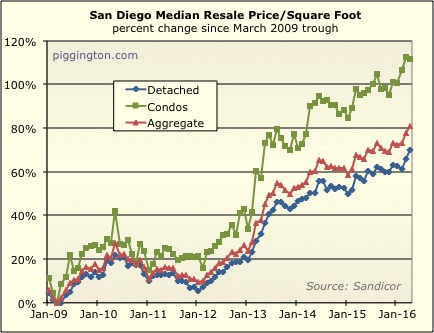

After a little dip in February, San Diego home prices* experienced a

sizable pop in March and April.

* (The detached home median price per square foot, to be exact…

but that takes so long to type).

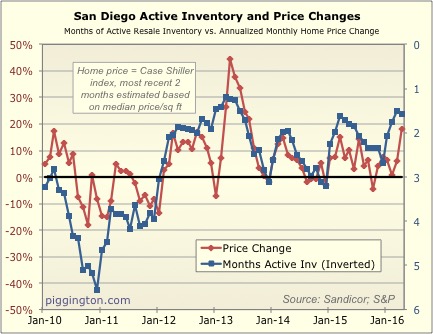

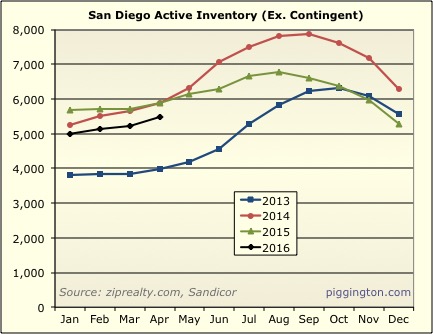

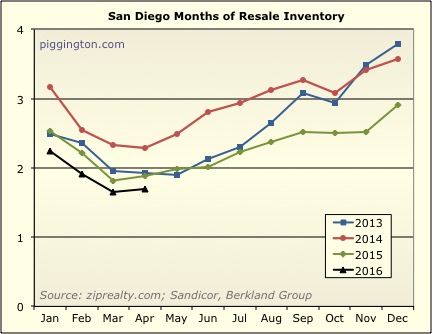

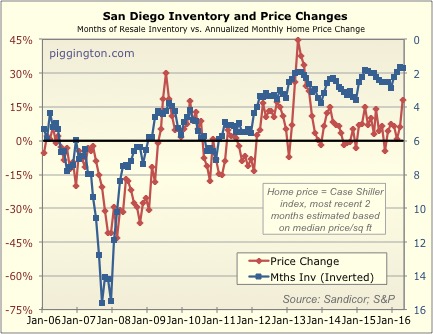

This isn’t surprising given the low level of inventory — note in

the chart below how the price change followed the (inverted) months

of inventory sharply upward, after a brief lag.

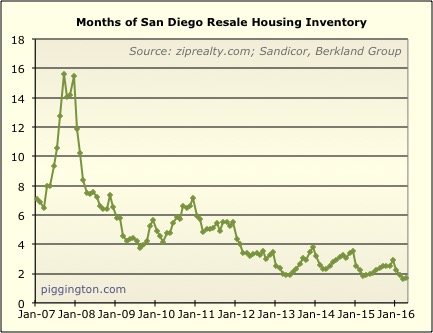

Here’s that months-of-inventory figure viewed year by year.

Months of inventory is slightly lower than this time last year,

which argues for more upward price pressure in the months ahead.

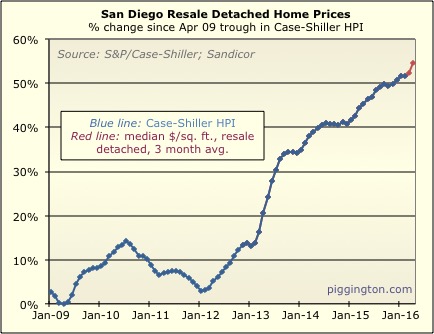

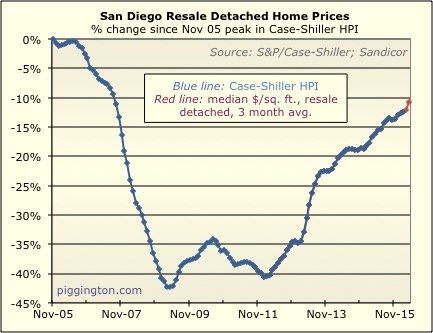

The “fake Case-Shiller” in red (3 month average of detached

price/sqft) experienced quite a bounce last month. (I really

should start displaying this on a logarithmic scale… I’ll put it

on my list of things I should be doing to make the site more

useful! It’s a long list and I don’t have much time these days

to work on it, but I can dream).

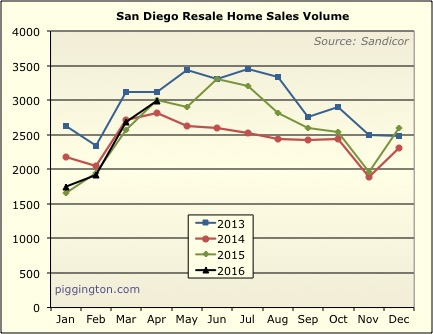

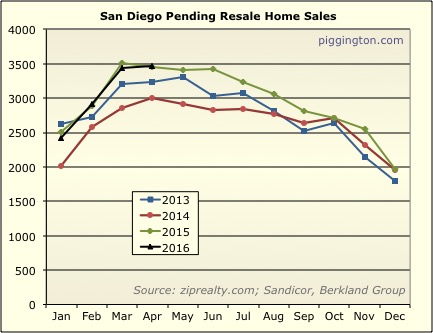

Sales volume was quite robust, just about identical to this time

last year. Those super-low mortgage rates are surely playing a

part here.

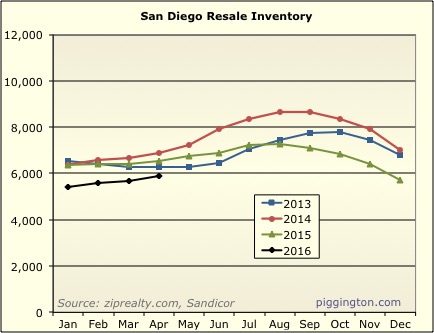

The big difference betwen now and the 2013 meltup is not in demand,

but in supply… there was just so little on the market back

then. But still, this is the lowest April inventory we’ve seen

since 2013.

Here’s a continuous view of inventory since 2010:

And months of active inventory over the same period:

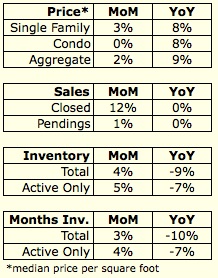

Here’s the summary table for April, with the rest of the graph

roundup to be found below… thank you for reading!

Where can I find the most

Where can I find the most recent “San Diego Home Valuation Index” and “San Diego Monthly Payment Index”? Is there anything for 2016 yet?

Most recent is here:

Most recent is here:

http://piggington.com/shambling_towards_affordability_midyear_2015

Yes, I really do need to get these updated. It won’t have changed a whole lot since then, though.

I’d like to see the

I’d like to see the inventory/price graphs at the end here to go back to 2004 or so to include the “bubble/peak” of housing prices.

I can’t understand why inventory is so low despite the near-record prices. If I had rental houses I’d be selling them to pocket cash that I could re-invest when the prices turn back down.

Based on the cyclical nature of the market, I have to believe that prices within the next 3-4 years will be much lower (10%-30%) than they are right now.

Unfortunately, I’m in the market to buy my first home. Horrible timing…

Cdmcdona wrote:I’d like to

[quote=Cdmcdona]I’d like to see the inventory/price graphs at the end here to go back to 2004 or so to include the “bubble/peak” of housing prices. [/quote]

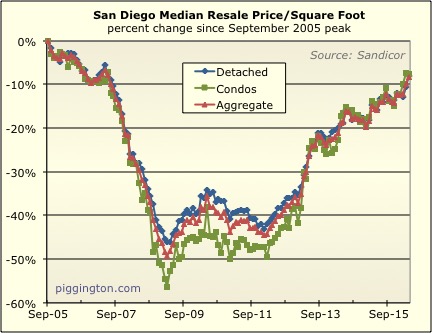

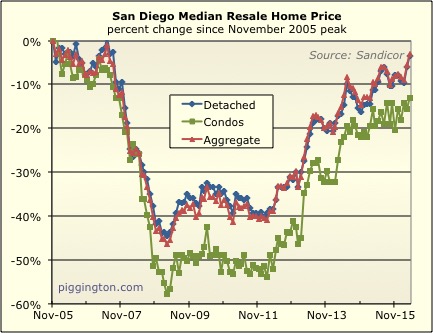

The bubble peak (price wise) was late 2005 so that very last graph gives you a decent idea of it.

[quote=Cdmcdona]I can’t understand why inventory is so low despite the near-record prices. If I had rental houses I’d be selling them to pocket cash that I could re-invest when the prices turn back down.[/quote]

I think it comes down to low rates. Rates are so unusually low that the monthly nut can stay pretty low even despite the unusually high purchase prices (see second graph here). Whether that remains the case or not is another question (I had some thoughts on that in this thread), but I believe that’s what’s going on right now.

Yeah, I guess I’m more

Yeah, I guess I’m more interested in what happened on the front side of the peak though because that’s where I think we are now. Its expected that we were back to 6 months of inventory by the time we got to the peak in 11/2005 (or even just before the peak) because by that point we were experiencing negative monthly price changes. But I wonder if low inventory had much of a correlation to driving up the prices 1-2 years prior to the peak. That might give us clues to see if we’re on a similar trajectory.

Cdmcdona wrote:Yeah, I guess

[quote=Cdmcdona]Yeah, I guess I’m more interested in what happened on the front side of the peak though because that’s where I think we are now. Its expected that we were back to 6 months of inventory by the time we got to the peak in 11/2005 (or even just before the peak) because by that point we were experiencing negative monthly price changes. But I wonder if low inventory had much of a correlation to driving up the prices 1-2 years prior to the peak. That might give us clues to see if we’re on a similar trajectory.[/quote]

IIRC, the general trend was that inventory bottomed out in Spring of 2004 during the meltup phase of the bubble, then slowly increased while prices still increased too, but more slowly, until the price peak in late 05.

Cdmcdona wrote:I can’t

[quote=Cdmcdona]I can’t understand why inventory is so low despite the near-record prices. If I had rental houses I’d be selling them to pocket cash that I could re-invest when the prices turn back down.[/quote]I’m not selling mine because it’s cash flowing quite well and it would only get better from here. My tax base is quite low and my tenant is great. Why take the risk in selling? I’ve learned awhile ago that I can’t time the market. Have you heard of the saying “one bird in the hand is worth two in the bush”? That’s exactly why I’m not selling.

Cdmcdona wrote:I can’t

[quote=Cdmcdona]I can’t understand why inventory is so low despite the near-record prices. If I had rental houses I’d be selling them to pocket cash that I could re-invest when the prices turn back down.

[/quote]

I think there are plenty of people who bought primary residences when both prices *and* rates were low, and got plenty of house for their money. People in that position, especially with families or pets, aren’t going to be motivated by today’s prices given the cost to buy back in or rent something comparable. They may sell to change schools or jobs or something, but not as a cash grab.

We have friends who bought a 2-on-1 short sale a few years ago. They are in the market again, but they are holding that property and buying a new primary.

In the neighborhoods I follow, a lot of what comes on the market in my price range is stuff people have been holding for 10 years and can finally break even on. It’s almost always a bad deal for the buyer, since sellers want 2006 prices but haven’t done much/any maintenance while underwater for a decade. Similarly there are a lot of cosmetic flips purchased from the same pool of sellers and put back on the market.

Cdmcdona,

Only a few things

Cdmcdona,

Only a few things could drag prices down in the near term: slower household formation, higher interest rates or a deep recession.

Many renters already have 2+ generations living in their homes so a change in household formation is not likely in San Diego any time soon. Population growth is usually 1%+/year and not likely to change soon. Last year was 2.7% in employment growth:

http://journal.firsttuesday.us/san-diego-housing-indicators-2/29246/

If we hit a recession, interest rates may actually go down. For the past several years, many economists/banks have forecast higher rates but it hasn’t happened. There is 7Trillion+ of negative yielding debt in the world, as the US is one of the few advanced economies with positive rates, more capital may come in keeping the 10 year treasury low.

http://www.investors.com/research/bonds/jpmorgan-slashes-forecast-for-10-year-treasury-from-2-15-to-1-9/

If you look at future implied yields, even 10 years from now, rates are not expected to be much higher.

The real solution for California is political, zoning/permitting costs and procedures need to be made easier/cheaper. In Escondido, the permits alone can be 40K is needed for permits and sewer and that’s on the low end.

https://www.escondido.org/Data/Sites/1/media/PDFs/Building/FeeGuideforDevelopmentProjects.pdf?v=2

There are many tax advantages for an property investor when it comes to estate planning as well as there is a step up in basis for the heirs. Additionally, if a property was purchased when prices were low, due to prop 13, that makes for a permanent advantage when renting it out as the property taxes are lower than for current buyers. This is more extreme in coastal areas.

Most new construction in SD is multi-family. The new SFH projects are usually in the 800-900K+ range. So effectively no starter or mid range homes are being built.

There is also a lack of good investment alternatives: the stock market is pricey, bonds don’t yield much, CDs pay less than 1%.

I was looking at a forecast today from Moody’s analytics which showed prices going up another 20% over the next 5 years.

2016: $551,000

2017: $567,530 (3% up)

2018: $584,555 (3% up)

2019: $613,782 (5% up)

2020: $650,608 (6% up)

http://time.com/money/4285854/real-estate-markets-housing-price-forecast-map/

I agree it is a tough market, probably the best option is be sure you’re advancing your career and earnings prospects as much as possible so if you do decide to buy a home, that the burden is offset by higher earnings. Good luck!

2 things I notice are how can

2 things I notice are how can the YOY increase for total be 9% when the SFH and condo are both 8%, secondly the move up buyer seems to be all but non existent. Can definitely understand that as Wife wants to move up and I’m saying let’s add on instead.

moneymaker wrote:2 things I

[quote=moneymaker]2 things I notice are how can the YOY increase for total be 9% when the SFH and condo are both 8%[/quote]

It’s the volume weighted aggregate (sfh volume*sfh price + condo volume + condo price) a year ago vs now… so, it can be changed via a shift in composition of condos vs sfr sales. They are all right around 8.5% but the aggregate was just a bit over and the other two a bit under.