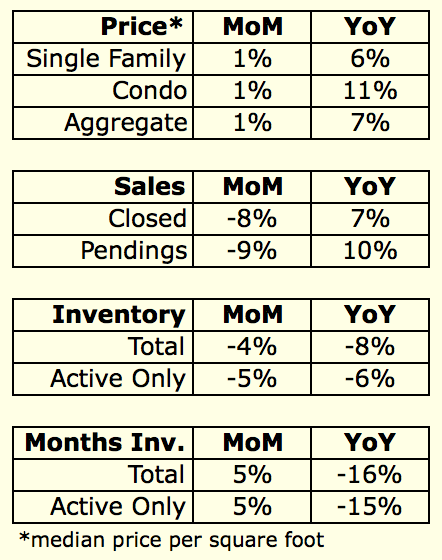

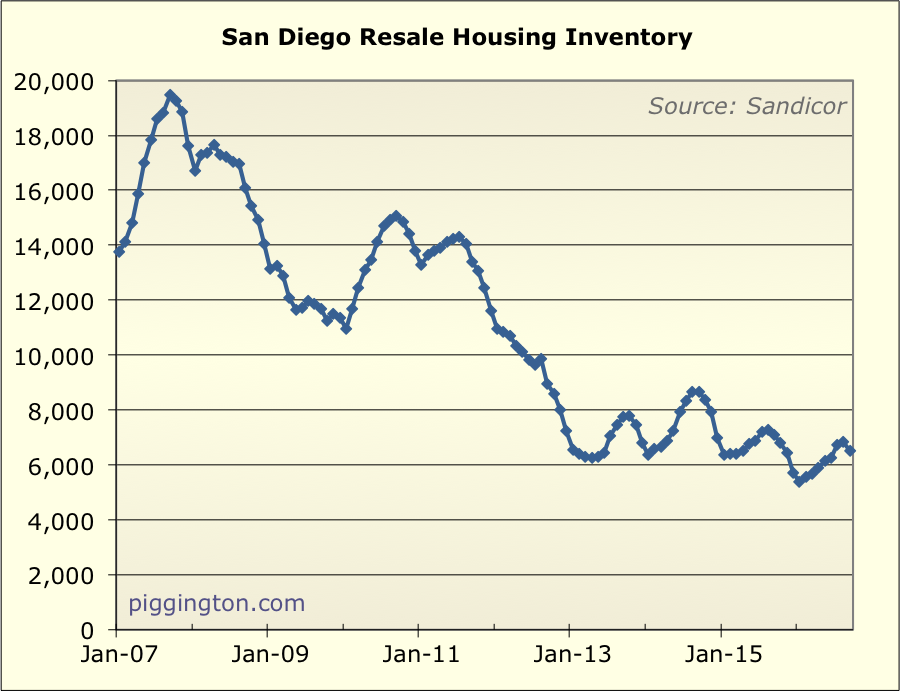

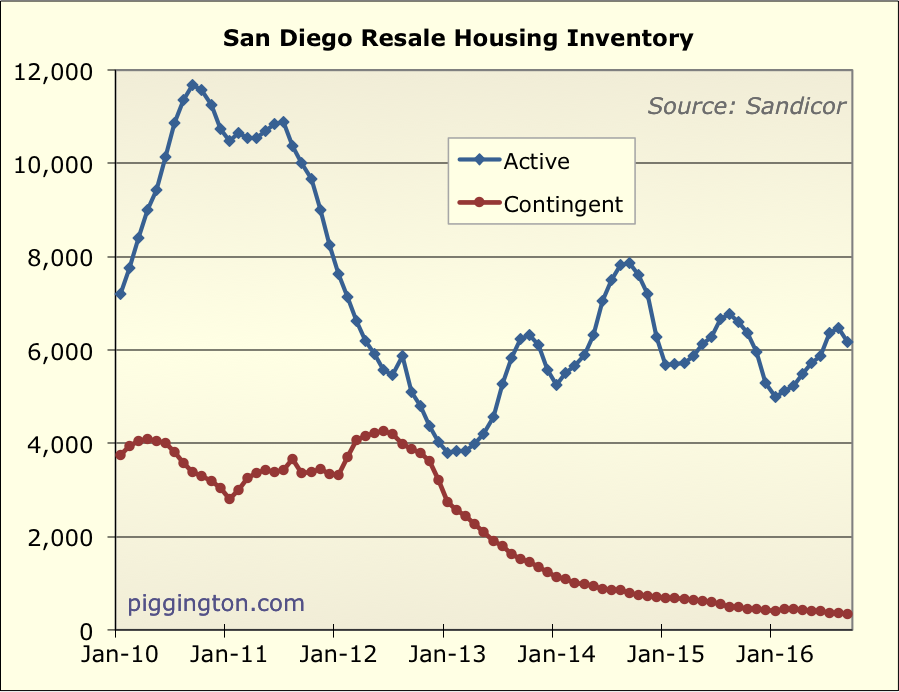

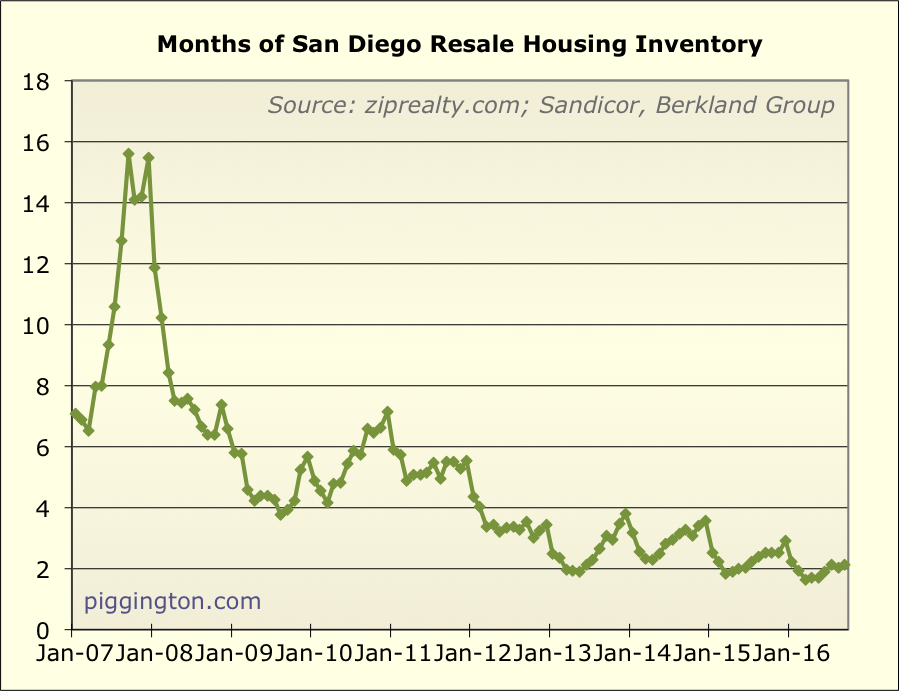

Just a quick update on the September data. Here’s an overview:

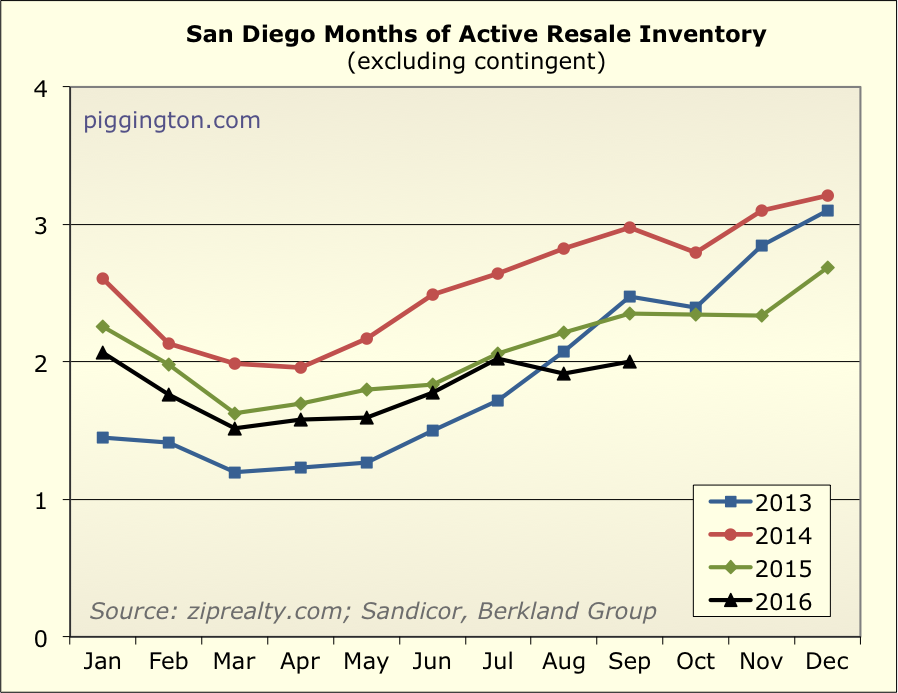

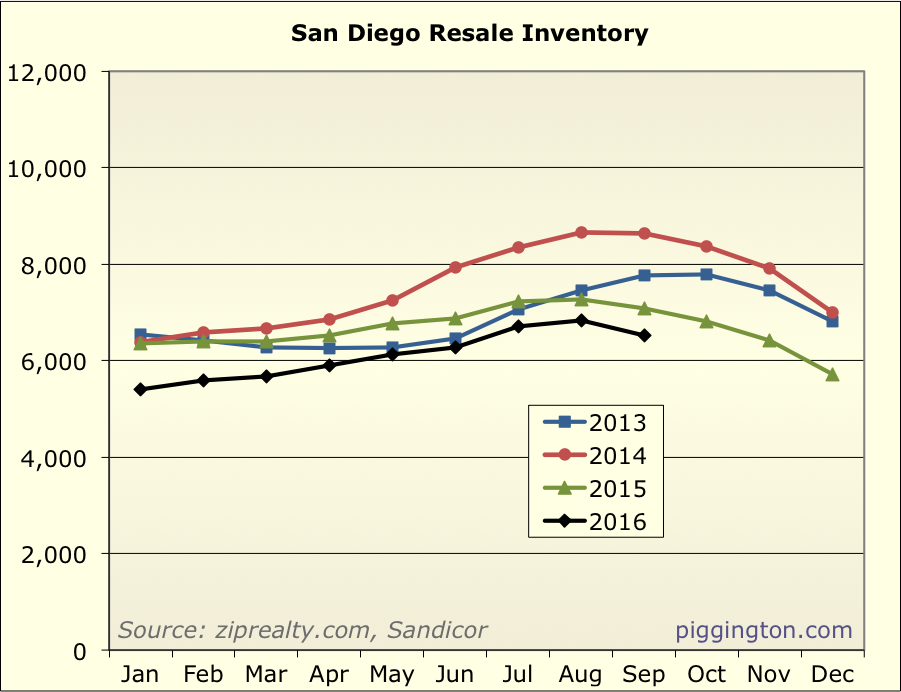

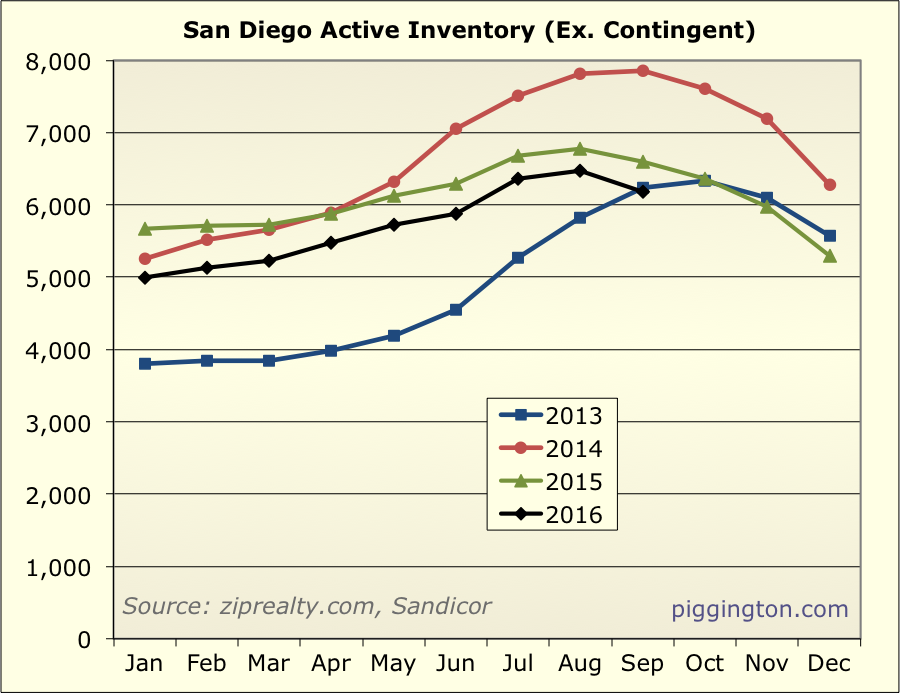

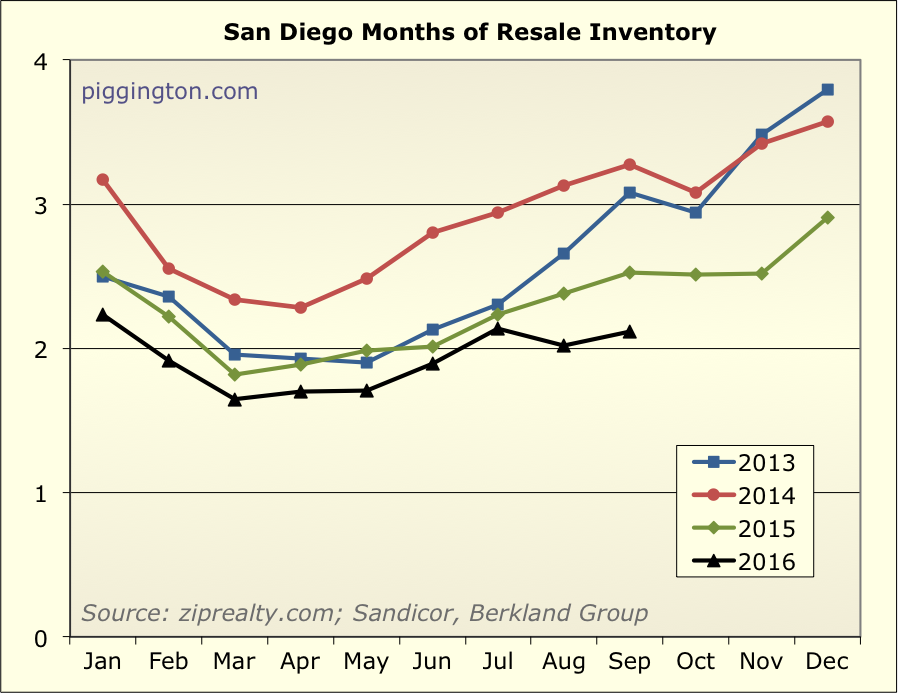

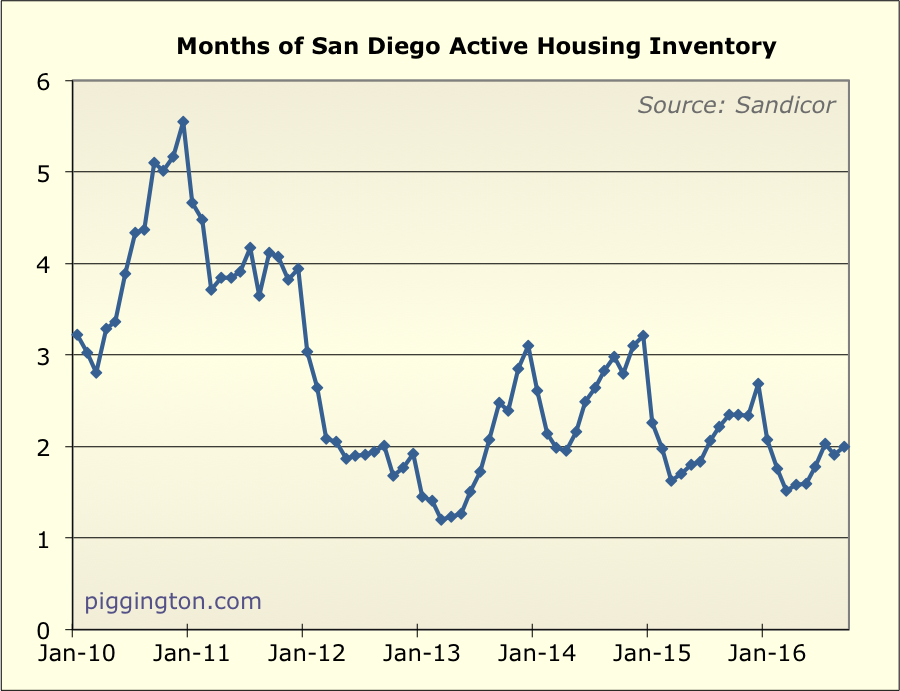

Inventory remained very tight, with months of inventory easily at the

lowest level in the past four years:

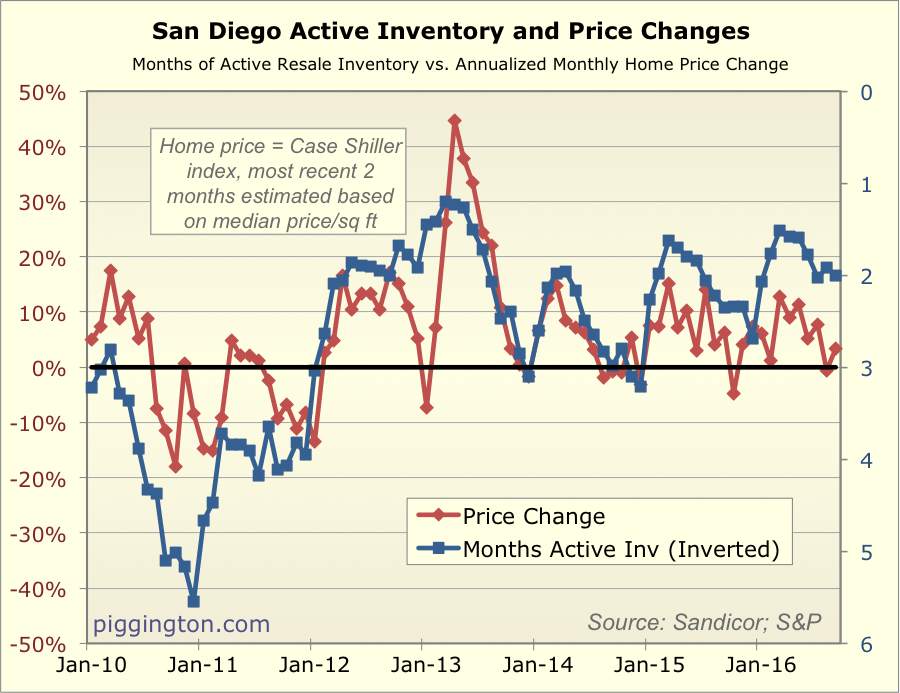

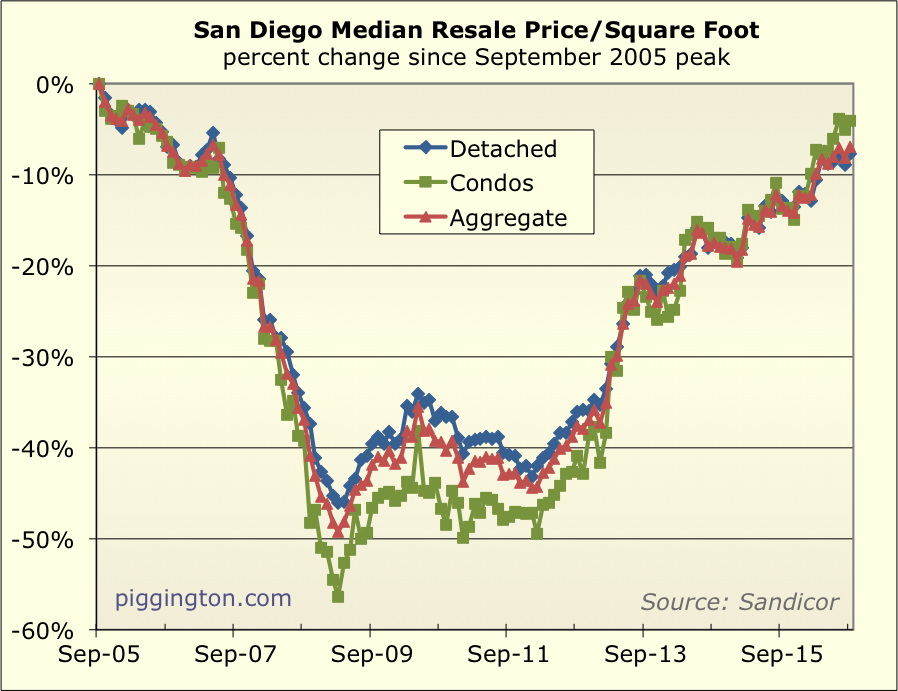

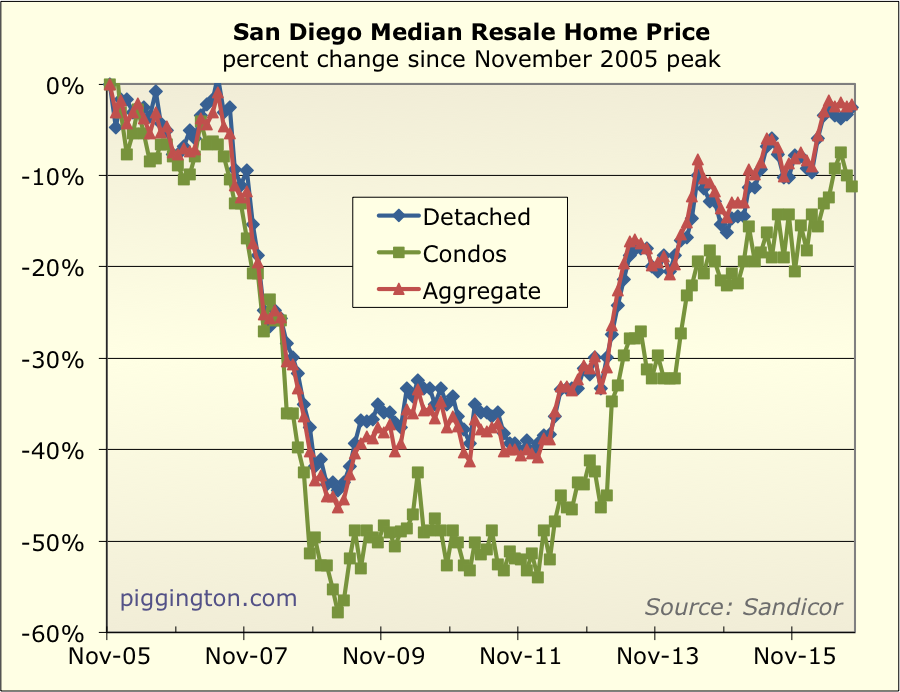

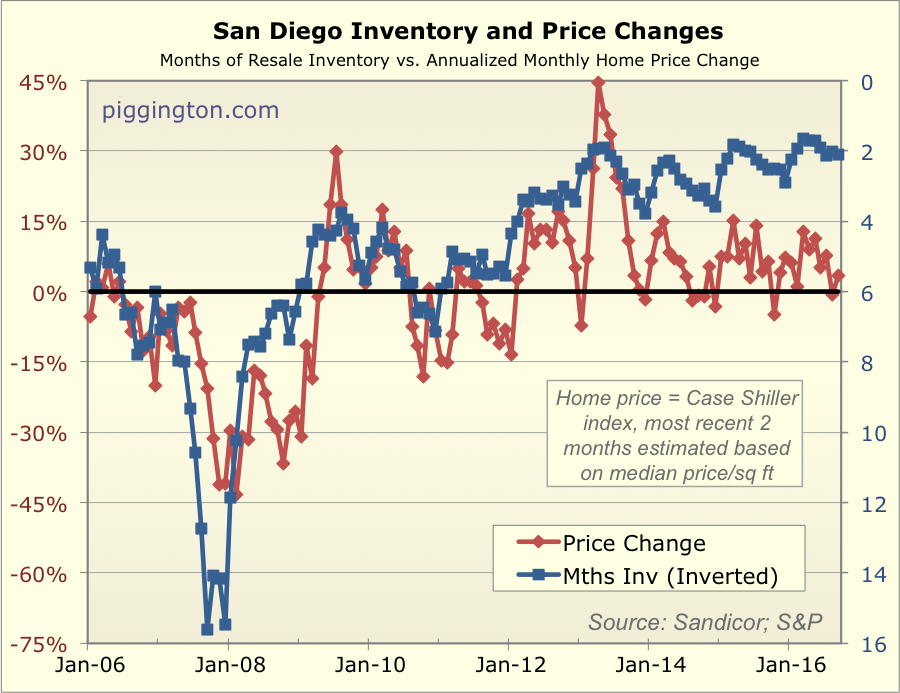

Price increases continue to be fairly muted despite the low inventory;

perhaps that’s partly a function of getting into the slow season, but

really that’s been the case for a while now. Based on the prior

relationship, one would expect either prices to increase faster, or

months of inventory to increase (resulting in a declining blue line on

the graph). Or both. But the divergence continues for now.

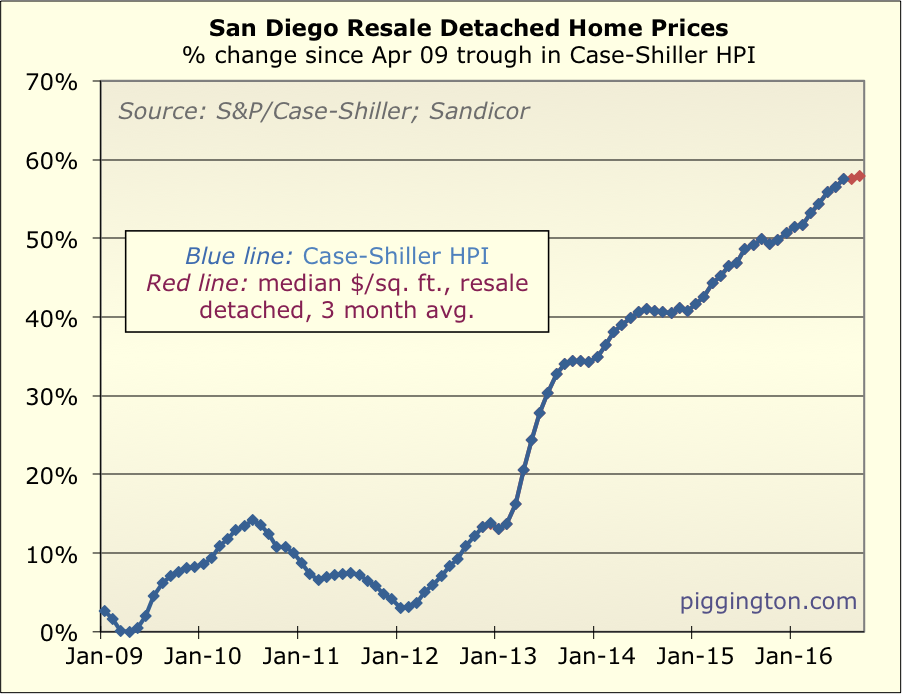

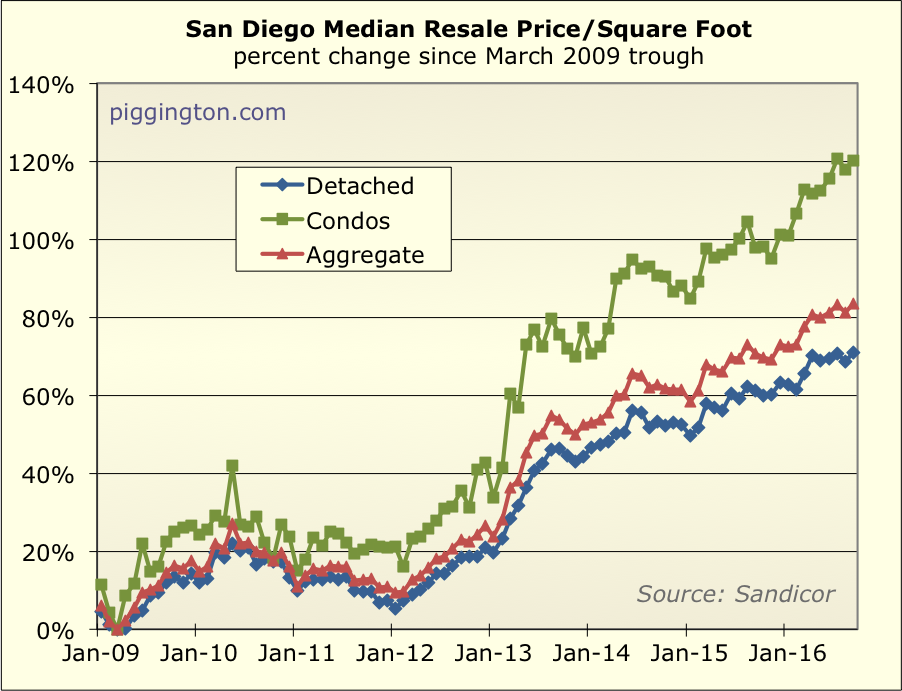

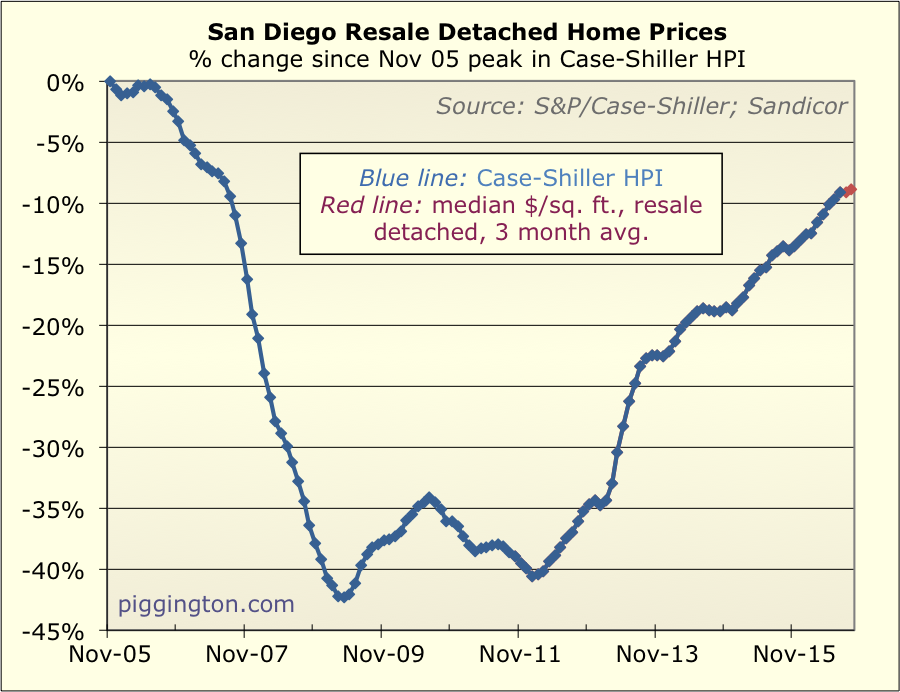

Here’s a look at the recent upward creep of prices:

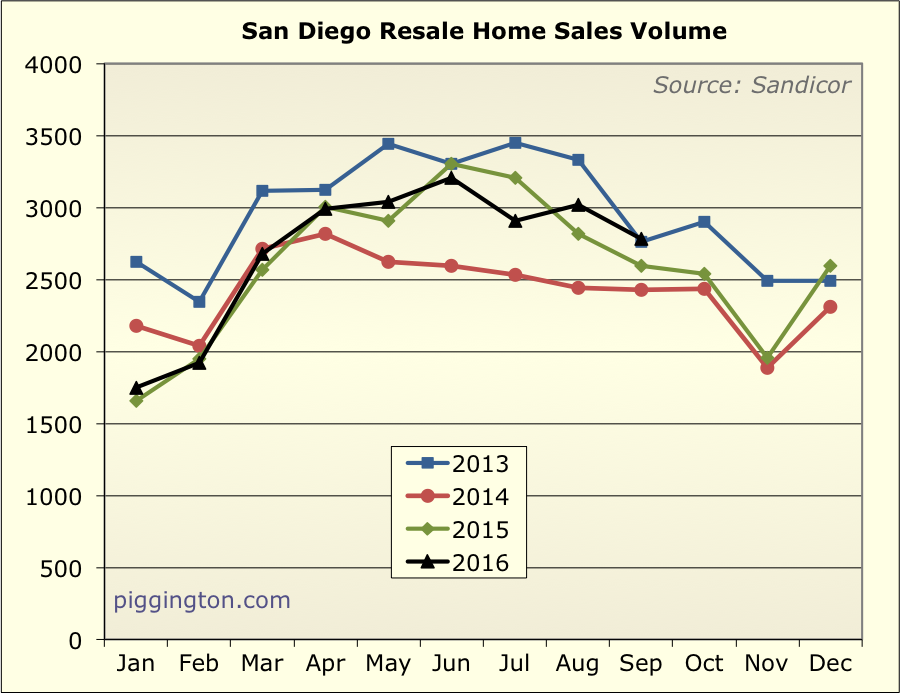

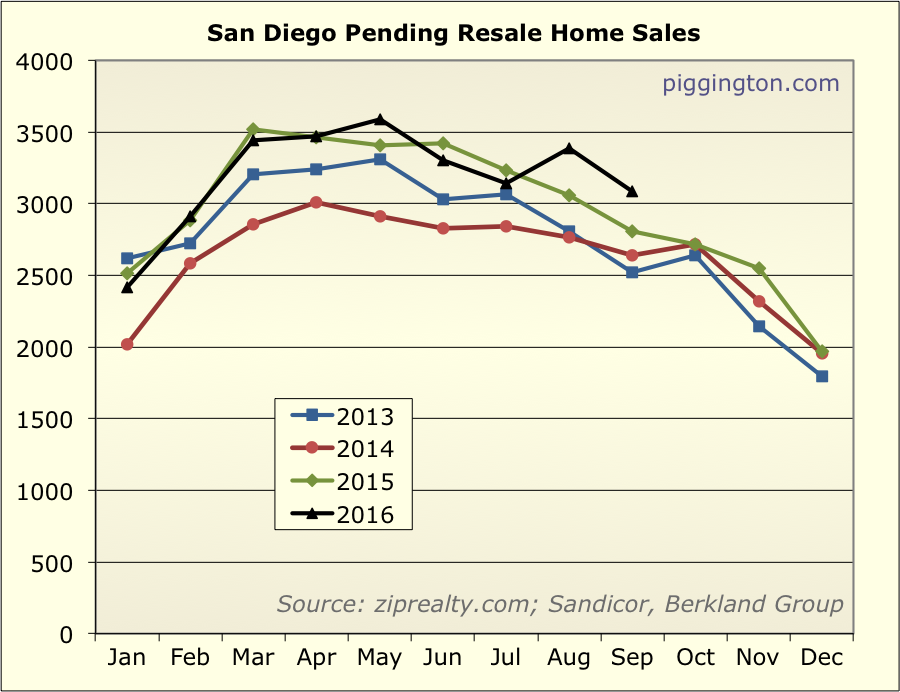

More graphs below…

Thanks again for posting this

Thanks again for posting this Rich. 🙂

Most welcome! 🙂

Most welcome! 🙂

Question for the group; how

Question for the group; how do you all use this data make buy, sell or hold decisions? I love the site and info, but I’m just curious. Thanks.

Can only speak for myself:

I

Can only speak for myself:

I lived in the SD area from 2000-2003 and watched the bubble inflate and deflate while working out of the country for 10 years.

Piggington helps validate what I learn from other sources: the overall trend in the SD market is lack of new construction, steady population and income growth, many newcomers who buy and don’t leave, investors who gradually acquire more property.

There was a lot of speculation in the 2000-2007 period so many long term observers probably felt that prices were not sustainable and there would be a pullback. I think many were surprised by the depth and duration of the drop from 2008-2012. I’m very grateful to sites like Piggington which confirmed that while prices hit bottom in 2012, there was also the inventory trend which supported buying more as there was less supply.

I focused on neighborhoods and areas I knew but did buy four more SFHs from early 2013 to mid 2014. It has worked out very well.

I continue to read Piggington to make sure my understanding of the market isn’t off base. Like an radar system. For the next few years, I don’t see a fundamental shift in supply mostly due to the expensive permitting process and how property taxes are protected by prop 13.

Best of luck

So bottom line

So bottom line question.

Given this data, would you buy a property today?

Alternatively, would you buy an investment property today?