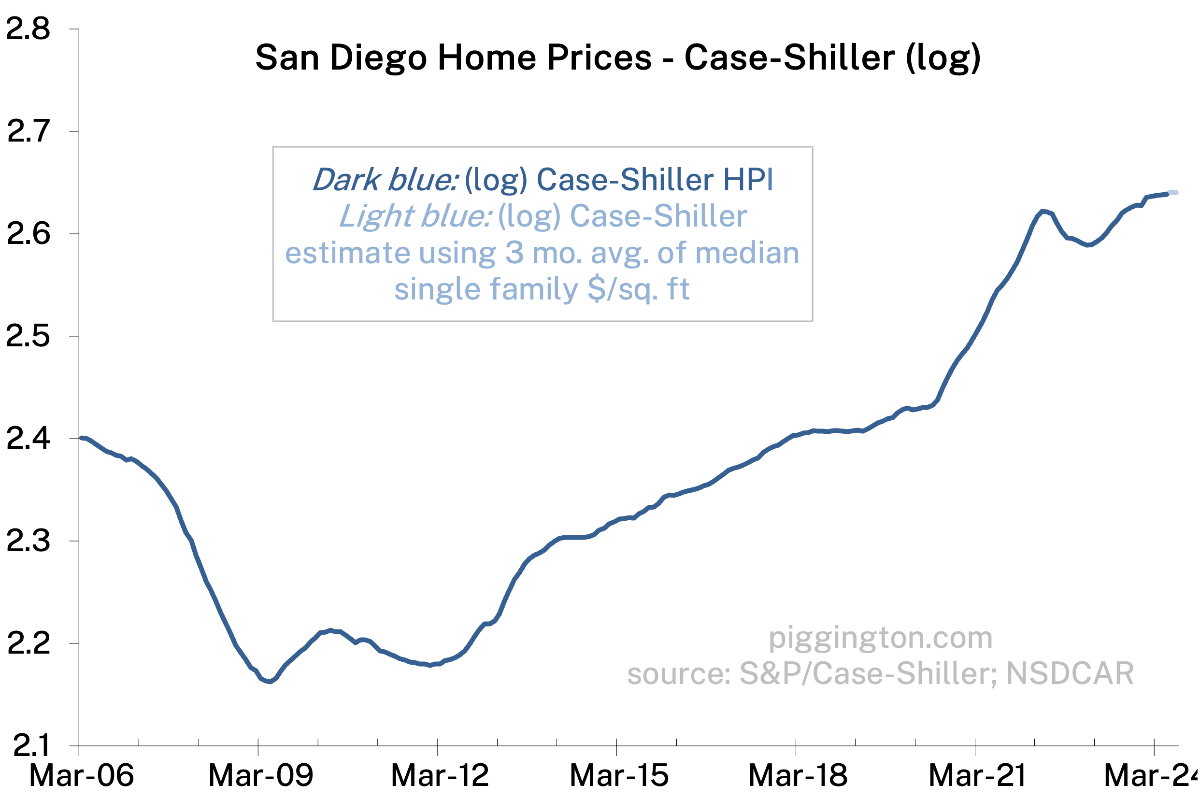

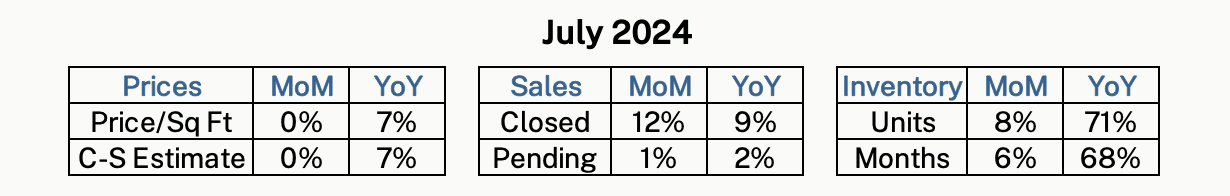

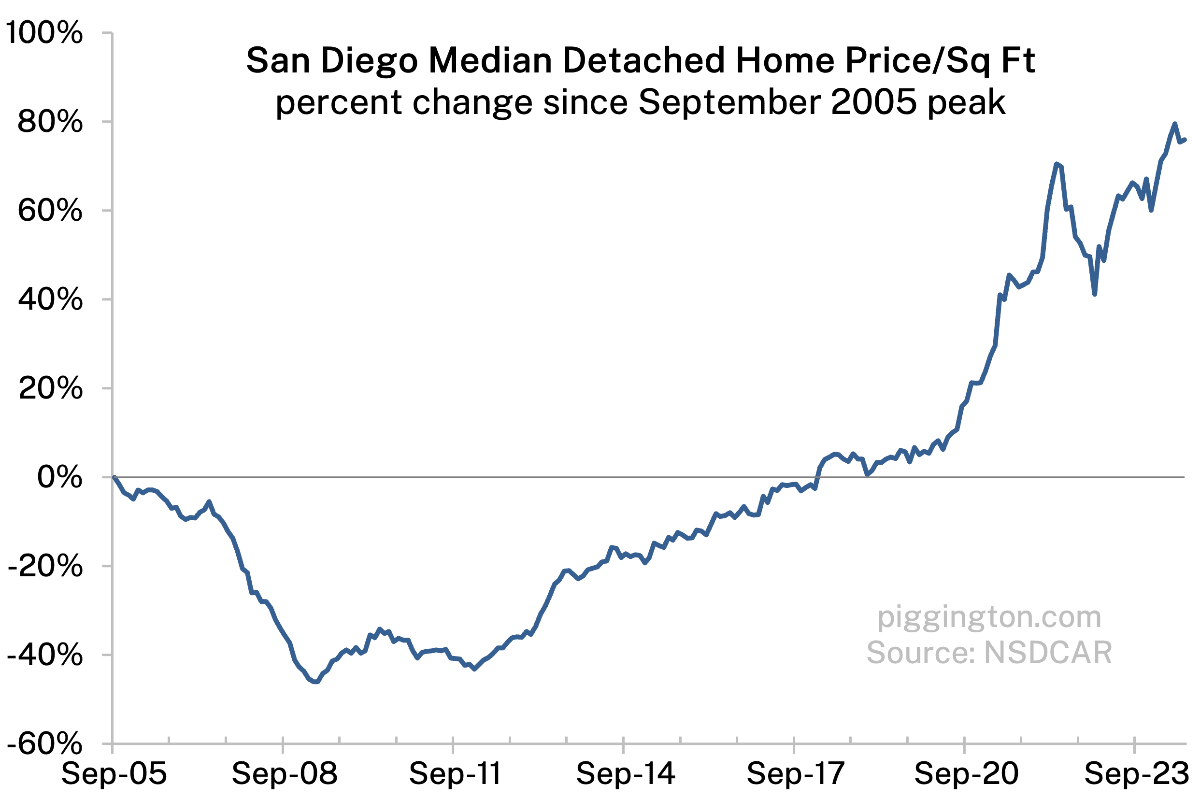

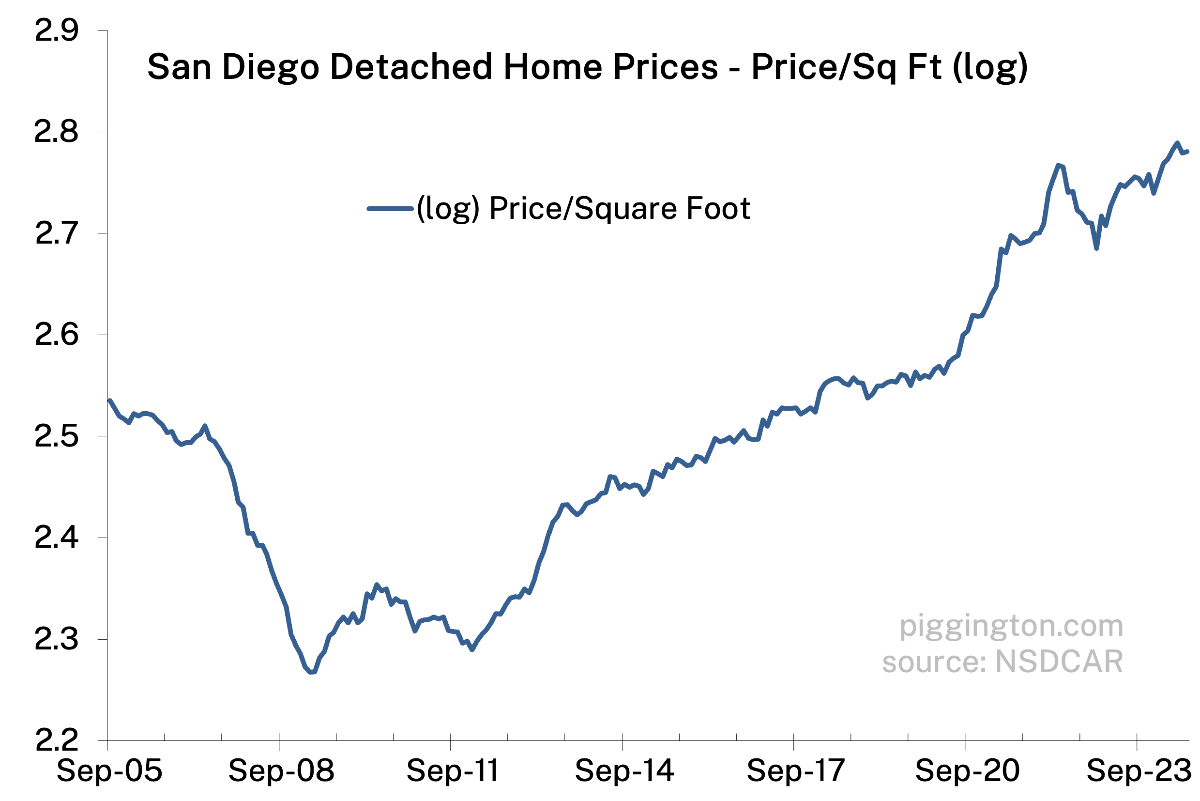

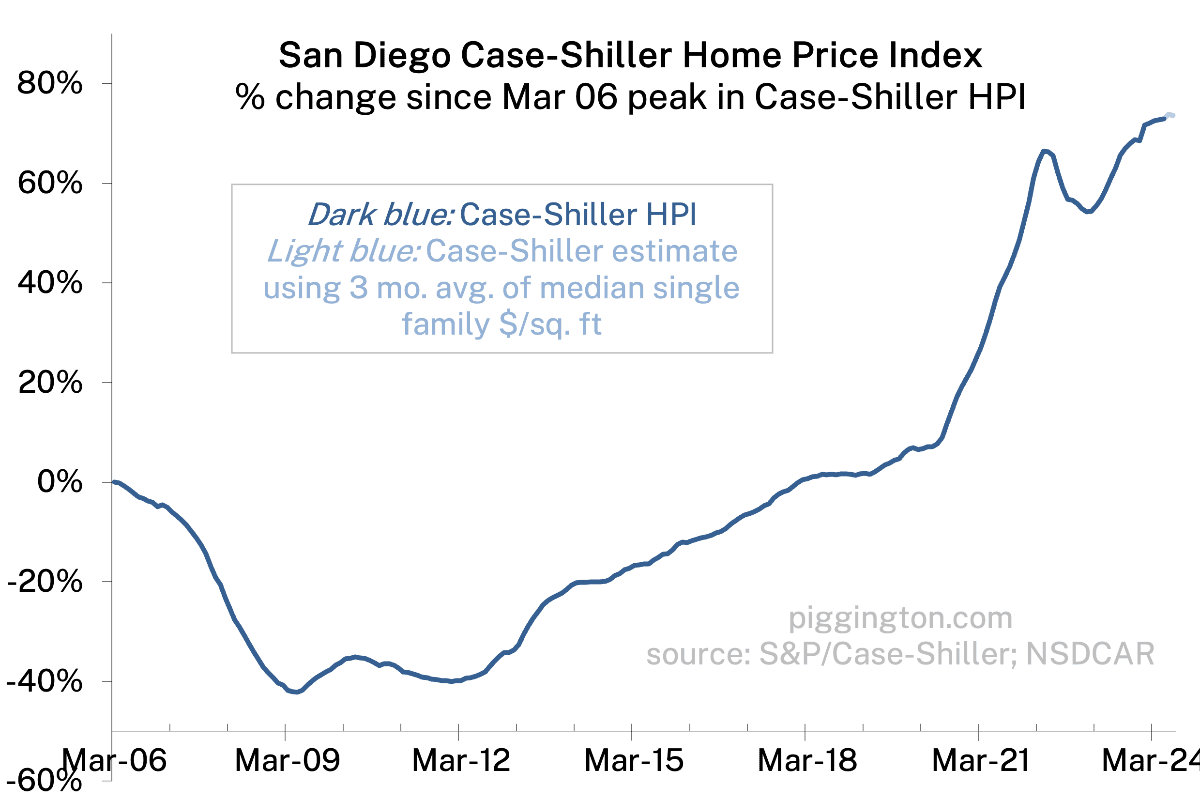

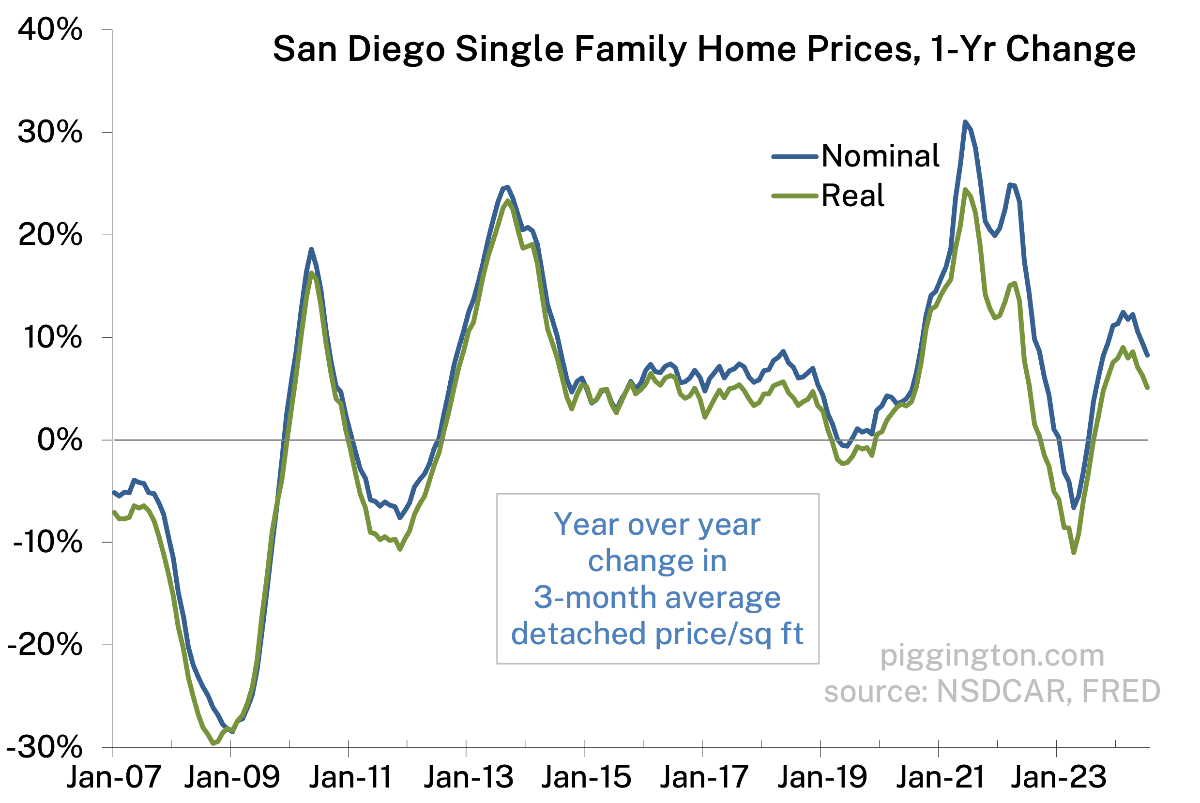

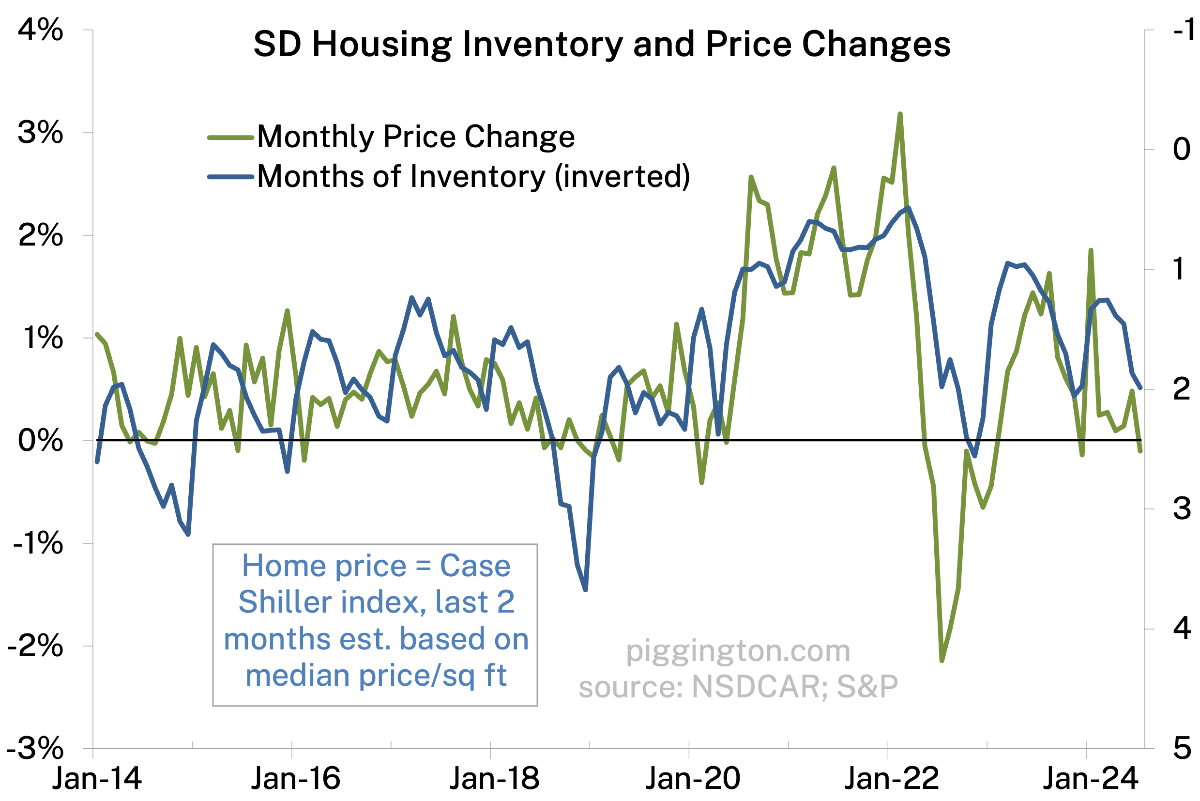

Home prices were basically flat last month:

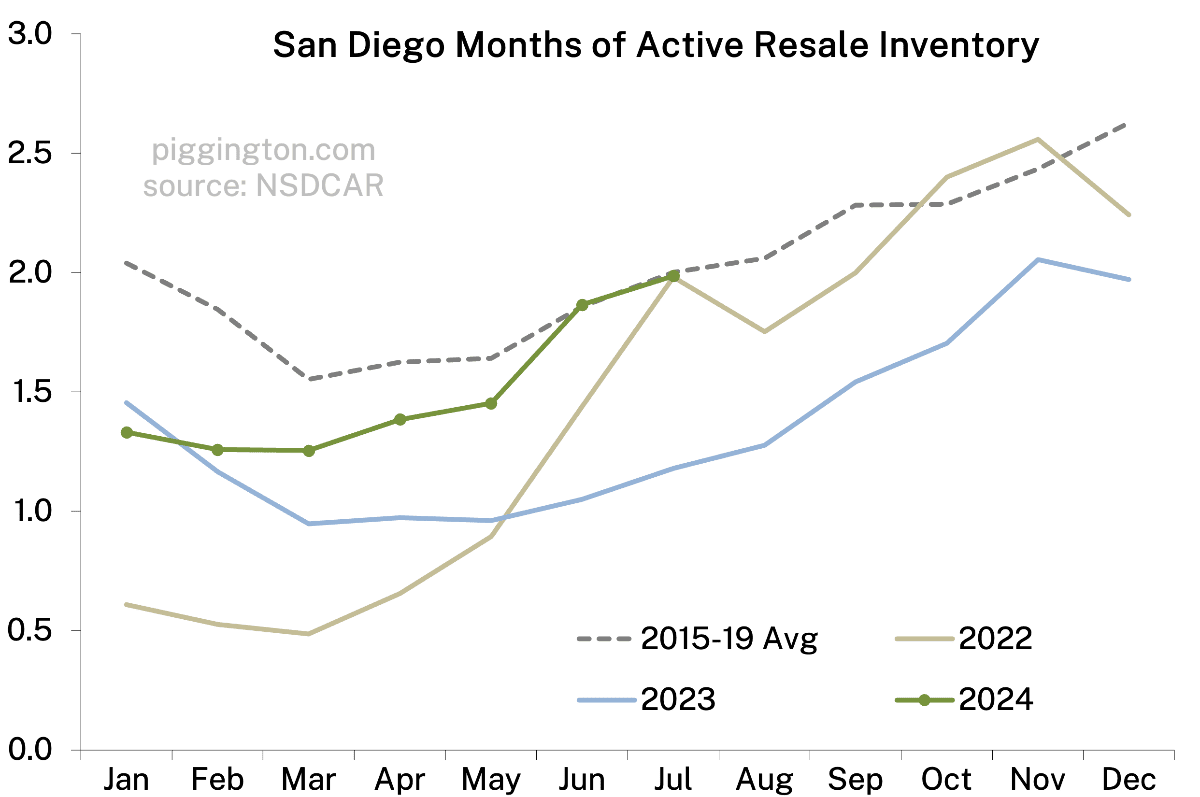

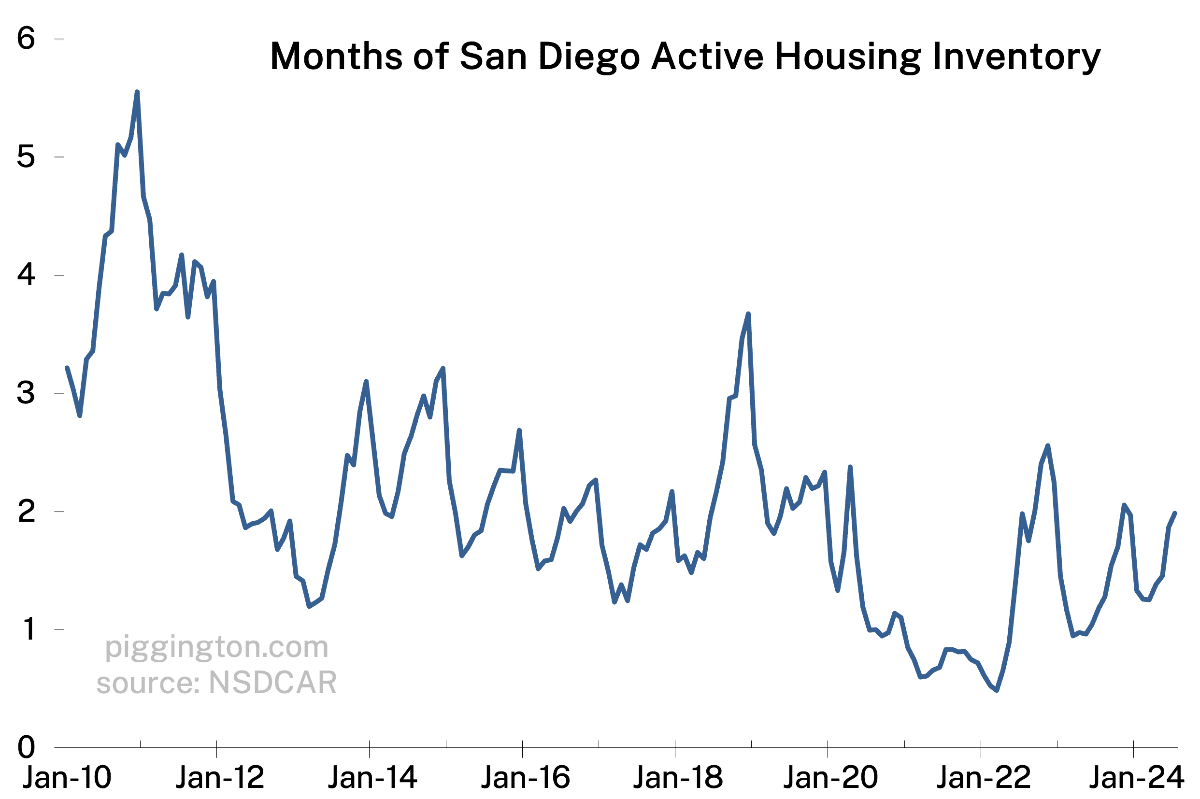

And months of inventory was again spookily in line with the pre-Covid average level:

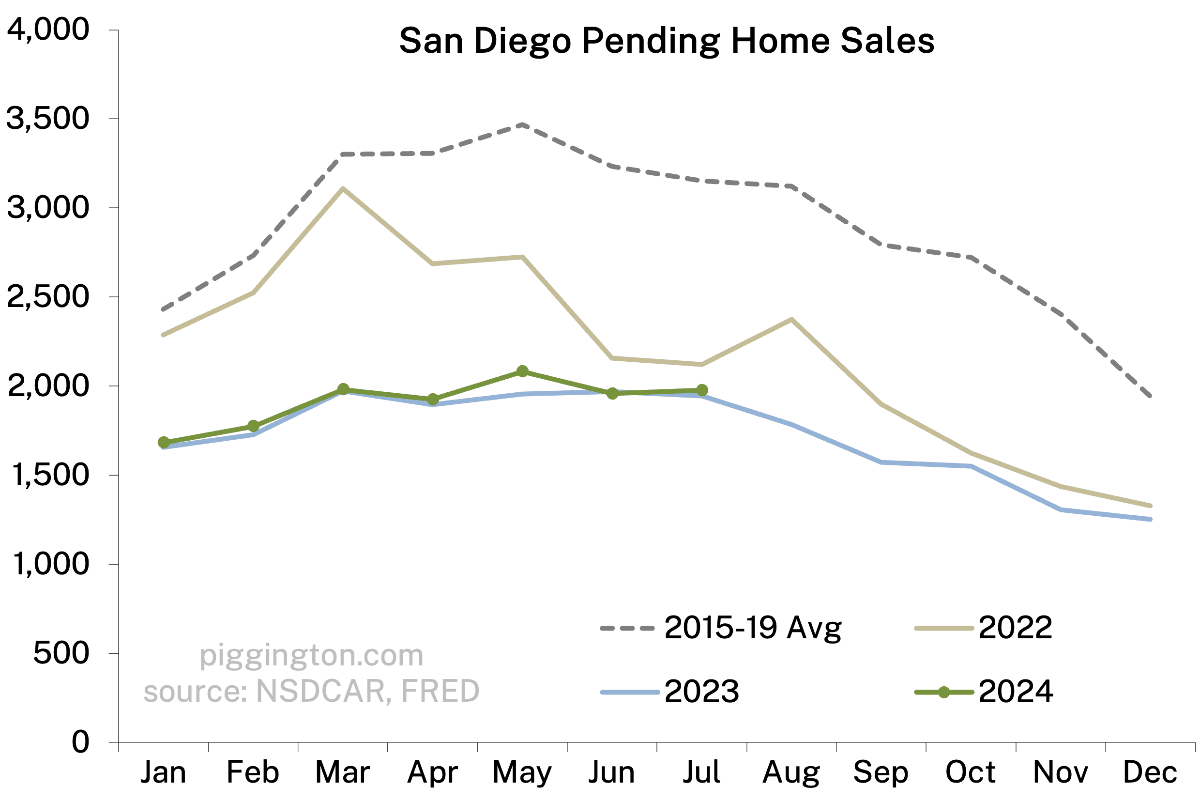

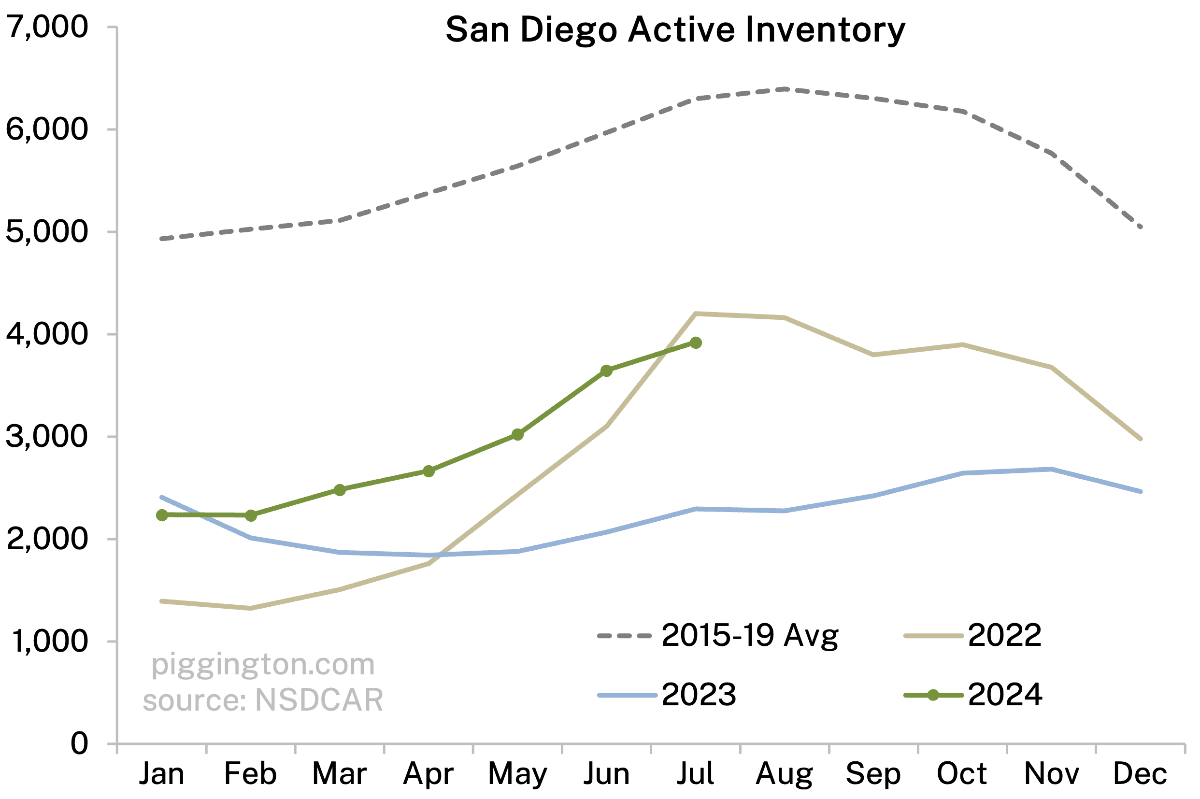

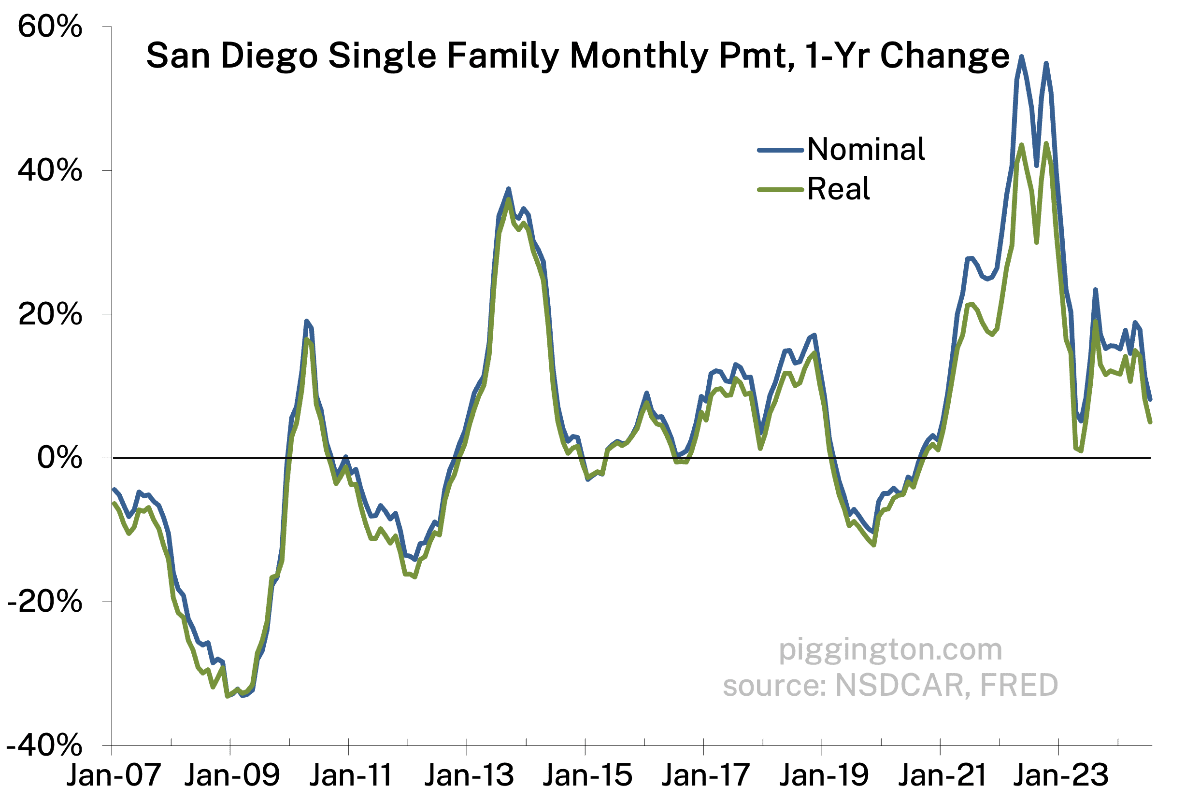

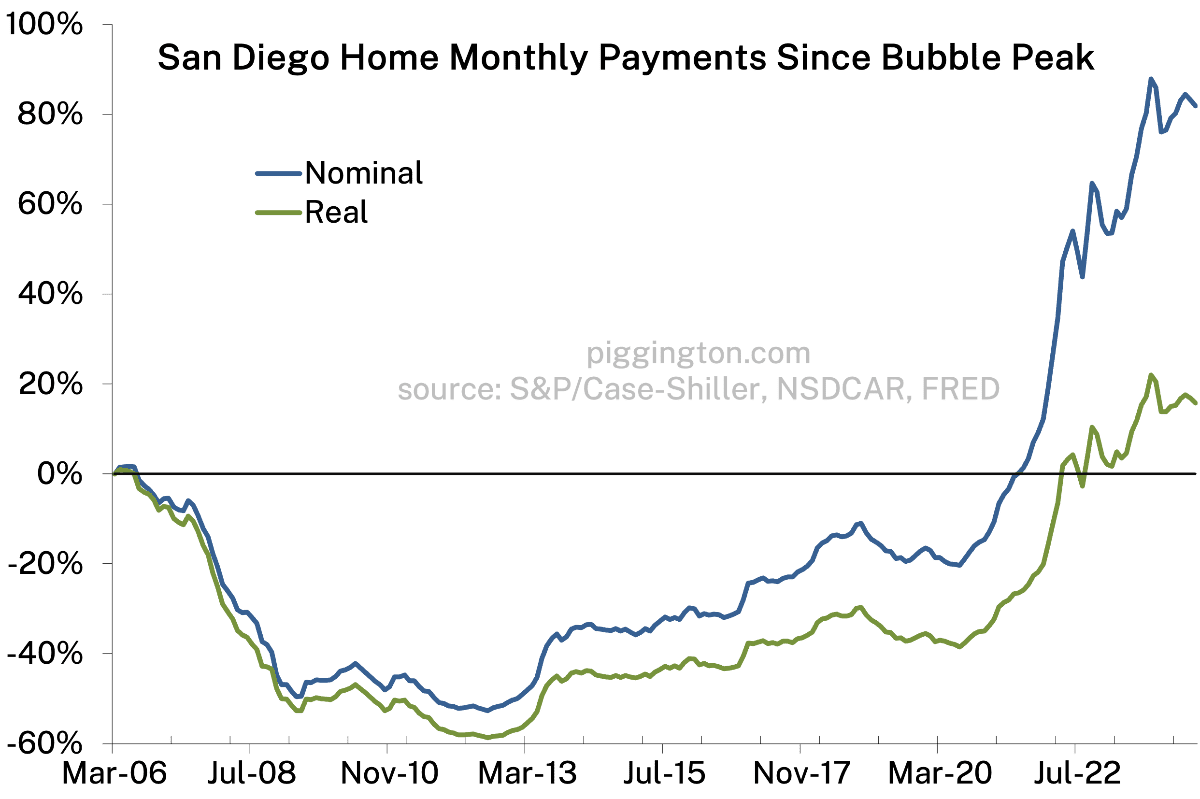

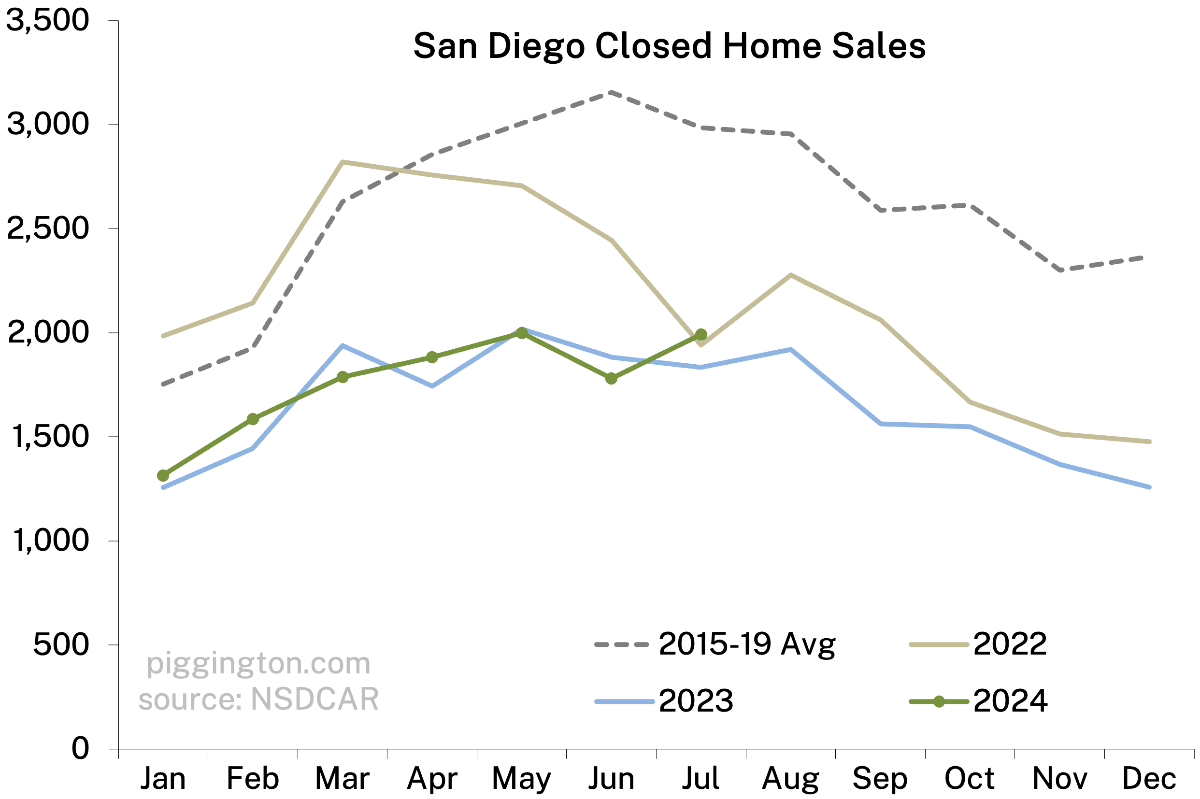

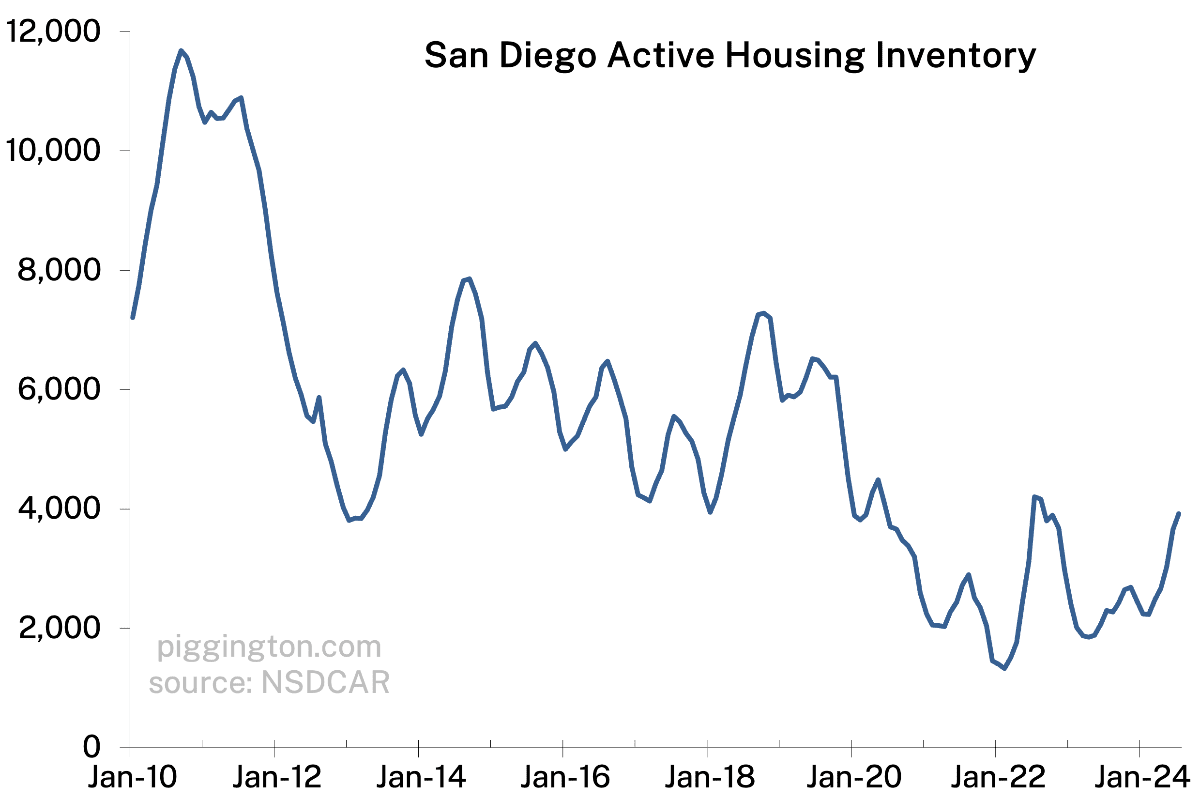

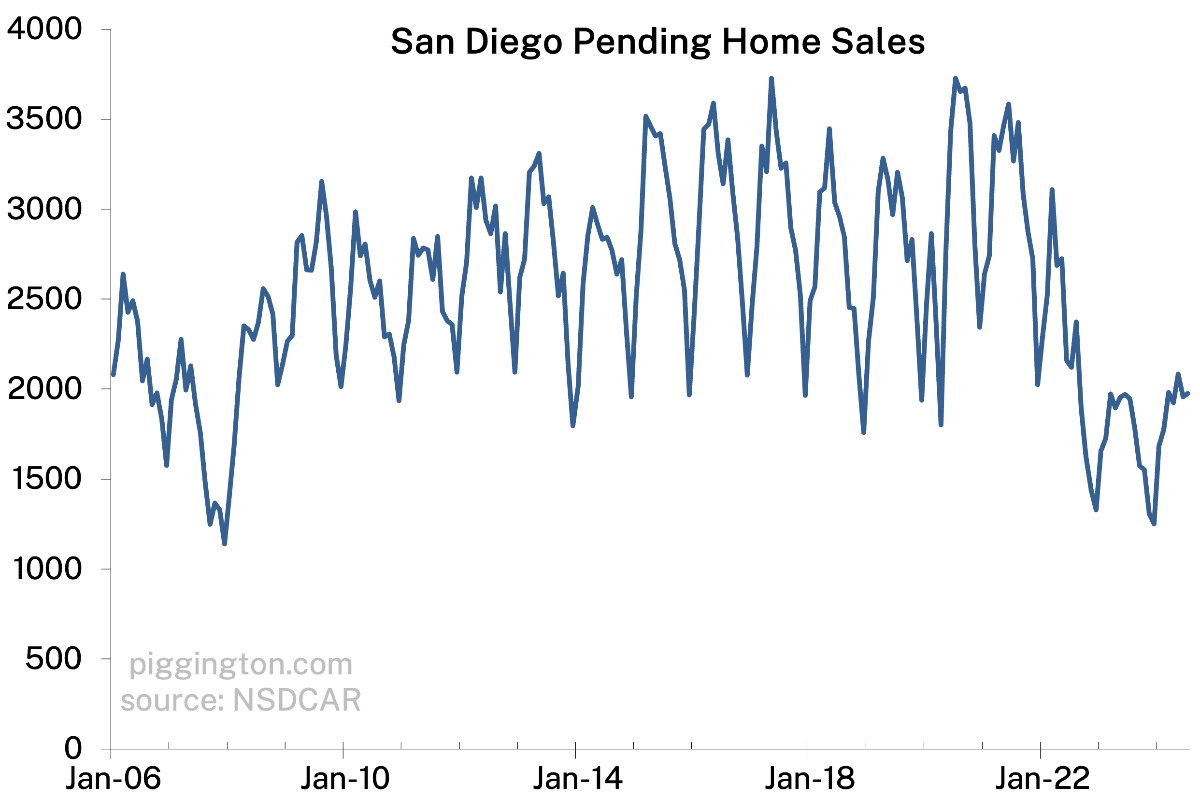

While the ratio looks pretty normal, both sides of it are very much below normal as the market remains somewhat frozen. A new development, not accounted for here, is the very recent drop in mortgage rates. That could change the equilbrium (but it cuts both ways, as I’m fond of pointing out).

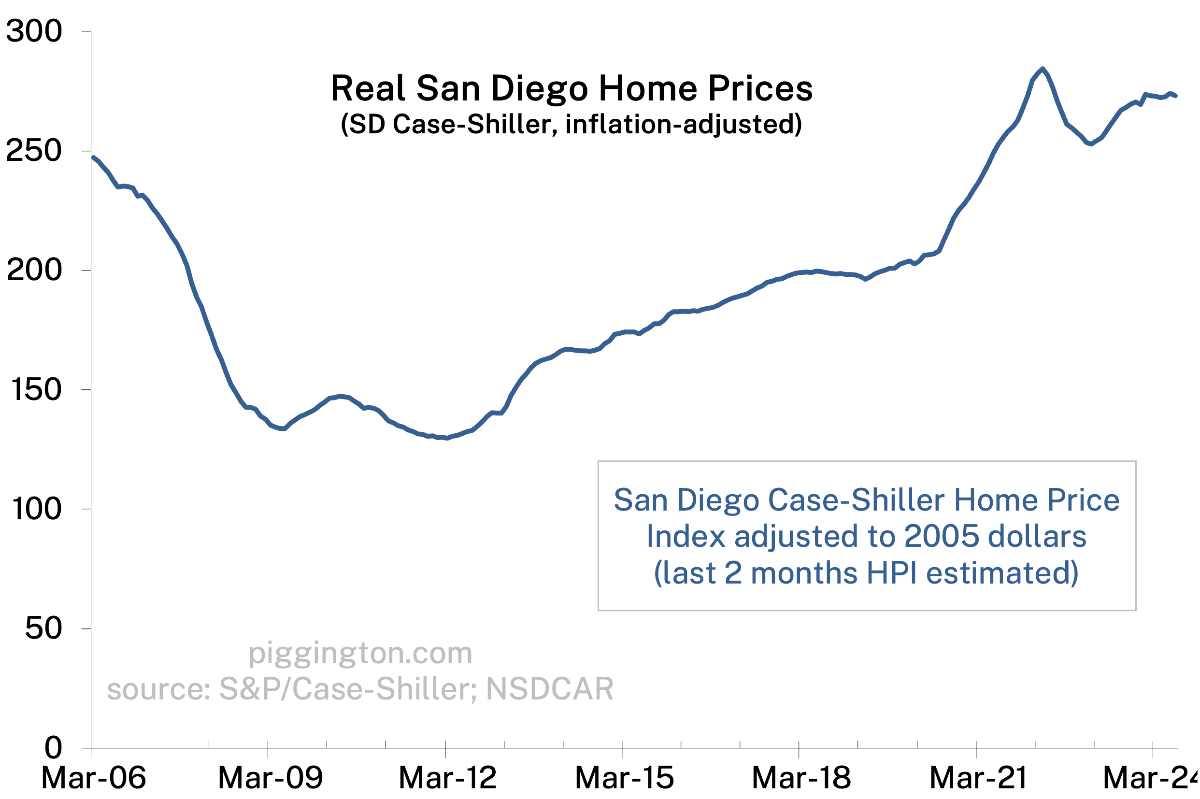

More charts below and soon I will post a valuation update.

I’m looking to buy SFH and visiting open houses. Anecdotally, I visited quote a few places that dropped out of escrow. Carmel valley, la Jolla, del Mar. Very few people at open houses here.

Most seemed to be cold feet, at least that was story from hosting realtor. But two were inability to get house insurance other than FAIR plan. Not even a quote from an insurer, just flat no.

However, two places university city seemed busy and went pending immediately. So some places going fast still. But these places were sub 2 million.

I have had a similar experience in Encinitas (Village Park and surrounding areas). The houses that are recently remodeled and “turn-key” have been competitive, getting multiple offers, most going over listing.

The others that are more original or have other quirks are getting price reductions or even being pulled off market.

I’ll be interested to see where we go from here and the impact of the anticipated fed rate cuts.

As a millennial starting a family and looking to buy a bigger house, I have been hearing about a “market crash” for years, when the exact opposite keeps happening.

Most everyone I know in my age group is now sitting on the sidelines saving more money, anticipating either rate drops or housing price reductions in the future.

To be fair, a market crash did happen in late summer 2022 into winter 2023. Houses were going 15-25% lower than peak pricing. I think millennials especially are conditioned to 2008-2012 global financial crisis copy cat scenarios (I’m a millennial).

If the Fed holds rates “high” into 2025-2026 then all bets are off when ARMs adjust at the high-end. I think it compresses the spread between low and high-end properties (absolute movements unknown for each price band since everyone needs a roof – low could go flat while upper goes down).

Affordability could come in the sense of smaller affordable condos as community plans get revised. Interesting times.

My daily market tracker of Redfin searches showing very high ratio of active homes relative to total supply (including contingent/pending). So, I expect overall median to drop through the fall/winter.

That being said, there’s more condos than detached relative to prior periods.

Nice properties move quickly to pending while quirky properties that need a renovation or undoing ADA upgrades etc. sit for a while.

Given the inventory and price action in weaker markets I say detached in SD is still a safe bet especially if you think the Fed will move into a cutting phase.

A few I’m watching

https://redf.in/UfR1nB

https://redf.in/qMMxv9

https://redf.in/3j8kBO