By 2001, San Diego had enjoyed a nice housing boom. Since bottoming out in 1996 after a nasty housing downturn, the price of the typical single family home had risen by 74 percent. As of 2001, adjusted for inflation, San Diego homes were more expensive than they’d ever been (at least since the 1970s, which is as far back as the available data goes).

At this point, one might have expected home price growth to slow down or even flatten out. But the show was only getting started. The typical home, already somewhat richly valued, would go on to nearly double in price in just a few years.

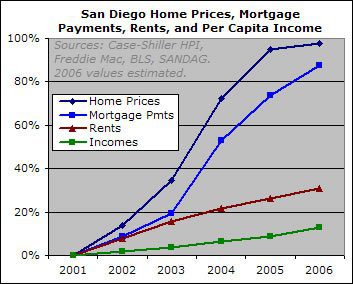

Interestingly, this price explosion occurred at a time when rents were growing fairly modestly. This is somewhat strange because the factors that typically drive home prices, such as incomes, employment, and population growth, also affect rents. Yet after 2001, while prices of already richly-valued homes increased 98 percent and the monthly payments on those homes rose 88 percent, rents only increased 31 percent.

rla

As I recall interest

rla

As I recall interest rates were in the 8 to 9% range in 2001. It is not surprising that if interest rates declined by 25% to 33% that home prices would increase by approximately an equivilent amount. The monthly cost of ownership would be approximately the same except for property taxes. The first 33% increase in prices is not at all surprising in fact I believe predictable assuming stable job markets. I agree that further increases beyond that are directly related to the loose lending standards and the get rich psychology.

I agree that there needs to

I agree that there needs to be a huge increase in rents which I believe will come over the next several years. 2x over inflation for the next 5 years in decent areas.

Rent increases will not

Rent increases will not happen. Rents have already increased at twice the rate of income growth.

If you look from 2000-2002, the rent, payments stayed in line. They were already exceeding wage growth but yet hadn’t become disruptive.

The current spike in wish price rents is no more sustainable than the wish price listings on homes for sale.

I could be wrong, maybe San Diego employers are finally ready to give up double digit wage increases for the average employee, but I kind of doubt it.

I’m curious Duck, how are

I’m curious Duck, how are 3000 additional condos becoming available downtown not going to affect rents?

Sales in the downtown market are already dead and there are 3000 more condos coming online in the next two years.

Obviously these condos aren’t going to be purchased by people who intend to occupy them which means they will become rentals (housing that won’t sell becomes rentals – the only other alternative is to burn it down or board it up).

Prices (including rents) are set at the margin so 3000 new rental units downtown are going to depress ALL of San Diego’s rental market including single-family houses.

In addition to the glut of condos downtown, there are several other factors that will cause San Diego rents to decline for the next several years:

> builders are continuing to build more housing units even though the market is already saturated

> there are several new large appartment complexes being built in Mission Valley and UTC

> some 30% of the houses and condos currently on the market are vacant – these housing units will become rentals after the owners realize that they aren’t going to sell (housing that won’t sell becomes rentals)

> there is net out-migration from San Diego – and not just 7/11 clerks and coffee barristas from Starbucks – people with college degrees and decent salaries are leaving San Diego because of the lack of affordable housing – and these are the people who actually have a shot at buying a house here (the coffee barrista and the 7/11 clerk certainly don’t)

~

I’d love to hear how you think rents will increase at twice the rate of inflation for the next several years. Please explain how people will afford these increased rents too.

Duck is obviously in denial

Duck is obviously in denial about the situation here in San Diego.

Rich, another very well written argument spelling out what has happened in regards to housing prices.

Great Overview!

I’m curious,

Great Overview!

I’m curious, is there similar info for LA county anywhere?

Rents here are seemingly over priced too, but I’m wondering if it’s still the same situation. A 1br 1ba unit of a triplex was going for $1200/mo down the street from me.

Few in LA think prices will come down, claiming there is nowhere to build new homes, (though they still pack them in some places in some form). Rents seem high, but maybe mortgage payments are equally higher.

Prices here are no dout out of whack, averaging $5-600 per sq ft, but is the desparity great enough to call for a similar correction?

I see the population thing

I see the population thing mentioned.. has new data been found? Or is that off of old data? Has the population declined again for SD?

“I’m curious Duck, how are

“I’m curious Duck, how are 3000 additional condos becoming available downtown not going to affect rents?

Sales in the downtown market are already dead and there are 3000 more condos coming online in the next two years.”

I don’t know but, I checked the rental listings in my neck of the woods and usually there are 10 or so, right now there are only 3. I have been watching this because I am going to become a renter soon.

I checked the rental

I checked the rental listings in my neck of the woods and usually there are 10 or so, right now there are only 3

If your selection criteria is so tight that it normally only identifies 10 homes, macroeconomics will have little impact. Essentially, you’re like the CA ISO looking for energy on the spot market because of the limits you’re using.

NSR

Thanks, hope your right!

NSR

Thanks, hope your right!

There is a lag time from

There is a lag time from construction glut to rental decline. I think we can all celebrate when the first REO or new construction becomes a rental. How long will it take for the builder and lender to give up on selling?

cooprider, my website will cover all of So CA, so keep checking CaliforniaHousingForecast.com. I have the charts already made, just have to put them up.