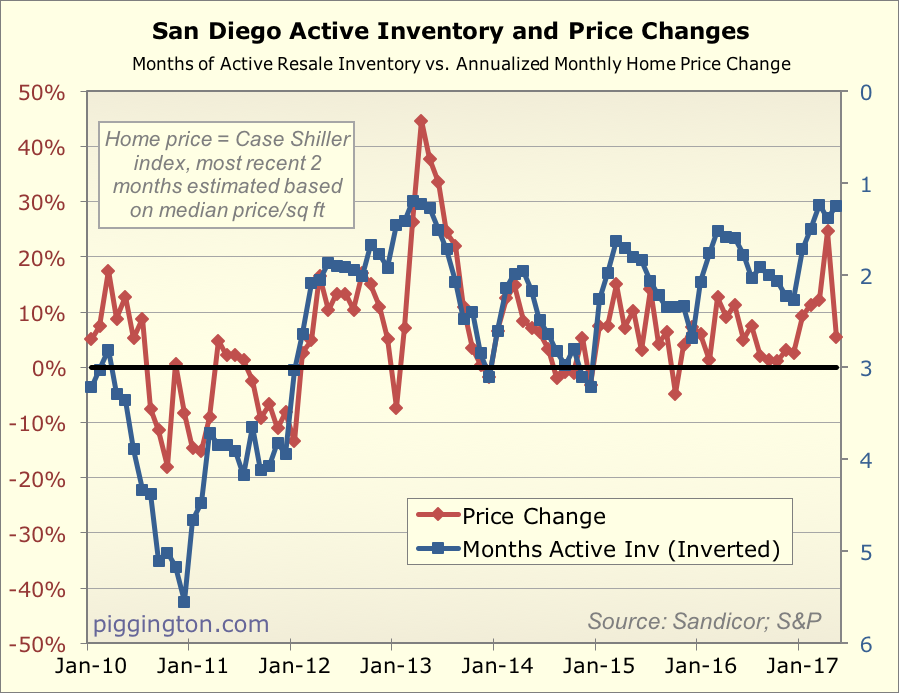

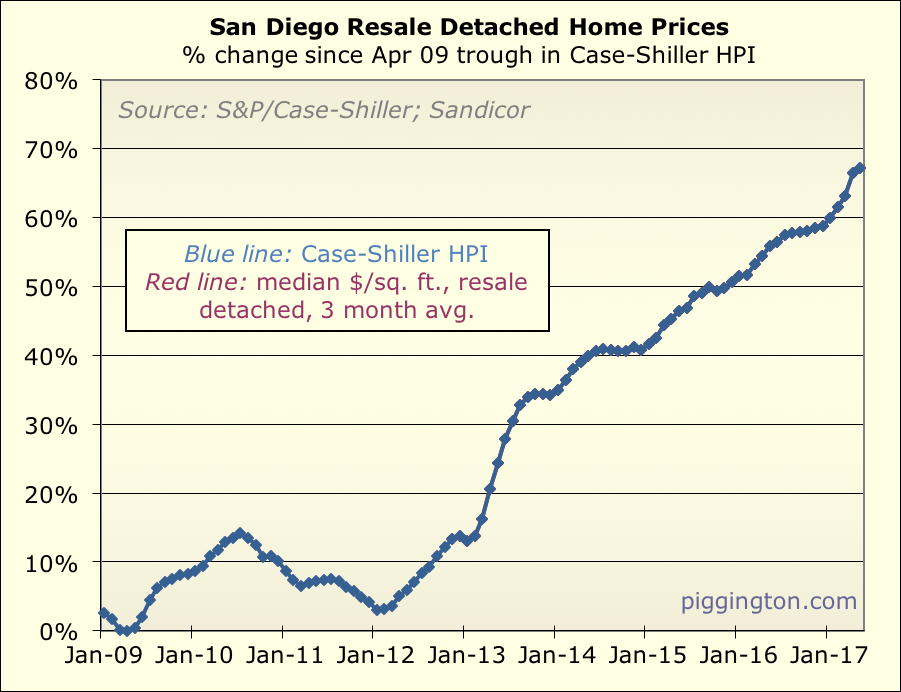

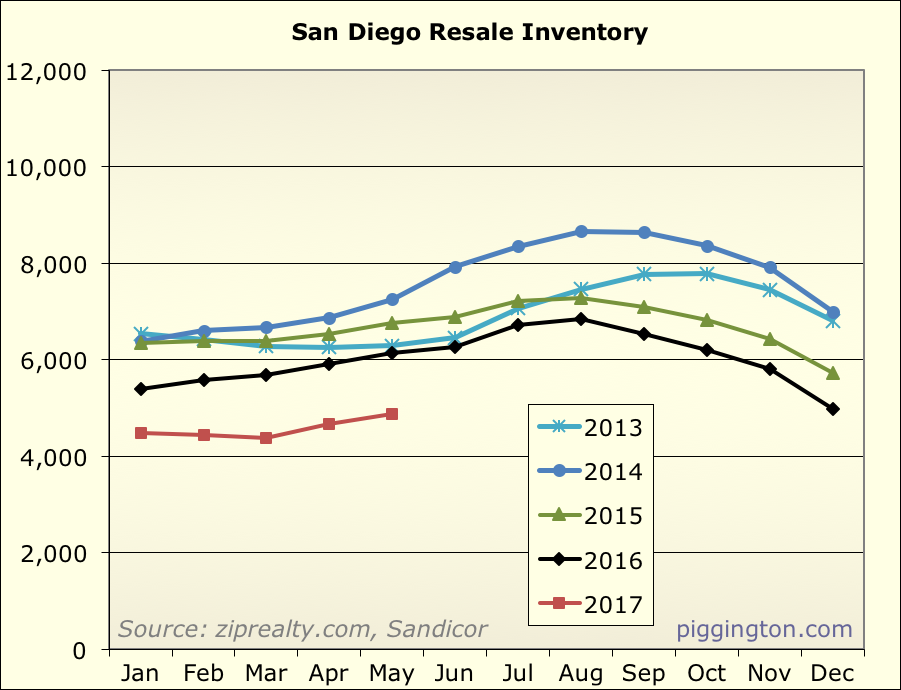

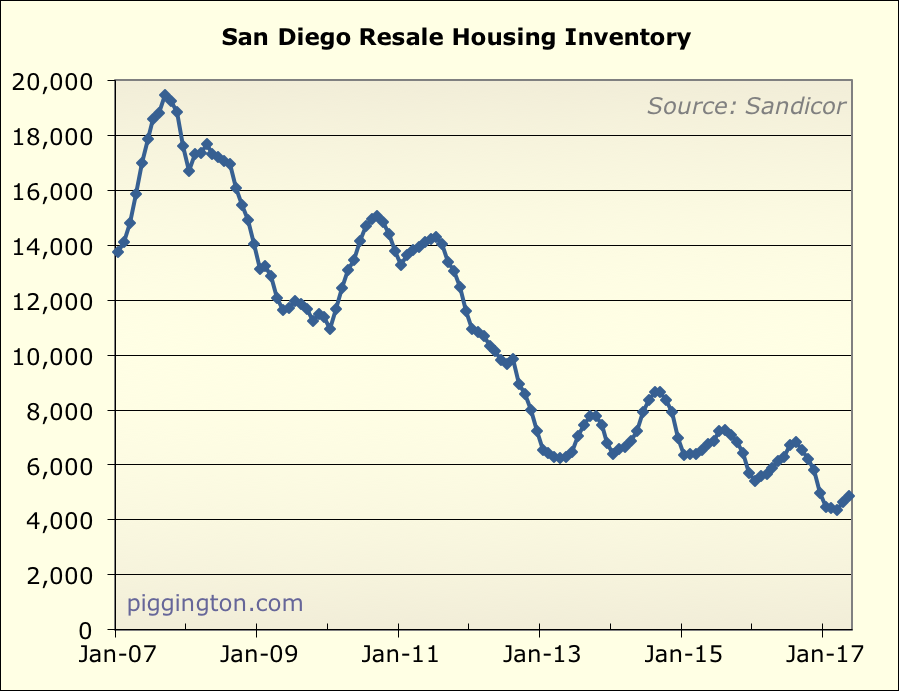

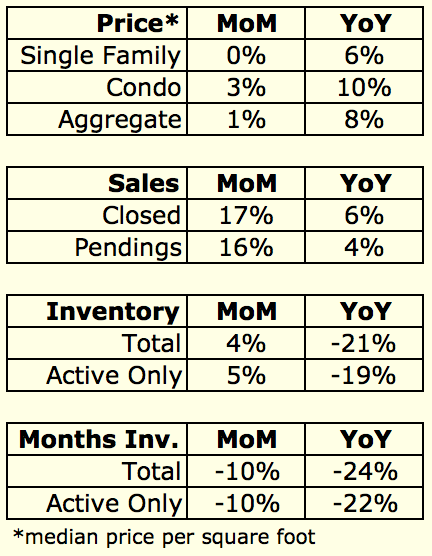

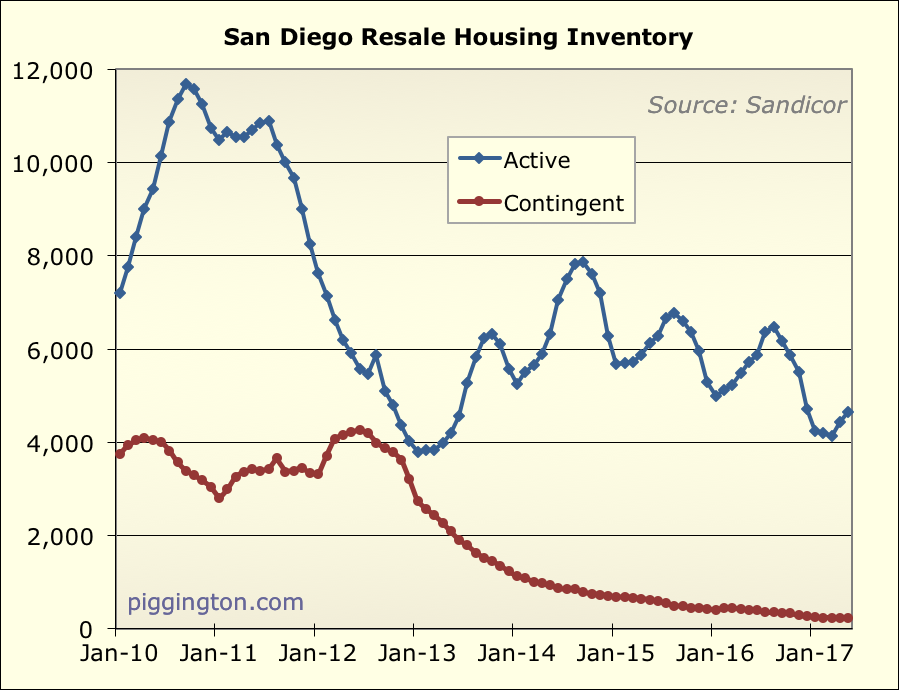

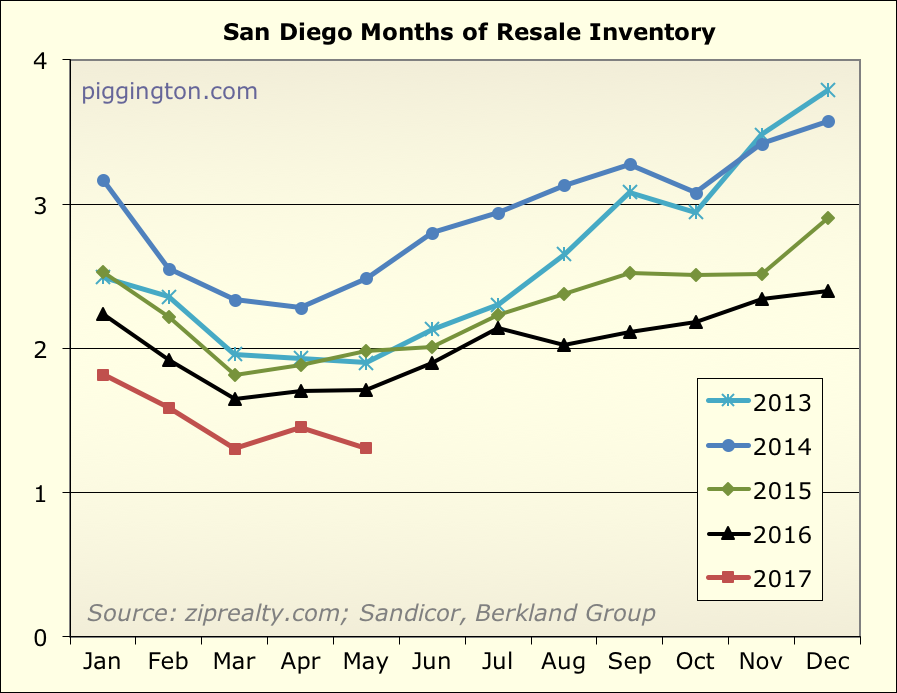

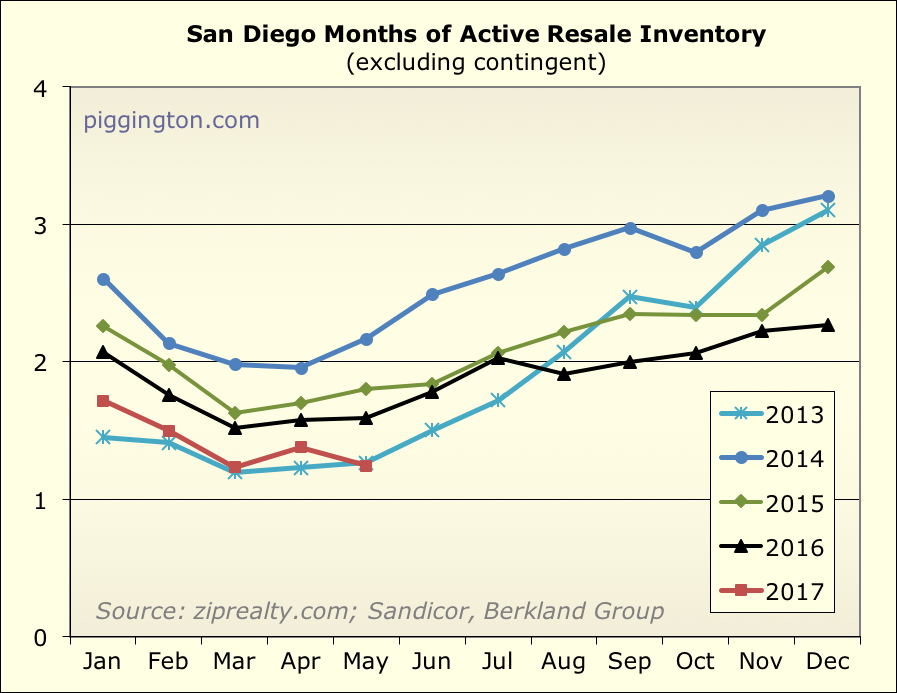

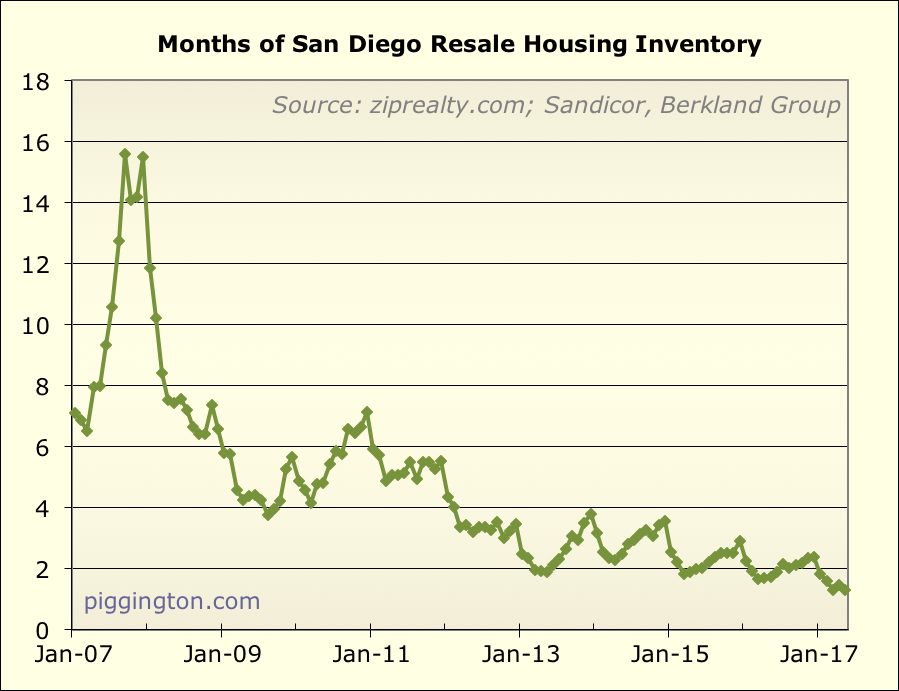

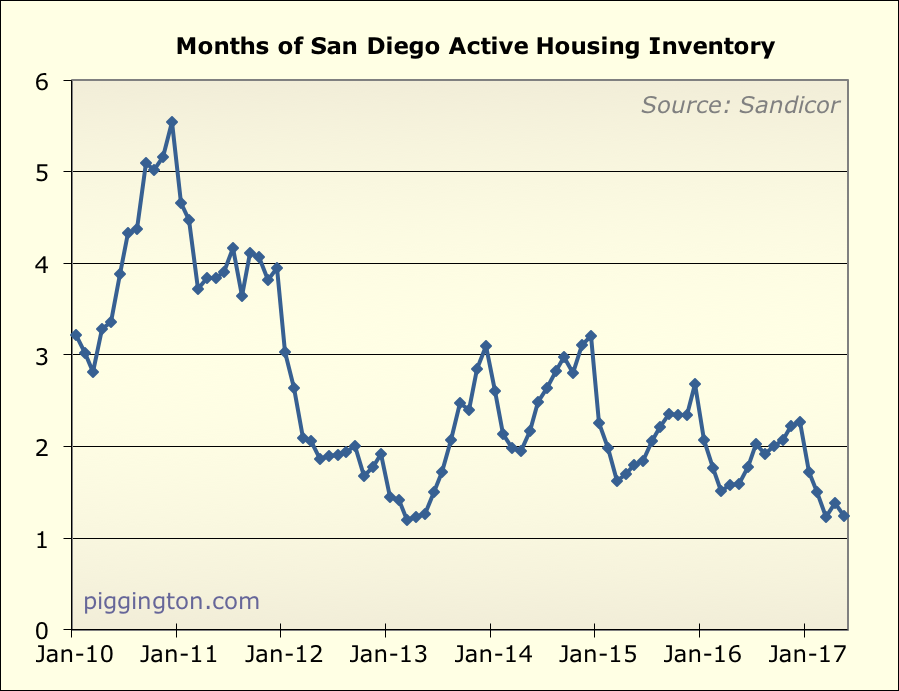

To sum up May: inventory rose, but sales rose more, resulting in even

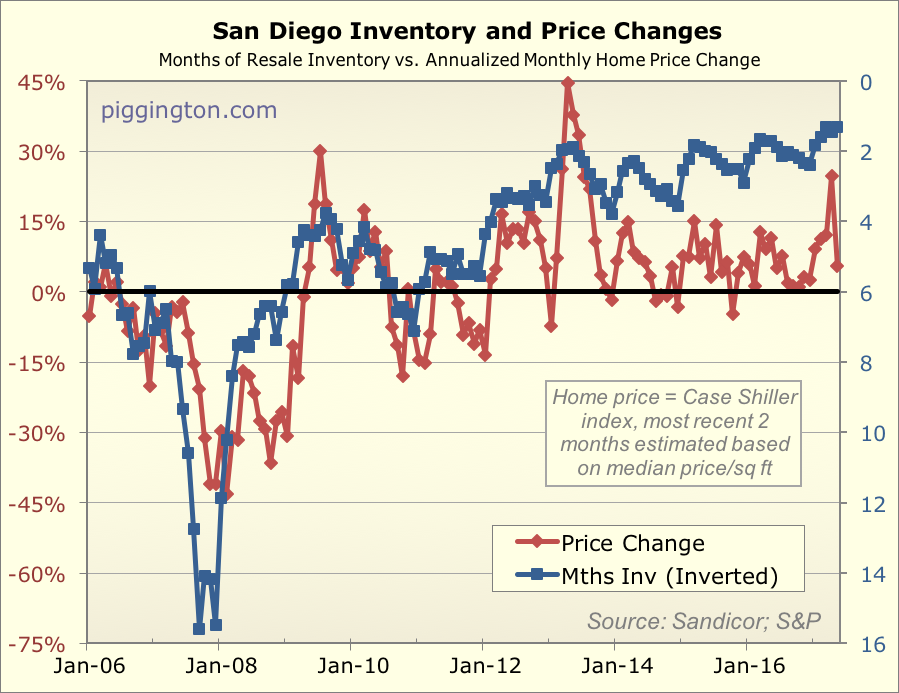

lower months-of-inventory. Despite that, single family home prices took

a breather. But the price trend is still comfortably “up.”

Further interpretation will be left as an exercise for the reader…

😉 Graphs below:

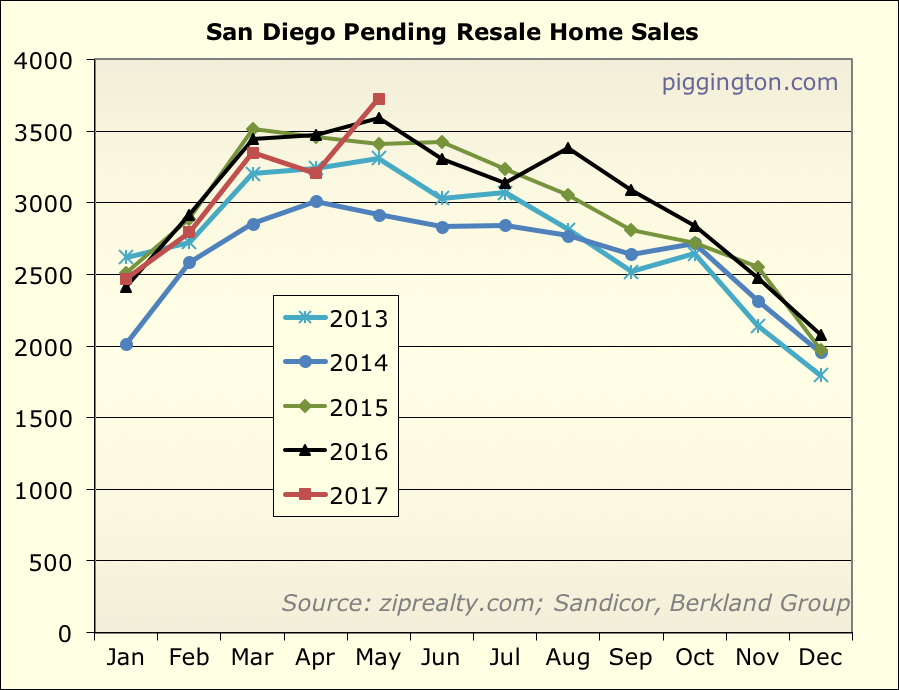

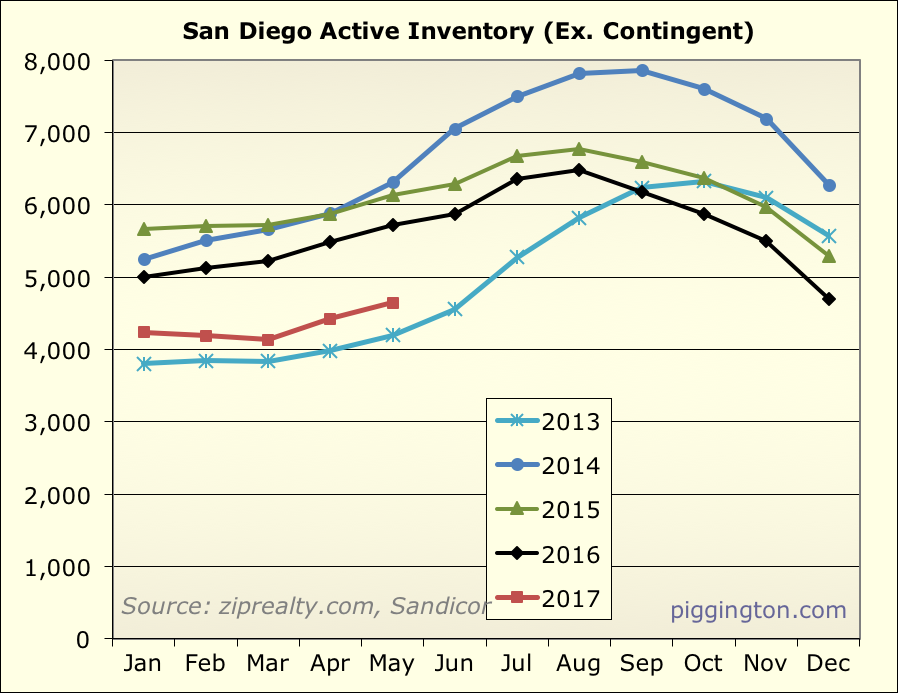

Perhaps this is just obvious,

Perhaps this is just obvious, as the volume of sales rises in May at a quicker pace than previous months, the level of remaining inventory drops even faster.

So everyone who sees this occurring and wants to buy also needs to make a decision faster.

Perhaps buyers are ever more confident the parameters driving the values are more permanent and are thus feeling surer in their decisions.

So main question, and I think the answer is yes, are buyers behaving rationally?

Escoguy wrote:

So main

[quote=Escoguy]

So main question, and I think the answer is yes, are buyers behaving rationally?[/quote]

Anecdotally, in Clairemont the rents for SFH have steadily increased. $2850 for 3/2, $2500 for a half a duplex. For a renter, buying does seem to make sense if you got a 10% downpayment, and can find a house for sale.

I’d say buying with 5% down

I’d say buying with 5% down is still much cheaper than renting. The extra MI and .25% interest stings. But it might only take 18 months of payments and appreciation to get the 20% equity needed to do a MI-drop refi.

double post, edited.

double post, edited.

bewildering wrote:Escoguy

[quote=bewildering][quote=Escoguy]

So main question, and I think the answer is yes, are buyers behaving rationally?[/quote]

Anecdotally, in Clairemont the rents for SFH have steadily increased. $2850 for 3/2, $2500 for a half a duplex. For a renter, buying does seem to make sense if you got a 10% downpayment, and can find a house for sale.[/quote]

It’s picking up way more than that for SFH per my view.

Just look at this place… 4/2 <1,800 sqft for $4k!!! I called, it's already rented!

https://www.zillow.com/homes/for_rent/San-Diego-CA/house,condo,apartment_duplex,mobile,townhouse_type/17200256_zpid/54296_rid/817828-_price/3000-_mp/32.871442,-117.147303,32.757469,-117.257166_rect/12_zm/

[quote=gzz]I’d say buying with 5% down is still much cheaper than renting. The extra MI and .25% interest stings. But it might only take 18 months of payments and appreciation to get the 20% equity needed to do a MI-drop refi.[/quote]

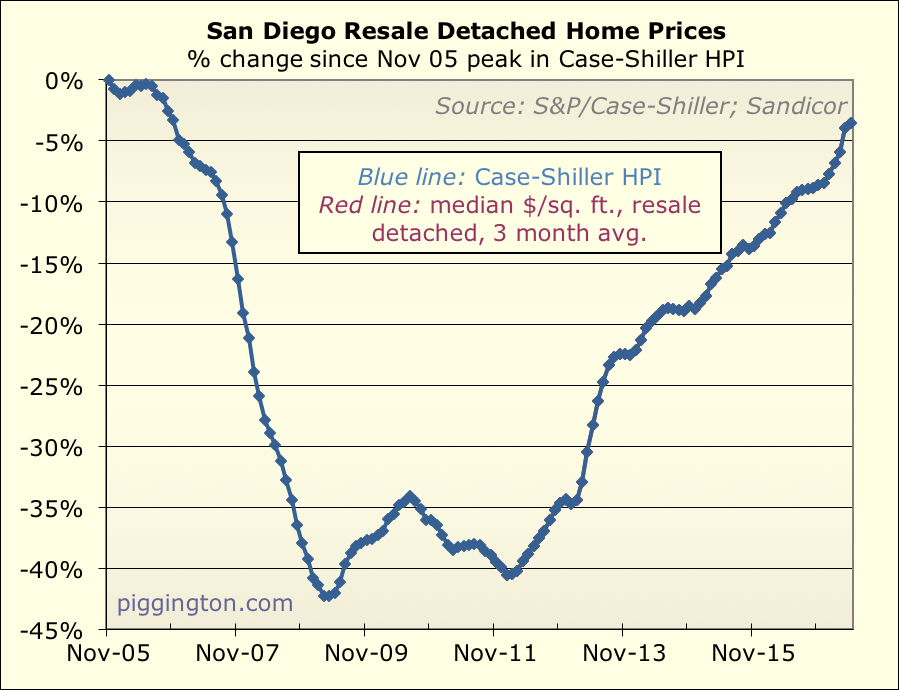

This kind of thinking is what did us in the last time.

Buying with the hope of 20% appreciation in 18 months while we’re at historic highs is dangerous.

Asitl, appreciation would

Asitl, appreciation would only need to be about 13% to do a MI dropping 20% down refi. 5% is already down and regular payments would be another 2% or so.