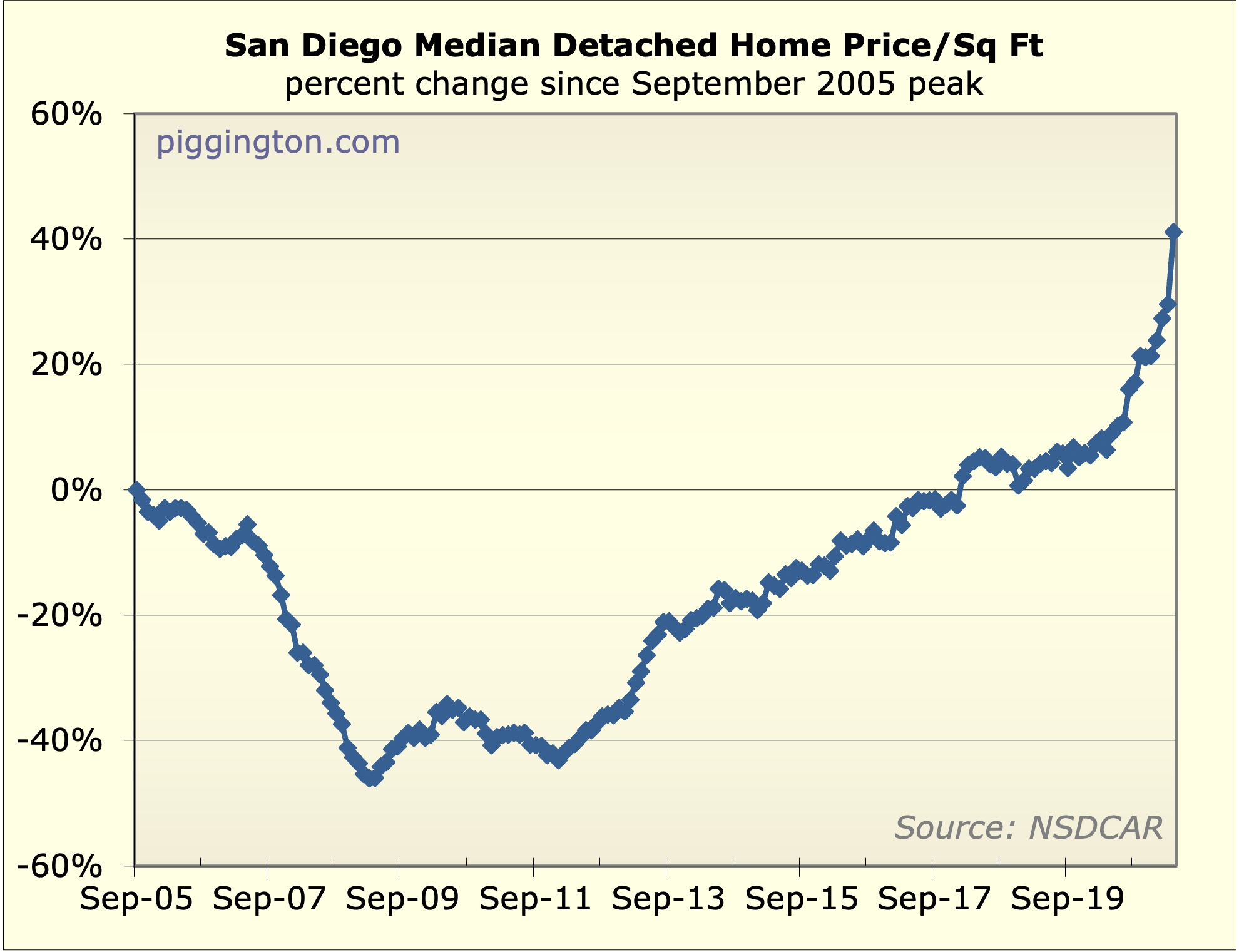

Here’s that rather alarming price chart from the prior post. The

rampup this year looks absolutely huge!

The price increase has been quite large, but the graph exaggerates

this effect. This is because the Y axis is on a linear scale… when

you are looking at a long-term compounding series like home prices,

a linear scale will have the effect of making the later moves look

bigger and the earlier moves (off of lower levels) look smaller.

Here’s a simple example: a 10% increase on 50 is 5, while a 10%

increase on 500 is 50. On a linear scale, the 50 will look a lot

bigger than the 5. But they are both just a 10% increase.

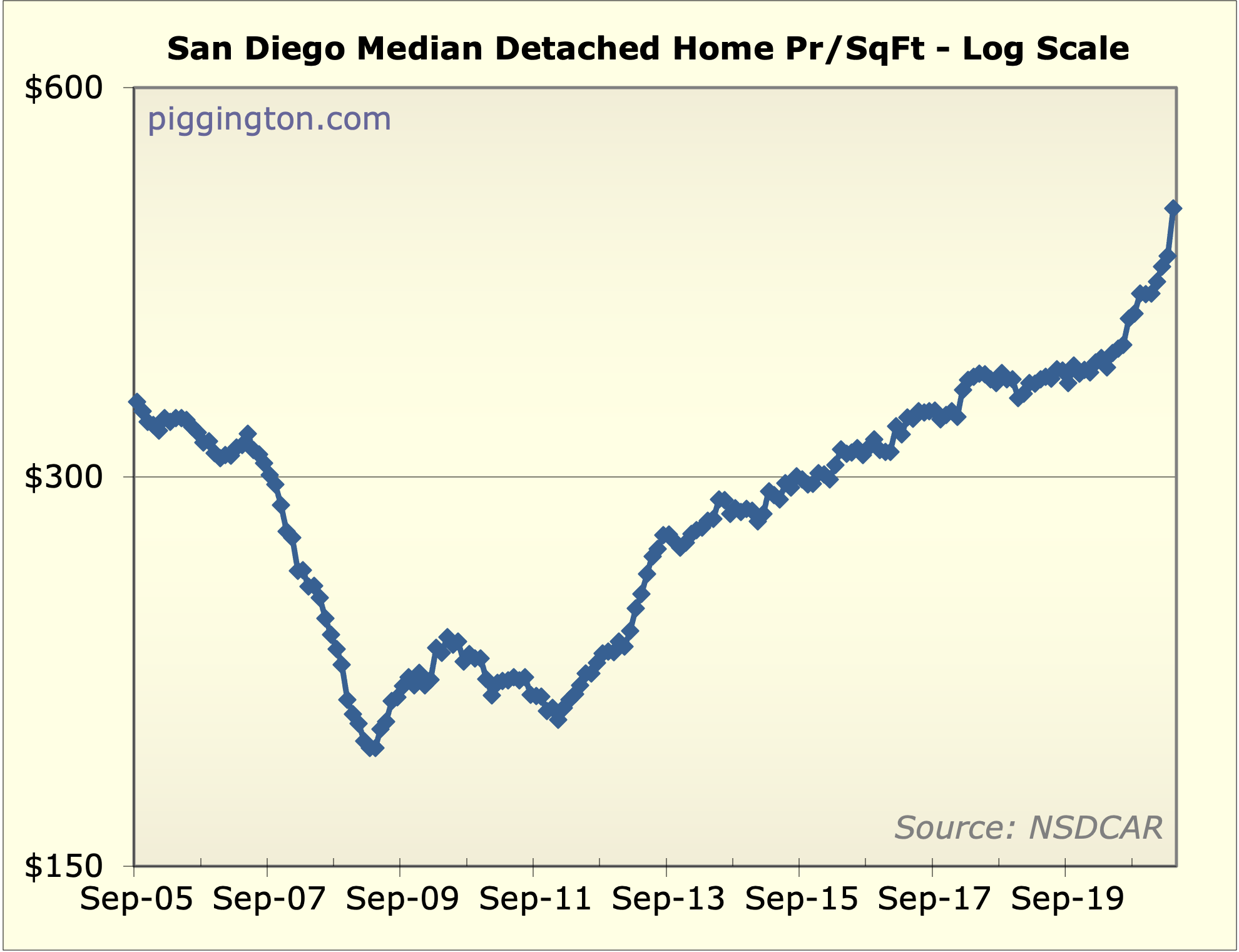

This can be addressed by using a log scale, in which the numbers on

the Y axis increase exponentially. This will make a 10% increase

always look the same, regardless of whether this entails an increase

from 50 to 55 or from 500 to 550.

Here are San Diego detached prices (pr/sqft) on log scale.

Unfortunately Excel kind of sucks at making nice looking log axes

(or maybe I suck) but it gets the idea across:

This puts the recent move in better perspective. For instance — in

the first chart, the recent move looks significantly bigger than the

2011-13 move. In fact, the current move is actually smaller than

2011-13 (in percent terms, but that’s what we really care about).

The recent price increase is substantial. But it’s not as big as the

linear graph made it look. Going forward I’ll be doing both linear

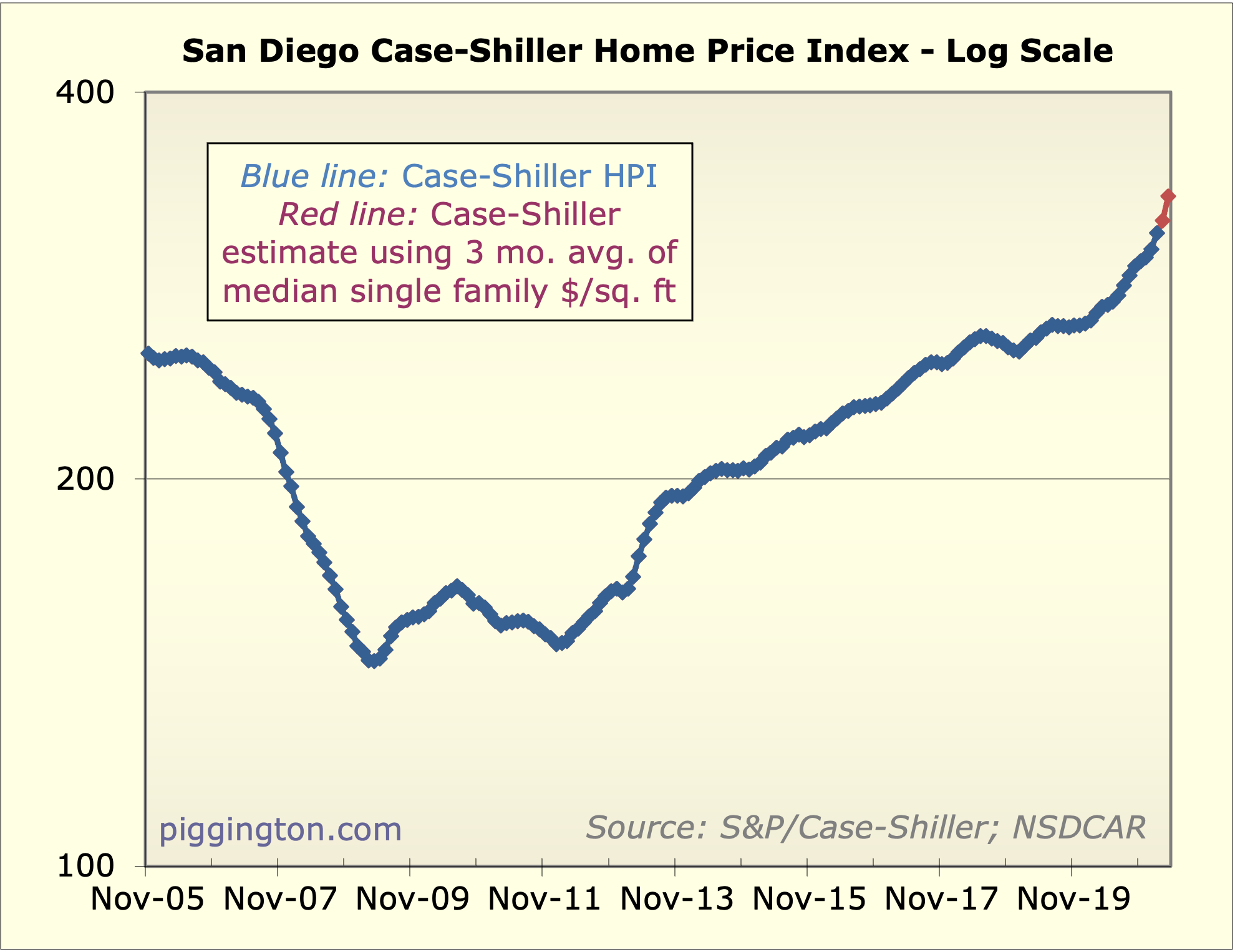

and log charts for the long-term price graphs. Here’s a log graph

for Case-Shiller:

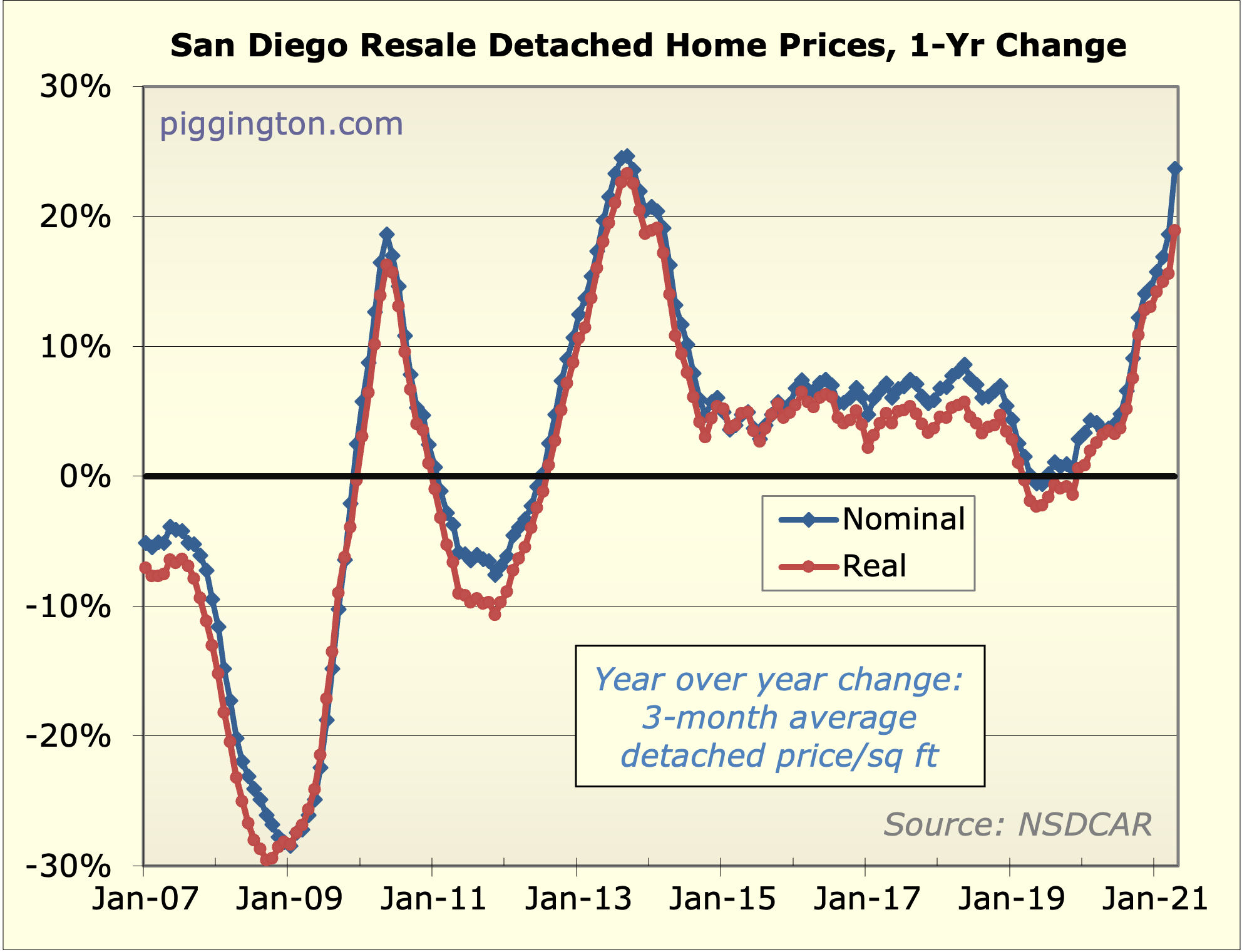

Another way of comparing to the 2013 boom is by looking at the

year-over-year price increase:

In nominal terms, we are at just about the same annual increase as

the peak (in terms of annual increase) of the 2013 boom. However, in

inflation-adjusted terms, we are still below the 2013 rate of

change.

The concern now is that the recent price surge began at a much higher

valuation level than the 2013 one. More on valuations in the next

post.

This is another case where

This is another case where the data does not match up with what happens on the street. The price increases of homes this year is significantly bigger and more jarring than the “2013 boom” for two reasons the first of which is the current increases came bigger, faster and in a shorter period of time. They didnt happen over a few years, the majority of it happened over 2 to 3 months but that is not the biggest difference.

What you see in the 2011-2013 data is a seismic shift in the mix of homes and how they were sold.

The period of 2009 to 2011 was the peak short sale market. It was the opportunity of lifetime to get incredible deals on just about anything.

In a short sale you had a seller who was indifferent to price. The objective was not to get top dollar, it was to get a buyer that would hang on through the lengthly short sale approval process at a price the lender would accept. These were far from the open market arms length sales we see now. There were some organic sales going on at relatively higher prices. But the short sales were the vast majority of sales and market makers.

In 2012 short sales were greatly declining and by the end of 2013 they were essentially gone having been replaced by organic sales.

This is not to say prices were not rising on each individual home between 2011 and 2013, they were. But much of what you are seeing is not the increase in the price of each and every home. It is a more of a shift in the market mix from lower end, distressed short sale homes sold by disinterested sellers to a move up/high end market mix sold by profit maximizing sellers with substantial equity.

Fast forward to today. Part of what we are seeing is a shift in the mix to more higher end homes being sold than ever before. Precious few entry level homes are hitting the market and we’ve never seen sales popping above $2M like we do now.

However the movement up in the price of each and every home is truly historic. It is unlike anything I have seen in 20 years by a pretty wide margin.

Rich is also onto something that its happening at a much higher valuation level. A move from $500K to $550K is much easier for a buyer to swallow than a move from $1.5M to 1.65M even at the higher rates in 2013 compared with much lower rates today

The charts agree that what

The charts agree that what we’ve seen in 2021 alone is unprecedented. I was more trying to put perspective on the size this surge thus far vs. the 2011-13 one (with 2011-13 having had more time to play out).

Regarding compositional effects, I agree this is always something to be careful of.* But this is mostly solved by the Case-Shiller index which is why I place by far the most weight on CS. Unfortunately it’s pretty laggy as you know so I also look at pr/sq ft and try to triangulate.

* (For those who maybe weren’t around back during the bubble years, here is a good example of why this is so important. Back when the bubble had just peaked and prices started to decline, the median price held steady for a while. This is because fewer low-priced homes were selling than had been before the peak — so the composition of homes sold shifted upwards. This composition effect masked the fact that prices were actually declining. Anyone looking at the median price — which was most people back then — didn’t know that the bubble had already burst.

This is why I think the median price is pretty useless. Price/sqft is a big step in the right direction by at least removing home size from the equation. But Case-Shiller, which actually is calculated by comparing repeat sales of the same home, is the most accurate gauge of market-wide prices.)

Rich Toscano wrote: But

[quote=Rich Toscano] But Case-Shiller, which actually is calculated by comparing repeat sales of the same home, is the most accurate gauge of market-wide prices.)[/quote]

Don’t tell that to sdr, he says Case Shiller is inaccurate.

deadzone wrote:Rich Toscano

[quote=deadzone][quote=Rich Toscano] But Case-Shiller, which actually is calculated by comparing repeat sales of the same home, is the most accurate gauge of market-wide prices.)[/quote]

Don’t tell that to sdr, he says Case Shiller is inaccurate.[/quote]

Dont worry, its only applicable to people that actually had the courage to buy real estate

sdrealtor wrote:deadzone

[quote=sdrealtor][quote=deadzone][quote=Rich Toscano] But Case-Shiller, which actually is calculated by comparing repeat sales of the same home, is the most accurate gauge of market-wide prices.)[/quote]

Don’t tell that to sdr, he says Case Shiller is inaccurate.[/quote]

Dont worry, its only applicable to people that actually had the courage to buy real estate[/quote]

Right, avoid the subject with some strange and weak attempt at demeaning the poster. You are great at that!

Not at all. I’ve clearly

Not at all. I’ve clearly stated my opinion on case shiller a bunch of times. While it’s the best we got, it’s horribly flawed just like your decision making. It got lags, makes no adjustments for whether a specific house has had significant additions or improvements, does not account for differences in market conditions when a home was sold by disinterested short sellers And later sold by profit seeking equity holders during the downturn and more. There I got both my point and ridiculing you in there this time. I can multitask

sdrealtor wrote:Not at all.

[quote=sdrealtor]Not at all. I’ve clearly stated my opinion on case shiller a bunch of times. While it’s the best we got, it’s horribly flawed just like your decision making. It got lags, makes no adjustments for whether a specific house has had significant additions or improvements, does not account for differences in market conditions when a home was sold by disinterested short sellers And later sold by profit seeking equity holders during the downturn and more. There I got both my point and ridiculing you in there this time. I can multitask[/quote]

All of your examples for Case Shiller “flaws” exist everywhere. So the fact that Case Shiller shows National home prices up 12% year over year cannot be discounted. You are the only person here that is clinging to the fantasy that San Diego is an outlier in this Pandemic real estate bubble.

deadzone wrote:sdrealtor

[quote=deadzone][quote=sdrealtor]Not at all. I’ve clearly stated my opinion on case shiller a bunch of times. While it’s the best we got, it’s horribly flawed just like your decision making. It got lags, makes no adjustments for whether a specific house has had significant additions or improvements, does not account for differences in market conditions when a home was sold by disinterested short sellers And later sold by profit seeking equity holders during the downturn and more. There I got both my point and ridiculing you in there this time. I can multitask[/quote]

All of your examples for Case Shiller “flaws” exist everywhere. So the fact that Case Shiller shows National home prices up 12% year over year cannot be discounted. You are the only person here that is clinging to the fantasy that San Diego is an outlier in this Pandemic real estate bubble.[/quote]

Ive never discounted that prices are up many if not most places. Its just that they are up some places considerably more. Like here. I am far from the only person who understands this.

Also the lags are different everywhere. Philadephia is NOT included in the national case shiller because the lag is too long and data too unreliable

sdrealtor wrote:Not at all.

[quote=sdrealtor]Not at all. I’ve clearly stated my opinion on case shiller a bunch of times. While it’s the best we got, it’s horribly flawed just like your decision making. It got lags, makes no adjustments for whether a specific house has had significant additions or improvements, does not account for differences in market conditions when a home was sold by disinterested short sellers And later sold by profit seeking equity holders during the downturn and more. There I got both my point and ridiculing you in there this time. I can multitask[/quote]

Very true on the lag (although that’s only ever an issue with the most recent couple of months).

This one is not correct though: “makes no adjustments for whether a specific house has had significant additions or improvements.” It does does correct for this.

True that it doesn’t account for different market conditions but I’m not sure why that matters? It’s measuring prices… how would that be distorted by different market conditions?

Probably the biggest downside to me is that it lumps all of San Diego, a giant place, into a single number. (Well it has low/medium/high priced homes, but not broken down by area).

How does it adjust for

How does it adjust for improvements? A house could have $200K in improvements and resell a year later for more simply because of that. That would be shown as market appreciation unless at least of portion of those improvements were subtracted from the higher price. How could they possibly assign a cost or even a value to the improvements added? That information exists nowhere except in the receipts of the owner. It is impossible to adjust for this.

House sells by disnterested shortseller in 2011 for 150K and similar home sold by equity seller goes for $200K the same month. Two years later, they both resell for $225K. How much appreciation was there in the market?

Maybe you take an average? Ok now there are 3 short sales and 1 traditional sale like this. Did the appreciation go down or did the mix cause the appreciation to go down?

sdrealtor wrote:How does it

[quote=sdrealtor]How does it adjust for improvements? A house could have $200K in improvements and resell a year later for more simply because of that. That would be shown as market appreciation unless at least of portion of those improvements were subtracted from the higher price. How could they possibly assign a cost or even a value to the improvements added? That information exists nowhere except in the receipts of the owner. It is impossible to adjust for this.

[/quote]

Something to do with how it treats price outliers… I don’t totally remember. It’s in the CS methodology document.

[quote=sdrealtor]House sells by disnterested shortseller in 2011 for 150K and similar home sold by equity seller goes for $200K the same month. Two years later, they both resell for $225K. How much appreciation was there in the market?[/quote]

The average of the two. It doesn’t matter why someone sold or how they were feeling at the time — what matters is the price, that’s what CS is reporting, correctly. This is how price indexes work.

I’m not saying that the scenario you described is not analytically interesting, but it’s not a valid criticism of CS.

But these are not price

But these are not price outliers. Homes are sold in a wide range of conditions. There is simply no way to adjust for this as the background info does not exist. I cant stress this enough. this information DOES NOT exist anywhere

Assume short sale is 1 and traditional sale is 5. Average is 3.

This time 4 short sales at 1 and only 1 traditional sale is 5. Average is now 1.8.

Same houses sold for same prices but index has changed with no underlying change in the value of a home. Its a change in the mix

Indexes work best with things like stock where all items are homogenous. Every home is unique and no index can account for that.

Furthermore I have poured over data for a couple decades. The recorded sales prices do not adjust for whether there were concessions made that are often significant.

Condo sells for $300K. Next month another sells for $310K with a credit back to buyer of $310K. Or maybe a realtor buys one direct from seller and rather than taking a commission he buys it for $285K. That would show up as a decline in vlaue. This kind of data is not collected in sales data and would be counted as appreciation or depreciation rather than simply a change in terms.

Case Shiller is an index and measures changes in an index but it does not accurately reflect what is happening to the value of any given home.

Also this deadzone/sdr back

Also this deadzone/sdr back and forth is annoying. It’s the new Brian…. every thread has to be threadjacked to continue this fight.

Talking about whether someone is a realtor or not, or whether they did or did not buy real estate at a given time, is just ad hominem. My view is that if you are resorting to personal attacks, you’ve lost the argument, or at very least, a lot of credibility.

Can we please stick to the facts and steer clear of the personal attacks and grudge matches? It is getting very tedious.

BTW in fairness it seems that dz keeps starting this (though sdr keeps rising to the bait) so I will specifically ask you, deadzone, to back off.

Thank you and you are

Thank you and you are correct.

BTW I still think it is very important that the 2013 rise happened from an over shot bottom and a transition from short sales to traditional sales.

The more recent increase has come at a time when most were calling a market top and for a reversal. That makes this most recent price action that much more remarkable.

sdrealtor wrote:Thank you and

[quote=sdrealtor]Thank you and you are correct.[/quote]

Thanks brother.

[quote=sdrealtor]BTW I still think it is very important that the 2013 rise happened from an over shot bottom and a transition from short sales to traditional sales.

The more recent increase has come at a time when most were calling a market top and for a reversal. That makes this most recent price action that much more remarkable.[/quote]

I agree that backdrop is interesting, but it doesn’t invalidate the CS price index. It just gives those values context. (As does, eg, the rate backdrop).

Rich Toscano wrote:Also this

[quote=Rich Toscano]Also this deadzone/sdr back and forth is annoying. It’s the new Brian…. every thread has to be threadjacked to continue this fight.

Talking about whether someone is a realtor or not, or whether they did or did not buy real estate at a given time, is just ad hominem. My view is that if you are resorting to personal attacks, you’ve lost the argument, or at very least, a lot of credibility.

Can we please stick to the facts and steer clear of the personal attacks and grudge matches? It is getting very tedious.

BTW in fairness it seems that dz keeps starting this (though sdr keeps rising to the bait) so I will specifically ask you, deadzone, to back off.[/quote]

Sure I agree this is tedious but not sure why you are singling me out for the personal attacks, I think you have it backwards. SDR is the undisputed king of personal attacks. The only reason I even jumped into this was because I saw him attacking other posters in his typical arrogant, condescending manner and chose to call him out. To further exemplify sdr’s insatiable need to attack people, he just revived a 15 year old thread just so he could take a pot shot at Poway Seller, calling her a “train wreck”. What kind of weirdo does this?

But given that sdr generates about 50% or more of the comments on piggington web site these days, I guess you need to protect him.

deadzone wrote:Rich Toscano

[quote=deadzone][quote=Rich Toscano]Also this deadzone/sdr back and forth is annoying. It’s the new Brian…. every thread has to be threadjacked to continue this fight.

Talking about whether someone is a realtor or not, or whether they did or did not buy real estate at a given time, is just ad hominem. My view is that if you are resorting to personal attacks, you’ve lost the argument, or at very least, a lot of credibility.

Can we please stick to the facts and steer clear of the personal attacks and grudge matches? It is getting very tedious.

BTW in fairness it seems that dz keeps starting this (though sdr keeps rising to the bait) so I will specifically ask you, deadzone, to back off.[/quote]

Sure I agree this is tedious but not sure why you are singling me out for the personal attacks, I think you have it backwards. SDR is the undisputed king of personal attacks. The only reason I even jumped into this was because I saw him attacking other posters in his typical arrogant, condescending manner and chose to call him out. To further exemplify sdr’s insatiable need to attack people, he just revived a 15 year old thread just so he could take a pot shot at Poway Seller, calling her a “train wreck”. What kind of weirdo does this?

But given that sdr generates about 50% or more of the comments on piggington web site these days, I guess you need to protect him.[/quote]

Well I guess you’re not capable of a high road. Peruse the threads and my conversations with all other posters are collegial. Its you not me.

As for the 15 year old thread that was an attempt to get some more old timers to come back and share their experiences. We have had an increase in visits by oldtimers and I hoped to get more contributing. I could not care less about PS.

FWIW it came out of an offline convo with Coronita where he pointed out that even people who bought at the prior peak came out in great shape if they just held on. Not as great as others but certainly sitting in a home that is now up 50 to 100% of their peak purchase is nothing to sneeze at.

And Id take that last comment as a personal attack on Rich’s integrity. Poor form….very poor form

For this particular thread I

For this particular thread I guess I am to blame but it did prompt a discussion on Case Shiller which is relevant.

deadzone wrote:But given that

[quote=deadzone]But given that sdr generates about 50% or more of the comments on piggington web site these days, I guess you need to protect him.[/quote]

Hahahahaha…. that is… let’s put it very charitably and say that is misguided.

Anyway you can see who started it up in this thread. I’m sure I could — if I wanted to spend time doing this, which I absolutely do not — find plentiful examples of an sdr market comment followed by your “that’s realtor propaganda” bs.

I mean, if you disagree, great. Explain why in logical, respectful terms. “You’re a realtor” isn’t an argument. For that matter, foaming at the mouth about the Fed isn’t much of an argument either.

With that said I agree that sdr likes to stir the pot which is why that post was addressed to both of you. I just felt it was only fair to mention that it seems like you are usually first to drag things into the gutter.

Rich Toscano wrote:deadzone

[quote=Rich Toscano][quote=deadzone]But given that sdr generates about 50% or more of the comments on piggington web site these days, I guess you need to protect him.[/quote]

Hahahahaha…. that is… let’s put it very charitably and say that is misguided.

Anyway you can see who started it up in this thread. I’m sure I could — if I wanted to spend time doing this, which I absolutely do not — find plentiful examples of an sdr market comment followed by your “that’s realtor propaganda” bs.

I mean, if you disagree, great. Explain why in logical, respectful terms. “You’re a realtor” isn’t an argument. For that matter, foaming at the mouth about the Fed isn’t much of an argument either.

With that said I agree that sdr likes to stir the pot which is why that post was addressed to both of you. I just felt it was only fair to mention that it seems like you are usually first to drag things into the gutter.[/quote]

Of course I was just joking about the “need to protect him”. But I do think it is fair to say he generates 50% or more of the overall commentary on this site so that was no exaggeration. I also don’t agree that I am the fist to drag things into the gutter. Just look at the last paragraph of the Poway Seller revived thread, that kind of commentary is uncalled for garbage and is all you need to know about what kind of person sdr is. Due to his high volume of comments on here he is allowed to be a bully, and anyone who calls him out gets the attacked.

You know nothing about what

You know nothing about what kind of person I am. Many of the posters on this site know me personally. You Won’t find anyone that knows me personally who agrees in the slightest. You’ve had a pathetic vendetta against me for over a decade. pretty much since you first arrived here. Rich has seen that and he just called you out for it but you keep digging a deeper grave.

Your obsession with me is more telling than anything and speaks to your integrity. I didn’t stop you from doing anything. I’ve helped many people here and beyond achieve great success. Dare I say, I’ve changed the personal fortunes of hundreds of people. I’ve walked away from much more business in my career than I’ve done and I’ve done a ton. My integrity has never been questioned by anyone that actually knows me. Keep digging your hole

You are truly delusional sir.

You are truly delusional sir. I’ve posted very infrequently on this site in the last 10 years. It is you that seems to have a vendetta, perhaps you are still butt hurt about some comment I made in 2006? Just like whatever vendetta you seem to have about poway seller that you drag her name into the mud 15 years later.

Neither have I for the last

Neither have I for the last 10 years up until about a year ago. I stopped posting around 2012. I stopped by and saw all the political ranting last year. I tried to get the conversation back to real estate which I’ve helped do to some degree. You’ve wasted no time in returning to the attacks on me since I’ve returned. Again Rich called you out for it but you can’t stop.

Well I can see I did a great

Well I can see I did a great job de-escalating that situation.

How about we leave it at that. You’ve both said your piece.

Sdr has been posting

Sdr has been posting profusely as of late. All to the tune of SD is “special” and that’s why prices are going parabolic here. No matter who questions his thesis with data provided, he rebut them with, your data is wrong because from my personal realtor experience on the ground, I know better.

Anecdotal evidence is nice, but not as nice as data and references imo.

As for personal attacks, for the record, from my perspective, sdr fired the first shot from the prev thread with,

This was in response to something dz said that was devoid of anything personal.

I do appreciate sdr’s numbers he provides. More numbers please.

I am super happy with my

I am super happy with my massive swole gainz, but anxious because I have not realized them and don’t really want to.

It’s like puberty, lots of new feelings to deal with all of a sudden. I am reluctant to even do the math on my net worth increase the past year.

I am thinking a lot about hedging by shorting a REIT.

I am already short a mall REIT, SPG. What had been a large gain there is now a small loss.

When I look at residential REITs, however, I cannot find any that look even a little overvalued. That doesn’t mean I can’t short them or buy puts, but it makes it harder.

I also buy S&P puts here and there, about $400 worth every few months.

pinkflamingo wrote:Sdr has

[quote=pinkflamingo]Sdr has been posting profusely as of late. All to the tune of SD is “special” and that’s why prices are going parabolic here. No matter who questions his thesis with data provided, he rebut them with, your data is wrong because from my personal realtor experience on the ground, I know better.

Anecdotal evidence is nice, but not as nice as data and references imo.

As for personal attacks, for the record, from my perspective, sdr fired the first shot from the prev thread with,

This was in response to something dz said that was devoid of anything personal.

I do appreciate sdr’s numbers he provides. More numbers please.[/quote]

That was hardly a personal attack. Calling someone a d bag is a personal attack but Im over it. Lets get onto what is going on. I have been posting to try and drum up more real estate talk. To get to people to tell stories about what worked for them and what they are trying to do now. I have been posting data on a couple markets for several months with commentary. It is far beyond anecdotal. It is current up to the minute data you wont get elsewhere as to what is happening right now. I do throw in anecdotes as well but the data is presented regularly, accurately and up to the minute.

The data shows exactly what I have been claiming all along, it just comes with a substantial time lag. Im trying to provide actionable information rather a synopsis of what happened 3 to 4 months ago. Im a few months ahead due the time lags it takes escrows to close and the delays in reporting. Sales I see go into escrow mid May will show up in data in August best case scenario

More numbers coming…

pinkflamingo wrote:Sdr has

[quote=pinkflamingo]Sdr has been posting profusely as of late. All to the tune of SD is “special” and that’s why prices are going parabolic here. No matter who questions his thesis with data provided, he rebut them with, your data is wrong because from my personal realtor experience on the ground, I know better.

Anecdotal evidence is nice, but not as nice as data and references imo.

As for personal attacks, for the record, from my perspective, sdr fired the first shot from the prev thread with,

This was in response to something dz said that was devoid of anything personal.

I do appreciate sdr’s numbers he provides. More numbers please.[/quote]

For the record we are both guilty of pushing the envelope on personal attacks. Although I don’t think I actually called sdr a d-bag, I referred to his comments as d-bag comments. That said, you are correct in your observation, sdr is more into what he sees on the ground, anecdotal stuff. I don’t mean to discount that, just doesn’t peak my interest as much as macro goings on.

So the article I just saw in the UT covered Case Shiller stats from March. San Diego is #2 in the nation in YoY appreciation at 19% while National average is 13%. So we are both right. RE is nuts all over the country, due to pandemic, interest rate and other factors. But San Diego is much higher than national average for whatever reasons that can be debated.

But in my view anything that happened during Covid is just complete temporary distortion so I don’t put any weight into the home sales stats for this period.

One need only go to the prior

One need only go to the prior thread to verify my claims. And I use both data and anecdotal evidence. The data I use is current and up to the minute not three to four months behind like C-S. What I’m writing about now you will be reading about in a few months. Try reading my NCC Monitor. I’ve been posting data for many months.

In my most recent past you will find data showing that there are huge variations in SD. Carmel Valley and Mira Mesa are showing about 20% appreciation in May over last year while the Bay Area target zips of Carlsbad/encinitas/4S/Del Sur are showing 30%. The variance is Much bigger than the SD vs national data variance. Different things are happening not just in SD as compared with the US but in some communities here as compared to others.

You last comment is particularly telling. You essentially said I don’t like what I’m seeing in the home sales stats for this period so I’m discounting it. I dig into many of these sales post closing to understand them better. Huge down payments if not cash, buyers coming from LA, Bay Area, Seattle, NYC with big time jobs. Nothing about that says temporary

And when I run comps for actual sales up here vs last year it’s closer to 40%. I can post example after example of that

Again your evidence of all

Again your evidence of all Bay area people moving to San Diego is anectodal, if all these buyers were leaving those other cities for Sand Diego in droves, over the long run, then prices would go down in those cities. The only way these prices keep up is if the Fed keeps the spigot on full Covid blast. Hard to imagine that would happen. IF it does, the houses everywhere may be up 40%.

Point is, no reasonable person would extrapolate what is happening during Covid to translate to long term trend. This is pure distortion and unsustainable. It doesn’t matter to me if Carmel Valley goes up 50% YoY during Covid, just means it has farther to fall if the Fed turns off the spigots.

You are doing it again. I

You are doing it again. I never said all Bay Area people nor did I say only Bay area people. Go back and read what I said over and over in this and the last thread. They are changing a few sub markets here that are appreciating much faster than the others. I never said they are coming in droves and specifically have said over and over We don’t need many to transform the landscape here over time.

Do not discount the immense power of the passage of time. I think that is one of the biggest mistakes people make. We only need 10-20 a month to completely change these sub markets. They come with cash and high salaries that are not Covid-19 dependent. I won’t even get started on the continuing wealth transfer to boomers and then from boomers. I’ve been talking about this trend for almost 20 years most of that here. The prime coastal areas of SD have been, are and will continue to fundamentally change. The horse has left the barn. It’s not coming back

sdrealtor wrote:You are doing

[quote=sdrealtor]You are doing it again. I never said all Bay Area people nor did I say only Bay area people. Go back and read what I said over and over in this and the last thread. They are changing a few sub markets here that are appreciating much faster than the others. I never said they are coming in droves and specifically have said over and over We don’t need many to transform the landscape here over time.

Do not discount the immense power of the passage of time. I think that is one of the biggest mistakes people make. We only need 10-20 a month to completely change these sub markets. They come with cash and high salaries that are not Covid-19 dependent. I’ve been talking about this trend for almost 20 years most of that here. The prime coastal areas of SD have been, are and will continue to fundamentally change. The horse has left the barn. It’s not coming back[/quote]

Yes wealthy people buying coastal property in San Diego is nothing new, its been going on for decades. There is no new insight here.

Again I have to question this idea of cash buyers. Anybody who is purchasing a multi-million dollar home with cash is by definition an investor or uber wealthy person purchasing a 2nd, 3rd, 5th home. There is no logical reason someone would purchase real estate, especially at these absurdly elevated prices, with cash when the mortgage market is this low.

This whole moving from Bay area to San Diego to remote work is the non-sense I keep hearing. For these folks, and I’m sure some do exist, there is no reason they would purchase a home in san diego with cash, even if they had it.

Its been going on but nothing

Its been going on but nothing like what is going on today. The pace went parabolic the last year.

People that werent ready to retire decided this was a good time to wrap it up.

Clients moved here from Bay Area 2 years ago. Not investors. Not uber wealthy. Mid level managers at best. Owned a home there for a while they sold for Bay Area price. Took less than half and bought a beautiful larger, newer canyon/ocean view home. Called it quits.

We only need a few of those each month to change the landscape over time.

I sit in their backyard every Friday night enjoying dinner and drinking wine enjoying the view with them. The lifestyle is the reason.

You are looking at this as if things are black and white with no middle ground. The world is mostly grey. There are lots of things moving our market not just WFH. That is another factor but not the only thing. Bring 10 WFH engineers to prime areas in SD each month and you change the market for everyone.

So I just did some back

So I just did some back testing in my neighborhood. Far from perfect but truly a small window into what is going on.

There have been 20 closed sales. I cross referenced buyers where possible with LinkedIn profiles.

7 all cash

Average down payment is 60% with none less than 30%

6 currently work for or own a business that has no presence in SD. These can be nothing other than choosing to live here and work from home. Not sure that could be any clearer. Thats 30%!

10 of them or 50% came from elsewhere.

7 of them (more than 1/3rd) from Bay Area. Others from Seattle, AZ and Canada

4 of the Bay Area folks work for companies that are based there and dont have operations here

Prices in my neighborhood are up close to 40% y-o-y. These folks are driving that

sdrealtor wrote:

You are

[quote=sdrealtor]

You are looking at this as if things are black and white with no middle ground. The world is mostly grey. There are lots of things moving our market not just WFH. That is another factor but not the only thing. Bring 10 WFH engineers to prime areas in SD each month and you change the market for everyone.[/quote]

Why do you insist the lifestyle in San Diego is so great? Specifically how is it better than Bay Area? Why would someone in great financial shape and owns their own home in the Bay area want to move to San Diego? Most people I’ve met from Bay area look down on San Diego. Just because your neighbors moved here from the bay area don’t try to extrapolate that to some type of long term trend. Again, what’s happening during Covid is a massive distortion and you can throw away any/all statistics from this year.

Again different strokes. Not

Again different strokes. Not everyone thinks like you. Not everyone has to think like me either. Just a handful and the market changes. You may not love the lifestyle but I’m heading out for a super Twilight round I can watch an ocean view sunset from then a nice dinner and wine with friends outside. Maybe not your lifestyle buy a dream for many. If you don’t love the lifestyle life affords you here why stay? Can’t be for the Affordable housing.

You asked for data, I provided it. You didn’t like it. You threw it away.

sdrealtor wrote: I’m heading

[quote=sdrealtor] I’m heading out for a super Twilight round I can watch an ocean view sunset from then a nice dinner and wine with friends outside. Maybe not your lifestyle buy a dream for many.

[/quote]

So you can’t get super twilight golf with ocean view in the Bay area?

Also, you never provide any meaningful data, just individual examples from your neighborhood or personal experience. You complain about how real economic data, most notably Case Shiller, is flawed since it doesn’t match your experience in your little bubble.

deadzone wrote:

Why do you

[quote=deadzone]

Why do you insist the lifestyle in San Diego is so great?[/quote]

Because it 100% is. We don’t need 100% of the Bay Area people to agree. We just need a steady flow of them (maybe 100-200/month) to do so and that should change the buyer pool. Especially considering the current supply level.

[quote=deadzone]Again, what’s happening during Covid is a massive distortion and you can throw away any/all statistics from this year.[/quote]If you think what happened over the last year is distortion, then are you suggesting that we’ll see a similar decline after June 15th when everything is opened back up in CA?

an wrote:deadzone wrote:

Why

[quote=an][quote=deadzone]

Why do you insist the lifestyle in San Diego is so great?[/quote]

Because it 100% is. We don’t need 100% of the Bay Area people to agree. We just need a steady flow of them (maybe 100-200/month) to do so and that should change the buyer pool. Especially considering the current supply level.

[quote=deadzone]Again, what’s happening during Covid is a massive distortion and you can throw away any/all statistics from this year.[/quote]If you think what happened over the last year is distortion, then are you suggesting that we’ll see a similar decline after June 15th when everything is opened back up in CA?[/quote]

I never said I don’t like the lifestyle, I live here by choice. But the lifestyle in San Diego is mostly the same as it was 10 years ago, 20 years ago, etc. There is nothing dramatic that has changed that makes San Diego more attractive than it was before. I would say less attractive unless you like huge crowds and traffic everywhere. There are also far less golf courses than there were 10 years ago and there is no longer an NFL team.

But again, you guys keep talking about “steady stream” of Bay area folks moving here. You have no evidence that statistically more people are moving from San Diego to Bay Area than vice versa. And the only reason it is affecting prices, as you point out, is due to the record low inventory. Most of the factors for the low inventory are due to Covid so you really think the inventory is going to stay super low forever? What do you think is going to happen when the eviction and foreclosure moratoriums expire? No affect?

I am not predicting prices immediately return to pre-covid levels after June 15, but certainly expect prices to flat line. But if (and that is a big IF) the Fed begins tapering to significant level, yes that will cause dramatic downward pressure on all asset prices.

deadzone wrote:an

[quote=deadzone][quote=an][quote=deadzone]

Why do you insist the lifestyle in San Diego is so great?[/quote]

Because it 100% is. We don’t need 100% of the Bay Area people to agree. We just need a steady flow of them (maybe 100-200/month) to do so and that should change the buyer pool. Especially considering the current supply level.

[quote=deadzone]Again, what’s happening during Covid is a massive distortion and you can throw away any/all statistics from this year.[/quote]If you think what happened over the last year is distortion, then are you suggesting that we’ll see a similar decline after June 15th when everything is opened back up in CA?[/quote]

I never said I don’t like the lifestyle, I live here by choice. But the lifestyle in San Diego is mostly the same as it was 10 years ago, 20 years ago, etc. There is nothing dramatic that has changed that makes San Diego more attractive than it was before. I would say less attractive unless you like huge crowds and traffic everywhere. There are also far less golf courses than there were 10 years ago and there is no longer an NFL team.

But again, you guys keep talking about “steady stream” of Bay area folks moving here. You have no evidence that statistically more people are moving from San Diego to Bay Area than vice versa. And the only reason it is affecting prices, as you point out, is due to the record low inventory. Most of the factors for the low inventory are due to Covid so you really think the inventory is going to stay super low forever? What do you think is going to happen when the eviction and foreclosure moratoriums expire? No affect?

I am not predicting prices immediately return to pre-covid levels after June 15, but certainly expect prices to flat line. But if (and that is a big IF) the Fed begins tapering to significant level, yes that will cause dramatic downward pressure on all asset prices.[/quote]

When they expire I expect little to no impact. I’d put money on it

I know one person that moved to Bay area and bought house there. My client and friend. When Covid-19 hit he saw a once in a lifetime opportunity to sell his house here and be able to compete there. His family is there. He bought a nice one story with nice backyard and pool he can entertain his family. He had been wanting to for over ten years and this was his chance. I spoke to him last week and he could never pull off today what we did last year.

The ability to work from home or a flexible workplace has changed. About 1/3 of recent buyers in my hood are working for a company that’s not here.. That was not the case ten years ago.

Drive around Encinitas along Coast Highway and you will see a place unrecognizable from what it was twenty years ago. There are fifty shades of grey

sdrealtor wrote:

When they

[quote=sdrealtor]

When they expire I expect little to no impact. I’d put money on it

[/quote]

When you say little to no impact when Covid measures expire, then you think YoY Case Shiller will continue growing at a 19% clip?

deadzone wrote:sdrealtor

[quote=deadzone][quote=sdrealtor]

When they expire I expect little to no impact. I’d put money on it

[/quote]

When you say little to no impact when Covid measures expire, then you think YoY Case Shiller will continue growing at a 19% clip?[/quote]

The eviction and foreclosure moratoriums expiring will have no impact. That means no inventory of any measureable amount coming from that or change in prices from that.

Of course I expect prices to slow down but that will have nothing to do with the eviction and foreclosure moratoriums ending.

sdrealtor wrote:

Drive around

[quote=sdrealtor]

Drive around Encinitas along Coast Highway and you will see a place unrecognizable from what it was twenty years ago. There are fifty shades of grey[/quote]

yeah and 20 years ago it was unrecognizable from 40 years ago. So what’s your point? More useless keyboard strokes from sdr

deadzone wrote:sdrealtor

[quote=deadzone][quote=sdrealtor]

Drive around Encinitas along Coast Highway and you will see a place unrecognizable from what it was twenty years ago. There are fifty shades of grey[/quote]

yeah and 20 years ago it was unrecognizable from 40 years ago. So what’s your point? More useless keyboard strokes from sdr[/quote]

This is what you said [quote=deadzone]But the lifestyle in San Diego is mostly the same as it was 10 years ago, 20 years ago, etc.[/quote]So which is it? Did the change or is it mostly the same?

an wrote:deadzone

[quote=an][quote=deadzone][quote=sdrealtor]

Drive around Encinitas along Coast Highway and you will see a place unrecognizable from what it was twenty years ago. There are fifty shades of grey[/quote]

yeah and 20 years ago it was unrecognizable from 40 years ago. So what’s your point? More useless keyboard strokes from sdr[/quote]

This is what you said [quote=deadzone]But the lifestyle in San Diego is mostly the same as it was 10 years ago, 20 years ago, etc.[/quote]So which is it? Did the change or is it mostly the same?[/quote]

The lifestyle sdr is referring to is weather, beach and outdoor activities. Those haven’t changed in principle. But if anything they have gotten worse since more crowds competing for those resources.

deadzone wrote:an

[quote=deadzone][quote=an][quote=deadzone][quote=sdrealtor]

Drive around Encinitas along Coast Highway and you will see a place unrecognizable from what it was twenty years ago. There are fifty shades of grey[/quote]

yeah and 20 years ago it was unrecognizable from 40 years ago. So what’s your point? More useless keyboard strokes from sdr[/quote]

This is what you said [quote=deadzone]But the lifestyle in San Diego is mostly the same as it was 10 years ago, 20 years ago, etc.[/quote]So which is it? Did the change or is it mostly the same?[/quote]

The lifestyle sdr is referring to is weather, beach and outdoor activities. Those haven’t changed in principle. But if anything they have gotten worse since more crowds competing for those resources.[/quote]

ROTFLMAO. Brings to mind the Yogi Berra classic “Nobody goes there anymore, its too crowded”

Okay, so the fact that SD

Okay, so the fact that SD beaches are more crowded makes them more desirable than before? Got it. Your right it sucked back in the day when I was forced to park right next to the beach. It’s way better walking the 5 blocks, the exercise does me good. And surfing back in the day was so boring with only 5-10 guys to share the break with, what an ordeal. Now I get the pleasure of sharing it with 50 guys, so much nicer. ROTFLMAO.

Whether it is nicer is

Whether it is nicer is subject to individual preferences.

Whether it is more crowded and thus popular is not

Another anecdote. Ran into

Another anecdote. Ran into agent friends that sold nearby neighbor house and one around the corner. Nearby neighbor had 9 offers on house with big lot and pool. Week after that house around corner had 13 offers. I asked if buyers who lost out on house one moved onto house two. Answer was no, all completely different buyers. I asked where buyers were coming from. Answer was nearly all from Bay Area. Buyers of first house coming from San Jose. Buyers of second from Santa Clara. They are lined up behind them waiting for the next one. Purely anecdotal but this is pretty solid evidence of what’s going on up here. This time next year we will likely have tract homes routinely selling in the $2m’s. There’s one coming soon that should be the first in next week or two

sdrealtor wrote:Another

[quote=sdrealtor]Another anecdote. Ran into agent friends that sold nearby neighbor house and one around the corner. Nearby neighbor had 9 offers on house with big lot and pool. Week after that house around corner had 13 offers. I asked if buyers who lost out on house one moved onto house two. Answer was no, all completely different buyers. I asked where buyers were coming from. Answer was nearly all from Bay Area. Buyers of first house coming from San Jose. Buyers of second from Santa Clara. They are lined up behind them waiting for the next one. Purely anecdotal but this is pretty solid evidence of what’s going on up here. This time next year we will likely have tract homes routinely selling in the $2m’s. There’s one coming soon that should be the first in next week or two[/quote]

So given the small sample size and record low inventory you can’t draw any conclusions from this. However, regarding the Bay area folks buying in SD, it would be interesting to know, are they actually up and moving to live here, or buying 2nd, 3rd home etc. for investment? If they are moving, why are they choosing to live in NCC san diego over San Jose or Santa Clara?

And of course the relevant data which would be hard or impossible to know, are there more Bay area people moving to San Diego (in real numbers) than before? Are there more people moving to SD from Bay Area than vice versa?

Are there more people moving

For purposes of RE markets, it is the movement of people with money that count.

The long term trend is natives with average and below skills and ambition are leaving both SF and SD areas and being replaced with high skill and ambition people.

Something else I have noticed is that people leaving the bay area because of the cost and crowds who have limited wealth go to inland states, Oregon, and the Sacramento area.

The ones with money, earned and family money both, are more attracted to San Diego (other spots include southern OC and Tahoe).

deadzone wrote:sdrealtor

[quote=deadzone][quote=sdrealtor]Another anecdote. Ran into agent friends that sold nearby neighbor house and one around the corner. Nearby neighbor had 9 offers on house with big lot and pool. Week after that house around corner had 13 offers. I asked if buyers who lost out on house one moved onto house two. Answer was no, all completely different buyers. I asked where buyers were coming from. Answer was nearly all from Bay Area. Buyers of first house coming from San Jose. Buyers of second from Santa Clara. They are lined up behind them waiting for the next one. Purely anecdotal but this is pretty solid evidence of what’s going on up here. This time next year we will likely have tract homes routinely selling in the $2m’s. There’s one coming soon that should be the first in next week or two[/quote]

So given the small sample size and record low inventory you can’t draw any conclusions from this. However, regarding the Bay area folks buying in SD, it would be interesting to know, are they actually up and moving to live here, or buying 2nd, 3rd home etc. for investment? If they are moving, why are they choosing to live in NCC san diego over San Jose or Santa Clara?

And of course the relevant data which would be hard or impossible to know, are there more Bay area people moving to San Diego (in real numbers) than before? Are there more people moving to SD from Bay Area than vice versa?[/quote]

Its hardly a small sample size and you can choose to ignore it. However, a few things. Right now we have a minimum of 15 folks looking to buy homes in my neighborhood from the Bay Area probably more. They are moving here to live in primary residences with families or to retire or whatever. They are moving here for nicer weather, nicer homes for a fraction of the price up there, beaches, better schools, new homes, bigger homes, wonderful outdoor spaces to enjoy and more. Ive been here 22 years. I know tons of people here. I sit on board committees and review architectural changes to homes. I see what they are doing and spending to improve the homes they buy here. If I wasnt bound by confidentiality I could share unbeleievably frivilous changes people are spending massive amounts of money on.

In all those years Ive seen nothing like this. We did not have many coming from there in prior years. People’s values and job situations have changed through this pandemic. Not everyone but enough to radically change this place. They will love it here as much as my friends that came here two years ago do. Its not going back. They are not going back. No how, no way.

sdrealtor wrote:deadzone

[quote=sdrealtor][quote=deadzone][quote=sdrealtor]Another anecdote. Ran into agent friends that sold nearby neighbor house and one around the corner. Nearby neighbor had 9 offers on house with big lot and pool. Week after that house around corner had 13 offers. I asked if buyers who lost out on house one moved onto house two. Answer was no, all completely different buyers. I asked where buyers were coming from. Answer was nearly all from Bay Area. Buyers of first house coming from San Jose. Buyers of second from Santa Clara. They are lined up behind them waiting for the next one. Purely anecdotal but this is pretty solid evidence of what’s going on up here. This time next year we will likely have tract homes routinely selling in the $2m’s. There’s one coming soon that should be the first in next week or two[/quote]

So given the small sample size and record low inventory you can’t draw any conclusions from this. However, regarding the Bay area folks buying in SD, it would be interesting to know, are they actually up and moving to live here, or buying 2nd, 3rd home etc. for investment? If they are moving, why are they choosing to live in NCC san diego over San Jose or Santa Clara?

And of course the relevant data which would be hard or impossible to know, are there more Bay area people moving to San Diego (in real numbers) than before? Are there more people moving to SD from Bay Area than vice versa?[/quote]

Its hardly a small sample size and you can choose to ignore it. However, a few things. Right now we have a minimum of 15 folks looking to buy homes in my neighborhood from the Bay Area probably more. They are moving here to live in primary residences with families or to retire or whatever. They are moving here for nicer weather, nicer homes for a fraction of the price up there, beaches, better schools, new homes, bigger homes, wonderful outdoor spaces to enjoy and more. Ive been here 22 years. I know tons of people here. I sit on board committees and review architectural changes to homes. I see what they are doing and spending to improve the homes they buy here. If I wasnt bound by confidentiality I could share unbeleievably frivilous changes people are spending massive amounts of money on.

In all those years Ive seen nothing like this. We did not have many coming from there in prior years. People’s values and job situations have changed through this pandemic. Not everyone but enough to radically change this place. They will love it here as much as my friends that came here two years ago do. Its not going back. They are not going back. No how, no way.[/quote]

But the fact remains RE is going up like gangbusters all over the Country. So keep believing it is only San Diego, enjoy living inside your bubble.

Never said that but keep

Never said that but keep believing I did while your rent climbs. Real estate is local. It’s different everywhere. I only care what is happening locally. What happens elsewhere? It’s not my problem

And you are staying with the personal attacks again

sdrealtor wrote:Never said

[quote=sdrealtor]Never said that but keep believing I did while your rent climbs. Real estate is local. It’s different everywhere. I only care what is happening locally. What happens elsewhere? It’s not my problem

And you are staying with the personal attacks again[/quote]

Yep, I buy one house on one street, not a San Diego house or California house. I can’t tell the seller of a house on a premium lot that… But houses nationally only went up 19%.

sdrealtor wrote:Never said

[quote=sdrealtor]Never said that but keep believing I did while your rent climbs. Real estate is local. It’s different everywhere. I only care what is happening locally. What happens elsewhere? It’s not my problem

And you are staying with the personal attacks again[/quote]

What personal attack? You are living in a bubble, you just admitted as much by saying you don’t care about anything outside San Diego.

deadzone wrote:sdrealtor

[quote=deadzone][quote=sdrealtor]

Drive around Encinitas along Coast Highway and you will see a place unrecognizable from what it was twenty years ago. There are fifty shades of grey[/quote]

yeah and 20 years ago it was unrecognizable from 40 years ago. So what’s your point? More useless keyboard strokes from sdr[/quote]

Ummm….actually it wasnt all that different visually although the demographics between the 1980 and 2000 up here changed dramatically. Now both are changing even more and even faster

deadzone wrote:I never said I

[quote=deadzone]I never said I don’t like the lifestyle, I live here by choice. But the lifestyle in San Diego is mostly the same as it was 10 years ago, 20 years ago, etc. There is nothing dramatic that has changed that makes San Diego more attractive than it was before. I would say less attractive unless you like huge crowds and traffic everywhere. There are also far less golf courses than there were 10 years ago and there is no longer an NFL team.

But again, you guys keep talking about “steady stream” of Bay area folks moving here. You have no evidence that statistically more people are moving from San Diego to Bay Area than vice versa. And the only reason it is affecting prices, as you point out, is due to the record low inventory. Most of the factors for the low inventory are due to Covid so you really think the inventory is going to stay super low forever? What do you think is going to happen when the eviction and foreclosure moratoriums expire? No affect?

I am not predicting prices immediately return to pre-covid levels after June 15, but certainly expect prices to flat line. But if (and that is a big IF) the Fed begins tapering to significant level, yes that will cause dramatic downward pressure on all asset prices.[/quote]

I’ve been living here for over 30 years, and I can see the changes. Better or worse is up to the person. To me, it’s definitely for the better. Especially over the last 10 years.

As for the evidence of “steady stream”, the best we can do is anecdotal since there’s no data source anywhere that I can find that have this data. If you do, please share. If you don’t, then I’d take anecdotal data than no data at all. As Rich’s tag line say at the bottom of the site, “In God We Trust. Everyone else Bring Data”. As for another anecdotal, my ex-coworker had 7 cousins in the bay area at the start of the pandemic working in tech, and 4 of them moved back to San Diego spring/summer of last year and bought in NCC. They were still working for the same company when they moved down (did not get fired/lay off).

You can’t have it both ways, if 2020 was a massive distortion, then it must revert to the norm. If prices stay high and continue to go up, then it’s not a distortion and has just become the norm, or at least changed the norm.

If you want to do a proper

If you want to do a proper log-scale graph in Excel, don’t. Just convert the y-axis to log using =log(cell#) and graph the x column vs the new column.

You can then manually edit the numbering on the y-axis using a graphic editor to reflect the original scale.

spdrun wrote:If you want to

[quote=spdrun]If you want to do a proper log-scale graph in Excel, don’t. Just convert the y-axis to log using =log(cell#) and graph the x column vs the new column.

You can then manually edit the numbering on the y-axis using a graphic editor to reflect the original scale.[/quote]

So it is me who sucks! I suspected as much. 🙂

That is a very good idea. I don’t really want to have to use a graphic editor for the scale though, I would rather have it just work. I suppose could just show the log(pr/sqft) or whatever. I will play with it if I get time, thanks for the tip.

Rich, thanks so much for

Rich, thanks so much for doing this. I have to admit though that when I look at the price per sq ft chart the old way and now with the log scale, yeah I can see a difference, but it doesn’t strike me as much of one. Anyway I look at it, it still looks like we’ve just had a big jump in prices. (I speak like it’s past tense, but there’s no indication, as far as I know, of it slowing.) And all this run up in prices during a pandemic, who would have thought? Not me! Guess that just proves not to trust my forecasting.

XBoxBoy

Thanks xbox. You are right,

Thanks xbox. You are right, it has been a huge price increase. I just didn’t want to exaggerate it with my linear scale.

I have never liked log scale

I have never liked log scale charts, especially for economic/social science data.

I am always switching to linear when I view charts online and they have log by default.

50 is a lot bigger than 5!

Don’t forget our good looks and winning personalities!

But of course, as well as my

But of course, as well as my rapidly improving golf game