I don’t have too much to add to what I wrote last month, so I’ll

mostly stick to charts for now and refer people to last

months’ writeup for the color commentary.

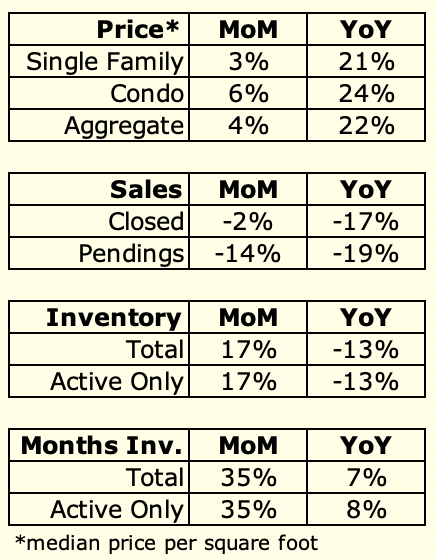

Just a couple quick notes on April:

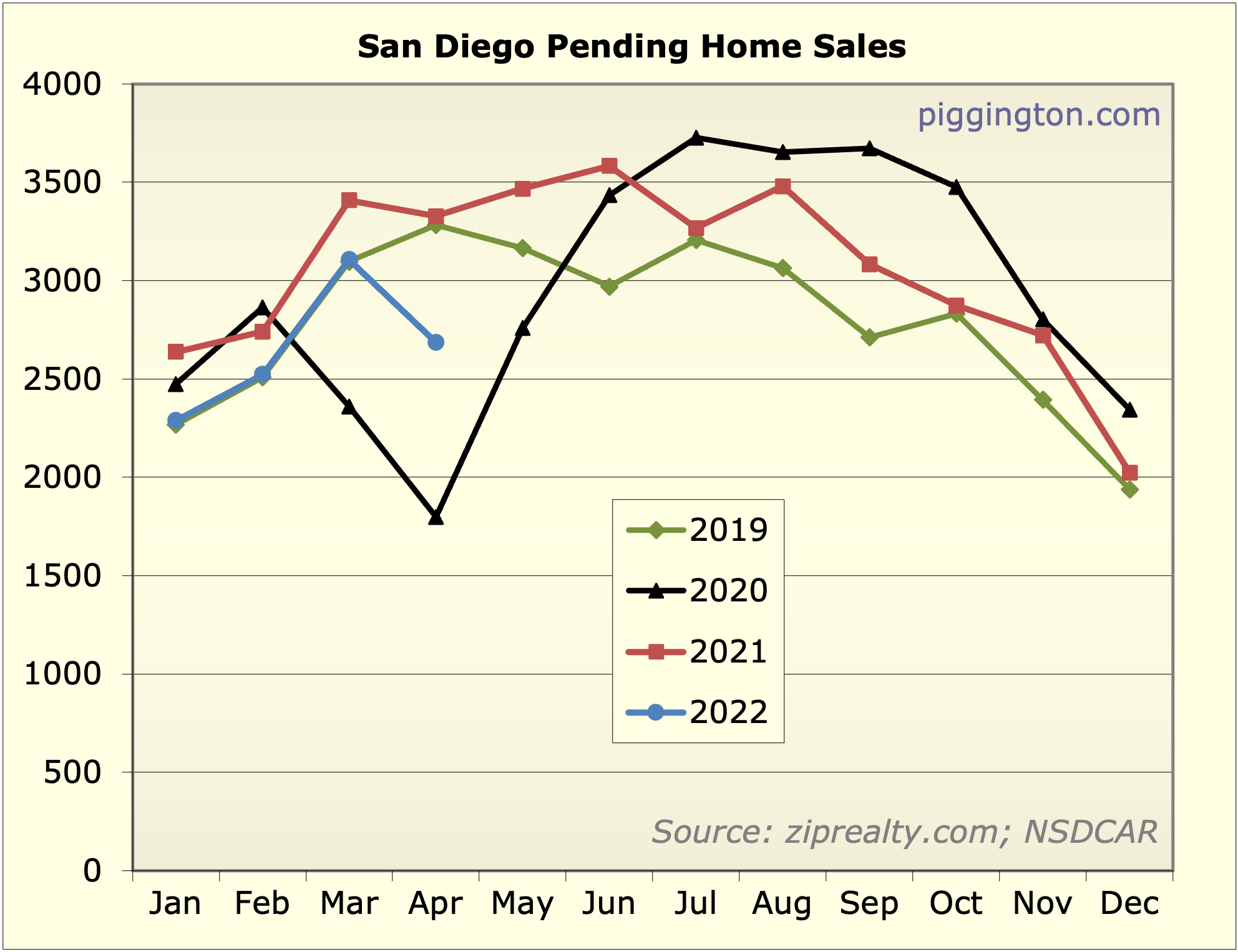

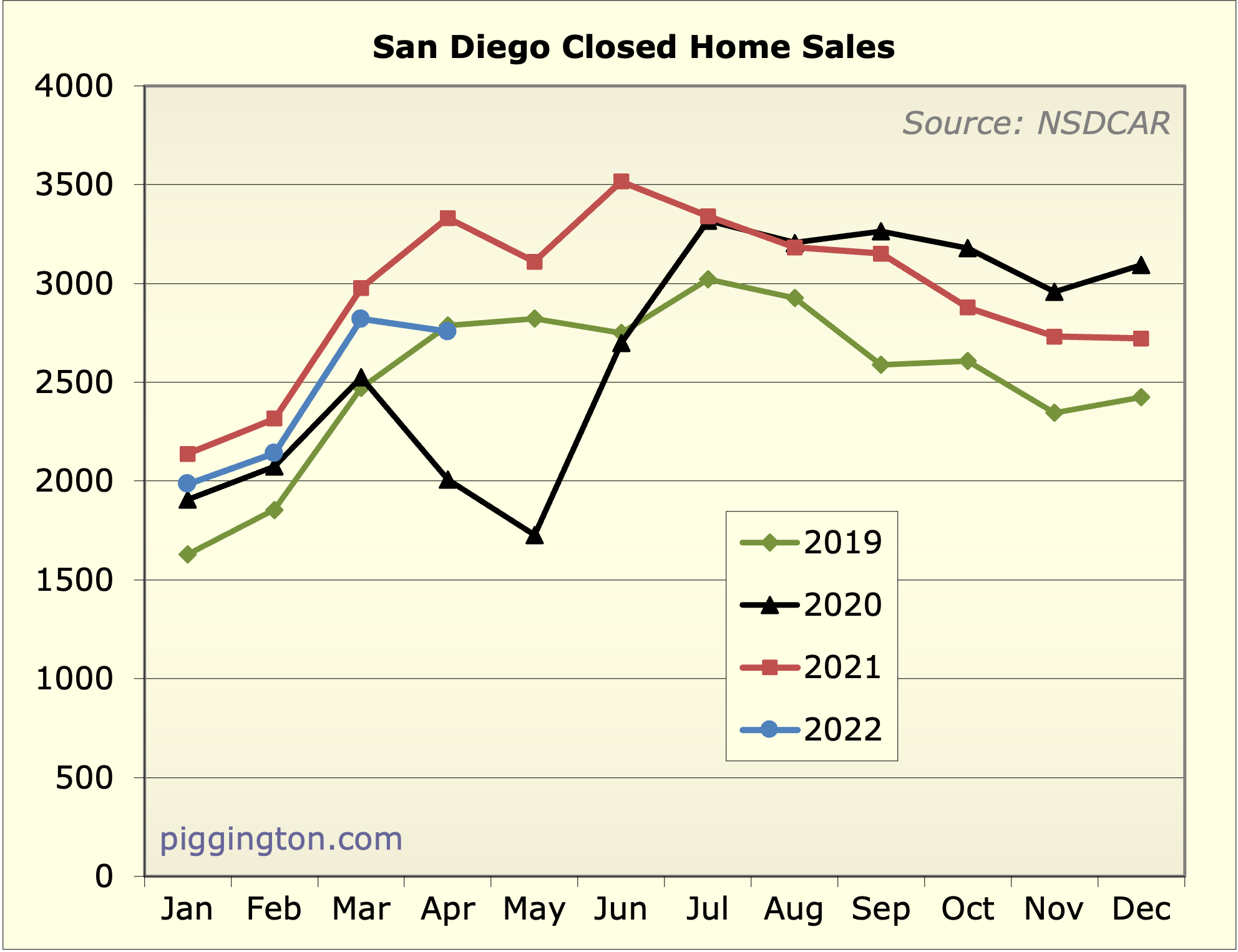

1. There was was a notable drop in pending sales:

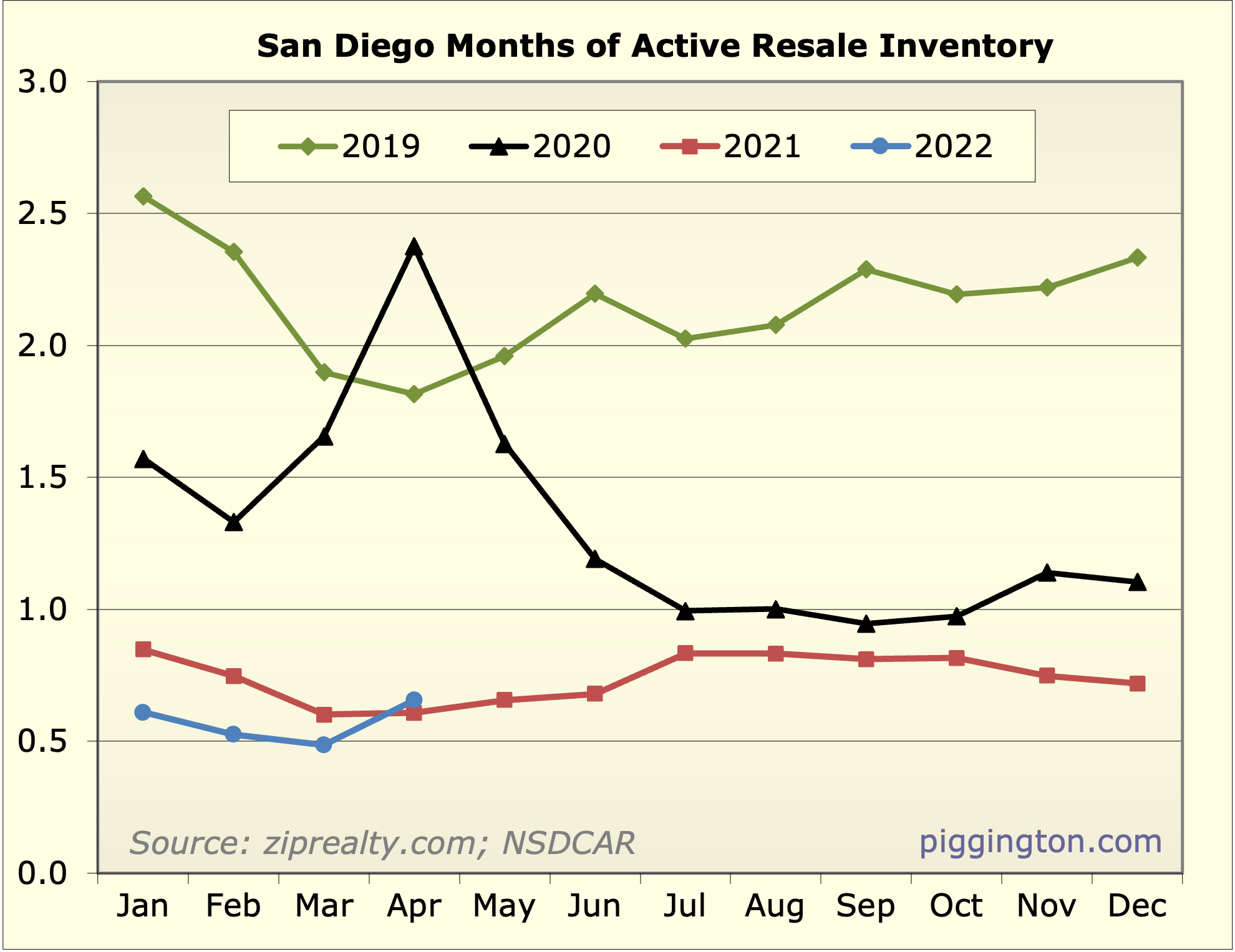

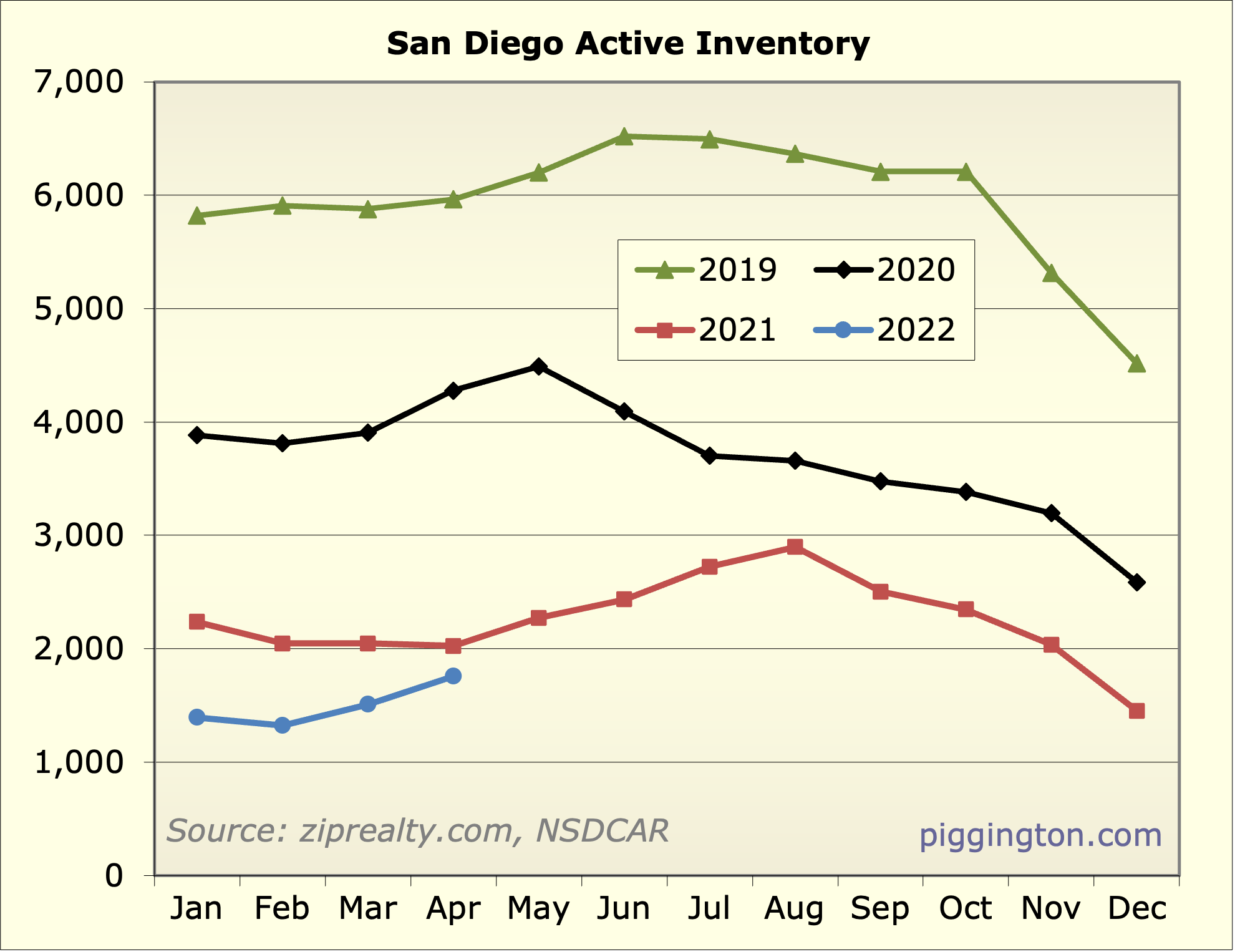

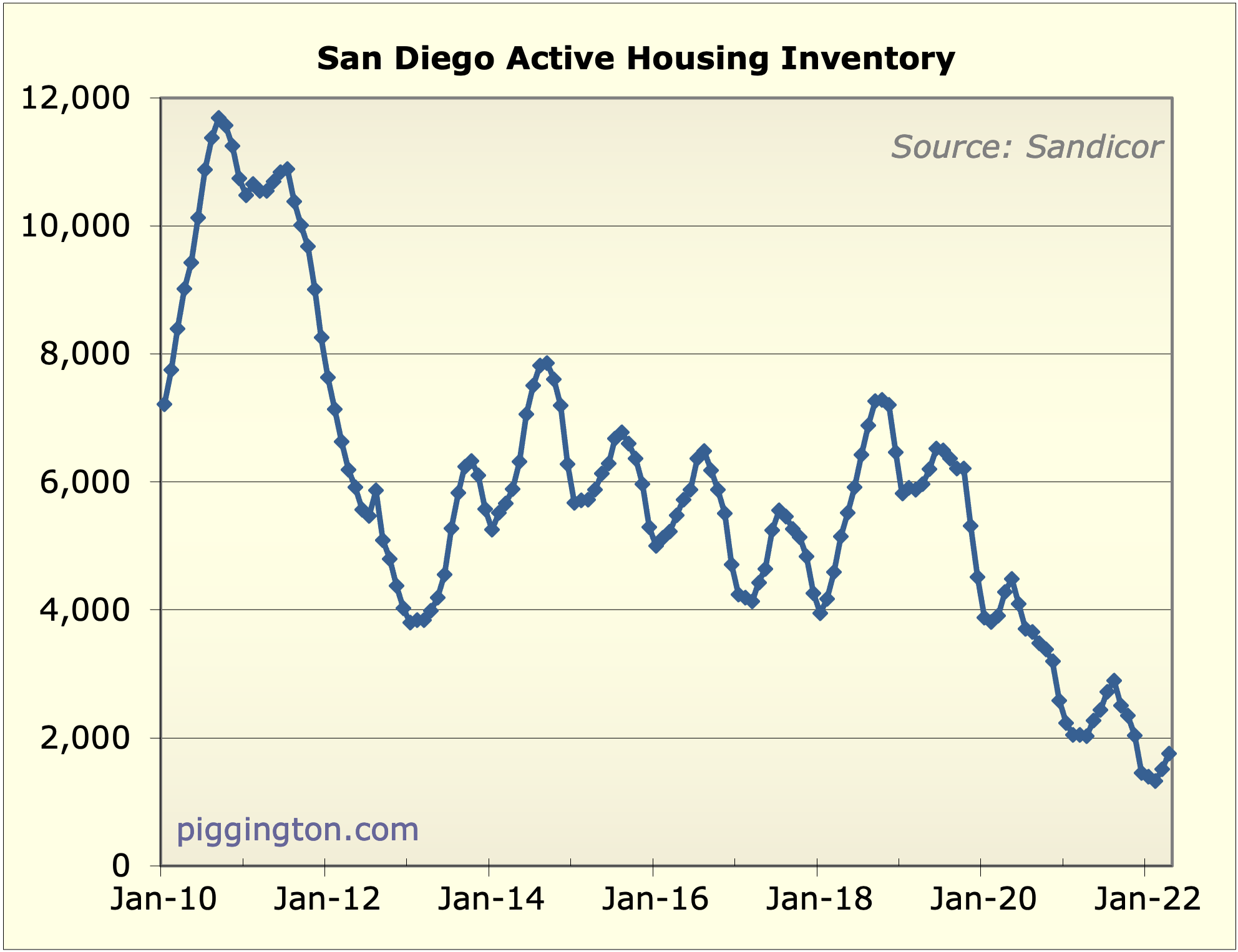

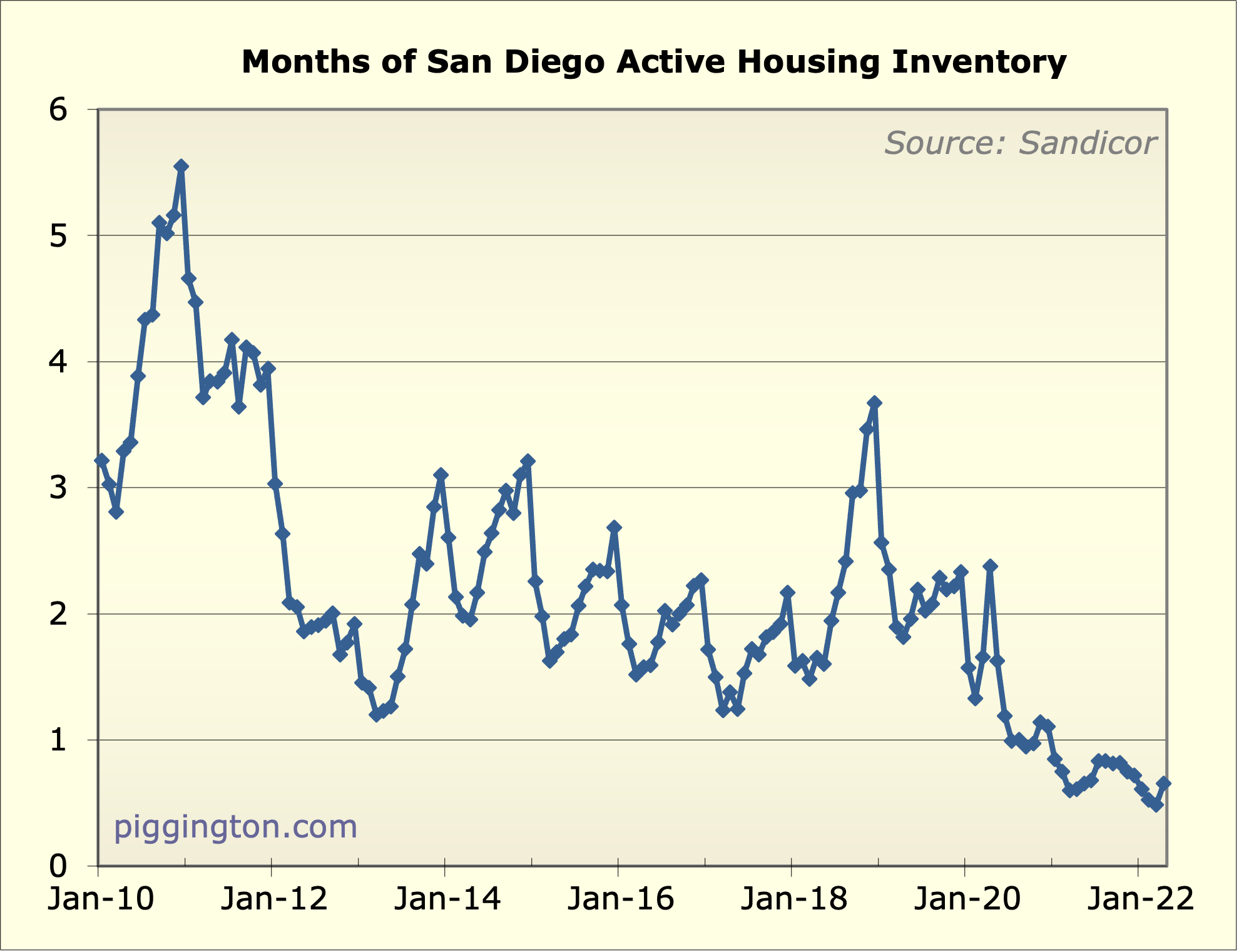

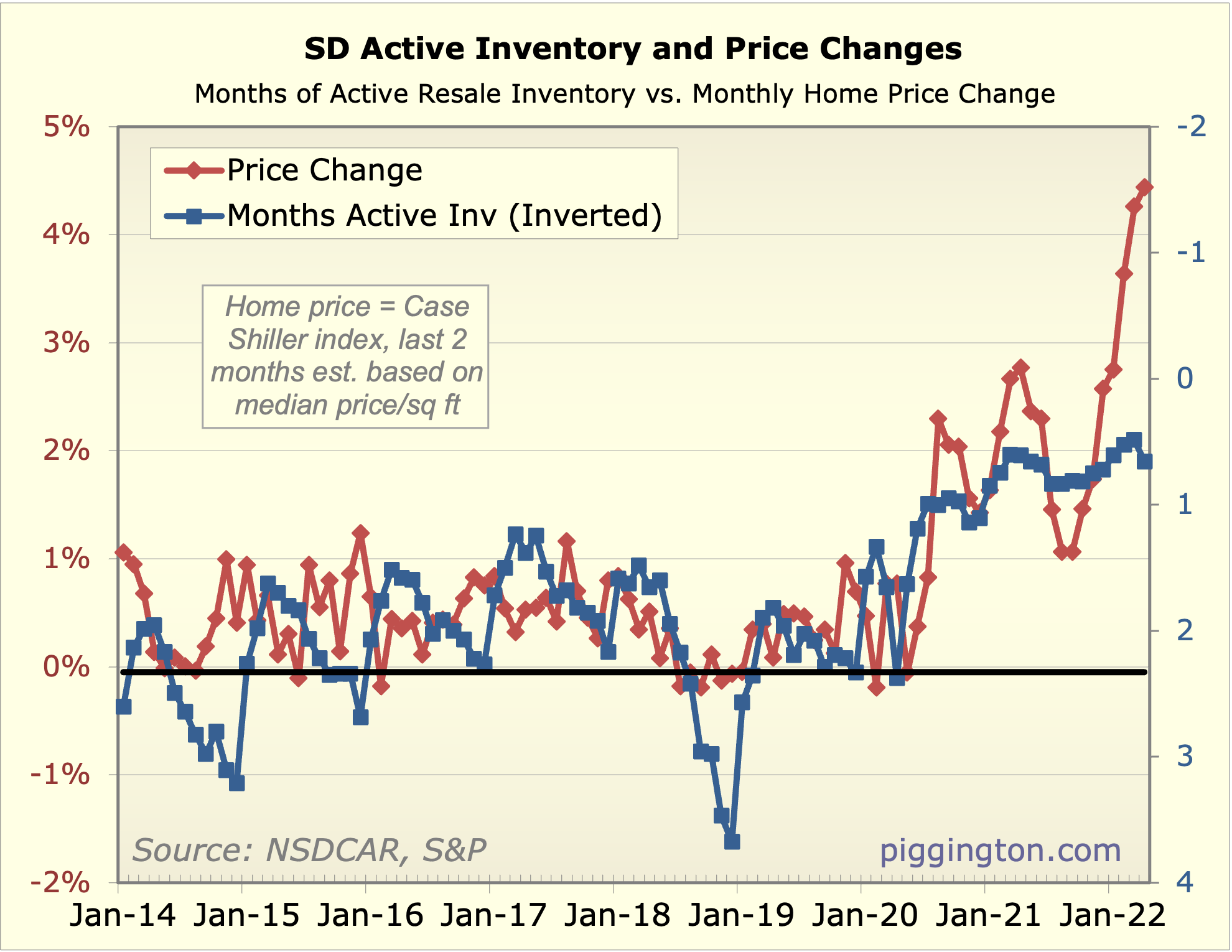

2. This pushed months of inventory above last year’s level (but

still extremely low in the grand scheme of things):

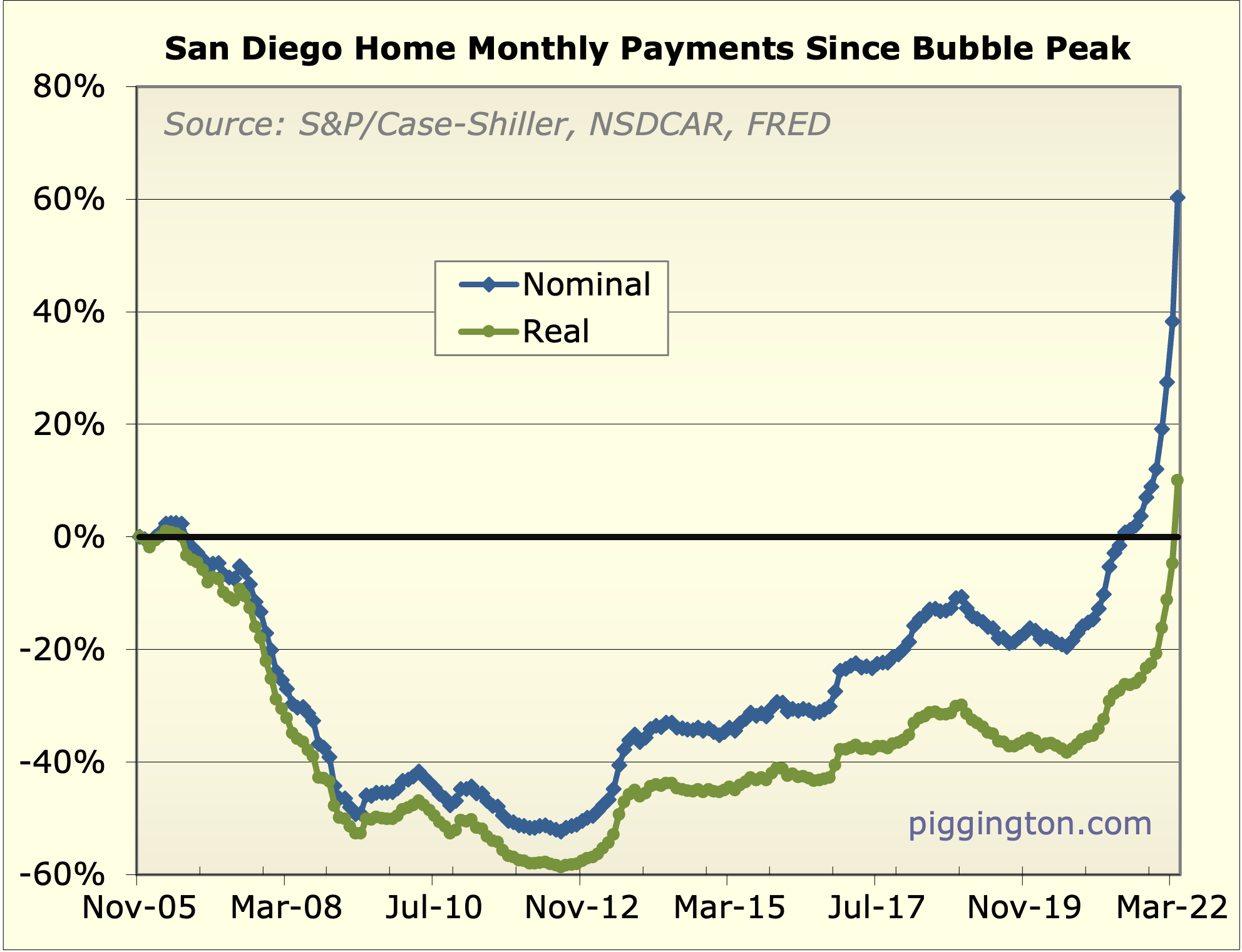

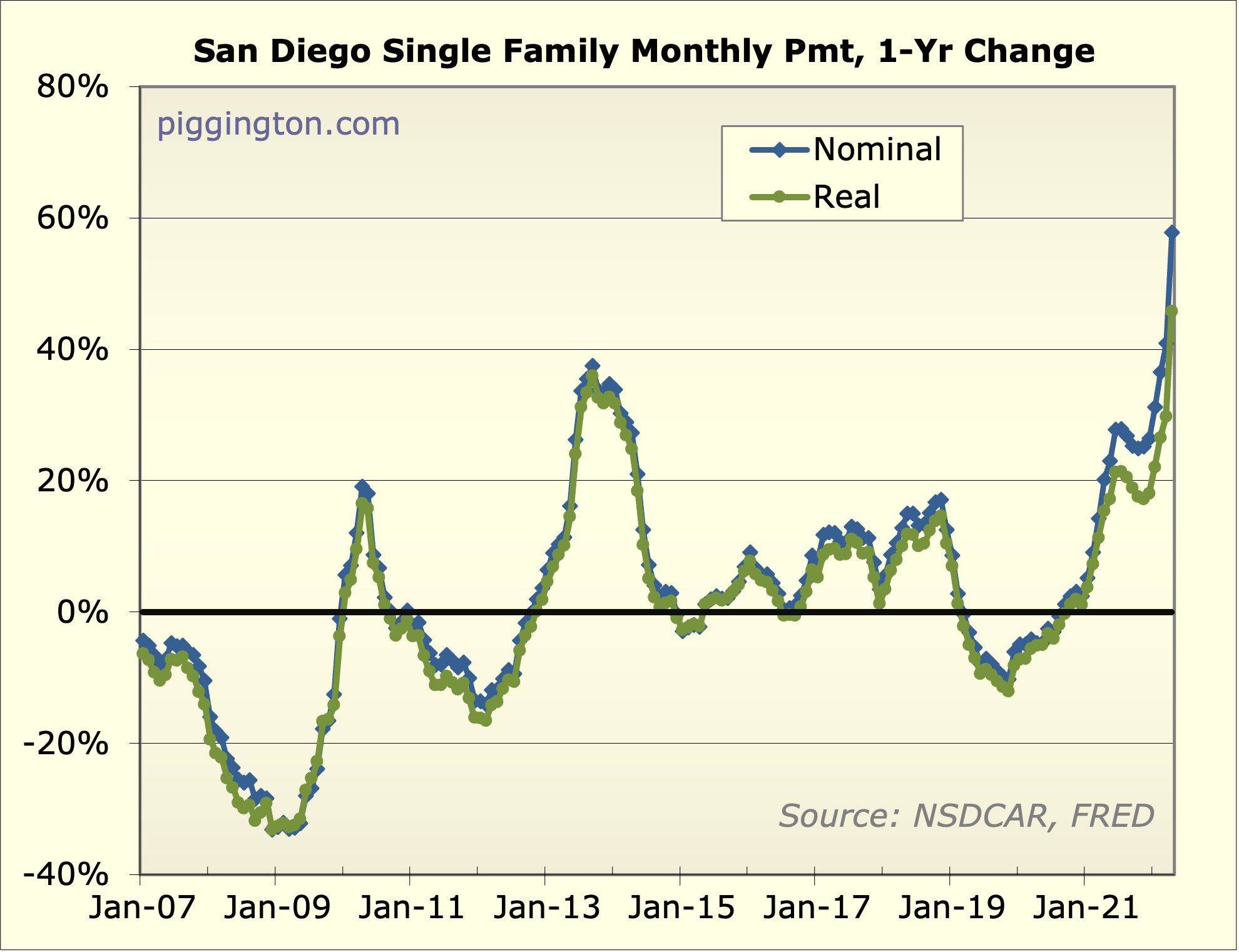

3. Inflation-adjusted monthly payments are now comfortably above the

bubble peak:

Given the lags in real estate transactions (rate locks, escrow

periods, etc.), it might take some time for the full impact of the

higher rates to be realized. The next couple months should be more

informative on that front.

In the meantime – more graphs below and some thoughts/ranting on

these valuations in the prior

entry.

I think we’ll still have

I think we’ll still have another strong month or two until we begin finding out where we’re going. Demand is definitely slowing but its impact will continue to be muted unless we get a surge of inventory of which there has been no signs of yet

sdrealtor wrote:I think we’ll

[quote=sdrealtor]I think we’ll still have another strong month or two until we begin finding out where we’re going. Demand is definitely slowing but its impact will continue to be muted unless we get a surge of inventory of which there has been no signs of yet[/quote]

IIRC in 2010-11 the only people selling were deaths, divorces and debt.

The debt problem in 2008 (overstretched people, speculators) might not be so bad this time? Considering Rich’s chart shows that non-investor folks are locked at historically normal monthly payment levels. No idea about investors, are they all using margin to buy up houses? will the lack of appreciation affect their portfolio and prevent further purchases.

bewildering wrote:sdrealtor

[quote=bewildering][quote=sdrealtor]I think we’ll still have another strong month or two until we begin finding out where we’re going. Demand is definitely slowing but its impact will continue to be muted unless we get a surge of inventory of which there has been no signs of yet[/quote]

IIRC in 2010-11 the only people selling were deaths, divorces and debt.

The debt problem in 2008 (overstretched people, speculators) might not be so bad this time? Considering Rich’s chart shows that non-investor folks are locked at historically normal monthly payment levels. No idea about investors, are they all using margin to buy up houses? will the lack of appreciation affect their portfolio and prevent further purchases.[/quote]

Nationally I have no idea but around here I think the impact of investors is overstated. It seems that most homes were sold to people who wanted to live in them. We don’t have nearly the debt situation we had back in the bubble. As much as anyone wants to think they know what’s gonna happen this is not like the bubble and things should progress very differently. It’s hard to imagine a surge of sellers under current market conditions but inventory will still grow simply with declining demand to balance out the market. Where we go from there will just have to wait and see

Given how much rent has

Given how much rent has increased (it didn’t increase much during the last bubble), where would people move to if they sell? Not to mention, what a few people have been saying here already, that most of the people have locked into a 30 years fixed at a much much lower rate.

If i had to pick a wild card

If i had to pick a wild card it would be long time owners of rental properties exiting particularly heirs of such properties. Not a huge impact but could bring some more unexpected supply. I seem to be hearing more stories from tenants that owners are selling around me

sdrealtor wrote:bewildering

[quote=sdrealtor][quote=bewildering][quote=sdrealtor]I think we’ll still have another strong month or two until we begin finding out where we’re going. Demand is definitely slowing but its impact will continue to be muted unless we get a surge of inventory of which there has been no signs of yet[/quote]

IIRC in 2010-11 the only people selling were deaths, divorces and debt.

The debt problem in 2008 (overstretched people, speculators) might not be so bad this time? Considering Rich’s chart shows that non-investor folks are locked at historically normal monthly payment levels. No idea about investors, are they all using margin to buy up houses? will the lack of appreciation affect their portfolio and prevent further purchases.[/quote]

Nationally I have no idea but around here I think the impact of investors is overstated. It seems that most homes were sold to people who wanted to live in them. We don’t have nearly the debt situation we had back in the bubble. As much as anyone wants to think they know what’s gonna happen this is not like the bubble and things should progress very differently. It’s hard to imagine a surge of sellers under current market conditions but inventory will still grow simply with declining demand to balance out the market. Where we go from there will just have to wait and see[/quote]

I wouldn’t want you to use a single data point, but for our 7 local properties, I have 6 mortgages, 5 fixed and one variable. Cost of funds is 2.89% on average (the variable is at 1.5%/product no longer offered). With 69% equity and a low cost of funds, I see no reason to sell. Average rent is now $4300 per month and 3-5% escalation is likely for next few years.

If I did sell, it would be one or two tops.

Now the property in Moscow is a different story.

Tenant moved out weeks before the war and it’s empty now.

It may take a while to figure that out. Fortunately owned for 20 years, we have long gotten our money out 4X but still hard to see a smooth exit anytime soon, might take 10 years. Oh well.

A few thoughts. When I was

A few thoughts. When I was referring to there not being a lot of investors I was referring to there not being a lot of institutional SFR investors. There are plenty of mom and pop investors like escoguy who I beleive hold primarily for passive income (he can correct me). The recent surge in rents was something few if any saw coming and will encourage them to hold that much longer and stronger (again EG can comment if this is the case).

Sorry to hear about the Moscow property but more importantly hope any family/friends on that side of the world are ok. Situations like this also are a good example of why international individuals buy homes here

sdrealtor wrote:A few

[quote=sdrealtor]A few thoughts. When I was referring to there not being a lot of investors I was referring to there not being a lot of institutional SFR investors. There are plenty of mom and pop investors like escoguy who I beleive hold primarily for passive income (he can correct me). The recent surge in rents was something few if any saw coming and will encourage them to hold that much longer and stronger (again EG can comment if this is the case).

Sorry to hear about the Moscow property but more importantly hope any family/friends on that side of the world are ok. Situations like this also are a good example of why international individuals buy homes here[/quote]

SD

In our case, the portfolio of rentals was all about creating a reliable stream of income so early retirement is a viable/predictable option.

The recent rent increases have been a positive and would cause us to be less likely to sell but some optimization may still happen i.e. sell one for a higher returning property.

Even before the run-up, the chances of becoming distressed were quite low, today a reversal would need to be that much more dramatic and for now none of the inventory numbers indicate a potential softening in rents.

Still for now, my risk management involves continuing to work until a few things settle out. I.e. the current stock market and the war in Ukraine/inflation situation.

Some of this may be with us for a while, at least months.

We will deal with Moscow in due time. The people we know in Ukraine (where my wife is from) are safe but some have had exposure to war activities which is more stressful than most of us will encounter.

Thank your sharing that and

Thank your sharing that and hope things improve for them though there will no doubt be scars. My ancestors were in Czarist Russia but to my knowledge all got out decades ago. As an 18 year old my maternal grandfather was literally on a train to fight in Siberia and my great grandfather rescued him off a moving train on horseback. Just like out of an Indiana Jones movie. They then fled to Poland and ultimately here in America coming through Ellis Island. Very fortuate for that act of bravery which changed the course of my family history.

Ive seen two recent posters come on these front page threads calling for a big time crash and asked both if they are selling their homes. Have yet to hear an answer and would be interested to hear if they are or not

Got this emailed to me

Got this emailed to me earlier. It addresses that the strongest markets have been the outlying suburbs of large cities. We’ll see whether that persists over time

https://www.zillow.com/research/urban-suburban-shift-31025/

Mortgage rates are probably

Mortgage rates are probably at or near cycle’s peak.

1. Giant demand destruction in every rate-sensitive borrower.

2. Decreased supply of government debt. 2022 will be the single largest reduction in both US and global government borrowing ever.

3. Inflation will drop as business investment drops.

4. The wealth effect of ~15 trillion in losses in the stock and bond markets worldwide will lead to decreased spending by both businesses and consumers.

5. The massive temporary COVID transfer payments are wound down and now largely spent.

6. Mortgage/treasury spreads will decrease as refi demand is very low without a concomitant decrease in investor demand for GSE and private MBS.

I think we are still midway into a huge housing boom, and in the early stage of an energy boom.

Oil is still way below prior real price peaks, and the world economy is larger and demand is just as inelastic as ever.

I think the Saudis and Gulf states don’t like Biden (“soft on Iran” in their view) and will be disinclined to help his re-election by increasing production. They are also the only producers operating below capacity.

SDR, death rates of the

SDR, death rates of the elderly are probably going to get much lower the next couple years, as Covid pulled forward deaths that otherwise would have happened in 2022-2025. So we had a wave of more inheriting heirs in 20 and 21 now we’ll see the opposite.

—

CalcRisk is getting mildly bearish:

https://calculatedrisk.substack.com/p/what-will-happen-with-house-prices?s=r

Maybe he’s right for national prices, but I don’t agree for San Diego.

gzz wrote:SDR, death rates of

[quote=gzz]SDR, death rates of the elderly are probably going to get much lower the next couple years, as Covid pulled forward deaths that otherwise would have happened in 2022-2025. So we had a wave of more inheriting heirs in 20 and 21 now we’ll see the opposite.

—

CalcRisk is getting mildly bearish:

https://calculatedrisk.substack.com/p/what-will-happen-with-house-prices?s=r

Maybe he’s right for national prices, but I don’t agree for San Diego.[/quote]

Maybe other places but In SD particularly up by me COVID deaths were very subdued relative to the rest of the country.

I’ve been reading CR. He’s not bearish at all he’s data based and pragmatic. I agree with his rational

He laid out three possible scenarios and put odds on each one happening. What more balanced could you ask for?

Just did a guesstimate of the

Just did a guesstimate of the effect of Covid deaths on the local market. In an average month, based on excess mortality estimates, about 70 extra SHFs were inherited by non-spouses in Sam Diego county over pre March 2020 baseline.

Of course such heirs often hold, so the effect is even lower. But as we transition from elevated to depressed death rates among seniors, that’s another small bullish factor.

It is also possible I suppose Covid could be some combination of Epstein Barr virus and permanently harm health for many and the flu that reoccurs each winter in mutated form, and permanently increases mortality.

Rich, it was a great treat to

Rich, it was a great treat to see that your site is alive and well! Your insights back in ’06 were a breath of fresh air. I look forward to reading your thoughts as this tricky, messy situation before us unwinds.

Thanks JG… nice to hear

Thanks JG… nice to hear from you.

(highly offensive and totally

(highly offensive and totally irrelevant conspiracy theory bullshit deleted by admin)

jg wrote:(highly offensive

[quote=jg](highly offensive and totally irrelevant conspiracy theory bullshit deleted by admin)[/quote]

Nope. I have a zero tolerance policy for disinformation on this website. I also hate political threadjacking and so does everyone else. Don’t try it again.

Thank you Rich.

Thank you Rich.

In fact on further thought

In fact on further thought I’m just banning you outright. For those that didn’t see it it was Uvalde conspiracy theory along the lines of the Sandy Hook Denier bullshit. Just the most offensive disinformation imaginable and that is a high bar. Imagine the nightmare of having your child violently killed, and then being hounded by internet nut jobs yelling at you that it didn’t happen.

Anyone who believes these vile fantasies (let alone who thinks they are appropriate to promote in the middle of a thread about SD housing) is not welcome here.

Sometimes I think wouldn’t it

Sometimes I think wouldn’t it be nice if more of the old-timers came around. Then I see crap like this and think maybe not so nice

Good call with the banning

Good call with the banning Rich.

And to bring things back to housing, which is why I’m here…

I’m curious your thoughts on this article claiming more homes are hitting the market:

https://www.nbcsandiego.com/news/local/more-home-sellers-helping-supply-shortage-in-san-diego-realtors-say/2960279/

and I’ll be curious to see if your next article shows an increase in inventory.

Yes, it will… inventory

Yes, it will… inventory definitely increasing.

bibsoconner wrote:Good call

[quote=bibsoconner]Good call with the banning Rich.

And to bring things back to housing, which is why I’m here…

I’m curious your thoughts on this article claiming more homes are hitting the market:

https://www.nbcsandiego.com/news/local/more-home-sellers-helping-supply-shortage-in-san-diego-realtors-say/2960279/

and I’ll be curious to see if your next article shows an increase in inventory.[/quote]

Thus far in the areas i follow inventory is building more because of a decrease in sales than an increase in new listings. I’m on a weekly call with the one economist i trust who follows socal markets and he’s been seeing the same. That is not to say it won’t change but thus far the volume of new listings has not risen much yet. I post weekly updates for Mira Mesa and NCC (South Carlsbad and Encinitas) with the data and my thoughts if you care to follow along closer. My feeling is a big drop in prices will require a big increase in new listings. Haven’t seen that yet and whether we do is still tbd. FWIW i think this Spring we overshot a bit on prices and will see some giveback through the rest of the year. Beyond that we’ll have to see. It could go either way or IMO settle for a while at a relative plateau