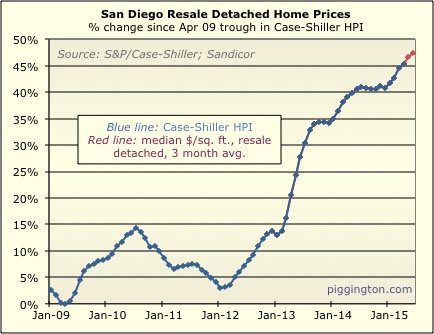

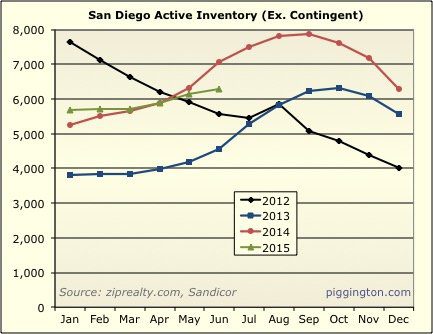

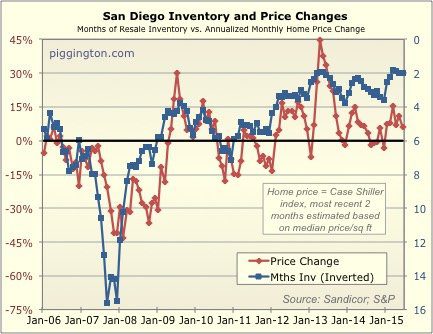

The local housing market was looking strong as of last month.

Prices continued to creep higher, sales were robust, and inventory,

while slightly higher, failed to outpace the increase in demand.

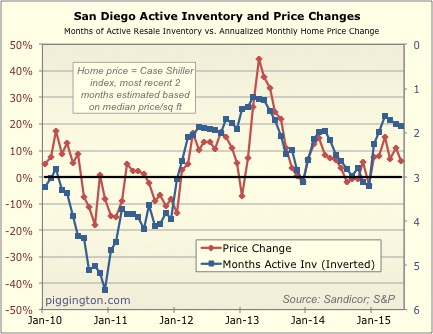

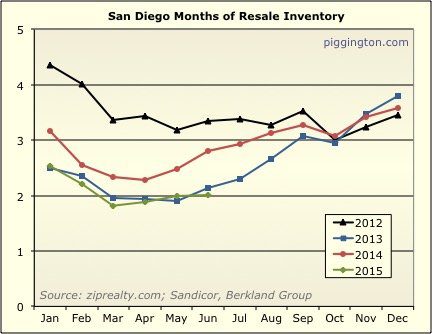

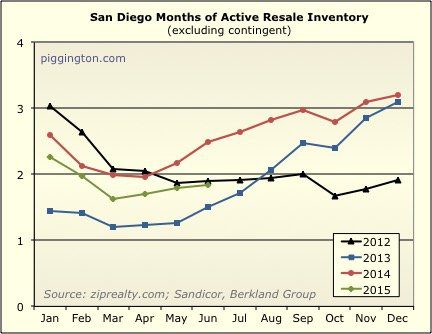

Months of inventory is not as low as it was during the 2013 feeding

frenzy, but it’s just about the lowest since — if that doesn’t

change, we can expect further upward price pressure immediately

ahead.

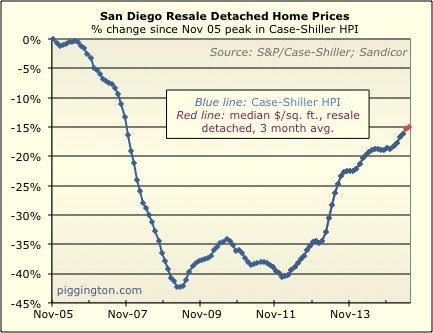

Longer term prospects are more dependent upon valuations, which is

another topic entirely. Nothing has substantially changed

since the last

update on that (yes, I know another one is due).

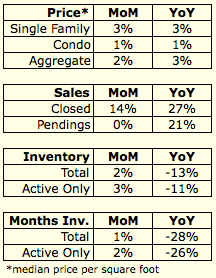

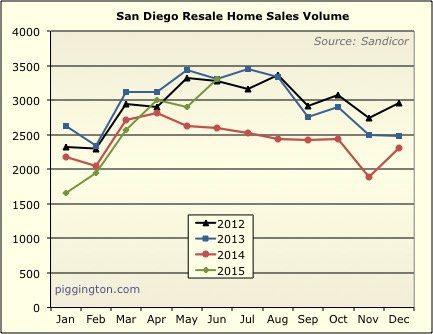

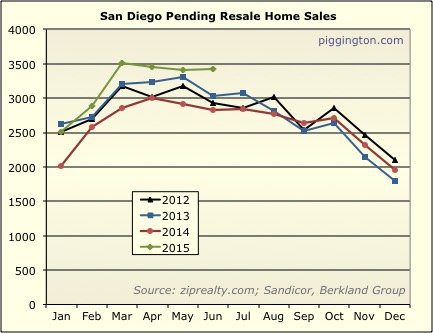

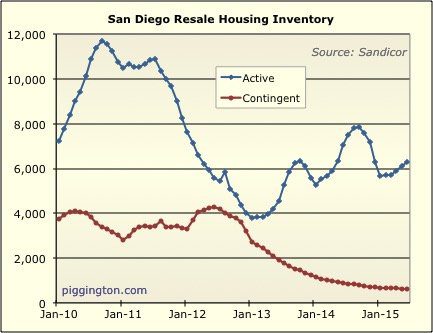

Here’s the overview of last month’s stats:

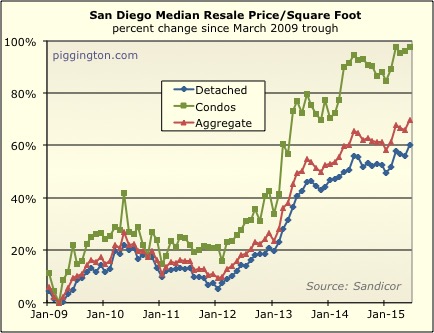

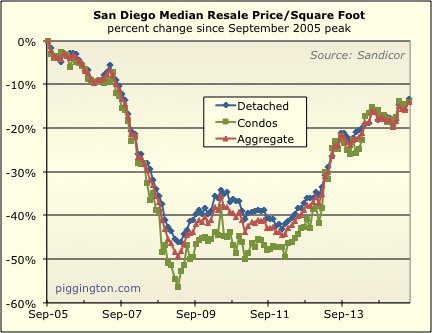

And the rest of the data presented without further comment:

Thanks, I always look forward

Thanks, I always look forward to the updates, especially now that I have joined other posters in having an investment property.

Updates are appreciated.

Updates are appreciated. Just for discussion, if one filters out homes on there market over 1M and less than 2BR, there are only about 4000 active listings.

Dropping the price to 700K leaves about 3000 homes with 2BR or more so yes supply is very tight. This is using the redfin data set link.

It’s interesting to me

It’s interesting to me there’s clearly still demand out there, even at current prices. I do wonder how the inevitable interest rate increase will affect that demand.

From personal experience,

From personal experience, many buyers are local move up buyers. I’ve often seen families which own in the 400-500K range upgrade to the 500-600K or from 500-600K to 600-700K. Not really big moves in the grand scheme of things. If there are two incomes, the additional payment is often just a few hundred a month. What I think is rarer is for newcomers from completely different regions coming and buying. I’ve seen families like that come, look/rent for a while then pick up and leave. If you’re from Arkansas, Florida, Texas, Midwest, it is hard to justify a downpayment which is the full price of the house. If you’re here and have roots, it’s easy to stay.

So if it’s a move up buyer who is local, then the interest rate has less impact as perhaps only half the price is financed vs 80-90% for newcomers. On balance, I’m guessing more than half of buyers are local move up just based on casual observations in North County for 15 odd years.

Let’s see how QCOM’s massive

Let’s see how QCOM’s massive layoffs are going to impact the market in SD…

SID

There’s been some

SID

There’s been some discussion about this earlier.

If 60% of the 1300 layoffs are homeowners, then about 800 families occupying homes would be affected.

My quick guess would be something like this:

10% go to early retirement and stay in area

10% go to early retirement and leave area

30%-40% get new jobs in the area

30%-40% sell and move on to another area

So my guess is that perhaps 400 homes may come on the market as a result.

It may soften prices some but defiantly not the start of a new down trend.

Some may do as I did and rent their homes and work elsewhere until it makes sense to come back. If they bought long ago, it may be easier to just rent out, make the mortgage payment and work elsewhere for a few years.