Home › Forums › Financial Markets/Economics › salaries in the mid 90s?

- This topic has 20 replies, 11 voices, and was last updated 10 years, 3 months ago by

svelte.

svelte.

-

AuthorPosts

-

October 21, 2015 at 12:42 PM #21740October 21, 2015 at 12:58 PM #790547

Anonymous

GuestShe is wrong. Salary increases had little to do with the housing bubble as most everyone on this site already knows.

In 1995 when I graduated, starting salary for entry level BS Engineering jobs were around 40K. Obviously Sr. engineers were making much more than that.

October 21, 2015 at 3:07 PM #790556 barnaby33Participant

barnaby33ParticipantI graduated in 98 and was the lowest paid of my cohort at 45k. She must have worked for that one company that always seems to find low self esteem programmers that hate looking for a job; they’ll take anything to avoid looking. In 99 most people even the idiots were making 100k.

JoshOctober 21, 2015 at 3:25 PM #790557The-Shoveler

ParticipantIMO she was about half right, in the mid 90’s Sr engineers were getting about 70k, entry about 40k (from my experience anyway).

By 1999 it was getting closer to 100k for Sr engineers (in Socal, again from my experience).

Now about 150K

But the interest rate was about 8-9 percent at that time I think that has a greater influence on house prices IMO.

The biggest issue is the non-tech workers have not kept up for the most part.

October 21, 2015 at 4:47 PM #790561Doofrat

Participant[quote=kev374]

She claims the average salary for a Sr. Software Engineer in Southern California in the mid 90s was about $40,000/yr and today it is triple that. Hence the tripling of home prices from mid 90s to now.I think this is hogwash. Who is right here?[/quote]

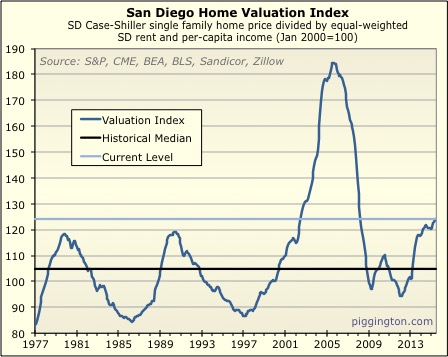

If that were the case, then the price to income ratio chart should be flat 🙂 The housing boom was driven by easy credit, lowering qualifications, and an everybody’s going to get rich mindset, had literally nothing to do with income.

http://piggington.com/images/primer/sdpricetoincome.gif

I worked as a lowly Desktop guy in 97′ and I was making $55,000/yr. as a contractor. I took a 10% (or so) pay cut a year or so later(better company full time with benefits and stock). I’d guess a software engineer would make more than some desktop guy with a fresh MCSE.

October 21, 2015 at 11:42 PM #790580an

Participant.

October 22, 2015 at 9:15 AM #790585 barnaby33Participant

barnaby33ParticipantActually in the late 90’s a freshly minted MCSE made more than a new Software Engineer. It didn’t last much more than the early 2000’s though.

JoshOctober 22, 2015 at 10:52 PM #790610mixxalot

ParticipantI was making 100k back then as a systems engineer. Now I make twice that but real estate is 10x more expensive so I feel poor.

October 23, 2015 at 6:16 AM #790611The-Shoveler

Participant10x is a bit of an exaggeration IMO, seriously not everyone can live in CV or Del-Mar (there is not enough room).

Try a bit further out.

October 23, 2015 at 7:31 AM #790615Rich Toscano

KeymasterIf she is trying to justify overall regional house prices we need to look at overall salaries, not just senior software engineer salaries.

You said mid-90s, so I will use 1995. Since 1995:

124% increase in SD per capita income

194% increase in SD home pricesSo your friend is right that home prices have tripled since the mid-1990s, but wrong that salaries have kept pace. Home prices have increased 56% more than incomes over that period.

This is specific to SD but I doubt that it’s much different for SoCal as a whole.

October 23, 2015 at 7:33 AM #790616Rich Toscano

KeymasterBTW here’s an easy visual on this… homes were cheap (compared to rents and incomes) in the mid 90s, but are about as overpriced now as they were underpriced back then.

So, in fairness, roughly half of the 56% outpacing of home prices since 1995 is attributable to home prices catching up with incomes, since they started out quite underpriced.

But it’s just plain wrong to say that incomes have kept up with home prices since the mid-90s.

October 23, 2015 at 7:45 AM #790617The-Shoveler

ParticipantIn the Mid 90’s (1994-1996) was also the bottom of the last housing bust so In this case it is kind of cherry picking your data points.

But I would agree that Most non engineers have not kept up with the Tech workers in general so that is also cherry picking (and becoming an issue on to itself but that is a different topic).

October 23, 2015 at 7:51 AM #790618moneymaker

ParticipantNice chart Rich, in 1986 interest rates were very high, in 1997 there were massive layoffs from government contractors, the 2006 bubble was from fog loans, 2009 and 2012 could be called dead cat bounces, current highs are due to low interest rates. How easy it seems to explain stuff with hind sight. I think the recent dip could be because of Qualcomm or the fear of rates going up.

October 23, 2015 at 7:59 AM #790619Rich Toscano

Keymaster[quote=moneymaker]Nice chart Rich, in 1986 interest rates were very high, in 1997 there were massive layoffs from government contractors, the 2006 bubble was from fog loans, 2009 and 2012 could be called dead cat bounces, current highs are due to low interest rates. How easy it seems to explain stuff with hind sight. I think the recent dip could be because of Qualcomm or the fear of rates going up.[/quote]

Except, some of those explanations don’t make sense. Rates were high in 1986, but they were a LOT higher in, say, 1982. The govt contractor layoffs you refer to happened in the early 1990s, not in 1997.

It’s harder than it seems to explain why valuations do what they do. All you can really know, in my view, is that if they are high they will probably eventually go lower, and if they’re low they will probably go higher… other than that, who knows.

October 23, 2015 at 8:16 AM #790623moneymaker

ParticipantThere is always lag. I remember gas rationing in the 70’s and I’m thinking there was a recession of some sort then. My brother bought his house in 1993 and rates then were around 7% which I thought were high but was really close to normal. My predictions are mostly off because I underestimate the lag, but you are right about the low/high thing. Right now house prices are high and interest rates are very low.

-

AuthorPosts

- You must be logged in to reply to this topic.