Home › Forums › Closed Forums › Buying and Selling RE › sell now or wait for Spring (Jan/Feb) next year

- This topic has 14 replies, 10 voices, and was last updated 10 years, 5 months ago by

nct.

-

AuthorPosts

-

September 9, 2015 at 5:23 PM #21676September 9, 2015 at 9:12 PM #789229

moneymaker

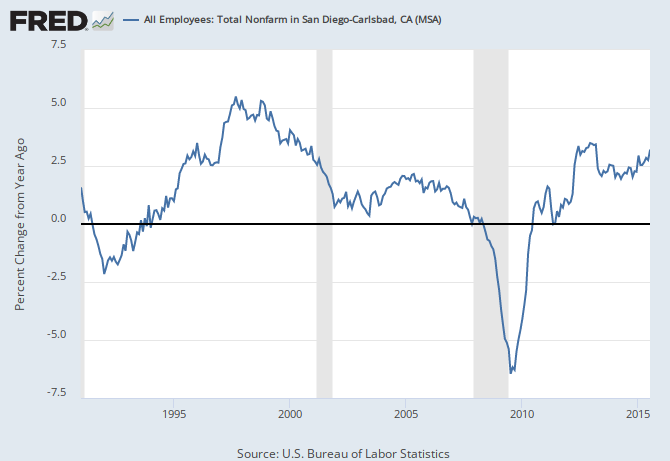

ParticipantYou could always try to sell, but my gut feeling is you are right about softening. Don’t have data to support it but driving around looks like there are lots of places for sale and builders are building again seems to me. When lots of people get layed off the results can last quite some time, remember General Dynamics in the 90’s?

September 9, 2015 at 10:56 PM #789232nct

ParticipantI wasn’t here at that time. Did GD cause the San Diego’s housing market crash in earlier 90s?

September 10, 2015 at 6:28 AM #789234CA renter

ParticipantIn normal circumstances, I’d say wait until late January/February. But if the markets continue to be volatile (it affects psychology, as well as the actual wealth of potential home buyers), it might be better to get out while housing prices are still peak-ish.

September 10, 2015 at 9:25 AM #789236 Rich ToscanoKeymaster

Rich ToscanoKeymaster[quote=nct]I wasn’t here at that time. Did GD cause the San Diego’s housing market crash in earlier 90s?[/quote]

No, it did not… there was a regional recession of which GD was just one part. That’s not happening at this time and while it could happen in the future, Qualcomm layoffs alone won’t be the cause.

Short term timing is always an uncertain thing. Very uncertain in my view. Fwiw right now the market is pretty undersupplied, making this a good time to sell, all things equal. Of course, that’s not to say it won’t be better next spring… it could, but it could also get worse. I don’t see it as being very predictable.

Maybe some helpful stuff in these articles:

September 10, 2015 at 10:05 AM #789238nct

ParticipantThank you Rich for taking time to reply.

It is very informative to see San Diego regional recession and it causing housing market to drop.

I have question: won’t a under-supply market typically lead to higher price until supply balances out demand?

I will read your analysis.

Thank you again!

September 10, 2015 at 10:33 AM #789240 Rich ToscanoKeymaster

Rich ToscanoKeymasterWell I would add one nuance: the recession may have been the immediate cause, but it’s important to bear in mind that housing was very expensive at the start of that time. So the recession kicked off the decline in this case, but it’s very possible that a decline would have happened anyway (though maybe it would have been shallower or slower… no way of knowing really).

That said, housing is as expensive now as it was then (albeit against a currently much more favorable rate climate for now)… so I don’t know how much comfort that should give you.

Re this:

“won’t a under-supply market typically lead to higher price until supply balances out demand?”

Yes, it will tend to, but all we know is that it is currently undersupplied. That could change in the months ahead. So the market is currently at a level that is pressuring prices upward, but it won’t necessarily be that way X months hence. As one example, if we were to have a 2013 style spike in rates, that’s something that could immediately put a damper on demand. (Not predicting that per se, just giving an example). That’s why I say the timing thing is pretty unreliable.

The way I look at it is:

– months of inventory predicts price changes in the immediate future (couple months out, maybe)

– valuations predict long-term potential price appreciation (or lack thereof)…and everything in between is a guess.

There’s probably more nuance to it than that, but I think it’s a pretty good summary.

September 10, 2015 at 3:30 PM #789256nct

ParticipantVery grateful for your analysis, Rich! Very helpful.

September 10, 2015 at 3:54 PM #789258fun4vnay2

ParticipantIn this era of information overload, boom n bust cycles are sped up and magnified as well.

QCOM lay offs won’t impact the engineers who would be laid off which can be in thousands .

Won’t impact==> They won’t have to resort to fire sale. They can easily rent out with +tive cash flow if they need to move out which may be the case most probably.The real damage would be done by the damage to the psyche which is magnified/sped up during the current time…

September 10, 2015 at 7:10 PM #789264Reality

Participant[quote=rockingtime]

Won’t impact==> They won’t have to resort to fire sale. They can easily rent out with +tive cash flow if they need to move out which may be the case most probably.The real damage would be done by the damage to the psyche which is magnified/sped up during the current time…[/quote]

How do you know they can rent out cash flow positive? That would depend on what the mortgage is.

Damage to the psyche? Please.

September 11, 2015 at 12:00 AM #789272Jazzman

ParticipantI’d probably put my house on the market now, but I don’t think a lot can happen in a few months. RE moves pretty slowly. I doubt we’re going to see a huge supply increase between now and Jan/Feb, and if we do it may take time to filter through to prices changes. Likewise with the Fed rate rise. This time next year may be a different story, however.

September 11, 2015 at 1:12 PM #789301Clifford

Participant[quote=nct]We plan to move out of current house @4s ranch. It is pretty new (~5-year old) in good condition.

Renting it out a big house (>3300 sf) for long term does not seem to make most financial sense (opportunity cost of equity, tenant risk, etc). Correct me if I am wrong please!

[/quote]Three things to consider:

1. Your house is relatively new, so you are right about tenant risks (newer houses get damaged more easily).

2. The buyers of larger houses tend to be folks with school age children. And the peak time to sell to these folks is Spring time.

3. On the other hand, I would be very surprised if there won’t be more bad news coming from China in the coming months. And we have seen the effects of that on the stock markets.

IMHO, #3 is a bigger risk than #2. I would try to unload before the holidays.

September 12, 2015 at 5:57 PM #789339joec

ParticipantThere are very few home rentals currently in 4S I think (about 4k/month rents):

https://sandiego.craigslist.org/search/apa?bedrooms=4&bathrooms=2&minSqft=2800&housing_type=6&query=4s+ranchThat said, if you bought 5 years ago, that was pretty close to the low and assuming lending standards then, you will probably cash flow positively since you had to come in with down payment if you had to rent it. I know I would. I also know of a few renters around here and they have lived there for year+ and paying close to 4k, that’s more than my mortgage personally so I don’t know about the whole tenant issue. Pretty much any renter is a family so that’s better already and less people to deal with as in multiple condos/townhomes.

These months are always slower and no one knows what will happen so I think whether to force/sell or rent simply depends on your situation…

All that is tons more important than anyone else’s “Guess” as to what will/can happen.

I don’t think you said why you are moving/selling so depending on those reasons is more important that asking if anyone can predict the future IMO.

I don’t think many people expect housing to be like this now even (so high), but if you look at rents, it’s far worst for a lot of people…who have had to face yearly increases.

Are you moving for work?

September 15, 2015 at 10:39 PM #789376La Jolla Renter

ParticipantYou could put it on the market now and see what happens. Take a serious look at the competition, you have to have a better product and price it right to get something to move in the fall season. I don’t see a big pop in price this spring, just my hunch. Too much financial market uncertainty that I don’t see shaking out anytime soon. So I vote to try to sell now.

September 16, 2015 at 1:50 AM #789378nct

ParticipantIt seems majority pigs are voting for selling now.

[quote=La Jolla Renter]You could put it on the market now and see what happens. Take a serious look at the competition, you have to have a better product and price it right to get something to move in the fall season. I don’t see a big pop in price this spring, just my hunch. Too much financial market uncertainty that I don’t see shaking out anytime soon. So I vote to try to sell now.[/quote]

-

AuthorPosts

- The forum ‘Buying and Selling RE’ is closed to new topics and replies.