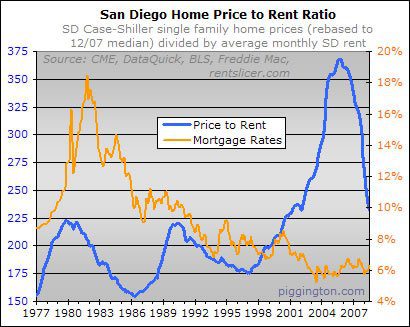

I’ve updated the long-term home price-to-income and price-to-rent charts through June 2008:

As of this June update the p/i ratio is now down below the prior bubble peaks. The p/r ratio is not, but both have similar relationships to the prior peak and trough:

- The p/i ratio is down 39% from the peak; it’s back to January 2002 levels; and it would have to fall 25% from here in order to hit the late-90s trough level.

- The p/r ratio is down 37% from the peak; it’s back to March 2002 levels; and it would have to fall 24% to hit the late-90s trough level (I’m not contending that this will necessarily happen, just pointing out what it would do to the ratio).

I’ve posted a longer writeup over at voiceofsandiego.org addressing interest rates, income estimates, and some other stuff that may or may not be old hat to regular piggs. Next week I will put up some charts comparing monthly payments to rents and incomes over time.

The comparison of monthly

The comparison of monthly mortgage payments to rents is going to be interesting because this really gets to the heart of the matter. Rents are much more stable than home prices and generally track increases in income. I suspect – and we’re going to find out after Rich’s analysis (thanks Rich!) – that we’re going to find that the median monthly payment-to-rent ratio is back around 2001 or 2000 because interest rates are so low (historically). It’s also why we may not see the depths of the troughs that we saw in the early- to mid-90s where price-to-income and price-to-rent are concerned; rates are anywhere from 100-200 bps lower. (Of course, that assumes that rates remain low.) Thus far we’re down about 30% from the peak here in SD according to Case-Shiller (and on a median p/sqft, which tracks Case-Shiller pretty well as Rich has pointed out). I still think we’ll bottom out at 40% or thereabouts, which is another 33% decline from where we are now. (In the past I’ve stated 35%-40%, but now I’m leaning toward the higher end of that range.) But we’ll probably bump along the bottom for a few years thereafter as well. Hell, who knows.

I think there is still a

I think there is still a substantial divergence between neighborhoods that is hidden in the countywide numbers. Per Esmiths website where the numbers are broken down on a zip code basis we see pretty outlandish ratios in most of the desireable areas including Encinitas, Scripps, Carmel Valley and so on. I think that we will continue to see a painfully slow convergence of this gulf over the next few years in steady increments as opposed to leaps and bounds.

Of course this is all subject to the conditional statements about employment and interest rates.

SD Realtor wrote:I think

[quote=SD Realtor]I think there is still a substantial divergence between neighborhoods that is hidden in the countywide numbers. [/quote]

Absolutely. I did make this disclaimer over at the Voice article fwiw, and it unfortunately applies to all these aggregate index graphs i put up. That’s why these graphs are better for getting the big picture of the county as a whole and not so much for analyzing a particular area. I agree with your point and your projection of a convergence… one bit of good news should that happen will be that analysis based on aggregate countywide data will be a bit more meaningful at that point.

davelj, I also agree with the points made in your post but would note that this:

[quote]Of course, that assumes that rates remain low.[/quote]

…is a big one! I am in the camp with our friend Jim Grant that we are in a secular period of rising rates (I admit it doesn’t look that way right this minute, but looking years down the road I think it’s very clear which direction the pressure on rates will be pressing). So the “what’s my monthly payment right now” argument should be taken with a grain of salt but it’s still worth looking at.

Hope everyone has a nice long weekend.

Rich

Okay, fill me in here.

I had

Okay, fill me in here.

I had noticed the disparity in neighborhoods.

My neighborhood has a price to rent of about 120-135.

It really catches my attention as well as that of investors.

So my question:

What leads you both to project a convergence?

Do you see my cheap-as-hell neighborhood gaining effective demand or the beachfront in Encinitas losing effective demand.

I was seeing the first part as likely with demand underpinned by wealth production. However, the second part (high end stuff coming into line with the low end demand-wise) tickles my noodle. I think of those places as conforming to a mercedes benz demand curve. That price can go (or remain) quite high before demand is measurably impacted.

What are you 2 seeing?

Short version:

– increased

Short version:

– increased must-sell supply in the high end because there are actually bad loans out there that haven’t blow’d up yet

– decreased demand due to substitution effect

– potential decreased demand due if job losses get worse

Long version: http://voiceofsandiego.org/articles/2008/04/09/toscano/823highendprices033108.txt

mit graph showing high end vulnerability in last downturn: http://www.voiceofsandiego.org/storyart/hightierpricestoincomejan08.jpg

Rich

The long version, and maybe I

The long version, and maybe I misunderstood, seems to indicate a smaller (than lower tiers) percentage of decline relative to index 0.

That would imply to me that the gulf between tiers would get bigger, not smaller.

If El Cajon conversions drop 45% wouldn’t beach front homes have to drop a lot more to converge.

Perhaps I am not understanding your meaning of convergence.

Can you help me see what you are seeing?

Also, what do you use to make your graphs?

El Cajon conversions have

El Cajon conversions have already dropped 45%, and beachfront places have hardly dropped at all… the “convergence” refers to the possibility that from here on out the beach front places will fall more percent wise than El Cajon conversions in order to do some catching up.

This is bearing in mind that the high end never got so out of whack as the low end — but whereas low end homes got comparatively more overvalued at the peak now it seems that the most desirable places are compartatively more overvalued, as compared to the relationships that prevailed before the bubble.

I use Excel for the graphs…

Rich

I need to think about

I need to think about that.

It seems to me that beach communities function on the same logic as SF or NY.

Put differently, a shortage of dirt with desirable attributes seems to mitigate market movements and insulate values.

This market imperfection is why it strikes me that WSJ articles about the SF bubble miss the point.

However, like you said in the article, this is not really about beach front (which I do consider less vulnerable). It is about beachfront combined with McMansions in Fletcher Hills. And that makes more sense.

Can you show me a convergence graph for the last cycle?

Like something that superimposes individual tier graphs.

My projection of a

My projection of a convergence is partly based on hope and some very coarse (if you want to call it that) analysis. The convergence will not be equivalent for all regions but the variance should be within maybe an aggregate of 20%, (which of course is not that small).

I feel as if some of the areas that have been holding up fairly well are exhibiting some of the fundamental characteristics that the harder hit areas exhibited a few years back. This includes large active to pending ratios for the most part. Not all of them have been doing that, for instance much to my chagrin Scripps has not. Indeed going to Esmiths page you can see somewhere like Scripps is still very much out of whack from a CS statistical valuation. More frustrating is the active/pending ratio and I as a buyer am really flustered by it.

Still though, it seems to me that we are in this period where more sellers then not in these areas are digging in and choosing not to list the homes they live in. Those that do still seem to be fetching a decent price for the home. Take La Costa Valley for instance. You see a sprinkling of “deals” every now and then over there but geez these deals are very relative and tend to be on the less desireable homes over there. So by my “theory” or “hope” of convergence I am projecting that they will perhaps come down maybe… 20% before it is all said and done? Can it happen? Perhaps… I think we will need a big catalyst but let’s see the tally come 2011 when we have chewed through the next credit wave and supposedly we will be in an era of higher rates.

Now will these declines converge closer to the same monster declines in say Eastlake or other comparable walloped spots. I doubt it. Maybe places like this are 30% off peak while other places have come off 50% or more. So my convergence is I guess quasi and based on hope.

If Mr. Mortgage is accurate

If Mr. Mortgage is accurate about both Alt A and Prime; that they are having growing default rates from loans made in the last 3 years, doesnt it stand to reason that these higher-end properties will be the more affected areas moving forward? I’m assuming these were mostly jumbo loans with high FICO scores.

For example, Encinitas. With about 60,000 people, there must have been quite a few transactions between 2004 to 2008, right? Is Foreclosure Radar still around? I think they track NOD’s by zip code.

Given the stickiness of prices in these areas, most people are probably not upside down. So it will probably take defaults to force the market down. And given the demand level for these areas, it will probably take a lot of them, and more time. IMO.

Interesting idea pete.

I

Interesting idea pete.

I don’t really buy it but it makes me think.

I don’t buy it because the fragile loans tend to concentrate in the lower tier.

It makes me think because your logic is compelling.

Just a thought. I think

Just a thought. I think people with higher incomes probably werent as reckless with their borrowing, but I could be wrong.People can surprise you with their lack of logic, at any income level, when emotional issues are involved.

Also, one of the sd_realtors mentioned tracking propertties that are behind in their tax payments as an indicator of distress. This makes sense and I think it’s public record as well.

As usual, Rich’s graphs are very helpful to get an idea of whats possible:

http://www.voiceofsandiego.org/storyart/hightierpricestoincomejan08.jpg

“Just a thought. I think

“Just a thought. I think people with higher incomes probably werent as reckless with their borrowing, but I could be wrong. People can surprise you with their lack of logic, at any income level, when emotional issues are involved.”

I think one of my all time favorite quotes from Warren Buffet applies to this situation.

“You always find out who’s been swimming naked when the tide goes out.”

I personally know of two friends/acquantices in the OC that are college educated, decently employed and are now coming to the realization they may have bitten off more than they can chew. These people seemingly made good decisions in every facet of their life with the exception of their last RE transaction. Do not underestimate the mania that was occurring at the peak. As the Alt-A and Prime tide recedes I agree with Peterb that higher end properties are going to see the brunt of this. Either way we are getting ready to find out starting right about now.

Everyone concerned about

Everyone concerned about higher priced homes in this market should spend the 10 minutes watching this video on utube.

http://www.youtube.com/watch?v=pmeBSWI9sF8

I’ve been following him for about a year now and he’s got very good cred, IMO.

I think everyone is too

I think everyone is too focused on foreclosures.

Yes, foreclosures helped move the lower-end down more quickly; and the end result is that they have probably seen the bulk of the drops already.

OTOH, prices are determined by forward-looking price expectations (witness the incredible rise in prices as everyone was convinced “real estate in CA NEVER goes down”).

This bubble was fed from the bottom-up. It was the entrance of formerly-unqualified buyers into the market with 100% LTV, neg-am, no-doc loans. This created unprecedented demand at high prices because nobody concerned themselves with the ability of these borrowers to pay back the loans.

The tremendous amount of money made by pre-bubble owners in starter homes was used to push up the next level of housing…all the way up to the $1MM-$2MM price range, where lenders actually wanted proof that they would recover their money — and even neg-ams/no-docs have some limits.

Buyers were competing just as much in the move-up markets as in the starter markets, and they stretched just as much. Difference is they were not usually using 100% LTV loans (the cause of the lower end going into foreclosure first). They have a cushion from the sales of prior homes.

Where are the **future buyers** going to get this cushion, if not from the starter market?

We’ve been watching this market for years, and the cracks are beginning to form in the higher-end markets. I think we’ll be seeing some major drops beginning in Q3 of 2009.

BTW, during the last downturn, my mother (RE Broker/investor) and I were looking at a LOT of foreclosures in Malibu — beachfront. They are NOT immune.

FWIW, homes in my area peaked

FWIW, homes in my area peaked in Spring 2004 while homes in less expensive areas kept going up for a year or two after that. Kinda shoots a big fat hole in CA renter’s logic.

I see CA Renters point that

I see CA Renters point that there’s no more upward pressure from people buying “starter” homes so that the sellers can then move up into the next tier…it certainly helps, because there’s that much less demand for the higher tier product. The demand destruction of the move-ups, if you will.

However, I think that in this down trending market, who would be compelled to sell at a loss or break-even…given transaction costs, etc?

Certainly, there are other forces besides default, like divorce, death, relocation, etc…

But, given the credit environment we just came out of, I would think the greatest pressure will come from buyers who took advantage of these loans and are now having to deal with the servicing of this new debt load. If this doesnt turn out to be an issue for these areas, there could be a stand-off that last a while before capitulation ensued.

We have danced this pole

We have danced this pole dance many times. What I hope verses what I think will happen are quite different and of course only my opinion. What I think will happen is that in the more desireable areas yes, those that are distressed and have to sell will indeed sell. It doesn’t matter if the sale is short or if it is a foreclosure. These sales will indeed happen and they will be at lower prices. I also believe that more of these types of sales will define the “good deals” in these areas then homes that are non distressed. I feel that indeed more of the non distressed sellers will hunker down and sit. If that means sitting a year, three years, five years, then so be it. What will be very interesting to me will be the composure of the sales volume in these desireable areas as time goes on. Does this imply a full tilt where the volume is heavily composed of distressed sales that in turn pull the median down? Or will it be a mix of distressed and non distressed that has a wider variance of price points for comparable homes? Scenario one dictates a much more static society where movement is much less prevalent then in recent years but this would not surprise me by any means.

What I am “hoping” for is scenario 3 where distressed properties are heavy in volume BUT there is also a wholesale surrender by non distressed sellers who price competitively. I doubt this will happen simply based on willingness (aka subborness) by sellers who have money and do not “have” to sell.

I am not trying to downgrade the impact of the volume of prime and alt a loans that will belly up. I still maintain that we will need some sort of voluminous event in the employment market to really lower the boom so to speak in a shorter timeframe. Without that then I am still afraid of a longer timeframe for the declines that I am hoping for in these areas.

FWIW, homes in my area peaked

FWIW, homes in my area peaked in Spring 2004 while homes in less expensive areas kept going up for a year or two after that. Kinda shoots a big fat hole in CA renter’s logic.

——————–

Not really.

You are right that prices in our area (I think we live in the same general area) peaked around mid-2004. Some sales after that went for slightly more, and some for slightly less, but the general trend has been very, very flat since mid-2004.

You are also correct about the lower-end still going up into Q3 2005; but did you notice how days-on-market grew significantly after mid-2004, even in the lower-end areas? Additionally, the rate of price increases slowed at that time.

It’s common to see price compression at turning points in the market. Doesn’t mean there’s no correlation between the lower and higher-end properties.

Of course, I’m willing to make a friendly wager with you, sdrealtor. You pick three neighborhoods in our area (south CBD/Encinitas) and I’ll bet we’ll see 45%+ drops from peak levels. They must be easy to comp (not RSF or other custom areas), and can be SFHs or condos — tract homes would be best. My bet is we’ll see these declines by Q4 2012. Loser buys the winner a bottle of wine (or other beverage) costing no more than $300. Deal? 😉

I’ll get back to you CAR. Let

I’ll get back to you CAR. Let me do some quick and dirty analysis and I’ll let you know. What would define the winner, it sounds like you dont think I can find even one?

If we do, here’s the bet I always make with my buds. Dinner at Donovan’s. Loser pays for dinner (usually a couple slabs of fine prime beef with an Australian Lobster tail entree served as an appetizer), winner brings a nice Cabernet ($50 to $100). Either way, we both have an awesome meal.

BTW, here would be a couple of early potential choices of the top of my head.

1.) Summerhill twin homes which peaked between 600 and 625K. Still selling around mid 500’s. They would have to get down around 330K.

2.) Low end La Costa Valley 4Br 2400 to 2800 sq ft homes which peaked between 900 and 925. Now selling 750 to 800K. They would have to go under 500K.

3.) Average Santa Fe Trails homes (similar size to above), same peak price. Would have to go under 500K.

The best news for you would be, I have a very nice wine collection so at least you would get to enjoy something you dont normally get to drink.

Can you show me a convergence

Can you show me a convergence graph for the last cycle?

See the prior post…

rich

sdrealtor,

Those terms work

sdrealtor,

Those terms work for me! 🙂

Here’s one way we could do it… I will find at least two homes that have listed or sold for 45% below their 2004/-2006 prices (hopefully same-house sales).

Do you think the Summerhill homes won’t go under $330K?

BTW, did you see the one on Old Mill that dropped their price like a rock yesterday? I’m sure it will be sold by the end of the day with this price (yes, it needs work, but it sold for $717K in 6/2005 and is now listed for $434,900 — a 39% drop!).

http://www.sdlookup.com/MLS-080058761-1715_Old_Mill_Encinitas_Ca_92024

CA R,

I think we need to look

CA R,

I think we need to look at general price levels rather than 1 or 2 examples. You can always find a couple exceptions.

Case in point, the house on Old Mill was sold by a certain hispanic agent that sold a bunch of 100% financed homes to hispanic buyers. Most of these are on their way to foreclosure as is the agents home. These buyers overpaid in 2005 by a bunch and the 434,900 price is ridiculously low anyway. A similar home in worse shape without a pool in a horrendous location (Corner of Village Run and Gardendale, you probably know the house as the backyard that looked like a stage overlooking mountain vista). It was very plain inside and needed everything. It sold quickly for $523,000. The owners were wealthy OC folks that inherited the home free and clear. They wanted a quick sale and took the first offer that came along. they could have gotten more. Old Mill is on a cul de sac and was listed at $503 a week ago. The end of August is one of the slowest times of the year with buyers otherwise occupied with vacations and back to school. They just dropped it to 435K which is lower than many siginificantly smaller townhomes in the area. Sorry but somethings fishy here.

FWIW, I dont believe Summerhill homes (the 1745sqft and larger models) will go under 330K.

Anyway back to the bet. If we cant agree on a winner, we just go and split the bill so we both win.

Here’s an interesting graph

Here’s an interesting graph put together by one of the main men in the business about the history of US home prices. Kinda cool.

http://www.speculativebubble.com/images/homevalues1.gif

If we cant agree on a winner,

If we cant agree on a winner, we just go and split the bill so we both win.

———————

Deal. 🙂

BTW, for the bet, I will have to find two properties in each of those areas that are at least 45% below their peak prices. We can agree to 2/3 (two out of three) for a win, or if you want to be tough on me, we can agree to 3/3 areas, with two properties each, at 45% below peak.

This between now and Q3 2012.

CAR,

I was gonna do some work

CAR,

I was gonna do some work to find the best ones I could but dont the time so lets just go with the ones my gut gave me. Here they are with some clarifications to eliminate the potential for a low outlier to be compared to high priced prime location in a given tract.

1.) Summerhill twin homes (1745 & 1986 sq ft models which make up the vast majority of the sales). The smaller and bigger ones are relatively rare anyway.

2.) Lower end La Costa Valley 4Br+ 2600 to 2800 sq ft homes including the KB and Centex homes. I gonna exclude the original Greystone homes because so many are under powerlines or just off RSF.

3.) Average Santa fe Trails homes 4Br+ 2600 to 2800 sq ft.

You said that I should pick 3 tracts and there would be 45%+ drops in each so its gotta be 3 out of 3.

Here’s my big question. Do you expect to be CA Renter or CA Homeowner then?

I can agree with those terms.

I can agree with those terms. 😉

As to the owner vs. renter part, my **hope** would be for govt to step back at this point and let the market correct. This would be the best possible outcome for our economy.

I plan on buying when we can get something nice in our general area at 2001 prices or less. Ideally, we’d like to buy raw land and build our own, but the options are open at this point.

The sooner, the better — as most people on this site probably feel.

As you know there’s not much

As you know there’s not much raw land left in this area so that plan is a pretty tall order. Whats left is in oldtimers hands for the most part who didnt sell at the peak and probably wont at the trough either.

I remember 2001 prices as the house next door sold in 2001. I dont think we’ll get there in my neck of the woods but who knows for sure. If we do, dinner will defintely be on me!

sdrealtor wrote:CAR,

I was

[quote=sdrealtor]CAR,

I was gonna do some work to find the best ones I could but dont the time so lets just go with the ones my gut gave me. Here they are with some clarifications to eliminate the potential for a low outlier to be compared to high priced prime location in a given tract.

1.) Summerhill twin homes (1745 & 1986 sq ft models which make up the vast majority of the sales). The smaller and bigger ones are relatively rare anyway.

2.) Lower end La Costa Valley 4Br+ 2600 to 2800 sq ft homes including the KB and Centex homes. I gonna exclude the original Greystone homes because so many are under powerlines or just off RSF.

3.) Average Santa fe Trails homes 4Br+ 2600 to 2800 sq ft.

You said that I should pick 3 tracts and there would be 45%+ drops in each so its gotta be 3 out of 3.

Here’s my big question. Do you expect to be CA Renter or CA Homeowner then?[/quote]

I don’t know why, but I love this banter between you guys

Probably because its a

Probably because its a poignant and fact based conversation between people who are well informed. Maybe we should open up the dinner to fellow piggs (dutch treat of course) if they happen to still be in attendance in 4 more years.

Maybe we should open up the

Maybe we should open up the dinner to fellow piggs (dutch treat of course) if they happen to still be in attendance in 4 more years.

—————-

Definitely up for that! 🙂

This has been fun, sdrealtor. Looking forward to the next four years and the long-awaited dinner, no matter who pays. Best of luck!

Same here

Same here

There is no reason for

There is no reason for “desirability” cushioning price declines.

Look at the area closest to Tokyo’s Imperial Palace: the most desirable spot in the world during the Japanese real estate bubble. It fell more than other properties during the collapse. Which properties are suffering the most in Spain right now? Coastal real estate. How did Hawaii coastal properties do after being affected by both the S&L and Japanese collapses?

The issue is not desirability, but speculative excess.

“Speculation” can be defined as: buying properties that you cannot afford in the hope of capital appreciation. “Cannot afford” can mean many things, not just being unable to afford the payment. For instance, I know a well-off couple who have three high end investment properties comprising most of their retirement savings (one rented, the other two for living in). They face a stark choice between securing their retirement now by unloading them, or potentially seeing the houses fall in value. Before long, two of these will go on the market.

The couple above was engaging in speculation, just like anyone that has tied up most of their savings in real estate, whether for personal use or investment. Other forms of speculation include: not having enough liquid savings to cushion against income declines or divorce; putting all savings in hedge funds or the market and having to sell real estate in order to rebuild them; etc. etc.

So its not just Option Arm blow-ups that will drive the high-end, its speculation in general.

Finally, desirability explains price LEVELS, not price CHANGES.

Man, I am really learning all

Man, I am really learning all the different aspects of deflation lately!! Stuff they never taught us in school. The last 50 plus years of US economics seems to have been all about inflation, but I think deflations time has come. Downward pressure on almost all asset classes seems to be happening.

“There is no reason for

“There is no reason for “desirability” cushioning price declines”

I believe this is a fairly outlandish statement and all one needs to do is look at the timing of the depreciation cycle in various regions of the county to disprove the statement.

If one actually performs an analysis on the housing stock in San Diego county there are some stark factors that become very apparent. If you are looking for a home built within the past 10 years in a very good school district that is withing a 20 minute drive to Sorrento Valley your choices are incredibly limited.

The word “desireability” carries a different definition for all of us. For me it used to be the coast and still is, however now that I am a father the word is now tilted in favor of a strong school district and a large lot.

I am not disagreeing that there will not be depreciation in regions that are more “desireable” and it could very well be that these have large depreciation drops. However to think that all regions drop the same amount is simply false and the reason they do not drop the same amount is because they are more or less desireable to buyers.

Rents should start wobbling

Rents should start wobbling very soon, with a full blown collapse underway within 6 months. There’s just too many bedrooms available.

Rents may already be starting

Rents may already be starting to wobble.

HereWeGo, I checked my old apartment complex earlier this week (called them up). On drive-bys after work in recent weeks, I’ve noticed a lot of empty spaces in the parking lot, which implies a higher vacancy rate than when I was there.

Sure enough, not only is the place now on SDUT’s classifieds page (which is wasn’t before), the desk lady told me they are offering “specials” (discounts) on rent on 2BRs of $100 or more (she quoted various sizes of 2BRs).

This is the probably nicest apartment complex in RB; I haven’t checked to see what the others are doing.