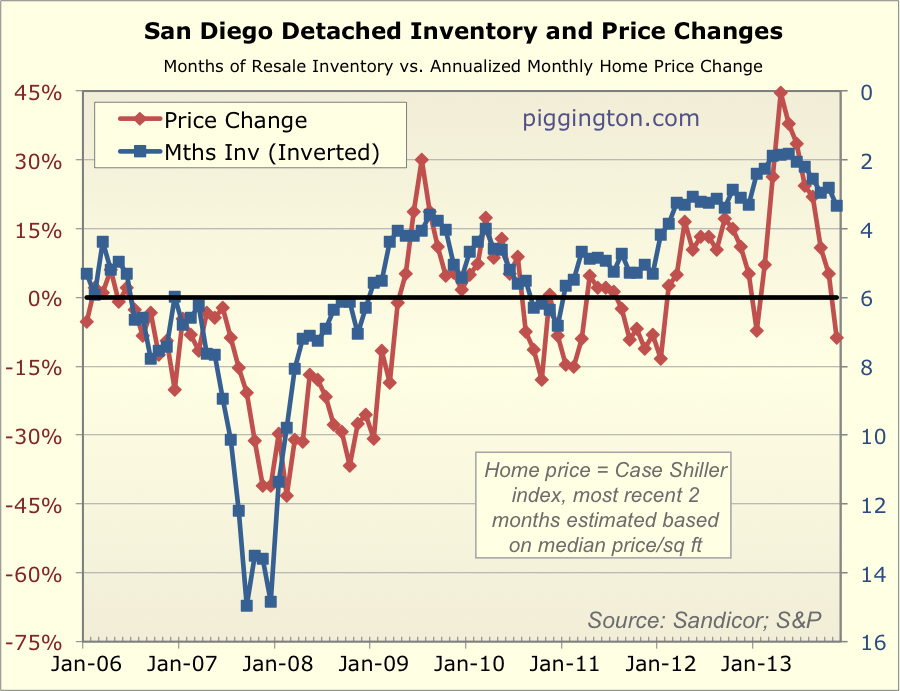

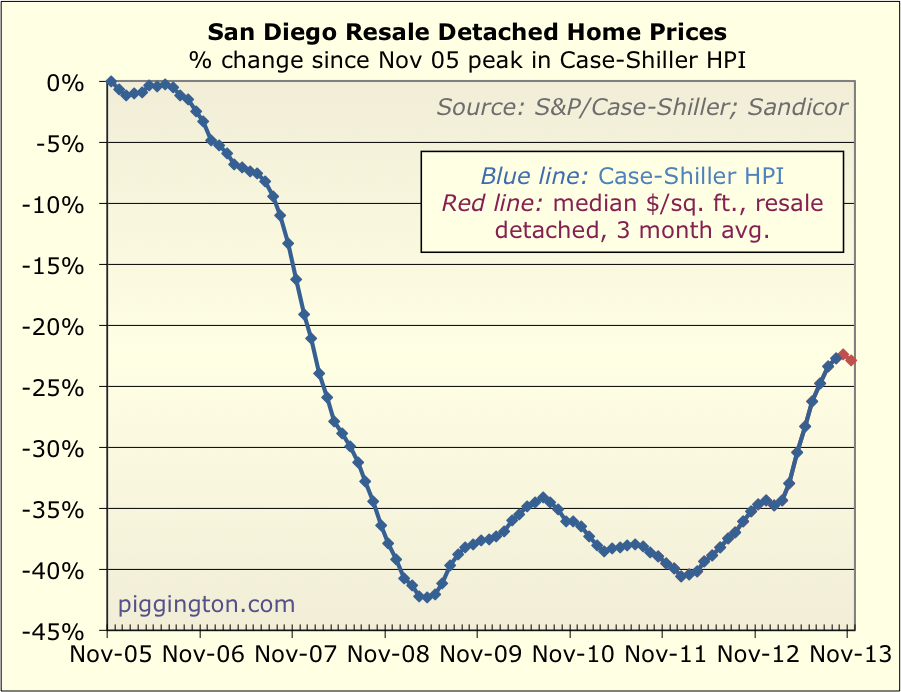

Hello there… the usual roundup of housing charts can be found

below. Prices have declined a bit in recent months, in a

somewhat more noticeable manner than the usual year-end lull — but

considering the magnitude of the early-2013 price increase and the

spike in rates midway through the year, this is perhaps

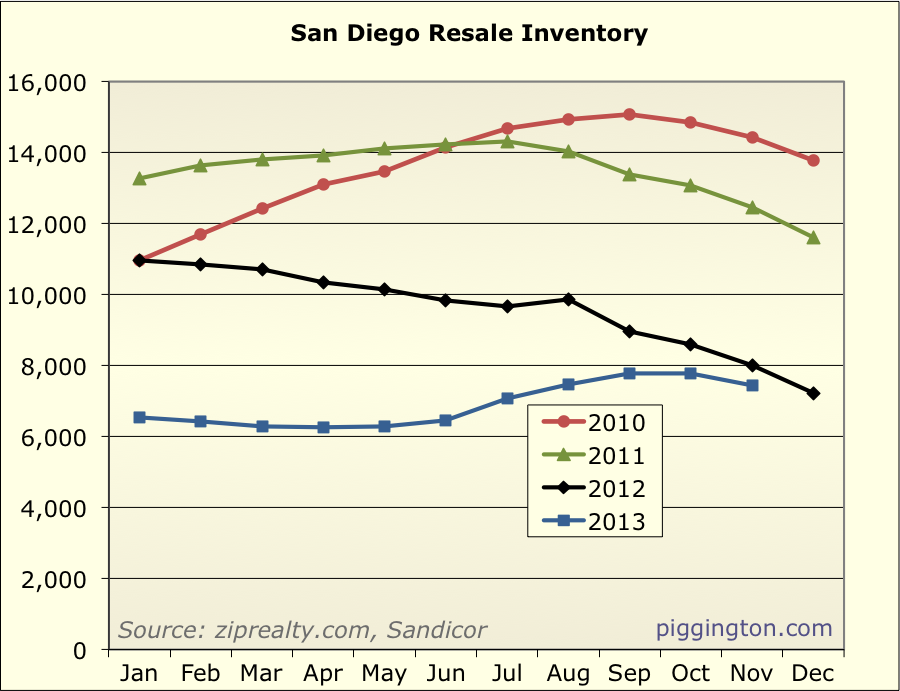

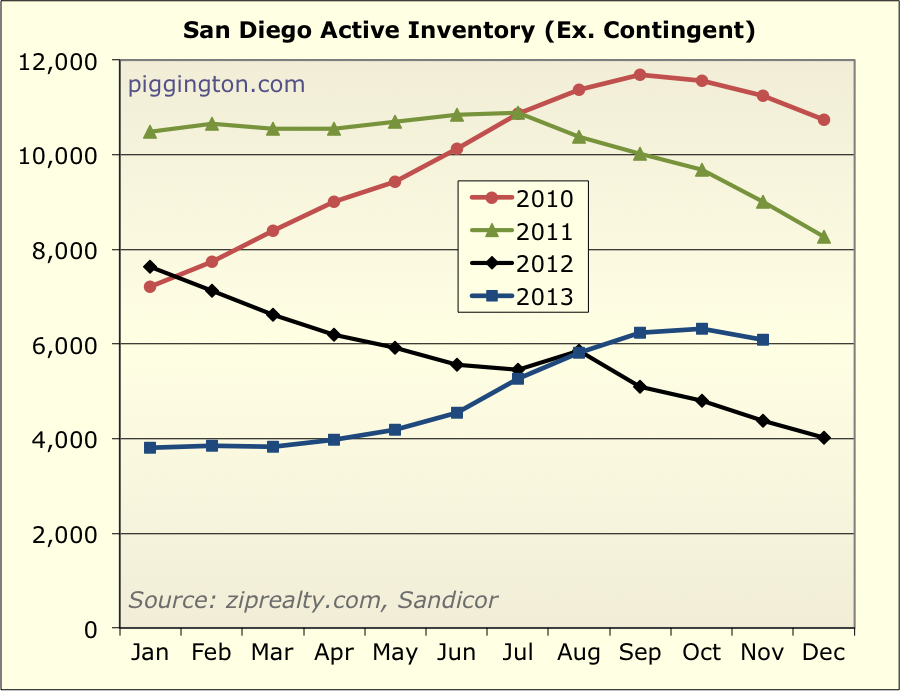

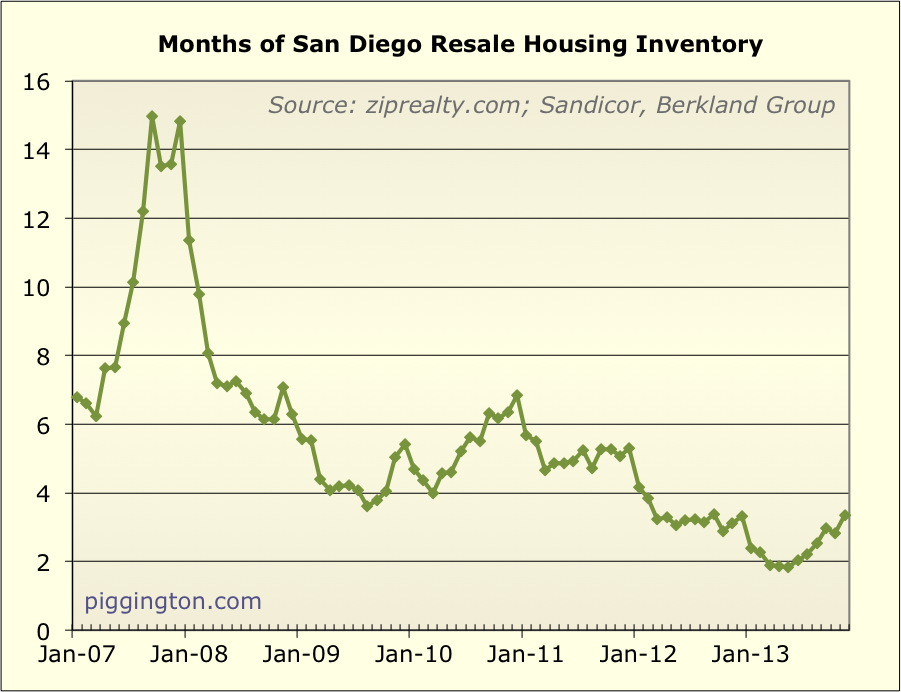

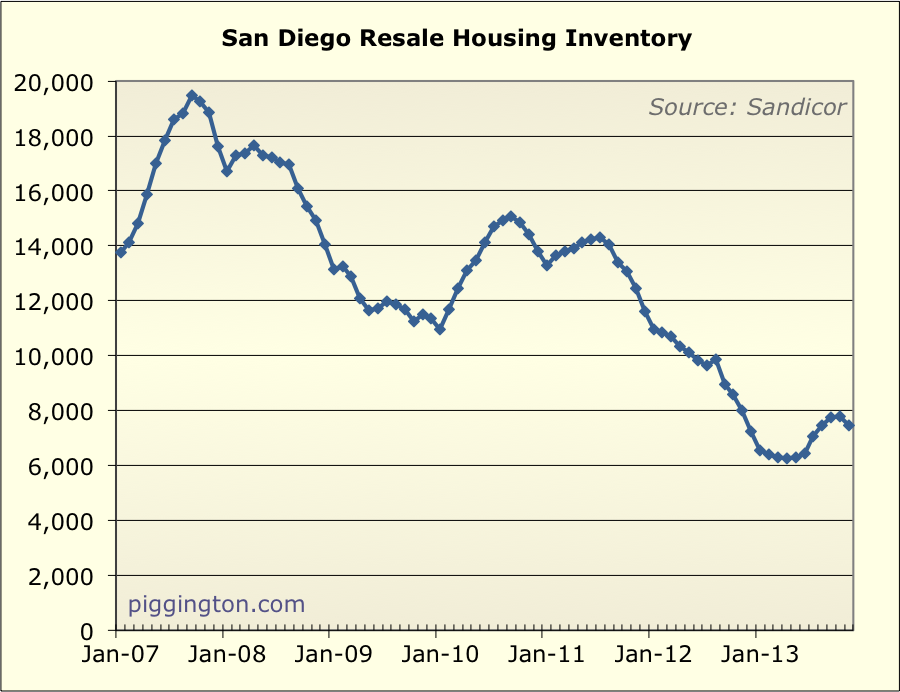

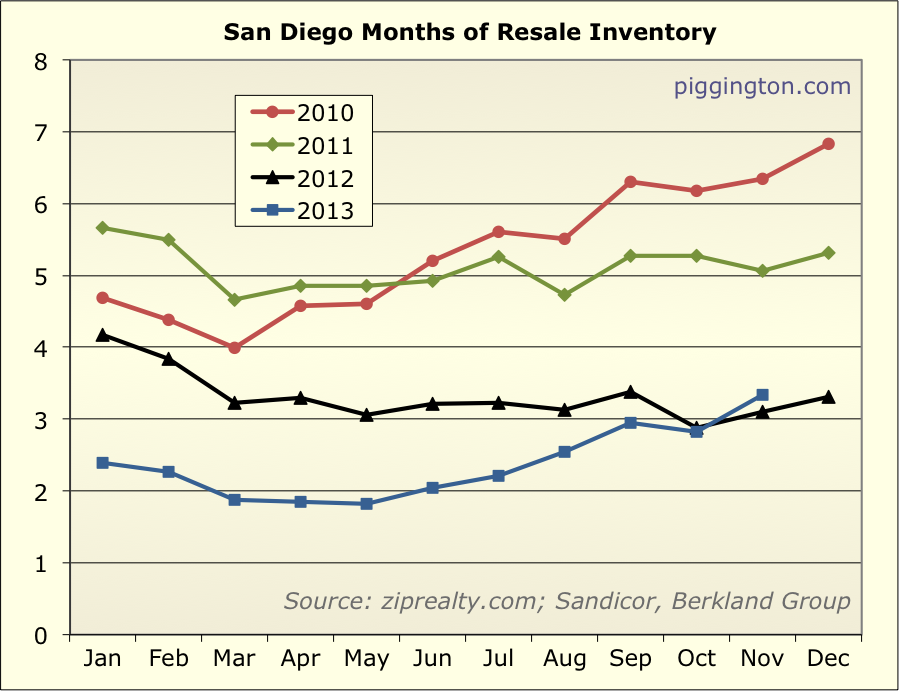

understandable. Months of inventory have increased back to the

levels that prevailed for most of 2012; this is a big change in

percent terms but supply still remains scarce, historically

speaking.

I hope everyone has a fantastic 2014!

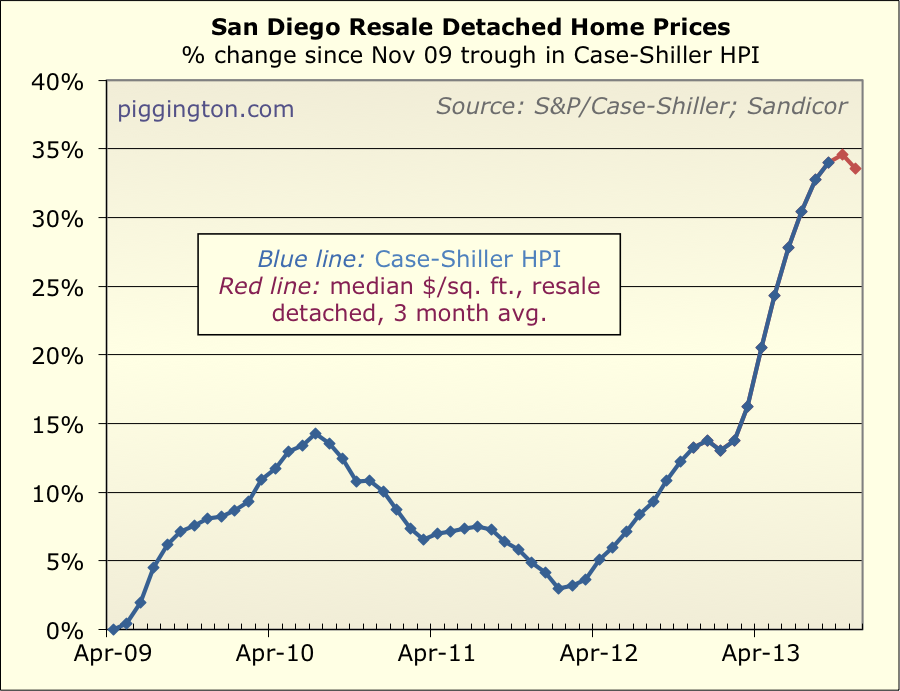

Good on you Rich. You could

Good on you Rich. You could always get a job as a cartographer. I heave a sigh looking at the Case Shiller graph, partly because it reminds me of the Alps, and partly because I just can’t believe what I see. The mini bubble (or rally) after the tax credits lost all its gains, and now we have the effects of low inventory and low rates presumably doing what tax credits clearly couldn’t. But what good does it really do? Does the economy need homes to become ATMs again? What happens if all those recent gains are lost again? They aren’t real gains, so it seems perfectly logical to assume they could be lost. OK, so many of those underwater homes can now sell, but that is not reflected much by increased inventory. My next door neighbor is a Realtor and said she is thinking of selling to lock in the gains. I said, but where are you going to live? Everyone loves Santa, but has he just filled our stockings with gift wrapped promissory notes? What monetary policy fails to do is take account of the large distortions created by regional differences.

We’ll see — a 1+% rise in

We’ll see — a 1+% rise in rates as we’ve seen since July 2013 will actually increase costs to borrowers MORE than the yoinking of the $8000(max) credit. Here’s hoping it will at least stabilize prices, if not bring them down. Give it some time 🙂

Santa already brought tapering. Hopefully, he’ll bring something more interesting in 2014 when rates cross 5%.

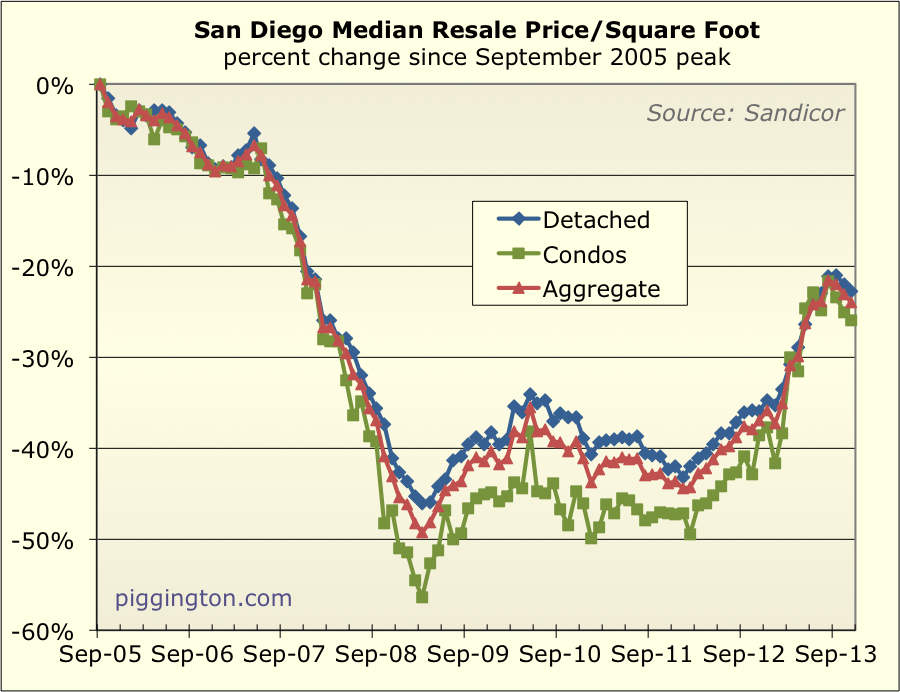

Great stuff Rich. How about

Great stuff Rich. How about another article (or comments) as to the bottom line… Is the housing marking over/under valued or fairly priced historically speaking? Are we in a bubble.

Thank you Bibs… that will

Thank you Bibs… that will be coming soon… in preview, I’d say homes are definitely overpriced to some degree, but no comparison to the housing bubble.