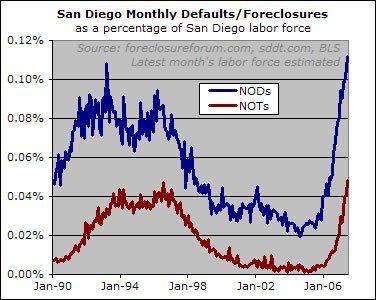

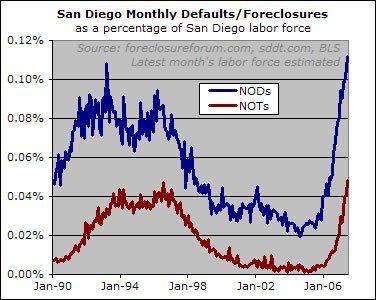

The month of June saw 1,708 Notices of Default and 738 Notices of Trustee Sale.

Even when adjusting for San Diego’s growth, as the graph shows, there were more NODs and NOTs filed in June than in any month during the entire 1990s housing bust.

The month of June saw 1,708 Notices of Default and 738 Notices of Trustee Sale.

Even when adjusting for San Diego’s growth, as the graph shows, there were more NODs and NOTs filed in June than in any month during the entire 1990s housing bust.

On the preforeclosure side

On the preforeclosure side of things, I am curious to find out what experience’s people have had with short sales, and given the huge increase in NOD and NOT’s, whether lender/investors are starting to let properties go at lower prices, and what their current criteria are. I have seen some good data under a different thread on this site about number of short sales, but am very curious about what they are being sold for.

Of course nationally June

Of course nationally June foreclosures numbers were not as horrible as May so the bulls will see this as the bottom. Though I must admit this MSN article admits more trouble is likely on the way, a signal I think indicating confidence is slowly eroding.

Rich, a question that leaps

Rich, a question that leaps to mind is this – if the foreclosure rate is the highest its been for quite some time, why isn’t the must-sell inventory driving home prices down more noticably.

I wonder if we need to wait for the NOT’s to catch up a little more.

I’m puzzled by how well the market continues to be fair in light of the otherwise dismal RE market.

HiggyBaby

So far, that “Must Sell”

So far, that “Must Sell” inventory is sitting on the banks balance sheets with wishing prices.

Since January, Countrywide’s REO holdings have doubled. They currently have $1.9 Billion dollars in REO homes. In California, they are holding 1900 properties for a total asking price of $732 Million dollars. A spot check of OC houses found most of the houses I looked at had a price on the Countrywide site that was 15-20% higher than the “last sold” price on Zillow which was usually in the 2-4 months.

Many of the other banks are doing the same.

Countrywide REO Tracking Blog

“In California, they are

“In California, they are holding 1900 properties for a total asking price of $732 Million dollars.”

And I’ll bet that keeping the asking prices high makes the company look like it’s not doing so bad. Even if they can’t sell them at those prices, they can say that they have $732 million in properties. If they dropped the asking price on each home, they’d have to reduce the value of these holdings. That would probably look worse on the books.

Sounds a lot like the

Sounds a lot like the alleged value of CDOs.

The accountants nowadays

The accountants nowadays seem like they are good at cooking the bank books. They make the balance sheets glossy and highly optimistic, and to make matters worse, the auditors are not doing the proper checks and balances anymore. So sad – the accounting profession is becoming disrespectful.

Yes, Nancy you are very

Yes, Nancy you are very correct. As a CPA and former financial auditor (Pre Enron and Tech bubble), I can tell you that even at lower levels, Financial Statement opinions are like a commodity.

I observed this happening back in the mid nineties when I got of college and starting working in a mid-tier Auditing firm back in Chicago. After 3 years, I decided to go into corporate finance and accounting and eventually into operations. Over the course of the past ten yeaers I’ve observed all of the same basic problems manifest in the Enron, Worldcom and now the Mortgage Lenders. It always boils down to relative value of assets on the balance sheet which are masking hidden losses (impairment). What is the fair value of the assets and the CPA firms always seemed to pass the buck on that issue.

Just as a point of

Just as a point of clarification. GAAP rules do not allow “asking” prices to have any effect on the balance sheet. As JWM correctly points out it could only be an “opinion” in a footnote. What REALLY matters is the selling price. That locks down the financials to actuals.

“Must Sell” inventory won’t

“Must Sell” inventory won’t kick in till more mortgage resets start. I know many borrowers with NW in the millions who are sitting on a powder keg of highly leveraged real estate with payments far less than interest only (neg-am) and I mean on 1-4 unit rentals with returns that are in actuality negative, some originally intended as flips that never occured that will inevitably go back to the banks.

Right now, it’s a standoff until regulators take action, but they may postpone doing anything because they are part of the problem. Google how the govt. stop publishing the M3 money supply figures in the last two years. They are just printing more money. I honestly think we may have another “D” and not a harsh recession, especially if a large-scale terrorist attack happens as has been promised by our enemies who sucker-punched us last time right after the stock market crashed for internet stocks. (don’t understimate their ability to time things just right again)

It’s a new paradigm alright, but not the one realtors with rose-colored glasses are seeing. Bankers don’t want to talk about what they are seeing reflected on the financials of their borrowers because if the inevitable occurs, they will also be affected personally.

Commercial real estate, thought by many to be unaffected because they actually have investment yields, albeit too low, is exactly in as bad a shape but for far more complicated reasons.

Take any 75% LTV commercial loan based on the 4-5.5% cap rate they have been selling at and recalculate the value based on a cap rate of say 8-9% to reflect the inevitable increase in interest rates and coming disfavor of real estate and you’ll see how quickly commercial property with somewhat decent returns can go upside down in a hurry.

To make matters worse, many commercial properties sell at ridiculous cap rates because they qualify for 10-year fixed rate conduit financing at 5%-6%, but guess what. Appraisers don’t make adjustments for those kinds of commercial properties when they are used as comps against properties that don’t qualify for financing at rates that low.

So what you get are investors buying commercial properties at a rate of return that is less than the rate they are being charged for the money being borrowed and they justify it by saying that’s where the cap rates are. Well, they are half right. That’s where the cap rates are on the comps, not the property they’re buying.

Folks, prepare yourself. We have the perfect economic storm coming our way and it’s of biblical (literally if you understand and study bible prophecy) proportions.

“Right now, it’s a standoff

“Right now, it’s a standoff until regulators take action, but they may postpone doing anything because they are part of the problem.”

You mean like Moodys and S&P???

Are you really a San Diego Banker???

Yes, I’m curious. What made

Yes, I’m curious. What made you doubt that I was?

because being a housing bear

because being a housing bear in SD has not been very popular until recently that is. Other than posters on this site, I have not run into very San Diegans who are bearish on RE. Being in the banking industry, you would have insight to what is really going on from the perspective here. True?

You’re right. That’s why I

You’re right. That’s why I have to remain anonymous : )

SD Banker, I’m trying to

SD Banker, I’m trying to gauge how bad things may get here is SD and in Socal in general with regard to residential real estate. Is your knowledge limited strictly to Commercial Real Estate??

No, both residential and

No, both residential and commercial. I think it will get progressively worse through 2009, stagnate 1-2 years, then very slowly pickup again.

The last five to six years have been unlike anything at any other time for a variety of reasons.

It won’t be catastrophic for those who did not equate debt with wealth as so many have : (

Just stay liquid. I know there’s a risk that our currency is being devalued, but having cash is still better than leveraging with debt when all indicators show that asset values across many classes are going down hard very soon.

Just frequently visit this site and as many others like it as you can weekly to keep your finger on the pulse of everything. The silver lining is that many banks and other lenders will eventually have to unload the REO, and then unbelievable buying opportunities will present themselves for those with some cash and not so much debt that they can’t qualify for a loan.

It’s just shocking that a

It’s just shocking that a banker would advise folks to hold cash.

I have a conscience. That

I have a conscience. That should be even more shocking ; )

I think there are a lot of

I think there are a lot of bankers who feel the same way you do but would never allow themselves to get caught saying it out loud.