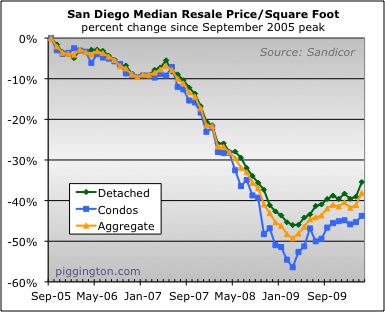

As discussed last week, the median price per square foot of San Diego

resale homes rallied hard in March.

There are always composition-shift issues with the median-based

indicators, but at the same time, there is no reason to believe that

composition shifted so drastically just in one month that it should

have accounted for that entire change. At the same time, it’s

unlikely that actual values would rise that much in a single

month. So I would venture to guess that it’s a bit of both —

that there is some noise, but that actual home prices were up in March

after having just drifted along since last fall.

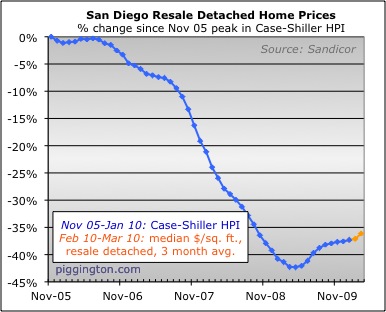

This was enough to give my Case-Shiller estimate for March a nice boost:

Now, have a gander at the following chart and you can see that this has

not been that typical spring rally/dead cat bounce that we saw in the

1990s:

Back then, each spring or summer rally was followed by a new price low

before the next dead cat bounce began. Contrast that with now:

here we in at spring rally 2010 and not only did prices not make a new

low post-spring rally 2009, but per the Case-Shiller index they never

even dropped for a single month.

Of course, back in the 1990s we didn’t have home buyer tax credits or

trillion-dollar MBS monetizations. So there you go.

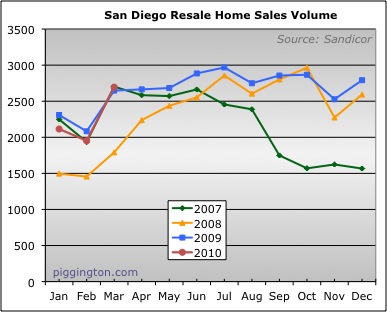

Volume came back strong after a couple weak months, which I think

validates my theory of a post-fake-tax-credit-expiration lull.

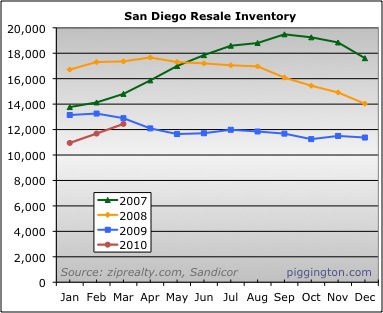

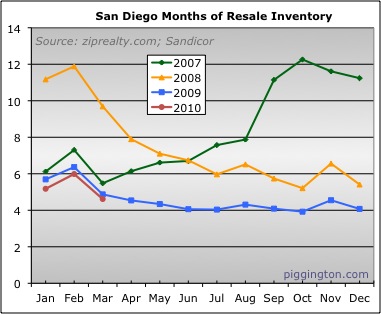

Unlike this time last year, inventory has been climbing:

However, sales were strong enough to offset that, bringing us to a

months-of-inventory reading that is marginally above that of late 2009

but the lowest March since I started tracking it:

As always these days, we have some interesting factors in play in the

near future.

We’re near to the next Federal tax credit expiration, which for one

month only will be stacked atop a new California tax credit (I thought

CA was low on funds or something? I must have imagined

that). I

believe that May will be the big month for the dual credits so we may

see another crescendo and then lull in the months ahead.

The Fed has bailed on their MBS purchase program and rates rose a bit,

but not by much. So that’s been kind of a non-event thus

far. I have always been of the mind that they would fire up their

monetization program again if there were any signs of trouble, but so

far it seems that someone else is stepping in to do the buying (good

luck to them, I say). It is by the way also possible that there

was a surge in sales activity as people anticipated rising rates and

thought it might be their last chance to lock in low rates.

On the shadow inventory front, rumors have been flying that the banks

are going to start getting some of these foreclosures through the

system (here’s one example). Now, my first reaction to this kind of thing is

that I’ve been hearing it forever and why should I believe it this

particular time, but for whatever reason, this time around it is coming

from multiple sources and those who haven’t raised false alarms

before. So maybe there is something to it. Maybe that’s

even part of the reason that listed inventory has finally been creeping

up. But they will have to release an awful lot of shadow

inventory to make a difference, especially given the tax credit-driven

demand over the next couple months.

We will watch to see how all these developments play out. For the

time being I continue to focus on trying to identify what’s happening,

rather than making forecasts, because — as I wrote

a while back — this market is being driven by political factors, not

economic fundamentals. What’s happening right now is that we

appear to have entered Spring Rally 2010 with a flourish.

Rich, is your ‘post-fake-tax

Rich, is your ‘post-fake-tax credit expiration lull’ another way of saying that these incentives are pulling demand forward and we will see a kind of stagnation in the late summer-fall?

Well, I’m really talking

Well, I’m really talking about the lull after the fake expiration last year, but yeah, presumably the same think could happen after any other expiration frenzy. As to it specifically happening in late-summer fall, who knows… the CA one goes until the money runs out, right? Anyway by then there may be a new federal one… doesn’t seem like something that can be predicted to me.

Rich

The 1990s were a different

The 1990s were a different period of time and therefore cannot totally be extrapolated to that of today. For one thing, the late 80s boom/early 90s bust was not national in nature and was largely confined to just California and a few other regions in the US whose economies were driven largely by defense spending. The boom/bust was less severe in intensity and there was no massive government support (because it was not perceived as a NATIONAL problem, but mainly a California one). Another phenomenom is the fact that people today are staying put. They are not leaving San Diego for better economies in say Utah, which is what happened in the 90s. The 1990s multi-year market lull was an unprecedented aberration in recent memory and may not necessarily be repeated again.

PS – A perfect example of

PS – A perfect example of this was in 1994, when the southern California real estate market was largely comatose. The Fed, however, didn’t care. They ratched up the federal funds rate that year in spite of our mostly local real estate issues.

asprogerakas wrote:The 1990s

[quote=asprogerakas]The 1990s were a different period of time and therefore cannot totally be extrapolated to that of today. For one thing, the late 80s boom/early 90s bust was not national in nature and was largely confined to just California and a few other regions in the US whose economies were driven largely by defense spending. The boom/bust was less severe in intensity and there was no massive government support (because it was not perceived as a NATIONAL problem, but mainly a California one). Another phenomenom is the fact that people today are staying put. They are not leaving San Diego for better economies in say Utah, which is what happened in the 90s. The 1990s multi-year market lull was an unprecedented aberration in recent memory and may not necessarily be repeated again.[/quote]

Agreed… what’s your point?

I guess I don’t have

I guess I don’t have one…other than to remind your readers that history never exactly repeats itself in the ways we expect-like people expecting the market to stay depressed for years when that typically is not the way things happen, at least not in California.