August looked a lot like July: no more frenzy, but still a very

undersupplied market.

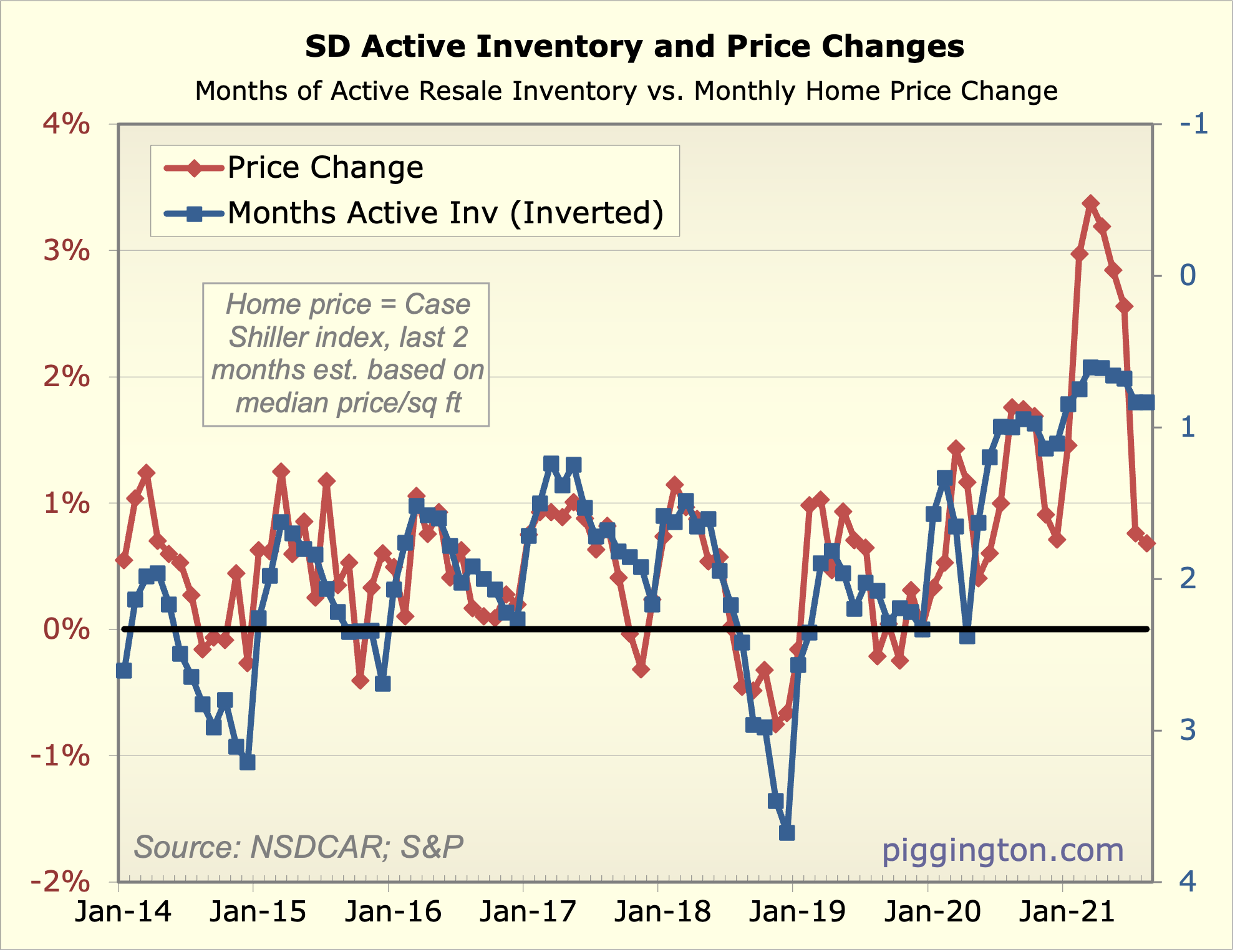

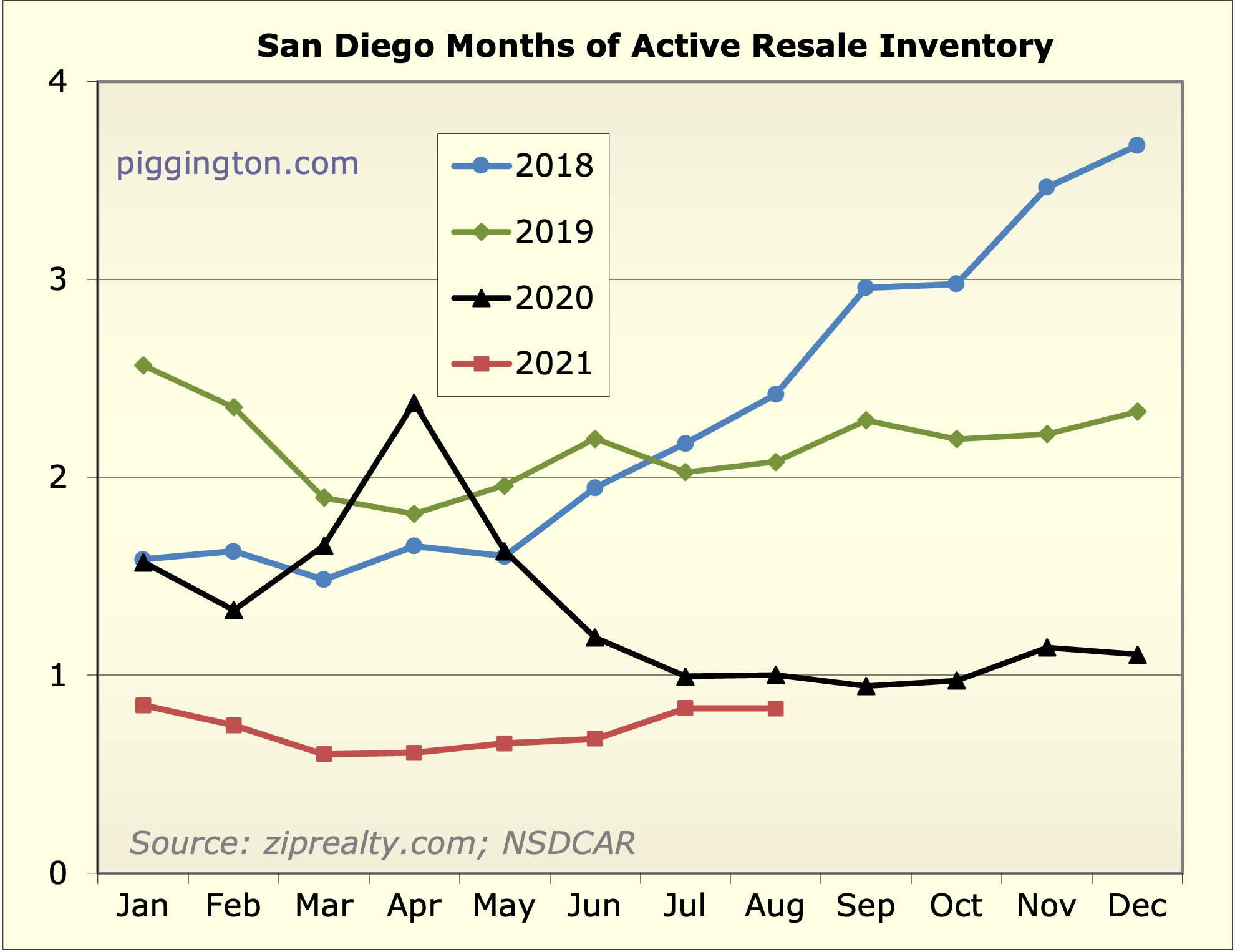

I want to note one thing about this graph, which compares months of

supply (blue line, inverted) with monthly price changes (red line).

Earlier in the year, we saw a very tight market as measured by a

high blue line — but the red line, prices, rose in excess even to

that! At the time I speculated that there might be eventually be

some price pullback to make up for that overshoot. It seems that

might be happening now, as we are in the opposite situation…

supply is still quite tight, and prices are rising, but less than

we’d expect at this level of supply. So if you put those two periods

together, they make sense. Based on the length of the frenzy

overshoot, we may be looking at a few more months of more muted

price increases (at least as compared to what one might expect at

these supply levels).

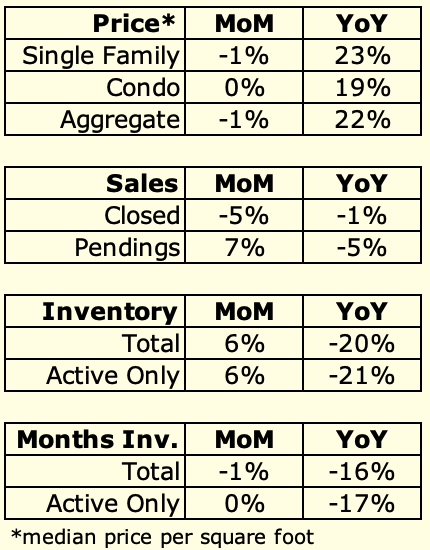

Other than that… yeah, more of the same… prices were flat-ish,

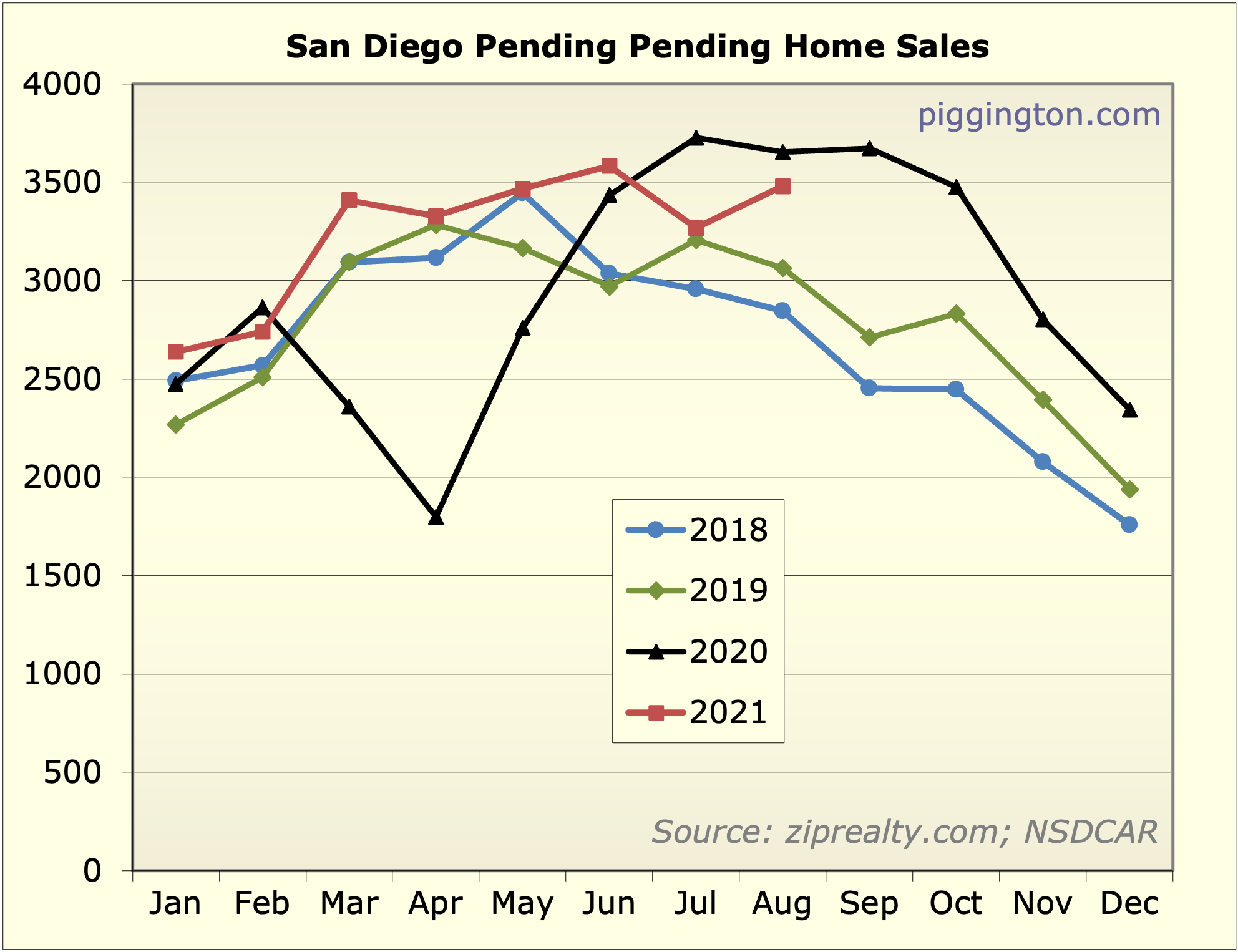

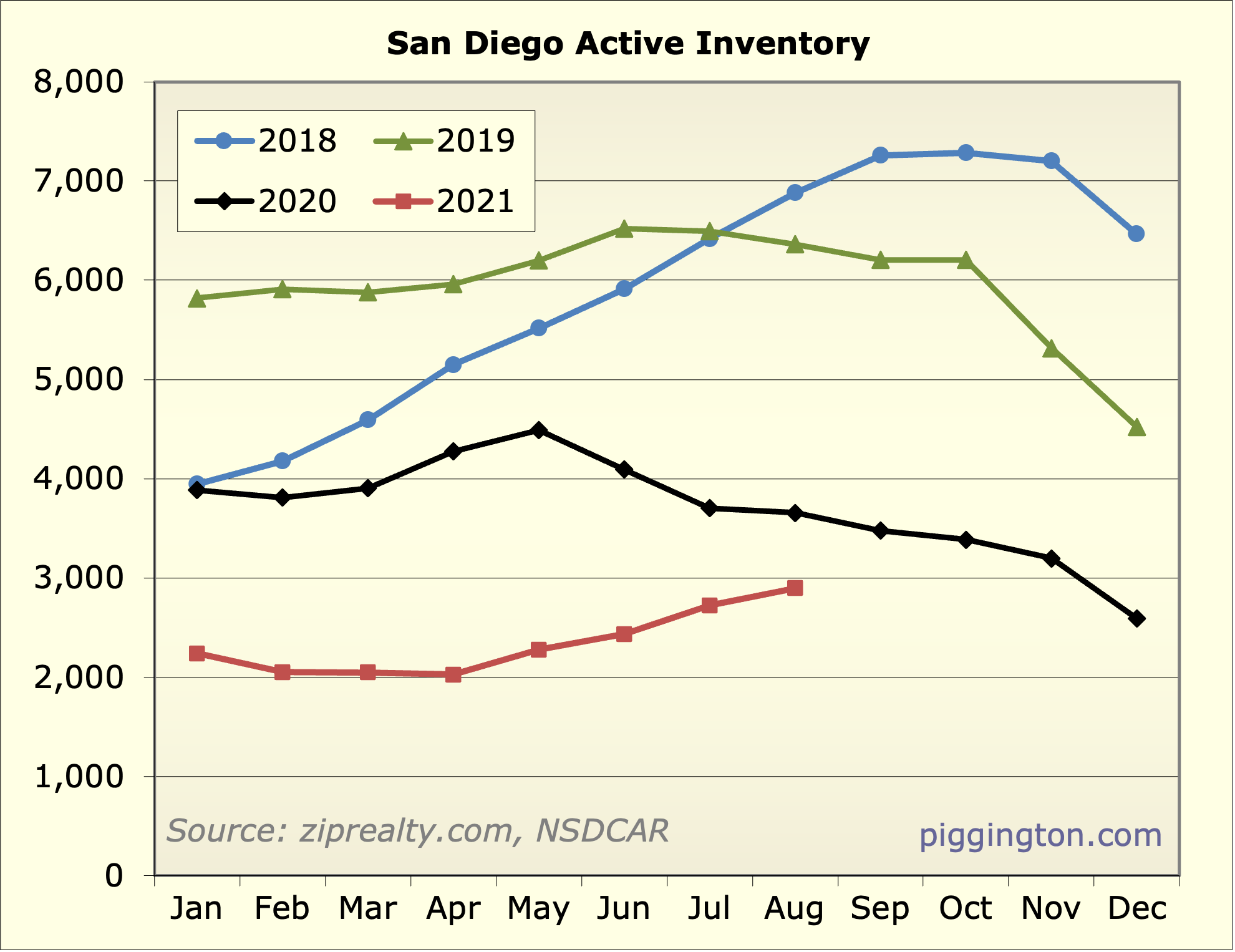

inventory increased a bit, but so did pendings so

months-of-inventory was basically unchanged. IE: no more feeding

frenzy, but still a very tight market. Graphs below…

In April 2011 there were 51

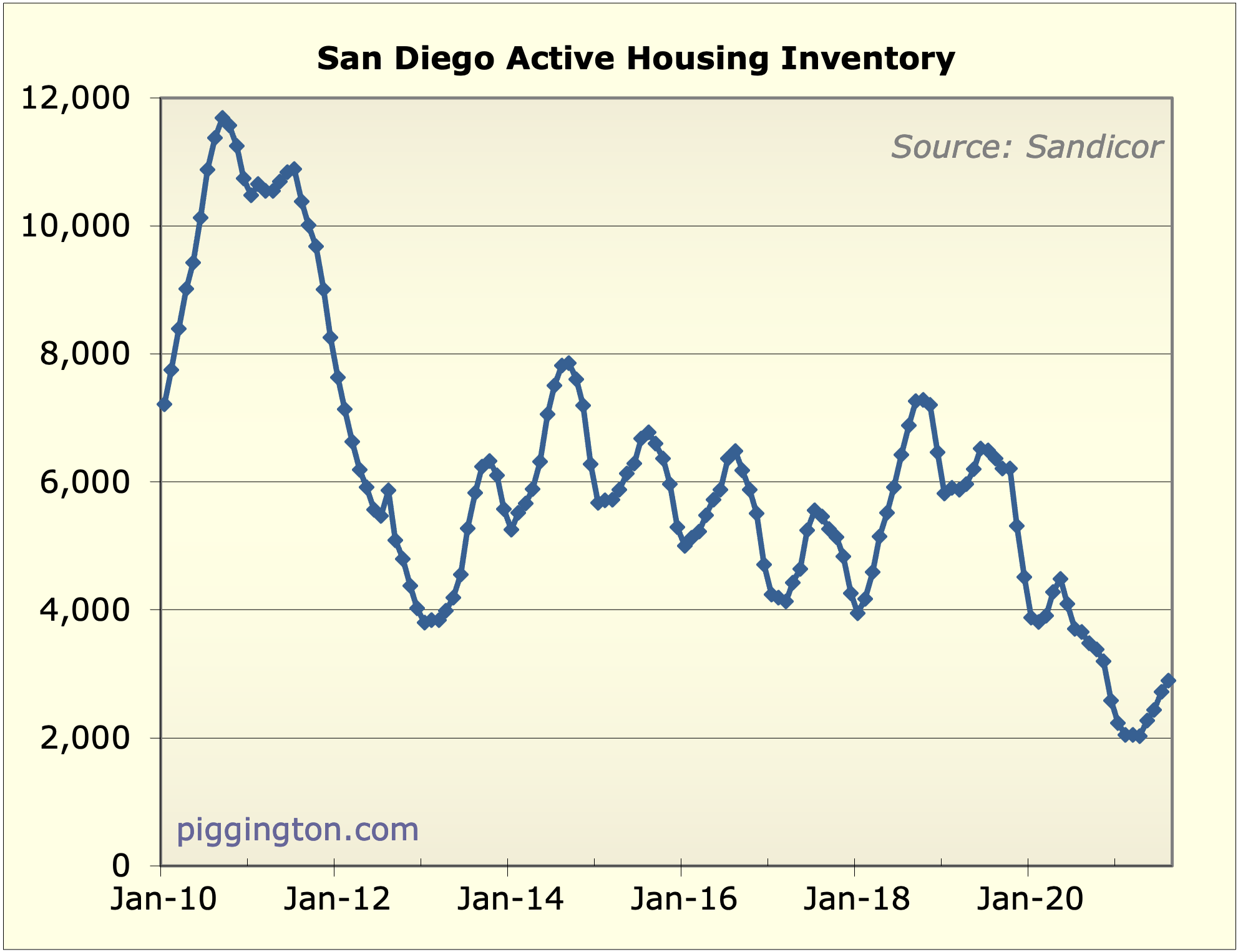

In April 2011 there were 51 condos for sale in OB on MLS. Right now there is one (1), an inventory decline of more than 98%!

The most recent sale was an 800sf unit for 425k. I ran the numbers, and it yields 3.3% with a pessimistic rent of 2k and less taxes insurance and hoa.

At a 2.5% yield, it is worth $560k. A 10% rent increase, it is $656k. That’s another 50% higher we can go and still easily be reasonable.

And 2.5% is still about double the yield of 10 year treasury bills, which in turn are among the highest in the developed world.

How will 2.25% conforming

How will 2.25% conforming loans up to $950,000 affect the market in 2022? I’d say UP.

I actually can’t find the exact formula for the conforming loan limits, but it should go up a record amount.

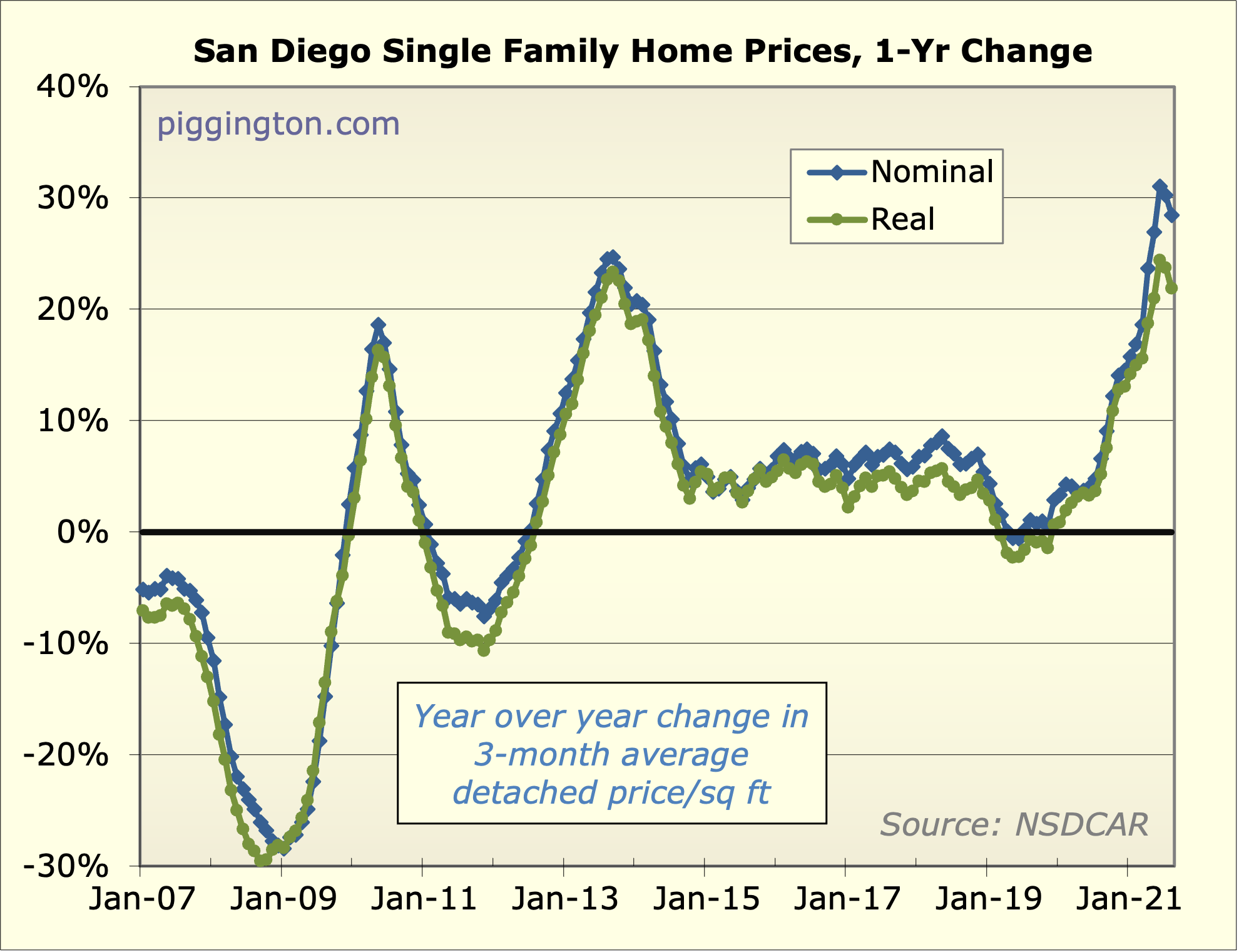

Seasonal price action going

Seasonal price action going on now. The median decline reported in UT seems more to do with a change in the mix. Priced out buyers shifting to condos more now. Prices seem mostly flat as they have since around Julyish

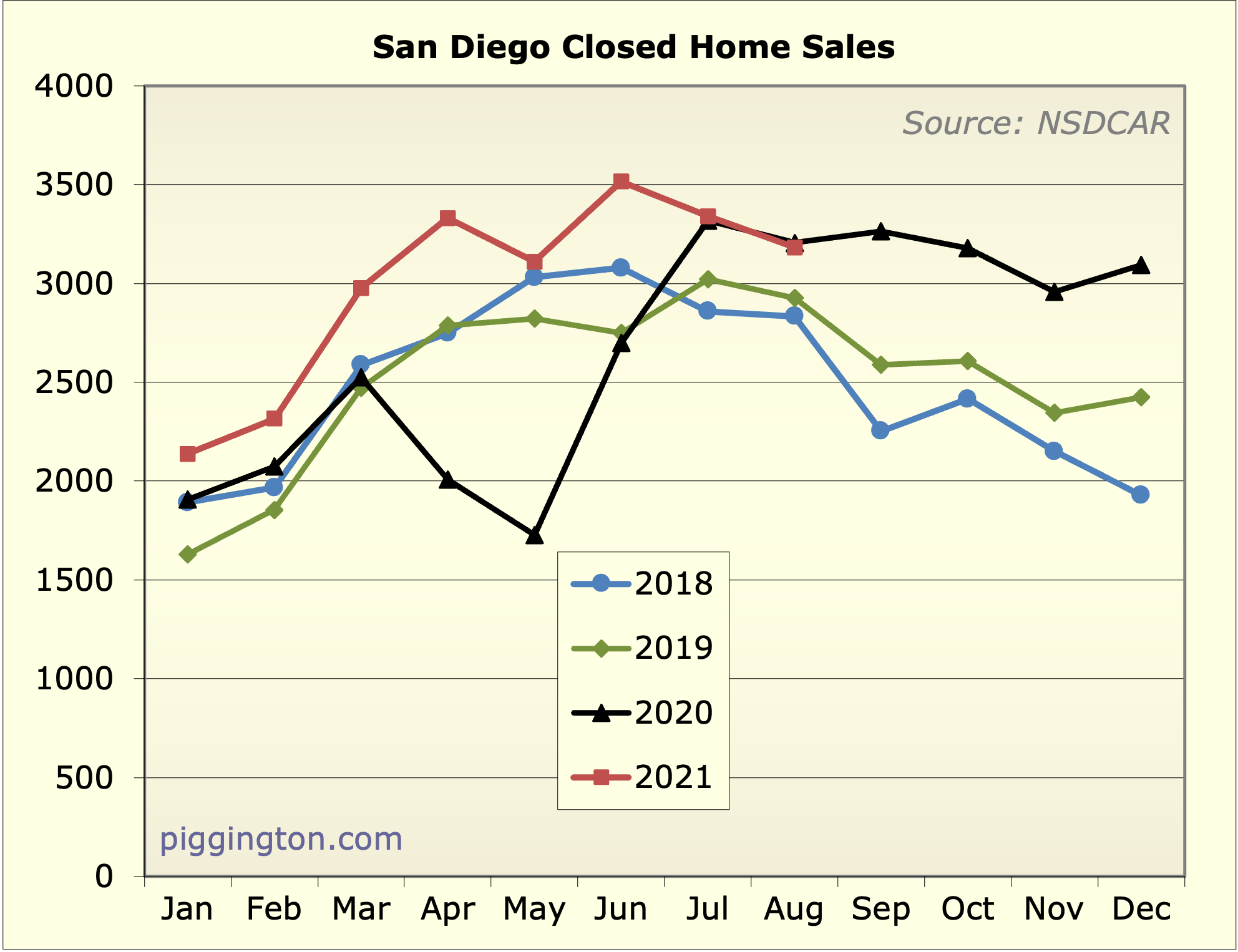

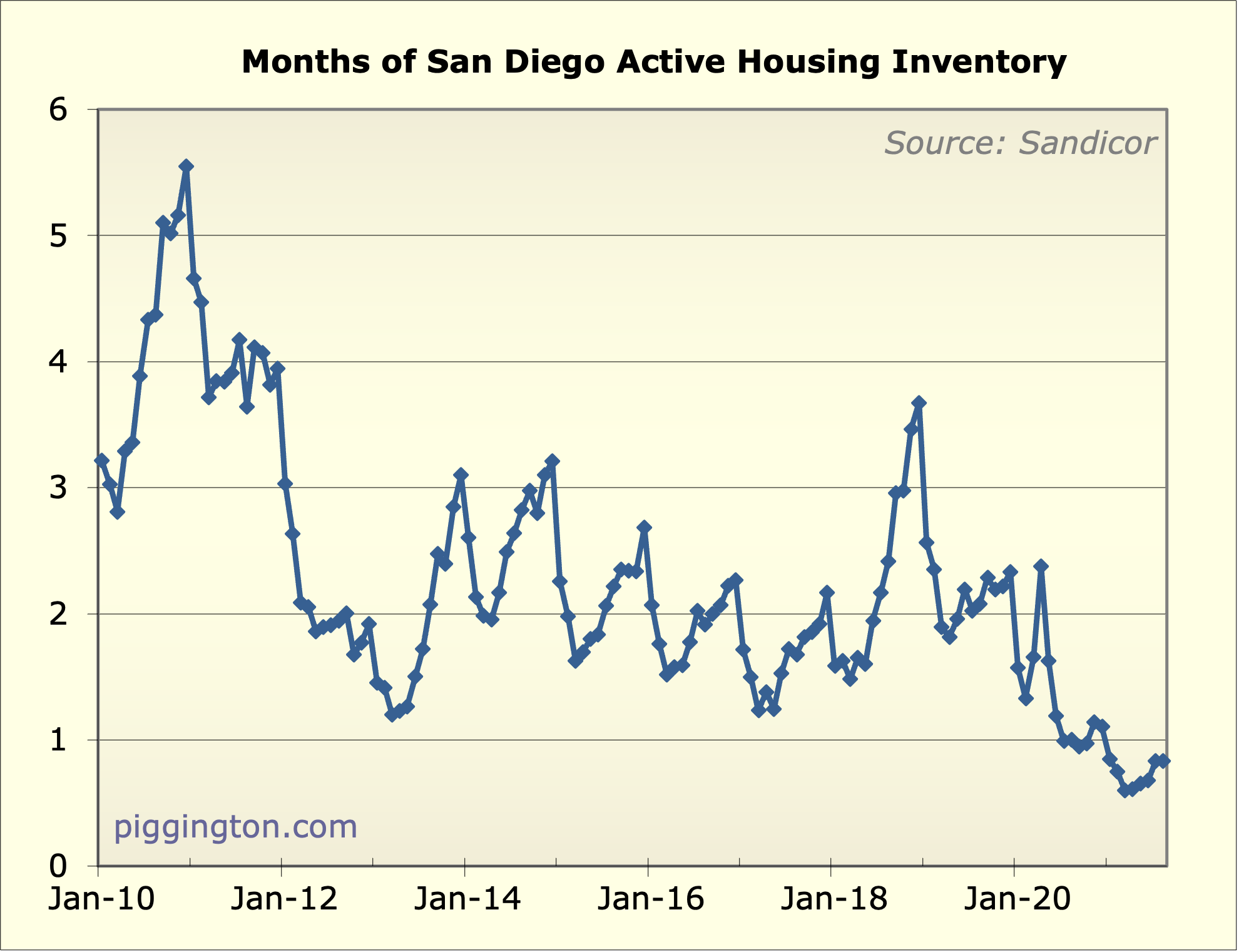

It’s a lot easier to see what’s going on if you disregard the black line for 2020 which was the pandemic aberration. Inventory way below what it should be and sales higher than normal

Weak hands and marginal

Weak hands and marginal sellers have never had it so easy to sell for the past 15 months. And sell they did in large numbers, but not enough to quench the massive demand.

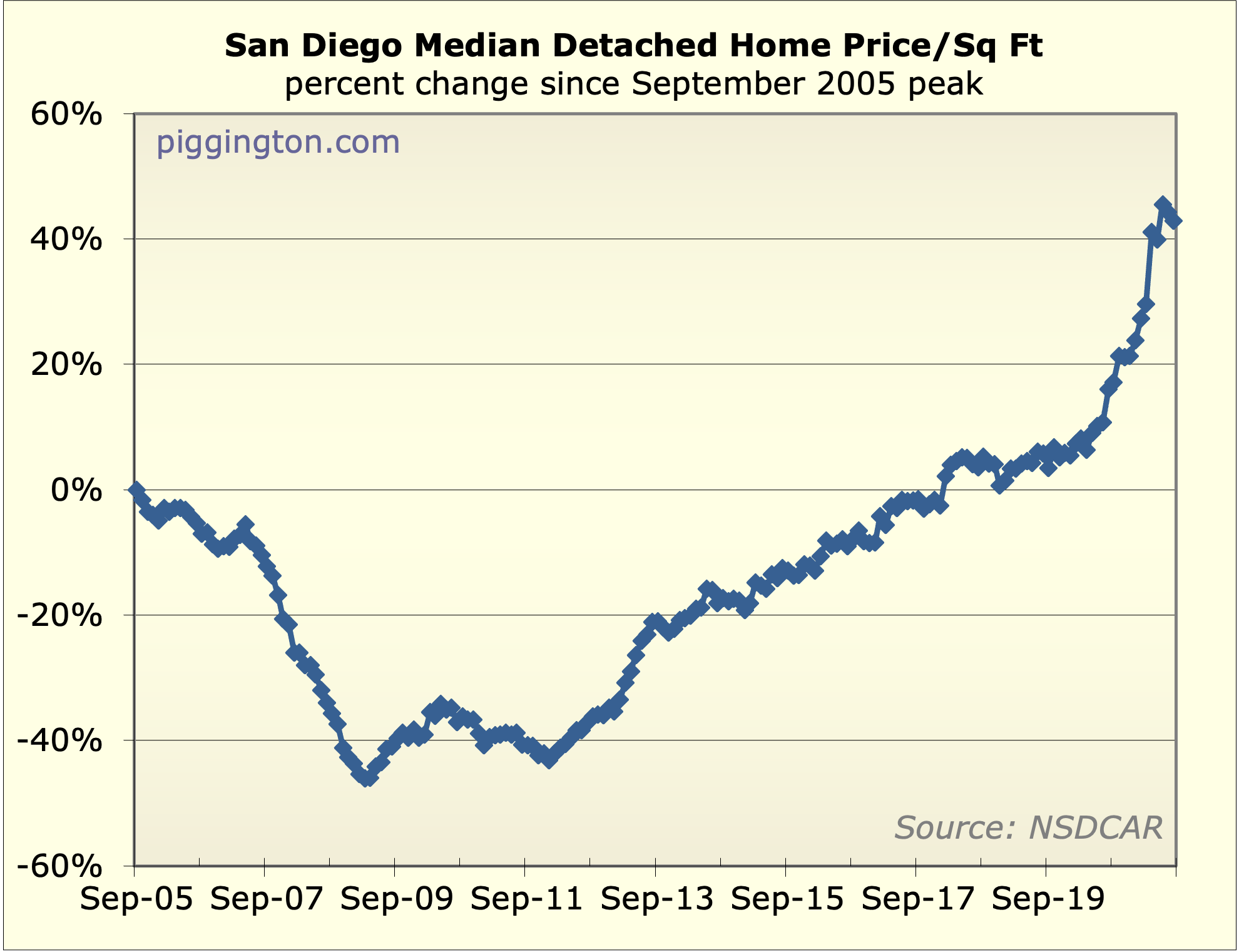

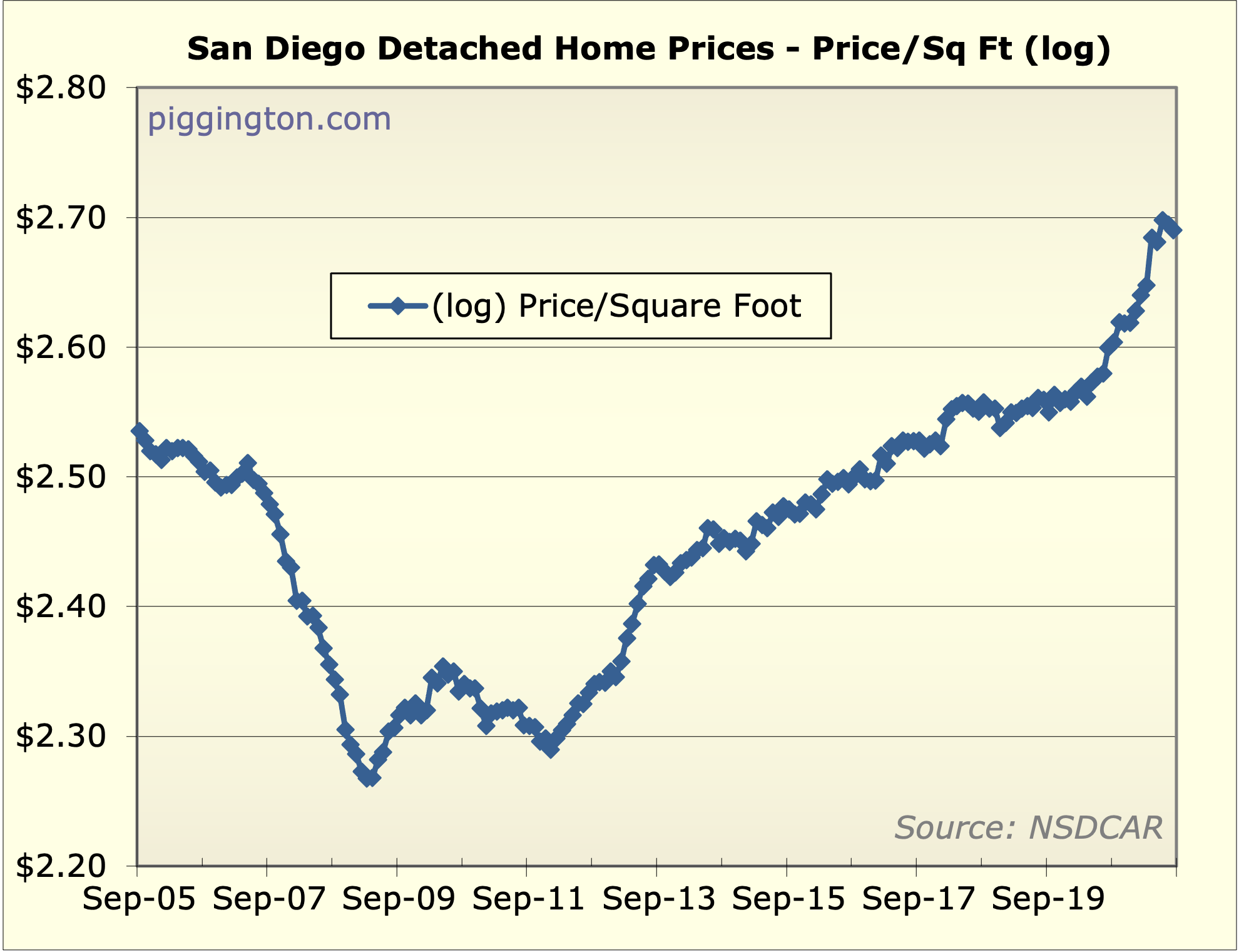

There’s no need to overthink this: under 2 month supply means double digit price gains, and under 1.5 means 15-30% increases. We have no relative valuation problems either, as our gains are matched or nearly so in every other major market. Rapidly increasing construction costs further constrain supply.

We have billions flowing into pretend internet money that cost nothing to produce and has no utility, and arguable stock and bond bubbles.

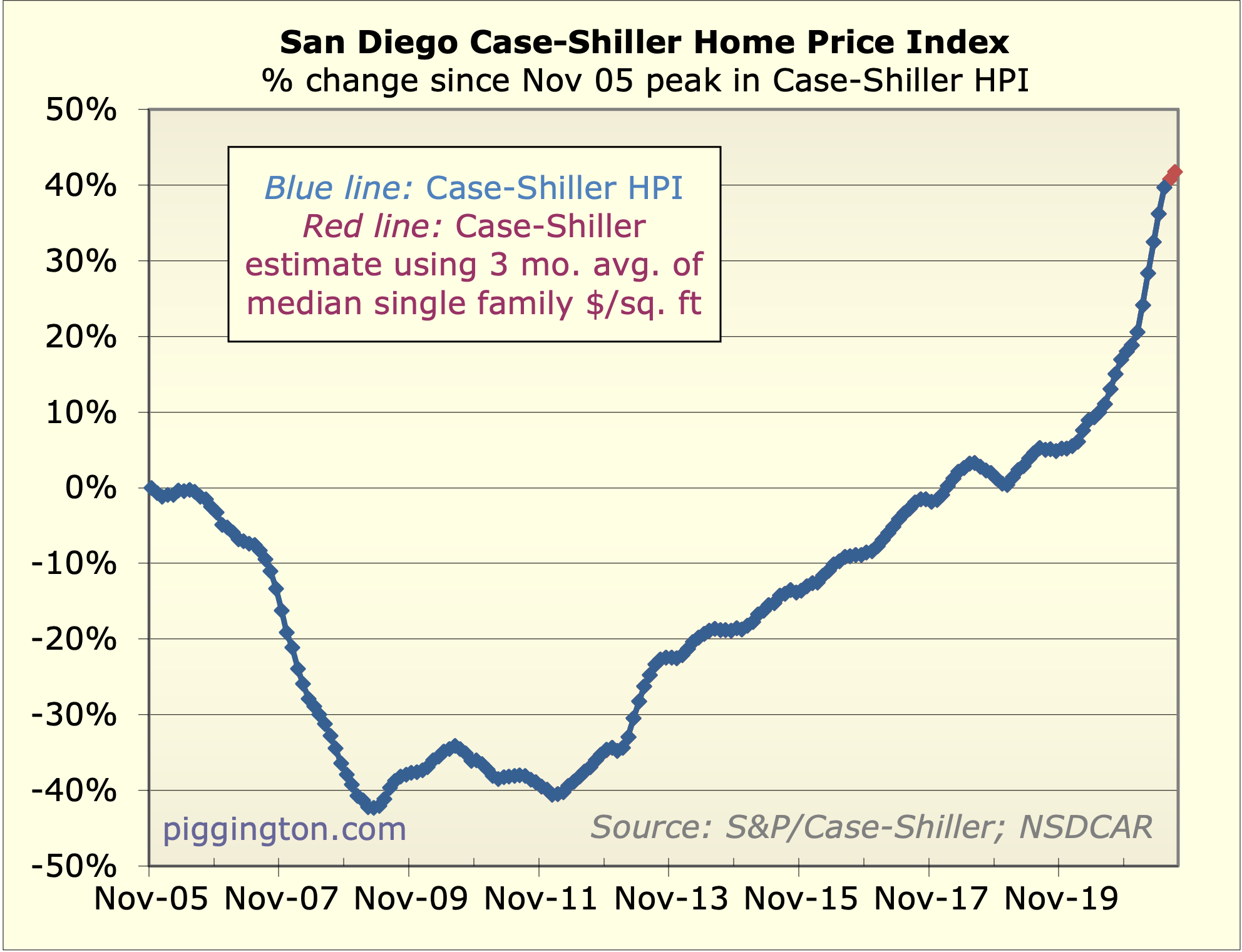

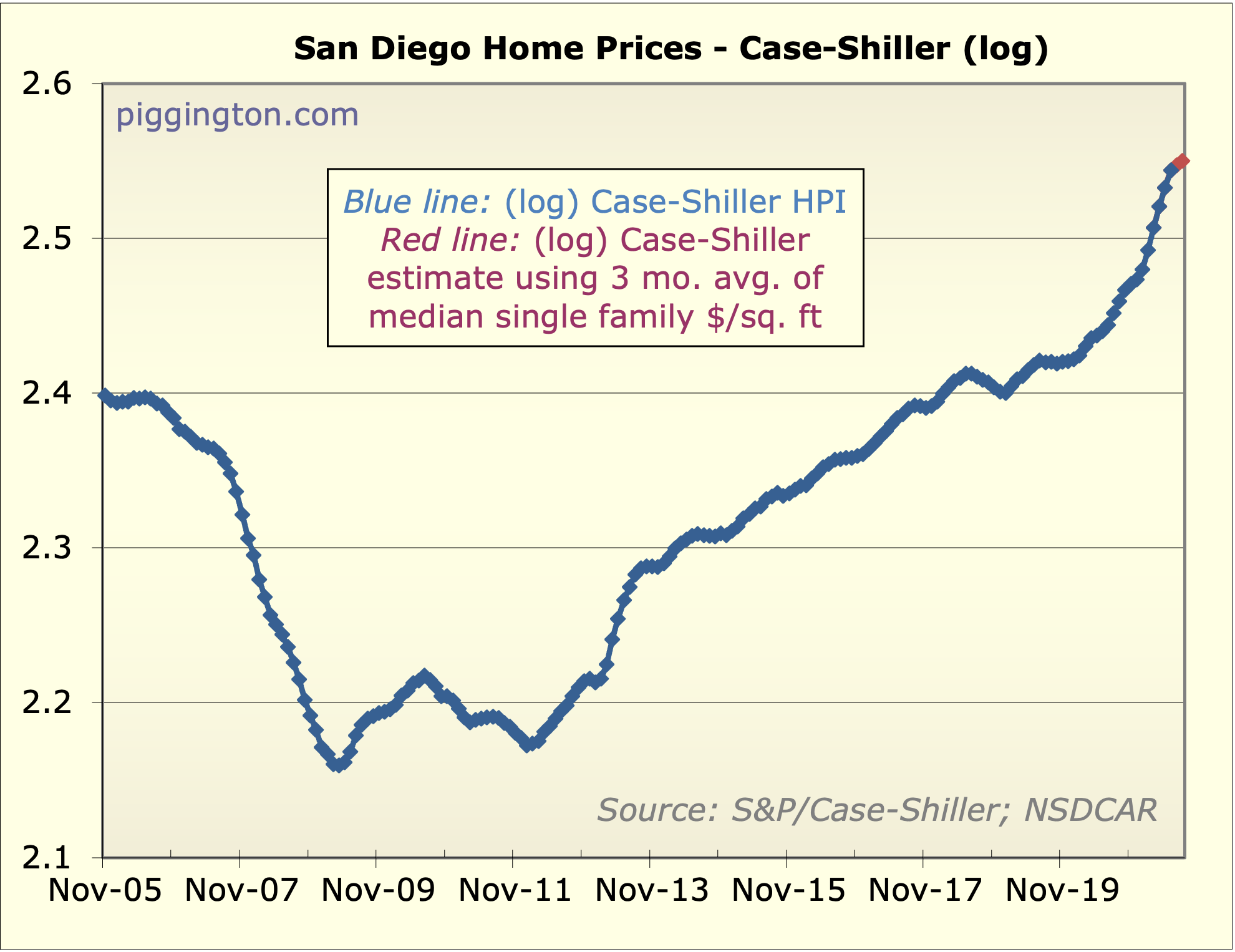

A 40-50% increase in SD residential prices is very possible in the next 2 years.

And if the US rates fell, not to the negative rates of Japan and Germanic Europe, but to Italy’s 0.7%? That gives us 1.7% 30 year mortgages. Italy has weaker growth, lower private wealth and higher debt to GDP than the USA.

gzz wrote:

A 40-50% increase

[quote=gzz]

A 40-50% increase in SD residential prices is very possible in the next 2 years.

[/quote]

I’m not going to say this CAN’T happen… but I’ll say that if it does, it will mean that we’re in an even bigger bubble than the mid-2000s (and that it will subsequently crash).

I’ll say it’s not gonna

I’ll say it’s not gonna happen and I’d place a big bet because if it does the big bet will be very small in the grand scheme of things. It would require the massive inflation gzz says doesn’t exist

I disagree that a 50%

I disagree that a 50% increase is a “bigger bubble” than 2006.

In 2006 the 10 year averaged 4.8%. Yet the yield on local condos after tax/hoa was under 2%.

Here, the situation is reversed, the real estate to treasury yield ratio is about 2.5, not ~0.3 as in the 2006 bubble.

Now maybe treasuries are part of an “everything bubble” that will collapse in a deflationary depression. However, the case that SD RE at plus 50% is a bad relative value destined to relatively crash is unsupported.

SDR: no contradiction in believing in strong asset price growth and very low inflation. That’s been happening for a long time in Denmark and Switzerland for example.

Another valuation metric is

Another valuation metric is SP500 earnings yield. In 2006 in ranged between 5.5 and 6% compared to the bubbly yield here of 2% and less.

Now it is 2.88% for the SP500 and about 3.3% of local real estate. If we were to rise 50% and go to 2.2%, we’d remain in the general ballpark of stocks, unlike 2006.

San Diego real estate is a luxury, positional, and durable good whose demand we can expect to rise faster than general economic growth. Comparing it to the largest luxury good stocks, LVMH yields 1.4%, Hermes 1.6%, and Ferrari is 2.5%.

Deflation watch: just stocked up on whole unbroken cashews at $4.20/lb at grocery outlet. Cheapest price I have ever paid!

Apple has cut the price of an iphone 11 64GB from $699 two years ago to $499 now. A 28.8% price cut.

Similarly, the iPhone 8 64 was $699 when introduced in 2017, and a highly improved version called the SE is $399, a 43% cut over 4 years, more with a hedonic adjustment.

All Piggs on this board

All Piggs on this board should just collectively throw down the gauntlet and buy the remaining inventory so Rich can have this well deserved break.

Then renters and anyone else can reminisce about the days it was still possible to buy a home in San Diego before the “cartel” took over and bought all the remaining homes.

This would serve many purposes: once the “cartel” completes its purchase.

There will be no more need to debate relative price increases or for that matter to forecast anything at all.

We could then switch to the British system of “freehold” so you effectively get a 100 year lease when you buy so realtors can still have some action.

Some academics wrote a paper

Some academics wrote a paper that sound like my comments here going back many years. I agree!

Full article:

https://www.kansascityfed.org/documents/8337/JH_paper_Sufi_3.pdf

Here’s a hostile write-up of the article which I found unconvincing.

https://www.ineteconomics.org/perspectives/blog/why-the-rich-get-richer-and-interest-rates-go-down