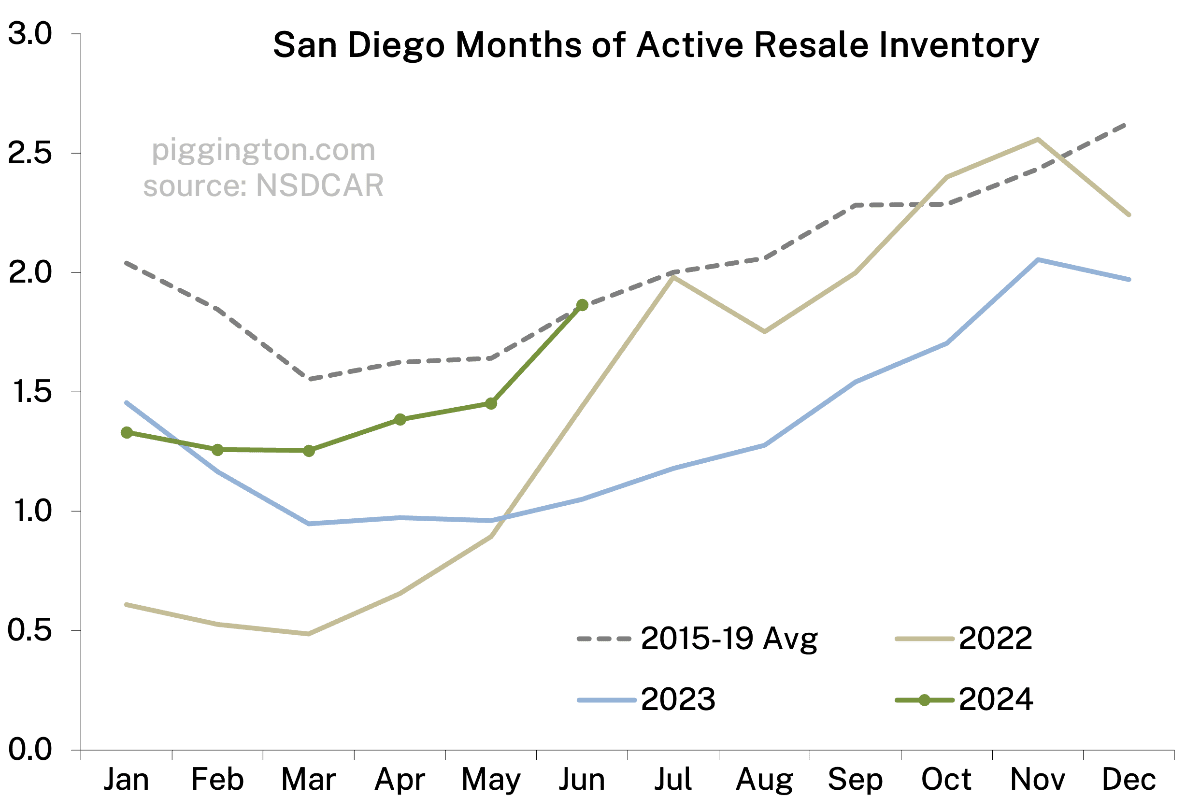

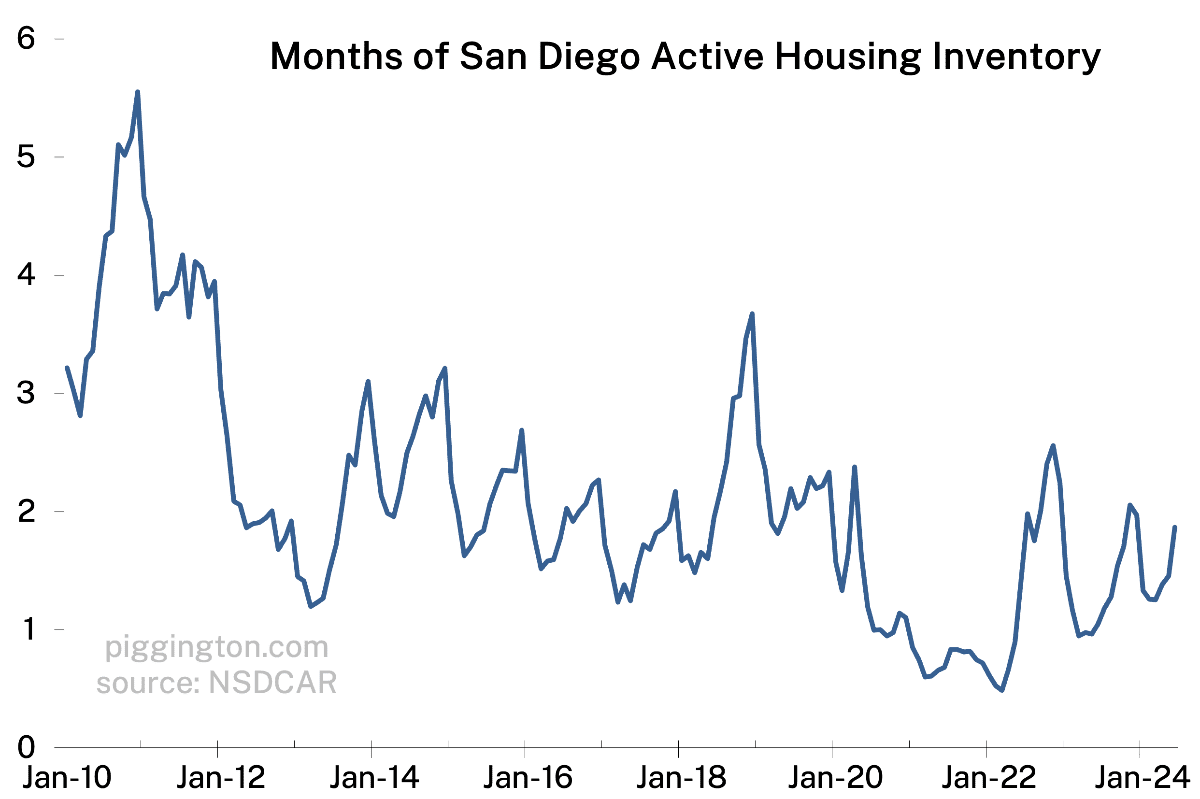

Months of inventory crossed into pre-Covid average territory last month:

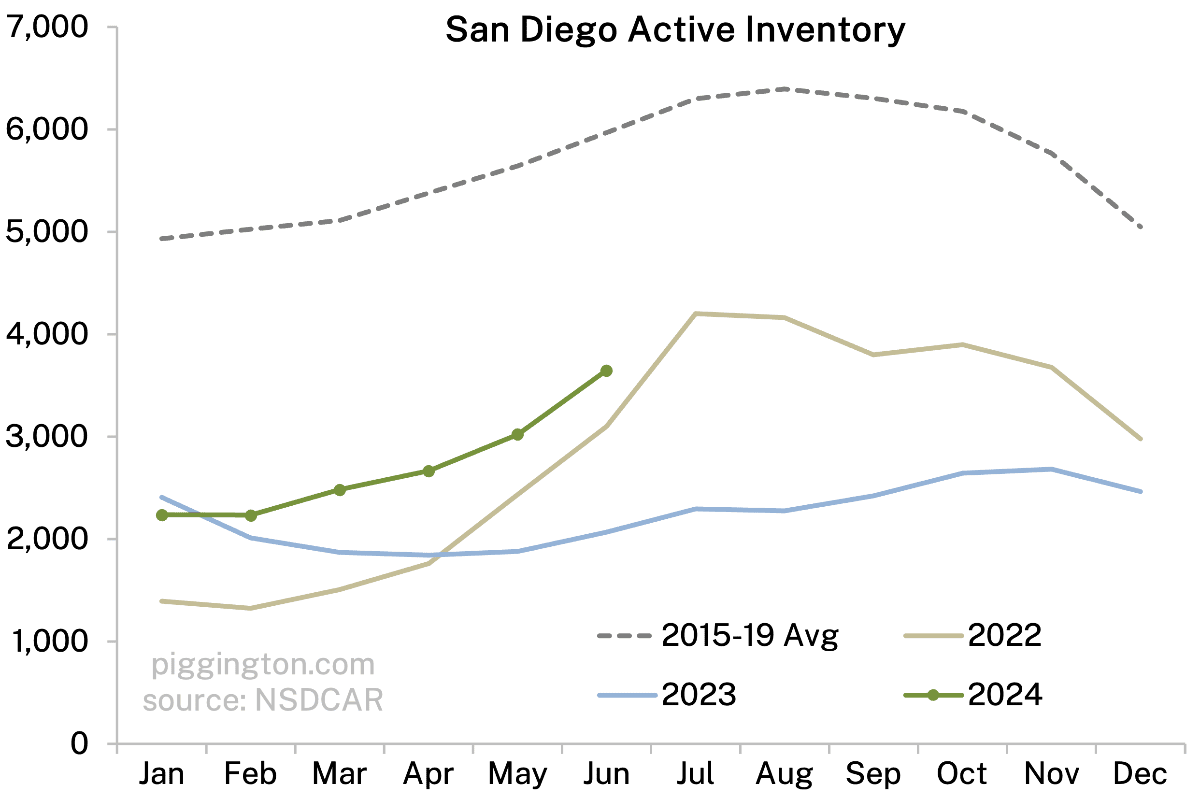

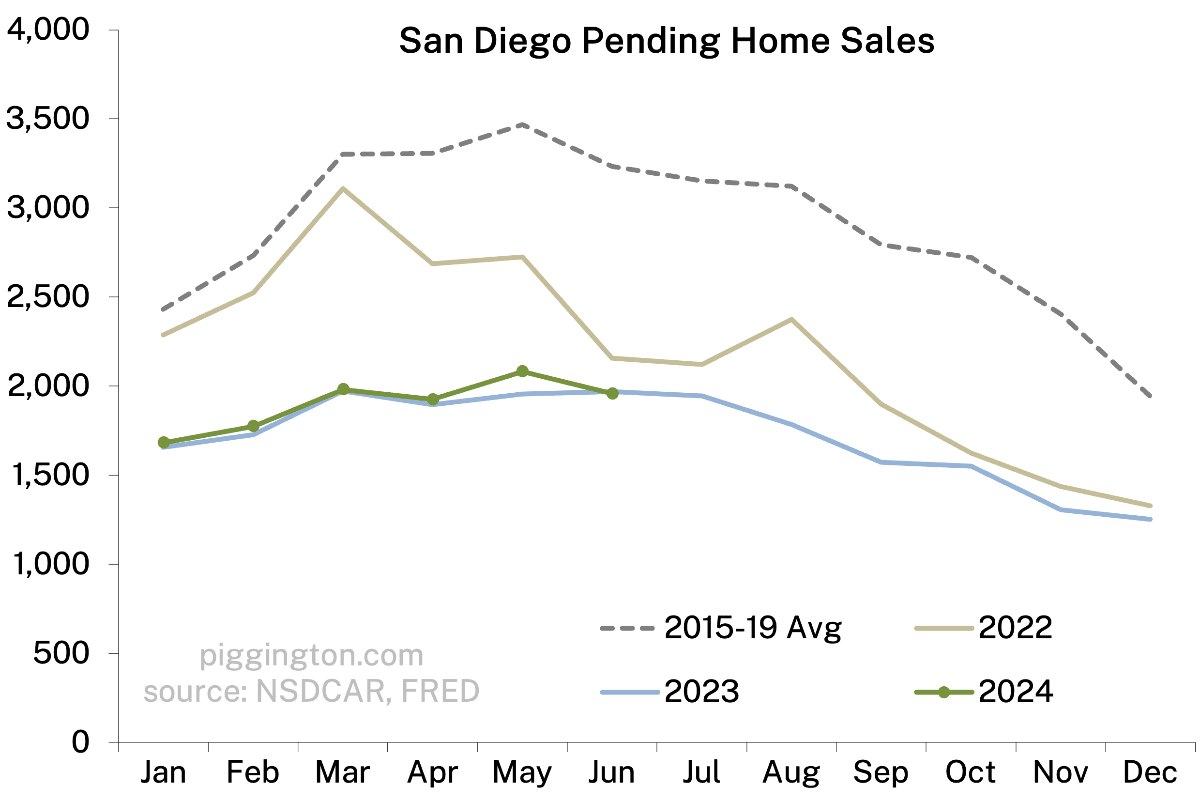

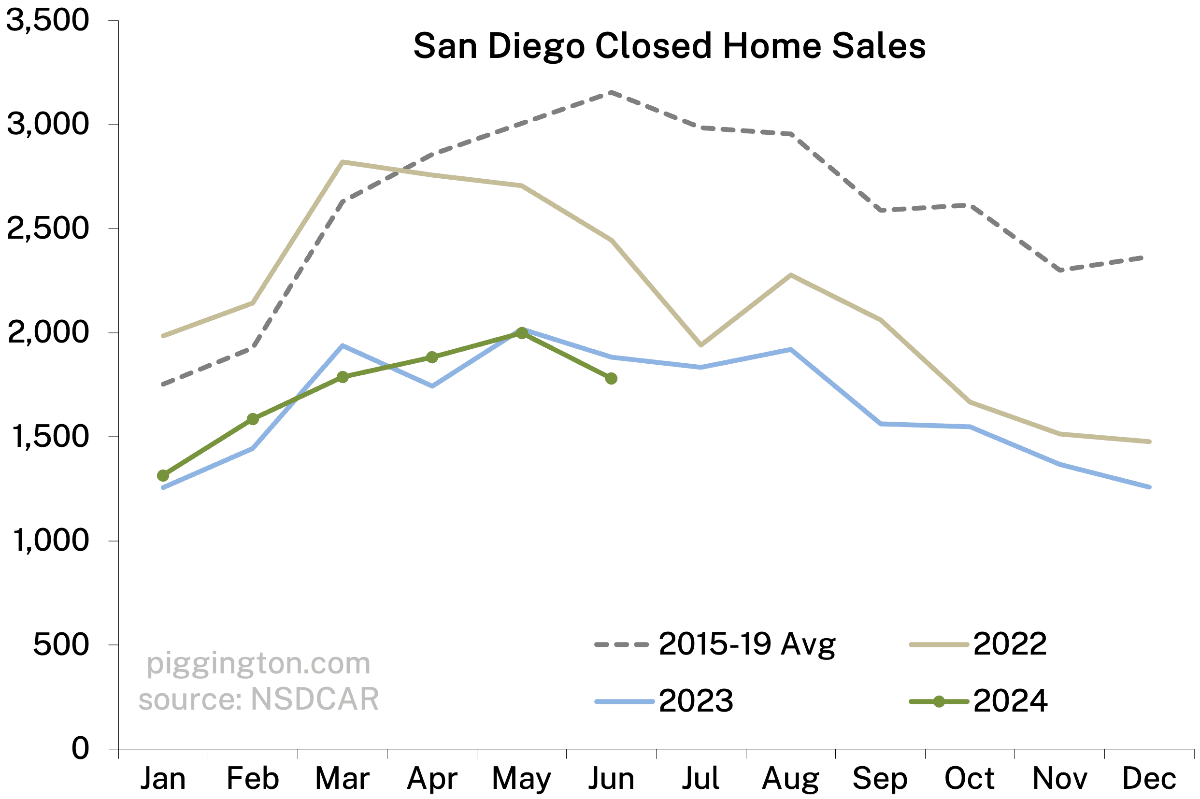

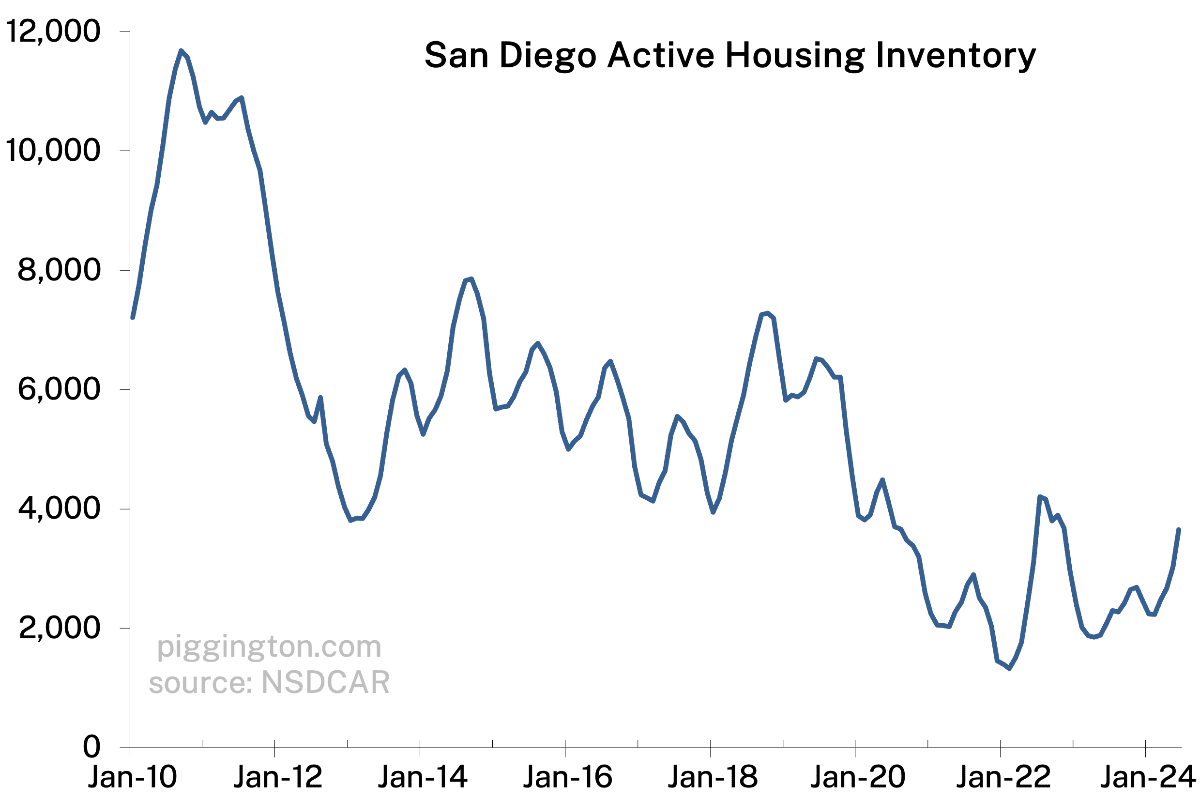

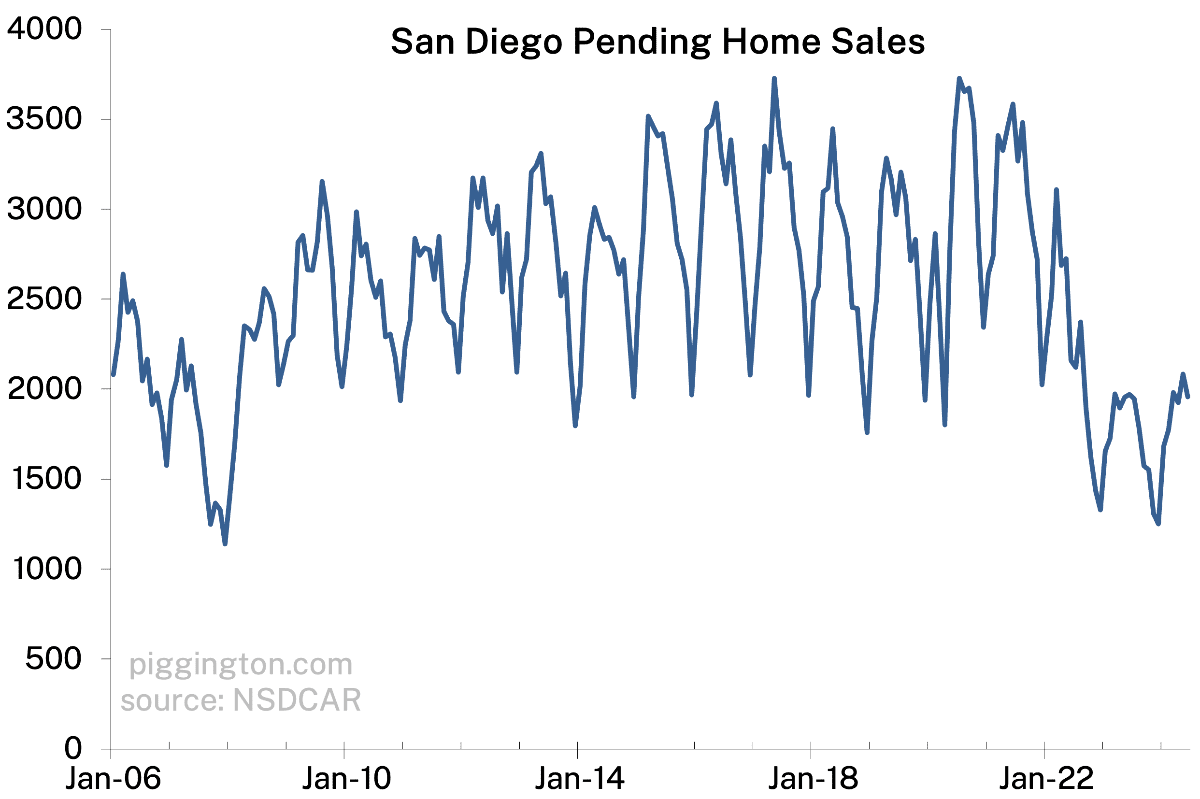

But while the ratio of supply to demand looks pretty normal, supply and demand themselves are both still quite abnormally low:

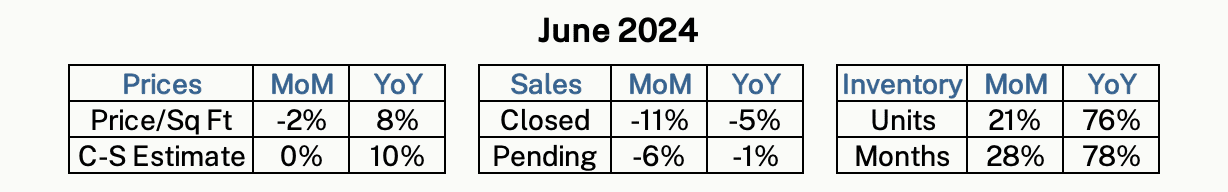

The difference is that while sales are stuck near their seasonal lows, inventory has risen quite strongly since last year (76% to be exact). So the ratio of inventory to sales, aka months of inventory, has risen quite a bit — up 78% from last year to the typical level of the Before Times.

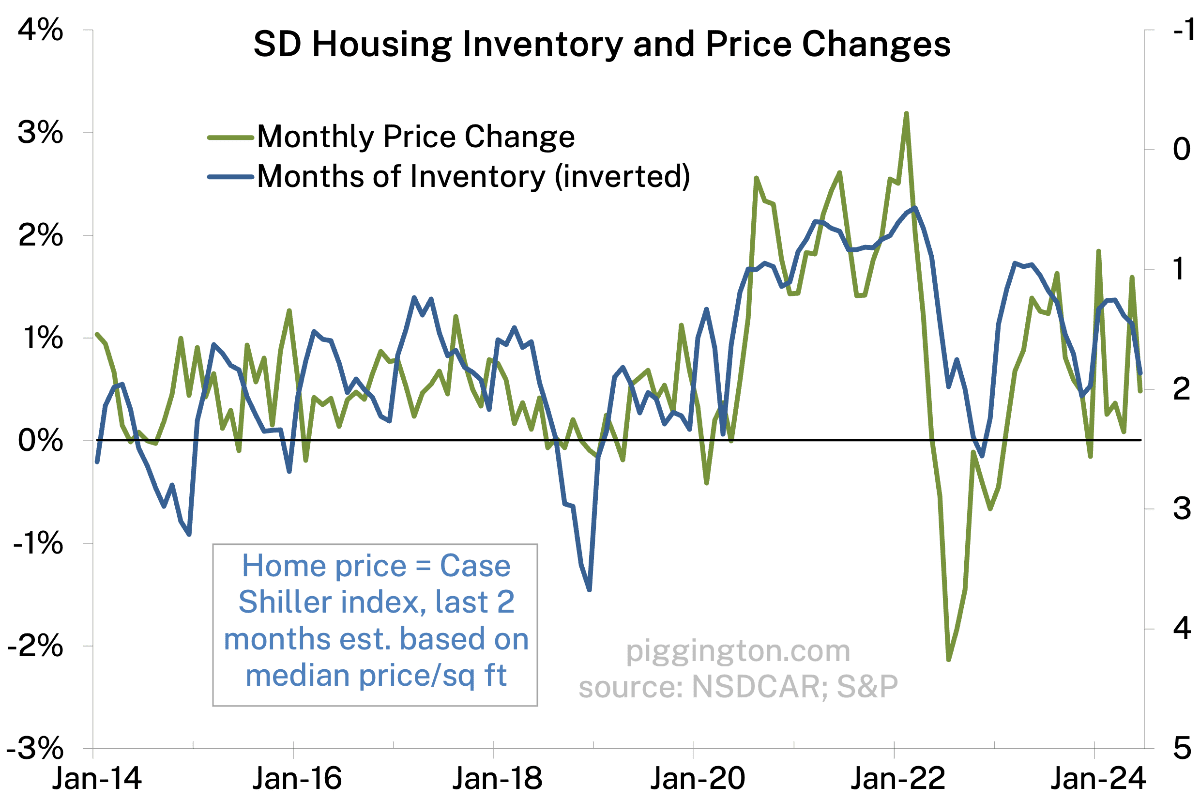

Why does this matter? Months of inventory is a pretty good indicator of near-term price pressures:

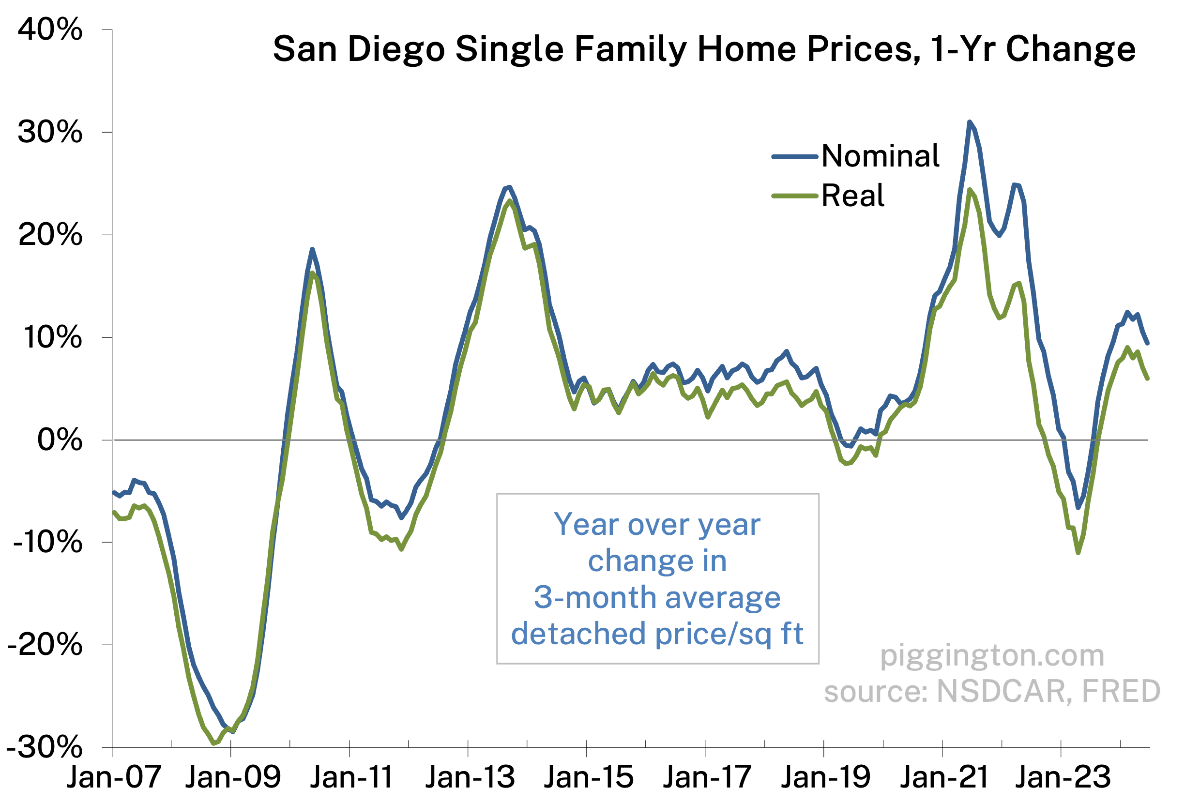

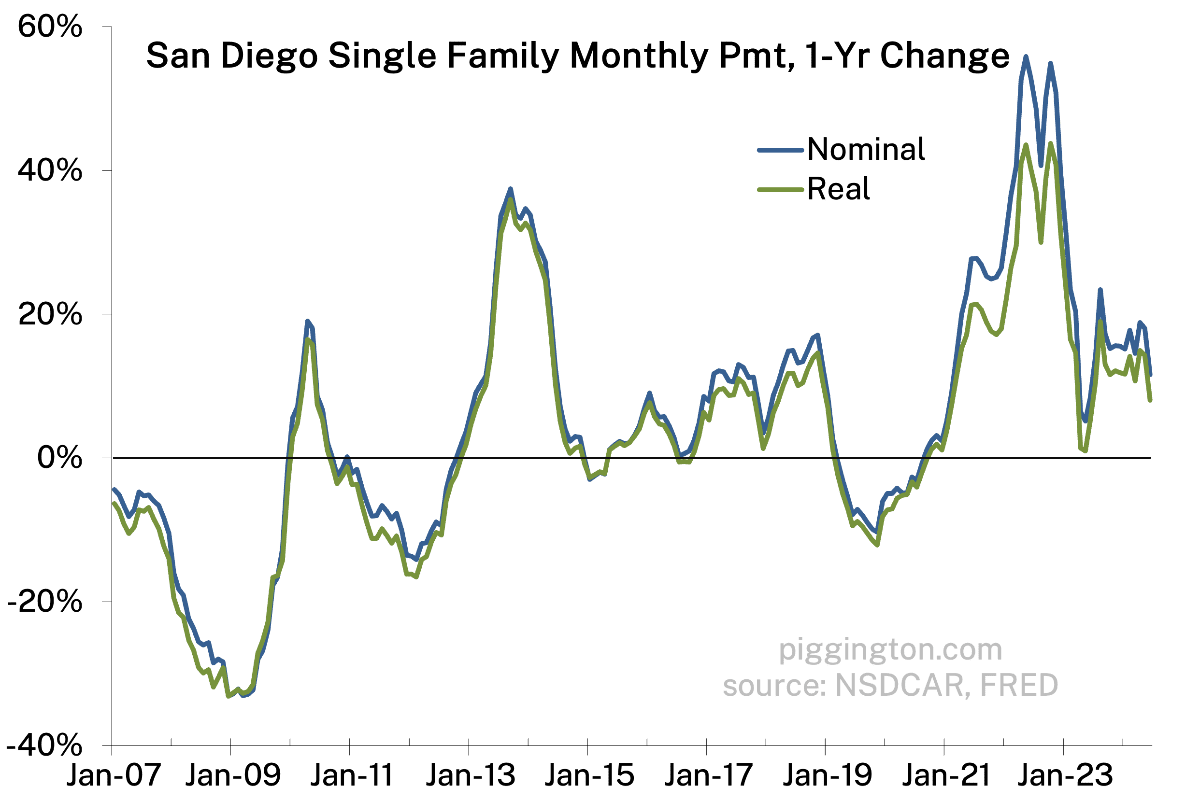

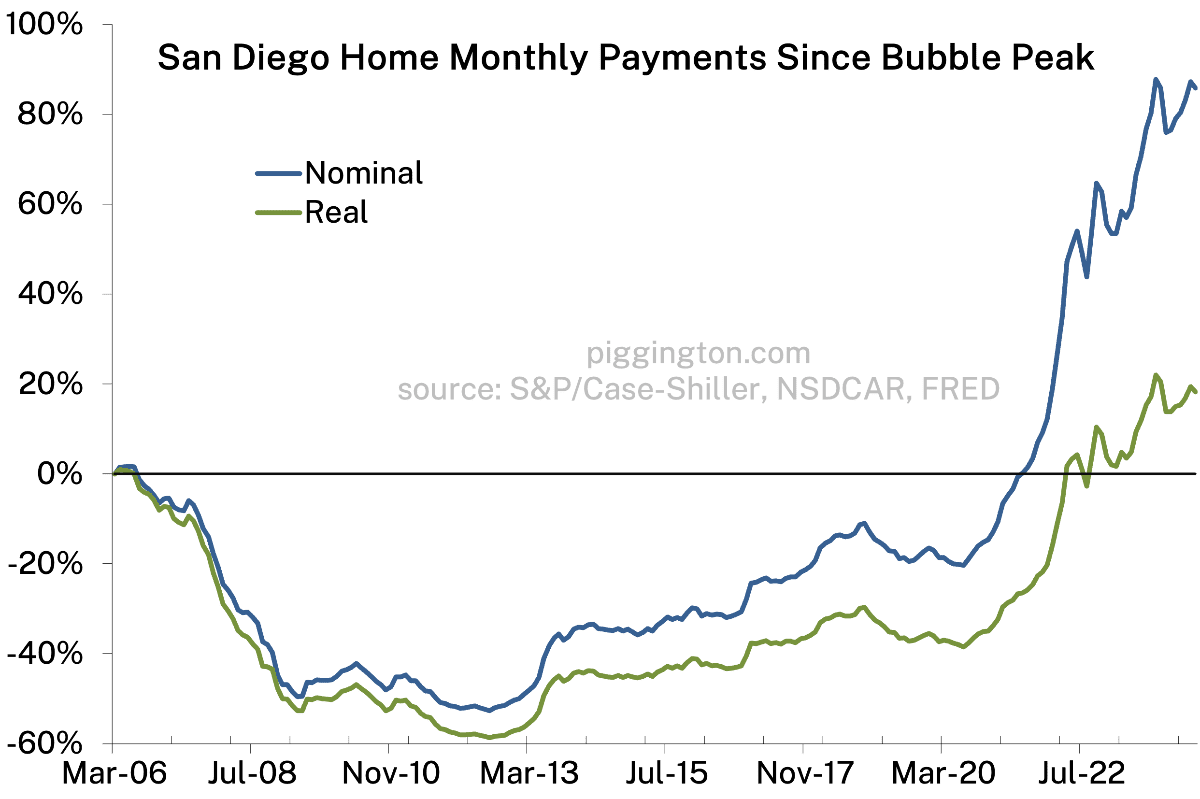

Generally, the current level has been associated with modest price increases. The exception was in 2022, when prices dropped pretty abruptly at inventory levels not much higher than this. It may be that the gruesome levels of unaffordability have changed the equilibrium somewhat, or it may just be that 2022 was a weird time. I guess we’ll get some more insight into that in the coming months.

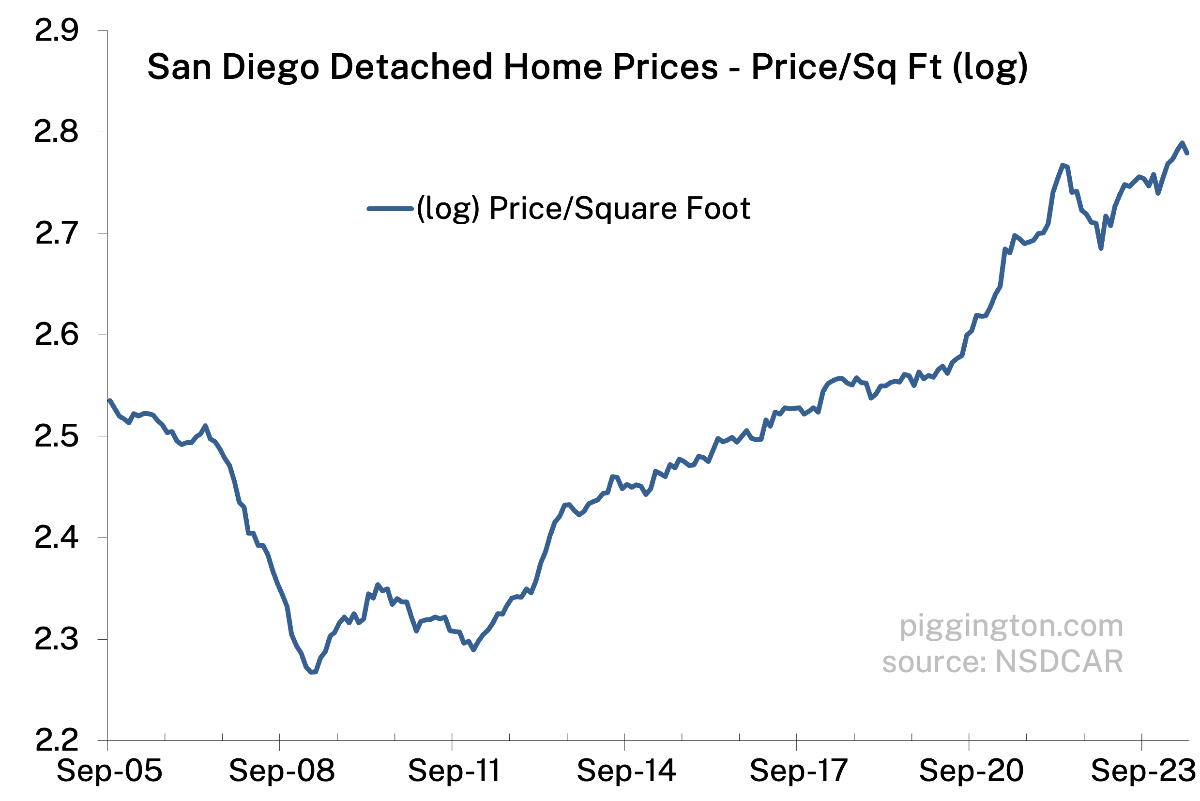

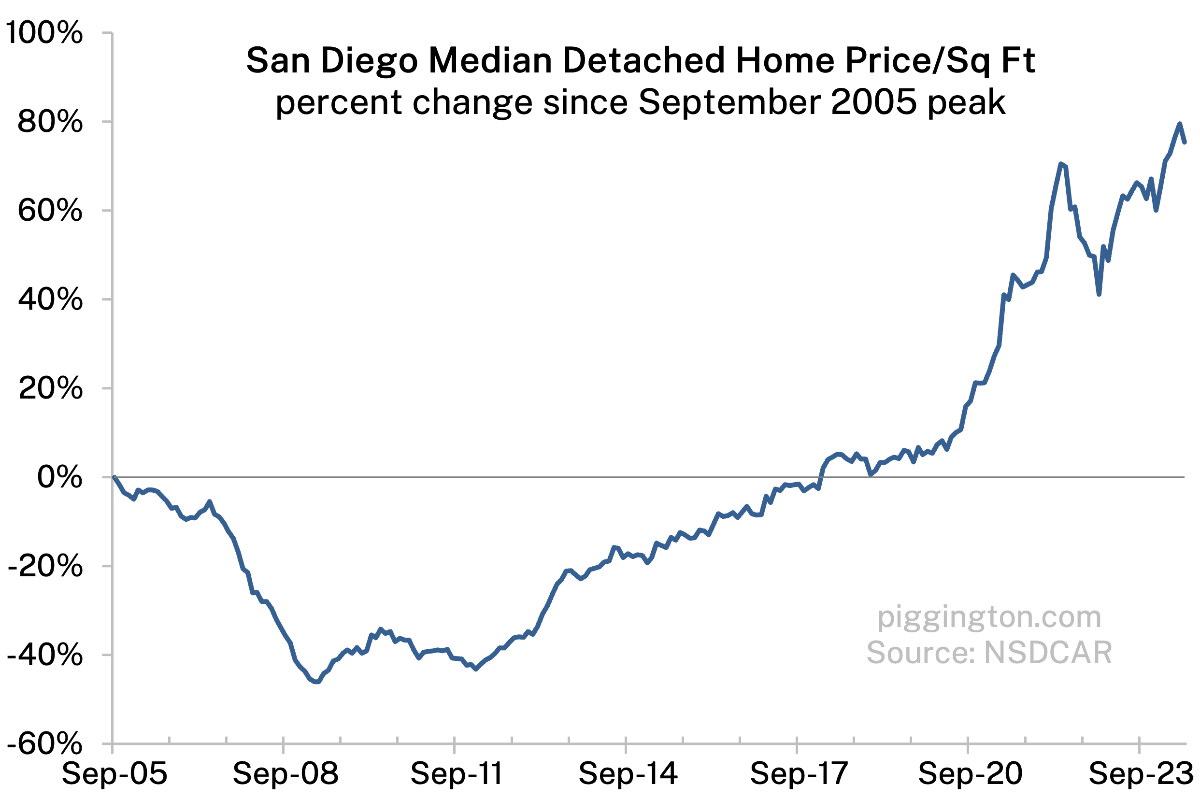

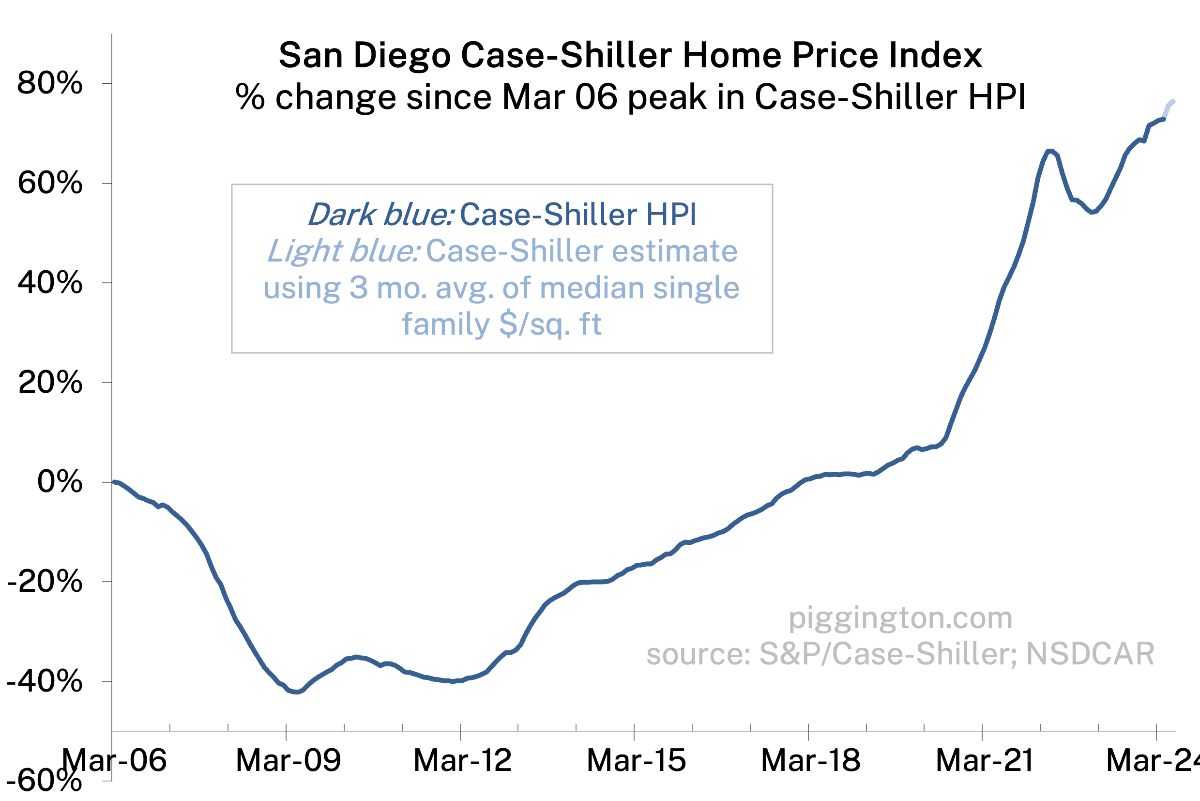

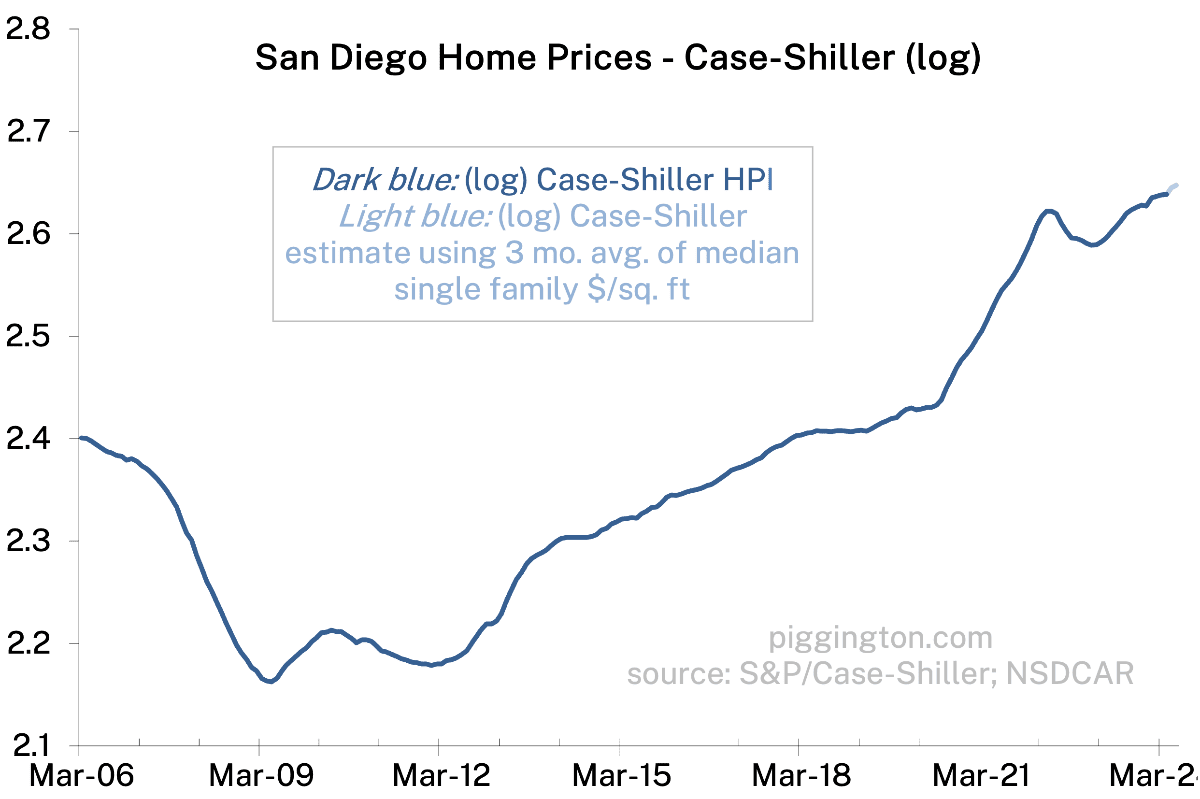

As for last month, there was a pullback in the median single family price/sqft.

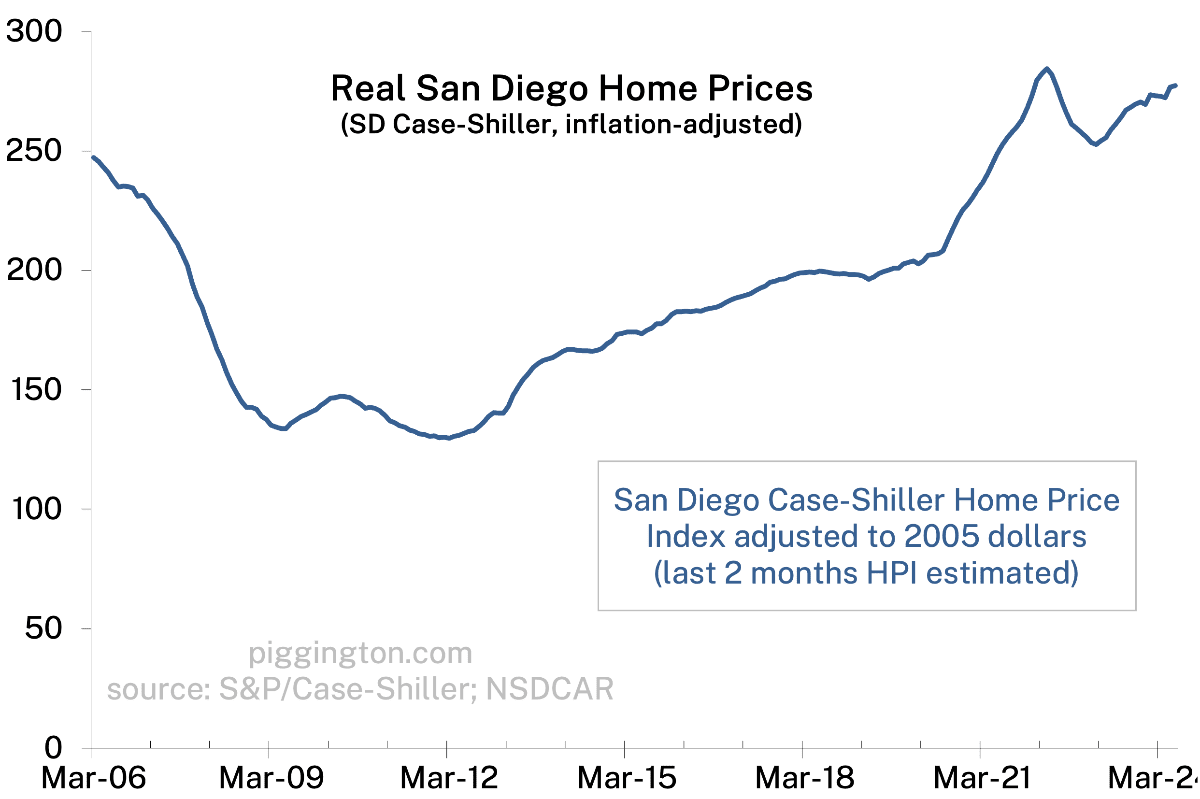

One month doesn’t mean much, of course, and the 3-month average price is still positive. But considering the laggy nature of these price metrics, and the pretty rapid rise in months of inventory, I’m interested to see what happens next. I think there’s a decent chance that the inflation-adjusted home price, at least, will start drifting down again.

More charts below…

Possible there is a longer term shift in moving patterns, with higher cost of housing (and associated transaction costs), moving is more difficult, WFH, or just a desire to be settled longer, interest rate lock in, etc.

As such if X% would normally move in any given year, that X% maybe meaningfully lower going forward. Maybe it’s just me getting older, but the idea of moving has no appeal to me whatsoever and can mentally extrapolate that many others have the same mindset.

Active inventory has nearly doubled since last year but prices have barely moved, something has got to give soon here…

It’ll be like 2010-12. No one selling unless they really need to move. Divorce, death, debt.

Biotech has been hit hard. Even tech has had drawback.

The thing is though, a 20% drop only gets us back to 2021 prices. I doubt prices will drop more than that.

Check out Altos Research for San Diego and you’ll see there’s a clear market split between detached SFR and condos. Detached is still about 30% below 2022 peak inventory whereas condo is about 20% higher than same 2022 peak.

If you’re looking for price reductions or deals then focus on condos as they can always build more cubes but there will never be affordable new detached SFR in San Diego proper. In fact, you’ll likely see permanent trending down supply of detached SFR as they get converted to townhomes, apartments, ADU clown houses, and the like.

You are not wrong but if you look at the 7 day average instead of the 90 day average, the peaks are much closer. Furthur more, it is pretty clear from their chart that the inventory increase in SFH and condos is accelerating, and has not peaked yet. Also condo prices and SFH arent fully independent of each other, if condos are way cheaper, more people will opt for those, and inventory of SFH will continue to increase unless the prices come down… If you look at the market action index 7 day average its nearing all time low on their chart, Im not sure how accurate that is for the most recent week tho…

Gist is that I don’t think your insinuation of no price decreases on SFH is correct.

My figures are from the 7-day inventory average. Respectfully, you’re entirely wrong about detached being “stuck” to condo prices. The only link is that it could slow the pace of price increases, but no one that seriously wants a detached house cares what the condo is going for, they’re entirely two different products. I can build an ADU, add floors, raze my house and build new, continue enjoying my 20yr grandfathered NEM 2 solar, add another EV charger, expand my garden and improve my landscaping, etc.

They can always build more cubes. They can’t build more detached in the best climate on the planet. The supply of what I have is in terminal decline. Cubes are ever increasing.

As San Diego becomes increasingly a bio, tech, and other high value sectors the detached house is becoming increasingly a luxury good. You’re seeing it in the price action right now if you’ve been watching the market.

Your extremely out of touch if you don’t think homebuyers (especially first time ones) aren’t willing to concede on the cons of condo vs sfh if they’re much cheaper. As a young millennial looking for a home and most of my friends as well, I assure you they aren’t SFH or bust despite them preffering a SFH…

Also you literally used “stuck” in quotes when what I said is they aren’t entirely independent.

First time home buyers are a sliver of the market. I’m an old millennial and my first place was a townhome. I couldn’t buy detached then, so I bought a condo. Did I want detached – yes. I eventually turned that into rental and bought detached in Sept 2022 at huge discount with still good rate (low 4s) and now I’ve round tripped the discount with comps plus NEM 2 solar increasing my value further.

The market is running away from you on detached home prices. First time home buyers mean nothing to the piles of money flowing into SD. People are fleeing SF and LA to OC and SD. There are numerous recent detached closings selling above list price and continue driving comps higher.

The bottom already happened in late 2022-spring 2023. That was the moment of max fear (when I bought). The market doesn’t care that you can’t afford detached, there are dozens more who can.

My personal belief: SD market is forever changed because of COVID and remote work. SD weather is amazing. Past two summers showed Austin, Vegas, and Phoenix being hot as hell. It’s not a total extreme leftist hellscape like SF or LA, yet. There’s innate rental demand from military (BAH go up) and colleges. Finally, it’s perfect to retire in place.

$70k over list

https://redf.in/zTZzno

$175k over list

https://redf.in/xhJAwi

$50k over list

https://redf.in/AcCkJ7

$100k over list

https://redf.in/XX2SFt

You are both a little right and a little wrong. The market is definitely softening among most if not all categories. A lot of that is seasonal but not all. I think there is a good 50/50 chance we revisit the Fall 2022 flash crash as all the pieces are in place for that to happen. Im seeing lots of single family homes sitting on the market at or below prices that would have flown off the shelf in Spring. If you waited until June to list your house for sale you made a mistake and quite possibly a very big one. Inventory has been building but I dont think it will build much more. The combination of more inventory than we’ve seen in a while, high prices, high rates, fear of political chaos in country and an industry settlement that is about to drop the selling of real estate on its ear with no solution in place. If you want to sell this year you may have to take 10% or more hit on Spring pricing. Thats if you can even sell at that. I think come Spring 2025 a lot of the factors I cited will resolve themselves and things will get back closer to where they were. But I wouldnt want to be sitting on a $1.5M+ East County property on the market carrying a mortgage for another 6 months hoping Spring bounces back

Sure, I wouldn’t want to June to list but I think that’s normal in any market (list in early spring). But I’d feel way better holding detached than condo given the inventory divergence.

With the Fed and both political parties itching to cut rates I think it’s a very dangerous time to not hold hard assets at fixed rates especially with SD bucking the price declines. Clairemont used to be working class, now it’s doctors/lawyer class.

The writing is on the wall and I’m fortunate my kid will get my other property versus renting. The government decrees about virtually unlimited ADUs make each detached SFR a valuable commodity much like they became in NorCal where prices rapidly outpaced price-to-rent ratios (ignore SF and Oakland that praised defund the police).

New apartments and densification will blunt rents, but won’t blunt the desire or price to own detached SFR for legacy and roots.

I totally agree with SDLiving. They can and will continue to build more condos at all price points, from luxury multi-million dollar ones to starter home homes. commercial areas like Sorrento Valley recently got rezoned for mixed use with developers having the ability to 7-10 stories residential buildings. However, the city is also limiting sprawl, which mean SFR is finite. On top of that, ADU will reduce that supply, one lot at a time. While there’s always a chance for a short term crash due to external forces. However, long term, I think we’re safe, due to limited supply.

SDLiving, help me calibrate here. What is your guess on:

I ask because I’ve heard this argument multiple times, and while it makes sense directionally, it also feels overstated in importance to me. So I’m curious what your impression is of the above two data points, that leads you to the views you’ve outlined here.

It’s not a metric I track, but you can use places like North Park, University Heights, Hillcrest, and UTC as examples. The city is going all-in on densification by changing community plans.

The only way to densify is raze and rebuild commercial or detached SFR lots.

North park and university heights prices for detached have skyrocketed due to developers bulldozing and building massive quadplexes, ADU clown houses, or large multifamily apartment buildings.

I see the loan requests hit my desk frequently.

Mira Mesa’s new community plan approved the increase of about 100% more units. I’m also seeing a lot of ADU being built. Every one of those Adu being built is one less Sfr in MM. So, using econ 101 logic of supply vs demand, you can guess what will happen to price when you reduce supply.

Thanks for the reply.

No problem. I’m actually worried that two of my adjacent neighbors with oversized lots could get scooped by investors and either bulldozed or sold as an ADU play changing the entire neighborhood and negatively impacting my property values. I’ve ironically turned into a NIMBY! I get routine calls from investors trying to buy my property and I keep increasing my price in hopes they stop calling or one day meet my make me move price and I move further toward the coast.

No question that single-family with the benefit that comes with it is preferable. And long term I remain very bullish on this area. But don’t kid yourself into thinking it can’t be a rocky road. There will be another significant downturn ahead. It could be sooner than later or not, but it’s coming at some point

And location trumps zoning. I’d rather invest in condos in encinitas than a sprawling estate in Jamul

100% agree that we will see a pullback. When and how much is TBD, but over the last 100 years, there were plenty of pull backs and the next 100 years won’t be any different. I also 100% agree that location trump zoning. I would rather get a run down tiny house on a SFR lot in Encinitas than a newer luxurious condo in Encinitas.