Home › Forums › Financial Markets/Economics › Investing in municipal bond funds

- This topic has 43 replies, 10 voices, and was last updated 9 years, 4 months ago by

phaster.

-

AuthorPosts

-

July 15, 2016 at 12:37 PM #799657July 17, 2016 at 8:44 PM #799669

phaster

Participant[quote=flu]

Not my problem because I will be out of the markets at least enough so that any additional loss on that latter half of a crash (IF it happens) stillwont offset all my gain that I’ve already cashed in up to this point.And as I mentioned before, there’s a natural pecking order on the economic ladder. So if something does happen, I won’t be at the bottom of that ladder, so relatively speaking, I’ll still be ok. lol… It’s like a class with the average grade being 50% but you get a 65%, so with a class curve, you still are doing pretty well.

I don’t try predict what and when things will happen. I figure it would be analysis to to paralysis and eventually cost me a fortune since I would discourage myself from doing anything. Kinda of like not buying a house after home prices were already down significantly. Doomsayers always end up losing.

It’s like a someone that believes in the bible that is so convinced that that rapture is going to happen in his/her lifetime, that he/she ends up suspending life to the point of not living it, only to find in the very end it didn’t happen in his/her lifetime. If rapture does happen, hopefully you are in good character so that there’s nothing to prepare for.[/quote]

market timing in theory is a brilliant concept, in practice it just doesn’t work for 99.99% of investors

agree about “relative” economic standing

my analogy is a variation about the joke about two hikers being chased by a bear in the woods,… to survive ya need to out run the other guy AND watch where you are going because you don’t want to recklessly run off a cliff or into a tree, in the process of escaping the oncoming bear market’s wrath

a timing system is difficult execute because it requires correctly recognizing indicators of an impending economic phuck up AND correctly executing an “exit strategy” into an investment vehicle that retains relative value

[quote=minyanville.com]

Market Timing Doesn’t WorkNumerous surveys and studies have shown that the percent of successful long-term market timers is right around 0%. Granted, there may be a handful of truly gifted individuals or organizations that can repeatedly and consistently pick highs and lows with astounding accuracy with all of their funds. But they are so few and far between as to render the strategy as unworkable for just about everyone else.

There is also another aspect of market timing that should be considered: What if you miss some of the big up days? What is the effect on your performance?

back to the matter @ hand, consider that the OP asked for opinions about investing in muni bonds as an alternative to ~1%CDs

perhaps the individual asking the question, has a majority of savings in an investment that grows @~1% annualized (which as time goes forward this does not seem to build up a nest egg sufficient for retirement) and the reason for sticking w/ ~1%CDs is because of “analysis paralysis” as you stated

NOW ponder scaling the problem,… where the managers of various portfolios of insurance and pension funds are similarly affected by “analysis paralysis” AND the masses are banking on these “professions” to generate returns necessary for a comfortable retirement,… bottom line, its difficult/impossible in a global environment of very low or negative interest rates!!!!

looking @ the bigger picture (and factoring in boundary conditions, etc.) essentially it seems there is too little productive work for everyone to do (given factors like advances in technology which increases productivity) AND in order for “retirement” to work for the masses there needs to be an economy to create/support ever growing fiat currency values assigned to “investment vehicles” (i.e. bonds, equities, mutual funds, FOREX, Gold, RE, etc.)

rock, meets hard place (majority of people caught in between)

just sayin seems a majority of people are “redundant” (as they say in the UK), therefore its a problem of biblical proportions given people’s hopes and expectations

July 17, 2016 at 8:55 PM #799670phaster

Participant[quote=FlyerInHi]

About the Bible, I used to dismiss religious people, but I have come to realize that a HUGE portion of the population thinks in terms of the bible.

[/quote]By ignoring the collective data and not being able to form a picture of what most likely will happen, the economy is going to gonna git “Medieval” on the majority caught off guard SO perhaps a fire and brimstone verse describing “God’s” wrath about corrupt politicians and idiotic investors (who created the problem) is appropriate

[quote=Ezekiel 25:17]

Well there’s this passage I’ve got memorized – sort of fits this occasion. Ezekiel 25:17.

The path of the righteous man is beset on all sides by the iniquities of the selfish and the tyranny of evil men. Blessed is he, who in the name of charity and good will, shepherds the weak through the valley of darkness, for he is truly his brother’s keeper and the finder of lost children. And I will strike down upon thee with great vengeance and furious anger those who would attempt to poison and destroy my brothers. And you will know my name is the Lord when I lay my vengeance upon thee.

https://www.youtube.com/watch?v=aNH8zLaZHAk

[/quote]

too many politicians/investors see the economy as they want to see it, because that way they can justify keeping their jobs and believe they can comfortably retire

which kinda reminds me of the joke about the man who fell off the roof of the investment bank sky scraper head quarters, and who was heard to remark, as he passed the seventh floor on his way down, “So far, so good”

food for thought, its not the fall the causes injury, but rather the sudden velocity change @ the end which causes trama

July 17, 2016 at 10:14 PM #799671 CoronitaParticipant

CoronitaParticipantLol phaster. You crack me up. On one hand you’re disputing the accuracy of all those stats provided by financial institutions about their returns and how it’s not the case…And on the other hand, you’re using some of these status from the same financial institutions about market timing.

Do you enjoy just googling shit and finding whatever sticks to your position. It’s even cute how you started to use the “boldface” type to highlight 1 or 2 lines out of an entire paragraph out of context and redirect you entire discussion on something else. How BG’ish….

Man, remind me never to hang out with folks like you. It’s not that I don’t value actual insight, positive or negative. I do. It’s just I don’t understand some of you that are so fixated with your beliefs that you can’t really think objectively in the only thing that matters…. “How can I make money?”

Warning: extreme mental states at either end of the spectrum can be hazardous to your financial health.

July 18, 2016 at 4:57 PM #799699FlyerInHi

Guest[quote=flu] It’s just I don’t understand some of you that are so fixated with your beliefs that you can’t really think objectively in the only thing that matters…. “How can I make money?”

Warning: extreme mental states at either end of the spectrum can be hazardous to your financial health.[/quote]

I agree about the making the money part.

The extreme mental states would be being extremely bullish vs. fearing a Great Depression.

Conducting ordinary business within an established order is perfectly normal. Fearing a Great Depression is extreme. As Paul Krugman would say, the truth is not equidistant from either of the sides.

July 26, 2016 at 8:00 PM #800029phaster

Participant[quote=flu]Lol phaster. You crack me up. On one hand you’re disputing the accuracy of all those stats provided by financial institutions about their returns and how it’s not the case…And on the other hand, you’re using some of these status from the same financial institutions about market timing.

Do you enjoy just googling shit and finding whatever sticks to your position. It’s even cute how you started to use the “boldface” type to highlight 1 or 2 lines out of an entire paragraph out of context and redirect you entire discussion on something else. How BG’ish….

Man, remind me never to hang out with folks like you. It’s not that I don’t value actual insight, positive or negative. I do. It’s just I don’t understand some of you that are so fixated with your beliefs that you can’t really think objectively in the only thing that matters…. “How can I make money?”

Warning: extreme mental states at either end of the spectrum can be hazardous to your financial health.[/quote]

glad you “Lol” last time I posted feedback about specifics, so guess I’ll continue and try to provide more laughs

WRT the… only thing that matters…. “How can I make money?”

sex trafficking??

selling drugs??

taking politically motivated bribes??which are commonly reported methods of making “Mo’ Money”

BUT IMHO individuals engaging in such money making activity basically have thrown out any belief system that takes into account human costs and instead created an environment where an (un)civil society grows

then we should consider the reason we’re in this “economic” mess is because prior to the bursting of the bubble most everyone (RE agents, mortgage brokers, bankers, wanabe homeowners, etc.) only thought about “How can I make money?” w/out thinking what the knock on effects would be

few thought about the risk, and some that did and were able to buy “swaps” had a nice windfall

so FWIW I consider the restraints imposed by a “belief system” (like perhaps religion) that values honesty and human costs (i.e. empathy), as a small price to pay for a nudging towards a sustainable economy and civil society

WRT bearishgurl’s so-called “cute” posting style…

huh where to start,

well we know bearishgurl is a legend in her own mind

we also know she lacks the mental horsepower and a moral compass to backup the delusion of being a mild mannered super hero who fights for economic justice for oppressed Gubment-Pensioner(s) who did nothing to corrupt or mis-manage the system

so have to disagree I am not worthy of such a comparison (to BGs posting style) because I have yet to post something dumb enough to deserve snarky responses from Rich (our host)

[quote=”misc. piggs”]

http://piggington.com/ot_predictions_2016_presidential_election?page=18#comment-266081

http://piggington.com/safe_neighborhood_we_can_afford#comment-269379

WRT “googling” shit…

yup big fan AND often there’s an aha moment, like when finding an older dedicated thread where other piggs note other mental processing problems w/ bearishgurl and a suggestion that she should clean up of her act

http://piggington.com/ot_bearishgurl_should_clean_her_act_or_go

(guess that’s why the idiom, you can’t teach an old dog new tricks was invented in the first place, to describe people/situations like bearishgurl…)

[/quote]actually given “frequency” of posts on this site you share much more in common w/ BG than I do, given you two seem to be more regular, regulars (i.e. very active long term users)… and IMHO FWIW the posts contain lots of “noise” and very little “signal”; on the other hand I just drop in every once in a while to see what piggs mostly think about the economy and try to contribute insights supported by data that others might have missed (SEE existing website slogan at bottom of page,… In God we trust. Everyone Else Bring Data!)

WRT the… Warning: extreme mental states at either end of the spectrum can be hazardous to your financial health.

thanks for the concern/warning, but see no need to enter a pissing contest comparing personal financial statements AND past “PERSONAL” PORTFOLIO PERFORMANCE as a way to perhaps score some meaningless ideological points

[quote=money.usnews.com]

How mutual fund firms use past performance to distract investors.Mutual fund companies tout past performance for one reason: It works, even though the relationship between past and future returns is highly problematic. One 2002 National Bureau of Economic Reserach study, “Mutual fund flows and Performance in Irrational Markets,” found that the “relative performance of mutual fund managers appears to be largely unpredictable using past relative performance.”

while i’m at it want to disclose the fact that I’ve never been all in or all out of the market (YET AGAIN), also thought I’d mention I’ve achieved and maintained a better than average “financial health” which I can easily prove to any CPA or mortgage broker if needed

therefore the statement you so graciously shared is not applicable BUT would say looking at it another way there is an unwritten kernel of truth to it,… perhaps even a corollary,… because I’ve managed to achieve and maintain a better than average “financial health” using a disciplined value investment “money management” approach (i.e. benjamin graham school of investing)

speaking of “money management” here’s one bit of recent financial news that seems relevant (AND not in a good way)

[quote=sacbee.com]

CalPERS earned less than 1% in fiscal year

CalPERS reported a 0.61 percent gain in investments in its latest fiscal year, the second straight year of subpar results for the big California pension fund.

…The latest results come on top of a gain of just 2.4 percent in the previous fiscal year. Both results are well below CalPERS’ official annual target of 7.5 percent.

http://www.sacbee.com/news/business/article90273587.html

[/quote]this data point along w/ other observations of market players…

[quote=livinincali][quote=henrysd]I have owned Vanguard long term CA muni bond fund since 2009. The fund is so called long term, but it is actually in high spectrum of intermediate term bond fund as the average duration is only 6.4 years. There were many good times to buy it like any time from 2009-2012. The best time was when “star analyst” Whitney called for massive default in muni bond which never happened. True star manager like Bill Gross added massive position in muni bond after Whitney made the call which causeed big selloff in muni bond. My entry point was about 4% YTM and with the yield down to 1.8% now, there is significant risk of losing value when interest goes up. I personally feel it is too late to jump into the boat. Be careful when tempted to the 1.8% yield using bank saving rate as reference.

I am still holding the position, and if Fed raise fed fund rate to 1% (likely in 3 baby steps), I’ll dump the fund and change position to CA muni money fund.[/quote]

The math says that eventually some muni bonds will be defaulted on. The problem is when and where. That’s what Whitney got wrong, the timing. It’s obvious that at some point Chicago is going to default on their muni bonds. They are currently paying the bond holders and defaulting on their contractors. CA sort of did the same thing with IOUs in the depths of the recession. You do have somewhat of a cushion because cities seems to value paying the bond holders before some of their other bills.[/quote]

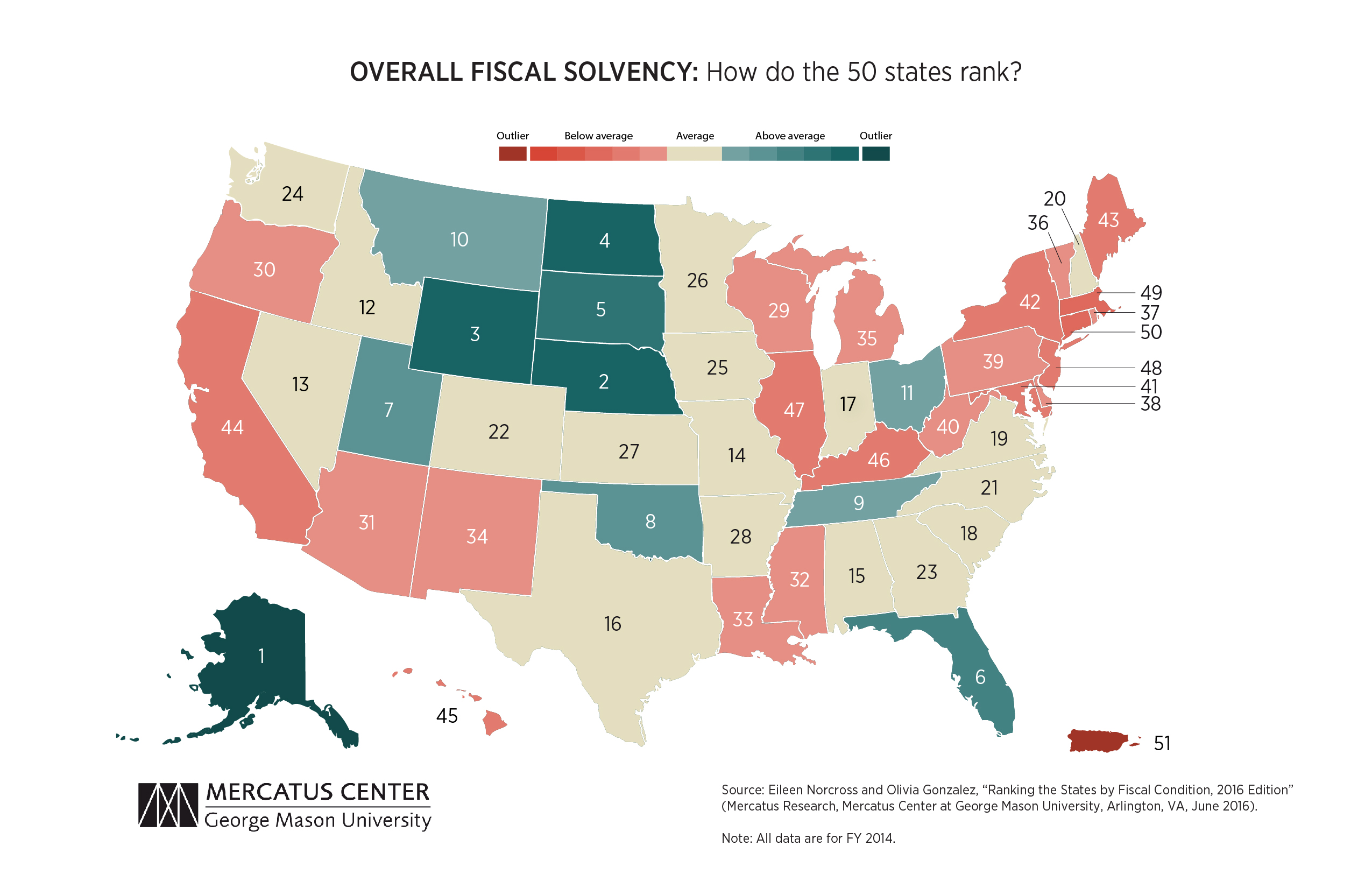

[quote=mercatus.org]

A new study for the Mercatus Center at George Mason University ranks each US state’s financial health based on short- and long-term debt and other key fiscal obligations, such as unfunded pensions and healthcare benefits.

#44 California

#45 Hawaii

#46 Kentucky

#47 Illinois

#48 New Jersey

#49 Massachusetts

#50 Connecticut

#51 Puerto Ricohttp://mercatus.org/statefiscalrankings

[/quote]sure looks like an un-appreciated trend that indicates its only a matter of when TSHTF WRT the muni “bond” funds sector,… so I’d suggest caution as per specific OP query (i.e. What does everyone think of municipal bond funds?… Any thoughts would be appreciated.)

PS WRT “actual insight”

its been said… This above all: to thine own self be true, so don’t be mad at me (the messenger) for pointing out various problems w/ muni bonds, its the first thing investors should be doing (i.e. due diligence)

as for an “actual insight” get the feeling that you might have CA bond fund misgivings or perhaps even “buyer’s remorse”

but what do I know

[quote=flu]

June 18, 2016 – 12:24pm.I have the vanguard intermediate term ca fund for a few years. Its alright. I personally wouldnt do the long term one. But what do I know.

July 15, 2016 – 7:46am.

what ends up happening is one end up spending a lot more time trying to rationalize the decision

[/quote]July 26, 2016 at 9:31 PM #800032 CoronitaParticipant

CoronitaParticipant[quote=phaster]

as for an “actual insight” get the feeling that you might have CA bond fund misgivings or perhaps even “buyer’s remorse”

but what do I know

[quote=flu]

June 18, 2016 – 12:24pm.I have the vanguard intermediate term ca fund for a few years. Its alright. I personally wouldnt do the long term one. But what do I know.

July 15, 2016 – 7:46am.

what ends up happening is one end up spending a lot more time trying to rationalize the decision

[/quote][/quote]I don’t know why you would jump to that conclusion. CA bonds serve the very purpose I bought them for. A consistent return that is higher than a 1-2% CD, which for practical purposes can be liquidated within 24 hours., no more than 5% of my total net worth, the other 5% being non-CA bonds….Which is considerably less than the 25% cash position I hold right now, and about the same as a 5% holding I have on metals. The remaining 60% is evenly split between stocks/index funds and paid of rental properties. It’s served it’s purpose these past few years just fine. Sure better than that 1%CD.

If I have any remorse, it’s selling ARM Holdings 1 week too early before the Softbank acquistion. That cost me around $40k.

[quote]

sure looks like an un-appreciated trend that indicates its only a matter of when TSHTF WRT the muni “bond” funds sector,… so I’d suggest caution as per specific OP query (i.e. What does everyone think of municipal bond funds?… Any thoughts would be appreciated.)

PS WRT “actual insight”

[/quote]Just curious, did you even both to look at the fund to see what the majority of the holdings of that fund is? Because the articles you quote and what the fund contains just seem, well never mind, you can do your own due diligence, or not, in your case.

July 26, 2016 at 10:35 PM #800033 CoronitaParticipant

CoronitaParticipantFor the lazy

Google It…

University of California Revenue PUT 5.000% 05/15/2048 $52,095,000 $64,364,935

Los Angeles CA Unified School District GO 5.000% 07/01/2019 $53,000,000 $59,938,760

California GO 5.000% 11/01/2020 $47,795,000 $56,212,655

California GO PUT 3.000% 12/01/2032 $52,000,000 $55,296,800

California Economic Recovery GO 5.000% 07/01/2020 $43,745,000 $49,687,758

Los Angeles CA Unified School District GO 4.750% 07/01/2032 $40,925,000 $42,781,767

California GO 5.750% 04/01/2031 $37,030,000 $42,322,328

California GO 5.000% 08/01/2019 $35,445,000 $40,231,138

California GO 5.000% 11/01/2022 $31,890,000 $39,066,526

California Department of Water Resources Power Supply Revenue 5.000% 05/01/2022 $31,560,000 $38,499,413

Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) 1.210% 04/01/2045 $37,550,000 $37,594,685

California Economic Recovery GO 5.000% 07/01/2019 $32,330,000 $36,722,031

California GO 5.750% 04/01/2027 $31,455,000 $36,051,205

California Statewide Communities Development Authority Revenue (Sutter Health) T 0.440% 11/15/2048 $35,963,402 $35,963,402

California Infrastructure & Economic Development Bank Revenue (Bay Area Toll Bri 0.460% 07/01/2024 $35,455,000 $35,455,000

Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) 2.000% 04/01/2034 $34,000,000 $34,961,860

California GO 5.750% 04/01/2028 $30,000,000 $34,364,400

Los Angeles CA Department of Water & Power Revenue 5.000% 12/01/2018 $30,630,000 $34,060,560

Los Angeles CA Unified School District GO 5.000% 07/01/2020 $28,975,000 $33,759,932

California GO VRDO 0.530% 04/07/2016 $33,300,000 $33,300,000

California Economic Recovery GO 5.250% 07/01/2021 $28,845,000 $32,994,642

Los Angeles CA Unified School District GO 4.500% 07/01/2023 $31,065,000 $32,617,007

California Infrastructure & Economic Development Bank Revenue (J. Paul Getty Tru 0.680% 10/01/2047 $32,470,000 $32,205,694

California GO 5.500% 04/01/2018 $29,250,000 $32,005,935

California Department of Water Resources Power Supply Revenue 5.000% 05/01/2021 $28,585,000 $31,116,488July 26, 2016 at 11:30 PM #800034ucodegen

Participant[quote=FlyerInHi]Doomdayers tend to be self sufficient people. They believe in hardwork. What I don’t get is why they believe that money should safely earn new money in safe investments (as when interest rates are higher than inflation).

Should it not take hard work and enterprise to invest money and earn a return?[/quote]

Actually it does. There is something known as the “risk free rate of return”, which is generally around the rate of return of a 3 month Treasury Bill. For anything more, you need to take a risk, work a bit more, dig a bit harder etc. “Risk free rate of return” is not necessarily higher than inflation – depends on behavior of fed, gov, markets.August 6, 2016 at 7:55 AM #800310phaster

Participant[quote=flu]

[quote]

sure looks like an un-appreciated trend that indicates its only a matter of when TSHTF WRT the muni “bond” funds sector,… so I’d suggest caution as per specific OP query (i.e. What does everyone think of municipal bond funds?… Any thoughts would be appreciated.)

PS WRT “actual insight”

[/quote]Just curious, did you even both to look at the fund to see what the majority of the holdings of that fund is? Because the articles you quote and what the fund contains just seem, well never mind, you can do your own due diligence, or not, in your case.[/quote]

yup, and the question investors should have about the overall viability of ALL muni bonds is what of “new” accounting rules which among other thing are suppose to fully account for retirement costs on the balance sheet BUT in reality stuff is basically being swept under the carpet, much like news of the head of calpers who was exposed as being corrupt because of bribes that surfaced, the local pensions (mis)use of derivatives, leverage and other bull$hit stuff like giving away an extra 13th pension payment for the last three decades, etc., etc., etc!!!

[quote=governing.com]

Why Some Public Pensions Could Soon Look Much WorseThe discount rate rule, known as GASB 67, is just part of the story. Another piece of the new rule, GASB 68, will hit financial statements starting later this year. Under that new rule, governments that are members of a pension plan — say, localities that pool their money with a state plan — are required to report their share of that plan’s unfunded liability on their governmentwide balance sheet for the 2015 fiscal year, something most of those governments have never before had to do.

http://www.governing.com/topics/mgmt/gov-gasb-pension-plans-may-look-worse-soon.html

[/quote][quote=californiapolicycenter.org]

UNMASKING STAGGERING PENSION DEBT AND HIDDEN EXPENSEThe Fatal Flaw is that pension expenses that create unfunded pension debt are reported in the future as that debt is paid. That’s absurd – the payments of a debt eliminate the debt, they don’t create it. Unfunded pension debt is created by pension expenses in the past – most of which have never been reported to the people. GASB is changing that.

GASB’s changes are only about how governments must report pension finances.

http://californiapolicycenter.org/unmasking-staggering-pension-debt-hidden-expense/

[/quote]as it stands public pensions share many traits of the old USSR five year economic plans,… in other words both are bureaucratic programs w/ lots of corruption/mis-management and w/ horse$hit propaganda that tries to justify management decisions/operations (the following for example is an article bearishgurl shared as evidence of how well managed the local public pension was doing)

[quote=sandiegouniontribune.com]

SDCERA uses smart investment strategy for pension fundRecent media coverage of the San Diego County Employees Retirement Association (SDCERA) has suggested its retirement fund’s portfolio managers have recklessly pursued riskier investments in pursuit of higher returns to close the pension funding gap. In fact, nothing could be further from the truth. SDCERA is answering the real concern impacting public pensions by using tried and true principles of asset liability management and diversification, and not relying heavily on more volatile equities to close this gap.

For the past decade, San Diego County and its employees paid 100 percent or more of their annually required contribution to the SDCERA retirement fund. Consistent employee and employer contributions over the years have laid a foundation for investment gains and asset growth. SDCERA’s investment strategy helps the employer’s budgeting process and stabilizes employer costs by reducing the volatility of returns and steadily achieving the rate of return needed to fund the benefit.

At $10 billion, the SDCERA fund is able to pursue certain investment strategies that larger plans like CalPERS cannot access and smaller plans do not have the resources to deploy. SDCERA’s investment strategy is purposely designed to be no riskier than traditional pension fund asset allocation strategies. Risk-parity and trend strategies, which utilize leverage, are limited to 25 percent of the SDCERA portfolio, not the entire set of portfolio assets. The other 75 percent of the portfolio is managed using traditional asset allocation and rebalancing approaches.

SDCERA’s meticulous risk management is the opposite of “gambling” — it is prudent governance. Managing risk exposure has been a long-standing practice at SDCERA, and one that continues in the fund’s current investment strategy. This context is crucial to fully understanding SDCERA’s approach to portfolio management.

http://www.sandiegouniontribune.com/news/2014/aug/15/sdcera-pension-investment-strategy/

[/quote]as with any other game one should be aware of rules that gover the way the contest is played/perceived and also should ponder the role of luck vs skill when it comes to the game of “investing”

basically how “lucky” an investor is, mostly depends upon the over all direction/mood of the economy because in general when the market is going UP most everyone looks like a genius and when the market is going DOWN most everyone looks like an idiot!

the skill factor(s) of investing, involve using god given traits of perception, patience, intellectual capacity and nerve to protect gains produced during the good times so one can survive the bad times

so IMHO if the goal is to be a succesful investor (who beats the averages), then it’s all about identifying what kind of economy we’re in, then ask how is the market climate currently trading (i.e. up, down or sideways) and only after all the data has been looked at, develop and deploy an appropriate strategy

for example prior to the bust of the housing bubble in 2007/08 because most people felt gun shy after the dot com bubble, the majority only focusing on RE and all but ignored “equities”

back then when I looked at the data, came to the conclusion that a “momentum” (i.e. the trend is your friend) equities strategy which was a method ignored by many, was an opportunity to stay a few steps ahead of the crowd and beat the so called market average

markets its been said are driven by fear and greed, and eventually switch course because of various thresholds and convictions

during the housing bubble, fear of missing out and greed of wanting to keep up w/ the joneses is what caused the mass of lemming w/out the necessary intellectual and financial firepower (backup) to jump into the housing market AND things kept going up, up and up until the threshold of “math” reality hit which indicated there was no way in hell it made sense financial to support the unrealistic prices, so the overall conviction of all the market players then pushed prices down ward

cut to the present where we see that the numbers indicate the lowest growth rate in the economy since WW II, which manifests into sucky feelings (for many) who then look for new political leadership who says they have answers… yeah right, a motto and a few crowd pleasing remarks at an election rally is going to fix the economy

[quote=wsj.com]

Seven Years Later, Recovery Remains the Weakest of the Post-World War II Era…seven years after the recession ended, the current stretch of economic gains has yielded less growth than much shorter business cycles.

The economy has grown at a 2.1% annual rate since the U.S. recovery began in mid-2009, according to gross-domestic-product data the Commerce Department released

…The average economic expansion since 1949 has lasted just more than five years. Only the expansion during the 1990s made it 10 years.

IMHO the economy had been sluggish for key three reasons:

1st, because advances in technology has boosted global productivity, so there exists much more production capacity than there is need/demand (which is why prices in oil markets is so low, and each player KSA vs Iran for example knows this, but they all still keep on pumping because that is how they make money)

2nd, there is lots of existing debt that is unserviceable (FYI aside from non-performing RE that is being juggled around on various balance sheets, unserviceable debt includes public pensions and stuff like social security)

http://time.com/money/4346186/social-security-broke-fix/

for a glimpse of a future in the USA where unserviceable debt due to corruption and mis-management causes problems w/ in the economy, just watch news reports and read up on events in venezuela, greece, argentina, mexico, nigeria, etc…

3rd reason is because a thus far a lack of ‘the next big thing’ (i.e. new industries/products/services) that create jobs for society (and in turn allows for even more trade, etc., etc.)

granted there have been a new class of consumer products, like the iPhone…

[quote=money.cnn.com]

Apple probably just sold its billionth iPhoneWall Street analysts predict that Apple sold its 1 billionth iPhone on Monday.

Here’s how the math works: Between June 29, 2007 — when the iPhone first went on sale — and March 2016, Apple sold 948 million iPhones. That means Apple only had to sell 52 million iPhones over the past four months to reach the billion mark.

Analysts polled by FactSet predict that Apple sold 40 million iPhones during the spring, pushing total sales to 988 million by the end of June. They expect Apple to sell 43 million iPhones during the current quarter, or roughly 500,000 per day.

The iPhone is one of the bestselling tech products of all time. For perspective, Apple also makes the bestselling tablet (the iPad) and music player (iPod), and the Mac is among the top selling PCs. Yet Apple has sold more iPhones than Macs, iPads and iPods combined, dating back to 1993.

http://money.cnn.com/2016/07/26/technology/billion-iphone-sales/

[/quote]BUT although an iPhone or a knockoff “smartphone” is a stylish fashion accessory and potentially useful tool, its not a true necessity for modern life un-like the basics of clean water and electricity,… actually if you think about it clean water and electricity were products/services that allowed the trend of growing populations and longer life spans to happen, this in turn created the problem we on plant earth face now face,… too many users of an iPhone or a knockoff “smartphone” have expectations they are entitled to live just like the “idealized” american consumer lifestyle shown in slick ads and marketing champaign’s, yet are basically “redundant” in the grand scheme of things

truth is the unpalatable solution to get the economy booming again is a darwinian flush AND using the metaphor just as night follows day, most are going to be caught off guard when the “economic” day (which is the phase we’re in right now) inevitably turns into night (the only unresolved questions is “when” and the “magnitude”)

PS my economic assessment isn’t a tin-foil-hat theory, seems the dude who made a name for himself running a bond fund, kinda is telling the world the same damn thing!

[quote=cnbc.com]

Bill Gross: I don’t like stocks or bonds“I don’t like bonds; I don’t like most stocks; I don’t like private equity,” the Janus Capital portfolio manager said Wednesday in his latest letter to investors.

There’s “too much risk for too little return” for banks to lend in the current climate, while the low-interest atmosphere helps asset prices but crimps savings and business investment.

“Banks, insurance companies, pension funds and Mom and Pop on Main Street are stripped of their ability to pay for future debts and retirement benefits,” Gross wrote. “Central banks seem oblivious to this dark side of low interest rates. If maintained for too long, the real economy itself is affected as expected income fails to materialize and investment spending stagnates.”

So where does he think people should invest? Well, that’s also difficult.

“Real assets such as land, gold, and tangible plant and equipment at a discount are favored asset categories,” he said. “But those are hard for an individual to buy because wealth has been ‘financialized.'”

http://www.cnbc.com/2016/08/03/bill-gross-i-dont-like-stocks-or-bonds.html

[/quote]August 6, 2016 at 9:58 AM #800321 CoronitaParticipant

CoronitaParticipantI don’t know, I don’t think the economy is as bad as people make it out to be. At least not for some of us. I guess if you’re in the rustbelt regions, that’s a different story.

August 6, 2016 at 11:22 AM #800332FlyerInHi

Guest[quote=flu]I don’t know, I don’t think the economy is as bad as people make it out to be. At least not for some of us. I guess if you’re in the rustbelt regions, that’s a different story.[/quote]

I know a guy with a good job. I encouraged him buy a better house. He still thinks the economy will go to shit. Has been watching too much scare mongering.

I think a recession (2 consecutive quarters of negative growth) is a least 3 years out. But then the economy would have grown from what it is today. Some people think a recession as some calamity. It’s just normal business cycle.

Depends where in the rustbelt. Harrisburg has government, medical, etc. downtown is rejuvenating with new condos. Pittsburg has education and medical, new condos and lofts in the city. Except for the wealthy suburbs, the outlying areas aren’t doing well, but it’s the normal reshaping of the urban geophaphy.

August 6, 2016 at 8:05 PM #800333 CoronitaParticipant

CoronitaParticipant[quote=FlyerInHi][quote=flu]I don’t know, I don’t think the economy is as bad as people make it out to be. At least not for some of us. I guess if you’re in the rustbelt regions, that’s a different story.[/quote]

I know a guy with a good job. I encouraged him buy a better house. He still thinks the economy will go to shit. Has been watching too much scare mongering.

I think a recession (2 consecutive quarters of negative growth) is a least 3 years out. But then the economy would have grown from what it is today. Some people think a recession as some calamity. It’s just normal business cycle.

Depends where in the rustbelt. Harrisburg has government, medical, etc. downtown is rejuvenating with new condos. Pittsburg has education and medical, new condos and lofts in the city. Except for the wealthy suburbs, the outlying areas aren’t doing well, but it’s the normal reshaping of the urban geophaphy.[/quote]

Most people can’t outsmart the economy consistently by being contrarian all the time. They might get lucky once or twice.

And if you are one the ones that think the system is rigged, even more of a reason why you won’t win being a contrarian over the long haul

September 22, 2016 at 9:07 PM #801467phaster

Participant[quote=ucodegen][quote=FlyerInHi]Doomdayers tend to be self sufficient people. They believe in hardwork. What I don’t get is why they believe that money should safely earn new money in safe investments (as when interest rates are higher than inflation).

Should it not take hard work and enterprise to invest money and earn a return?[/quote]

Actually it does. There is something known as the “risk free rate of return”, which is generally around the rate of return of a 3 month Treasury Bill. For anything more, you need to take a risk, work a bit more, dig a bit harder etc. “Risk free rate of return” is not necessarily higher than inflation – depends on behavior of fed, gov, markets.[/quote]FYI…

[quote=New York Times]

…Public Pensions: Two Sets of Books…Calpers,… keeps two sets of books: the officially stated numbers, and another set that reflects the “market value” of the pensions that people have earned. The second number is not publicly disclosed.

…governments nationwide do not know the true condition of the pension funds they are responsible for. That exposes millions of people, including retired public workers, local taxpayers and municipal bond buyers — who are often retirees themselves — to risks they have no way of knowing about.

…The market value of a pension reflects the full cost today of providing a steady, guaranteed income for life — and it’s large. Alarmingly large, in fact. This is one reason most states and cities don’t let the market numbers see the light of day.

…the routine practice of translating future pension payments into today’s dollars,… is called discounting.

…With everybody either retired, or about to be… there is no guesswork in determining everybody’s pensions. The actuaries at Calpers project each of the future monthly payments due… assuming they will live to age 90…. Then, they translate all those future payments into today’s dollars with a rate — often called a discount rate. This is exactly how a lender would calculate a home mortgage.

The problem is, which rate should be used? An economist would say the right rate for Calpers is the one for a risk-free bond, like a Treasury bond, because public pensions in California are guaranteed by the state and therefore risk-free. And that’s what Calpers does when it calculates market values. It used 2.56 percent when it calculated the bill…

But the rest of the time, Calpers and virtually all other public pension funds use their assumed annual rate of return on assets, now generally around 7.5 percent. Presto: This makes a pension appear to have a much smaller liability — or even a surplus…

[/quote] -

AuthorPosts

- You must be logged in to reply to this topic.