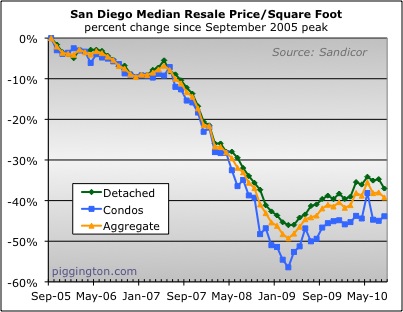

The median price per square foot of San Diego homes dropped in August,

at least on the whole. Condos managed to rise by 2.0% for the month,

but detached homes were own 3.5%, putting the volume-weighted aggregate

at -2.0%:

Detached homes have tended to be less volatile and thus a better

indicator of what was really going on, so when the two property types

are in conflict it’s probably the detached series that’s correct.

The Case-Shiller index is calculated using only detached homes.

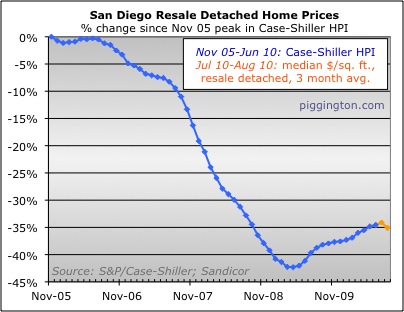

If my Case-Shiller proxy turns out to be correct, August will be the

first month in which the Case-Shiller index has declined since April

2009. (This proxy tends to by more volatile than the CS-index,

but so far it has always been directionally correct).

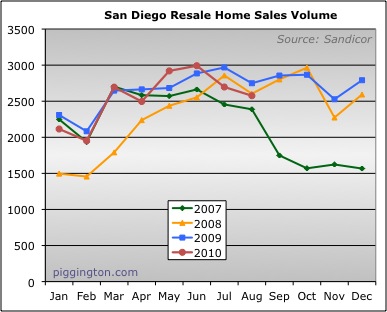

Volume was down again, as expected in the post-stimulus environment:

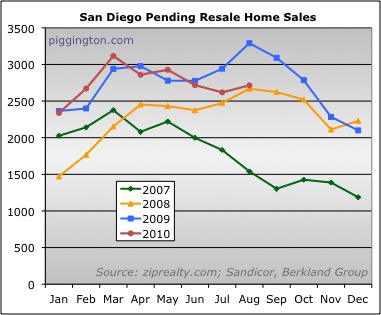

However, pending sales actually rose:

If that trend holds up, it would indicate that the non-stimulated level

of sales is not so bad after all. We shall see… in the

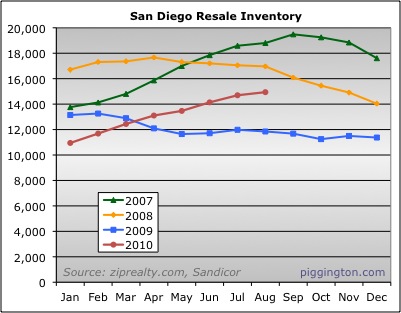

meantime, inventory rose again, as it has all year:

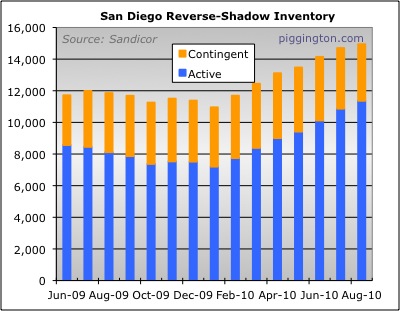

Here’s one I don’t think we’ve checked in on in a while… the number

of “contingent” listings (aka “reverse shadow inventory) as opposed to

active listings. The graph shows that contingents have

actually been declining as actives rose, so the increase in inventory

represents more listings that are actually for sale and available, as

opposed to held up in the short-sale process:

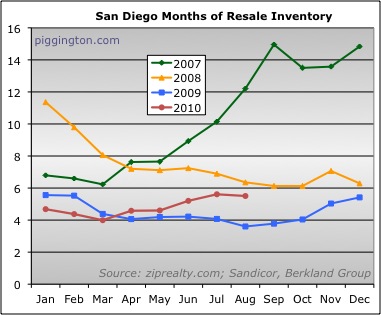

Since months of inventory are calculated using pendings, they actually

dropped a bit but remained at about the 5.5 months level.

So the post-double-tax-credit housing market performance as of August

was: prices down, closed sales down, pendings (while down from a

few months back) up month-to-month, months of inventory down but absolute inventory up.