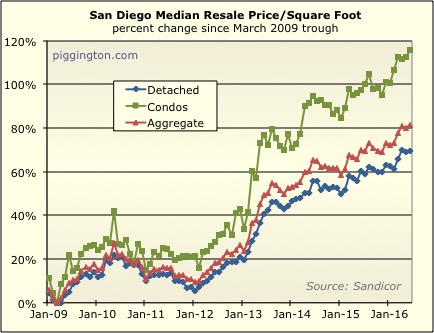

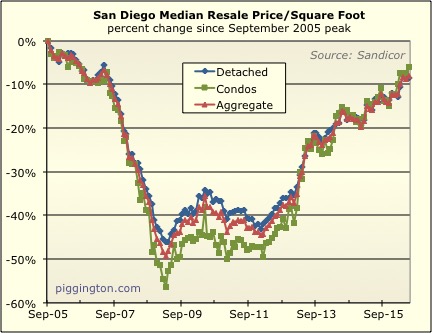

Home prices continued their general uptrend last month. The monthly

graph of median price/square foot is a bit noisy…

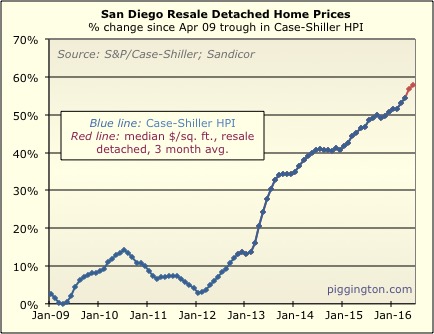

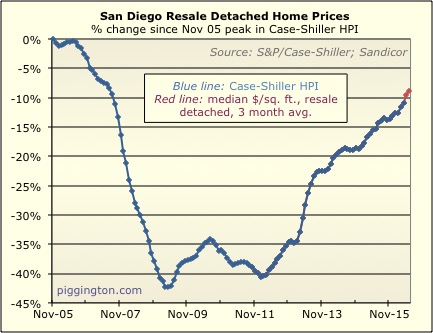

…so the trend is better seen with a 3-month average, as in this

graph:

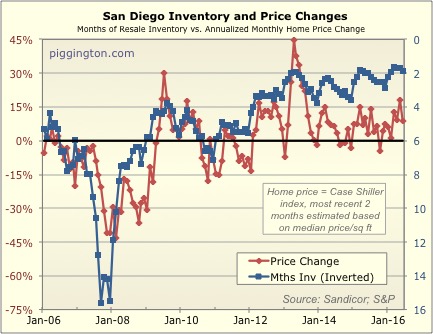

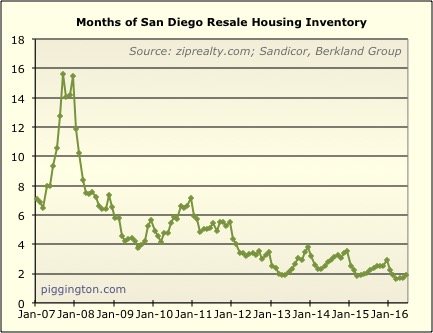

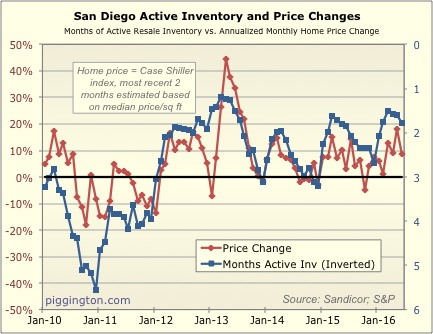

Inventory has been quite tight, so I’m actually surprised prices

haven’t been rising a bit faster, based on the historical

correlation between monts of inventory and price changes shown in

this graph:

I wouldn’t be surprised if the red and blue lines in that chart

started to converge a bit more in the months ahead. But for

now, months of inventory is low enough (high enough in the above

chart, where it’s inverted) that at least some degree of further

price gains seem likely in the near term.

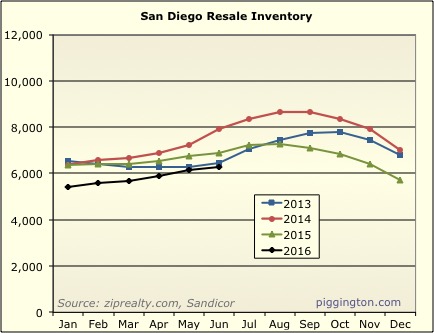

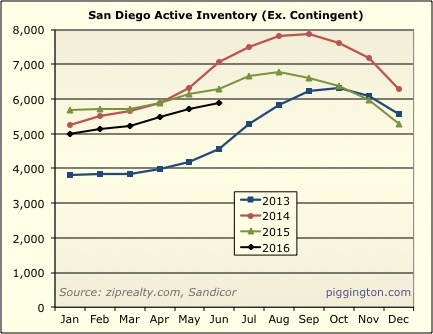

Here are a couple closer looks at months of inventory… it’s risen

in the short term (per the seasonal pattern) but is quite low

overall.

The recent plunge in mortage rates is not fully registering on these

graphs yet, given the lags involved… if the low rates stick, this

should be another positive for the markets in the months to come.

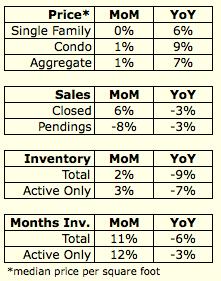

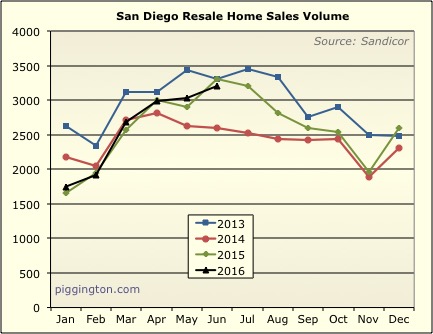

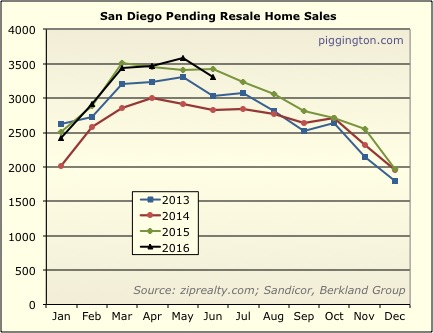

Here’s an overview of the M2M and Y2Y changes:

And the usual barrage of charts below:

So are we in a bubble still?

So are we in a bubble still? The first 2 charts show prices still going up, but maybe the scale of 7 years just doesn’t show the recent detail. Last chart shows prices seasonally adjusted as falling with rising inventory. Don’t really notice prices falling when looking at listings but maybe those are wishful listings. Thanks for posting Rich. Seems like people don’t ever want to call it a bubble until it bursts.

Last chart shows prices

The last chart shows a decrease in the rate of price rise. Prices are still rising.

Thanks for the info Rich.

Quick question. When in history has inventory been as low as now? Your graphs start in 2007 – but i am guessing inventory was just as tight during the run up to the 2005-7 bubble?

I think it was really tight

I think it was really tight in 03-04… I don’t think it was as tight in 05-06, but then prices were being pushed further upward as the lending got more and more nuts. There might be some sources out there for inventory data, but I don’t have it…

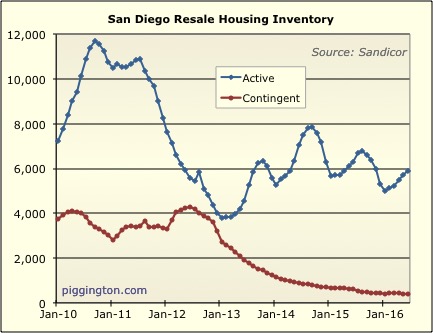

One thing to note is that ACTIVE inventory was lower in 2013. Overall wasn’t, but active is what really matters…

It looks like inventory was a

It looks like inventory was a lot higher in 2007 from the charts. It would be great to see an inventory chart going back to say 2004 to present. It would be interesting to see exactly when the uptick in inventory started leading to the price crash in 2008. I remember things started to slow in 2nd half of 2006, and slow more in 2007, before prices falling off a cliff in 2008. My guess is inventory started rising in 2006. So there was probably 2 yrs of rising inventory before the cliff in 2008. I also remember notice of defaults began really rising in the 2nd half of 2007. Because obviously as we know the main thing to look out for that would signal the start of the next buyers market would be rising inventory.

Last bubble caused by loose

Last bubble caused by loose lending standards,this bubble is being caused in my opinion by investors chasing yield. When we reach a point that real estate is no longer rising and there is a new profit center then a dump may occur in a race for the exits. Then again I’ve long thought that was going to happen in the bond market too, so what do I know.

moneymaker wrote:Last bubble

[quote=moneymaker]Last bubble caused by loose lending standards,this bubble is being caused in my opinion by investors chasing yield. When we reach a point that real estate is no longer rising and there is a new profit center then a dump may occur in a race for the exits. Then again I’ve long thought that was going to happen in the bond market too, so what do I know.[/quote]The thing is though, if rent keep on increasing, then yield would keep on increasing. So, if you’re already getting good yield today, unless rent drops dramatically, why would you rush for the exit? I don’t see it happening.

Agree, rent increases are

Agree, rent increases are real. In some cases, rents are 50% higher than 10 years ago but the prices are about the same, so from a cash flow perspective, this isn’t the same situation.

Not only has rent increased

Not only has rent increased from 10 years ago, rates has dropped dramatically from 10 years ago. So, PITI vs rent in some area is still just as good today as it was 10 years ago.

not in my case. Just renewed

not in my case. Just renewed my lease and rent is same as it was a year ago. The new mega complex rents are insane however- 2500 for a 1 bedroom! I pay 1350 for same size apartment next door. Will keep renting until this bubble pops.

Ok, so we’re in the market to

Ok, so we’re in the market to buy our first home right now, but prices are crazy. We’re looking in Point Loma where there seems to be lower inventory compared to similar priced areas like Mission Hills, La Jolla and Coronado. If you were me, would you buy right now or rent for 3-5 more years before buying? If we can save 20% on our purchase price (of get 20% more house) by waiting 3-5 years it would likely be worth it. But what’s the likelihood that a 20% downturn will occur in 3-5 years?

For reference, we’re looking around $1.2M.

You’re buying your first

You’re buying your first house, yet you’re looking at the $1.2M range, however, don’t have 20% down? I personally would say wait until you have at least 20% down and 6 months of reserve before consider buying.

Cdmcdona wrote:If you were

[quote=Cdmcdona]If you were me, would you buy right now or rent for 3-5 more years before buying? If we can save 20% on our purchase price (of get 20% more house) by waiting 3-5 years it would likely be worth it. But what’s the likelihood that a 20% downturn will occur in 3-5 years?

[/quote]

Based on the fundamentals, a 20% downturn doesn’t seem especially likely to me.

5% is way more plausible. Although people throw around the word “bubble”, this isn’t really a bubble. The biggest threat to home prices is rising mortgage rates. But that will also affect you if you choose to buy later.

Keep in mind global interest

Keep in mind global interest rates are lower than in the US which will likely cap any rise in US rates for the next 3-5 years minimum. Japan and Europe have aging populations with a high savings mindset. The seniors there depend on the interest payments to live. If that stays negative, a certain portion of funds will come to the US.

I’m not sure where you’re

I’m not sure where you’re seeing that we didn’t have 20% down. It was a question about the housing market and how long the momentum can last considering that it’s pretty much back to its all time max and from a historical perspective would seem “due” for a downturn.

I just threw the price range in there in case some users thought there might be some nuance to the market in the different price brackets, coastal neighborhoods, etc.

If this wasn’t our first purchase, I wouldn’t care as much where the market was at because I’d be selling and buying in similar market conditions. But the market conditions for a first home purchase could affect the “level” of houses you will live in for the rest of your life by as much as 50%

My bad, I miss read your post

My bad, I miss read your post and thought you meant buy now or wait 3-5 years until you have 20% down. Since you have 20% down and can easily afford $1.2M, I’d say why worry about it. I don’t think anyone will know how long this run will last and how high it’ll get before it’ll have a pull back. If your life necessitate a home, then buy it. Worse comes to worse, you’ll just have to live in it a little longer than expected. If your plan to stay in it for 10+ years, then it’s a no brainer IMHO. Just look at the last peak. After 10 years, we’re now back to where we were 10 years ago and rent has gone up a lot.

You can go here to do the purchase vs rent to see if it’s worth it to buy vs rent base on your situation and assumptions: http://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html?partner=digg