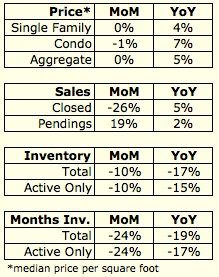

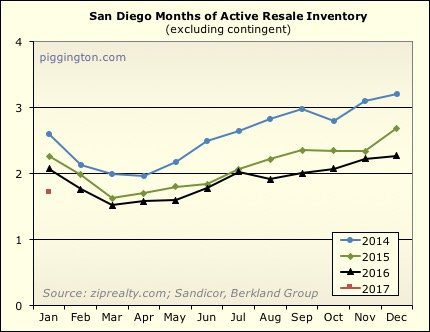

I’m working on some valuation stuff to be posted soon. Meanwhile,

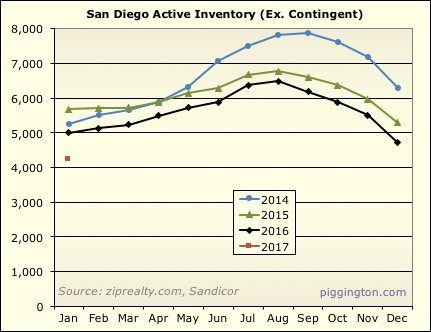

here’s a selection of graphs on the January resale data. Take

note of that steep decline in months of inventory from this time last

year… if that doesn’t rectify itself, it’s a sign of higher prices

immediately ahead.

Interesting side note from

Interesting side note from Calculated Risk: Update on lack of Chinese Residential Real Estate Buyers

Rich Toscano

[quote=Rich Toscano]Interesting side note from Calculated Risk: Update on lack of Chinese Residential Real Estate Buyers[/quote]

I was under the impression that Chinese buyers were not a big factor in San Diego?

I’ve heard it mentioned as a

I’ve heard it mentioned as a bullish factor for SD in the comments. I don’t actually know how big a factor it is here though.

Yes, I had heard that San

Yes, I had heard that San Diego was the next big destination for Chinese house shoppers, but I had not seen any evidence.

I am still astounded at how little inventory is available. Prices are high, but few properties are being put on sale.

Saw a story making the rounds

Saw a story making the rounds on a few different sites today in which investors made up a record 37% of home purchases in 2016. Small investors constituted the majority of these purchases. Certainly seems to be one component of the inventory story.

https://www.bloomberg.com/news/articles/2017-02-23/landlords-are-taking-over-the-u-s-housing-market

San Diego is the 7th hottest

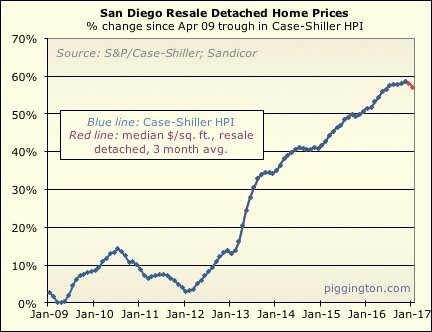

San Diego is the 7th hottest market in the USA as measured by average time to sell. CoreLogic predicts a 10.3% price increase for San Diego in 2017.

http://www.nbcsandiego.com/news/local/San-Diego-Single-Family-Home-Market-6th-Hottest-in-US-414716473.html

Looks like there is a

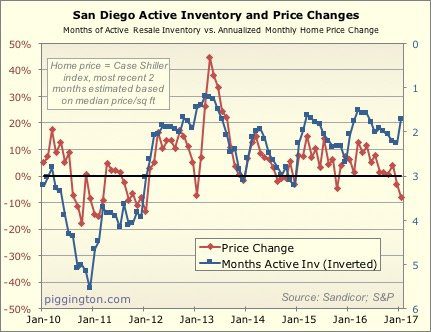

Looks like there is a seasonal pattern the last few years where price increases for the year mostly happen in the first half of the year. So +10% by July could happen!

My 92107 zip has 1.2 months

My 92107 zip has 1.2 months of active inventory and median SFH price of 1.6 million.

Unlike even 2-3 years ago, the 1.5m+ listings are flying off the shelf. At some points they took 3 or 4 times longer.

Meanwhile median apartment rent in SF is now 4500. San Diego is quite the bargain, that is well over what the true cost of buying a San Diego million dollar house.

H gzz,

I didn’t realize you

H gzz,

I didn’t realize you were in 92107 (Pt. Loma/OB for everyone else). My impression is that things have slowed down in the area. I notice my own valuation (based on Redfin/Zillow) is down a bit. I hope you are right and I am wrong! I didn’t think much of it – I assumed it was due to slightly higher interest rates and uncertainty associated with Trump. It’s of mild interest to me because we are toying with the idea of moving out of state (for jobs). We probably won’t – in which case it doesn’t really matter if the markets are up 10% or down 10%.

Cheers,

Dave

I hope gzz is wrong and bibs

I hope gzz is wrong and bibs is right. Another virtuous/vicious cycle of price decreases lasting a year, followed by a recovery would be a hell of an opportunity.

Dave I have followed Zillow

Dave I have followed Zillow in 92107 for about 10 years. They did something stange that made zestimates very suddenly less accurate in 2015 after many years of getting better and better. It is still a nice site, but you really just need to find comparables yourself now if you want to value your place. When I first noticed the issue I posted about it here. RedFin has also downgraded its site, which used to let you select comparables from a suggested list and then automatically adjusted for size, condition, etc.

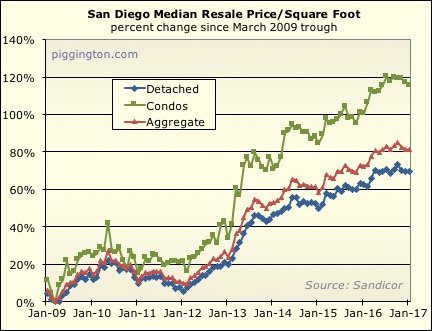

The simplist thing would also be to just increase your home’s price by the overall market price change reported in Rich’s graphs.