Home › Forums › Financial Markets/Economics › Any Investment ideas for 2019?

- This topic has 14 replies, 8 voices, and was last updated 7 years ago by

gzz.

-

AuthorPosts

-

January 4, 2019 at 4:50 PM #22650January 6, 2019 at 10:20 AM #811513

phaster

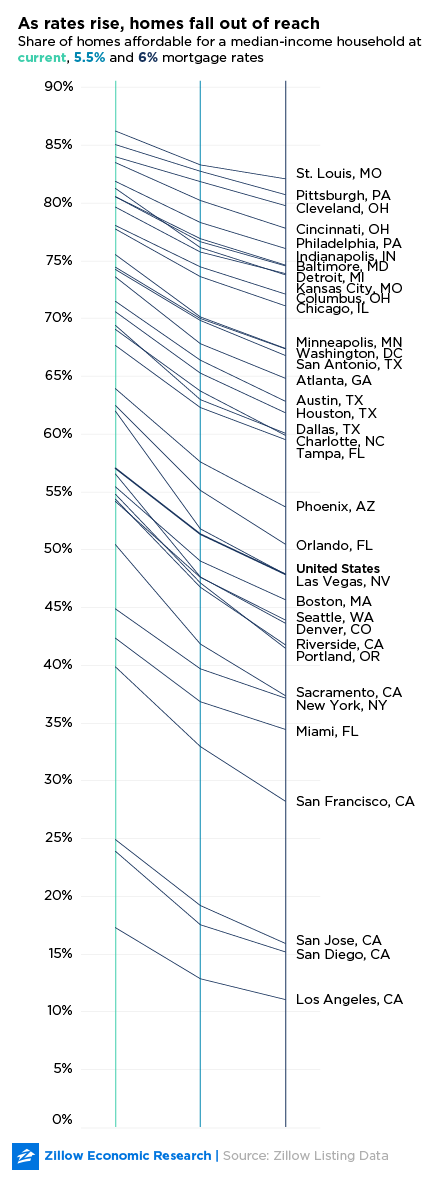

Participantif “affordability” is defined as the typical household looking to spend no more than 30 percent of its income on housing (in the 35 largest metro areas in the U.S.A.) then zillow has an interesting info-graph showing “affordability” vs “interest rates”

NOTE for the info-graph,… the current average 30 year fixed mortgage rate for the U.S. was 4.63 percent

no surprise that metro areas w/ in CA are the least “affordable” so income property seems to be the least risky investment as long as the overall economy is positive and the CA region remains having a favorable public impression BUT given various storm clouds on the horizon think it prudent to have a hedge strategy AND a rainy day cash reserve to ride out an inevitable financial storm

January 6, 2019 at 8:37 PM #811518 CoronitaParticipant

CoronitaParticipantI am keeping my eyes on a bankruptcy filing for PG&E.

If that happens, I might try to pick up shares afterwards.

Remember what happened to BP when the gulf disaster struck? Where is BP now?

Remember a long time ago when Texaco filed for bankruptcy to escape its liabilities? What happened to Texaco after? Let’s review memory lane on why Texaco filed for Chap 11.

https://www.apnews.com/fdc62f40897fc5e2f88fd390e517a276

Different company and circumstances, same playbook

January 14, 2019 at 5:49 AM #811606 CoronitaParticipant

CoronitaParticipantlooks like PG&R will file for Chapter 11

https://finance.yahoo.com/news/exclusive-pg-e-talking-banks-123300636.html

January 14, 2019 at 6:07 AM #811607Hobie

ParticipantI’m in for PG&E too. SDGE had to buy helo,turns off backcountry power during wind storms, paid a bunch of damages, now has new trucks driving on the road. They are making $, same track for PGE.

January 14, 2019 at 7:57 AM #811608spdrun

ParticipantScrew PG&E — they caved in to NIMBY cowards and are planning to close Diablo Canyon. Nuclear energy = clean energy.

January 14, 2019 at 8:50 AM #811610 CoronitaParticipant

CoronitaParticipant[quote=Hobie]I’m in for PG&E too. SDGE had to buy helo,turns off backcountry power during wind storms, paid a bunch of damages, now has new trucks driving on the road. They are making $, same track for PGE.[/quote]

too big to fail. This will be a less than $5 stock soon.

January 14, 2019 at 10:12 AM #811612Hobie

ParticipantRemember Exxon Valdez. Customers paid for damages. PGE will bounce back in just a few years. Electricity will cost more due to forthcoming new laws. I’m in./

January 14, 2019 at 1:50 PM #811614 CoronitaParticipant

CoronitaParticipantprivitize profits, publicize losses. Isn’t this country great or what!!!!

January 14, 2019 at 4:35 PM #811617 CoronitaParticipant

CoronitaParticipantI guess it was a good thing that I got out of the Vanguard CA tax exempt municipal bond fund a few years ago that is stacked high with PG&E’s bond…

I wonder how that’s going to play out.

January 14, 2019 at 7:08 PM #811619henrysd

Participant[quote=flu]I guess it was a good thing that I got out of the Vanguard CA tax exempt municipal bond fund a few years ago that is stacked high with PG&E’s bond…

I wonder how that’s going to play out.[/quote]

Out of $415 m Vanguard owns, $413 m is insured, only $2 m subject to loss. Considered it is owned 3 funds with combined assets over 25b, the 2m possible loss is basically negligible. Even within 2 m possible loss, muni recovery rate is still high enough on get decent percentage out of the 2m back.

When Detroit went bankrupt, Vanguard also had large positions, but lost nothing in the end because the positions were insured.

January 14, 2019 at 7:10 PM #811620 CoronitaParticipant

CoronitaParticipant[quote=henrysd][quote=flu]I guess it was a good thing that I got out of the Vanguard CA tax exempt municipal bond fund a few years ago that is stacked high with PG&E’s bond…

I wonder how that’s going to play out.[/quote]

Out of $415 m Vanguard owns, $413 m is insured, only $2 m subject to loss. Considered it is owned 3 funds with combined assets over 25b, the 2m possible loss is basically negligible. Even within 2 m possible loss, muni recovery rate is still high enough on get decent percentage out of the 2m back.

When Detroit went bankrupt, Vanguard also had large positions, but lost nothing in the end because the positions were insured.[/quote]

ic.. ok, good to know. I stand corrected.

January 16, 2019 at 7:47 AM #811630scaredyclassic

Participanthow risky is this?

January 20, 2019 at 12:40 PM #811660gzz

ParticipantI sold off all my stocks over 2017 and 2018 to finance one more rental and business working capital and also some taxable munis.

Those munis are now up 10% from my big October 2018 purchase (still have a healthy 6+% yield), so i took some profits, sold 1/3 of the position, and am holding cash at the moment.

I still like taxable munis a lot. The CEF tickers are BBN and GBAB.

January 20, 2019 at 12:48 PM #811661gzz

ParticipantI will buy a little PGE if it dips to the 4’s.

At that point it would be (speculation here) 50% chance of complete loss or ending up below 2 and 50% chance of recovering to 10 or even 20.

The scenerio where it goes low and stays low is a bail in that requires a ton of stock issuance.

I think they offer a giant settlement fund that 90% or more of the victims take BP style, and fight the rest in court, possibly with a lot of success.

-

AuthorPosts

- You must be logged in to reply to this topic.