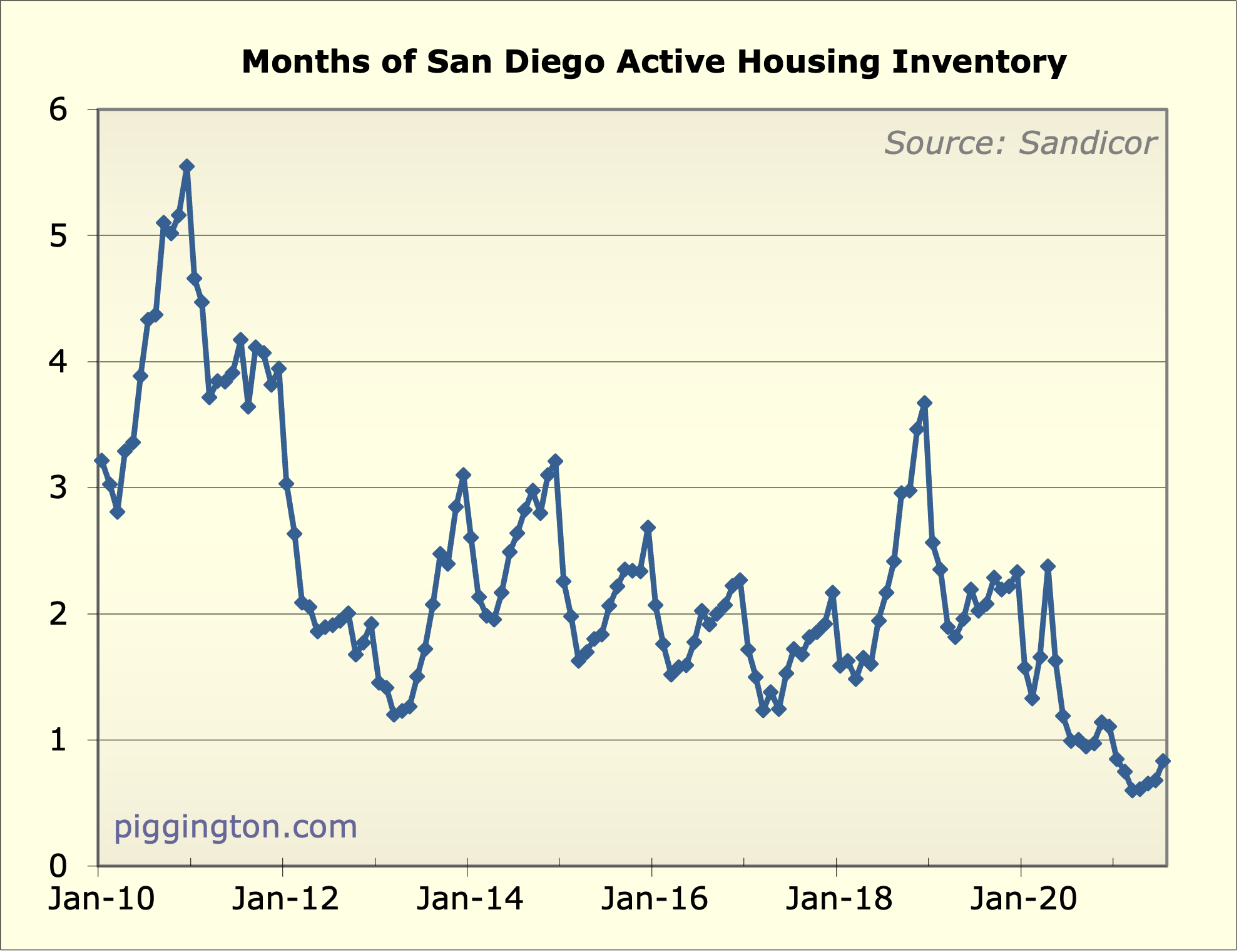

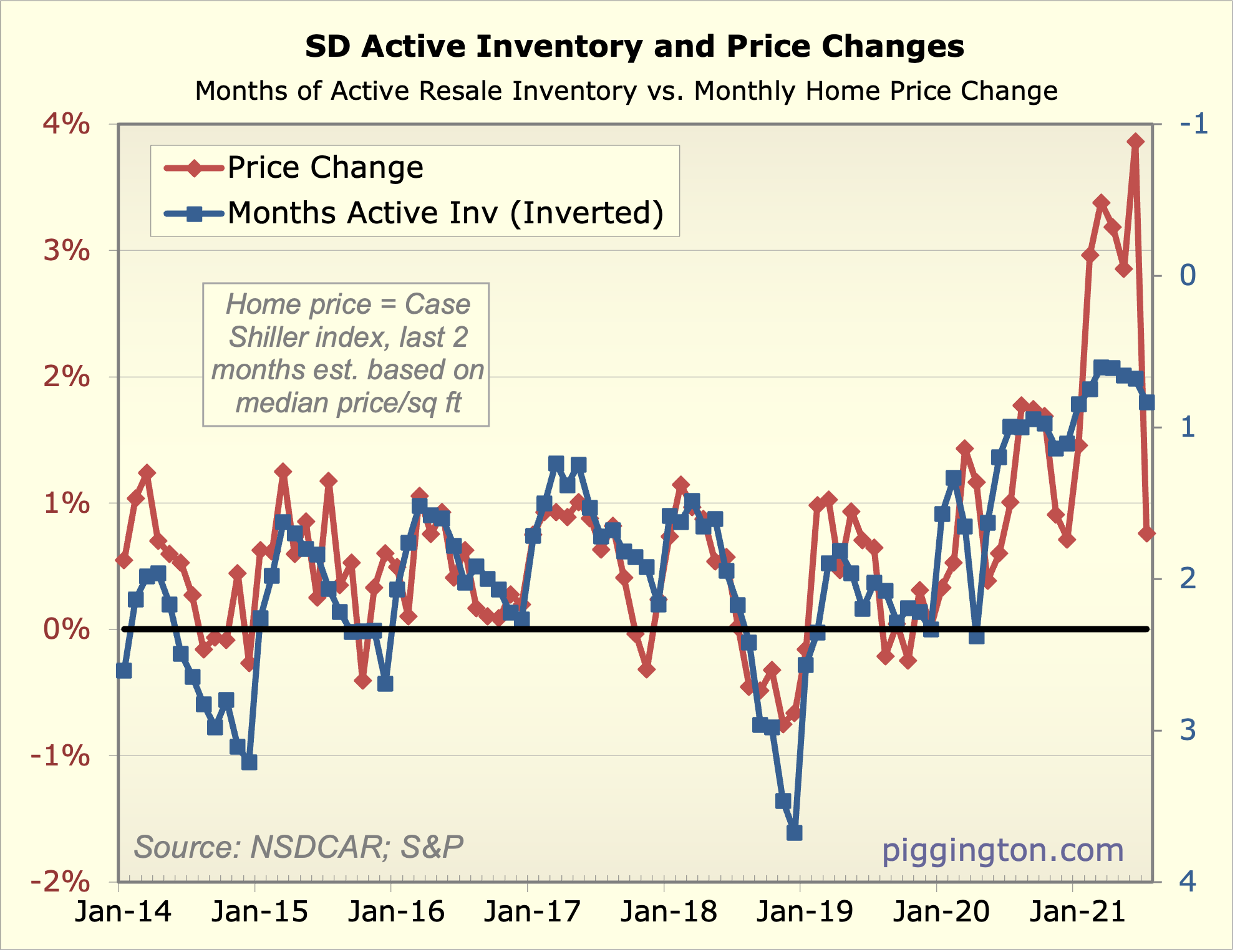

Prices backed off a bit last month, sales declined, and inventory

rose. It seems that the market has finally come off the boil

somewhat. However, supply is still quite low compared to demand, as

measured by months of inventory. So while the panic buying phase

seems to be over, this is still a strong market. Charts below.

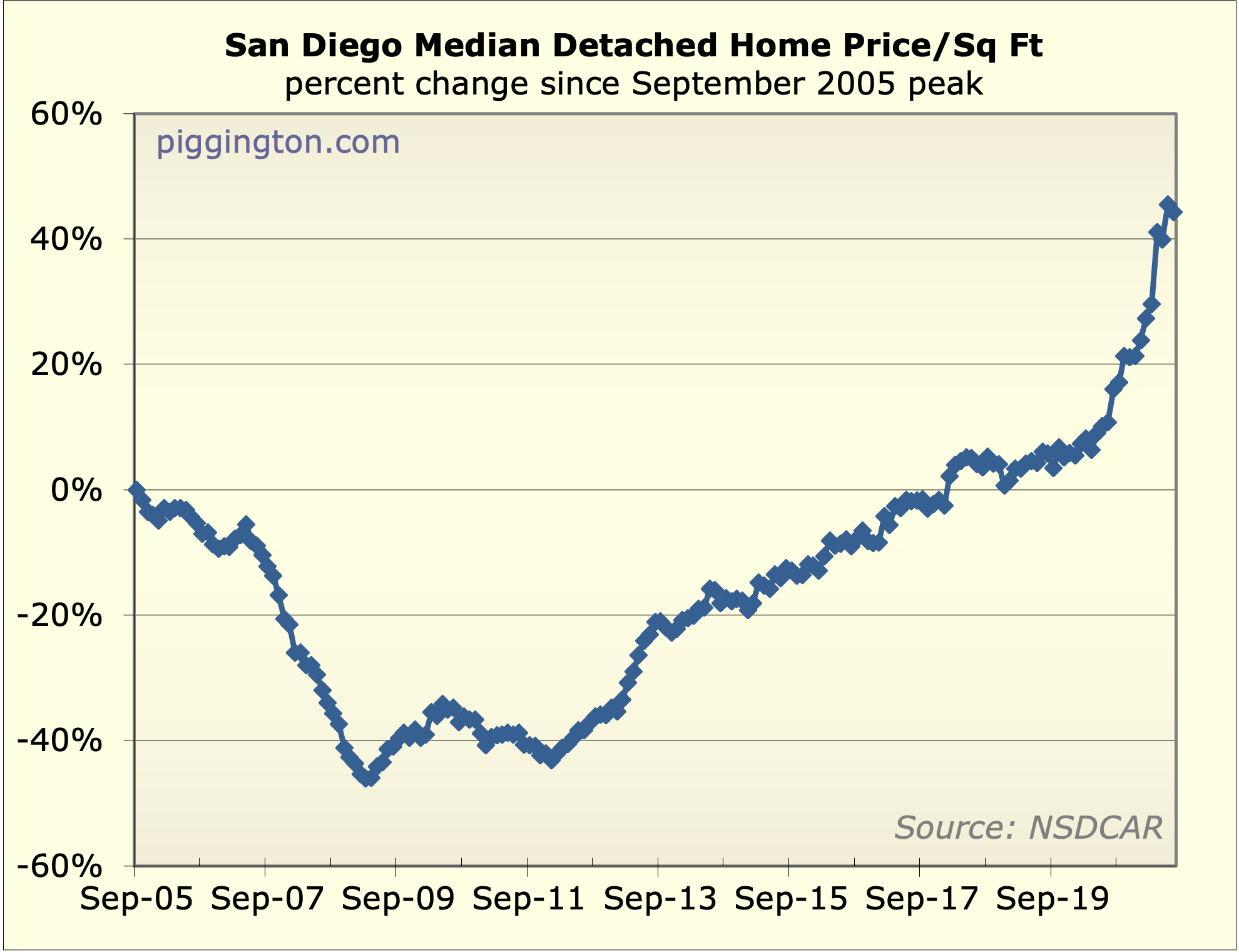

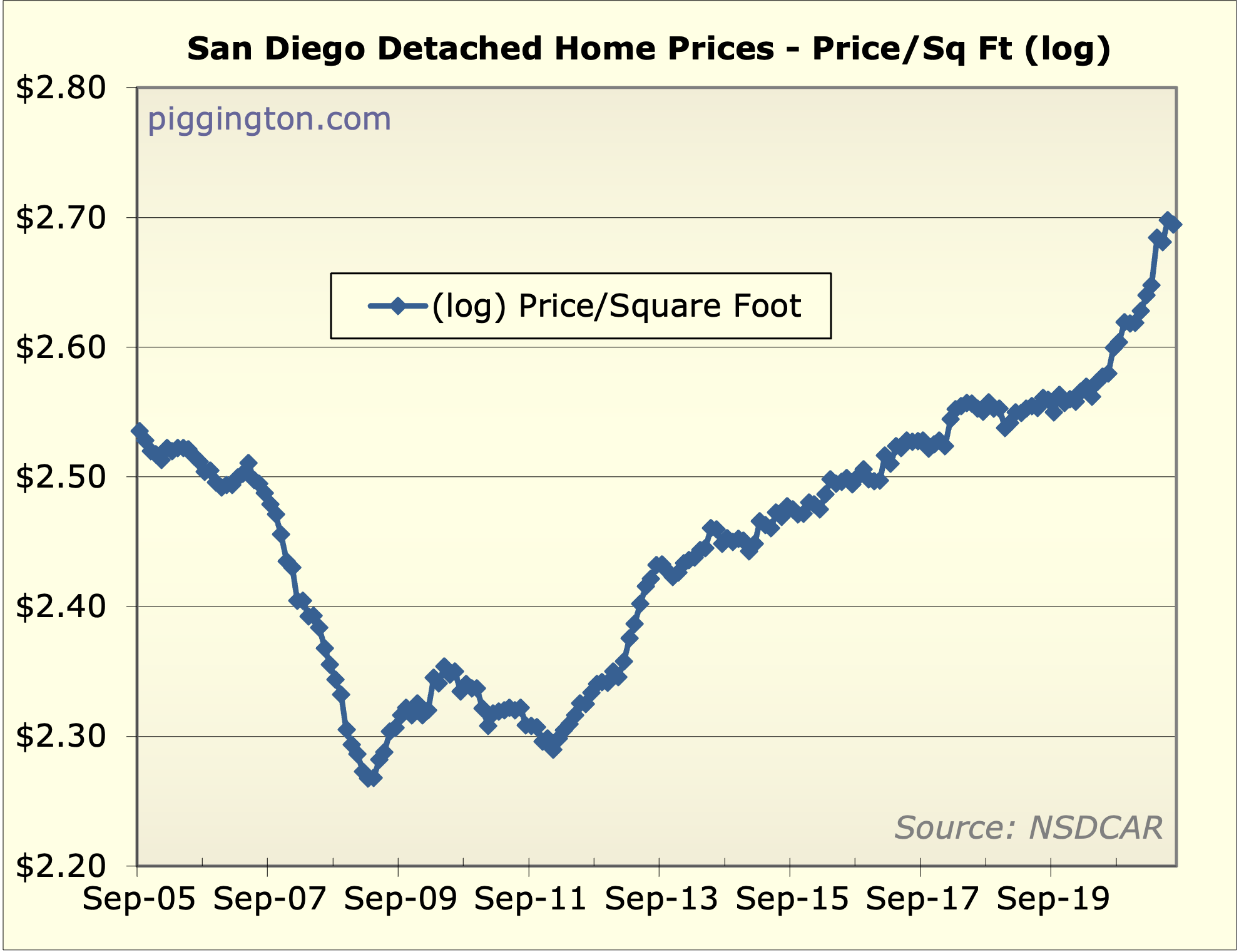

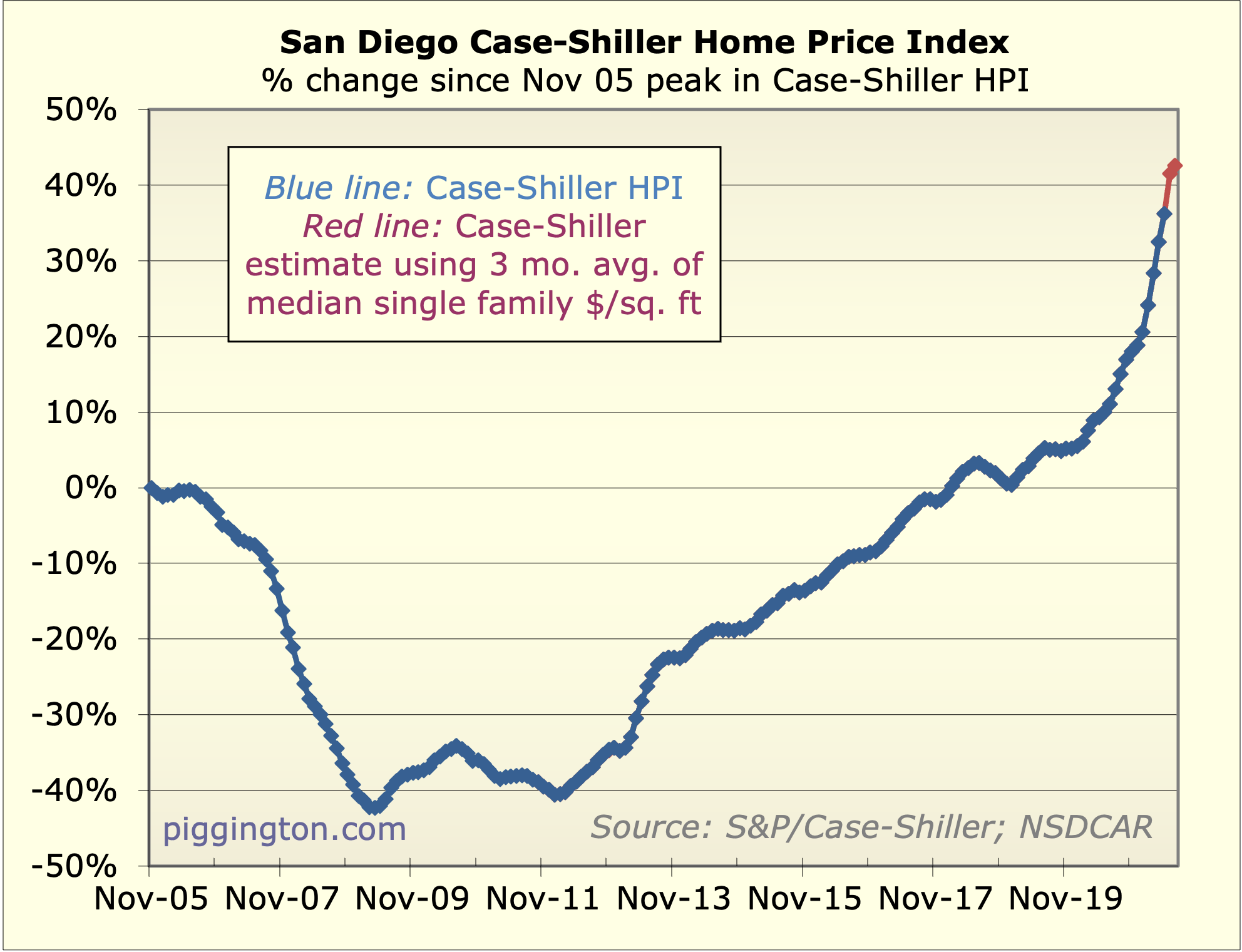

Calming down but not turning

Calming down but not turning down. If you pull the 2020 line off the multi year graphs it’s easy to see we are getting back to our more typical seasonal ebb and flow

stopped by to get a read on

stopped by to get a read on the local RE market

basically wondering what other investors feelings are about how the continued low fed fund rate rate is playing a role in all of this (also have to take into account low inventory AND increased population) which in my mind explains the ever increasing prices of RE

https://www.bankrate.com/rates/interest-rates/federal-funds-rate.aspx

looking at the much bigger picture,… guess what I am asking is how much longer can the local RE prices increase before something surprising gives like perhaps the triffin paradox??

https://www.investopedia.com/financial-edge/1011/how-the-triffin-dilemma-affects-currencies.aspx

https://www.youtube.com/watch?v=y5ayiYQJb1M

phaster wrote:

basically

[quote=phaster]

basically wondering what other investors feelings are about how the continued low fed fund rate rate is playing a role in all of this (also have to take into account low inventory AND increased population) which in my mind explains the ever increasing prices of RE

https://www.bankrate.com/rates/interest-rates/federal-funds-rate.aspx

[/quote]

Phaster, I think the natural real interest rate in the USA is historically low, and headed lower because of demographic changes and a declining numbers of creditworthy people who want to actually borrow money. Fed policy really doesn’t have much to do with it.

The USA is not as far down this trend as Japan, SK, and Western Europe, which is why they have even lower rates. But we’re just 5 to 15 years behind them.

As for San Diego, we’re a city of winners and wealth, with both the lowest crime and best weather of any major city. I think our real estate is a very safe long-term bet. I also think there will probably be another crazy bubble in the next few years and want to enjoy that ride when it happens.

Rich,

Off topic appreciate

Rich,

Off topic appreciate your investing article re growth vs value. Most of my equities are in value and while they have consistently performed well over the last decade that portfolio is up about 20% YTD and far out performing the other 1/3 that is in growth. A very pleasant surprise this year and glad I’ve held onto all my risk based assets. Between value and real estate it’s been a year for the ages

gzz wrote:phaster

[quote=gzz][quote=phaster]

basically wondering what other investors feelings are about how the continued low fed fund rate rate is playing a role in all of this (also have to take into account low inventory AND increased population) which in my mind explains the ever increasing prices of RE

https://www.bankrate.com/rates/interest-rates/federal-funds-rate.aspx

[/quote]

Phaster, I think the natural real interest rate in the USA is historically low, and headed lower because of demographic changes and a declining numbers of creditworthy people who want to actually borrow money. Fed policy really doesn’t have much to do with it.

The USA is not as far down this trend as Japan, SK, and Western Europe, which is why they have even lower rates. But we’re just 5 to 15 years behind them.

As for San Diego, we’re a city of winners and wealth, with both the lowest crime and best weather of any major city. I think our real estate is a very safe long-term bet. I also think there will probably be another crazy bubble in the next few years and want to enjoy that ride when it happens.[/quote]

one things about RE investments,…. is its a “need” so there will always be a built in demand by people (so agree its a safe long term bet)

BUT can’t help but get a nagging feeling many things are amiss (like the threat of drought, and various unanswered questions about political mismanagement)

https://www.piggington.com/goodbye_san_diego?page=3#comment-292747

https://www.piggington.com/state_and_local_recalls

so want to plan ahead right now so I can enjoy the ride (or said another way not worry too much if and when SHTF)

phaster wrote:stopped by to

[quote=phaster]stopped by to get a read on the local RE market

basically wondering what other investors feelings are about how the continued low fed fund rate rate is playing a role in all of this (also have to take into account low inventory AND increased population) which in my mind explains the ever increasing prices of RE

https://www.bankrate.com/rates/interest-rates/federal-funds-rate.aspx

looking at the much bigger picture,… guess what I am asking is how much longer can the local RE prices increase before something surprising gives like perhaps the triffin paradox??

https://www.investopedia.com/financial-edge/1011/how-the-triffin-dilemma-affects-currencies.aspx

https://www.youtube.com/watch?v=y5ayiYQJb1M%5B/quote%5D

In 2008, I was living in Russia. The Russian rouble was very strong against the greenback.

The rate was 24 roubles per USD which was an appreciation of 30% in a few years. I rented out our townhouse in Moscow for $4000 a month.

As it was paid off, the full payment could be saved.

Fast forward to 2013/14, I used the rent from several years to buy four houses in San Diego. The collapse was severe and the dollar was weak.

My point is simply this, there are many around the world who could and would do the same if the dollar weakens vs other currencies. Currencies and real estate are not directly connected.

Still have the place in Moscow, it’s kind of an odd currency hedge.

If oil explodes, or the dollar weakens, might see a similar scenario again.

Most likely, our economic and political competitors will not allow their currencies to appreciate meaningfully against the USD in the next couple of decades.

I would be worried owning

I would be worried owning property in Moscow that the Russian Mafia would extort it from me or a government would expropriate it from me.

Yes one one think that would

Yes one one think that would be a concern, but somehow even going on 20 years, no issues at all. Main issue has been oil price and the overall global economy.

i’m probably much to small to bother with.

There is some serious money over there.

That being said, one day, will need to exit.

It is notable that their central bank warns of real estate bubbles in their own country. Imagine that!

https://www.reuters.com/article/russia-realestate-idUSL8N2IC4OU